false

0001546296

0001546296

2025-03-07

2025-03-07

--12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 7, 2025

|

PROFESSIONAL DIVERSITY NETWORK, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

001-35824

|

|

80-0900177

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

55 E. Monroe Street, Suite 2120, Chicago, Illinois 60603

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (312) 614-0950

|

N/A

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

IPDN

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 3.03

|

Material Modifications to Rights of Security Holders.

|

On January 24, 2025, certain stockholders of Professional Diversity Network, Inc. (the “Company”) who collectively held approximated 52.13% of the total issued and outstanding voting power of the Company, approved an amendment to the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split (the “Reverse Stock Split”) of the Company’s common stock, par value $0.01 per share (the “Common Stock”), at a ratio of 1.5-to-1, 2-to-1, 3-to-1, 4-to-1, 5-to-1, 10-to-1, or 20-to-1, as determined necessary and desirable by management to achieve and maintain a minimum market trading price of at least $1.00 per share for the Common Stock, which may be implemented multiple times if necessary with any resulting fractional shares to be cashed out. The management later fixed the reverse stock split ratio at 10-to-1.

On March 7, 2025, the Company filed a Certificate of Amendment to its Amended and Restated Certificate of Incorporation with the Secretary of State of Delaware (the “Certificate of Amendment”), which effects the Reverse Stock Split at a ratio of 10-to-1, and such Certificate of Amendment will become effective as of 12:01 a.m. ET on March 13, 2025 (the “Effective Time”).

As a result of the Reverse Stock Split, every ten shares of Common Stock will be combined into one share of Common Stock and the total number of shares of Common Stock outstanding will be reduced from 19,322,748 shares to 1,933,274 shares. Stockholders who otherwise would be entitled to receive fractional shares because they held a number of shares not evenly divisible by the ratio of the Reverse Stock Split will automatically be entitled to receive cash in lieu of such fractional shares.

Trading of the Company’s Common Stock on The Nasdaq Capital Market on a split-adjusted basis is expected to begin on March 13, 2025. The Company’s new Common Stock will continue to be traded under the symbol IPDN. A new CUSIP number has been issued for the Company’s new Common Stock (74312Y400) to replace the old CUSIP number (74312Y301). The Company’s stockholders should not send their stock certificates to the Company. Stockholders will be notified by the Company’s transfer agent, Computershare Inc., regarding the process for exchanging existing stock certificates representing pre-split shares.

The above description of the Certificate of Amendment and the Reverse Stock Split is qualified in its entirety by reference to the Certificate of Amendment, a copy of which is attached hereto as Exhibit 3.1.

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws.

|

The description of the Certificate of Amendment and the Reverse Stock Split set forth in Item 3.03 of this Current Report is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

Exhibit No. Description

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Professional Diversity Network, Inc.

|

|

| |

|

|

|

Date: March 7, 2025

|

/s/ Xin (Adam) He

|

|

| |

Xin (Adam) He

Chief Executive Officer

|

|

Exhibit 3.1

CERTIFICATE OF AMENDMENT TO

THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF

PROFESSIONAL DIVERSITY NETWORK, INC.

Professional Diversity Network, Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Company”), does hereby certify as follows:

1. The name of the Company is Professional Diversity Network, Inc., and the Company was originally incorporated pursuant to the General Corporation Law on January 31, 2012.

2. The Amended and Restated Certificate of Incorporation of the Company (the “Certificate of Incorporation”) is hereby amended as follows:

Article IV of the Certificate of Incorporation is hereby deleted in its entirety and replaced with the following:

4. Stock

4.1 Classes of Stock. The Corporation is authorized to issue two classes of stock to be designated, respectively, common stock (“Common Stock”) and preferred stock (“Preferred Stock”). The total number of shares of all classes of stock that the Corporation is authorized to issue is 46,000,000.

4.2 Common Stock. The total number of shares of Common Stock that the Corporation shall have authority to issue is 45,000,000 shares, $0.01 par value per share. The number of authorized shares of Common Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the total voting power of the outstanding shares of capital stock of the Corporation entitled to vote, irrespective of the provisions of Section 242(b)(2) of the General Corporation Law or any corresponding provision hereinafter enacted.

Effective as of 12:01 a.m. ET on March 13, 2025 (the “Effective Time”), each ten (10) shares of Common Stock issued and outstanding immediately prior to the Effective Time shall be combined and changed into one (1) validly issued, fully paid, and non-assessable share of Common Stock without any further action by the Corporation or any holder thereof, subject to the treatment of fractional share interests as described below (the “Reverse Stock Split”). No certificates representing fractional shares of Common Stock shall be issued in connection with the Reverse Stock Split. Stockholders who otherwise would be entitled to receive fractional shares of Common Stock because they hold a number of shares not evenly divisible by the Reverse Stock Split ratio will instead be entitled to receive a cash payment in lieu of such fractional shares. The cash payment to be paid will be in an amount equal to the relevant percentage of the amount received per share upon the sale in one or more open market transactions of the aggregate of all such fractional shares. Each certificate that immediately prior to the Effective Time represented shares of Common Stock (“Old Certificates”), shall thereafter represent that number of shares of Common Stock into which the shares of Common Stock represented by the Old Certificate shall have been combined.

4.3 Preferred Stock. The total number of shares of Preferred Stock that the Corporation shall have authority to issue is 1,000,000 shares, $0.01 par value per share. The Preferred Stock may be issued from time to time in one or more series. The Board of Directors is hereby authorized, within the limitations and restrictions stated in the Corporation’s Certificate of Incorporation, as amended as restated (the “Charter”), to provide for the issue of all or any of the shares of Preferred Stock in one or more series, and to fix the number of shares and to determine or alter for each such series, such voting powers, full or limited, or no voting powers, and such designations, preferences and relative, participating, optional, or other rights and such qualifications, limitations, or restrictions thereof, as shall be stated and expressed in the resolution or resolutions adopted by the Board of Directors providing for the issue of such shares and as may be permitted by the General Corporation Law. The Board of Directors is also authorized to increase or decrease the number of shares of any series of Preferred Stock subsequent to the issue of shares of that series, but not below the number of shares of such series then outstanding. In case the number of shares of any series shall be so decreased, the shares constituting such decrease shall resume the status of which they had prior to the adoption of the resolution originally fixing the number of shares of such series.

3. This Amendment of the Certificate of Incorporation herein certified has been duly adopted and written consent has been given in accordance with the provisions of Sections 228 and 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, the Company has caused this Certificate of Amendment to be signed as of March 7, 2025.

| |

PROFESSIONAL DIVERSITY NETWORK, INC.

|

| |

|

|

| |

By:

|

/s/ Xin (Adam) He

|

| |

|

Name: Xin (Adam) He

|

| |

|

Title: CEO

|

v3.25.0.1

Document And Entity Information

|

Mar. 07, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

PROFESSIONAL DIVERSITY NETWORK, INC.

|

| Current Fiscal Year End Date |

--12-31

|

| Document, Type |

8-K

|

| Document, Period End Date |

Mar. 07, 2025

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-35824

|

| Entity, Tax Identification Number |

80-0900177

|

| Entity, Address, Address Line One |

55 E. Monroe Street

|

| Entity, Address, City or Town |

Chicago

|

| Entity, Address, State or Province |

IL

|

| Entity, Address, Postal Zip Code |

60603

|

| City Area Code |

312

|

| Local Phone Number |

614-0950

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

IPDN

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001546296

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

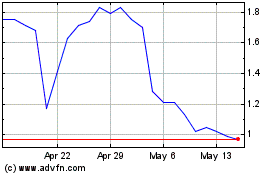

Professional Diversity N... (NASDAQ:IPDN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Professional Diversity N... (NASDAQ:IPDN)

Historical Stock Chart

From Mar 2024 to Mar 2025