Iris Energy Limited (NASDAQ: IREN) (together with its subsidiaries,

“

IREN”) today provided a business update.

“We are pleased to announce that we’ve reached our 20 EH/s

milestone ahead of schedule. This achievement reflects the hard

work of our global team. Thank you for your dedication and efforts

in making this happen,” said Daniel Roberts, Co-Founder and Co-CEO

of IREN. “We look forward to continuing this momentum as we expand

to over 30 EH/s in the next three months.”

IREN achieves 20 EH/s milestone

IREN has increased its installed capacity to 20 EH/s (16 J/TH

efficiency).

Through optimization of its existing data center infrastructure,

IREN now expects to increase its installed capacity to 21 EH/s in

the coming days.

On track for 31 EH/s in 4Q 2024

Childress Phase 3 (150MW) construction is well underway, with

approximately 430 people mobilized to site.

As part of the expansion from 21 EH/s to 31 EH/s, previously

purchased Bitmain S21 XP miners (13.5 J/TH) are scheduled for

shipping over the next 2 months.

Based on 31 EH/s (15 J/TH efficiency):

- $20k electricity

cost per Bitcoin mined1

- $30k all-in cash

cost per Bitcoin mined2

Pathway to industry leadership

Childress Phase 2 and 3 construction(September 2024)

Assumptions and Notes

- Calculations assume 662 EH/s (global hashrate), 3.125 BTC

(block reward), 0.1 BTC (transaction fees), 0.15% (pool fees),

484MW (power consumption), $0.038/kWh electricity costs (4.5c/kWh

BC, 3.5c/kWh Childress – note August 2024 electricity price at

Childress of 3.1c/kWh following transition to spot pricing).

- Estimated all-in cash costs per Bitcoin mined at 31 EH/s

include electricity costs (as noted above) and indicative all other

opex (including all corporate overheads) of ~$80m per annum.

Forward-Looking Statements

This investor update includes “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements generally relate to

future events or IREN’s future financial or operating performance.

For example, forward-looking statements include but are not limited

to IREN’s business strategy, expected operational and financial

results, and expected increase in power capacity and hashrate. In

some cases, you can identify forward-looking statements by

terminology such as “anticipate,” “believe,” “may,” “can,”

“should,” “could,” “might,” “plan,” “possible,” “project,”

“strive,” “budget,” “forecast,” “expect,” “intend,” “target”,

“will,” “estimate,” “predict,” “potential,” “continue,” “scheduled”

or the negatives of these terms or variations of them or similar

terminology, but the absence of these words does not mean that

statement is not forward-looking. Such forward-looking statements

are subject to risks, uncertainties, and other factors which could

cause actual results to differ materially from those expressed or

implied by such forward-looking statements. In addition, any

statements or information that refer to expectations, beliefs,

plans, projections, objectives, performance or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking.

These forward-looking statements are based on

management’s current expectations and beliefs. These statements are

neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause

IREN’s actual results, performance or achievements to be materially

different from any future results performance or achievements

expressed or implied by the forward looking statements, including,

but not limited to: Bitcoin price and foreign currency exchange

rate fluctuations; IREN’s ability to obtain additional capital on

commercially reasonable terms and in a timely manner to meet its

capital needs and facilitate its expansion plans; the terms of any

future financing or any refinancing, restructuring or modification

to the terms of any future financing, which could require IREN to

comply with onerous covenants or restrictions, and its ability to

service its debt obligations, any of which could restrict its

business operations and adversely impact its financial condition,

cash flows and results of operations; IREN’s ability to

successfully execute on its growth strategies and operating plans,

including its ability to continue to develop its existing data

center sites and to diversify and expand into the market for high

performance computing (“HPC”) solutions it may offer (including the

market for AI Cloud Services); IREN’s limited experience with

respect to new markets it has entered or may seek to enter,

including the market for HPC solutions (including AI Cloud

Services); expectations with respect to the ongoing profitability,

viability, operability, security, popularity and public perceptions

of the Bitcoin network; expectations with respect to the

profitability, viability, operability, security, popularity and

public perceptions of any current and future HPC solutions

(including AI Cloud Services) that IREN offers; IREN’s ability to

secure and retain customers on commercially reasonable terms or at

all, particularly as it relates to its strategy to expand into

markets for HPC solutions (including AI Cloud Services); IREN’s

ability to manage counterparty risk (including credit risk)

associated with any current or future customers, including

customers of its HPC solutions (including AI Cloud Services) and

other counterparties; the risk that any current or future

customers, including customers of its HPC solutions (including AI

Cloud Services), or other counterparties may terminate, default on

or underperform their contractual obligations; Bitcoin global

hashrate fluctuations; IREN’s ability to secure renewable energy,

renewable energy certificates, power capacity, facilities and sites

on commercially reasonable terms or at all; delays associated with,

or failure to obtain or complete, permitting approvals, grid

connections and other development activities customary for

greenfield or brownfield infrastructure projects; IREN’s reliance

on power and utilities providers, third party mining pools,

exchanges, banks, insurance providers and its ability to maintain

relationships with such parties; expectations regarding

availability and pricing of electricity; IREN’s participation and

ability to successfully participate in demand response products and

services and other load management programs run, operated or

offered by electricity network operators, regulators or electricity

market operators; the availability, reliability and/or cost of

electricity supply, hardware and electrical and data center

infrastructure, including with respect to any electricity outages

and any laws and regulations that may restrict the electricity

supply available to IREN; any variance between the actual operating

performance of IREN’s miner hardware achieved compared to the

nameplate performance including hashrate; IREN’s ability to curtail

its electricity consumption and/or monetize electricity depending

on market conditions, including changes in Bitcoin mining economics

and prevailing electricity prices; actions undertaken by

electricity network and market operators, regulators, governments

or communities in the regions in which IREN operates; the

availability, suitability, reliability and cost of internet

connections at IREN’s facilities; IREN’s ability to secure

additional hardware, including hardware for Bitcoin mining and any

current or future HPC solutions (including AI Cloud Services) it

offers, on commercially reasonable terms or at all, and any delays

or reductions in the supply of such hardware or increases in the

cost of procuring such hardware; expectations with respect to the

useful life and obsolescence of hardware (including hardware for

Bitcoin mining as well as hardware for other applications,

including any current or future HPC solutions (including AI Cloud

Services) IREN offers); delays, increases in costs or reductions in

the supply of equipment used in IREN’s operations; IREN’s ability

to operate in an evolving regulatory environment; IREN’s ability to

successfully operate and maintain its property and infrastructure;

reliability and performance of IREN’s infrastructure compared to

expectations; malicious attacks on IREN’s property, infrastructure

or IT systems; IREN’s ability to maintain in good standing the

operating and other permits and licenses required for its

operations and business; IREN’s ability to obtain, maintain,

protect and enforce its intellectual property rights and

confidential information; any intellectual property infringement

and product liability claims; whether the secular trends IREN

expects to drive growth in its business materialize to the degree

it expects them to, or at all; any pending or future acquisitions,

dispositions, joint ventures or other strategic transactions; the

occurrence of any environmental, health and safety incidents at

IREN’s sites, and any material costs relating to environmental,

health and safety requirements or liabilities; damage to IREN’s

property and infrastructure and the risk that any insurance IREN

maintains may not fully cover all potential exposures; ongoing

proceedings relating to the default by two of IREN’s wholly-owned

special purpose vehicles under limited recourse equipment financing

facilities; ongoing securities litigation relating in part to the

default; and any future litigation, claims and/or regulatory

investigations, and the costs, expenses, use of resources,

diversion of management time and efforts, liability and damages

that may result therefrom; IREN's failure to comply with any laws

including the anti-corruption laws of the United States and various

international jurisdictions; any failure of IREN's compliance and

risk management methods; any laws, regulations and ethical

standards that may relate to IREN’s business, including those that

relate to Bitcoin and the Bitcoin mining industry and those that

relate to any other services it offers, including laws and

regulations related to data privacy, cybersecurity, the storage,

use or processing of information and consumer laws; IREN’s ability

to attract, motivate and retain senior management and qualified

employees; increased risks to IREN’s global operations including,

but not limited to, political instability, acts of terrorism, theft

and vandalism, cyberattacks and other cybersecurity incidents and

unexpected regulatory and economic sanctions changes, among other

things; climate change, severe weather conditions and natural and

man-made disasters that may materially adversely affect IREN’s

business, financial condition and results of operations; public

health crises, including an outbreak of an infectious disease (such

as COVID-19) and any governmental or industry measures taken in

response; IREN’s ability to remain competitive in dynamic and

rapidly evolving industries; damage to IREN’s brand and reputation;

expectations relating to Environmental, Social or Governance issues

or reporting; the costs of being a public company; and other

important factors discussed under the caption “Risk Factors” in

IREN’s annual report on Form 20-F filed with the SEC on August 28,

2024 as such factors may be updated from time to time in its other

filings with the SEC, accessible on the SEC’s website at

www.sec.gov and the Investor Relations section of IREN’s website at

https://investors.iren.com.

These and other important factors could cause

actual results to differ materially from those indicated by the

forward-looking statements made in this investor update. Any

forward-looking statement that IREN makes in this investor update

speaks only as of the date of such statement. Except as required by

law, IREN disclaims any obligation to update or revise, or to

publicly announce any update or revision to, any of the

forward-looking statements, whether as a result of new information,

future events or otherwise.

Non-IFRS Financial Measures

This investor update includes non-IFRS financial

measures, including electricity costs (presented on a net basis).

We provide these measures in addition to, and not as a substitute

for, measures of financial performance prepared in accordance with

IFRS. There are a number of limitations related to the use of

non-IFRS financial measures. For example, other companies,

including companies in our industry, may calculate these measures

differently. IREN believes that these measures are important and

supplement discussions and analysis of its results of operations

and enhances an understanding of its operating performance.

Electricity costs are calculated as our IFRS Electricity charges

net of Realized gain/(loss) on financial asset, ERS revenue

(included in Other income) and ERS fees (included in Other

operating expenses), and excludes the cost of RECs.

About IREN

IREN is a leading data center business powering the future of

Bitcoin, AI and beyond utilizing 100% renewable energy.

- Bitcoin Mining:

providing security to the Bitcoin network, expanding to 31 EH/s in

2024. Operations since 2019.

- AI Cloud Services:

providing cloud compute to AI customers, 1,896 NVIDIA H100 &

H200 GPUs. Operations since 2024.

- Next-Generation Data

Centers: 345MW of operating data centers, expanding to 510MW in

2024. Specifically designed and purpose-built infrastructure for

high-performance and power-dense computing applications.

- Technology:

technology stack for performance optimization of AI Cloud Services,

Bitcoin Mining and energy trading operations.

- Development

Portfolio: 2,310MW of grid-connected power secured across North

America, >1,000 acre property portfolio and additional

development pipeline.

- 100% Renewable

Energy (from clean or renewable energy sources or through the

purchase of RECs): targets sites with low-cost & underutilized

renewable energy, and supports electrical grids and local

communities.

Contacts

| MediaJon

Snowball Domestique +61 477 946 068Danielle GhiglieraAircover

Communications+1 510 333 2707 |

InvestorsLincoln

Tan IREN+61 407 423 395lincoln.tan@iren.com |

To keep updated on IREN’s news releases and SEC filings, please

subscribe to email alerts at

https://iren.com/investor/ir-resources/email-alerts.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/f364061d-d227-47d9-b226-ce0b30a6a15d

https://www.globenewswire.com/NewsRoom/AttachmentNg/f796e473-6215-4d37-91ea-6b5f738b7f4a

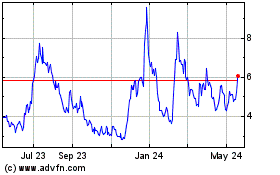

Iris Energy (NASDAQ:IREN)

Historical Stock Chart

From Oct 2024 to Nov 2024

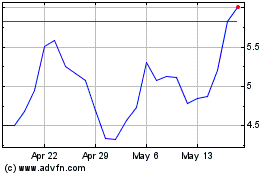

Iris Energy (NASDAQ:IREN)

Historical Stock Chart

From Nov 2023 to Nov 2024