Inspirato Incorporated (“Inspirato” or the “Company”) (NASDAQ:

ISPO), the innovative luxury travel club, today announced it has

entered into a definitive investment agreement with One Planet

Group LLC (“One Planet Group”) on a comprehensive transaction (“the

Transaction”) that includes $10 million of equity financing in

exchange for approximately 2.9 million new shares of Inspirato

Class A Common Stock and an equivalent number of warrants.

“I’m incredibly excited for what this transaction does for the

future of Inspirato and our members,” said President, David

Kallery. “Over the last several quarters, we’ve worked tirelessly

with our members top of mind to improve our product offerings and

optimize our portfolio. While the decision to reduce our workforce

was not easy, I’m grateful for the hard work and dedication of the

entire team and am confident that under Payam Zamani’s leadership,

Inspirato will continue to provide a world-class travel experience

to its members for years to come.”

Upon closing, One Planet Group will name three new Directors to

the Inspirato Board of Directors, including Mr. Zamani as Chairman.

The size of the Company’s Board is expected to remain at seven

Directors. The Company also plans to implement initiatives expected

to reduce costs by approximately $25 million on an annualized

basis. This includes a reduction in workforce of 15% and the

termination of previously impaired, poorly performing

leases.

CEO and Chairman, Payam Zamani, commented, “This transaction,

not only strengthens Inspirato’s liquidity and improves the

Company’s capital structure with a large, supportive shareholder,

but it injects our boardroom with a fresh perspective. I look

forward to working with the team, meeting our members and taking

Inspirato to new heights in a more sustainable and profitable

manner.”

The purchase price for each share and warrant in the transaction

is $3.43. The first tranche of the transaction will close August

13, 2024 for consideration of approximately $4.6 million; the

second tranche is expected to close in September 2024, subject to

shareholder approval, for consideration of approximately $5.4

million. Following the second closing, One Planet Group will have

an option to invest an additional $2.5 million on the same

terms.

About Inspirato

Inspirato (NASDAQ: ISPO) is a luxury travel company that

provides exclusive access to a managed and controlled portfolio of

curated vacation options, delivered through an innovative model

designed to ensure the service, certainty, and value that

discerning customers demand. The Inspirato portfolio includes

branded luxury vacation homes, accommodations at five-star hotel

and resort partners, and custom travel experiences. For more

information, visit www.inspirato.com and follow @inspirato on

Instagram, Facebook, X, and LinkedIn.

About One Planet Group LLC

One Planet Group is a closely held private equity firm that

owns a suite of technology and media businesses while also

investing in early-stage companies. Owned and operated businesses

span a variety of industries including ad tech, publishing, and

media. One Planet Group’s mission is to support strong business

ideas while building an ethos that helps improve society and give

back to communities. The company’s investment portfolio

includes a diverse group of innovative tech-enabled products and

solutions. Investing primarily in high-growth early-stage entities,

emphasizing companies that aspire to ‘Innovation + Intention.’ One

Planet Group was founded by tech entrepreneur Payam Zamani in 2015.

With offices and employees in over ten countries, its global

headquarters is in Walnut Creek, California. For more information,

visit www.oneplanetgroup.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act and

Section 21E of the Exchange Act. Forward-looking statements

generally relate to future events or the Company’s future financial

or operating performance. In some cases, you can identify

forward-looking statements because they contain words such as

“believe,” “may,” “will,” “estimate,” “potential,” “continue,”

“anticipate,” “intend,” “expect,” “could,” “would,” “project,”

“forecast,” “plan,” “intend,” “target,” or the negative of these

words or other similar expressions that concern the Company’s

expectations, strategy, priorities, plans, or intentions.

Forward-looking statements in this release include, but are not

limited to, the Company’s ability to consummate the Transaction and

satisfy applicable closing conditions, including stockholder

approval, where applicable. The Company’s expectations and beliefs

regarding these matters may not materialize, and actual results in

future periods are subject to risks and uncertainties, including

changes in the Company’s plans or assumptions, that could cause

actual results to differ materially from those projected. These

risks include the risk of the Company’s stockholders not approving

the Transaction, the occurrence of any event, change or other

circumstances that could result in the investment agreement being

terminated or the transactions not being completed on the terms

reflected in the investment agreement, or at all, and uncertainties

as to the timing of the consummation of the transactions; the

ability of each party to consummate the transactions; and other

risks detailed in the Company’s filings with the Securities and

Exchange Commission (“SEC”), including the Company’s Annual Report

on Form 10-K filed with the SEC on March 12, 2024. All

information provided in this press release is as of the date

hereof, and the Company undertakes no duty to update this

information unless required by law. These forward-looking

statements should not be relied upon as representing the Company’s

assessment as of any date subsequent to the date of this press

release.

Additional Information and Where to Find

It

The Company, its directors and certain executive

officers are participants in the solicitation of proxies from

stockholders in connection with a special meeting (the “Special

Meeting”) to approve a proposal to issue a portion of the

securities contemplated by the transactions described herein. The

Company plans to file a proxy statement (the “Special Meeting Proxy

Statement”) with the SEC in connection with the solicitation of

proxies for the Special Meeting. Additional information regarding

such participants, including their direct or indirect interests, by

security holdings or otherwise, will be included in the Special

Meeting Proxy Statement and other relevant documents to be filed

with the SEC in connection with the Special Meeting. Information

relating to the foregoing can also be found in the Company’s proxy

statement for the 2024 annual meeting of stockholders as filed with

the SEC (the “2024 Proxy Statement”). To the extent that such

participants’ holdings of the Company’s securities have changed

since the amounts set forth in the 2024 Proxy Statement, such

changes have been or will be reflected on Statements of Change in

Ownership on Form 4s filed with the SEC.

Promptly after filing the definitive Special

Meeting Proxy Statement with the SEC, the Company will mail the

definitive Special Meeting Proxy Statement and related proxy card

to each stockholder entitled to vote at the Special Meeting.

STOCKHOLDERS ARE URGED TO READ THE SPECIAL MEETING PROXY STATEMENT

(INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER

RELEVANT DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC WHEN

THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. Stockholders may obtain, free of charge, the

preliminary and definitive versions of the Special Meeting Proxy

Statement, any amendments or supplements thereto, and any other

relevant documents filed by the Company with the SEC in connection

with the Special Meeting at the SEC’s website (http://www.sec.gov).

Copies of the Company’s definitive Special Meeting Proxy Statement,

any amendments or supplements thereto, and any other relevant

documents filed by the Company with the SEC in connection with the

Special Meeting will also be available, free of charge, at the

Company’s investor relations website

(https://investor.inspirato.com/) or by writing to the Company at

Inspirato Incorporated, 1544 Wazee Street, Denver, Colorado 80202,

Attention: Investor Relations.

Contacts:

Investor Relations: ir@inspirato.com

Media

Relations: Inspirato communications@inspirato.com

One Planet Group pr@oneplanetgroup.com

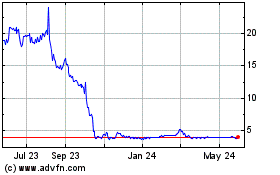

Inspirato (NASDAQ:ISPO)

Historical Stock Chart

From Dec 2024 to Jan 2025

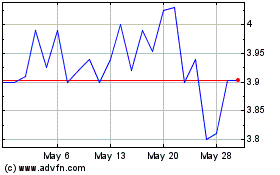

Inspirato (NASDAQ:ISPO)

Historical Stock Chart

From Jan 2024 to Jan 2025