UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 12, 2024

Inspirato Incorporated

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-39791 |

|

85-2426959 |

(State or other jurisdiction

of incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

|

1544 Wazee Street

Denver, CO |

|

80202 |

| (Address of principal executive

offices) |

|

(Zip Code) |

(303) 839-5060

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

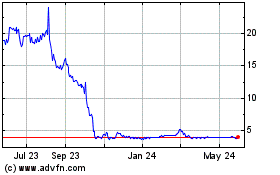

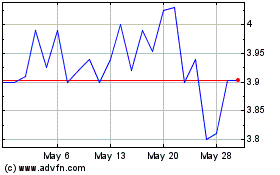

| Class A common stock, $0.0001 par value per share |

|

ISPO |

|

The Nasdaq Stock Market LLC |

| Warrants to purchase Class A common stock |

|

ISPOW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

Investment Agreement

On August 12, 2024, Inspirato Incorporated

(the “Company”) entered into an investment agreement (the “Investment Agreement”) with One Planet

Group LLC, a Delaware limited liability company (the “Purchaser”), relating to the issuance and sale to the Purchaser

of (i) 1,335,271 shares (the “Tranche 1 Shares”) of Class A common stock, $0.0001 par value per share,

of the Company for an aggregate purchase price of $4,579,980 (such transaction, the “Tranche 1 Purchase”) and

(ii) 1,580,180 shares of Class A common stock (the “Tranche 2 Shares”) for an aggregate purchase price

of $5,420,020 and an accompanying warrant (the “Warrant”) to purchase up to 2,915,451 shares of Class A common

stock (the “Warrant Shares”) (such transaction, the “Tranche 2 Purchase”). In addition, pursuant

to the Investment Agreement, the Purchaser was granted an option (the “Option”) to acquire an additional number of

shares of Class A common stock with an aggregate purchase price of up to $2,500,000, where the purchase price for each share will

be the same as the per share purchase price in the Tranche 1 Purchase and the Company will deliver a number of warrants equal to

the number of shares of Class A common stock being purchased as part of the Option (such shares and warrants being collectively referred

to as the “Optional Securities”).

The closing of the Tranche 1 Purchase occurred

on August 13, 2024 (the “Tranche 1 Closing”). The closing of the Tranche 2 Purchase will take place

on September 13, 2024, or as soon as practicable thereafter following the satisfaction of certain closing conditions (the “Tranche 2

Closing,” with each of the Tranche 1 Closing and the Tranche 2 Closing being referred to as a “Closing”).

The Tranche 2 Closing is conditioned upon the approval by the Company’s stockholders at a special meeting of stockholders (the

“Special Meeting”) of a proposal to authorize the issuance of the Tranche 2 Shares, the Warrant, the Warrant Shares,

and the Optional Securities, to the extent such approval is required under the rules of the Nasdaq Stock Market LLC (such proposal, the

“Nasdaq Proposal”), in addition to other customary closing conditions.

The Investment Agreement includes customary representations,

warranties and covenants by the Company. Subject to certain limitations, the Investment Agreement also provides the Purchaser with the

right to designate up to three members of the Company’s Board of Directors (the “Board”) and certain registration

rights with respect to the Tranche 1 Shares, the Tranche 2 Shares, the Warrant Shares and the Optional Securities.

The Investment Agreement provides that, during

the period from the date of the Investment Agreement until the Tranche 2 Closing or the earlier termination of the Investment Agreement

in accordance with its terms, the Company is subject to certain restrictions on its ability to solicit alternative transaction proposals

from third parties, provide non-public information to third parties or engage in discussions with third parties regarding alternative

transaction proposals.

The Investment Agreement provides that the Tranche 2

Purchase may be terminated in certain circumstances prior to the Tranche 2 Closing, including (i) by mutual agreement of the

Purchaser and the Company, with the approval of the Board; (ii) by either the Purchaser or the Company, if the Tranche 1 Purchase

or the Tranche 2 Purchase has been permanently restrained, enjoined or otherwise prohibited from being consummated; (iii) automatically,

if (A) the Tranche 1 Closing has not occurred on or prior to August 17, 2024 or (B) the Tranche 2 Closing has

not occurred on or prior to October 11, 2024 (in each case, unless otherwise mutually agreed by the Company and the Purchaser in

writing); or (iv) by either the Purchaser or the Company, if, prior to the relevant Closing, there is an uncured breach by the other

party to the Investment Agreement. Upon termination of the Investment Agreement in respect of only the Tranche 2 Shares, the Warrant,

the Warrant Shares and the Optional Securities, the terms of the Investment Agreement will remain in effect insofar as they relate to

the Tranche 1 Purchase. The Optional Securities will be issued only if the Tranche 2 Closing occurs.

The foregoing summary of the Investment Agreement

does not purport to be complete and is qualified in its entirety by reference to the full text of the Investment Agreement, a copy of

which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Oakstone Ventures, Inc. an affiliate of Capital

One Financial Corporation and holder of the 8% Senior Secured Convertible Note due 2028 (the “Note”), waived its rights

to require the Company to repurchase all or any part of the Note in connection with the transactions contemplated by the Investment Agreement

(collectively, the “Transactions”).

The Warrant

The Warrant will be exercisable at an exercise

price of $3.43 per share, subject to customary adjustments set forth in the Warrant for stock splits and similar transactions. The Warrant

will be exercisable in whole or in part beginning on the date of the Tranche 2 Closing (the “Commencement Date”)

and until (i) the date which is five years after the Commencement Date or (ii) in the case of Fundamental Change (as defined

in the Warrant) which is publicly announced before the date described in clause (i) above but which closes after the date described

in clause (i) above, the closing date of such Fundamental Change. The Purchaser may exercise part or all of the Warrant via a cashless

exercise mechanism set forth in the Warrant. The exercise price of the Warrant, and the number of Warrant Shares, will be adjusted proportionately

if the Company subdivides its shares of Class A common stock into a greater number of shares or combines its shares of Class A

common stock into a smaller number of shares. The Purchaser will have the right to receive an instrument of a successor entity that is

comparable to the Warrant, or to have its Warrant repurchased, in certain circumstances involving business combination and similar transactions.

The foregoing summary of the Warrant does not

purport to be complete and is qualified in its entirety by reference to the full text of the Warrant, the form of which is filed as Exhibit A

to Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Voting Agreements

Contemporaneously with the execution of the Investment

Agreement, certain stockholders of the Company, including the directors and executive officers of the Company, representing approximately

49% of the voting power of the Class A common stock and the Class V common stock, $0.0001 par value per share, of the Company

(collectively, the “Voting Shares”), entered into voting agreements (collectively, the “Voting Agreements”)

with the Company and the Purchaser, pursuant to which, among other things, such stockholders agreed to vote their respective Voting Shares

in favor of the Nasdaq Proposal and not to transfer their respective Voting Shares until the date that is one business day after the record

date to be set forth in the proxy statement to be provided in connection with the Nasdaq Proposal. The Voting Agreements do not preclude

any director, in his or her capacity as such, from exercising his or her fiduciary duties and electing to terminate the Investment Agreement

in the circumstances permitted in the Investment Agreement.

The foregoing description of the form of Voting

Agreement is qualified in its entirety by reference to the full text of the Voting Agreement, the form of which is included as Exhibit 10.2

to this Current Report on Form 8-K and incorporated herein by reference.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information related to the Investment Agreement

contained in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

The Tranche 1 Shares, the Tranche 2

Shares, the Warrant, the Warrant Shares, and the Optional Securities have not been registered under the Securities Act of 1933, as amended

(the “Securities Act”), in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities

Act and/or Regulation D promulgated thereunder.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

The information related to the Investment Agreement

contained in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

On August 13, 2024, Brad Handler stepped

down as a Class III director of the Company and the Chairman of the Board, effective immediately.

On August 13, 2024, in connection with the

Tranche 1 Closing and pursuant to the Investment Agreement, (i) Eric Grosse stepped down as the Chief Executive Officer and

a Class I director of the Company, effective immediately; and (ii) Payam Zamani was appointed as the Chief Executive Officer,

a Class I director (with a term expiring at the Company’s 2026 annual meeting of stockholders) and the Chairman of the Board,

effective immediately. Chief Financial Officer Robert Kaiden temporarily assumed the duties of principal executive officer following Mr.

Grosse's departure through the filing of the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, after which

Mr. Zamani assumed those duties.

In addition, on August 15, 2024, (i) John Melicharek

stepped down as a Class III director of the Company, and a member of each of the Compensation Committee and Nominating and Corporate Governance

Committee of the Board, effective immediately; (ii) David Kallery, the President of the Company, was appointed as a Class III director

of the Company (with a term expiring at the Company’s 2025 annual meeting of stockholders), effective immediately; and (iii) May

Samali was appointed as a Class III director of the Company (with a term expiring at the Company’s 2025 annual meeting of stockholders),

effective immediately.

Neither Mr. Zamani nor Ms. Samali has been appointed

to any board committee, and there is no such committee to which Mr. Zamani or Ms. Samali is currently expected to be appointed.

The resignations of Messrs. Handler, Melicharek,

and Grosse were not the result, in whole or in part, of any disagreement with the Company or its management relating to the respective

operations, policies or practices of the Company.

Appointment

of Mr. Zamani

Mr. Zamani, age 53, is the founder, chairman

and CEO of One Planet Group LLC, a closely held private equity firm focused on operating technology and media companies, an early-stage

investor and a startup business incubator, established in 2015. In 1994, Mr. Zamani co-founded Autoweb.com. Ultimately becoming a

catalyst in the way people bought and sold vehicles, Autoweb made its stock market debut on March 23, 1999. In 2001, Mr. Zamani launched

Reply.com, a performance-based marketing company which in 2015 was relaunched as Buyerlink and is now owned by One Planet Group. In 2020,

Mr. Zamani was honored as a Best CEO for Diversity by Comparably. He received the University of California, Davis Award of Distinction

in 2018, and was granted the Tahirih Justice Center’s Hope Award in 2016. Mr. Zamani graduated from UC Davis with a degree

in environmental toxicology in 1994.

Except for the Investment Agreement, there are

no arrangements or understandings between Mr. Zamani and any other person pursuant to which Mr. Zamani was selected as a director.

In addition, there are no transactions in which Mr. Zamani has an interest that would require disclosure under Item 404(a) of

Regulation S-K.

In

connection with the appointment of Mr. Zamani as the Company’s Chief Executive Officer, Inspirato LLC, the Company’s

operating subsidiary, and Mr. Zamani entered into an Executive Employment Agreement, effective as of August 13, 2024 (the “Zamani

Employment Agreement”). Pursuant to the Zamani Employment Agreement, Mr. Zamani will receive an annual base salary and

certain travel benefits with the Company and be eligible to participate in employee benefit or group insurance plans maintained from time

to time by the Company. Mr. Zamani’s initial base annual salary is $1.00, and he will not be eligible for a cash annual performance

bonus related to any period commencing prior to August 13, 2025. Additionally, the Zamani Employment Agreement provides for the following:

| · | an initial one-time equity grant consisting of 500,000 restricted stock units (“RSUs”),

with 25% of the RSUs subject to the award vest on the one-year anniversary of the date of grant and the remaining 75% of the RSUs subject

to the award vest in quarterly installments over the subsequent three years (the “One-Time Equity Grant”); |

| · | a performance-based equity award of 500,000 RSUs, which will vest in full on the trading day after the

Class A common stock achieves a closing price of $15.00 per share or more over a period of at least 30 consecutive trading days during

the performance period of August 14, 2024 through August 13, 2025 (the “Performance-Based Equity Grant”);

and |

| · | eligibility for ongoing annual equity awards under the Company’s Equity Incentive Plan commensurate

with his position and in accordance with the program applicable to other similarly situated executive officers for periods after August 13,

2025. |

If

Mr. Zamani’s employment is terminated by the Company without Cause (as defined in the Zamani Employment Agreement) or

by Mr. Zamani for Good Reason (as defined in the Zamani Employment Agreement) and Mr. Zamani has completed at least 180 days

as the Chief Executive Officer under the Zamani Employment Agreement, in each case regardless of whether Mr. Zamani continues in

service as a member of the Board, then Mr. Zamani will also become eligible to receive the following benefits:

| · | a lump-sum cash severance payment equal to $1,100,000; and |

| · | immediate accelerated vesting of all of Mr. Zamani’s unvested equity (including any unvested

portion of the One-Time Equity Grant and the Performance-Based Equity Grant), provided that the Performance Based Equity Grant

will only vest if the performance-based targets have been achieved in the aforementioned performance period. |

The

foregoing description of the Zamani Employment Agreement does not purport to be complete and is qualified in its entirety by reference

to the full text of the Zamani Employment Agreement, a copy of which is filed as Exhibit 10.3 to this Current Report on Form 8-K

and incorporated herein by reference.

In accordance with the Company’s customary

practice, the Company will also enter into its standard form of indemnification agreement with Mr. Zamani, which agreement is filed

as Exhibit 10.1 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Appointment of Ms. Samali

Except for the Investment Agreement, there are

no arrangements or understandings between Ms. Samali and any other person pursuant to which she was selected as a director. In addition,

there are no transactions in which Ms. Samali has an interest that would require disclosure under Item 404(a) of Regulation S-K.

In accordance with the Company’s customary

practice, the Company will also enter into its standard form of indemnification agreement with Ms. Samali, which agreement is filed as

Exhibit 10.1 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Handler Separation Agreement

On August 13, 2024, Inspirato LLC and Mr. Handler

entered into a Separation and Release Agreement, effective as of August 13, 2024 (the “Handler Separation Agreement”).

Pursuant to the Handler Separation Agreement, Mr. Handler will be entitled to (i) severance payments in an aggregate gross amount

of $216,000 to be paid in 36 equal bimonthly installments beginning on January 15, 2025; (ii) accelerated vesting of all

Mr. Handler’s unvested equity awards; and (iii) copayment of Mr. Handler’s COBRA premiums for a period of up

to 18 months. In consideration for such benefits, Mr. Handler agreed to a general release of claims in favor of the Company,

and to customary confidentiality and cooperation covenants.

The foregoing summary of the Handler Separation

Agreement is qualified in its entirety by reference to the full text of the Handler Separation Agreement, a copy of which is filed as

Exhibit 10.4 to this Current Report on Form 8-K and is incorporated herein by reference.

Grosse Separation Agreement

On August 13, 2024, Inspirato LLC and Mr. Grosse

entered into a Separation and Release Agreement, effective as of August 13, 2024 (the “Grosse Separation Agreement”).

Pursuant to the Grosse Separation Agreement, Mr. Grosse will be entitled to (i) severance payments in an aggregate gross amount

of $555,000, representing 12 months of Mr. Grosse’s annual base salary to be paid in 36 bimonthly installments in

accordance to the payment schedule provided in the Grosse Separation Agreement; (ii) a one-time grant of 166,667 RSUs, which will

become fully vested on the Company’s quarterly vesting date; and (iii) copayment of Mr. Grosse’s COBRA premiums

for a period of up to 18 months. In consideration for such benefits, Mr. Grosse agreed to a general release of claims in favor

of the Company, and to customary confidentiality and cooperation covenants.

The foregoing summary of the Grosse Separation

Agreement is qualified in its entirety by reference to the full text of the Grosse Separation Agreement, a copy of which is filed as Exhibit 10.5

to this Current Report on Form 8-K and is incorporated herein by reference.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities

Act and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events

or the Company’s future financial or operating performance. In some cases, you can identify forward-looking statements because they

contain words such as “believe,” “may,” “will,” “estimate,” “potential,” “continue,”

“anticipate,” “intend,” “expect,” “could,” “would,” “project,”

“forecast,” “plan,” “intend,” “target,” or the negative of these words or other similar

expressions that concern the Company’s expectations, strategy, priorities, plans, or intentions. Forward-looking statements in this

Current Report on Form 8-K include, but are not limited to, the Company’s ability to consummate the Transactions and satisfy

applicable closing conditions, including the receipt of its stockholders’ approval of the Nasdaq Proposal. The Company’s expectations

and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties,

including changes in the Company’s plans or assumptions, that could cause actual results to differ materially from those projected.

These risks include the risk of the Company’s stockholders not approving the Transactions, the occurrence of any event, change or

other circumstances that could result in the Investment Agreement being terminated or the Transactions not being completed on the terms

reflected in the Investment Agreement, or at all, and uncertainties as to the timing of the consummation of the Transactions; the ability

of each party to consummate the Transactions; and other risks detailed in the Company’s filings with the SEC, including the Company’s

Annual Report on Form 10-K filed with the SEC on March 12, 2024. All information provided in this Current Report on Form 8-K

is as of the date hereof, and the Company undertakes no duty to update this information unless required by law. These forward-looking

statements should not be relied upon as representing the Company’s assessment as of any date subsequent to the date of this Current

Report on Form 8-K.

Additional Information and Where to Find It

The Company, its directors and certain executive

officers are participants in the solicitation of proxies from stockholders in connection with the Special Meeting to approve the Nasdaq

Proposal. The Company plans to file a proxy statement (the “Special Meeting Proxy Statement”) with the SEC in connection

with the solicitation of proxies for the Special Meeting. Additional information regarding such participants, including their direct or

indirect interests, by security holdings or otherwise, will be included in the Special Meeting Proxy Statement and other relevant documents

to be filed with the SEC in connection with the Special Meeting. Information relating to the foregoing can also be found in the Company’s

proxy statement for its 2024 annual meeting of stockholders (the “2024 Proxy Statement”). To the extent that such participants’

holdings of the Company’s securities have changed since the amounts printed in the 2024 Proxy Statement, such changes have been

or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC.

Promptly after filing the definitive Special Meeting

Proxy Statement with the SEC, the Company will mail the definitive Special Meeting Proxy Statement and related proxy card to each stockholder

entitled to vote at the Special Meeting. STOCKHOLDERS ARE URGED TO READ THE SPECIAL MEETING PROXY STATEMENT (INCLUDING ANY AMENDMENTS

OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge, the preliminary and definitive versions of the Special Meeting

Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by the Company with the SEC in connection

with the Special Meeting at the SEC’s website (http://www.sec.gov). Copies of the Company’s definitive Special Meeting Proxy

Statement, any amendments or supplements thereto, and any other relevant documents filed by the Company with the SEC in connection with

the Special Meeting will also be available, free of charge, at the Company’s investor relations website (https://investor.inspirato.com/)

or by writing to the Company at Inspirato Incorporated, 1544 Wazee Street, Denver, Colorado 80202, Attention: Investor Relations.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

|

Description |

| 10.1 |

|

Investment Agreement, dated as of August 12, 2024, between Inspirato Incorporated and One Planet Group LLC |

| 10.2 |

|

Form of Voting Agreement |

| 10.3+ |

|

Executive Employment Agreement, dated as of August 13, 2024, between Inspirato LLC and Payam Zamani |

| 10.4+ |

|

Separation and Release Agreement, dated as of August 13, 2024, between Inspirato LLC and Brad Handler |

| 10.5+ |

|

Separation and Release Agreement, dated as of August 13, 2024, between Inspirato LLC and Eric Grosse |

| 104 |

|

Cover Page Interactive Data File (formatted in Inline XBRL and included as Exhibit 101). |

| + |

Indicates a management contract or any compensatory plan, contract or arrangement. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 15, 2024

| |

INSPIRATO INCORPORATED |

| |

|

| |

By: |

/s/ Robert Kaiden |

| |

|

Name: Robert Kaiden |

| |

|

Title: Chief Financial Officer |

Exhibit 10.1

Execution Version

INVESTMENT AGREEMENT

This INVESTMENT AGREEMENT (this

“Agreement”), dated as of August 12, 2024 is by and between Inspirato Incorporated, a Delaware corporation (the

“Company”), and One Planet Group LLC, a Delaware limited liability company (the “Purchaser”). Capitalized

terms not otherwise defined where used shall have the meanings ascribed thereto in Section 1.01.

WHEREAS, the Purchaser desires

to purchase from the Company, and the Company desires to issue and sell to the Purchaser, the Firm Securities, which shall be issued

in accordance with the terms and subject to the conditions set forth in this Agreement;

WHEREAS, the Company desires

to grant to the Purchaser an option to acquire the Optional Securities upon the terms and subject to the conditions set forth in this

Agreement;

WHEREAS, prior to the execution

hereof, the Board of Directors has approved and authorized the execution and delivery of this Agreement and the other Transaction Agreements

and the consummation of the transactions contemplated hereby and thereby; and

WHEREAS, substantially concurrently

with the execution of this Agreement, certain stockholders of the Company have entered into voting agreements (each, a “Voting

Agreement”) with the Company and the Purchaser, pursuant to which, among other things, such stockholders hold Company Common

Stock representing approximately 49% of the voting power of the Company Common Stock as of the date hereof and have agreed to vote all

of their shares of Company Common Stock in favor of the Nasdaq Proposal.

NOW, THEREFORE, in consideration

of the premises and the representations, warranties and agreements herein contained and intending to be legally bound hereby, the parties

hereby agree as follows:

ARTICLE I

DEFINITIONS

1.01 Definitions.

As used in this Agreement, the following terms shall have the meanings set forth below:

“Affiliate”

shall mean, with respect to any Person, any other Person which directly or indirectly controls or is controlled by or is under common

control with such Person. For the avoidance of doubt, with respect to the Purchaser, (i) the Company (or any of its Affiliates)

shall not be considered an Affiliate of the Purchaser or any of the Purchaser’s Affiliates and (ii) the term Affiliates shall

include the Persons to whom the Subject Securities are transferred on or about the date of the Tranche 1 Closing. As used in this definition,

“control” (including its correlative meanings, “controlled by” and “under common control with”) shall

mean possession, directly or indirectly, of power to direct or cause the direction of management or policies (whether through ownership

of securities or partnership or other ownership interests, by contract or otherwise).

“Alternative Transaction

Proposal” shall mean any indication of interest, inquiry, proposal, agreement or offer, whether or not in writing, from any

Person (other than the Purchaser or its Affiliates) or “group,” within the meaning of Section 13(d) of the Exchange

Act, relating to any transaction or series of transactions that (i) would, or would reasonably be expected to, prevent, materially

impair or materially delay the consummation of the Transactions or (ii) would, or would reasonably be expected to, cause a condition

to the Tranche 1 Closing or the Tranche 2 Closing set forth herein to not be satisfied prior to the applicable Termination Date.

“Available”

means, with respect to a Registration Statement, that such Registration Statement is effective and there is no stop order with respect

thereto and such Registration Statement does not contain an untrue statement of a material fact or omit to state a material fact required

to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not misleading

such that such Registration Statement will be available for the resale of Registrable Securities.

“Beneficially Own,”

or “Beneficially Owned” shall have the meaning set forth in Rule 13d-3 of the rules and regulations promulgated

under the Exchange Act.

“Blackout Period”

means in the event that the Company determines in good faith that any registration or sale pursuant to any registration statement would

reasonably be expected to materially adversely affect or materially interfere with any bona fide financing of the Company or any material

transaction under consideration by the Company or would require disclosure of information that has not been, and is not otherwise required

to be, disclosed to the public, the premature disclosure of which the Board of Directors determines in good faith would reasonably be

expected to materially adversely affect or materially interfere with such bona fide financing of the Company or material transaction

under consideration by the Company or materially adversely affect the Company, a period of up to sixty (60) days; provided that a Blackout

Period may not be called by the Company more than twice in any period of twelve (12) consecutive months and may not be called by the

Company in consecutive fiscal quarters.

“Board of Directors”

shall mean the board of directors of the Company.

“Business Day”

shall mean any day, other than a Saturday, Sunday or a day on which banking institutions in the City of New York, New York are authorized

or obligated by law or executive order to remain closed.

“Code” shall

mean the Internal Revenue Code of 1986, as amended.

“Company Board Recommendation”

shall mean the unanimous recommendation of the Board of Directors to the stockholders of the Company to approve the Nasdaq Proposal.

“Company Class A

Common Stock” shall mean the Class A common stock,

$0.0001 par value per share,

of the Company.

“Company Class B

Common Stock” shall mean the Class B non-voting common stock, $0.0001 par value per share, of the Company.

“Company Class V

Common Stock” shall mean the Class V common stock, $0.0001 par value per share, of the Company.

“Company Common Stock”

shall mean the Company Class A Common Stock, the Company Class B Common Stock and the Company Class V Common Stock.

“Company Covered Person”

means, with respect to the Company as an “issuer” for purposes of Rule 506 of the Securities Act, any Person listed

in the first paragraph of Rule 506(d)(1) of the Securities Act.

“Company Preferred

Stock” shall mean the preferred stock, $0.0001 par value per share, of the Company.

“Company Stockholder

Approval” means the approval of the Nasdaq Proposal at the Company Special Meeting in accordance with the DGCL, the organizational

documents of the Company and the rules and regulations of Nasdaq.

“DGCL” means the General Corporation Law

of the State of Delaware.

“Exchange Act” shall mean the U.S. Securities

Exchange Act of 1934, as amended.

“GAAP” shall

mean U.S. generally accepted accounting principles. “Governmental Entity” shall mean any court, administrative agency

or commission or other governmental authority or instrumentality, whether federal, state, local or foreign, and any applicable industry

self-regulatory organization.

“Material Adverse

Effect” shall mean any events, changes, developments, facts, occurrences or circumstances that, individually or in the aggregate

(x) have had, or would reasonably be expected to have, a material adverse effect on the business, financial condition or results

of operations of the Company or (y) prevent, materially impair or materially delay or would reasonably be expected to prevent, materially

impair or materially delay the ability of the Company to consummate the Transactions, other than, solely in the case of clause (x), any

event, change, development, fact, occurrence or circumstance resulting from or arising out of the following: (a) events, changes,

developments, facts, occurrences or circumstances after the date hereof generally affecting the economy, the financial or securities

markets, or political, legislative or regulatory conditions, in each case in the United States or elsewhere in the world, (b) events,

changes, developments, facts, occurrences or circumstances after the date hereof in the industries in which the Company conducts its

business, (c) any adoption, repeal or modification after the date hereof of any rule, regulation, ordinance, Order, protocol or

any other law of or by any national, regional, state or local Governmental Entity, or market administrator, (d) any changes after

the date hereof in GAAP or accounting standards or interpretations thereof, (e) epidemics, pandemics, earthquakes, any weather-related

or other force majeure event or natural disasters or outbreak or escalation of hostilities or acts of war or terrorism, (f) the

announcement or entry into this Agreement (it being understood and agreed that this clause (f) will not apply with respect to any

representation or warranty the purpose of which is to address the consequences of the announcement or entry into this Agreement), (g) any

taking of any action at the express written request of Purchaser, (h) any failure by the Company to meet any financial projections

or forecasts or estimates of revenues, earnings or other financial metrics for any period (provided that the exception in this clause

(h) shall not prevent or otherwise affect a determination that any event, change, effect, development, fact, occurrence or circumstance

underlying such failure has resulted in a Material Adverse Effect so long as it is not otherwise excluded by this definition) or (i) any

changes in the share price or trading volume of the Company Class A Common Stock (provided that the exception in this clause (i) shall

not prevent or otherwise affect a determination that any event, change, effect, development, fact, occurrence or circumstance underlying

such change has resulted in a Material Adverse Effect so long as it is not otherwise excluded by this definition); except, in each case

with respect to subclauses (a) through (e), to the extent that such event, change or development materially disproportionately affects

the Company relative to other similarly situated companies in the industries in which the Company operates.

“Nasdaq” shall

mean the Nasdaq Stock Market LLC.

“Nasdaq Proposal”

shall mean the proposal to authorize the issuance of the Tranche 2 Shares, the Optional Securities and the Company Common Stock upon

the exercise of the Warrant, to the extent such approval is required under the rules of the Nasdaq, including Nasdaq Rule 5635(b).

“Necessary Action”

means, with respect to a specified result, all actions (to the extent such actions are permitted by law and by the governing documents

of the Company) necessary to cause such result, including (i) voting or providing a written consent or proxy with respect to the

Company Common Stock, (ii) causing the adoption of shareholders’ resolutions and amendments to the governing documents of

the Company, (iii) causing directors (subject to any fiduciary duties that such directors may have as directors) to act in a certain

manner or causing them to be removed in the event they do not act in such a manner, (iv) executing agreements and instruments, and

(v) making, or causing to be made, with governmental, administrative or regulatory authorities, all filings, registrations or similar

actions that are required to achieve such result.

“Order”

shall mean any decision, ruling, order, writ, judgment, injunction, stipulation, determination, decree or award entered by or with any

Governmental Entity.

“Person”

or “person” shall mean an individual, corporation, limited liability or unlimited liability company, association,

partnership, trust, estate, joint venture, business trust or unincorporated organization, or a government or any agency or political

subdivision thereof, or other entity of any kind or nature.

“Proxy Statement”

shall mean the proxy statement to be provided to the Company’s stockholders in connection with the Company Special Meeting.

“Registrable Securities”

shall mean the Subject Securities; provided that any Subject Securities will cease to be Registrable Securities when (a) such Subject

Securities have been sold or otherwise disposed of to a Person that is not an Affiliate of Purchaser (or the Persons to whom the Subject

Securities are transferred on or about the date of the Tranche 1 Closing) or (b) such Subject Securities cease to be outstanding.

“Registration Expenses”

shall mean all expenses incurred by the Company in complying with Article V, including all registration, listing and filing fees,

printing expenses, fees and disbursements of counsel and independent public accountant for the Company, fees and expenses incurred by

the Company in connection with complying with state securities or “blue sky” laws, fees of the Financial Industry Regulatory

Authority, Inc., transfer Taxes, and fees of transfer agents and registrars, and the reasonable and out-of-pocket legal expenses

of one counsel to the Purchaser in the case of an Underwritten Offering but excluding any underwriting fees, discounts and selling commissions

to the extent applicable to the Registrable Securities of the Selling Holders.

“Registration Statement”

shall mean any registration statement of the Company filed or to be filed with the SEC under the rules and regulations promulgated

under the Securities Act, including the related prospectus, amendments and supplements to such registration statement, and including

pre- and post-effective amendments, and all exhibits and all material incorporated by reference in such registration statement.

“Representative”

means, with respect to any Person, such Person’s Affiliates and its and their respective officers, directors, managers, partners,

employees, accountants, counsel, financial advisors, consultants, temporary agency employees, independent contractors, and other advisors,

agents or representatives.

“Rule 144”

shall mean Rule 144 promulgated by the SEC pursuant to the Securities Act, as such rule may be amended from time to time, or

any similar rule or regulation hereafter adopted by the SEC having substantially the same effect as such rule.

“Rule 405”

shall mean Rule 405 promulgated by the SEC pursuant to the Securities Act, as such rule may be amended from time to time, or

any similar rule or regulation hereafter adopted by the SEC having substantially the same effect as such rule.

“SEC” shall

mean the U.S. Securities and Exchange Commission. “Securities Act” shall mean the U.S. Securities Act of 1933, as

amended.

“Solvent”

means, with respect to any Person on any date of determination, that on such date (a) the fair value (to be calculated as the amount

at which the assets (both tangible and intangible), in their entirety, of such Person taken as a whole would change hands between a willing

buyer and a willing seller, within a commercially reasonable period of time, each having reasonable knowledge of the relevant facts,

with neither being under any compulsion to act) of the assets of such Person taken as a whole exceeds the total amount of liabilities

(it being understood that the term “liabilities,” for the purposes of this definition, will be limited to the recorded liabilities

(including contingent liabilities that would be recorded in accordance with GAAP) of such Person taken as a whole, on such date of determination,

determined in accordance with GAAP consistently applied), (b) the present fair salable value (defined as the amount that could be

obtained by an independent willing seller from an independent willing buyer if the assets of such Person taken as a whole are sold with

reasonable promptness in an arm’s-length transaction under present conditions for the sale of comparable business enterprises insofar

as such conditions can be reasonably evaluated) of the assets of such person taken as a whole exceeds their liabilities, (c) such

Person, taken as whole, does not have unreasonably small capital (defined as sufficient capital to reasonably ensure that such Person

will continue to be a going concern for the period from the date of determination through the one-year anniversary of the Tranche 2 Closing

set forth herein, based on the needs and anticipated needs for capital of the business conducted or anticipated to be conducted by such

Person reflected in such Person’s projected financial statements and in light of its anticipated credit capacity), and (d) such

Person and its Subsidiaries, taken as a whole, will be able to pay its liabilities as they mature.

“Subject Securities”

shall mean (i) the Tranche 1 Shares and the Tranche 2 Shares issued pursuant to this Agreement (or transferred to the Persons on

or about the date of the Tranche 1 Closing) and any shares of Company Common Stock issued upon the Option Closing Date; (ii) the

shares of Company Common Stock issuable or issued upon the exercise of the Warrant; and (iii) any securities issued as or pursuant

to (or issuable upon the conversion, exercise or exchange of any warrant, right or other security that is issued as or pursuant to) a

dividend, stock split, combination or any reclassification, recapitalization, merger, consolidation, exchange or any other distribution

or reorganization with respect to, or in exchange for, or in replacement of, the securities referenced in clause (i) or (ii) above

or this clause (iii).

“Subsidiary”

shall mean, with respect to any Person, any other Person of which 50% or more of the shares of the voting securities or other voting

interests are owned or controlled, or the ability to select or elect 50% or more of the directors or similar managers is held, directly

or indirectly, by such first Person or one or more of its Subsidiaries, or by such first Person, or by such first Person and one or more

of its Subsidiaries.

“Tax” or

“Taxes” shall mean all federal, state, local, and foreign income, excise, gross receipts, gross income, ad valorem,

profits, gains, property, capital, sales, transfer, use, license, payroll, employment, social security, severance, unemployment, unclaimed

property, withholding, duties, windfall profits, intangibles, franchise, backup withholding, value-added, alternative or add-on minimum,

estimated and other taxes, charges, levies or like assessments imposed by a Governmental Entity, together with all interest, penalties

and additions to tax imposed with respect thereto.

“Tax Return”

shall mean a report, return, information statement, declaration, claim for refund, election, statement or other document supplied or

required to be supplied to a Governmental Entity with respect to Taxes, including any schedule or attachment thereto, and including any

amendment thereof.

“Third Party”

shall mean a Person other than Purchaser or any of its Affiliates. “Underwritten Offering” shall mean a sale of Registrable

Securities to an underwriter or underwriters for reoffering to the public, including in a block trade offered and sold through an underwriter

or underwriters.

1.02 General

Interpretive Principles. Whenever used in this Agreement, except as otherwise expressly provided or unless the context otherwise

requires, any noun or pronoun shall be deemed to include the plural as well as the singular and to cover all genders. The name assigned

to this Agreement and the section captions used herein are for convenience of reference only and shall not be construed to affect the

meaning, construction or effect hereof. Whenever the words “include,” “includes,” or “including”

are used in this Agreement, they shall be deemed to be followed by the words “without limitation.” The word “will”

shall be construed to have the same meaning as the word “shall.” The words “include,” “includes”

and “including” shall be deemed to be followed by the phrase “without limitation.” The word “extent”

in the phrase “to the extent” shall mean the degree to which a subject or other thing extends, and such phrase shall not

mean simply “if.” The word “or” shall not be exclusive. Unless otherwise specified, the terms “hereto,”

“hereof,” “herein” and similar terms refer to this Agreement as a whole (including the exhibits, schedules and

disclosure statements hereto), references to “the date hereof” refer to the date of this Agreement and references herein

to Articles or Sections refer to Articles or Sections of this Agreement. References from or through any date mean, unless otherwise specified,

from and including such date or through and including such date, respectively. References to any period of days will be deemed to be

the relevant number of calendar days unless otherwise specified and if the last day of such period is not a Business Day, the period

shall end on the next succeeding Business Day. This Agreement shall be construed without regard to any presumption or rule requiring

construction or interpretation against the party drafting or causing any instrument to be drafted.

ARTICLE II

SALE AND PURCHASE OF THE SECURITIES

2.01 Sale

and Purchase of the Tranche 1 Securities. Subject to the terms and conditions of this Agreement, at the Tranche 1 Closing, the Company

shall issue and sell to the Purchaser, and the Purchaser shall purchase and acquire from the Company, 1,335,271 shares of Class A

Common Stock (the “Tranche 1 Shares” or the “Tranche 1 Securities”) for an aggregate purchase price

of four million five hundred seventy-nine thousand nine hundred seventy-nine dollars and fifty-three cents ($4,579,979.53) (such price,

the “Tranche 1 Purchase Price,” and such transaction, the “Tranche 1 Purchase”).

2.02 Sale

and Purchase of the Tranche 2 Securities. Subject to the terms and conditions of this Agreement, at the Tranche 2 Closing, the Company

shall issue and sell to the Purchaser, and the Purchaser shall purchase and acquire from the Company, 1,580,180 shares of Class A

Common Stock (the “Tranche 2 Shares”) and the Warrant, in the form attached hereto as Exhibit A (the “Warrant”

and, together with the Tranche 2 Shares, the “Tranche 2 Securities”), for an aggregate purchase price of five million

four hundred twenty thousand twenty dollars and forty- seven cents ($5,420,020.47) (such price, the “Tranche 2 Purchase Price,”

and such transaction, the “Tranche 2 Purchase”). The Tranche 1 Securities and the Tranche 2 Securities are referred

to collectively as the “Firm Securities”, and the Tranche 1 Purchase Price and the Tranche 2 Purchase Price are referred

to collectively as the “Purchase Price”.

2.03

Closing.

(a) The

closing of the Tranche 1 Purchase (the “Tranche 1 Closing”) shall take place on August 13, 2024 or as soon as

practicable thereafter following the satisfaction or waiver (to the extent permitted by applicable law) of all of the conditions set

forth in this Article II (other than such conditions that by their nature are to be satisfied at the Closing, but subject to the

satisfaction or waiver of such conditions at or prior to the Closing). The closing of the Tranche 2 Purchase (the “Tranche 2

Closing”, with each of the Tranche 1 Closing and the Tranche 2 Closing being referred to as a “Closing”)

shall take place on September 13, 2024, or as soon as practicable thereafter following the satisfaction or waiver (to the extent

permitted by applicable law) of all of the conditions set forth in this Article II (other than such conditions that by their nature

are to be satisfied at the Closing, but subject to the satisfaction or waiver of such conditions at or prior to the Closing) (the date

on which each Closing actually occurs, the “Tranche 1 Closing Date” or the “Tranche 2 Closing Date”,

as applicable, with each being referred to as a “Closing Date”), by electronic exchange of deliverables, unless another

date, time or place is agreed to in writing by the parties hereto.

(b) At

the Tranche 1 Closing, (i) the Company shall issue to the Purchaser the Tranche 1 Shares, (ii) the Purchaser shall cause a

wire transfer to be made in immediately available funds to an account of the Company designated in writing by the Company to the Purchaser

in an amount equal to the Tranche 1 Purchase Price and (iii) the Purchaser shall deliver to the Company a duly completed and executed

Internal Revenue Service Form W-9 or Form W-8, as applicable.

(c) At

the Tranche 2 Closing, (i) the Company shall issue to the Purchaser the Tranche 2 Shares, (ii) the Company shall execute and

deliver to the Purchaser the Warrant, (iii) the Company and the Purchaser shall execute one or more certificates dated as of the

date of the Tranche 2 Closing that the respective conditions to such closing have been satisfied as of such date and (iv) the Purchaser

shall cause a wire transfer to be made in immediately available funds to an account of the Company designated in writing by the Company

to the Purchaser in an amount equal to the Tranche 2 Purchase Price.

(d) Neither

party shall be obligated to effect the Tranche 1 Purchase or the Tranche 2 Purchase, as applicable, if (i) a statute, rule or

regulation that prohibits such purchase shall have been enacted, issued, enforced or promulgated and remains in effect by any Governmental

Entity or if there shall be an Order or injunction of a court of competent jurisdiction prohibiting or making illegal the consummation

of such purchase or (ii) in the case of the Tranche 2 Purchase, the Nasdaq Proposal has not been approved.

(e) The

obligations of the Purchaser to effect the Tranche 1 Purchase or the Tranche 2 Purchase, as applicable, are subject to the satisfaction

or written waiver by the Purchaser of the following conditions as of the applicable Closing:

(i) (A) the

representations and warranties of the Company set forth in Section 3.01(a), Section 3.01(c), Section 3.01(g), Section 3.01(h)(i),

Section 3.01(t) and Section 3.01(aa) shall be true and correct in all material respects on and as of the date hereof and

the relevant Closing Date, (B) the representations and warranties of the Company set forth in Section 3.01(b) shall be

true and correct in all respects on and as of the date hereof (other than de minimis inaccuracies), (C) the representations

and warranties of the Company set forth in Section 3.01(j)(ii) shall be true and correct on and as of the date hereof and the

relevant Closing Date and (D) the other representations and warranties of the Company set forth in Section 3.01 shall be true

and correct on and as of the date hereof and the relevant Closing Date (without giving effect to materiality, Material Adverse Effect,

or similar phrases in the representations and warranties), except where the failure of such representations and warranties referenced

in this clause (C) to be so true and correct, individually or in the aggregate, has not had and would not reasonably be expected

to have a Material Adverse Effect;

(ii) the

Company shall have entered into Voting Agreements in respect of Company Common Stock that represent at least 35% of the voting power

of the Company Common Stock outstanding as of the Tranche 1 Closing Date; and

(iii) the

Company shall have performed and complied in all material respects with all agreements and obligations required by this Agreement to

be performed or complied with by it on or prior to the Closing Date.

(f) The

obligations of the Company to effect the each of the Tranche 1 Purchase and the Tranche 2 Purchase are subject to the satisfaction or

waiver by the Company of the following conditions as of the relevant Closing:

(i) (A) the

representations and warranties of the Purchaser set forth in Section 3.02(a), Section 3.02(b)(i), Section 3.02(b)(iii) and

Section 3.02(e) shall be true and correct in all material respects on and as of the date hereof and the relevant Closing Date,

and (B) the other representations and warranties of the Purchaser set forth in Section 3.02 shall be true and correct on and as

of the date hereof and the relevant Closing Date (without giving effect to materiality or similar phrases in the representations and

warranties), except where the failure of such representations and warranties referenced in this clause (B) to be so true and correct,

individually or in the aggregate, would not reasonably be expected to prevent, materially impair or materially delay the ability of the

Purchaser to consummate the Transactions; and

(ii) the

Purchaser shall have performed and complied in all material respects with all agreements and obligations required by this Agreement to

be performed or complied with by it on or prior to the relevant Closing Date.

2.04 Termination

of Prior to Closing. The Tranche 1 Purchase and the Tranche 2 Purchase may be abandoned at any time prior to the relevant Closing

(provided that if the Tranche 1 Purchase has been consummated, the following shall apply only to the Tranche 2 Purchase and the Optional

Securities):

(a) upon

the mutual written agreement of the Purchaser and the Company, with the approval of the Board of Directors;

(b) by

either the Purchaser or the Company, if a court of competent jurisdiction or other Governmental Entity shall have issued an Order or

ruling or taken any other action, and such Order or ruling or other action will have become final and non-appealable, or there will exist

any statute, rule or regulation, in each case, permanently restraining, enjoining or otherwise prohibiting the consummation of the

Tranche 1 Purchase or the Tranche 2 Purchase, as applicable, provided, however, that the right to terminate this Agreement in accordance

with this Section 2.04(b) will not be available to any party whose failure to comply with its obligations under this Agreement

has been the primary cause of such restraint or the failure to remove such restraint;

(c) upon

the failure of the Tranche 1 Closing to occur on or prior to the date this is five (5) days after the date of this Agreement or,

with respect to the Tranche 2 Closing, the failure of such Closing to occur on or prior to the date that is sixty (60) days after the

date of this Agreement (unless otherwise mutually agreed by the Company and Purchaser in writing) (each, a “Termination Date”);

provided, however, that the right to terminate this Agreement under this Section 2.04(c) shall not be available to any party

whose failure to comply with its obligations under this Agreement has been the primary cause of the failure of the relevant Closing to

occur on or before such time;

(d) by

Purchaser, if, prior to the relevant Closing, there has been a breach by the Company of, or any inaccuracy in, any representation, warranty,

covenant or other agreement of the Company set forth in this Agreement such that a condition set forth in Section 2.03(e) would

not be then satisfied and such breach or inaccuracy has not been cured within fifteen (15) days following notice by the Purchaser thereof

or such breach or inaccuracy is not reasonably capable of being cured; provided that the Purchaser will not be entitled to terminate

this Agreement pursuant to this Section 2.04(d) at any time as of which the Purchaser is in breach of any representation, warranty,

covenant or agreement such that a condition set forth in Section 2.03(f) would not be then satisfied, measured as of such time;

or

(e) by

the Company if, prior to the relevant Closing, there has been a breach by the Purchaser of, or any inaccuracy in, any representation,

warranty, covenant or other agreement of the Purchaser set forth in this Agreement such that a condition set forth in Section 2.03(f) would

not be then satisfied and such breach or inaccuracy has not been cured within fifteen (15) days following notice by the Company thereof

or such breach or inaccuracy is not reasonably capable of being cured; provided that the Company will not be entitled to terminate this

Agreement pursuant to this Section 2.04(e) at any time as of which the Company is in breach of any representation, warranty,

covenant or agreement such that a condition set forth in Section 2.03(e) would not be then satisfied, measured as of such time.

Any termination of this Agreement

in accordance with this Section 2.03 will be effective immediately upon the delivery of a written notice of the terminating party

to Purchaser, if the Company is the terminating party, or to the Company, if the Purchaser is the terminating party. If this Agreement

is terminated in accordance with this Section 2.03, this Agreement will become null and void and be of no further force or effect

with respect to all of the Securities or, as applicable, the Tranche 2 Securities and the Optional Securities, and there will be no liability

on the part of any party hereto (or any of their respective Representatives); provided, however, that (x) this paragraph of this

Section 2.04 shall survive any such termination, (y) nothing herein will relieve any party from liability for fraud in the

making of any of its representations and warranties set forth in this Agreement or willful breach of any of its covenants or agreements

set forth in this Agreement prior to such termination and (z) if the termination applies only to the Tranche 2 Securities and the

Optional Securities, the terms of this Agreement will remain in effect insofar as they relate to the Tranche 1 Securities.

2.05 Option

to Purchase Additional Shares. In addition, the Purchaser shall have the option to purchase up to 728,863 additional shares of Class A

Common Stock and warrants to purchase an additional 728,863 shares of Class A Common Stock (the securities so purchased being referred

to as the “Optional Securities”) for up to an aggregate purchase price of $2,500,000 (the “Option”)

where the purchase price for each share of Class A Common Stock will be the same per share purchase price as in the Tranche 1 Purchase

and where the Company will deliver a number of warrants equal to the number of shares of Class A Common Stock being purchased as

part of the Option. Such warrants shall have the same terms as issued in the Warrant (and may be included in the Warrant) except such

warrants will not contain a limitation on exercise relating to stockholder approval of the Nasdaq Proposal. The Option may be exercised

by the Purchaser on a one-time basis at any time after the Tranche 2 Closing and prior to the date (the “Option Expiration Date”)

that is thirty (30) days after the date of the Tranche 2 Closing (it being understood that such exercise shall be at the sole discretion

of the Purchaser and without regard to any condition, including, for the avoidance of doubt, any requirement for pre-clearance under

the Company’s insider trading policy) (such exercise date, the “Option Notice Date”), in whole or in part, upon

notice by the Purchaser to the Company (the “Option Notice”) setting forth the aggregate purchase price of the Optional

Securities as to which the Purchaser is exercising the Option (the “Option Purchase Amount”), the corresponding number

of Optional Securities to be issued and the time and date of payment and delivery for the Optional Securities. The time and date of delivery

of the Optional Securities (the “Option Closing Date” and such closing, the “Option Closing”) shall

be determined by the Purchaser in its sole discretion but shall not be earlier than the date of the Tranche 2 Closing Date and shall

not be later than five (5) Business Days following Purchaser’s delivery of the Option Notice. The number of shares of Class A

Common Stock being purchased by the Purchaser at the Option Closing shall be a number equal to (i) the Option Purchase Amount divided

by (ii) the per share purchase price in the Tranche 1 Purchase (rounded down to the nearest whole share). At the Option Closing,

(i) the Company shall issue to the Purchaser the Optional Securities, (ii) the Company and the Purchaser shall execute one

or more certificates dated as of the date of the Option Closing that the respective conditions to such closing have been satisfied as

of such date and (iii) the Purchaser shall cause a wire transfer to be made in immediately available funds to an account of the

Company designated in writing by the Company to the Purchaser in an amount equal to the Option Purchase Amount. Neither party shall be

obligated to effect the Option Closing if a statute, rule or regulation that prohibits the Option Closing shall have been enacted,

issued, enforced or promulgated and remains in effect by any Governmental Entity or if there shall be an Order or injunction of a court

of competent jurisdiction prohibiting or making illegal the consummation of the Option Closing. The obligations of the Purchaser to effect

the Option Closing are subject to the satisfaction or written waiver by the Purchaser of the conditions as of the Option Closing set

forth in Section 2.03(e)(i) and (iii) where references therein to “Closing Date” shall be deemed to be references

to “Option Closing Date”. The obligations of the Company to effect the Option Closing are subject to the satisfaction or

waiver by the Company of the conditions set forth in 2.04(f)(i) and (ii) where references therein to “Closing Date”

shall be deemed to be references to “Option Closing Date”. For purposes of this Agreement, except as the context otherwise

indicates, all references to Securities shall be deemed to refer to the Firm Securities with respect to the Tranche 1 Closing and the

Tranche 2 Closing, and shall be deemed to refer to the Optional Securities with respect to the Option Closing. The Purchaser agrees that

if the Purchaser does not exercise the Option as contemplated by this Section 2.05 by the end of the day on the Option Expiration

Date, the Company, as directed by the Board, may offer the Optional Securities to other parties.

ARTICLE III

REPRESENTATIONS AND WARRANTIES

3.01 Representations

and Warranties of the Company. Except as disclosed in the Company Reports filed with or furnished to the SEC and publicly available

prior to the date hereof (excluding in each case any general disclosures set forth in the risk factors or “forward-looking statements”

sections of such reports, and any other general disclosures included therein to the extent they are predictive or forward-looking in

nature), the Company represents and warrants to the Purchaser, as of the date hereof, as of the Closing Date and as of the Option Closing

Date, as follows:

(a) Existence

and Power. The Company is duly organized, validly existing and in good standing under the laws of the jurisdiction of its formation

and has all requisite corporate power and authority to own, operate and lease its properties and to carry on its business as it is being

conducted on the date of this Agreement, and, except as would not, individually or in the aggregate, reasonably be expected to have a

Material Adverse Effect, has been duly qualified as a foreign corporation for the transaction of business and is in good standing under

the laws of each other jurisdiction in which it owns or leases properties, or conducts any business so as to require such qualification.

The Company is not in material breach of its organizational documents.

(b)

Capitalization.

(i) The

authorized share capital of the Company consists of 80,000,000 shares of Company Common Stock (consisting of 50,000,000 shares of Company

Class A Common Stock, 25,000,000 shares of Company Class V Common Stock, and 5,000,000 shares of Company Class B Common

Stock) and 5,000,000 shares of Company Preferred Stock. As of August 8, 2024, there were 3,818,727 shares of Company Class A

Common Stock, 2,857,635 shares of Company Class V Common Stock, no shares of Company Class B Common Stock and no shares of

Company Preferred Stock issued and outstanding. As of August 8, 2024, there were (a) no shares of Company Class A Common

Stock underlying Company restricted stock awards, (b) options to purchase an aggregate of 150,940 shares of Company Common Stock

at an exercise price of $15.60 per share issued and outstanding, (c) 869,021 shares of Company Class A Common Stock underlying

the Company’s restricted stock unit awards, (d) 8,624,792 shares of Company Class A Common Stock underlying the Company’s

warrants that are listed on the Nasdaq, which warrants have an exercise price of $230.00 per share (the “Public Warrants”)

and 884,733 shares of Company Class A Common Stock issuable upon conversion of the Company’s 8% Senior Secured Convertible

Note (the “Capital One Note”). Since August 8, 2024, (a) the Company has only issued options, shares of

restricted stock or restricted stock units to acquire shares of Company Common Stock in the ordinary course of business consistent with

past practice and (b) the only shares of capital stock issued by the Company were pursuant to restricted stock, outstanding options

or restricted stock units to purchase shares of Company Common Stock or issuances of shares of Company Class A Common Stock in exchange

for shares of Company Class V Common Stock and common units of Inspirato LLC (“OpCo”) in accordance with the

organizational documents of the Company and the OpCo LLCA (as defined below). All outstanding shares of Company Common Stock are duly

authorized, validly issued, fully paid and nonassessable, and are not subject to and were not issued in violation of any preemptive or

similar right, purchase option, call or right of first refusal or similar right. Except as set forth above, the Company does not have

any issued and outstanding securities. Except as provided in this Agreement (including the Warrant and the Optional Securities) or the

Eleventh Amended and Restated Limited Liability Company Agreement of OpCo, dated October 16, 2023 (the “OpCo LLCA”),

the Public Warrants and the Capital One Note and except as set forth in or contemplated by this Section 3.01(b)(i), there are no

existing options, warrants, calls, preemptive (or similar) rights, subscriptions or other rights, agreements or commitments obligating

the Company to issue, transfer or sell, or cause to be issued, transferred or sold, any capital stock of the Company or any securities

convertible into or exchangeable for such capital stock and there are no current outstanding contractual obligations of the Company to

repurchase, redeem or otherwise acquire any of its shares of capital stock.

(c) Authorization.

The execution, delivery and performance of this Agreement, the Warrant and the Voting Agreements (the “Transaction Agreements”)

and the consummation of the transactions contemplated herein and therein (collectively, the “Transactions”) have been

duly authorized by the Board of Directors and all other necessary corporate action on the part of the Company other than the receipt

of the Company Stockholder Approval. The execution, delivery and performance of each Transaction Agreement and the consummation of the

Transactions contemplated thereby has been duly authorized by the governing body of the Company and all other necessary corporate action

on the part of the Company. Assuming this Agreement constitutes the valid and binding obligation of the Purchaser, this Agreement is

a valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, subject to the limitation

of such enforcement by (A) the effect of bankruptcy, insolvency, reorganization, receivership, conservatorship, arrangement, moratorium

or other laws affecting or relating to creditors’ rights generally, (B) the rules governing the availability of specific

performance, injunctive relief or other equitable remedies and general principles of equity, regardless of whether considered in a proceeding

in equity or at law and (C) public policy limitations on indemnification, advancement and contribution (the “Enforceability

Exceptions”). Pursuant to resolutions previously provided to the Purchaser, the Board of Directors has, by resolutions unanimously

adopted by the Board of Directors: (i) determined that the Tranche 1 Purchase, the Tranche 2 Purchase and the other Transactions

are advisable and in the best interests of the Company and the Company’s stockholders; (ii) approved and declared it advisable

to enter into this Agreement and the other Transaction Agreements; (iii) directed that the Nasdaq Proposal be submitted to a vote

of the Company’s stockholders at the Company Special Meeting; and (iv) resolved to recommend that that the Company stockholders

approve the Nasdaq Proposal. The Company Board Recommendation has not been amended, rescinded or modified. Approval of the Nasdaq Proposal

at the Company Special Meeting requires the affirmative vote of a majority of the voting power of the shares of Company Common Stock

(not including the Class B Common Stock) present in person or represented by proxy at the Company Special Meeting and entitled to

vote on the Nasdaq Proposal.

(d) General

Solicitation; No Integration. Neither the Company nor any other Person or entity authorized by the Company to act on its behalf has

engaged in a general solicitation or general advertising (within the meaning of Regulation D of the Securities Act) of investors in connection

with the offer or sale of the Securities. The Company has not, directly or indirectly, sold, offered for sale, solicited offers to buy

or otherwise negotiated in respect of, any security (as defined in the Securities Act) which, to its knowledge, is or will be integrated

with the Securities sold pursuant to this Agreement.

(e) No

Registration. Assuming the accuracy of the representations of the Purchaser set forth herein, no registration under the Securities

Act is required for the offer and sale of the Securities by the Company to the Purchaser in the manner contemplated by this Agreement.

The Securities are not being offered in a manner involving a public offering under, or in a distribution in violation of, the Securities

Act, or any state securities laws.

(f) No

Disqualification Event. No disqualifying event described in Rule 506(d)(1)(i-viii) of the Securities Act (a “Disqualification

Event”) is applicable to the Company or, to the Company’s knowledge, any Company Covered Person, except for a Disqualification

Event as to which Rule 506(d)(2)(ii-iv) or (d)(3) of the Securities Act is applicable. The Company has complied, to the extent

applicable, with any disclosure obligations under Rule 506(e) under the Securities Act.

(g) Valid

Issuance. The Securities have been duly authorized by all necessary corporate action of the Company. When issued and sold against

receipt of the consideration therefor, the Warrant will be a valid and legally binding obligation of the Company, enforceable in accordance

with its terms, subject to the limitation of such enforcement by the Enforceability Exceptions. The Company has available for issuance

the maximum number of shares of Company Common Stock issuable upon exercise of the Warrant. All of the shares of Company Common Stock

to be issued upon exercise of the Warrant have been duly authorized and will, upon such issuance, be validly issued, fully paid and nonassessable

and free of pre-emptive or similar rights.

(h) Non-Contravention/No

Consents. The execution, delivery and performance of the Transaction Agreements, the issuance of the shares of Company Common Stock

upon exercise of the Warrant in accordance with its terms and the consummation by the Company of the Transactions, does not conflict

with, violate or result in a breach of any provision of, or constitute a default under, or result in the termination of or accelerate

the performance required by, or result in a right of termination or acceleration under, (i) the certificate of incorporation, bylaws,

limited liability company agreement, operating agreement, partnership agreement or other applicable organizational documents of the Company,

(ii) any mortgage, note, indenture, deed of trust, lease, license, loan agreement or other agreement binding upon the Company or

(iii) any permit, license, judgment, order, decree, ruling, injunction, statute, law, ordinance, rule or regulation applicable

to the Company, other than in the cases of clauses (ii) and (iii) as would not, individually or in the aggregate, reasonably

be expected to have a Material Adverse Effect. Assuming the accuracy of the representations of the Purchaser set forth herein, other

than (A) requirements or regulations in connection with the issuance of shares of Company Common Stock upon the exercise of the

Warrant, (B) any required filings pursuant to the Exchange Act or the rules of the SEC or Nasdaq or (C) as have been obtained

prior to the date of this Agreement, no consent, approval, order or authorization of, or registration, declaration or filing with, any

Governmental Entity is required on the part of the Company in connection with the execution, delivery and performance by the Company

of the Transaction Documents and the consummation by the Company of the Transactions, except for any consent, approval, order, authorization,

registration, declaration, filing, exemption or review the failure of which to be obtained or made, individually or in the aggregate,

would not reasonably be expected to have a Material Adverse Effect.

(i)

Reports; Financial Statements.

(i) The

Company has filed or furnished, as applicable, (A) its annual report on Form 10-K for the fiscal year ended December 31,