0001659323false00-000000000016593232024-10-282024-10-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 28, 2024 |

Iterum Therapeutics plc

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Ireland |

001-38503 |

Not applicable |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

Fitzwilliam Court 1st Floor Leeson Close |

|

Dublin 2, , Ireland |

|

Not applicable |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: +353 1 6694820 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Ordinary Shares, par value $0.01 per share |

|

ITRM |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Pursuant to the License Agreement, dated November 18, 2015, by and among of Iterum Therapeutics plc (the “Company”), Iterum Therapeutics International Limited (“ITIL”) and Pfizer Inc. (“Pfizer” and such agreement, the “Pfizer License Agreement”), ITIL agreed to make a regulatory milestone payment of $20.0 million to Pfizer (the “Milestone Payment”) upon the approval of oral sulopenem for commercial sale in the United States by the U.S. Food and Drug Administration (“FDA”). The Company had the option to deliver notice of its election to defer such payment for up to two years from the date of such approval and a promissory note issued by ITIL in the amount of the Milestone Payment to Pfizer (the “Note”) within 30 calendar days of such approval. On October 25, 2024, the Company received FDA approval for ORLYNVAH™ (sulopenem etzadroxil and probenecid) for the treatment of uncomplicated urinary tract infections caused by the designated microorganisms Escherichia coli, Klebsiella pneumoniae, or Proteus mirabilis in adult women who have limited or no alternative oral antibacterial treatment options. On October 28, 2024, the Company notified Pfizer that it was electing to defer payment of the Milestone Payment for two years, or until October 25, 2026 (such period, the “Deferral Period”), and delivered the Note to Pfizer.

The Note bears interest at an annual rate of eight percent (8%) on a daily compounded basis until paid in full and matures on October 25, 2026. ITIL has the right to prepay the unpaid principal balance of the Note together with accrued and unpaid interest at any time without premium or penalty. Pursuant to the terms of the Note, ITIL may (i) assign the Note to an affiliate of ITIL; (ii) designate one of its affiliates to perform its obligations thereunder; or (iii) assign the Note in the event of a change of control, provided that in the case of clauses (i) and (ii) ITIL is not relieved of any liability thereunder. Pursuant to the terms of the Pfizer License Agreement, if a change of control of ITIL or the Company occurs during the Deferral Period, Pfizer may, in its sole discretion and at its sole option, declare the Milestone Payment to be immediately due and payable together with all interest accrued under the Note. The Company has guaranteed all of the amounts payable by ITIL under the terms of the Pfizer License Agreement, including the amounts owed under the Note, pursuant to the guarantee entered into by ITIL, the Company and Pfizer on November 18, 2015 in connection with the Pfizer License Agreement.

The foregoing description of the Note does not purport to be complete and is qualified by reference to the full text of the Note, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Iterum Therapeutics plc |

|

|

|

|

Date: |

November 1, 2024 |

By: |

/s/ Corey N. Fishman |

|

|

|

Corey N. Fishman

Chief Executive Officer |

EXHIBIT 10.1

PROMISSORY NOTE

$20,000,000 Dated: October 28, 2024

FOR VALUE RECEIVED, the undersigned Iterum Therapeutics International Limited, a company organized and existing under the laws of Ireland having its registered office address at Fitzwilliam Court, 1st Floor, Leeson Close, Dublin 2 (together with its permitted successors and assigns, "Maker"), hereby promises to pay to the order of Pfizer Inc., a corporation organized and existing under the laws of Delaware with offices at 235 East 42nd Street, New York, NY 10017 (together with its successors and any subsequent holder of this Note being referred to as "Payee"), the principal sum of $20,000,000, together with accrued and unpaid interest thereon, on October 25, 2026 (as defined in the Pfizer License)] (the "Maturity Date"). Interest on the principal of this Note from time to time outstanding shall accrue daily from the date of this Note until this Note is paid in full at a per annum interest rate equal to eight percent (8%), compounded daily. Interest on this Note shall be calculated at a rate per annum based upon the actual number of days elapsed over a year of 360 days.

This Note is issued pursuant to Section 5.4.1 of the license agreement November 18, 2015, between Maker, Payee and Iterum Therapeutics plc (the "Pfizer License").

Maker shall have the right from time to time and at any time prior to the Maturity Date to prepay, in whole or part, the unpaid principal balance of this Note, together with accrued and unpaid interest thereon, without premium or penalty. Upon any pre-payment of this Note, the accrued and unpaid interest on the principal of this Note being pre-paid shall be immediately due and payable and shall be paid at the time of any pre-payment of this Note. Any pre-payment of this Note shall be applied first to the payment of accrued and unpaid interest on the principal amount of this Note being pre paid and the remainder, if any, shall be applied to principal.

If, on the Maturity Date, the principal of and interest on this Note has not been received by the Payee in accordance with the terms hereof, then all of the principal of and interest on this Note shall mature and become at once due and payable without further notice, demand or presentment for payment, together with all reasonable and actually incurred costs incurred by the Payee in the enforcement and collection of this Note.

Notwithstanding anything contained herein to the contrary, this Note is hereby expressly limited so that in no contingency or event whatsoever, shall the amount paid or agreed to be paid to Payee for the use, forbearance or detention of money exceed the highest lawful rate permissible under applicable law. If, from any circumstances whatsoever, Payee shall ever receive as interest hereunder an amount that would exceed the highest lawful rate applicable to Maker, such amount that would be excessive interest shall be applied to the reduction of the unpaid principal balance of the indebtedness evidenced hereby and not to the payment of interest, and if the principal amount of this Note is paid in full, any remaining excess shall forthwith be paid to Maker, and in such event, Payee shall not be subject to any penalties provided by any laws for contracting for, charging, taking, reserving or receiving interest in excess of the highest lawful rate permissible under applicable law.

Maker and each surety, endorser, guarantor, and other party now or hereafter liable for payment of this Note, severally waive demand, presentment for payment, notice of dishonor, protest, notice of protest, diligence in collecting or bringing suit against any party liable hereon, and further agree to any and all extensions, renewals, modifications, partial payments, substitutions of evidence of indebtedness, and the taking or release of any collateral with or without notice before or after demand by Payee for payment hereunder. All sums payable hereunder will be payable by Maker to Payee in lawful money of the United States of America and in immediately available funds.

In the event this Note is placed in the hands of any attorney for collection or

suit is filed hereon or if proceedings are had in bankruptcy, receivership, reorganization, or other legal or judicial proceedings for the collection hereof, Maker and any guarantor hereby jointly and severally agree to pay to Payee all expenses and costs of collection, including, but not limited to, reasonable attorneys' fees incurred in connection with any such collection, suit, or proceeding, in addition to the principal and interest then due.

Time is of the essence with respect to all of Maker's obligations and agreements under this Note.

THIS NOTE SHALL BE GOVERNED BY THE LAWS OF THE STATE OF NEW YORK, WITHOUT REGARD TO CHOICE OF LAW PRINCIPLES THEREOF, AND MAKER CONSENTS TO JURISDICTION IN THE COURTS LOCATED IN NEW YORK CITY, NEW YORK.

All of the covenants, obligations, promises and agreements contained in this Note made by Maker shall be binding upon its permitted successors and assigns. Maker shall not allow or cause this Note to be assumed, or assign, delegate or otherwise transfer this Note or any of its rights, interests or obligations hereunder without the prior written consent of Payee; excepting, however, and notwithstanding anything in this Note to the contrary, that Maker may, without the consent of Payee, (a) assign any or all of its rights and interests hereunder to one or more of its Affiliates (as defined in the Pfizer License), or (b) designate one or more of its Affiliates to perform its obligations hereunder, in each of subsection (a) and (b), so long as the Maker is not relieved of any liability or obligation hereunder, or (c) assign this Note in the event of a Change of Control of Maker (as defined in the Pfizer License).

MAKER'S OBLIGATION TO MAKE PAYMENTS UNDER THIS NOTE IS ABSOLUTE AND UNCONDITIONAL. MAKER WAIVES ANY AND ALL RIGHT OF SET-OFF OR SIMILAR DEFENSES OR COUNTERCLAIMS WITH RESPECT TO THE PAYMENT OF AMOUNTS UNDER THIS NOTE THAT MAKER MAY NOW OR HEREINAFTER HAVE AGAINST PAYEE OR ANY OTHER PERSON OR ENTITY, OR AGAINST ANY AMOUNTS UNDER THIS NOTE.

IN WITNESS WHEREOF, the undersigned has executed this Note effective the day and year first written above.

ITERUM THERAPEUTICS INTERNATIONAL LIMITED

By: /s/ Corey N. Fishman

Name: Corey N. Fishman

Title: Director

v3.24.3

Document And Entity Information

|

Oct. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 28, 2024

|

| Entity Registrant Name |

Iterum Therapeutics plc

|

| Entity Central Index Key |

0001659323

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38503

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Address, Address Line One |

Fitzwilliam Court

|

| Entity Address, Address Line Two |

1st Floor

|

| Entity Address, Address Line Three |

Leeson Close

|

| Entity Address, City or Town |

Dublin 2

|

| Entity Address, Country |

IE

|

| Entity Address, Postal Zip Code |

Not applicable

|

| City Area Code |

+353

|

| Local Phone Number |

1 6694820

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary Shares, par value $0.01 per share

|

| Trading Symbol |

ITRM

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

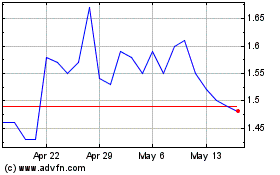

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Mar 2025 to Apr 2025

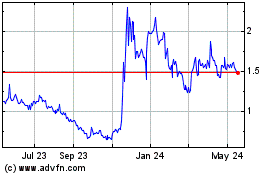

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Apr 2024 to Apr 2025