0001659323false00-000000000016593232024-12-102024-12-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 10, 2024 |

Iterum Therapeutics plc

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Ireland |

001-38503 |

Not applicable |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

Fitzwilliam Court 1st Floor Leeson Close |

|

Dublin 2, , Ireland |

|

Not applicable |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: +353 1 6694820 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Ordinary Shares, par value $0.01 per share |

|

ITRM |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On December 10, 2024, Iterum Therapeutics plc (the “Company”) filed with the Securities and Exchange Commission a prospectus supplement (the “Prospectus Supplement”) under the Company’s effective registration statement on Form S-3 (the “Registration Statement”) (File No. 333-267795), relating to the offer and sale of the Company’s ordinary shares, nominal value $0.01 per share, from time to time for additional aggregate gross proceeds of up to $25.0 million (the “Shares”), under its existing at the market offering agreement, dated October 7, 2022 (the “Sales Agreement”), with H.C. Wainwright & Co., LLC, as sales agent.

As of the date of the Prospectus Supplement, the Company previously issued and sold ordinary shares for an aggregate gross sale proceeds of approximately $16.0 million pursuant to the Sales Agreement and a prior prospectus, dated October 7, 2022, as amended and supplemented by the Company’s prospectus supplements filed on October 11, 2024, October 28, 2024 and October 30, 2024.

A&L Goodbody LLP, Irish counsel to the Company, has issued a legal opinion relating to the Shares. A copy of such legal opinion, including the consent included therein, is attached as Exhibit 5.1 hereto.

The offering of the Shares has been registered pursuant to the Registration Statement, and offerings of the Shares will be made only by means of the Prospectus Supplement and the accompanying base prospectus. This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy the Shares described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities law of such state or jurisdiction.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ITERUM THERAPEUTICS PLC |

|

|

|

|

Date: |

December 11, 2024 |

By: |

/s/ Corey N. Fishman |

|

|

|

Name: Corey N. Fishman

Title: Chief Executive Officer |

|

|

|

|

|

|

A&L Goodbody LLP |

Dublin Belfast London New York San Francisco |

|

3 Dublin Landings |

|

North Wall Quay, Dublin 1 |

|

D01 C4E0 |

|

T: +353 1 649 2000 |

|

DX: 29 Dublin | www.algoodbody.com |

EXHIBIT 5.1

|

|

Date |

11 December 2024 |

|

|

Our ref |

01416740 |

|

|

Your ref |

|

Iterum Therapeutics plc

Fitzwilliam Court, 1st Floor

Leeson Close

Dublin 2

Ireland

Re: Iterum Therapeutics plc (the Company)

Dear Sirs

We are acting as Irish counsel to the Company, a public limited company incorporated under the laws of Ireland (registered number 563531), in connection with (i) the registration statement (Registration Statement) on Form S-3 (File No. 333-267795) originally filed by the Company with the United States Securities and Exchange Commission (the SEC) under the Securities Act of 1933, as amended, on 7 October 2022, with respect to the issuance and sale by the Company, from time to time, of, among other things, an indeterminate number of company securities, at an initial aggregate offering price not to exceed $100,000,000 pursuant to the terms of the Registration Statement, and any amendments or supplements thereto, and the prospectus contained therein, and (ii) the prospectus supplement, dated 10 December 2024 (the Prospectus Supplement), forming part of the Registration Statement, relating to the issuance and sale from time to time by the Company of ordinary shares in the capital of the Company, nominal value $0.01 per share (Ordinary Shares), with an aggregate offering price of up to $25,000,000 (the Shares).

The Shares are to be issued and sold by the Company pursuant to an At The Market Offering Agreement, dated 7 October 2022, between the Company and H.C. Wainwright & Co (the Sale Agreement). The Sale Agreement was filed with the SEC on 7 October 2022 as Exhibit 1.2 to the Registration Statement.

In connection with this Opinion, we have reviewed and relied upon copies of:

•the Registration Statement and the prospectus contained therein;

•the Prospectus Supplement;

•copies of such corporate records of the Company as we have deemed necessary as a basis for the opinions hereinafter expressed.

In rendering this Opinion, we have examined, and have assumed the truth and accuracy of the contents of, all such corporate records, documents and certificates of officers of the Company and of public officials as to factual matters and have conducted such searches on 11 December 2024 in public registries in Ireland as we have deemed necessary or appropriate for the purposes of this Opinion but have made no independent investigation regarding such factual matters. In our examination we have assumed the (continued) truth and accuracy of the information

|

|

|

CE Gill • JG Grennan • PD White • VJ Power • SM Doggett • M Sherlock • C Rogers • G O’Toole • JN Kelly • N O’Sullivan • MJ Ward • D Widger • C Christle • S Ó Cróinin • DR Baxter

A McCarthy • JF Whelan • JB Somerville • MF Barr • AM Curran • A Roberts • RM Moore • D Main • J Cahir • M Traynor • PM Murray • P Walker • K Furlong • PT Fahy

D Inverarity • M Coghlan • DR Francis • A Casey • B Hosty • M O’Brien • L Mulleady • K Ryan • E Hurley • D Dagostino • R Grey • R Lyons • J Sheehy • C Carroll • SE Carson • P Diggin

J Williams • A O’Beirne • J Dallas • SM Lynch • M McElhinney • C Owens • AD Ion • K O'Connor • JH Milne • T Casey • M Doyle • CJ Comerford • R Marron • K O'Shaughnessy • S O'Connor

SE Murphy • D Nangle • C Ó Conluain • N McMahon • HP Brandt • A Sheridan • N Cole • M Devane • D Fitzgerald • G McDonald • N Meehan • R O'Driscoll • B O'Malley • C Bollard

M Daly • D Geraghty • LC Kennedy • E Mulhern • MJ Ellis • D Griffin • D McElroy • C Culleton • B Nic Suibhne • S Quinlivan • J Rattigan • K Mulhern • A Muldowney • L Dunne

A Burke • C Bergin • P Fogarty • CM Carroll Consultants: Professor JCW Wylie • MA Greene • AV Fanagan • PM Law • SW Haughey • PV Maher • KP Allen |

contained in such documents, the genuineness of all signatures (electronic or otherwise), that any signatures (electronic or otherwise) are the signatures of the persons who they purport to be, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as certified or photostatic copies and the authenticity of the originals of such documents.

We have further assumed:

1that, at the time of the issuance of the Shares, a sufficient number of Ordinary Shares will be authorised and available for issuance by the Company’s board of directors (the Board) pursuant to the Company’s memorandum and articles of association (the M&A), that the consideration for the issuance of such Shares will not be less than the nominal value of such Ordinary Shares, and that the Board, or any appropriate committee appointed thereby, will have the valid authority to issue such Ordinary Shares on a non-pre-emptive basis;

2that, at the time of the issuance of the Shares, pursuant to the M&A, that the Board, or any appropriate committee appointed thereby, will have the valid authority to issue such Shares and that such Shares will have been duly executed, authenticated (if applicable), issued and delivered against payment therefor in accordance with the terms of the Sale Agreement and in the manner contemplated by the applicable prospectus and that such Shares will be the legally valid and binding obligations of the Company, enforceable against the Company in accordance with their terms;

3that the filing of the Prospectus Supplement with the SEC has been authorised by all necessary actions under all applicable laws other than Irish law;

4that the M&A as amended and restated by shareholder resolution on 3 May 2023 and as are available as Exhibit 3.1 to the Company's Form 8-K, as filed with the SEC on 3 May 2023, are correct and up to date;

5that the issuance of the Shares will be in compliance with the Irish Companies Act 2014, the Irish Takeover Panel Act, 1997, Takeover Rules, 2022, and all applicable Irish company, takeover, securities, market abuse, insider dealing laws and other rules and regulations;

6that there are no agreements or arrangements in existence which in any way amend or vary the terms of the Sale Agreement relating to the offering, issuance and payment for the Shares;

7where the Sale Agreement has been executed on behalf of the Company using a software platform that enables an advanced electronic signature or a qualified electronic signature to be applied to that agreement, that each such signature was applied under the authority and control of the relevant signatory;

8the accuracy and completeness of all information appearing on public records;

9that none of the resolutions and authorities of the Board, any committee of the Board and/or shareholders of the Company upon which we have relied have been or will be varied, amended or revoked in any respect or have expired and that the Shares will be issued in accordance with such resolutions and authorities;

10that no authorisations, approvals, licences, exemptions or consents of governmental or regulatory authorities with respect to the agreements or arrangements referred to in the Registration Statement and the Prospectus Supplement or with respect to any issue, offer or sale of the Shares are or will be required to be obtained, that the Shares will conform with the descriptions and restrictions contained in the Registration Statement and the Prospectus Supplement, subject to such changes as may be required in order to comply with any requirement of Irish law, that the selling restrictions contained therein have been and will be at all times observed;

11that the terms of the Shares will have been established so as not to, and that the execution and delivery by the Company of, and the performance of its obligations under, the Shares, will not violate, conflict with or constitute a default under (i) the constitution of the Company, (ii) any agreement or instrument to which the Company or its properties are subject, (iii) any law, rule or regulation to which the Company or its properties is subject, (iv) any judicial or regulatory order or decree of any governmental authority or (v) any consent, approval, license, authorisation or validation of, or filing, recording or registration with, any governmental authority;

12that any issue of Shares will be paid up in consideration of the receipt by the Company prior to, or simultaneously with, the issue of such Shares of cash at least equal to the nominal value of such Shares;

13that the Registration Statement, including the prospectus contained therein, and the Prospectus Supplement do not constitute (and is not intended/required to constitute) a prospectus within the meaning of Part 23 of the Irish Companies Act 2014 and to the extent that any offer of Shares is being made to investors in any member state of the European Union, the Company is satisfied that the obligation to propose and publish a prospectus pursuant to Irish prospectus law, or in particular pursuant to the European Union (Prospectus) Regulations 2019, does not arise;

14the absence of fraud on the part of the Company and its respective officers, employees, agents and advisers, and that the Company will issue the Shares in good faith, for its legitimate and bona fide business purposes; and

15that: (i) the Company will be fully solvent at the time of and immediately following the issue of any Shares; (ii) no resolution or petition for the appointment of a liquidator or examiner will be passed or presented prior to the issue of any Shares; (iii) no receiver will have been appointed in relation to any of the assets or undertaking of the Company prior to the issue of any Shares; and (iv) no composition in satisfaction of debts, scheme of arrangement, or compromise or arrangement with creditors or members (or any class of creditors or members) will be proposed, sanctioned or approved in relation to the Company prior to the issue of any Shares.

Subject to the foregoing and to the within additional qualifications and assumptions, and based upon searches carried out in the Irish Companies Registration Office and the Central Office of the High Court on 11 December 2024, we are of the opinion that:

•the Company is a company duly incorporated under the laws of Ireland and validly existing under the laws of Ireland; and

•the Shares, when issued in accordance with all the necessary corporate action of the Company, and in accordance with the terms and conditions of the Sale Agreement will be duly authorised, validly issued, fully paid and will not be subject to calls for any additional payments (non-assessable).

In rendering this Opinion, we have confined ourselves to matters of Irish law. We express no opinion on any laws other than the laws of Ireland (and the interpretation thereof) in force as at the date hereof. This Opinion speaks only as of its date. We are not under any obligation to update this Opinion from time to time, nor to notify you of any change of law, facts or circumstances referred to or relied upon in the giving of this Opinion.

This Opinion is given solely for the benefit of the addressee of this Opinion and may not be relied upon by any other person without our prior written consent, provided, however, that it may be relied upon by persons entitled to rely on it pursuant to applicable provisions of US federal securities laws.

This Opinion is also strictly confined to the matters expressly stated herein and is not to be read as extending by implication or otherwise to any other matter.

We hereby consent to the filing of this Opinion with the SEC as an exhibit to the Company's Current Report on Form 8-K filed with the SEC and to the use of our name therein and in the related Prospectus Supplement under the caption “Legal Matters”.

The Opinion is governed by and construed in accordance with the laws of Ireland.

Yours faithfully

A&L Goodbody LLP

v3.24.3

Document And Entity Information

|

Dec. 10, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 10, 2024

|

| Entity Registrant Name |

Iterum Therapeutics plc

|

| Entity Central Index Key |

0001659323

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38503

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Address, Address Line One |

Fitzwilliam Court

|

| Entity Address, Address Line Two |

1st Floor

|

| Entity Address, Address Line Three |

Leeson Close

|

| Entity Address, City or Town |

Dublin 2

|

| Entity Address, Country |

IE

|

| Entity Address, Postal Zip Code |

Not applicable

|

| City Area Code |

+353

|

| Local Phone Number |

1 6694820

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary Shares, par value $0.01 per share

|

| Trading Symbol |

ITRM

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

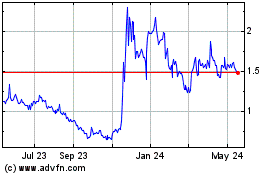

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Mar 2025 to Apr 2025

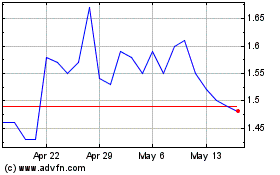

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Apr 2024 to Apr 2025