Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

31 May 2024 - 8:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY

STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant x

Filed by a

Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

JAGUAR HEALTH, INC.

(Name of Registrant as Specified

in its Charter)

(Name of Person(s) Filing

Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that

apply):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

JAGUAR HEALTH, INC.

SUPPLEMENT TO THE DEFINITIVE PROXY STATEMENT

DATED MAY 21, 2024

FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON FRIDAY, JUNE 21, 2024

This supplement (this “Supplement”)

amends and supplements the proxy statement of Jaguar Health, Inc. (the “Company”), dated May 21, 2024 (the “Proxy

Statement”), filed with the U.S. Securities and Exchange Commission in connection with the Company’s 2024 Annual Meeting of

Stockholders to be held on June 21, 2024 (the “Annual Meeting”).

The New York Stock Exchange (“NYSE”)

notified the Company of the NYSE’s ruling that Proposal 5 in the Proxy Statement (to approve a proposal to grant discretionary authority

for the Company to adjourn the Annual Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient

votes at the time of the Annual Meeting to approve Proposal 4, which is the proposal to approve an amendment to the Company’s 2014

Stock Incentive Plan to increase the number of shares of Common Stock authorized for issuance under the 2014 Plan by 45,500,000 shares

(equivalent to 758,333 shares following the 1-for-60 reverse stock split effectuated on May 23, 2024)) is a “non-routine”

matter under NYSE rules. Therefore, brokerage firms may not vote uninstructed shares regarding Proposal 5.

Except as specifically supplemented by the information

contained herein, all information set forth in the Proxy Statement remains unchanged. From and after the date of this Supplement, all

references to the “Proxy Statement” are to the Proxy Statement as supplemented this Supplement. The Proxy Statement contains

important information and this Supplement should be read in conjunction with the Proxy Statement.

The Proxy Statement previously advised stockholders

that Proposal 5 is a discretionary or “routine” matter. As a result of NYSE’s ruling, the following disclosures under

the heading “Broker Voting” contained in the Proxy Statement are hereby amended and restated in their entirety to read as

follows:

Broker Voting

Brokers holding shares of record in “street

name” for a beneficial owner have the discretionary authority to vote on some matters (routine matters) if they do not receive instructions

from the beneficial owner regarding how the beneficial owner wants the shares voted at least 10 days before the date of the meeting;

provided the proxy materials are transmitted to the beneficial owner at least 15 days before the meeting. There are also some matters

with respect to which brokers do not have discretionary authority to vote (non-routine matters) if they do not receive timely instructions

from the beneficial owner. When a broker does not have discretion to vote on a particular matter and the beneficial owner has not given

timely instructions on how the broker should vote, a broker non-vote results. Any broker non-vote will be counted as present at the Annual

Meeting for purposes of determining a quorum, but will not be treated as votes cast with respect to non-routine matters.

The proposal to ratify the appointment of RBSM

as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal 2) is a considered routine

matter and brokers will be permitted to vote in their discretion on this matter on behalf of beneficial owners who have not furnished

voting instructions at least 10 days before the date of the Annual Meeting. In contrast, the proposal to elect the Class III

director (Proposal 1), the proposal to approve, on an advisory basis, the compensation paid to our named executive officers (Proposal

3), the proposal to approve an amendment to the Company’s 2014 Stock Incentive Plan to increase the number of shares of Common Stock

authorized for issuance under the 2014 Plan by 45,500,000 shares (equivalent to 758,333 shares following the 1-for-60 reverse stock split

effectuated on May 23, 2024) (Proposal 4) and the proposal to approve discretionary authority for the Company to adjourn the Annual

Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the Annual Meeting

to approve Proposal 4 (Proposal 5) are not considered “routine” matters and brokers do not have discretionary authority to

vote on behalf of beneficial owners on such matters.

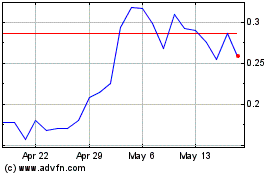

Jaguar Health (NASDAQ:JAGX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Jaguar Health (NASDAQ:JAGX)

Historical Stock Chart

From Jan 2024 to Jan 2025