0000788329

False

0000788329

2025-02-03

2025-02-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): February 3,

2025

_______________________________

Johnson

Outdoors Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Wisconsin |

0-16255 |

39-1536083 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

555

Main Street

Racine,

Wisconsin

53403

(Address of Principal Executive Offices) (Zip Code)

(262)

631-6600

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since

last report)

_______________________________

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of

each class |

Trading Symbol(s) |

Name of each

exchange on which registered |

| Class A Common Stock,

$.05 par value per share |

JOUT |

NASDAQ

Global Select Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 - Financial Information

Item 2.02. Results of Operations and Financial Condition.

On February 3, 2025, Johnson Outdoors Inc. (the “Company”) issued a press

release announcing results for the first fiscal quarter ended December 27, 2024 (the “Press Release”). A copy of the Press

Release is being furnished as Exhibit 99.1 to this Report.

The information in this Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the

liability of that Section, nor shall such information be deemed to be incorporated by reference in any registration statement or other

document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise stated in such filing.

Section 9 - Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibit is being furnished herewith:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report

to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Johnson Outdoors Inc. |

| |

|

|

| |

|

|

| Date: February 3, 2025 |

By: |

/s/ David W. Johnson |

| |

|

David W. Johnson |

| |

|

Vice President and Chief Financial Officer |

| |

|

|

JOHNSON OUTDOORS INC.

Exhibit Index to Current Report on Form 8-K

EXHIBIT 99.1

Johnson Outdoors Reports Fiscal First Quarter Results

RACINE, Wis., Feb. 03, 2025 (GLOBE NEWSWIRE) -- Johnson Outdoors Inc. (Nasdaq:JOUT), a leading global innovator of outdoor recreation equipment and technology, today announced operating results for the Company’s first fiscal quarter ending December 27, 2024.

“Ongoing market challenges, a cautious retail and trade channel environment, and competitive pressures resulted in lower first quarter sales and profitability. We remain focused on our key strategic priorities and the changes necessary for future growth—investing in strong consumer-driven innovation, enhancing our go-to-market strategy, and improving operational efficiencies,” said Helen Johnson-Leipold, Chairman and Chief Executive Officer.

FIRST QUARTER RESULTS

The Company’s first fiscal quarter typically generates the lowest sales and profits due to the lead up to the primary selling season. Total Company net sales in the first quarter declined 22 percent to $107.6 million compared to $138.6 million in the prior year first fiscal quarter.

- Fishing revenue decreased 25 percent, due to continued challenging market and competitive dynamics as well as a strong sell-in of new products in the prior year quarter

- Camping & Watercraft Recreation* sales were down 12 percent, primarily due to general declines in consumer demand

- Diving sales decreased 10 percent, driven by softening market demand across all geographic regions

Total Company operating loss was $(20.2) million for the first fiscal quarter versus operating profit of $0.05 million in the prior year first quarter. Gross margin was 29.9 percent, compared to 38.1 percent in the prior year quarter. The margin decline was due primarily to unfavorable overhead absorption and unfavorable product mix, as well as increased promotional pricing. Operating expenses of $52.4 million decreased $0.4 million from the prior year period, due primarily to lower sales volumes between quarters and decreased expense on the Company’s deferred compensation plan, nearly offset by increases in consulting expenses and warranty expenses.

Loss before income taxes was $(18.9) million in the current year quarter, compared to profit before income taxes of $5.9 million in the prior year first quarter. In addition to the decline in operating profit noted above, Other income also declined by approximately $4.4 million due primarily to a decline in earnings on the Company’s deferred compensation plan, as well as a gain in the prior year quarter of approximately $1.9 million related to the sale of a building. Net loss was $(15.3) million, or $(1.49) per diluted share, versus net income of $4.0 million, or $0.38 per diluted share in the previous year’s first quarter. The effective tax rate was 19.2 percent compared to 33.0 percent in the prior year first quarter.

OTHER FINANCIAL INFORMATION

The Company reported cash and short-term investments of $101.6 million as of December 27, 2024. Depreciation and amortization were $4.8 million in the three months ending December 27, 2024, compared to $5.0 million in the prior three-month period. Capital spending totaled $4.1 million in the current quarter compared with $5.0 million in the prior year period. In December 2024, the Company’s Board of Directors approved a quarterly cash dividend to shareholders of record as of January 9, 2025, which was payable January 23, 2025.

“Although we were disappointed in our operating results in what is historically our slowest quarter of the year, we were able to mitigate some of the profit losses through our cost savings initiatives, which we’ll expand this fiscal year, and we continued to make progress on managing our inventory levels,” said David W. Johnson, Vice President and Chief Financial Officer. “Our debt-free balance sheet provides a competitive advantage in today’s marketplace and we remain confident in our ability to create long-term value and pay dividends to shareholders.”

WEBCAST

The Company will host a conference call and audio web cast at 11:00 a.m. Eastern Time on Monday, February 3, 2025. A live listen-only web cast of the conference call may be accessed at Johnson Outdoors’ home page or here. A replay of the call will be available for 30 days on the Internet.

*The Company has historically reported "Camping" and "Watercraft Recreation" segments and financial results separately. As of December 27, 2024, the Company combined these two segments into one reporting segment, "Camping & Watercraft Recreation."

About Johnson Outdoors Inc.

JOHNSON OUTDOORS is a leading global innovator of outdoor recreation equipment and technologies that inspire more people to experience the awe of the great outdoors. The company designs, manufactures and markets a portfolio of winning, consumer-preferred brands across four categories: Watercraft Recreation, Fishing, Diving and Camping. Johnson Outdoors' iconic brands include: Old Town® canoes and kayaks; Carlisle® paddles; Minn Kota® trolling motors, shallow water anchors and battery chargers; Cannon® downriggers; Humminbird® marine electronics and charts; SCUBAPRO® dive equipment; and Jetboil® outdoor cooking systems.

Visit Johnson Outdoors at http://www.johnsonoutdoors.com

Safe Harbor Statement

Certain matters discussed in this press release are “forward-looking statements,” intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical fact are considered forward-looking statements. These statements may be identified by the use of forward-looking words or phrases such as "anticipate," "believe," "confident," "could," "expect," "intend," "may," "planned," "potential," "should," "will," "would" or the negative of those terms or other words of similar meaning. Such forward-looking statements are subject to certain risks and uncertainties, which could cause actual results or outcomes to differ materially from those currently anticipated. Factors that could affect actual results or outcomes include the matters described under the caption “Risk Factors” in Item 1A of the Company’s Form 10-K filed with the Securities and Exchange Commission on December 8, 2023, and the following: changes in economic conditions, consumer confidence levels and discretionary spending patterns in key markets; uncertainties stemming from political instability (and its impact on the economies in jurisdictions where the Company has operations), uncertainties stemming from changes in U.S. trade policies, tariffs, and the reaction of other countries to such changes; the global outbreaks of disease, such as the COVID-19 pandemic, which has affected, and may continue to affect, market and economic conditions, along with wide-ranging impacts on employees, customers and various aspects of our operations; the Company’s success in implementing its strategic plan, including its targeted sales growth platforms, innovation focus and its increasing digital presence; litigation costs related to actions of and disputes with third parties, including competitors; the Company’s continued success in its working capital management and cost-structure reductions; the Company’s success in integrating strategic acquisitions; the risk of future write-downs of goodwill or other long-lived assets; the ability of the Company’s customers to meet payment obligations; the impact of actions of the Company’s competitors with respect to product development or enhancement or the introduction of new products into the Company’s markets; movements in foreign currencies, interest rates or commodity costs; fluctuations in the prices of raw materials or the availability of raw materials or components used by the Company; any disruptions in the Company’s supply chain as a result of material fluctuations in the Company’s order volumes and requirements for raw materials and other components, or the demand for those same raw materials and components by third parties, necessary to manufacture and produce the Company’s products including related to shortages in procuring necessary raw materials and components to manufacture and produce such products; the success of the Company’s suppliers and customers and the impact of any consolidation in the industries of the Company’s suppliers and customers; the ability of the Company to deploy its capital successfully; unanticipated outcomes related to outsourcing certain manufacturing processes; unanticipated outcomes related to litigation matters; and adverse weather conditions. Shareholders, potential investors and other readers are urged to consider these factors in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included herein are only made as of the date of this filing. The Company assumes no obligation, and disclaims any obligation, to update such forward-looking statements to reflect subsequent events or circumstances.

JOHNSON OUTDOORS INC.

| (thousands, except per share amounts) | | |

| | THREE MONTHS ENDED |

| Operating results | December 27, 2024 | December 29, 2023 |

| Net sales | $ | 107,649 | | $ | 138,644 | |

| Cost of sales | | 75,466 | | | 85,790 | |

| Gross profit | | 32,183 | | | 52,854 | |

| Operating expenses | | 52,422 | | | 52,808 | |

| Operating (loss) profit: | | (20,239 | ) | | 46 | |

| Interest income, net | | (986 | ) | | (1,160 | ) |

| Other income, net | | (326 | ) | | (4,693 | ) |

| (Loss) profit before income taxes | | (18,927 | ) | | 5,899 | |

| Income tax (benefit) expense | | (3,637 | ) | | 1,944 | |

| Net (loss) income | $ | (15,290 | ) | $ | 3,955 | |

| Weighted average common shares outstanding - Dilutive | | 10,270 | | | 10,220 | |

| Net (loss) income per common share - Diluted | $ | (1.49 | ) | $ | 0.38 | |

| | | |

| Segment Results | | |

| Net sales: | | |

| Fishing | $ | 82,472 | | $ | 110,492 | |

| Camping & Watercraft Recreation | | 9,451 | | | 10,726 | |

| Diving | | 15,684 | | | 17,478 | |

| Other / Eliminations | | 42 | | | (52 | ) |

| Total | $ | 107,649 | | $ | 138,644 | |

| Operating profit (loss): | | |

| Fishing | $ | (8,261 | ) | $ | 11,529 | |

| Camping & Watercraft Recreation | | (646 | ) | | (1,720 | ) |

| Diving | | (908 | ) | | (578 | ) |

| Other / Eliminations | | (10,424 | ) | | (9,185 | ) |

| Total | $ | (20,239 | ) | $ | 46 | |

| | | |

| Balance Sheet Information (End of Period) | | |

| Cash, cash equivalents and short-term investments | $ | 101,617 | | $ | 109,555 | |

| Accounts receivable, net | | 68,297 | | | 83,043 | |

| Inventories, net | | 201,606 | | | 267,321 | |

| Total current assets | | 388,052 | | | 476,224 | |

| Long-term investments | | — | | | 4,668 | |

| Total assets | | 612,868 | | | 692,683 | |

| Total current liabilities | | 91,661 | | | 104,067 | |

| Total liabilities | | 172,584 | | | 188,813 | |

| Shareholders’ equity | | 440,284 | | | 503,870 | |

| | |

Johnson Outdoors Inc.

David Johnson

VP & Chief Financial Officer

262-631-6600

| Patricia Penman

Chief Marketing Officer

262-631-6600 |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

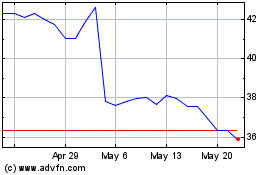

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Feb 2024 to Feb 2025