James River Announces Legacy Reinsurance Agreement with State National Insurance Company

10 July 2024 - 6:20AM

James River Group Holdings, Ltd. (“James River” or the “Company”)

(NASDAQ: JRVR) today announced that two of its principal operating

subsidiaries entered into a combined loss portfolio transfer and

adverse development cover reinsurance agreement with State National

Insurance Company, Inc. (“State National”).

Under the terms of the agreement, State National

will provide $160.0 million of adverse development reinsurance

coverage for James River’s Excess and Surplus Lines segment

casualty portfolio for accident years 2010-2023 (both years

inclusive), subject to a 15% co-participation by the Company. The

reinsurance structure has no coverage sublimits but does exclude

exposure to the Company’s former large commercial auto insured,

with the vast majority of that exposure already subject to a

previously executed loss portfolio transfer. James River will

retain claims management. State National is rated “A” (Excellent)

by AM Best.

Frank D’Orazio, the Company’s Chief Executive

Officer, commented, “We are pleased to have successfully completed

a significant legacy reinsurance transaction with a highly rated

carrier that is consistent with the Company's track record of

de-risking the organization while bolstering the balance sheet and

providing improved certainty to our stakeholders.”

The reinsurance agreement was executed on July

2, 2024 and is effective January 1, 2024. During the third quarter

of 2024, James River will recognize a $52.2 million reduction in

pre-tax income for the excess consideration paid over reserves

ceded in connection with the agreement. Once the transaction is

recognized, should the Company experience adverse development on

the subject business (as early as the January 1, 2024 effective

date), it would be subject to the reinsurance agreement. The

agreement also includes a profit commission to James River for 50%

of any favorable development on the business ceded to State

National below 104.5% of carried reserves, capped at $87.0

million.

Please see the Frequently Asked Questions slides

being made available simultaneously with this press release for

further information on this transaction.

The transaction closed upon signing. James River

was represented by Howden Re and Mayer Brown LLP.

Forward Looking Statements

This press release contains forward-looking

statements as that term is defined in the Private Securities

Litigation Reform Act of 1995. In some cases, such forward-looking

statements may be identified by terms such as believe, expect,

seek, may, will, should, intend, project, anticipate, plan,

estimate, guidance or similar words. Forward-looking statements

involve risks and uncertainties that could cause actual results to

differ materially from those in the forward-looking statements.

Although it is not possible to identify all of these risks and

uncertainties, they include, among others, the following: the

inherent uncertainty of estimating reserves and the possibility

that incurred losses may be greater than our loss and loss

adjustment expense reserves; inaccurate estimates and judgments in

our risk management may expose us to greater risks than intended;

downgrades in the financial strength rating of our regulated

insurance subsidiaries impacting our ability to attract and retain

insurance business that our subsidiaries write, our competitive

position, and our financial condition; uncertainty regarding the

outcome and timing of our exploration of strategic alternatives,

and the impacts that it may have on our business; the potential

loss of key members of our management team or key employees and our

ability to attract and retain personnel; adverse economic factors

resulting in the sale of fewer policies than expected or an

increase in the frequency or severity of claims, or both; the

impact of a persistently high inflationary environment on our

reserves, the values of our investments and investment returns, and

our compensation expenses; exposure to credit risk, interest rate

risk and other market risk in our investment portfolio; reliance on

a select group of brokers and agents for a significant portion of

our business and the impact of our potential failure to maintain

such relationships; reliance on a select group of customers for a

significant portion of our business and the impact of our potential

failure to maintain, or decision to terminate, such relationships;

our ability to obtain reinsurance coverage at prices and on terms

that allow us to transfer risk, adequately protect our company

against financial loss and that supports our growth plans; losses

resulting from reinsurance counterparties failing to pay us on

reinsurance claims, insurance companies with whom we have a

fronting arrangement failing to pay us for claims, or a former

customer with whom we have an indemnification arrangement failing

to perform its reimbursement obligations, and our potential

inability to demand or maintain adequate collateral to mitigate

such risks; inadequacy of premiums we charge to compensate us for

our losses incurred; changes in laws or government regulation,

including tax or insurance law and regulations; changes in U.S. tax

laws and the interpretation of certain provisions of Public Law No.

115-97, informally titled the 2017 Tax Cuts and Jobs Act (including

associated regulations), which may be retroactive and could have a

significant effect on us including, among other things, by

potentially increasing our tax rate, as well as on our

shareholders; in the event we do not qualify for the insurance

company exception to the passive foreign investment company

(“PFIC”) rules and are therefore considered a PFIC, there could be

material adverse tax consequences to an investor that is subject to

U.S. federal income taxation; the Company or its foreign subsidiary

becoming subject to U.S. federal income taxation; a failure of any

of the loss limitations or exclusions we utilize to shield us from

unanticipated financial losses or legal exposures, or other

liabilities; losses from catastrophic events, such as natural

disasters and terrorist acts, which substantially exceed our

expectations and/or exceed the amount of reinsurance we have

purchased to protect us from such events; potential effects on our

business of emerging claim and coverage issues; the amount of the

final post-closing adjustment to the purchase price received in

connection with the sale of our casualty reinsurance business; the

potential impact of internal or external fraud, operational errors,

systems malfunctions or cyber security incidents; our ability to

manage our growth effectively; failure to maintain effective

internal controls in accordance with the Sarbanes-Oxley Act of

2002, as amended (“Sarbanes-Oxley”); changes in our financial

condition, regulations or other factors that may restrict our

subsidiaries’ ability to pay us dividends; and an adverse result in

any litigation or legal proceedings we are or may become subject

to. Additional information about these risks and uncertainties, as

well as others that may cause actual results to differ materially

from those in the forward-looking statements, is contained in our

filings with the U.S. Securities and Exchange Commission ("SEC"),

including our most recently filed Annual Report on Form 10-K and

Quarterly Report on 10-Q. These forward-looking statements speak

only as of the date of this release and the Company does not

undertake any obligation to update or revise any forward-looking

information to reflect changes in assumptions, the occurrence of

unanticipated events, or otherwise.

About James River Group Holdings,

Ltd.

James River Group Holdings, Ltd. is a

Bermuda-based insurance holding company that owns and operates a

group of specialty insurance companies. The Company operates in two

specialty property-casualty insurance segments: Excess and Surplus

Lines and Specialty Admitted Insurance. Each of the Company’s

regulated insurance subsidiaries are rated “A-” (Excellent) by A.M.

Best Company. Visit James River Group Holdings, Ltd. on the web at

www.jrvrgroup.com.

For more information contact:

Brett Shirreffs

SVP, Finance, Investments and Investor Relations

(919) 980-0524

Investors@jrvrgroup.com

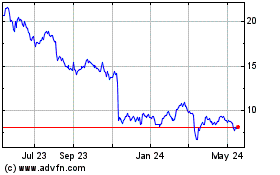

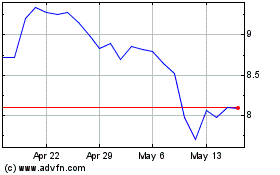

James River (NASDAQ:JRVR)

Historical Stock Chart

From Jan 2025 to Feb 2025

James River (NASDAQ:JRVR)

Historical Stock Chart

From Feb 2024 to Feb 2025