false

0001612630

0001612630

2024-12-19

2024-12-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 19, 2024

The Joint Corp.

(Exact Name of Registrant

as Specified in Charter)

| Delaware |

001-36724 |

90-0544160 |

| (State

or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

16767

N. Perimeter Drive, Suite 110

Scottsdale,

Arizona 85260

(Address

of principal executive offices) (Zip Code)

(480)

245-5960

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common

Stock, $0.001 |

|

JYNT |

|

The NASDAQ Capital Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 §CFR

230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry Into a Material Definitive Agreement.

On

December 19, 2024, we entered into an Amended and Restated Nomination and Standstill Agreement (the “Amended Nomination and

Standstill Agreement”) with Bandera Partners LLC and certain of its affiliates (collectively, “Bandera”),

which amends and restates in its entirety that certain Nomination and Standstill Agreement, dated as of November 6, 2023, by and among

us and Bandera.

Pursuant

to the Amended Nomination and Standstill Agreement, subject to certain conditions, we have agreed to, among other things, include Mr.

Gramm in our slate of nominees for the election of directors at our 2025 annual meeting of stockholders (the “2025 Annual Meeting”)

and recommend that our stockholders vote in favor of his election at the 2025 Annual Meeting. The Amended Nomination and Standstill Agreement

also provides for director replacement rights prior to the termination of the Amended Nomination and Standstill Agreement, subject to

certain conditions as further described in the Amended Nomination and Standstill Agreement.

The

Amended Nomination and Standstill Agreement includes certain voting commitments and standstill obligations by Bandera as well as certain

restrictions on the transfer of our common stock, par value $0.001 per share, held by Bandera and mutual non-disparagement provisions.

The Amended Nomination and Standstill Agreement will remain in place until the earlier of (i) January 2, 2026 and (ii) thirty (30) days

prior to the nomination deadline for our 2026 annual meeting of stockholders.

The

above summary of the terms of the Amended Nomination and Standstill Agreement is qualified in its entirety by reference to the full text

of the Amended Nomination and Standstill Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is

incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

THE JOINT CORP. |

| |

|

|

| |

|

|

| Date:

December 23, 2024 |

By: |

/s/ Sanjiv K. Razdan |

| |

|

Sanjiv

K. Razdan |

| |

|

President

and Chief Executive Officer |

Exhibit

10.1

Section

1. AMENDED AND RESTATED NOMINATION AND STANDSTILL AGREEMENT

This

Amended and Restated Nomination and Standstill Agreement (as the same may be amended, this “Agreement”), dated as

of December 19, 2024 (the “Effective Date”), is by and among The Joint Corp., a Delaware corporation (the “Company”),

and the Persons (as defined below) set forth on the signature pages hereto (collectively “Bandera”). Capitalized terms

used in this Agreement without definition shall have the meanings set forth in Section 19.

WHEREAS,

the Company and Bandera are parties to that certain Nomination and Standstill Agreement, dated as of November 6, 2023 (the “Original

Agreement”), pursuant to which the Company and Bandera agreed to certain matters relating to the composition of the Board of

Directors of the Company (the “Board”), including the appointment and nomination of Jefferson Gramm (the “Bandera

Director”) to the Board, and to certain standstill matters; and

WHEREAS,

the Company and Bandera desire to amend and restate the Original Agreement in its entirety as set forth herein.

NOW,

THEREFORE, in consideration of the foregoing premises and the mutual covenants and agreements contained herein, and for other good

and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound

hereby, agree as follows:

Section

2. Board Nomination and Related Agreements.

(a)

Bandera Director Nomination. The Company shall (A) include the Bandera Director as a nominee for election to the Board in its

proxy statement for election of directors at the 2025 Annual Meeting of Stockholders of the Company (the “2025 Annual Meeting”)

as a nominee of the Company, and (B) recommend that the Company’s stockholders vote in favor of the election of the Bandera

Director at the 2025 Annual Meeting in a manner no less rigorous and favorable than the manner in which the Company supports its

other nominees in connection with the 2025 Annual Meeting. Notwithstanding anything to the contrary in the foregoing provisions of this

Section 1(a), in the event that the Board (or a duly authorized committee thereof) determines, in good faith, after consultation

with outside legal counsel, that the taking of the foregoing actions would constitute a breach of fiduciary duties to the Company and

the Company’s stockholders, then the Company shall not be required to take such actions and shall notify Bandera in writing promptly

of such determination and the reasons therefor and Bandera shall be entitled to nominate a new natural person (acceptable to the Board

and/or the Nominating and Governance Committee of the Board (the “Nominating Committee”) in the exercise of their

fiduciary duties) for election to the Board as the Bandera Director within ten (10) days of Bandera’s receipt of such notice from

the Company. The rights and obligations of the Company and Bandera as provided in this Section 1(a) shall terminate upon any material

breach of this Agreement by Bandera or any of its controlled Affiliates or Representatives upon five (5) Business Days’ written

notice by the Company to Bandera if such breach has not been cured by the end of such notice period; provided, however,

that the Company is not in material breach of this Agreement at the time such notice is given or during the notice period.

(b)

Replacement Rights. If the Bandera Director is unable to serve as a director of the Company due to disability and resigns as a

director of the Company, or no longer serves as a director of the Company due to death, in either case, during the Cooperation Period,

Bandera shall be permitted to privately identify a replacement candidate who meets the Director Criteria (a “Replacement Nominee”)

and, as long as (i) neither Bandera nor any of Bandera’s controlled Affiliates or

Representatives are in breach of this Agreement (and such breach has not been cured within five (5) Business Days after written notice

has been delivered by the Company to Bandera of such breach), (ii) the Replacement Nominee provides to the Company all information

concerning the Replacement Nominee that the Company is required to include in its proxy statement in connection with the election of

directors at an annual meeting of stockholders, (iii) the Replacement Nominee agrees to comply with the Company Policies (as defined

below), (iv) the Replacement Nominee agrees that the he or she is not, and during the Cooperation Period will not, become a party to

any agreement, arrangement or understanding (whether written or oral) with any other Person with respect to his or her service as a director

of the Company, including any such agreement, arrangement or understanding with respect to how such Replacement Nominee should or would

vote or act on any issue or question as a director of the Company, and (v) the Replacement Nominee has been approved by the Nominating

Committee and/or the Board after exercising their good-faith customary due diligence review and consistent with the fiduciary duties

owed to the Company and its stockholders, the Replacement Nominee shall be appointed to fill the vacancy created by the aforesaid resignation

or death of the Bandera Director (any Replacement Nominee so appointed as a director of the Company, a “Replacement Director”),

it being understood that Bandera may continue to propose privately additional Replacement Nominees in the event an identified Replacement

Nominee is not approved by the Nominating Committee and/or the Board in accordance with the foregoing clause (v) until a Replacement

Nominee is appointed to the Board to fill the vacancy created by the aforesaid resignation or death of the Bandera Director. If a Replacement

Nominee is appointed to the Board pursuant to this Section 1(b), all references in this Agreement to the Bandera Director shall

include such Replacement Director, as applicable.

(c)

Board Size. During the Cooperation Period, the number of directors serving on the Board shall not exceed eight (8) directors unless

the Board (or a duly authorized committee thereof) determines, in good faith, after consultation with outside legal counsel, that the

failure to increase the number of directors serving on the Board would constitute a breach of fiduciary duties to the Company and the

Company’s stockholders.

(d)

Additional Agreements.

(i)

Bandera agrees (A) to cause its controlled Affiliates and Representatives to comply with the terms of this Agreement and (B) that Bandera

shall be responsible for any breach of this Agreement by any such controlled Affiliate or Representative. A breach of this Agreement

by any controlled Affiliate or Representative of Bandera, if such controlled Affiliate or Representative is not a party hereto, shall

be deemed to occur if such controlled Affiliate or Representative engages in conduct that would constitute a breach of this Agreement

if such controlled Affiliate or Representative were a party hereto to the same extent as Bandera.

(ii)

During the Cooperation Period (provided that the Bandera Director is nominated for election to the Board in accordance with Section

1(a)), Bandera agrees that it shall, and shall cause each of its controlled Affiliates to, appear in person or by proxy at each annual

or special meeting of the stockholders of the Company (each, a “Stockholder Meeting”) and vote all Voting Securities

beneficially owned, directly or indirectly, by Bandera or such Affiliate (or which Bandera or such Affiliate has the right or ability

to vote) at such meeting (A) in favor of the slate of directors recommended by the Board and (B) against the election of any nominee

for director not approved, recommended and nominated by the Board for election at any such Stockholder Meeting.

(iii)

During the Cooperation Period, Bandera shall not (and Bandera shall cause its controlled

Affiliates not to), directly or indirectly, (A) Transfer any shares of common stock, par value $0.001 per share, of the Company (the

“Common Stock”), Beneficially Owned by Bandera or any of its controlled Affiliates to any Prohibited Transferee, or

(B) consummate a Substantial Disposition or enter into any agreement, arrangement or understanding to consummate a Substantial Disposition,

other than in the case of each of clauses (A) and (B), (x) through open market transactions where the identity of the purchaser

is unknown to Bandera or any of its controlled Affiliates or (y) pursuant to a tender or exchange offer or other Extraordinary Transaction;

provided, that such restrictions shall not apply to the pledging of shares of Common Stock to a lender in connection with bona

fide margin loans or the exercise of remedies in connection therewith.

(iv)

Notwithstanding anything herein to the contrary, the Company agrees that Bandera and its

controlled Affiliates are permitted to Transfer all or any portion of shares of Common Stock Beneficially Owned by them and any Synthetic

Position in any Voting Securities of the Company to any Person that is a controlled Affiliate of Bandera; provided, that such

controlled Affiliate of Bandera executes and delivers an instrument agreeing to be bound by and comply with this Agreement, and that

such Transfer will not constitute a breach of, or implicate any provision of, this Agreement.

(e)

The Parties acknowledge that the Bandera Director, upon election or appointment to the Board, will be governed by the same protections

and obligations regarding confidentiality, conflicts of interest, related person transactions, fiduciary duties, codes of conduct, trading,

and disclosure policies, director resignation policy, stock ownership guidelines, and other governance guidelines and policies of the

Company as other directors of the Company (collectively, “Company Policies”), and shall have the same rights and benefits,

including with respect to insurance, indemnification, compensation, and fees, as are applicable to all non-management directors of

the Company. At all times while serving as a member of the Board, the Bandera Director shall comply with all laws, regulations, stock

exchange rules, policies, codes and guidelines applicable to Board members generally.

Section

3. Standstill Agreement. During the Cooperation Period, Bandera

shall not, and shall cause each of its controlled Affiliates not to, directly or indirectly (including through any director, officer,

employee, partner, member, manager, agent or other representative in each case acting on its behalf (each of the foregoing, a “Representative”

and more than one, “Representatives”) of Bandera or any controlled Affiliate of Bandera), in any manner, alone or

in concert with others (unless expressly permitted in writing by the Board):

(a)

(i) acquire, cause to be acquired, or offer, seek or agree to acquire, whether by purchase,

tender or exchange offer, through the acquisition of control of another Person, by joining or forming a partnership, limited partnership,

syndicate or other group (including any group of Persons that would be treated as a single “person” under Section 13(d) of

the Exchange Act), through swap or hedging transactions or otherwise (the taking of any such action, an “Acquisition”),

Beneficial Ownership of any equity securities of the Company (or any direct or indirect rights or options to acquire such ownership,

including voting rights decoupled from the underlying Voting Securities), such that after giving effect to any such Acquisition, Bandera

or any of its controlled Affiliates holds, directly or indirectly, in excess of that number of Voting Securities held by Bandera and

its controlled Affiliates on the Effective Date; provided, however, it is understood and agreed that any securities acquired

pursuant to or underlying any award or grant from the Company with respect to the Bandera Director’s service as a director of the

Company shall be excluded from such restriction, (ii) acquire, cause to be acquired, or offer, seek or agree to acquire, whether by purchase

or otherwise, any interest in any indebtedness of the Company, (iii) acquire, cause to be acquired, or offer, seek or agree to acquire,

ownership (including Beneficial Ownership) of any asset or business of the Company or any right or option to acquire any such asset or

business from any Person, in each case other than (x) securities of the Company or (y) in the ordinary course of the Company’s

business, (iv) offer, seek or agree to acquire, whether by purchase or otherwise, any Synthetic Position in any Voting Securities,

or (v) effect or seek to effect, offer or propose, or knowingly encourage any other Person to effect or seek to effect, an Extraordinary

Transaction; provided, however, that nothing in this Agreement shall prohibit Bandera from (x) tendering into a tender

or exchange offer available to all stockholders of the Company or (y) transferring Bandera’s shares of Common Stock pursuant to

any Extraordinary Transaction approved by the Board and, if required by applicable law, the stockholders of the Company;

(b)

other than in accordance with this Agreement, (i) nominate, give notice of an intent to nominate,

or recommend for nomination a natural person for election to the Board or take any action in respect of the removal of any director of

the Company, (ii) knowingly seek or encourage any Person to submit any nomination in furtherance of a “contested solicitation”

with respect to, or take any other action in respect of, the election or removal of any director of the Company, (iii) submit, or knowingly

seek or encourage the submission of, any stockholder proposal (pursuant to Rule 14a-8 or otherwise) for consideration at, or bring any

other business before, any Stockholder Meeting, (iv) request, or knowingly initiate, encourage or participate in any request, to call

a Stockholder Meeting, (v) seek to amend any provision of the certificate of incorporation, bylaws or other governing documents of the

Company (each as may be amended from time to time) or (vi) take any action prohibited by clause (i) or (ii) with respect to any subsidiary

of the Company; provided, for the avoidance of doubt, that nothing in this Agreement shall prevent Bandera or its controlled Affiliates

from taking actions in furtherance of identifying director candidates in connection with the exercise of its rights under Section

1(a) and Section 1(b), so long as such actions do not create a public disclosure obligation for Bandera or the Company and

are undertaken on a basis reasonably designed to be confidential;

(c)

(i) grant any proxy, consent or other authority to vote with respect to any matters for any Stockholder Meeting or (ii) deposit or agree

or propose to deposit any securities of the Company in any voting trust or similar arrangement, or subject any securities of the Company

to any agreement or arrangement with respect to the voting of such securities (including

a voting agreement or pooling arrangement), in each case of clauses (i) and (ii) other than (A) customary brokerage accounts, margin

accounts, prime brokerage accounts and the like, (B) granting any proxy, consent or other authority to vote in any solicitation

approved by the Board and consistent with the recommendation of the Board, (C) granting any proxy, consent or other authority to

vote in any solicitation pursuant to Schedule 14A in connection with any matter in a manner that is not in contravention of Section

1(d)(ii), or (D) otherwise in accordance with this Agreement;

(d)

form, join, knowingly encourage the formation of, or knowingly participate in any partnership, limited partnership, syndicate or group

(within the meaning of Section 13(d)(3) of the Exchange Act) with respect to any Voting Securities (other than a group that includes

Bandera and its controlled Affiliates, but does not include any other Persons that are not Bandera or any of its controlled Affiliates);

(e)

publicly make, publicly advance or publicly disclose any request or proposal to

amend, modify or waive any provision of this Agreement, or take any action challenging the validity or enforceability of any

provision of or obligation arising under this Agreement (provided, however, that Bandera may make confidential

requests to the Board (or a duly authorized committee thereof) to amend, modify or waive any provision of this Agreement, so long as

any such request is not publicly disclosed by Bandera and is made by Bandera in a manner that could not reasonably be expected to

require, and that does not require, the public disclosure thereof by the Company, Bandera or any other Person (it being understood

that the Board (or a duly authorized committee thereof) shall have no obligation to grant any such waiver request and may reject

such requests in its sole and exclusive discretion); provided, further, that nothing in this Agreement shall prevent

Bandera from taking any action to enforce the provisions of this Agreement or making counterclaims with respect to any action

initiated by or on behalf of the Company against Bandera;

(f)

make a request for a list of the Company’s stockholders or for any books and records

of the Company whether pursuant to Section 220 of the Delaware General Corporation Law or otherwise;

(g)

take any action that would reasonably be expected to require Bandera or the Company to make a public announcement or disclosure regarding

the matters set forth in Section 2(a)(v);

(h)

enter into any discussion, negotiation, agreement, arrangement or understanding with any third party (other than the Company, Bandera,

any controlled Affiliate of Bandera, any of its Representatives or any of its actual or potential financing sources or advisors as long

as it would not reasonably be expected to require Bandera to make a public announcement or disclosure and such activity does not directly

or indirectly create any exclusivity, lock-up, dry-up or other similar agreement, arrangement or understanding with any such potential

financing source) concerning the matters set forth in Section 2(a)(v); or

(i)

knowingly encourage, assist, solicit, or seek to cause any Person to undertake any action

in violation of this Section 2.

Notwithstanding

anything in this Agreement to the contrary, the provisions of this Agreement shall not and shall not be deemed to (i) prohibit Bandera

or any of its controlled Affiliates or Representatives from communicating privately with the Company’s directors, officers or Representatives

regarding any matter, so long as such communications are not intended to, and would not reasonably be expected to, require any public

disclosure of such communications by any Person, (ii) prohibit or restrict the Bandera Director, in the exercise of his or her fiduciary

duties in good faith, from taking any action in his or her capacity as a director of the Company, (iii) prohibit Bandera or any

of its controlled Affiliates or Representatives from communicating privately with stockholders of the Company and others in a manner

that does not otherwise violate this Agreement, or (iv) prevent Bandera or its controlled Affiliates or Representatives from taking any

action necessary to comply with or as required by a Legal Requirement (as defined below), provided, however, that a breach

by Bandera or any of its controlled Affiliates or Representatives of this Agreement is not the cause of the applicable Legal Requirement.

The

restrictions in this Section 2 shall terminate automatically upon the earliest of: (i) the expiration of the Cooperation

Period; (ii) five (5) Business Days’ prior written notice delivered by Bandera to the Company following a material breach

of this Agreement by the Company if such breach has not been cured within such notice period, provided, however, that neither

Bandera nor any of its controlled Affiliates or Representatives is then in material breach of this Agreement; (iii) (A) upon the

announcement by the Company that it has entered into a definitive agreement with respect to any Extraordinary Transaction that would

result in the acquisition by any person or group of more than 50% of the Voting Securities or a sale of all or substantially all assets

of the Company or (B) upon the announcement by the Company that it has entered into a definitive agreement with respect to any Extraordinary

Transaction that would not result in the acquisition by any person or group of more than 50% of the Voting Securities or a sale of all

or substantially all assets of the Company and (iv) the commencement of any tender or exchange offer (by a Person other than Bandera

or any of its controlled Affiliates or Representatives) if (and only if) the Board does not, within ten (10) Business Days of such commencement,

recommend against acceptance of such tender or exchange offer, and which such tender or exchange offer, if consummated, would constitute

an Extraordinary Transaction that would result in the acquisition by any person or group of more than 50% of the Voting Securities.

Section

4. Representations and Warranties of All Parties. Each Party

represents and warrants to the other Party that (a) such Party has all requisite power and

authority to execute and deliver this Agreement and to perform its obligations hereunder, (b) this Agreement has been duly and validly

authorized, executed and delivered by it and is a valid and binding obligation of such Party, enforceable against such Party in accordance

with its terms (subject to applicable bankruptcy and similar laws relating to creditors’ rights and to general equity principles)

and (c) this Agreement will not result in a material violation of any (i) term or condition of any agreement to which such Person

is a party or by which such Party may otherwise be bound or (ii) law, rule, license, regulation, judgment, order or decree governing

or affecting such Party.

Section 5. Representations,

Warranties and Covenants of Bandera. Bandera represents, warrants and covenants to the

Company that, as of the date of this Agreement, Bandera collectively Beneficially Owns and is entitled to vote an aggregate of 3,937,296

shares of Common Stock and does not have a Synthetic Position with respect to the Company.

Section

6. Press Release; Communications. During the

Cooperation Period, neither the Company (including the Board or any committee thereof) nor Bandera shall make or cause to be made, and

the Company and Bandera will cause their respective controlled Affiliates and Representatives not to make or cause to be made, any public

announcement or statement with respect to the subject matter of this Agreement that is contrary to the statements made in the Press Release

or the terms of this Agreement, except as required by applicable law or the rules of any stock exchange or with the prior written consent

of the other Party. The Company acknowledges that Bandera may file this Agreement as an exhibit to its Schedule 13D and any amendment

thereof. The Company shall be given a reasonable opportunity to review and comment on any Schedule 13D filing made by Bandera with respect

to this Agreement, and Bandera shall give reasonable consideration to any comments of the Company. Bandera acknowledges and agrees that

the Company may file this Agreement and file or furnish the Press Release with the SEC as exhibits to a Current Report on Form 8-K and

other filings with the SEC. Bandera shall be given a reasonable opportunity to review and comment on any Current Report on Form 8-K or

other filing with the SEC made by the Company with respect to this Agreement, and the Company shall give reasonable consideration to

any comments of Bandera.

Section

7. Confidentiality.

(a)

The Company hereby agrees that during the period in which the Confidentiality Agreement (as defined below) is in effect, the

Bandera Director shall be permitted to and may provide to Bandera confidential information, including discussions or matters considered

in meetings of the Board or any Board committees. The “Confidentiality Agreement” shall mean that certain Confidentiality

Agreement, dated as of November 6, 2023, by and among the Company and Bandera, a copy of which is attached as Exhibit A

hereto. Bandera acknowledges that it is aware, and will advise each of its Affiliates or Representatives who receive confidential information

pursuant to this Section 6, that United States securities laws prohibit any Person who has received material, non-public information

from purchasing or selling securities on the basis of such information or from communicating such information to any other Person under

circumstances in which it is reasonably foreseeable that such Person may trade securities on the basis of such information. During the

Cooperation Period, the Company shall provide Bandera with at least five (5) Business Days’ advance written notice of each opening

and expiration of each blackout period, and Bandera shall not purchase or sell, directly or indirectly, any securities of the Company

during any blackout periods applicable to all directors under the Company’s insider trading policy.

(b)

For the avoidance of doubt, the Parties acknowledge and agree that the obligations of Bandera

and the Bandera Director under this Section 6 and the Confidentiality Agreement shall be in addition to, and not in lieu of, any

confidentiality obligations of the Bandera Director under Delaware law and the applicable corporate governance policies of the Company

(collectively, the “Governing Documents”); provided, however, that in the event of a conflict between

the Bandera Director’s confidentiality obligations under the applicable Governing Documents and those in the Confidentiality Agreement,

the terms of the Confidentiality Agreement shall control. The Company agrees that during the Cooperation Period, any changes to the Governing

Documents will be adopted in good faith and not for the purpose of undermining or conflicting with the agreements or arrangements contemplated

hereby.

Section

8. Non-Disparagement. Subject to applicable

law, each of the Parties covenants and agrees that, during the Cooperation Period, neither

it nor any of its respective controlled Affiliates or Representatives shall in any way publicly disparage, comment negatively upon, slander,

criticize, attempt to discredit, make derogatory statements with respect to, call into disrepute, defame, make or cause to be made any

public statement or announcement that constitutes an ad hominem attack on, or otherwise disparages (or causes to be disparaged) the other

Party or such other Party’s subsidiaries, Affiliates, successors, permitted assigns or Representatives, in each case in their capacities

as such. Nothing in this Section 7 will (a) prevent either the Company or Bandera or any of their respective Affiliates or Representatives

from complying with their respective disclosure obligations under any applicable law, legal process, subpoena, the rules of any stock

exchange or any legal requirement or as part of a response to a request for information from any governmental authority with jurisdiction

over the Party from whom information is sought (collectively, a “Legal Requirement”), (b) apply to any private communications

between Bandera, its Affiliates and their respective Representatives, on the one hand, and the directors or officers of the Company,

on the other hand, or (c) be deemed to prevent the Parties or any of their respective Affiliates or Representatives from bringing litigation

to enforce the provisions of this Agreement or making counterclaims with respect to any proceeding initiated by or on behalf of a Party

or its Affiliates or any of their respective Representatives.

Section

9. Notices. Any

notices, consents, determinations, waivers or other communications required or permitted

to be given under the terms of this Agreement must be in writing and will be deemed to have been delivered (a) upon receipt, when delivered

personally, (b) upon confirmation of receipt, when sent by e-mail (provided, that such confirmation is not automatically generated),

or (c) one Business Day after deposit with a nationally recognized overnight delivery service, in each case properly addressed to the

Party to receive the same. The addresses for such communications shall be:

If

to the Company:

The

Joint Corp.

16767 North Perimeter Drive, Suite 110

Scottsdale, Arizona 85260

Attention: Chief Executive Officer

E-mail: sanjiv.razdan@thejoint.com

with

a copy (which shall not constitute notice) to:

Greenberg

Traurig, LLP

2375 E. Camelback Rd., Suite 800

Phoenix, Arizona 85016

Attention: Katherine A. Beck

E-mail: beckk@gtlaw.com

If

to Bandera:

c/o

Bandera Partners LLC

50 Broad Street, Suite 1820

New York, New York 10004

Attention: Jefferson Gramm

E-mail: jeff@banderapartners.com

with

a copy (which shall not constitute notice) to:

Olshan

Frome Wolosky LLP

1325 Avenue of the Americas

New York, New York 10019

Attention: Ryan P. Nebel

E-mail: rnebel@olshanlaw.com

Section

10. Governing Law; Jurisdiction; Jury Waiver. This Agreement and

all actions, suits or proceedings, including any counterclaims (whether based on contract,

tort or otherwise) with respect to this Agreement or arising out of or relating to this Agreement or any action of the Parties in the

negotiation, administration, performance or enforcement hereof, or for recognition and enforcement of any judgment in respect of this

Agreement brought by the other Party or its successors or permitted assigns, shall be governed by and construed and enforced in accordance

with the laws of the State of Delaware without giving effect to any choice or conflict of laws provision or rule (whether of the State

of Delaware or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the State of Delaware.

Each Party irrevocably agrees, to the fullest extent permitted by applicable law, that any action, suit or proceeding with respect to

this Agreement or arising out of or relating to this Agreement or any action of the Parties in the negotiation, administration, performance

or enforcement hereof, or for recognition and enforcement of any judgment in respect of this Agreement brought by the other Party or

its successors or permitted assigns, shall be brought and determined exclusively in the Court of Chancery of the State of Delaware and

any state appellate court therefrom within the State of Delaware (or, if the Court of Chancery of the State of Delaware declines to accept

jurisdiction over a particular matter, any federal court within the State of Delaware) (the “Chosen Courts”). To the

fullest extent permitted by applicable law, each Party hereby irrevocably submits with regard to any such action, suit or proceeding

for itself and in respect of its property, generally and unconditionally, to the personal jurisdiction of the Chosen Courts and agrees

that it will not bring any action relating to this Agreement in any court other than the Chosen Courts. To the fullest extent permitted

by applicable law, each Party hereby irrevocably waives, and agrees not to assert in any such action, suit or proceeding, (a) any claim

that it is not personally subject to the jurisdiction of the Chosen Courts for any reason, (b) any claim that it or its property is exempt

or immune from jurisdiction of any Chosen Court or from any legal process commenced in the Chosen Courts (whether through service of

notice, attachment prior to judgment, attachment in aid of execution of judgment, execution of judgment or otherwise) and (c) any claim

that (i) such action or proceeding in any Chosen Court is brought in an inconvenient forum,

(ii) the venue of such action or proceeding is improper or (iii) this Agreement, or the

subject matter hereof, may not be enforced in or by the Chosen Courts. EACH PARTY HERETO HEREBY IRREVOCABLY WAIVES ANY AND ALL RIGHT

TO TRIAL

BY JURY IN ANY SUCH ACTION, SUIT OR PROCEEDING TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW.

Section

11. Termination. Unless otherwise mutually agreed in writing by each Party, this

Agreement shall terminate on the expiration of the Cooperation Period. Notwithstanding the foregoing, Sections 9 through 19

shall survive the termination or expiration of this Agreement. No termination of this Agreement shall relieve any Party from liability

for any breach of this Agreement prior to such termination.

Section

12. Mandatory Injunctive Relief. Each Party acknowledges and agrees

that any breach of any provision of this Agreement shall cause the other Party irreparable harm which would not be adequately

compensable by money damages. Accordingly, in the event of a breach or threatened breach by a Party (or such Party’s respective

Affiliates or Representatives, as applicable) of any provision of this Agreement, the other Party shall, to the fullest extent permitted

by applicable law, be entitled to the remedies of injunction or other preliminary or equitable relief against the breaching Party (or

such Party’s respective Affiliates or Representatives, as applicable), without having to prove irreparable harm or actual damages

or post a bond or other security. The foregoing right shall, to the fullest extent permitted by applicable law, be in addition to such

other rights or remedies that may be available to the non-breaching Party for such breach or threatened breach, including the recovery

of money damages.

Section 13. Counterparts; Electronic Transmission. This Agreement may be

executed in two or more counterparts, which together shall constitute a single agreement. Any signature to this Agreement transmitted

by facsimile transmission, by electronic mail in “portable document format” (“.pdf”) form or by

any other electronic means intended to preserve the original graphic and pictorial appearance of a document, shall have the same effect

as physical delivery of the paper document bearing the original signature.

Section

14. Severability. If any term, provision, covenant or restriction of this

Agreement is held by a court of competent jurisdiction to be invalid, void or unenforceable, the remainder of the terms, provisions,

covenants and restrictions of this Agreement, to the fullest extent permitted by applicable law, shall remain in full force and effect

and shall in no way be affected, impaired or invalidated. Each Party agrees to use its commercially reasonable best efforts to agree

upon and substitute a valid and enforceable term, provision, covenant or restriction for any of such that is held invalid, void or unenforceable

by a court of competent jurisdiction.

Section

15. No Waiver. Any waiver by any Party of a breach of any provision of

this Agreement shall not operate as or be construed to be a waiver of any other breach of such provision or of any breach of any

other provision of this Agreement. The failure of a Party to insist upon strict adherence to any term of this Agreement on one or more

occasions shall not be considered a waiver of, or deprive that Party of the right thereafter to insist upon strict adherence to, that

term or any other term of this Agreement.

Section

16. Entire Agreement; Amendments. This Agreement, including the

exhibits and schedules attached hereto, and the Confidentiality Agreement contain the entire understanding of the Parties with

respect to the subject matter hereof and supersede all prior and contemporaneous

agreements, representations, warranties, statements, promises, information, arrangements and understandings, whether oral or written,

express or implied, with respect to the subject matter hereof. This Agreement may only be amended pursuant to a written agreement executed

by each Party.

Section

17. Successors and Assigns. This Agreement may not be transferred or

assigned by any Party without the prior written consent of the other Party. Any purported assignment without such consent shall,

to the fullest extent permitted by applicable law, be null and void. Subject to the foregoing, this Agreement shall be binding upon,

inure to the benefit of, and be enforceable by and against the successors and permitted assigns of each Party.

Section

18. No Third-Party Beneficiaries. This Agreement is solely for the

benefit of the Parties and is not enforceable by any other Person.

Section

19. Interpretation and Construction. Each Party acknowledges that it has been represented

by independent counsel of its choice throughout all negotiations that have preceded the execution of this Agreement, and that it has

executed the same with the advice of said independent counsel. Each Party and its counsel cooperated and participated in the drafting

and preparation of this Agreement and the documents referred to herein, and any and all drafts relating thereto exchanged among the Parties

shall be deemed the work product of all of the Parties and may not be construed against any Party by reason of its drafting or preparation.

Accordingly, any rule of law or any legal decision that would require interpretation of any ambiguities in this Agreement against any

Party that drafted or prepared it is of no application and is hereby expressly waived by each Party, and any controversy over any interpretation

of this Agreement shall be decided without regards to events of drafting or preparation. The Section headings contained in this Agreement

are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement. In this Agreement, (i)

the word “including” (in its various forms) means “including, without limitation,” (ii) the words

“hereunder,” “hereof,” “hereto” and words of similar import are references to

this Agreement as a whole and not to any particular provision of this Agreement, and (iii) the word “or” is not exclusive.

Section

20. Certain Defined Terms. For purposes of this Agreement:

(a)

“Activist Investor” means any Person who is identified on the list delivered

to Bandera in connection with the execution of this Agreement, it being understood that the Company may update such list from time to

time after the date of this Agreement to reflect updates to the list of activist investors maintained by Diligent/Activist Insight (or

any successor thereto) by prior written notice to the Bandera during the Cooperation Period. Activist Investors shall, as of the Effective

Date, expressly include JCP Investment Management and any Affiliate thereof and Alta Fox Capital and any Affiliate or Representative

thereof.

(b)

“Affiliate” has the meaning set forth in Rule 12b-2 promulgated by the

SEC under the Exchange Act and shall include all Persons that at any time during the term of this Agreement become Affiliates of any

Person referred to in this Agreement; provided that none of the Company or its Affiliates or Representatives, on the one

hand, and Bandera and its Affiliates or Representatives, on the other hand, shall be deemed to be “Affiliates” with

respect to the other for purposes of this Agreement; provided, further, that “Affiliates” of a Person

shall not include any

entity solely by reason of the fact that one or more of such Person’s employees or principals serves as a member of such entity’s

board of directors or similar governing body, unless such Person otherwise controls such entity; provided, further, that,

with respect to Bandera, “Affiliates” shall not include any portfolio operating company (as such term is understood in the

private equity industry) of any of Bandera or its Affiliates (unless such portfolio operating company is acting at the direction of Bandera

or any of its Affiliates to engage in conduct prohibited by this Agreement).

(c)

“Beneficial Ownership” means having the right or ability to vote, cause to

be voted or control or direct the voting of any Voting Securities (in each case whether directly or indirectly, including pursuant to

any agreement, arrangement or understanding, whether or not in writing); provided, that a Person shall be deemed to have “Beneficial

Ownership” of any Voting Securities that such Person has a right, option or obligation to own, acquire or control or direct the

voting of upon conversion, exercise, expiration, settlement or similar event (“Exercise”) under or pursuant to (i)

any Derivative (whether such Derivative is subject to Exercise immediately or only after the passage of time or upon the satisfaction

of one or more conditions) and (ii) any Synthetic Position that is required or permitted to be settled, in whole or in part, in Voting

Securities. A Person shall be deemed to be the “Beneficial Owner” of, or to “Beneficially Own,” any securities

that such Person has Beneficial Ownership of.

(d)

“Business Day” means any day that is not (i) a Saturday, (ii) a Sunday or (iii)

other day on which commercial banks in the State of New York are authorized or required to be closed by applicable law.

(e)

“Cooperation Period” means the period commencing with the Effective Date and ending upon the earlier of (i) January

2, 2026 and (ii) thirty (30) days prior to the nomination deadline for the Company’s 2026 annual meeting of stockholders.

(f)

“Director Criteria” means that a Person qualifies as “independent”

pursuant to SEC rules and regulations, applicable stock exchange listing standards and applicable corporate governance policies.

(g)

“Exchange Act” means the Securities Exchange Act of 1934, as amended

(together with the rules and regulations promulgated thereunder).

(h)

“Extraordinary Transaction” means any merger, consolidation, acquisition,

tender or exchange offer, recapitalization, reorganization, liquidation, sale, lease, exchange or other disposition of all or substantially

all of the assets of the Company or other business combination or extraordinary transaction involving the Company or any of its subsidiaries.

(i)

“Party” means the Company and Bandera, individually, and “Parties”

means the Company and Bandera, collectively.

(j)

“Person” means any natural person, firm, corporation, partnership (whither

general, limited or limited liability), limited liability company, trust, unincorporated association or other entity.

(k)

“Prohibited Transferee” means (i) any Activist Investor and (ii) any Affiliate

of Bandera that has not executed and delivered an instrument agreeing to be bound by and comply with this Agreement.

(l)

“SEC” means the U.S. Securities and Exchange Commission.

(m)

“Substantial Disposition” means any transaction or series of transactions

pursuant to which Bandera Transfers or agrees to Transfer, through swap or hedging transactions or otherwise, any Voting Securities or

any voting rights decoupled from the underlying Voting Securities held by Bandera or by any Affiliate of Bandera constituting 10% or

more of the then-outstanding Voting Securities to any Person.

(n)

“Synthetic Position” means any right, option, warrant, convertible security,

stock appreciation right or other security, contract right or derivative position or similar right (including any “swap”

transaction with respect to any security, other than a broad based market basket or index) (each of the foregoing, a “Derivative”),

whether or not presently exercisable, that has an exercise or conversion privilege or a settlement payment or mechanism at a price related

to the value of Voting Securities or a value determined in whole or in part with reference to, or derived in whole or in part from, the

value of Voting Securities and that increases in value as the market price or value of Voting Securities increases or that provides an

opportunity, directly or indirectly, to profit or share in any profit derived from any increase in the value of Voting Securities, in

each case regardless of whether (x) it conveys any voting rights in such Voting Securities to any Person, (y) it is required to be or

capable of being settled, in whole or in part, in Voting Securities, or (z) any Person (including the holder of such Synthetic Position)

may have entered into other transactions that hedge its economic effect.

(o)

“Transfer” means, in any single transaction or series of related transactions,

to sell, assign, pledge, hypothecate or otherwise transfer (or enter into any contract or other obligation regarding the future sale,

assignment, pledge or transfer of) Beneficial Ownership.

(p)

“Voting Securities” means the Common Stock and any other securities of

the Company entitled to vote in the election of directors.

[Signature

Pages Follow]

IN

WITNESS WHEREOF, each Party has executed this Agreement or caused the same to be executed by its duly authorized representative as

of the Effective Date.

| |

COMPANY: |

| |

|

| |

THE JOINT CORP. |

| |

|

| |

By:

/s/ Sanjiv K. Razdan |

| |

Name: Sanjiv K. Razdan |

| |

Title: President and Chief Executive Officer |

SIGNATURE PAGE TO NOMINATION AND STANDSTILL

AGREEMENT

IN

WITNESS WHEREOF, each Party has executed this Agreement or caused the same to be executed by its duly authorized representative as of

the Effective Date.

| |

BANDERA |

| |

|

| |

BANDERA MASTER FUND L.P. |

| |

|

| |

By:

Bandera Partners LLC, its investment manager |

| |

|

| |

By:

/s/ Jefferson Gramm |

| |

Name: Jefferson Gramm |

| |

Title: Managing Member |

| |

BANDERA PARTNERS LLC |

| |

|

| |

By:

/s/ Jefferson Gramm |

| |

Name: Jefferson Gramm |

| |

Title: Managing Member |

| |

|

| |

/s/

Gregory Bylinsky |

| |

GREGORY BYLINSKY |

| |

|

| |

/s/ Jefferson Gramm |

| |

JEFFERSON GRAMM |

SIGNATURE PAGE TO NOMINATION AND STANDSTILL

AGREEMENT

Exhibit

A

Confidentiality

Agreement

Filed

as an exhibit to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 8, 2023

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

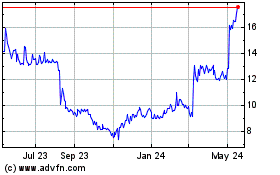

Joint (NASDAQ:JYNT)

Historical Stock Chart

From Mar 2025 to Apr 2025

Joint (NASDAQ:JYNT)

Historical Stock Chart

From Apr 2024 to Apr 2025