Cartrack’s strong customer acquisition and margin expansion drives Karooooo’s EPS up 27%

09 May 2023 - 6:22AM

Business Wire

Karooooo, that owns 100% of Cartrack, a leading provider of

insightful real-time data analytics and business intelligence,

reported robust results for its fourth quarter ("Q4 2023") ended

February 28, 2023. These strong results extend the group’s track

record of growth at scale, profitability and cash generation.

Assessing the results, Zak Calisto, CEO and Founder,

said:

“Despite Covid reshuffling the world and creating various new

macro-economic headwinds, we were still able to maintain our

decade-plus track record of strong growth.

Cartrack achieved strong subscription revenue growth, robust

margin expansion, record earnings and healthy free cash flow.

As we continue to scale our customer base, our easy-to-use

platform is helping small to large enterprise customers in diverse

geographical markets and industries bolster their profits and

mitigate risk.”

For the full year ("FY 2023"), Karooooo’s total revenue grew 28%

to ZAR3,507 million (FY 2022: ZAR2,746 million) and subscription

revenue grew 17% to ZAR3,010 million (FY 2022: ZAR2,568

million).

Strong customer acquisition and disciplined capital allocation

benefitted earnings per share, up 51% to ZAR4.70 for Q4 2023 (Q4

2022: ZAR3.11) and up 27% to ZAR19.29 for FY 2023 (FY 2022:

ZAR15.24).

Free cash flow for FY 2023 rose 44% to a record ZAR547 million

(FY 2022: ZAR379 million).

Net cash and cash equivalents at the end of February 2023 were

35% higher at ZAR966 million (Q4 2022: ZAR718 million) after paying

a dividend of 60 USD cents per share in September 2022.

Cartrack’s operating profit margin expanded to 30% (FY 2022:

27%).

Based on the record earnings, healthy free cash flow generation

and strong and unleveraged balance sheet, Karooooo declared a

dividend of 85 USD cents per share (about ZAR 15.64 at the current

exchange rate) to be paid on the 3rd of July 2023.

Karooooo's leading Operations Cloud powers the digital

transformation of over 105,000 commercial customers, which

represents impressive growth from over 88,000 customers a year ago.

Karooooo has shown a high rate of successful implementation and 95%

commercial customer retention across businesses of varying sizes in

diverse geographical markets and industries, including logistics,

field-service-maintenance, transport, finance, mining, agriculture,

and emergency services.

Full earnings and webinar details at www.karooooo.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230508005452/en/

Investor Relations IR@karooooo.com +27 73 287 6064 or +65 6876

7900 Media media@karooooo.com

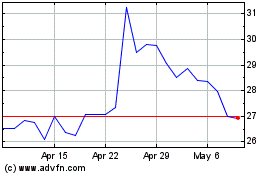

Karooooo (NASDAQ:KARO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Karooooo (NASDAQ:KARO)

Historical Stock Chart

From Jan 2024 to Jan 2025