UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2024

Commission File Number: 001-40300

KAROOOOO LTD.

(Exact name of registrant as specified in its

charter)

1 Harbourfront Avenue

Keppel Bay Tower #14-07

Singapore 098632

+65 6255 4151

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Karooooo Ltd. |

| |

|

| |

By: |

/s/ Isaias (Zak) Jose Calisto |

| |

|

Name: |

Isaias (Zak) Jose Calisto |

| |

|

Title: |

Chief Executive Officer |

Date: October 15, 2024

EXHIBIT INDEX

2

Exhibit 99.1

● Karooooo Subscribers Increased 17% Y/Y to 2.14 Million

● Cartrack Net Subscriber Additions Increased 18% Y/Y to a Record 89,168

● Karooooo Adjusted Earnings Per Share increased 31% Y/Y to a Record ZAR7.35

● Raising FY25 Outlook for Subscribers and Cartrack Subscription Revenue at Midpoint

SINGAPORE (October 15, 2024) - Karooooo Limited

(“Karooooo”) reported strong results and a positive outlook in second quarter (“Q2 2025”) and Half-Year (“HY

2025”) ended August, 31 2024. Karooooo owns 100% of Cartrack and 74.8% of Karooooo Logistics, (collectively, “the group”).

Karooooo Adjusted Earnings Per Share increased

31% Y/Y to ZAR7.35 for Q2 2025, driven by healthy subscription revenue growth and higher gross margins.

“We delivered another strong quarter of

profitable growth in the second quarter,” said Zak Calisto, Group CEO of Karooooo. “Importantly, we recently completed the

move to our newly built central office in South Africa, which positions us to support higher organic growth in the region. In addition,

we started to increase our investment in sales and marketing in Southeast Asia to capitalize on the compelling growth opportunity for

the group in the region. Despite increased capital allocation to growth in Southeast Asia, we remain committed to a disciplined approach

to growth as evidenced by our continued strong unit economics.”

Second Quarter 2025 Financial Overview (Unaudited)

Highlights

(Comparisons are relative to Q2 2024, unless otherwise

stated.)

SCALE

| |

● |

Cartrack subscribers up 17% to 2,136,610 at August 31, 2024 (Q2 2024: 1,832,708) |

| |

● |

Net Cartrack subscriber additions up 18% to 89,168 (Q2 2024: 75,256) |

GROWTH

| |

● |

Subscription revenue increased 15% to ZAR986 million (Q2 2024: ZAR860 million) |

| |

● |

Subscription revenue increased 22% to USD1 55 million (a non-IFRS measure). |

| 1 | For convenience purposes only, amounts in South African rand

as at August 31, 2024 have been translated to U.S. dollars using an exchange rate of ZAR 17.7910 to U.S.$1.00 (August 31, 2023: ZAR 18.9061),

as set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System. |

Second Quarter 2025 Financial Overview

Supplemental Financial Information and Business

Metrics

| | |

Three

Months Ended August 31, | |

| | |

Cartrack | | |

| | |

Carzuka | | |

| | |

Karooooo

Logistics | | |

| | |

Karooooo

Consolidated | |

| Figures

in Rand Thousands | |

2024 | | |

2023 | | |

Y-o-Y

% | | |

2024 | | |

2023 | | |

Y-o-Y

% | | |

2024 | | |

2023 | | |

Y-o-Y

% | | |

2024 | | |

2023 | | |

Y-o-Y

% | |

| Subscription

revenue | |

| 983,453 | | |

| 857,655 | | |

| 15 | % | |

| - | | |

| - | | |

| - | | |

| 2,532 | | |

| 2,676 | | |

| (5 | )% | |

| 985,985 | | |

| 860,331 | | |

| 15 | % |

| Other revenue1 | |

| 22,356 | | |

| 25,943 | | |

| -14 | % | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 22,356 | | |

| 25,943 | | |

| -14 | % |

| Vehicle

sales2 | |

| - | | |

| - | | |

| - | | |

| - | | |

| 84,673 | | |

| (100 | )% | |

| - | | |

| - | | |

| - | | |

| - | | |

| 84,673 | | |

| -100 | % |

| Delivery

service | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 98,380 | | |

| 69,266 | | |

| 42 | % | |

| 98,380 | | |

| 69,266 | | |

| 42 | % |

| Revenue | |

| 1,005,809 | | |

| 883,598 | | |

| 14 | % | |

| - | | |

| 84,673 | | |

| (100 | )% | |

| 100,912 | | |

| 71,942 | | |

| 40 | % | |

| 1,106,721 | | |

| 1,040,213 | | |

| 6 | % |

| Cost of

Sales | |

| (258,521 | ) | |

| (253,189 | ) | |

| 2 | % | |

| - | | |

| (78,175 | ) | |

| (100 | )% | |

| (69,532 | ) | |

| (48,312 | ) | |

| 44 | % | |

| (328,053 | ) | |

| (379,676 | ) | |

| -14 | % |

| Gross

Profit | |

| 747,288 | | |

| 630,409 | | |

| 19 | % | |

| - | | |

| 6,498 | | |

| (100 | )% | |

| 31,380 | | |

| 23,630 | | |

| 33 | % | |

| 778,668 | | |

| 660,537 | | |

| 18 | % |

| Gross

Profit Margin | |

| 74 | % | |

| 71 | % | |

| | | |

| - | | |

| 8 | % | |

| | | |

| 31 | % | |

| 33 | % | |

| | | |

| 70 | % | |

| 64 | % | |

| | |

| Operating

Profit/(loss) | |

| 293,061 | | |

| 252,455 | | |

| 16 | % | |

| - | | |

| (12,896 | ) | |

| (100 | )% | |

| 9,137 | | |

| 7,627 | | |

| 20 | % | |

| 302,198 | | |

| 247,186 | | |

| 22 | % |

| Operating

Profit Margin | |

| 29 | % | |

| 29 | % | |

| | | |

| - | | |

| (15 | )% | |

| | | |

| 9 | % | |

| 11 | % | |

| | | |

| 27 | % | |

| 24 | % | |

| | |

| Adjusted

EBITDA (a non-IFRS measure) | |

| 452,512 | | |

| 416,952 | | |

| 9 | % | |

| - | | |

| (11,792 | ) | |

| (100 | )% | |

| 9,991 | | |

| 8,104 | | |

| 23 | % | |

| 462,503 | | |

| 413,264 | | |

| 12 | % |

| Adjusted

EBITDA Margin (a non-IFRS measure) | |

| 45 | % | |

| 47 | % | |

| | | |

| - | | |

| (14 | )% | |

| | | |

| 10 | % | |

| 11 | % | |

| | | |

| 42 | % | |

| 40 | % | |

| | |

| 1. |

Other revenue is non-subscription-based revenue and relates predominantly to the sale of telematics devices to large enterprise customers opting for a non-bundled contracts. Cartrack remains focused on bundled sales. |

| |

|

| 2. |

Effective from Q1 2025, Carzuka has been fully integrated to support Cartrack operations, with the final on-hand vehicle sold off in this quarter. |

Total Revenue and Subscription Revenue

Karooooo grew subscription revenue by 15% to ZAR986

million (Q2 2024 : ZAR860 million) in Q2 2025.

Cartrack grew revenue by 14% to ZAR1,006 million

(Q2 2024: ZAR884 million) and subscription revenue by 15% to a record ZAR983 million in Q2 2025 (Q2 2024: ZAR858 million). Subscription

revenue equated to 98% of total revenue. Cartrack achieved net subscriber additions in the quarter, building on its solid track record

of growing at scale.

Karooooo Logistics grew revenue by 40% to ZAR101

million (Q2 2024: ZAR72 million). Karooooo Logistics focuses on delivery-as-a-service (“DaaS”) for our large enterprise customers

wishing to scale and digitalise their e-commerce operations without investing unnecessarily in additional assets by connecting them into

an elastic fleet of third party delivery drivers.

Operating Expenses

| | |

Three Months Ended August 31, | |

| Figures in Rand Thousands | |

2024 | | |

2023 | | |

Y-o-Y

% | |

| Karooooo’s Operating Expenses | |

| 480,754 | | |

| 418,290 | | |

| 15 | % |

| - Cartrack | |

| 458,510 | | |

| 382,891 | | |

| 20 | % |

| - Carzuka | |

| - | | |

| 19,394 | | |

| (100 | )% |

| - Karooooo Logistics | |

| 22,244 | | |

| 16,005 | | |

| 39 | % |

Karooooo’s operating expenses increased

15% to ZAR481 million (Q2 2024: ZAR418 million).

Of the total, ZAR459 million, was attributable

to Cartrack (Q2 2024: ZAR383 million). This comprised investment in territorial expansion and growth. We continued to invest prudently

in scaling Karooooo Logistics, equating to ZAR22 million (Q2 2024: ZAR16 million) of total operating expenses.

Cartrack’s sales and marketing operating

expenses increased 33% to ZAR157 million (Q2 2024: ZAR118 million). This strategic investment in customer acquisition positions us well

for continued growth. Our ratio of lifetime value (LTV) of customer relationships to customer acquisition costs (CAC) remains at over

9 times.

Cartrack’s general and administration operating

expenses increased 18% to ZAR220 million (Q2 2024: ZAR187 million). This planned increase reflects management’s commitment to building

strong infrastructure that supports our growth plans. While demonstrating our ability to contain costs, we plan to prudently continue

to increase these costs to support our planned customer acquisition strategy.

Cartrack’s R&D operating expenses decreased

2% to ZAR51 million (Q2 2024: ZAR52 million). We remain focused on driving substantial benefit from our R&D capital allocation. The

decrease is as a result of the strengthening ZAR.

Cartrack prudently provided for expected credit

losses of ZAR30 million (Q2 2024: ZAR26 million).

Cartrack’s expenses as a proportion of subscription

revenue aligns with Karooooo’s long-term financial goals, and reflects our investment in growth.

| |

● |

Cartrack’s sales and marketing expenses as a percentage of Cartrack’s subscription revenue increased to 16% (Q2 2024: 14%) |

| |

● |

Cartrack’s general and administration expenses as a percentage of Cartrack’s subscription revenue remained at 22% (Q2 2024: 22%) |

| |

● |

Cartrack’s R&D expenses as a percentage of Cartrack’s subscription revenue decreased at 5% (Q2 2024: 6%) |

Operating Profit and Earnings Per Share

Karooooo’s operating profit grew by 22%

to ZAR302 million (Q2 2024: ZAR247 million) and earnings per share by 22% to ZAR6.85 (Q2 2024: ZAR5.61).

After adjusting Karooooo’s earnings per

share for the secondary public offering in July 2024, Adjusted EPS (a non-IFRS measure) grew by 31% to ZAR7.35 (Q2 2024: ZAR5.61).

Cartrack delivered record operating profit of

ZAR293 million, up 16% (Q2 2024: ZAR252 million). The gross profit margin expanded to 74% (Q2 2024: 71%) and the operating profit margin

remains at 29% (Q2 2024: 29%).

Karooooo Logistics operating profit grew by 20%

to ZAR9 million (Q2 2024: ZAR8 million) as it continues to scale. The gross profit margin was 31% (Q2 2024: 33%) with a healthy operating

profit margin of 9% (Q2 2024: 11%).

Adjusted EBITDA

Karooooo’s Adjusted EBITDA (a non-IFRS measure)

grew by 12% to ZAR463 million (Q2 2024: ZAR413 million).

Cartrack’s Adjusted EBITDA grew by 9% to

ZAR453 million (Q2 2024: ZAR417 million).

Karooooo Logistics’ Adjusted EBITDA grew

by 23% to ZAR10 million (Q2 2024: ZAR8 million).

See “Reconciliation of Profit for the Period

to Adjusted EBITDA (a non-IFRS measure)” below for a reconciliation of Adjusted EBITDA to profit, its most directly comparable IFRS

financial measure.

Half-Year 2025 Financial Overview (Unaudited)

Highlights

(Comparisons are relative to HY 2024, unless otherwise

stated.)

SCALE

| |

● |

2,136,610 Cartrack subscribers at August 31, 2024, up by 17% (HY 2024: 1,832,708) |

| |

● |

Net Cartrack subscriber additions of 165 078, up by 43% (HY 2024: 115,631) |

GROWTH

| |

● |

Subscription revenue increased 15% to ZAR1,950 million (HY 2024: ZAR1,697 million) |

| |

● |

Subscription revenue increased 22% to USD1 110 million (a non-IFRS measure). |

| 1 | For convenience purposes only, amounts in South African rand

as at August 31, 2024 have been translated to U.S. dollars using an exchange rate of ZAR 17.7910 to U.S.$1.00 (August 31, 2023: ZAR 18.9061),

as set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System. |

Half-Year 2025 Financial Overview

Supplemental Financial Information and Business Metrics

| | |

Six

Months Ended August 31, | |

| | |

Cartrack | | |

Carzuka | | |

Karooooo

Logistics | | |

Karooooo

Consolidated | |

| Figures

in Rand Thousands | |

2024

| | |

2023

| | |

Y-o-Y

% | | |

2024 | | |

2023 | | |

Y-o-Y

% | | |

2024 | | |

2023 | | |

Y-o-Y

% | | |

2024 | | |

2023 | | |

Y-o-Y

% | |

| Subscription

revenue | |

| 1,943,056 | | |

| 1,691,887 | | |

| 15 | % | |

| - | | |

| - | | |

| - | | |

| 6,697 | | |

| 4,841 | | |

| 38 | % | |

| 1,949,753 | | |

| 1,696,728 | | |

| 15 | % |

| Other revenue1 | |

| 41,728 | | |

| 45,140 | | |

| (8 | )% | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| 41,728 | | |

| 45,140 | | |

| (8 | )% |

| Vehicle

sales | |

| 2,099 | | |

| - | | |

| - | | |

| - | | |

| 166,236 | | |

| (100 | )% | |

| - | | |

| - | | |

| | | |

| 2,099 | | |

| 166,236 | | |

| (99 | )% |

| Delivery

service | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 194,966 | | |

| 128,896 | | |

| 51 | % | |

| 194,966 | | |

| 128,896 | | |

| 51 | % |

| Revenue | |

| 1,986,883 | | |

| 1,737,027 | | |

| 14 | % | |

| - | | |

| 166,236 | | |

| (100 | )% | |

| 201,663 | | |

| 133,737 | | |

| 51 | % | |

| 2,188,546 | | |

| 2,037,000 | | |

| 7 | % |

| Cost of

Sales | |

| (526,581 | ) | |

| (506,154 | ) | |

| 4 | % | |

| - | | |

| (152,620 | ) | |

| (100 | )% | |

| (135,888 | ) | |

| (91,150 | ) | |

| 49 | % | |

| (662,469 | ) | |

| (749,924 | ) | |

| (12 | )% |

| Gross

Profit | |

| 1,460,302 | | |

| 1,230,873 | | |

| 19 | % | |

| - | | |

| 13,616 | | |

| (100 | )% | |

| 65,775 | | |

| 42,587 | | |

| 54 | % | |

| 1,526,077 | | |

| 1,287,076 | | |

| 19 | % |

| Gross

Profit Margin | |

| 73 | % | |

| 71 | % | |

| | | |

| | | |

| 8 | % | |

| | | |

| 33 | % | |

| 32 | % | |

| | | |

| 70 | % | |

| 63 | % | |

| | |

| Operating

Profit/(loss) | |

| 580,248 | | |

| 484,356 | | |

| 20 | % | |

| - | | |

| (24,952 | ) | |

| (100 | )% | |

| 21,697 | | |

| 12,156 | | |

| 78 | % | |

| 601,945 | | |

| 471,560 | | |

| 28 | % |

| Operating

Profit Margin | |

| 29 | % | |

| 28 | % | |

| | | |

| | | |

| (15 | )% | |

| | | |

| 11 | % | |

| 9 | % | |

| | | |

| 28 | % | |

| 23 | % | |

| | |

| Adjusted

EBITDA (a non-IFRS measure) | |

| 905,845 | | |

| 809,042 | | |

| 12 | % | |

| - | | |

| (22,750 | ) | |

| (100 | )% | |

| 23,395 | | |

| 13,096 | | |

| 79 | % | |

| 929,240 | | |

| 799,388 | | |

| 16 | % |

| Adjusted

EBITDA Margin (a non-IFRS measure) | |

| 46 | % | |

| 47 | % | |

| | | |

| | | |

| (14 | )% | |

| | | |

| 12 | % | |

| 10 | % | |

| | | |

| 42 | % | |

| 39 | % | |

| | |

| 1. | Other

revenue is non-subscription-based revenue and relates predominantly to the sale of telematics devices to a large enterprise customer

opting for a non-bundled contract. Cartrack remains focused on bundled sales. |

Total Revenue and Subscription Revenue

Karooooo grew revenue by 7% to ZAR2,189 million

(HY 2024: ZAR2,037 million) and subscription revenue by 15% to ZAR1,950 million in HY 2025 (HY 2024: ZAR1,697 million).

Cartrack grew revenue by 14% to ZAR1,987 million

(HY 2024: ZAR1,737 million) and subscription revenue by 15% to a record of ZAR1,943 million in HY 2025 (HY 2024: ZAR1,692 million). Subscription

revenue equated to 98% of total revenue (HY 2024: 97%). Cartrack continues to build on its strong track record of growing at scale.

As planned, Karooooo Logistics continued to scale

and bolster Karooooo’s revenue growth.

Karooooo Logistics (trading as Picup in South

Africa) generated record revenue of ZAR202 million in HY 2025 (HY 2024: ZAR134 million), growth of 51%.

Operating Expenses

| | |

Six Months Ended August 31, | |

| Figures in Rand Thousands | |

2024 | | |

2023 | | |

Y-o-Y

% | |

| Karooooo’s Operating Expenses | |

| 930,098 | | |

| 822,783 | | |

| 13 | % |

| - Cartrack | |

| 886,019 | | |

| 753,770 | | |

| 18 | % |

| - Carzuka | |

| - | | |

| 38,568 | | |

| (100 | )% |

| - Karooooo Logistics | |

| 44,079 | | |

| 30,445 | | |

| 45 | % |

Karooooo’s operating expenses increased

13% to ZAR930 million in HY 2025 (HY 2024: ZAR823 million).

The majority, ZAR886 million, was attributable

to Cartrack (HY 2024: ZAR754 million), comprising prudent investment in infrastructure and headcount for territorial expansion. We continued

to invest in brand building and infrastructure for Karooooo Logistics amounting to ZAR44 million, of the group’s total operating

expenses (HY 2024: ZAR30 million).

Cartrack’s sales and marketing expenses

increased 27% to ZAR296 million in HY 2025 (HY 2024: ZAR233 million). We expect to see future benefit in customer acquisition from this

investment in growth.

Cartrack’s general and administration operating

expenses were 16% higher at ZAR423 million (HY 2024: ZAR365 million). This reflects our investment in infrastructure to meet our growth

plans.

Cartrack’s R&D operating expenses were

8% higher at ZAR106 million (HY 2024: ZAR98 million). Our planned investment in improving, enriching and expanding our Operations Cloud

and internal management systems is focused on enhancing our value proposition to our customers.

Cartrack provided for expected credit losses of

ZAR60 million (HY 2024: ZAR57 million), with expected credit losses for the period at 3% of revenue (HY 2024: 3.3%).

Operating Profit and Earnings per share

Karooooo grew operating profit by 28% to a record

of ZAR602 million (HY 2024: ZAR472 million) and earnings per share by 31% to ZAR14.02 (HY 2024: ZAR10.70).

After adjusting Karooooo’s earnings per

share for the secondary public offering in July 2024, Adjusted EPS (a non-IFRS measure) grew by 36% to ZAR14.52 (HY 2024: ZAR10.70).

Cartrack grew operating profit by 20% to a record

of ZAR580 million (HY 2024: ZAR484 million).

Karooooo Logistics grew operating profit by 78%

to a record of ZAR22 million (HY 2024: ZAR12 million).

Adjusted EBITDA and Adjusted EBITDA margin

Karooooo’s Adjusted EBITDA (a non-IFRS measure)

increased by 16% to ZAR929 million (HY 2024: ZAR799 million).

Cartrack’s Adjusted EBITDA (a non-IFRS measure)

increased by 12% to ZAR906 million (HY 2024: ZAR809 million).

Karooooo Logistics’ Adjusted EBITDA (a non-IFRS

measure) increased by 79% to ZAR23 million (HY 2024: ZAR13 million).

See “Reconciliation of Profit for the Period

to Adjusted EBITDA (a non-IFRS measure)” below for a reconciliation of Adjusted EBITDA to profit, its most directly comparable IFRS

financial measure.

Outlook

We believe Karooooo is strongly positioned for

growth. We operate in a growing and largely underpenetrated market, with strong demand from customers needing to be competitive and digitalise

their operations.

Our proven, robust and consistently profitable

business model, underpinned by a strong balance sheet and healthy cash position, gives us multiple levers for expansion. We expect our

continuous investment in our AI products, platform and customer experience to generate robust results in the future.

We remain confident that our track record of success,

specifically our ability to generate healthy cash flows, is sustainable.

Our mission is to be a leading Operations Cloud

service provider.

Actual results may differ materially from Karooooo’s

outlook due to various factors, including those described under “Forward-Looking Statements” below and described under “Risk

Factors” in our latest Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission.

With Cartrack’s revenue making up the majority

of group revenue, the guidance below relates primarily to Cartrack.

Given our results, we revised our guidance for

FY 2025 to:

| |

● |

Cartrack’s number of subscribers expected to be between 2,300,000 and 2,400,000, previously 2,200,000 and 2,400,000 |

| |

● |

Cartrack’s subscription revenue expected to be between ZAR3,950 million and ZAR4,150 million, previously ZAR3,900 million and ZAR4,150 million |

| |

● |

Cartrack’s operating profit margin expected to be between 27% and 31% |

| |

● |

Karooooo’s Adjusted Earnings Per Share expected to be between ZAR27.50 and ZAR31.00 |

Balance Sheet, Liquidity and Cash Flow

Our strategic approach to capital allocation supports

Karooooo’s strong growth at scale, profitability and high cash-generation. Given our balanced capital structure and strong cash

generation, we have ample runway to accelerate our customer acquisition strategy while remaining profitable.

At August 31, 2024, Karooooo’s property,

plant and equipment had increased by ZAR218 million to ZAR2,251 million (February 29, 2024: ZAR2,033 million). This was primarily due

to an increase of ZAR138 million in in-vehicle capitalized telematic devices, an increase of ZAR15 million in telematic devices available

for future sales and an investment of ZAR49 million in building the South African central office. We have now occupied the South African

central office and do not expect significant capital allocation to the building going forward.

Karooooo’s property, plant and equipment

of uninstalled telematic devices for future sales was ZAR361 million (February 29, 2024: ZAR346 million).

In line with business growth and currency fluctuations,

trade and other payables increased to ZAR499 million (February 29, 2024: ZAR446 million). Trade and other receivables and prepayments

decreased to ZAR521 million (February 29, 2024: ZAR985 million). At February 29, 2024, fixed deposits placed with banks amounting to ZAR486

million, which matured in June and July 2024, were included in other receivables.

Debtor’s collection days remain within our

historical norms at 27 days (February 29, 2024: 29 days).

In line with the group’s cash management

policy, overseen by our capital allocation committee, Karooooo’s excess cash reserves are held in US Dollars.

Cash and Cash Equivalents

After allocating ZAR49 million to the new South

African central office and paying a dividend of USD33.4 million in HY 2025, Karooooo reported a net cash and cash equivalents balance

of ZAR674 million at August 31, 2024 (February 29, 2024: ZAR436 million). At February 29, 2024, the net cash and cash equivalents balance

did not include bank fixed deposits maturing after 3 months amounting to ZAR486 million.

At August 31, 2024, the group had bank facilities

for growth initiatives and other general corporate purposes of ZAR300 million with Capitec Bank Limited.

Free Cash Flow (a non-IFRS measure)

Karooooo generated cash from operating activities

of ZAR394 million for the quarter ended August 31, 2024 (August 31, 2023 ZAR304 million). After allocating ZAR12 million (August 31, 2023:

ZAR 54 million) to the South African central office building, the group generated Free Cash Flow (a non-IFRS measure) of ZAR166 million

for the quarter ended August 31, 2024 (August 31, 2023: ZAR 68 million).

The Free Cash Flow (a non-IFRS measure) generated

is in keeping with our planned capital allocation for future growth.

Share Capital and Reserves

At August 31, 2024, Karooooo had 30,893,300 ordinary

shares issued and outstanding, and paid-up share capital of USD505,956,659 plus SGD1,000.

The negative common control reserve of ZAR2.7

billion on the balance sheet relates to a common control transaction on November 18, 2020, in which the loan of USD194 million from Isaias

Jose Calisto was converted into Karooooo share capital. Consequently, Karooooo acquired control of Cartrack. On that date, 20,331,894

shares were issued to Isaias Jose Calisto and Karooooo registered ZAR2.7 billion in paid-up capital, resulting in the common control reserve.

The ZAR3.6 billion other reserve on the balance

sheet relates to the buyout of 95,350,657 Cartrack shares at ZAR42.00 per share from minorities when Cartrack delisted from the JSE, totaling

ZAR4.0 billion. This was offset by the ZAR0.4 billion previously reported in the non-controlling interest. The ZAR0.4 billion relates

to the net asset value of 95,350,657 Cartrack minority shares acquired by Karooooo.

ZAR12 million of capital reserve on the balance

sheet relates to the cancellation of Karooooo’s treasury shares and ZAR11.4 million of capital reserve relates to the repurchase

and cancellation of 279 ordinary shares of Karooooo Logistics, which represent 6.29% of Karooooo Logistics’s issued ordinary shares.

Geographical Overview for Cartrack

South Africa

Cartrack’s number of subscribers in this

region increased 16% to 1,616,071 at August 31, 2024 (August 31, 2023: 1,393,353), with subscription revenue growth of 15%.

We believe that the economic environment in South

Africa is improving and we are confident that our move to our newly built central office in September 2024 positions us to support strong

organic growth as it will allow us to expand our customer base and increase subscription sales to existing customers in the region.

We believe that we are the largest and fastest

growing enterprise mobility SaaS provider on the African continent.

Asia Pacific, Middle East and United States

Cartrack’s number of subscribers in this

region increased 21% to 251,076 at August 31, 2024 (August 31, 2023: 206,946). This translates to 18% growth in subscription revenue.

As the second largest contributor to group revenue,

Southeast Asia continues to present the most compelling growth opportunity for the group in the medium to long term. In September 2024,

we started a strong, yet prudent, drive to increase Sales and marketing in Southeast Asia.

Europe

Cartrack’s number of subscribers in this

region increased 17% to 181,383 at August 31, 2024 (August 31, 2023: 155,671). This translates to 16% growth in subscription revenue.

Karooooo is building a leading mobility and connected-vehicle

platform to give our customers easier access to valuable insights. Demonstrating Karooooo’s standing as a platform of choice, leading

OEMs have partnered with us to give their customers access to our platform, seamlessly integrating their connected vehicle data. We are

poised to leverage our extensive offerings to further develop the connected-vehicle ecosystem, and expect these partnerships to contribute

to our results in the medium term. In addition, we are experiencing encouraging demand for our proprietary compliance technology in the

region as customers seek to be compliant with new legislation.

Africa (excluding South Africa)

Cartrack’s number of subscribers in this

region increased 15% to 88,080 at August 31, 2024 (August 31, 2023: 76,738). This translates to 4% growth in subscription revenue.

This region remains a positive cash generator

and is strategic to Karooooo’s South African operations.

Dividend Policy

The Board recognizes the importance of investment

in achieving growth at scale, and endeavors to avoid swings in dividend profile.

However, the payment and timing of dividends

in cash or other distributions (such as a return of capital to shareholders through share buy-backs, for example) are determined by the

Board after considering factors that include: earnings and free cash flow; current and anticipated capital requirements; economic conditions;

contractual, legal, tax and regulatory restrictions (including covenants contained in any financing agreements); the ability of group

subsidiaries to distribute funds to Karooooo; and such other factors the Board may deem relevant.

Karooooo aims to reinvest retained earnings to

the extent that it aligns with the group’s required return on incrementally reinvested capital, return on equity, and short- to

medium-term growth strategy.

Subject to Karooooo’s constitution and in

accordance with the Singapore Companies Act, the Board may, without the approval of shareholders, declare and pay interim dividends.

Any final dividends must be approved by an ordinary resolution at a general meeting of shareholders.

The Board may review and amend the dividend policy

from time to time.

Corruption, Bribery and Whistleblowing

The Karooooo Anti-Bribery and Corruption policy,

Code of Ethics, Whistleblowing policy and employment contracts contain clear guidelines with regard to bribery, corruption, client confidentiality

and acceptable behavior towards fellow employees, customers, contractors and suppliers. Annual awareness and practical training are provided

to all employees, reinforced by individual affirmations on an annual basis. These measures ensure awareness and understanding of our business

principles and the consequences of non-compliance. Our policies also apply to third-party providers.

We provide a contact email and hotline for whistleblowing

and reporters are assured of confidentiality.

Webinar Information

Karooooo management will host a Zoom webinar on

Tuesday, October 15, 2024 at 08:00 a.m. Eastern Time (02:00 p.m. South African time; 08:00 p.m. Singaporean time).

Investors are invited to join the Zoom at:: https://us02web.zoom.us/j/82027776209

Webinar ID: 820 2777 6209

Telephone:

| |

● |

US (New York) Toll-free: +1 646 558 8656 |

| |

● |

South Africa Toll-free: +27 87 551 7702 |

A replay will be available at www.karooooo.com

approximately three hours after the conclusion of the live event.

IFRS Accounting

We prepare our consolidated financial statements

in accordance with IFRS as issued by the IASB. The summary consolidated financial information presented has been derived from the consolidated

financial statements of Karooooo.

About Karooooo

Karooooo is a provider of a leading operational

IoT SaaS cloud that maximizes the value of operations and workflow data by providing insightful real-time data analytics to thousands

of enterprise customers by digitally transforming their operations. The Cartrack (wholly owned by Karooooo) SaaS platform provides customers

with differentiated insights and data analytics to optimize their business operations. Cartrack assists customers to sustainably improve

workflows, manage field workers, increase efficiency, decrease costs, improve safety, monitor environmental impact, assist with regulatory

compliance and manage risk.

Currently, there are over 2,175,000 connected

vehicles and equipment on the Cartrack cloud platform.

For more information, visit www.karooooo.com.

| Investor Relations Contact |

IR@karooooo.com |

| |

|

| Media Contact |

media@karooooo.com |

KAROOOOO LTD.

CONSOLIDATED STATEMENT OF PROFIT AND LOSS

(UNAUDITED)

| | |

Three Months Ended

August 31, | | |

Six Months Ended

August 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Rand Thousands) | |

| Revenue | |

| 1,106,721 | | |

| 1,040,213 | | |

| 2,188,546 | | |

| 2,037,000 | |

| Cost of sales | |

| (328,053 | ) | |

| (379,676 | ) | |

| (662,469 | ) | |

| (749,924 | ) |

| Gross profit | |

| 778,668 | | |

| 660,537 | | |

| 1,526,077 | | |

| 1,287,076 | |

| Other income | |

| 4,284 | | |

| 4,939 | | |

| 5,966 | | |

| 7,267 | |

| Operating expenses | |

| (480,754 | ) | |

| (418,290 | ) | |

| (930,098 | ) | |

| (822,783 | ) |

| Sales and marketing | |

| (156,898 | ) | |

| (127,890 | ) | |

| (297,146 | ) | |

| (252,595 | ) |

| General and administration | |

| (239,418 | ) | |

| (208,759 | ) | |

| (460,912 | ) | |

| (407,022 | ) |

| Research and development | |

| (54,109 | ) | |

| (56,035 | ) | |

| (111,718 | ) | |

| (105,686 | ) |

| Expected credit losses on financial assets | |

| (30,329 | ) | |

| (25,606 | ) | |

| (60,322 | ) | |

| (57,480 | ) |

| Operating profit | |

| 302,198 | | |

| 247,186 | | |

| 601,945 | | |

| 471,560 | |

| Offering costs | |

| (15,470 | ) | |

| - | | |

| (15,470 | ) | |

| - | |

| Finance income | |

| 13,708 | | |

| 9,287 | | |

| 24,921 | | |

| 20,165 | |

| Finance costs | |

| (11,826 | ) | |

| (2,982 | ) | |

| (17,460 | ) | |

| (5,156 | ) |

| Profit before taxation | |

| 288,610 | | |

| 253,491 | | |

| 593,936 | | |

| 486,569 | |

| Taxation | |

| (72,844 | ) | |

| (75,277 | ) | |

| (152,887 | ) | |

| (146,408 | ) |

| Profit for the period | |

| 215,766 | | |

| 178,214 | | |

| 441,049 | | |

| 340,161 | |

| | |

| | | |

| | | |

| | | |

| | |

| Profit attributable to: | |

| | | |

| | | |

| | | |

| | |

| Owners of the parent | |

| 211,543 | | |

| 173,678 | | |

| 433,127 | | |

| 331,159 | |

| Non-controlling interest | |

| 4,223 | | |

| 4,536 | | |

| 7,922 | | |

| 9,002 | |

| | |

| 215,766 | | |

| 178,214 | | |

| 441,049 | | |

| 340,161 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per share | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted earnings per share (ZAR) | |

| 6.85 | | |

| 5.61 | | |

| 14.02 | | |

| 10.70 | |

KAROOOOO LTD.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(UNAUDITED)

| | |

As of

August 31,

2024 | | |

As of

February 29,

2024 | | |

As of

August 31,

2023 | |

| | |

(Rand Thousands) | |

| ASSETS | |

| | |

| | |

| |

| Non-current assets | |

| | |

| | |

| |

| Property, plant and equipment4 | |

| 2,250,984 | | |

| 2,032,794 | | |

| 1,789,501 | |

| Capitalized commission assets | |

| 425,142 | | |

| 374,521 | | |

| 326,488 | |

| Intangible assets | |

| 76,309 | | |

| 83,123 | | |

| 81,897 | |

| Goodwill | |

| 215,737 | | |

| 227,380 | | |

| 223,605 | |

| Loans to related parties | |

| 28,200 | | |

| 28,200 | | |

| 25,800 | |

| Long-term other receivables and prepayments | |

| 15,278 | | |

| 18,831 | | |

| 21,376 | |

| Non-current financial asset | |

| - | | |

| - | | |

| 388 | |

| Deferred tax assets6 | |

| 103,706 | | |

| 81,903 | | |

| 55,534 | |

| Total non-current assets | |

| 3,115,356 | | |

| 2,846,752 | | |

| 2,524,589 | |

| Current assets | |

| | | |

| | | |

| | |

| Inventories | |

| 4,345 | | |

| 6,582 | | |

| 110,146 | |

| Trade and other receivables and prepayments | |

| 521,327 | | |

| 985,398 | | |

| 479,085 | |

| Income tax receivables | |

| 9,454 | | |

| 8,714 | | |

| 10,883 | |

| Cash and cash equivalents | |

| 706,815 | | |

| 459,527 | | |

| 651,115 | |

| Total current assets | |

| 1,241,941 | | |

| 1,460,221 | | |

| 1,251,229 | |

| Total assets | |

| 4,357,297 | | |

| 4,306,973 | | |

| 3,775,818 | |

| EQUITY AND LIABILITIES | |

| | | |

| | | |

| | |

| Equity | |

| | | |

| | | |

| | |

| Share capital | |

| 7,131,059 | | |

| 7,142,853 | | |

| 7,142,853 | |

| Treasury shares | |

| - | | |

| (23,816 | ) | |

| - | |

| Capital reserve1,3 | |

| (3,609,451 | ) | |

| (3,582,568 | ) | |

| (3,582,568 | ) |

| Common control reserve2 | |

| (2,709,236 | ) | |

| (2,709,236 | ) | |

| (2,709,236 | ) |

| Foreign currency translation reserve | |

| 232,853 | | |

| 330,812 | | |

| 277,276 | |

| Retained earnings | |

| 1,624,191 | | |

| 1,803,482 | | |

| 1,396,449 | |

| Equity attributable to equity holders of parent | |

| 2,669,416 | | |

| 2,961,527 | | |

| 2,524,774 | |

| Non-controlling interest | |

| 42,714 | | |

| 40,935 | | |

| 41,764 | |

| Total equity | |

| 2,712,130 | | |

| 3,002,462 | | |

| 2,566,538 | |

| Liabilities | |

| | | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Term loans5 | |

| 258,894 | | |

| 41,645 | | |

| 44,967 | |

| Lease liabilities | |

| 138,113 | | |

| 131,285 | | |

| 108,628 | |

| Deferred revenue | |

| 123,468 | | |

| 121,302 | | |

| 115,843 | |

| Deferred tax liabilities | |

| 68,051 | | |

| 69,840 | | |

| 54,301 | |

| Total non-current liabilities | |

| 588,526 | | |

| 364,072 | | |

| 323,739 | |

| Current liabilities | |

| | | |

| | | |

| | |

| Term loans5 | |

| 31,879 | | |

| 6,534 | | |

| 8,736 | |

| Trade and other payables | |

| 498,677 | | |

| 446,284 | | |

| 449,001 | |

| Loans from related parties | |

| 556 | | |

| 924 | | |

| 875 | |

| Lease liabilities | |

| 66,251 | | |

| 63,055 | | |

| 57,250 | |

| Deferred revenue | |

| 330,221 | | |

| 325,848 | | |

| 308,743 | |

| Bank overdraft | |

| 32,491 | | |

| 23,362 | | |

| - | |

| Income tax payables | |

| 95,286 | | |

| 73,375 | | |

| 59,304 | |

| Provision for warranties | |

| 1,280 | | |

| 1,057 | | |

| 1,632 | |

| Total current liabilities | |

| 1,056,641 | | |

| 940,439 | | |

| 885,541 | |

| Total liabilities | |

| 1,645,167 | | |

| 1,304,511 | | |

| 1,209,280 | |

| Total equity and liabilities | |

| 4,357,297 | | |

| 4,306,973 | | |

| 3,775,818 | |

| 1. |

The ZAR3.6 billion negative capital reserve on the balance sheet relates to the buyout of 95,350,657 Cartrack shares at ZAR42.00 per share from minorities when Cartrack delisted from the JSE totaling ZAR4.0 billion, offset by the ZAR0.4 billion previously reported in the non-controlling interest reserve line item. The ZAR0.4 billion relates to the net asset value of the 95,350,657 Cartrack minority shares bought by Karooooo. |

| 2. |

The negative common control reserve of ZAR2.7 billion on the balance sheet relates to a common control transaction on November 18, 2020 in which the loan of USD194 million from Isaias Jose Calisto was converted into Karooooo share capital and as a consequence Karooooo acquired control of Cartrack. On that date, 20,331,894 shares were issued to Isaias Jose Calisto and Karooooo registered ZAR2.7 billion paid-up capital resulting in the common control reserve. |

| |

|

| 3. |

Included in capital reserves are ZAR12 million relating to the cancellation of Karooooo’s treasury shares and ZAR11.4 million of capital reserve relating to the repurchase and cancellation of Karooooo Logistics’s ordinary shares. |

| 4. |

Included in property, plant and equipment are: |

| | |

As of

August 31,

2024 | | |

As of

February 29,

2024 | | |

As of

August 31,

2023 | |

| | |

(Rand Thousands) | |

| Capitalized telematics devices – Work in progress | |

| 236,429 | | |

| 130,511 | | |

| 155,515 | |

| Capitalized telematic devices – Uninstalled | |

| 124,894 | | |

| 215,539 | | |

| 181,183 | |

| Capitalized telematic devices – Installed | |

| 1,170,478 | | |

| 1,032,250 | | |

| 936,858 | |

| Construction of South African Central Office | |

| 315,768 | | |

| 266,870 | | |

| 163,237 | |

| 5. |

In June 2024, The Standard Bank of South Africa Limited extended a loan of ZAR 250 million to Purple Rain Properties No. 444 Proprietary Limited (the owner of the regional South Africa central office under constructions) at the South Africa Prime Interest Rate less 1.5%. The loan will mature on 21 December 2025 and these funds were used to settle an inter company loan from Cartrack Pty Ltd. |

| 6. |

The movement in deferred tax assets reflects the recognition past tax losses by now-profitable entities and temporary differences between tax and accounting profits within group entities. |

KAROOOOO LTD.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(UNAUDITED)

| | |

Three Months Ended

August 31, | | |

Six Months Ended

August 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Rand Thousands) | |

| Net cash flows from operating activities | |

| 394,129 | | |

| 303,867 | | |

| 1,230,362 | | |

| 644,079 | |

| Net cash flows utilized by investing activities | |

| (241,118 | ) | |

| (245,615 | ) | |

| (520,477 | ) | |

| (442,929 | ) |

| Net cash flows utilized by financing activities | |

| (388,720 | ) | |

| (517,968 | ) | |

| (426,818 | ) | |

| (536,297 | ) |

| Net cash and cash equivalents movements for the period | |

| (235,709 | ) | |

| (459,716 | ) | |

| 283,067 | | |

| (335,147 | ) |

| Cash and cash equivalents as at the beginning of the period | |

| 949,558 | | |

| 1,137,444 | | |

| 436,165 | | |

| 965,750 | |

| Translation differences on cash and cash equivalents | |

| (39,525 | ) | |

| (26,613 | ) | |

| (44,908 | ) | |

| 20,512 | |

| Total cash and cash equivalents at the end of the period | |

| 674,324 | | |

| 651,115 | | |

| 674,324 | | |

| 651,115 | |

KAROOOOO LTD.

RECONCILIATION OF FREE CASH FLOW (A NON-IFRS MEASURE)

(UNAUDITED)

| | |

Three Months Ended

August 31, | | |

Six Months Ended

August 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Rand Thousands) | |

| Net cash generated from operating activities | |

| 394,129 | | |

| 303,867 | | |

| 1,230,362 | | |

| 644,079 | |

| Less: purchase of property, plant and equipment1 | |

| (228,587 | ) | |

| (236,354 | ) | |

| (495,858 | ) | |

| (418,833 | ) |

| Free Cash Flow (a

non-IFRS measure) | |

| 165,542 | | |

| 67,513 | | |

| 734,504 | | |

| 225,246 | |

| 1. | For the quarter ended August 31, 2024, included in the

purchase of property, plant and equipment are development cost of ZAR 12 million (August 31, 2023: ZAR 54 million) for the new South

African Central Office in Rosebank, Johannesburg. |

KAROOOOO LTD.

RECONCILIATION OF PROFIT FOR THE PERIOD TO ADJUSTED EBITDA (A NON-IFRS MEASURE)

(UNAUDITED)

| | |

Three Months Ended

August 31, | | |

Six Months Ended

August 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Rand Thousands) | |

| Profit for the period | |

| 215,766 | | |

| 178,214 | | |

| 441,049 | | |

| 340,161 | |

| Taxation | |

| 72,844 | | |

| 75,277 | | |

| 152,887 | | |

| 146,408 | |

| Finance income | |

| (13,708 | ) | |

| (9,287 | ) | |

| (24,921 | ) | |

| (20,165 | ) |

| Finance costs | |

| 11,826 | | |

| 2,982 | | |

| 17,460 | | |

| 5,156 | |

| Offering costs | |

| 15,470 | | |

| - | | |

| 15,470 | | |

| - | |

| Depreciation of property, plant and equipment and amortization of intangible assets | |

| 160,305 | | |

| 166,078 | | |

| 327,295 | | |

| 327,828 | |

| Adjusted

EBITDA (a non-IFRS measure) | |

| 462,503 | | |

| 413,264 | | |

| 929,240 | | |

| 799,388 | |

| Profit margin | |

| 20 | % | |

| 17 | % | |

| 19 | % | |

| 17 | % |

| Adjusted EBITDA

margin (a non-IFRS measure) | |

| 42 | % | |

| 40 | % | |

| 42 | % | |

| 39 | % |

KAROOOOO LTD.

BASIC AND DILUTED EARNINGS PER SHARE AND

ADJUSTED EARNING PER SHARE (A NON-IFRS MEASURE)

(UNAUDITED)

| | |

Three Months Ended

August 31, | | |

Six Months Ended

August 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Rand Thousands) | |

| Reconciliation between basic earnings and adjusted earnings (a non-IFRS measure) | |

| | |

| | |

| | |

| |

| Profit attributable to ordinary shareholders | |

| 211,543 | | |

| 173,678 | | |

| 433,127 | | |

| 331,159 | |

| Adjust for: | |

| | | |

| | | |

| | | |

| | |

| Offering costs | |

| 15,470 | | |

| - | | |

| 15,470 | | |

| - | |

| Adjusted

profit attributable to ordinary shareholders (a non-IFRS measure) | |

| 227,013 | | |

| 173,678 | | |

| 448,597 | | |

| 331,159 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of ordinary shares in issue at period end (000’s) on which the per share figures have been calculated | |

| 30,896 | | |

| 30,951 | | |

| 30,896 | | |

| 30,951 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted earnings per share | |

| 6.85 | | |

| 5.61 | | |

| 14.02 | | |

| 10.70 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted basic

and diluted earnings per share1 (a non-IFRS measure) | |

| 7.35 | | |

| 5.61 | | |

| 14.52 | | |

| 10.70 | |

| 1. | Adjusted earnings per share, (a non-IFRS measure) is defined

as, earnings per share defined by IFRS excluding the impact of non-recurring operational expenses relating to offering costs. |

The inclusion of headline earnings per share

(“HEPS”), a non-IFRS measure, in this announcement is a requirement of our inward listing on the JSE. Basic and diluted HEPS

is calculated using profit attributable to ordinary shareholders which has been determined based on IFRS. Accordingly, this may differ

from the headline earnings per share calculation of other companies listed on the JSE as these companies may report their financial results

under a different financial reporting framework. Basic or diluted HEPS is calculated using profit attributable to shareholders adjusted

for (gain)/loss on disposal of property, plant and equipment divided by the weighted average number of ordinary shares in issue. We have

provided a reconciliation between our profit attributable to shareholders used to calculate basic and diluted earnings per share and

headline earnings used to calculate the HEPS and have included the weighted average number of shares in issue for the period.

KAROOOOO LTD.

RECONCILIATION OF BASIC AND DILUTED EARNINGS PER SHARE

TO HEADLINE EARNINGS PER SHARE (A NON-IFRS MEASURE)

(UNAUDITED)

| | |

Three Months Ended

August 31, | | |

Six Months Ended

August 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Rand Thousands) | |

| Reconciliation between basic earnings to headline earnings (a non-IFRS

measure) | |

| | |

| | |

| | |

| |

| Profit attributable to ordinary shareholders | |

| 211,543 | | |

| 173,678 | | |

| 433,127 | | |

| 331,159 | |

| Adjust for: | |

| | | |

| | | |

| | | |

| | |

| (Gain)/loss on disposal of property, plant and equipment | |

| (4 | ) | |

| 1,633 | | |

| (454 | ) | |

| 609 | |

| Tax effect on loss/ (gain) on disposal of property, plant and equipment | |

| 2 | | |

| (439 | ) | |

| 127 | | |

| (158 | ) |

| Headline

earnings (a non-IFRS measure) | |

| 211,541 | | |

| 174,872 | | |

| 432,800 | | |

| 331,610 | |

| Weighted average number of ordinary shares in issue at period end (000’s) on which the per share figures have been calculated | |

| 30,896 | | |

| 30,951 | | |

| 30,896 | | |

| 30,951 | |

| Basic and diluted earnings per share | |

| 6.85 | | |

| 5.61 | | |

| 14.02 | | |

| 10.70 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and

diluted headline earnings per share (a non-IFRS measure) | |

| 6.85 | | |

| 5.65 | | |

| 14.01 | | |

| 10.71 | |

CONSTANT CURRENCY (A NON-IFRS MEASURE)

Constant currency information has been presented

to illustrate the impact of changes in currency rates on the group’s results. The tables below provide the unaudited constant currency

reconciliation to the reported measure for the periods presented.

Three Months and Half Year Ended August 31,

2024

The constant currency information has been determined

by adjusting the current financial reporting period results to the results reported for the three months and half year ended August 31,

2023, as applicable using the average of the monthly exchange rates applicable to that period. The measurement has been performed for

each of the group’s operating currencies.

SUBSCRIPTION REVENUE

| | |

Three Months Ended August 31, | |

| | |

2024 | | |

2023 | | |

Quarter-

on-Quarter

Change | |

| | |

(Rand Thousands) | | |

Percentage | |

| Subscription revenue as reported | |

| 985,985 | | |

| 860,331 | | |

| 15 | % |

| Conversion impact of other currencies | |

| 7,912 | | |

| - | | |

| | |

| Subscription revenue on a constant currency basis | |

| 993,897 | | |

| 860,331 | | |

| 16 | % |

TOTAL REVENUE

| | |

Three Months Ended August 31, | |

| | |

2024 | | |

2023 | | |

Quarter-

on-Quarter Change | |

| | |

(Rand Thousands) | | |

Percentage | |

| Total revenue as reported | |

| 1,106,721 | | |

| 1,040,213 | | |

| 6 | % |

| Conversion impact of other currencies | |

| 8,124 | | |

| - | | |

| | |

| Total revenue on a constant currency basis | |

| 1,114,845 | | |

| 1,040,213 | | |

| 7 | % |

SUBSCRIPTION REVENUE

| | |

Six Months Ended August 31, | |

| | |

2024 | | |

2023 | | |

Year-

on-Year

Change | |

| | |

(Rand Thousands) | | |

Percentage | |

| Subscription revenue as reported | |

| 1,949,753 | | |

| 1,696,728 | | |

| 15 | % |

| Conversion impact of other currencies | |

| 8,676 | | |

| - | | |

| - | |

| Subscription revenue on a constant currency basis | |

| 1,958,429 | | |

| 1,696,728 | | |

| 15 | % |

TOTAL REVENUE

| | |

Six Months Ended August 31, | |

| | |

2024 | | |

2023 | | |

Year-

on-Year Change | |

| | |

(Rand Thousands) | | |

Percentage | |

| Total revenue as reported | |

| 2,188,546 | | |

| 2,037,000 | | |

| 7 | % |

| Conversion impact of other currencies | |

| 8,897 | | |

| - | | |

| - | |

| Total revenue on a constant currency basis | |

| 2,197,443 | | |

| 2,037,000 | | |

| 8 | % |

DEFINITIONS

Adjusted Earnings per Share

Adjusted earnings per share, (a non-IFRS measure)

is defined as, earnings per share defined by IFRS excluding the impact of non-recurring operational expenses relating to offering costs.

Adjusted EBITDA

We define Adjusted EBITDA (a non-IFRS measure)

as profit less finance income, plus finance costs, taxation, depreciation and amortization, plus impact of non-recurring operational expenses,

if any. In addition to our results determined in accordance with IFRS, we believe Adjusted EBITDA (a non-IFRS measure) is useful in evaluating

our operating performance. We use Adjusted EBITDA in our operational and financial decision-making and believe Adjusted EBITDA is useful

to investors because similar measures are frequently used by securities analysts, investors, ratings agencies and other interested parties

to evaluate our competitors and to measure profitability. However, non-IFRS financial information is presented for supplemental informational

purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information

presented in accordance with IFRS. Investors are encouraged to review the related IFRS financial measure and the reconciliation of Adjusted

EBITDA to profit, its most directly comparable IFRS financial measure, and not to rely on any single financial measure to evaluate our

business.

Adjusted EBITDA Margin

We define Adjusted EBITDA Margin (a non-IFRS measure)

as Adjusted EBITDA (a non-IFRS measure) divided by revenue. In addition to our results determined in accordance with IFRS, we believe

Adjusted EBITDA Margin (a non-IFRS measure) is useful in evaluating our operating performance. We use Adjusted EBITDA Margin in our operational

and financial decision-making and believe Adjusted EBITDA Margin is useful to investors because similar measures are frequently used by

securities analysts, investors, ratings agencies and other interested parties to evaluate our competitors and to measure profitability.

However, non-IFRS financial information is presented for supplemental informational purposes only, has limitations as an analytical tool

and should not be considered in isolation or as a substitute for financial information presented in accordance with IFRS.

Annualized Delivery-as-a-service Revenue (DaaS)

DaaS Revenue (a non-IFRS) measure) is defined

as the annualized business to business (B2B) delivery-as-a-service revenue during the month and multiplying by twelve.

Annualized Recurring Revenue (SaaS ARR)

SaaS ARR (a non-IFRS measure) is defined as the

annual run-rate subscription revenue of subscription agreements from all customers at a point in time, calculated by taking the monthly

subscription revenue for all customers during that month and multiplying by twelve.

Average Revenue per Subscriber per month (ARPU)

ARPU (a non-IFRS measure) is calculated on a quarterly

basis by dividing the cumulative subscription revenue for the quarter by the average of the opening subscriber balance at the beginning

of the quarter and closing subscriber balance at the end of the quarter and dividing this by three.

Cartrack Holdings (“Cartrack”)

Earnings per share

Basic earnings per share in accordance with IFRS.

Free Cash Flow and Adjusted Free Cash Flow

We define Free Cash Flow (a non-IFRS measure)

as net cash generated from operating activities less purchases of property, plant and equipment. In addition to our results determined

in accordance with IFRS, we believe Free Cash Flow (a non-IFRS measure), is useful in evaluating our operating performance. We believe

that Free Cash Flow is a useful indicator of liquidity and the ability of the group to turn revenues into Free Cash Flow, respectively,

that provide information to management and investors about the amount of cash generated from our operations that, after the investments

in property, plant and equipment, can be used for strategic initiatives, including investing in our business, and strengthening our financial

position. However, non-IFRS financial information is presented for supplemental informational purposes only, has limitations as an analytical

tool and should not be considered in isolation or as a substitute for financial information presented in accordance with IFRS. Investors

are encouraged to review the related IFRS financial measure and the reconciliation of Free Cash Flow to net cash generated operating activities

and net cash generated from operating activities as a percentage of revenue, their most directly comparable IFRS financial measure, and

not to rely on any single financial measure to evaluate our business.

Rule of 40

The sum of revenue growth and operating margin

for a period of 12-months sum to greater than 40.

Rule of 60

The sum of revenue growth and adjusted EBITDA

margin for the period of 12 months sum to greater than 60.

Unit economics

These are non-IFRS financial measures that are

used as reference of Cartrack’s performance.

Lifetime value (LTV of a Customer) of customer

relationships to customer acquisition costs (CAC)

We calculate the LTV of our customer relationships

as of a measurement date by dividing (i) the product of our subscription revenue gross margin measured over the past twelve months, and

the difference between our current period SaaS ARR and prior comparative period (twelve months) SaaS ARR by (ii) the percentage of SaaS

ARR lost as a result of customer churn over the past twelve months. We calculate our CAC as our annual sales and marketing expense measured

over the past twelve months.

Lifetime value (LTV of a Subscriber), cost

of acquiring a subscriber (CAS) and cost of servicing a subscriber (CSS)

It is important to distinguish between the subscriber

contract life cycle (the life cycle of a vehicle or other equipment on our connected cloud) and the customer lifecycle (one customer normally

has multiple ongoing subscriber contract life cycles as customers de-fleet and re-fleet their vehicle parc and other equipment on our

connected cloud).

We calculate the LTV of a subscriber by multiplying

the ARPU with the expected contract life cycle months, multiplied by the subscription revenue gross margin percentage, which is defined

as gross profit relating to subscription revenue divided by subscription revenue.

We calculate CAS, which is calculated on a per

subscriber basis, as (i) sales and marketing expenses, plus (ii) sales commissions, plus (iii) cost of installing IoT equipment, divided

by (iv) the average subscriber base for such period.

We calculate CSS, which is calculated on a per

subscriber basis, as (i) operating expenses excluding estimated general business expansion costs, plus (ii) costs of sales that relates

to subscription revenue, less (iii) all costs used to calculate CAS, divided by (iv) the average subscriber balance for such period.

We estimate our long-term unit economics operational

profit by multiplying (i) the product of the expected life cycle of a subscriber on our connected cloud by ARPU, minus (ii) CAS added

to the product of the expected life cycle of a subscriber on our connected cloud by CSS.

Forward-Looking Statements

The information in this announcement (which includes

any oral statements made in connection therewith, as applicable) includes “forward-looking statements.” Forward-looking statements

are based on our beliefs and assumptions and on information currently available to us, and include, without limitation, statements regarding

our business, financial condition, strategy, results of operations, certain of our plans, objectives, assumptions, expectations, prospects

and beliefs and statements regarding other future events or prospects, including outlook statements. Forward-looking statements include

all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believe,”

“expect,” “plan,” “intend,” “seek,” “anticipate,” “estimate,”

“predict,” “potential,” “assume,” “continue,” “may,” “will,” “should,”

“could,” “shall,” “risk” or the negative of these terms or similar expressions that are predictions

of or indicate future events and future trends.

By their nature, forward-looking statements involve

risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution

you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition

and liquidity, the development of the industry in which we operate, the effect of acquisitions and operating decisions on us may differ

materially from those made in or suggested by the forward-looking statements contained in this announcement. In addition, even if our

results of operations, financial condition and liquidity, the development of the industry in which we operate, the effect of acquisitions

and operating decisions on us are consistent with the forward-looking statements contained in this announcement, those results or developments

may not be indicative of results or developments in subsequent periods.

Factors that could cause actual results to vary from

projected results include, but are not limited to:

| |

● |

our ability to acquire new customers and retain existing customers; |

| |

● |

our ability to acquire new subscribers and retain existing subscribers; |

| |

● |

our expectations regarding the effects of a pandemic or widespread outbreak of an illness, the Russia-Ukraine conflict, geopolitical tensions, and similar macroeconomic events, including financial distress caused by recent or potential bank failures, global supply chain challenges, foreign currency fluctuations, elevated inflation and interest rates and monetary policy changes, upon our and our customers’ and partners’ respective businesses; |

| |

● |

our anticipated growth strategies, including our ability to increase sales to existing customers, the introduction of new solutions and international expansion; |

| |

● |

our ability to adapt to rapid technological change in our industry; |

| |

● |

our dependence on cellular networks; |

| |

● |

competition from industry consolidation; |

| |

● |

market adoption of software-as-a-service (“SaaS”) fleet management platform; |

| |

● |

automotive market conditions and the evolving nature of the automotive industry towards autonomous vehicles; |

| |

● |

expected changes in our profitability and certain cost or expense items as a percentage of our revenue; |

| |

● |

our dependence on certain key component suppliers and vendors; |

| |

● |

our ability to maintain or enhance our brand recognition; |

| |

● |

our ability to maintain our key personnel or attract, train and retain other highly qualified personnel; |

| |

● |

the impact and evolving nature of laws and regulations relating to the internet, including cybersecurity and data privacy; |

| |

● |

our ability to protect our intellectual property and proprietary technologies and address any infringement claims; |

| |

● |

significant disruption in service on, or security breaches of, our websites or computer systems; |

| |

● |

dependence on third-party technology and licenses; |

| |

● |

fluctuations in the value of the South African rand and inflation rates in the countries in which we conduct business; |

| |

● |

our ability to access the capital markets in the future; and |

| |

● |

other risk factors discussed under “Risk Factors”. |

Forward-looking statements speak only as of the date

they are made, and we do not undertake any obligation to update them in light of new information or future developments or to release

publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated

events.

You are cautioned not to place undue reliance on any

forward-looking statements. We disclaim any duty to update and do not intend to update any forward-looking statements, all of which are

expressly qualified by the statements in this section, to reflect events or circumstances after the date of this announcement.

Non-IFRS Financial Measures

This announcement includes certain non-IFRS financial

measures. These non-IFRS financial measures are not measures of financial performance in accordance with IFRS and may exclude items that

are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation

or as an alternative or superior to IFRS measures. You should be aware that our announcement of these measures may not be comparable to

similarly titled measures used by other companies.

Market and Industry Data

We include statements and information in this

announcement concerning our industry ranking and the markets in which we operate, including our general expectations and market opportunity,

which are based on information from independent industry organizations and other third-party sources (including a third-party market study,

industry publications, surveys and forecasts). While Karooooo believes these third-party sources to be reliable as of the date of this

announcement, we have not independently verified any third-party information and such information is inherently imprecise. In addition,

projections, assumptions and estimates of the future performance of the industry in which we operate, and our future performance are necessarily

subject to a high degree of uncertainty and risk due to a variety of risks. These and other factors could cause results to differ materially

from those expressed in the estimates made by the independent parties and by us.

Trademarks and Trade Names

In our key markets, we have rights to use, or

hold, certain trademarks relating to Cartrack, or the respective applications for trademark registration are underway. We do not hold

or have rights to any other additional patents, trademarks or licenses, that, if absent, would have had a material adverse effect on our

business operations. Solely for convenience, trademarks and trade names referred to in this announcement may appear without the “®”

or “™” symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest

extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not

intend our use or display of other companies’ tradenames, trademarks or service marks to imply a relationship with, or endorsement

or sponsorship of us by, any other companies. Each trademark, trade name or service mark of any other company appearing in this announcement

is the property of its respective holder.

22

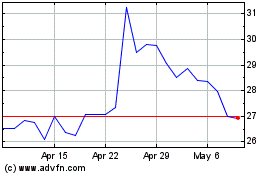

Karooooo (NASDAQ:KARO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Karooooo (NASDAQ:KARO)

Historical Stock Chart

From Feb 2024 to Feb 2025