SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange

Act of 1934

(Amendment No. 15)*

KEURIG DR PEPPER INC.

(Name of Issuer)

Common Stock, Par Value

$0.01 Per Share

(Title of Class of

Securities)

49271V100

(CUSIP Number)

Joachim Creus

Piet Heinkade 55

Amsterdam, 1019 GM

The Netherlands

Tel.: +31 202 355 000

(Name, Address and Telephone

Number of Person Authorized to Receive Notices and Communications)

Copies To:

Paul T. Schnell, Esq.

Sean C. Doyle, Esq.

Maxim O. Mayer-Cesiano, Esq.

Skadden, Arps, Slate,

Meagher & Flom LLP

One Manhattan West

New York, New York 10001

Tel.: (212) 735-3000

October 28, 2024

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

NOTE: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of

the Act (however, see the Notes).

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ¨.

| CUSIP No. 49271V100 |

|

|

| 1. |

|

NAMES OF REPORTING PERSONS:

JAB BevCo B.V. |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) x

|

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS

N/A |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(d) OR 2(e):

|

|

¨ |

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Netherlands |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7. |

SOLE VOTING POWER |

| |

None |

| |

8. |

SHARED VOTING POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

None |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

214,443,879 shares of Common Stock (1) (see Items 4 and 5) |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

¨ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

15.8% of Common Stock (2) (see Item 5) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON

HC |

|

|

(1) This represents the aggregate

voting and dispositive power of shares of common stock, par value $0.01 per share (“Common Stock”), of Keurig Dr Pepper

Inc. (“KDP”) that may be deemed to be beneficially owned by JAB BevCo B.V. (“JAB BevCo”), after

giving effect to the transactions described in Item 4.

(2) The percentage ownership

is based upon 1,356,453,649 shares of Common Stock issued and outstanding as of October 22, 2024 as set forth in the Quarterly Report

on Form 10-Q (the “Latest Periodic Report”), filed by KDP with the United States Securities and Exchange Commission

(the “Commission”) on October 24, 2024.

| CUSIP No. 49271V100 |

|

|

| 1. |

|

NAMES OF REPORTING PERSONS:

Acorn Holdings B.V. |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨

|

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS

N/A |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(d) OR 2(e):

|

|

¨ |

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Netherlands |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7. |

SOLE VOTING POWER |

| |

None |

| |

8. |

SHARED VOTING POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

None |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

214,443,879 shares of Common Stock (see Items 4 and 5) |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

¨ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

15.8% of Common Stock (2) (see Item 5) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON

HC |

|

|

(1) This represents the

aggregate voting and dispositive power of shares of Common Stock that may be deemed to be beneficially owned by JAB BevCo. Acorn Holdings

B.V. (“Acorn”) may be deemed to have beneficial ownership of such shares since JAB BevCo is an indirect subsidiary

of Acorn. Neither the filing of this Statement on Schedule 13D nor any of its contents shall be deemed to constitute an admission by Acorn

that it is the beneficial owner of any of the common stock referred to herein for purposes of Section 13(d) of the Exchange

Act, or for any other purpose, and such beneficial ownership is expressly disclaimed.

(2) The percentage ownership

is based upon 1,356,453,649 shares of Common Stock issued and outstanding as of October 22, 2024, as set forth in the Latest Periodic

Report.

| CUSIP No. 49271V100 |

|

|

| 1. |

|

NAMES OF REPORTING PERSONS:

JAB Coffee & Beverages Holdings 2 B.V. |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨

|

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS

N/A |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(d) OR 2(e):

|

|

¨ |

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Netherlands |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7. |

SOLE VOTING POWER |

| |

None |

| |

8. |

SHARED VOTING POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

None |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

214,443,879 shares of Common Stock (see Items 4 and 5) |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

¨ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

15.8% of Common Stock (2) (see Item 5) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON

HC |

|

|

(1) This represents the aggregate

voting and dispositive power of shares of Common Stock that may be deemed to be beneficially owned by JAB BevCo. JAB Coffee & Beverages

Holdings 2 B.V. (“Holdings 2”) may be deemed to have beneficial ownership of such shares since JAB BevCo is an indirect

subsidiary of Holdings 2. Neither the filing of this Statement on Schedule 13D nor any of its contents shall be deemed to constitute an

admission by Holdings 2 that it is the beneficial owner of any of the common stock referred to herein for purposes of Section 13(d) of

the Exchange Act, or for any other purpose, and such beneficial ownership is expressly disclaimed.

(2) The percentage ownership

is based upon 1,356,453,649 shares of Common Stock issued and outstanding as of October 22, 2024, as set forth in the Latest Periodic

Report.

| CUSIP No. 49271V100 |

|

|

| 1. |

|

NAMES OF REPORTING PERSONS:

JAB Coffee & Beverages Holdings B.V. |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨

|

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS

N/A |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(d) OR 2(e):

|

|

¨ |

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Netherlands |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7. |

SOLE VOTING POWER |

| |

None |

| |

8. |

SHARED VOTING POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

None |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

214,443,879 shares of Common Stock (see Items 4 and 5) |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

¨ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

15.8% of Common Stock (2) (see Item 5) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON

HC |

|

|

(1) This represents the aggregate

voting and dispositive power of shares of Common Stock that may be deemed to be beneficially owned by JAB BevCo. JAB Coffee & Beverages

Holdings B.V. (“Holdings”) may be deemed to have beneficial ownership of such shares since JAB BevCo is an indirect

subsidiary of Holdings. Neither the filing of this Statement on Schedule 13D nor any of its contents shall be deemed to constitute an

admission by Holdings that it is the beneficial owner of any of the common stock referred to herein for purposes of Section 13(d) of the

Exchange Act, or for any other purpose, and such beneficial ownership is expressly disclaimed.

(2) The percentage ownership

is based upon 1,356,453,649 shares of Common Stock issued and outstanding as of October 22, 2024, as set forth in the Latest Periodic

Report.

| CUSIP No. 49271V100 |

|

|

| 1. |

|

NAMES OF REPORTING PERSONS:

JAB Coffee & Beverages B.V. |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨

|

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS

N/A |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(d) OR 2(e):

|

|

¨ |

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Netherlands |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7. |

SOLE VOTING POWER |

| |

None |

| |

8. |

SHARED VOTING POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

None |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

214,443,879 shares of Common Stock (see Items 4 and 5) |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

¨ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

15.8% of Common Stock (2) (see Item 5) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON

HC |

|

|

(1) This represents the aggregate

voting and dispositive power of shares of Common Stock that may be deemed to be beneficially owned by JAB BevCo. JAB Coffee & Beverages

B.V. (“JAB C&B”) may be deemed to have beneficial ownership of such shares since JAB BevCo is an indirect subsidiary

of JAB C&B. Neither the filing of this Statement on Schedule 13D nor any of its contents shall be deemed to constitute an admission

by JAB C&B that it is the beneficial owner of any of the common stock referred to herein for purposes of Section 13(d) of the Exchange

Act, or for any other purpose, and such beneficial ownership is expressly disclaimed.

(2) The percentage ownership

is based upon 1,356,453,649 shares of Common Stock issued and outstanding as of October 22, 2024, as set forth in the Latest Periodic

Report.

| CUSIP No. 49271V100 |

|

|

| 1. |

|

NAMES OF REPORTING PERSONS:

JAB Forest B.V. |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨

|

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS

N/A |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(d) OR 2(e):

|

|

¨ |

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Netherlands |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7. |

SOLE VOTING POWER |

| |

None |

| |

8. |

SHARED VOTING POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

None |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

214,443,879 shares of Common Stock (see Items 4 and 5) |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

¨ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

15.8% of Common Stock (2) (see Item 5) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON

HC |

|

|

(1) This represents the aggregate

voting and dispositive power of shares of Common Stock that may be deemed to be beneficially owned by JAB BevCo. JAB Forest B.V. (“Forest”)

may be deemed to have beneficial ownership of such shares since JAB BevCo is an indirect subsidiary of Forest. Neither the filing of this

Statement on Schedule 13D nor any of its contents shall be deemed to constitute an admission by Forest that it is the beneficial owner

of any of the common stock referred to herein for purposes of Section 13(d) of the Exchange Act, or for any other purpose, and such beneficial

ownership is expressly disclaimed.

(2) The percentage ownership is based upon 1,356,453,649 shares of

Common Stock issued and outstanding as of October 22, 2024, as set forth in the Latest Periodic Report.

| CUSIP No. 49271V100 |

|

|

| 1. |

|

NAMES OF REPORTING PERSONS:

JAB Holdings B.V. |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨

|

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS

N/A |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(d) OR 2(e):

|

|

¨ |

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Netherlands |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7. |

SOLE VOTING POWER |

| |

None |

| |

8. |

SHARED VOTING POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

None |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

214,443,879 shares of Common Stock (see Items 4 and 5) |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

¨ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

15.8% of Common Stock (2) (see Item 5) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON

HC |

|

|

(1) This represents the aggregate

voting and dispositive power of shares of Common Stock that may be deemed to be beneficially owned by JAB BevCo. JAB Holdings B.V. (“JAB

Holdings”) may be deemed to have beneficial ownership of the shares held by JAB BevCo since JAB BevCo is an indirect subsidiary

of JAB Holdings. Neither the filing of this Statement on Schedule 13D nor any of its contents shall be deemed to constitute an admission

by JAB Holdings that it is the beneficial owner of any of the common stock held by JAB BevCo for purposes of Section 13(d) of the Exchange

Act, or for any other purpose, and such beneficial ownership is expressly disclaimed.

(2) The percentage ownership

is based upon 1,356,453,649 shares of Common Stock issued and outstanding as of October 22, 2024, as set forth in the Latest Periodic

Report.

| CUSIP No. 49271V100 |

|

|

| 1. |

|

NAMES OF REPORTING PERSONS:

JAB Investments S.à r.l. |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨

|

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS

N/A |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(d) OR 2(e):

|

|

¨ |

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Luxembourg |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7. |

SOLE VOTING POWER |

| |

None |

| |

8. |

SHARED VOTING POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

None |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

214,443,879 shares of Common Stock (see Items 4 and 5) |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

¨ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

15.8% of Common Stock (2) (see Item 5) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON

HC |

|

|

(1) This represents the aggregate

voting and dispositive power of shares of Common Stock that may be deemed to be beneficially owned by JAB BevCo. JAB Investments S.à

r.l. (“JAB Investments”) may be deemed to have beneficial ownership of such shares since JAB BevCo is an indirect subsidiary

of JAB Investments. Neither the filing of this Statement on Schedule 13D nor any of its contents shall be deemed to constitute an admission

by JAB Investments that it is the beneficial owner of any of the common stock referred to herein for purposes of Section 13(d) of the

Exchange Act, or for any other purpose, and such beneficial ownership is expressly disclaimed.

(2) The percentage ownership

is based upon 1,356,453,649 shares of Common Stock issued and outstanding as of October 22, 2024, as set forth in the Latest Periodic

Report.

| CUSIP No. 49271V100 |

|

|

| 1. |

|

NAMES OF REPORTING PERSONS:

JAB Holding Company S.à r.l. |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨

|

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS

N/A |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(d) OR 2(e):

|

|

¨ |

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Luxembourg |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7. |

SOLE VOTING POWER |

| |

None |

| |

8. |

SHARED VOTING POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

None |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

214,443,879 shares of Common Stock (see Items 4 and 5) |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

¨ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

15.8% of Common Stock (2) (see Item 5) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON

HC |

|

|

(1) This represents the

aggregate voting and dispositive power of shares of Common Stock that may be deemed to be beneficially owned by JAB BevCo. JAB Holding

Company S.à r.l. (“JAB Holding Company”) may be deemed to have beneficial ownership of such shares since JAB

BevCo is a indirect subsidiary of JAB Holding Company. Neither the filing of this Statement on Schedule 13D nor any of its contents shall

be deemed to constitute an admission by JAB Holding Company that it is the beneficial owner of any of the common stock referred to herein

for purposes of Section 13(d) of the Exchange Act, or for any other purpose, and such beneficial ownership is expressly disclaimed.

(2) The percentage ownership

is based upon 1,356,453,649 shares of Common Stock issued and outstanding as of October 22, 2024, as set forth in the Latest Periodic

Report.

| CUSIP No. 49271V100 |

|

|

| 1. |

|

NAMES OF REPORTING PERSONS:

Joh. A. Benckiser S.à r.l. |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨

|

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS

N/A |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(d) OR 2(e):

|

|

¨ |

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Luxembourg |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7. |

SOLE VOTING POWER |

| |

None |

| |

8. |

SHARED VOTING POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

None |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

214,443,879 shares of Common Stock (see Items 4 and 5) |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

¨ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

15.8% of Common Stock (2) (see Item 5) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON

HC |

|

|

(1) This represents the

aggregate voting and dispositive power of shares of Common Stock that may be deemed to be beneficially owned by JAB BevCo. Joh. A. Benckiser

S.à r.l. (“Joh. A. Benckiser”) may be deemed to have beneficial ownership of such shares since JAB BevCo is

an indirect subsidiary of Joh. A. Benckiser. Neither the filing of this Statement on Schedule 13D nor any of its contents shall be deemed

to constitute an admission by Joh. A. Benckiser that it is the beneficial owner of any of the common stock referred to herein for purposes

of Section 13(d) of the Exchange Act, or for any other purpose, and such beneficial ownership is expressly disclaimed.

(2) The percentage ownership

is based upon 1,356,453,649 shares of Common Stock issued and outstanding as of October 22, 2024, as set forth in the Latest Periodic

Report.

| CUSIP No. 49271V100 |

|

|

| 1. |

|

NAMES OF REPORTING PERSONS:

Agnaten SE |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨

|

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS

N/A |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(d) OR 2(e):

|

|

¨ |

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Luxembourg |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7. |

SOLE VOTING POWER |

| |

None |

| |

8. |

SHARED VOTING POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

None |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

214,443,879 shares of Common Stock (see Items 4 and 5) |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

¨ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

15.8% of Common Stock (2) (see Item 5) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON

HC |

|

|

(1) This represents the

aggregate voting and dispositive power of shares of Common Stock that may be deemed to be beneficially owned by JAB BevCo. Agnaten SE

(“Agnaten”) may be deemed to have beneficial ownership of such shares since JAB BevCo is an indirect subsidiary of

Agnaten. Neither the filing of this Statement on Schedule 13D nor any of its contents shall be deemed to constitute an admission by Agnaten

that it is the beneficial owner of any of the common stock referred to herein for purposes of Section 13(d) of the Exchange

Act, or for any other purpose, and such beneficial ownership is expressly disclaimed.

(2) The percentage ownership

is based upon 1,356,453,649 shares of Common Stock issued and outstanding as of October 22, 2024, as set forth in the Latest Periodic

Report.

| CUSIP No. 49271V100 |

|

|

| 1. |

|

NAMES OF REPORTING PERSONS:

Lucresca SE |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨

|

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS

N/A |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(d) OR 2(e):

|

|

¨ |

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Luxembourg |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7. |

SOLE VOTING POWER |

| |

None |

| |

8. |

SHARED VOTING POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

None |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

214,443,879 (1) (see Items 4 and 5) |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

214,443,879 shares of Common Stock (see Items 4 and 5) |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

¨ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

15.8% of Common Stock (2) (see Item 5) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON

HC |

|

|

(1) This represents the

aggregate voting and dispositive power of shares of Common Stock that may be deemed to be beneficially owned by JAB BevCo. Lucresca SE

(“Lucresca”) may be deemed to have beneficial ownership of such shares since JAB BevCo is an indirect subsidiary of

Lucresca. Neither the filing of this Statement on Schedule 13D nor any of its contents shall be deemed to constitute an admission by Lucresca

that it is the beneficial owner of any of the common stock referred to herein for purposes of Section 13(d) of the Exchange

Act, or for any other purpose, and such beneficial ownership is expressly disclaimed.

(2) The percentage ownership

is based upon 1,356,453,649 shares of Common Stock issued and outstanding as of October 22, 2024, as set forth in the Latest Periodic

Report.

EXPLANATORY NOTE

This Schedule 13D/A constitutes

Amendment No. 15 (“Amendment No. 15”) to and amends and supplements the prior statement on Schedule 13D as filed on

July 19, 2018, as amended by Amendment No. 1 filed on May 16, 2019, Amendment No. 2 filed on May 28, 2019, Amendment No. 3 filed on March

9, 2020, Amendment No. 4 filed on May 22, 2020, Amendment No. 5 filed on June 12, 2020, Amendment No. 6 filed on August 19, 2020, Amendment

No. 7 filed on September 9, 2020, Amendment No. 8 filed on November 19, 2020, Amendment No. 9 filed on November 14, 2022, Amendment No.

10 filed on May 3, 2023, Amendment No. 11 (“Amendment No. 11”) filed on March 4, 2024, Amendment No. 12 filed on March

7, 2024, Amendment No. 13 filed on March 12, 2024 and Amendment No. 14 filed on March 18, 2024 (as so amended, the “Schedule

13D”), by (i) JAB BevCo B.V. (formerly known as Maple Holdings B.V.), a private limited liability company (besloten vennootschap

met beperkte aansprakelijkheid) organized under the laws of the Netherlands (“JAB BevCo”), (ii) Acorn Holdings

B.V., a private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) organized under the laws of the

Netherlands, which is the parent company of JAB BevCo (“Acorn”), (iii) JAB Coffee & Beverages Holdings 2 B.V.,

a private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) organized under the laws of the Netherlands,

which is the parent company of Acorn (“Holdings 2”), (iv) JAB Coffee & Beverages Holdings B.V., a private limited

liability company (besloten vennootschap met beperkte aansprakelijkheid) organized under the laws of the Netherlands, which is

the parent company of Holdings 2 (“Holdings”), (v) JAB Coffee & Beverages B.V. (formerly known as Acorn Top Holding

B.V.), a private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) organized under the laws of the

Netherlands, which is the parent company of Holdings (“JAB C&B”), (vi) JAB Forest B.V., a private limited liability

company (besloten vennootschap met beperkte aansprakelijkheid) organized under the laws of the Netherlands, which is the parent

company of JAB C&B (“Forest”), (vii) JAB Holdings B.V., a private limited liability company (besloten vennootschap

met beperkte aansprakelijkheid) organized under the laws of the Netherlands, which is the parent company of Forest (“JAB

Holdings”), (viii) JAB Investments S.à r.l., a private limited liability company incorporated under the laws of Luxembourg,

which is the parent company of JAB Holdings (“JAB Investments”), (ix) JAB Holding Company S.à r.l., a private

limited liability company incorporated under the laws of Luxembourg, which is the parent company of JAB Investments (“JAB Holding

Company”), (x) Joh. A. Benckiser S.à r.l., a private limited liability company incorporated under the laws of Luxembourg,

which is a parent company of JAB Holding Company (“Joh. A. Benckiser”), (xi) Agnaten SE, a private company incorporated

under the laws of Luxembourg, which is a parent company of Joh. A. Benckiser (“Agnaten”), and (xii) Lucresca SE, a

private company incorporated under the laws of Luxembourg, which is a parent company of Joh. A. Benckiser (“Lucresca”,

and together with JAB BevCo, Acorn, Holdings 2, Holdings, JAB C&B, Forest, JAB Holdings, JAB Investments, JAB Holding Company, Joh.

A. Benckiser and Agnaten, the “Reporting Persons”). Except as set forth herein, the Schedule 13D as previously amended

remains applicable.

Item 4.

Purpose of Transaction.

Item 4 is hereby amended

and supplemented as follows, and paragraph four of Amendment No. 11 is amended and restated as paragraph two below:

On October 28, 2024, JAB BevCo

entered into an Underwriting Agreement (the “Underwriting Agreement”) with Morgan Stanley & Co. LLC (the “Underwriter”)

pursuant to which JAB BevCo agreed to sell 60,000,000 shares of Common Stock (the “Common Stock”), par value $0.01

per share (the “Shares”), of Keurig Dr Pepper Inc. (“KDP”) through a secondary offering (the “Offering”).

JAB BevCo also granted an option to the Underwriter to purchase up to an additional 9,000,000 Shares for a period of 30 days following

the date of the Offering. The Offering closed on October 30, 2024. Also on October 30, 2024, JAB BevCo sold 9,000,000 Shares to the Underwriter

pursuant to the foregoing option granted to the Underwriter in the Underwriting Agreement.

Under the terms of the transaction,

the remaining Shares beneficially owned by JAB BevCo will be subject to a customary 90 day lock-up agreement with the Underwriter with

respect to KDP securities, subject to certain customary exceptions (“Lock-up Agreement”).

The foregoing description

of the Underwriting Agreement and Lock-up Agreement does not purport to be complete and is qualified in its entirety by reference to the

Underwriting Agreement and accompanying form of Lock-up Agreement, substantially in the form attached as Exhibit 19 to this Schedule

13D and incorporated herein by reference.

Item 5. Interest in Securities of the Issuer.

Item 5 is hereby amended and supplemented as

follows:

(a) – (b) JAB BevCo

beneficially owns 214,443,879 Shares, after giving effect to the Offering, which represents 15.8% of the issued and outstanding Shares

as of October 22, 2024, as set forth in the Quarterly Report on Form 10-Q (the “Latest Periodic Report”) filed by KDP

with the United States Securities and Exchange Commission (the “Commission”) on October 24, 2024.

Each of Acorn, Holdings 2,

Holdings, JAB C&B, Forest, JAB Holdings, JAB Investments, JAB Holding Company, Joh. A. Benckiser, Agnaten and Lucresca may be deemed,

for purposes of Rule 13d-3 under the Exchange Act, to share with JAB BevCo the power to vote or dispose, or to direct the voting or disposition

of, the 214,443,879 Shares beneficially owned by JAB BevCo. Therefore, for the purpose of Rule 13d-3, each of such Reporting Persons may

be deemed to be the beneficial owners of an aggregate of 214,443,879 Shares.

As of the date hereof, Mr.

Harf may be deemed to be the beneficial owner of an aggregate of 3,802,205 Shares, which represents 0.3% of the issued and outstanding

Shares as of October 22, 2024, as set forth in the Latest Periodic Report.

As of the date hereof, Mr.

Creus beneficially owns 142,236 Shares, which represents less than 0.1% of the issued and outstanding Shares as of October 22, 2024, as

set forth in the Latest Periodic Report.

Except as set forth in this

Item 5(a), none of the Reporting Persons, and, to the best knowledge of the Reporting Persons, none of the persons named in Schedule A

to the Schedule 13D beneficially owns any Shares. Neither the filing of this Amendment No. 15 nor any of its contents shall be deemed

to constitute an admission by the Reporting Persons that it is the beneficial owner of any Shares.

(c) Except for the Offering

disclosed in Item 4 herein, none of the Reporting Persons, and to the best knowledge of the Reporting Persons, none of the persons named

in Schedule A to the Schedule 13D, has effected any transactions in the Shares during the past 60 days.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item 6 is hereby amended and supplemented as

follows:

In connection with the

Offering referred to in Item 4 above, JAB BevCo entered into the Underwriting Agreement and accompanying Lock-Up Agreement (see Item

4), substantially in the form attached as Exhibit 19 to this Amendment No. 15 of the Schedule 13D and is incorporated herein

by reference (incorporated by reference to Exhibit 1.1 of KDP's Current Report on Form 8-K filed with the Securities and Exchange Commission on October

30, 2024).

SIGNATURE

After reasonable inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: October 30, 2024

| |

JAB FOREST B.V.

JAB HOLDINGS B.V.

|

| |

|

|

| |

By: |

/s/ Frank Engelen |

| |

Name: |

Frank Engelen |

| |

Title: |

Managing Director |

| |

|

|

| |

By: |

/s/ Sebastiaan Wolvers |

| |

Name: |

Sebastiaan Wolvers |

| |

Title: |

Managing Director |

| |

|

|

| |

|

|

| |

JAB COFFEE & BEVERAGES B.V.

JAB COFFEE & BEVERAGES HOLDINGS B.V.

JAB COFFEE & BEVERAGES HOLDINGS 2 B.V. |

| |

|

| |

|

|

| |

By: |

/s/ Rafael Da Cunha |

| |

Name: |

Rafael Da Cunha |

| |

Title: |

Managing Director |

| |

|

|

| |

By: |

/s/ Sebastiaan Wolvers |

| |

Name: |

Sebastiaan Wolvers |

| |

Title: |

Managing Director |

| |

|

|

| |

|

|

| |

ACORN HOLDINGS B.V. |

| |

|

| |

|

|

| |

By: |

/s/ Rafael Da Cunha |

| |

Name: |

Rafael Da Cunha |

| |

Title: |

Managing Director |

| |

|

|

| |

By: |

/s/ Sebastiaan Wolvers |

| |

Name: |

Sebastiaan Wolvers |

| |

Title: |

Managing Director |

| |

|

| |

JOH. A. BENCKISER S.À R.L |

| |

|

|

| |

|

|

| |

By: |

/s/ Joachim Creus |

| |

Name: |

Joachim Creus |

| |

Title: |

Managing Director |

| |

|

|

| |

By: |

/s/ Jonathan Norman |

| |

Name: |

Jonathan Norman |

| |

Title: |

Managing Director |

| |

JAB HOLDING COMPANY S.À r.l. |

| |

|

|

| |

By: |

/s/ Frank Engelen |

| |

Name: |

Frank Engelen |

| |

Title: |

Manager |

| |

|

|

| |

By: |

/s/ Jonathan Norman |

| |

Name: |

Jonathan Norman |

| |

Title: |

Manager |

| |

|

|

| |

JAB INVESTMENTS S.À R.L. |

| |

|

|

| |

By: |

/s/ Sebastiaan Wolvers |

| |

Name: |

Sebastiaan Wolvers |

| |

Title: |

Manager |

| |

|

|

| |

By: |

/s/ Jonathan Norman |

| |

Name: |

Jonathan Norman |

| |

Title: |

Manager |

| |

|

|

| |

|

|

| |

AGNATEN SE |

| |

LUCRESCA SE |

| |

|

|

| |

By: |

/s/ Joachim Creus |

| |

Name: |

Joachim Creus |

| |

Title: |

Authorized Representative |

| |

JAB BEVCO B.V. |

| |

|

|

| |

By: |

/s/ Sebastiaan Wolvers |

| |

Name: |

Sebastiaan Wolvers |

| |

Title: |

Managing Director |

| |

|

|

| |

By: |

/s/ Leo Burgers |

| |

Name: |

Leo Burgers |

| |

Title: |

Managing Director |

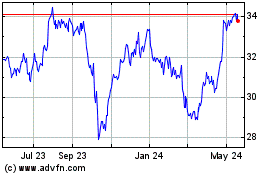

Keurig Dr Pepper (NASDAQ:KDP)

Historical Stock Chart

From Dec 2024 to Jan 2025

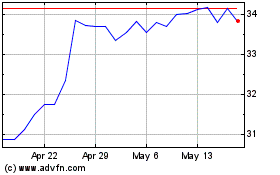

Keurig Dr Pepper (NASDAQ:KDP)

Historical Stock Chart

From Jan 2024 to Jan 2025