UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrant |

|

☒ |

| Filed by a Party other than the Registrant |

|

☐ |

Check the appropriate box:

| ☐ |

|

Preliminary Proxy Statement |

| ☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

|

Definitive Proxy Statement |

| ☐ |

|

Definitive Additional Materials |

| ☐ |

|

Soliciting Material Pursuant to Rule 14(a)-12 |

Kandi Technologies Group, Inc.

(Name of Registrant as Specified in Charter)

Payment of filing fee (check the appropriate box):

| ☒ |

|

No fee required. |

| ☐ |

|

Fee paid previously with preliminary materials. |

| ☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

KANDI TECHNOLOGIES GROUP, INC.

November 17, 2023

To the Shareholders of Kandi Technologies Group,

Inc.:

You are cordially invited to

attend the Annual Meeting of Shareholders of Kandi Technologies Group, Inc., a Delaware corporation (the “Company”, or “Kandi”),

to be held at our executive office, located at Building 1, Floor 4, Zhijiangyin, Yunhe Road, Xihu District, Hangzhou City, Zhejiang Province,

China, 310024, on December 27, 2023, at 6:00 a.m. E.T. (7:00 p.m. Beijing Time).

The Notice of Annual Meeting

of Shareholders and Proxy Statement/Prospectus describe the formal business to be transacted at the annual meeting. We are providing our

shareholders access to our proxy materials and our Annual Report on Form 10-K, for the fiscal year ended December 31, 2022,

over the Internet. This allows us to provide you with information relating to our 2022 Annual Meeting of Shareholders in a fast and efficient

manner. On or about November 17, 2023, we will mail to our shareholders a Notice of Internet Availability of Proxy Materials containing

instructions on how to access our proxy materials and Annual Report on Form 10-K for the fiscal year ended December 31, 2022

online and how to vote online. If you receive this notice by mail, you will not receive a printed copy of the materials unless you specifically

request one. Included within this notice will be instructions on how to request and receive printed copies of these materials and a proxy

card by mail.

As discussed in the enclosed

Proxy Statement/Prospectus, the Annual Meeting will be devoted to approve our reincorporation from the State of Delaware to the country

of the British Virgin Islands, the election of seven (7) directors, the ratification of the appointment of ARK Pro CPA & Co as

our independent auditor for the fiscal year ended December 31, 2023, the approval of an amendment to our Certificate of Incorporation,

as amended, to increase the number of authorized shares of common stock from 100,000,000 shares to 300,000,000 shares, and to correspondingly

increase the number of authorized shares of preferred stock from 10,000,000 to 30,000,000 shares, the conduct of an advisory “say-on-pay”

vote regarding the compensation of our named executive officers, and any other business matters properly brought before the Annual Meeting.

Whether or not you plan to

attend the meeting, please vote as soon as possible. If you request a printed copy of the proxy materials, please complete, sign, date,

and return the proxy card you will receive in response to your request as soon as possible or you can vote via the Internet or by telephone.

This will ensure that your shares will be represented and voted at the meeting, even if you do not attend. If you attend the meeting,

you may revoke your proxy and personally cast your vote. Attendance at the meeting does not of itself revoke your proxy.

| |

|

Sincerely, |

| |

|

|

| |

|

/s/

Dong Xueqin |

| |

|

Dong

Xueqin |

| |

|

President

and Chief Executive Officer |

Neither the Securities and

Exchange Commission nor any state securities commission has determined if this attached proxy statement/prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

This proxy statement/prospectus

is dated November 17, 2023, and is first being mailed to the shareholders of Kandi with a form of proxy card or voting instructions on

or about November 17, 2023.

KANDI TECHNOLOGIES GROUP, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held December 27, 2023

To the Shareholders of Kandi Technologies Group,

Inc.:

NOTICE HEREBY IS GIVEN that

the 2022 Annual Meeting of Shareholders of Kandi Technologies Group, Inc., a Delaware corporation, will be held at our executive office,

located at Building 1, Floor 4, Zhijiangyin, Yunhe Road, Xihu District, Hangzhou City, Zhejiang Province, China, 310024, on December 27,

2023, at 6:00 a.m. E.T. (7:00 p.m. Beijing Time), to consider and act upon the following:

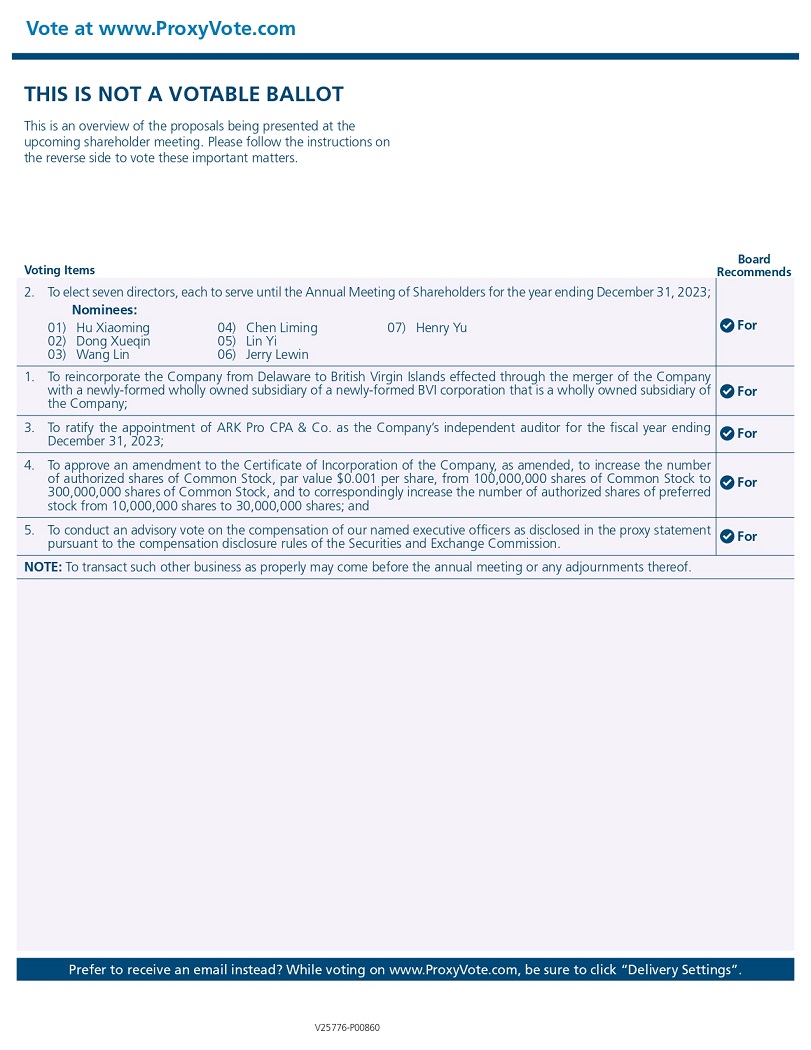

| 1. | To approve the Company’s reincorporation from the State

of Delaware to the country of the British Virgin Islands; |

| 2. | To elect seven directors, each to serve until the 2023 Annual

Meeting of Shareholders; |

| 3. | To

ratify the appointment of ARK Pro CPA & Co. (“ARK”) as

the Company’s independent auditor for the fiscal year ended December 31, 2023; |

| 4. | To approve an amendment to our Certificate of Incorporation,

as amended, to increase the number of authorized shares of common stock from 100,000,000 shares to 300,000,000 shares, and to correspondingly

increase the number of authorized shares of preferred stock from 10,000,000 to 30,000,000 shares; |

| 5. | To conduct an advisory vote on the compensation of our named

executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange

Commission; and |

| 6. | To transact such other business as properly may come before

the annual meeting or any adjournments thereof. |

Shareholders of record at the

close of business on November 6, 2023 are entitled to receive notice of and to vote at the Annual Meeting and any adjournments thereof.

We are furnishing proxy materials to our shareholders on the Internet, rather than mailing printed copies of those materials to each shareholder.

If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials

unless you request them. Instead, the Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and

review the proxy materials, and vote your proxy, on the Internet or by telephone.

| |

|

By

Order of the Board of Directors |

| |

|

|

| |

|

/s/

Hu Xiaoming |

| |

|

Hu

Xiaoming |

| |

|

Chairman

of the Board of Directors |

Jinhua, Zhejiang Province, China

November 17, 2023

Important Notice Regarding the Availability

of Proxy Materials for the

Annual Meeting of Shareholders to be held on December 27, 2023:

WHETHER OR NOT YOU PLAN

TO ATTEND THE ANNUAL MEETING, YOUR VOTE IS IMPORTANT. PLEASE FOLLOW THE INSTRUCTIONS ON THE NOTICE OF INTERNET AVAILABILITY OF PROXY

MATERIALS TO VOTE YOUR PROXY VIA THE INTERNET OR BY TELEPHONE OR REQUEST AND PROMPTLY COMPLETE, EXECUTE AND RETURN THE PROXY CARD BY FOLLOWING

THE INSTRUCTIONS ON THE PROXY CARD. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON IF YOU SO DESIRE.

TABLE OF CONTENTS

CONVENTIONS

In this proxy statement/prospectus,

we refer to Kandi Technologies Group, Inc., the Delaware corporation whose shares you currently own (together with its direct and indirect

subsidiaries, unless the context otherwise indicates), as “Kandi.” Additionally, we sometimes refer to Kandi as the “Company”,

“we,” “us,” or “our.” “You” refers to the shareholders of Kandi. We refer to Kandi Technologies

Group, Inc., the newly-formed company incorporated under the laws of the British Virgin Islands that is currently a wholly-owned subsidiary

of Kandi, as “Kandi BVI,” and we refer to Kandi Technologies Mergerco Inc., a wholly-owned subsidiary of Kandi BVI, as “Merger

Sub.” In addition, we refer to the People’s Republic of China as “PRC” or “China.” References to “Renminbi”

and “RMB” are to the legal currency of China and references to “U.S. dollars,” “dollars,” “US$”

and “$” are to the legal currency of the United States. Unless otherwise noted, all monetary amounts are stated in U.S. Dollars.

Our reporting currency is the

US$. The functional currency of our entities located in China is the RMB. For the entities whose functional currency is the RMB,

results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated

at the unified exchange rate at the end of the period, and equity is translated at historical exchange rates. As a result, amounts relating

to assets and liabilities reported on the statements of cash flows may not necessarily agree with the changes in the corresponding balances

on the balance sheets. Translation adjustments resulting from the process of translating the local currency financial statements into

US$ are included in determining comprehensive income/loss. Transactions denominated in foreign currencies are translated into the functional

currency at the exchange rates prevailing on the transaction dates. Assets and liabilities denominated in foreign currencies are translated

into the functional currencies at the exchange rates prevailing at the balance sheet date with any transaction gains and losses that arise

from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results

of operations as incurred.

Investing in our securities

involves a high degree of risk. Prior to making a decision about investing in our securities, you should carefully consider the specific

risk factors discussed below, and the risk factors contained in our annual report on Form 10-K for the fiscal year ended December 31,

2022 under the heading “Item 1A. Risk Factors,” and as described or may be described in any subsequent quarterly

report on Form 10-Q under the heading “Item 1A. Risk Factors,” together with all of the other information contained

in this prospectus. For a description of these reports and documents, and information about where you can find them, see “Where

You Can Find Additional Information.” If any of the risks or uncertainties described in our SEC filings or any additional risks

and uncertainties actually occur, our business, financial condition and results of operations could be materially and adversely affected,

and the trading price of our securities could decline and you might lose all or part of the value of your investment. Kandi is a holding

company with most of its operations in China, and a minority of business in the United States, Therefore, the Company is subject

to a series of unique risk factors such as the substantial uncertainties with respect to the policies of PRC government and PRC legal

system; limitations of oversea listing; heightened threshold for data security examination; and potential inabilities of fully examining

the auditing materials in China by PCAOB, as indicated by the list below. However, by no means will the list be a completion summarization

of all the risk factors the Company is facing with. For more details, please see Summary of Risk Factors and Risk Factors sections.

| ● | Substantial uncertainties and restrictions with respect to

the political and economic policies of the PRC government and PRC laws and regulations could have a significant impact upon the business

that we may be able to conduct in the PRC and accordingly on the results of our operations and financial condition. |

| ● | Adverse regulatory developments in China may subject us to

additional regulatory review, and additional disclosure requirements and regulatory scrutiny to be adopted by the SEC in response to

risks related to recent regulatory developments in China may impose additional compliance requirements for companies like us with China-based

operations, all of which could increase our compliance costs, subject us to additional disclosure requirements. |

| ● | Compliance with China’s new Data Security Law, Measures

on Cybersecurity Review (revised draft for public consultation), Personal Information Protection Law (second draft for consultation),

regulations and guidelines relating to the multi-level protection scheme and any other future laws and regulations may entail significant

expenses and could materially affect our business. |

| ● | The CSRC has released the Trial Administrative Measures of

Overseas Securities Offering and Listing by domestic companies and five guidelines, which Became effective on March 31, 2023. Currently

it does not pose any additional burden to the Company, however, the Chinese government may exert more oversight and control over offerings

that are conducted overseas and foreign investment in China-based issuers, which could significantly limit or completely hinder our ability

to offer or continue to offer our common stock to investors and could cause the value of our common stock to significantly decline or

become worthless. |

| ● | It may be difficult for overseas regulators to conduct investigation

or collect evidence within China. |

| ● | Our auditor is subject to inspection by The United States

Public Company Accounting Oversight Board (“PCAOB”) on a regular basis. To the extent that our independent registered public

accounting firm’s audit documentation related to their audit reports for our company becomes located in China, the PCAOB may not

be able inspect such audit documentation and, as such, you may be deprived of the benefits of such inspection and our common stock could

be delisted from the stock exchange pursuant to the Holding Foreign Companies Accountable Act. |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Please note that this proxy

statement/prospectus contains or incorporates by reference “forward-looking statements” and “forward-looking information”

under applicable securities laws. These forward-looking statements include, but are not limited to, statements about the Merger and reorganization

and our plans, objectives, expectations and intentions with respect to future operations, including the benefits or impact described in

this proxy statement/prospectus that we expect to achieve as a result of the Merger and reorganization. You can find many of these statements

by looking for words such as “anticipate,” “believe,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,”

“will,” “would” or similar expressions in this proxy statement/prospectus or in the documents included and delivered

herewith.

Any forward-looking statements

in this proxy statement/prospectus reflect only expectations that are current as of the date of this proxy statement/prospectus or the

date of any document included and delivered with this document, as the case may be, are not guarantees of performance, and are inherently

subject to significant business, economic and competitive risks, uncertainties and contingencies, many of which are difficult to predict

and generally beyond our ability to control. These risks and uncertainties include, but are not limited to, the factors described in the

section captioned “Risk Factors” below.

Further, these forward-looking

statements are based on assumptions with respect to business strategies and decisions that are subject to change. Actual results or performance

may differ materially from those we express in our forward-looking statements. Except as may be required by applicable securities laws,

we disclaim any obligation or undertaking to disseminate any updates or revisions to our statements, forward-looking or otherwise, to

reflect changes in our expectations or any change in events, conditions or circumstances on which any such statements are based.

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This document, which forms

a part of a registration statement on Form F-4 (File No. 333-259881) filed by Kandi Technologies Group, Inc., a company incorporated

under the laws of the British Virgin Islands (“Kandi BVI”), with the U.S. Securities and Exchange Commission (the “SEC”),

constitutes a prospectus of Kandi BVI under Section 5 of the Securities Act of 1933, as amended, or the Securities Act,

with respect to the ordinary shares of Kandi BVI to be issued to the shareholders of Kandi Technologies Group, Inc., a Delaware corporation,

in connection with (and subject to the consummation of) the merger described herein. This document also constitutes a proxy statement

under Section 14(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the rules

thereunder, and a notice of meeting, with respect to the annual meeting of the shareholders of Kandi Technologies Group, Inc. at which

such shareholders will be asked to consider and vote upon, among other proposals, a proposal to approve the merger described herein.

This proxy statement/prospectus

does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction

to or from any person to whom it is not lawful to make any such offer or solicitation in such jurisdiction.

ADDITIONAL INFORMATION

This proxy statement/prospectus

incorporates important business and financial information about Kandi from documents Kandi has filed with the U.S. Securities and

Exchange Commission, or SEC, that are incorporated by reference in or delivered in connection with this proxy statement/prospectus. Please

see the section entitled “Where You Can Find Additional Information.”

You should rely only on the

information contained or incorporated by reference in this proxy statement/prospectus or the documents that are delivered to you in connection

herewith. We have not authorized anyone to provide you with different or additional information. Neither Kandi BVI nor Kandi is making

an offer of the securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained

in this proxy statement/prospectus is accurate as of any date other than the date on the front cover of this proxy statement/prospectus

or, in the case of documents that are incorporated by reference in or delivered in connection with this proxy statement/prospectus, the

date of such document, and neither the mailing of this proxy statement/prospectus to you nor the issuance of Kandi BVI ordinary shares

in the Merger shall create any implication to the contrary.

KANDI TECHNOLOGIES GROUP, INC.

INFORMATION ABOUT THE ANNUAL MEETING OF SHAREHOLDERS

To Be Held December 27, 2023

We are providing this proxy

statement/prospectus to the shareholders of Kandi Technologies Group, Inc., a Delaware corporation, in connection with the solicitation,

by the Board of Directors of Kandi Technologies Group, Inc. (the “Board”), of proxies to be voted at our 2022 Annual Meeting

of Shareholders (the “Annual Meeting”) to be held at our executive office, located at Building 1, Floor 4, Zhijiangyin, Yunhe

Road, Xihu District, Hangzhou City, Zhejiang Province, China, 310024, on December 27, 2023, at 6:00 a.m. E. T. (7:00 p.m.

Beijing Time), and at any adjournments or postponements of the Annual Meeting.

On or about November 17, 2023,

we will mail to our shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy

materials and Annual Report on Form 10-K, for the fiscal year ended December 31, 2022 online and how to vote online. You will

be eligible to vote your shares electronically via the Internet, by telephone or by mail by following the instructions on the Notice of

Internet Availability of Proxy Materials. If you receive Notice of Internet Availability of Proxy Materials by mail, you will not receive

a printed copy of the materials unless you specifically request one. Included within this notice will be instructions on how to request

and receive printed copies of these materials and a proxy card by mail.

This proxy statement/prospectus,

our Annual Report on Form 10-K for fiscal year ended December 31, 2022, and other proxy materials, including the Proxy Card

and the Notice of Annual Meeting, are available free of charge online at www.proxyvote.com. Directions to our Annual Meeting are

available by calling +86-579-8223-9856 or by written request to Board Secretary, Kandi Technologies Group, Inc. at Jinhua New Energy Vehicle

Town, Jinhua, Zhejiang Province, China, 321016.

ABOUT THE ANNUAL MEETING

General: Date, Time and Place

We are providing this proxy

statement/prospectus to you in connection with the solicitation, on behalf of our Board, of proxies to be voted at our Annual Meeting

or any postponement or adjournment of that meeting. The Annual Meeting will be held on December 27, 2023, at 6:00 a.m. E.T.

(7:00 p.m. Beijing Time) at our executive office, located at Building 1, Floor 4, Zhijiangyin, Yunhe Road, Xihu District, Hangzhou

City, Zhejiang Province, China, 310024.

Matters to be Considered and Voted Upon

At the Annual Meeting, shareholders

will be asked to consider and vote to reincorporate the Company in the British Virgin Islands; to elect the nominees named herein as directors

to serve until the 2022 Annual Meeting of Shareholders; to ratify the appointment of ARK as the Company’s independent auditor for

the fiscal year ending December 31, 2023; to approve an amendment to our Certificate of Incorporation, as amended, to increase the

number of authorized shares of common stock from 100,000,000 shares to 300,000,000 shares, and to correspondingly increase the number

of authorized shares of preferred stock from 10,000,000 to 30,000,000 shares and to conduct an advisory vote on the compensation of the

named executive officers. The Board does not know of any matters to be brought before the Annual Meeting other than as set forth in the

notice of meeting. If any other matters properly come before the Annual Meeting, the persons named in the form of proxy or their substitutes

will vote in accordance with their best judgment on such matters.

Record Date; Stock Outstanding and Entitled

to Vote

Our Board established November

6, 2023 as the record date. Only holders of shares of the Company’s common stock, par value $0.001 per share, as of the record date,

are entitled to notice of, and to vote at, the Annual Meeting. Each share of common stock entitles the holder thereof to one vote per

share on each matter presented to our shareholders for approval at the Annual Meeting. At the close of business on the record date, we

had 87,522,800 shares of our common stock outstanding.

Internet Availability of Proxy Materials and

Annual Report

These proxy solicitation materials

are available at www.proxyvote.com on or about November 17, 2023 to all shareholders entitled to vote at the Annual Meeting. A

copy of the Company’s Annual Report on Form 10-K will be made available at www.proxyvote.com concurrently with these

proxy solicitation materials.

The Company is furnishing proxy

materials to our shareholders primarily via the Internet, rather than mailing printed copies of these materials to each shareholder. We

believe that this process should expedite shareholders’ receipt of proxy materials, lower the costs incurred by us for the Annual

Meeting and help to conserve natural resources. On or about November 17, 2023, we will mail to each shareholder of record and beneficial

owners (other than those who previously requested electronic or paper delivery) a Notice of Internet Availability of Proxy Materials,

in the form of a mailing titled “Important Notice Regarding the Availability of Proxy Materials”, that contains instructions

on how to access and review the proxy materials, including this proxy statement/prospectus and the Company’s Annual Shareholders

Report, including a letter to the shareholders and the annual report on Form 10-K, on a website referred to in such notice and how

to access a proxy card to vote on the Internet or by telephone. The Notice of Internet Availability of Proxy Materials also contains instructions

on how to receive a paper copy of the proxy materials. If you receive a Notice of Internet Availability of Proxy Materials by mail, you

should not expect to receive a printed copy of the proxy materials unless you request one. If you received a Notice of Internet Availability

of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, currently or on an ongoing basis, please follow

the instructions included in the Notice of Internet Availability of Proxy Materials.

Quorum; Required Vote

A quorum of shareholders is

required for the transaction of business at the Annual Meeting. The presence of at least a majority of all of our shares of common stock

issued and outstanding and entitled to vote at the Annual Meeting, present in person or represented by proxy, will constitute a quorum

at the Annual Meeting. Votes cast by proxy or in person at the Annual Meeting will be tabulated by an election inspector appointed for

the Annual Meeting and will be taken into account in determining whether or not a quorum

is present. Abstentions and broker non-votes, which occur when a broker has not received customer instructions and indicates that it does

not have the discretionary authority to vote on a particular matter on the proxy card, will be included in determining the presence of

a quorum at the Annual Meeting.

Assuming that a quorum is present,

our shareholders may take action at the annual meeting with the votes described below.

Reincorporation in the British

Virgin Islands. Under Delaware law and the Amended and Restated Bylaws of the Company (“Bylaws”),

the required vote to approve the change of our place of incorporation from Delaware to the British Virgin Islands is the affirmative vote

of a majority of the shares issued and outstanding. Abstentions and broker non-votes will not be counted toward a nominee’s total.

Election of Directors. Under

Delaware law and the Company’s Bylaws, the affirmative vote of a plurality of the votes cast by the holders of our shares of common

stock is required to elect each director. Consequently, only shares that are voted in favor of a particular nominee will be counted toward

such nominee’s achievement of a plurality. Shareholders do not have any rights to cumulate their votes in the election of directors.

Abstentions and broker non-votes will not be counted toward a nominee’s total.

Approval of the Appointment

of the Independent Auditor. Under Delaware law and the Company’s Bylaws, the required vote to approve

the appointment of ARK as the Company’s independent auditor for the fiscal year ending December 31, 2023, is the affirmative

vote of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting.

Approval of Increase in

the Authorized Shares. Under Delaware law and the Company’s Bylaws, the required vote to approve an amendment to our Certificate

of Incorporation, as amended, to increase the number of authorized shares of common stock from 100,000,000 shares to 300,000,000 shares,

and to correspondingly increase the number of authorized shares of preferred stock from 10,000,000 to 30,000,000 shares, is the affirmative

vote of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting. Abstentions and

broker non-votes will not be counted toward a nominee’s total.

Non-Binding Advisory Vote

on Executive Compensation. Under Delaware law and the Company’s Bylaws, the required vote to approve

the compensation of the named executive officers as disclosed in this proxy statement/prospectus pursuant to the compensation disclosure

rules of the SEC, is the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at

the annual meeting.

Abstentions and Broker Non-Votes

Under applicable regulations,

if a broker holds shares on your behalf, and you do not instruct your broker how to vote those shares on a matter considered “routine”,

the broker may generally vote your shares for you. A “broker non-vote” occurs when a broker has not received voting instructions

from you on a “non-routine” matter, in which case the broker does not have authority to vote your shares with respect to such

matter. Rules that govern how brokers vote your shares have recently changed. Unless you provide voting instructions to a broker holding

shares on your behalf, your broker may no longer use discretionary authority to vote your shares on any of the matters to be considered

at the Annual Meeting other than the ratification of our independent registered public accounting firm. Please vote your proxy so your

vote can be counted.

Voting Procedure; Voting of Proxies; Revocation

of Proxies

Shareholders of Record

If your shares are registered

directly in your name with our transfer agent, Equiniti Trust Company, you are considered the “shareholder of record” with

respect to those shares. As the shareholder of record, you may vote in person at the Annual Meeting or vote, most conveniently vote by

telephone, Internet or mail. Whether or not you plan to attend the annual meeting, we urge you to vote by proxy to ensure your vote is

counted. You may still attend the Annual Meeting and vote in person even if you have already voted by proxy.

By Internet — shareholders

may vote on the internet by logging on to www.proxyvote.com and following the instructions given.

By Telephone — shareholders

may vote by calling 1-800-690-6903 (toll-free) with a touch tone telephone and following the recorded instructions.

By Mail — shareholders

must request a paper copy of the proxy materials to receive a proxy card and follow the instructions given for mailing. A paper copy of

the proxy materials may be obtained by logging to www.proxyvote.com and following the instructions given. To vote using the proxy

card, simply print the proxy card, complete, sign and date it and return it promptly to Vote Processing, c/o Broadridge, 51 Mercedes Way,

Edgewood, New York 11717. In the alternative, the proxy card can be mailed directly to the Company: Board Secretary, Kandi Technologies

Group, Inc. located in Jinhua New Energy Vehicle Town, Jinhua, Zhejiang Province, China, 321016 or to Kewa Luo at Kandi Technologies Group,

Inc., The Helmsley Building, 230 Park Avenue, 3rd & 4th Floor West, New York, NY 10169. Our Board

has selected each of Hu Xiaoming and Jehn Ming Lim to serve as proxies.

If you vote by telephone or

via the Internet, you do not need to return your proxy card. Telephone and Internet voting are available 24 hours a day and

will close at 11:59 P.M. Eastern Time on December 26, 2023.

In Person — shareholders

may vote in person at the Annual Meeting. To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive.

The Board recommends that you

vote using one of the other voting methods, since it is not practical for most shareholders to attend the Annual Meeting.

Shares of our common stock

represented by proxies properly voted that are received by us and are not revoked will be voted at the Annual Meeting in accordance with

the instructions contained therein. If instructions are not given, such proxies will be voted FOR the Company’s reincorporation

from the State of Delaware in the United States to the country of the British Virgin Islands, FOR election of each nominee

for director named herein, FOR ratification of ARK as Independent auditor for the fiscal year ended December 31, 2023, FOR

approval of the amendment to our Certificate of Incorporation to increase the authorized shares of common stock and preferred stock,

and FOR approval of the compensation of the named executive officers described in this proxy statement/prospectus. In addition,

we reserve the right to exercise discretionary authority to vote proxies, in the manner determined by us, in our sole discretion, on any

matters brought before the Annual Meeting for which we did not receive adequate notice under the proxy rules promulgated by the SEC.

Street Name Shareholders

If you hold your shares in

“street name” through a stockbroker, bank or other nominee rather than directly in your own name, you are considered the “beneficial

owner” of such shares. Because a beneficial owner is not a shareholder of record, you may not vote these shares in person at the

Annual Meeting unless you obtain a “legal proxy” from the broker, bank or nominee that holds your shares, giving you the right

to vote those shares at the Annual Meeting. The Board recommends that you vote using one of the other voting methods, since it is not

practical for most shareholders to attend the Annual Meeting.

If you hold your shares in

“street name” through a stockbroker, bank or other nominee rather than directly in your own name, you can most conveniently

vote by telephone, Internet or mail. Please review the voting instructions on your voting instruction form.

Your proxy is revocable at

any time before it is voted at the Annual Meeting in any of the following three ways:

| 1. | You may submit another properly completed proxy bearing a

later date. |

| 2. | You may send a written notice that you are revoking your

proxy to Board Secretary, Kandi Technologies Group, Inc., located in Jinhua New Energy Vehicle Town, Jinhua, Zhejiang Province, China,

321016 or to Kewa Luo located at Kandi Technologies Group, Inc., The Hemsley Building, 230 Park Avenue, 3rd/4th

Floor West, New York, NY 10169. |

| 3. | You may attend the Annual Meeting and vote in person. However,

simply attending the Annual Meeting will not, by itself, revoke your proxy. |

Dissenters’ Right of Appraisal

Under the Delaware General

Corporation Law and the Company’s Certificate of Incorporation, shareholders are not entitled to any appraisal or similar rights

of dissenters with respect to any of the proposals to be acted upon at the Annual Meeting.

Proxy Solicitation

We will pay for the entire

cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone

or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may

also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

Householding

SEC rules permit us to deliver

a single Notice of Internet Availability of Proxy Materials or, if applicable, a paper copy of our annual report and proxy statement,

to one address shared by two or more of our shareholders. This delivery method is referred to as “householding” and can result

in significant cost savings. To take advantage of this opportunity, we have delivered only one Notice of Internet Availability of Proxy

Materials or, if applicable, a paper copy of the annual report and proxy statement, to multiple shareholders who share an address, unless

we received contrary instructions from the impacted shareholders prior to the mailing date. If you received a householded mailing this

year and you would like to have additional copies of our Notice of Internet Availability of Proxy Materials or, if applicable, additional

copies of our annual report and proxy statement mailed to you or you would like to opt out of this practice for future mailings, contact

Board Secretary located in Jinhua New Energy Vehicle Town, Jinhua, Zhejiang Province, China, 321016 or to Kewa Luo located at Kandi Technologies

Group, Inc., The Helmsley Building, 230 Park Avenue, 3rd/4th Floor West, New York, NY 10169. We agree

to deliver promptly, upon written or oral request, a separate copy of this proxy statement and annual report to any shareholder at the

shared address to which a single copy of those documents were delivered.

Shareholder List

For at least ten days

prior to the Annual Meeting, a list of shareholders entitled to vote at the Annual Meeting, arranged in alphabetical order, showing the

address of and number of shares registered in the name of each shareholder, will be open for examination by any shareholder, for any purpose

related to the Annual Meeting, during ordinary business hours at our principal executive office. The list will also be available

for examination at the Annual Meeting.

Other Business

The Board is not aware of any

other matters to be presented at the Annual Meeting other than those mentioned in this proxy statement/prospectus and our accompanying

Notice of Annual Meeting of Shareholders. If, however, any other matters properly come before the Annual Meeting, the persons named in

the accompanying proxy will vote in accordance with their best judgment.

Proposals of Shareholders for Annual Meeting

of Shareholders for the year ending December 31, 2023

Shareholder proposals will

be considered for inclusion in the proxy statement for the Annual Meeting of Shareholders for the year ending December 31, 2023 in

accordance with Rule 14a-8 under Securities Exchange Act of 1934, as amended (the “Exchange Act”),

if they are received by the Company, on or before September 29, 2024.

Shareholders who intend to

present a proposal at the Annual Meeting of Shareholders for the year ending December 31, 2023 without inclusion of such proposal

in our proxy materials for the Annual Meeting of Shareholders for the year ending December 31, 2023, are required to provide notice

of such proposal not less than ninety (90) days nor more than one hundred twenty (120) days prior to the one-year anniversary

of the preceding year’s annual meeting; provided, however, that if the date of the annual meeting is more than thirty (30) days

before or more than sixty (60) days after such anniversary date, notice by the shareholder to be timely must be so delivered, or

mailed and received, not earlier than the one hundred and twentieth (120th) day prior to such annual meeting, and not

later than the ninetieth (90th) day prior to such meeting or tenth (10th) day following the day on

which public disclosure of the date of such annual meeting was first made. Therefore, shareholder proposals must be received by us no

earlier than August 30, 2024, but no later than September 29, 2024, and must otherwise comply with the notice requirements set forth under

all applicable Exchange Act and SEC rules. The chairman of our Annual Meeting of Shareholders for the year ended December 31,

2023 may refuse to allow the transaction of any business or acknowledge the nomination of any person not made in compliance with the requisite

procedures.

Shareholder notice shall set

forth as to each matter the shareholder proposes to bring before the annual meeting: (i) a brief description of the business desired

to be brought before the annual meeting and the reasons for conducting such business at the annual meeting, (ii) the name and address,

as they appear on our books, of the shareholder proposing such business, (iii) the class and number of shares of the Company, which

are beneficially owned by the shareholder, (iv) any material interest of the shareholder in such business and (v) any other

information that is required to be provided by the shareholder pursuant to Regulation 14A under the Exchange Act, in his capacity

as a proponent to a shareholder proposal.

A shareholder’s notice

relating to nomination for directors shall set forth as to each person, if any, whom the shareholder proposes to nominate for election

or re-election as a director: (i) the name, age, business address and residence address of such person, (ii) the principal occupation

or employment of such person, (iii) the class and number of shares of the Company, which are beneficially owned by such person, (iv) a

description of all arrangements or understandings between the shareholder and each nominee and any other person(s) (naming such person(s))

pursuant to which the nominations are to be made by the shareholder and (v) any other information relating to such person that is

required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A

under the Exchange Act (including without limitation such person’s written consent to being named in our Proxy Statement/Prospectus,

if any, as a nominee and to serving as a director if elected).

Proposals and notices of intention

to present proposals at the Annual Meeting of Shareholders for the year ended December 31, 2023 should be addressed to Board Secretary

at Jinhua New Energy Vehicle Town, Jinhua, Zhejiang Province, People’s Republic of China 321016.

Voting Results of Annual Meeting

Voting results will be published

in a Current Report on Form 8-K issued by us within four (4) business days following the Annual Meeting.

PROPOSAL 1

REINCORPORATION FROM DELAWARE TO THE BRITISH

VIRGIN ISLANDS

We propose to change our state

of incorporation from Delaware to the British Virgin Islands (the “BVI”), which we refer to as the “Reincorporation,”

or “Merger”. The Reincorporation would be effected through the merger of the Company with a newly-formed wholly owned subsidiary

of a newly-formed BVI corporation that is a wholly owned subsidiary of the Company, which we refer to herein as Kandi BVI, pursuant to

an Agreement and Plan of Merger, or “merger agreement,” in substantially the form attached as Appendix A to this

Proxy Statement/Prospectus. Upon completion of the merger, Kandi BVI will be the surviving corporation and will continue to operate our

business under the name “Kandi Technologies Group, Inc.” In this section, we refer to the Company before the Reincorporation

as “the Company” and after the Reincorporation as “Kandi BVI.” In connection with the Reincorporation:

| ● | There will be no change in our business, management, employees,

headquarters, benefit plans, assets, liabilities or net worth (other than as a result of the costs incident to the Reincorporation, which

we expect to be immaterial); |

| ● | The directors and officers of the Company prior to the Reincorporation

will hold the same respective positions with Kandi BVI following the Reincorporation, and there will be no substantive change in direct

or indirect interests of the current directors or executive officers of the Company; and |

| ● | Your shares of common stock of the Company will automatically

be converted into an equivalent number of ordinary shares of Kandi BVI. YOU WILL NOT NEED TO EXCHANGE YOUR EXISTING STOCK CERTIFICATES

FOR STOCK CERTIFICATES OF KANDI BVI. |

| ● | Kandi BVI, the surviving corporation after the Merger, which is also

the listing company post-merger, will be governed by the Third Amended and Restated Memorandum and Articles of Association of Kandi BVI

under BVI law in the form attached as Appendix B. |

| ● | For the avoidance of confusion, the Certificate of Amendment

to the Certificate of Incorporation of Kandi Technologies Group, Inc. in the form attached as Appendix C will only be effective

if (i) such proposal is passed by the necessary votes, and (ii) in the event the Reincorporation is not consummated. |

Upon completion of the Reincorporation,

the authorized capital stock of Kandi BVI will consist of 300,000,000 ordinary shares, $0.001 par value, and 30,000,000 preferred shares,

$0.001 par value. Our common stock is currently quoted on NASDAQ. We believe that the ordinary shares of Kandi BVI will also be quoted

on NASDAQ immediately after the Reincorporation.

INFORMATION ABOUT THE MERGER

Record Date and Voting Securities

Only our shareholders of record

at the close of business on November 6, 2023 are entitled to vote. Our authorized securities consist of 100,000,000 shares of common

stock with a par value of $0.001 per share and 10,000,000 shares of preferred stock with a par value of $0.001 per share. As of the record

date, there were 87,522,800 shares of common stock issued and outstanding held by 55 holders of

record, and there were no shares of preferred stock outstanding. Each share of common stock entitles the holder thereof to one non-cumulative

vote on all matters submitted to a vote of shareholders.

Questions and Answers Relating to the Merger

| A: | Under the Merger Agreement, Merger Sub will merge with and

into Kandi, with Kandi surviving the Merger as a wholly-owned subsidiary of Kandi BVI. Upon consummation of the Merger, each issued

and outstanding share of Kandi’s common stock will be converted into the right to receive one ordinary share in the capital of

Kandi BVI, which shares will be issued by Kandi BVI in connection with the Merger. Following the Merger, Kandi BVI, together with its

subsidiaries, will own and continue to conduct our business in substantially the same manner as it is currently being conducted by Kandi

and its subsidiaries. Kandi BVI will also be managed by the same Board of Directors and executive officers that manage Kandi today. |

| Q: | Why does Kandi want to engage in the Merger? |

| A: | The Merger is part of a reorganization of Kandi’s corporate

structure approved by our Board of Directors that we expect will, among other things, result in a reduction in operational, administrative,

legal and accounting costs over the long term and provide us with flexibility to pursue corporate development including mergers and acquisitions,

spin-off and separate listing. Please see the section entitled “Reorganization Merger — Background and Reasons

for the Merger.” However, there can be no assurance that following the Merger we will be able to realize these expected benefits

for the reasons discussed in the section entitled “Risk Factors — Risks Relating to the Merger and Reorganization — The

expected benefits of the Merger and reorganization may not be realized.” We also have incurred and will continue to incur transaction

costs. |

| Q: | Will the Merger affect current or future operations? |

| A: | The Merger is not expected to have a material impact on how

we conduct day-to-day operations. While the new corporate structure would not change our future operational plans to grow our business,

including our focus on our Chinese business, it may improve our ability to expand internationally. The location of future operations

will depend on the needs of the business, which will be determined without regard to Kandi BVI’s jurisdiction of incorporation.

Please see the section entitled “Reorganization Merger — Background and Reasons for the Merger.” |

| Q: | Is the Merger taxable to me? |

| A: | The Merger should be characterized for U.S. federal

income tax purposes as either a “reorganization” within the meaning of Section 368(a) of the Code, or as a transaction

qualifying under Section 351 of the Code. In either case, U.S. holders will not recognize gain or loss for U.S. federal

income tax purposes upon receipt of Kandi BVI ordinary shares in exchange for Kandi common stock. The aggregate tax basis in the ordinary

shares of Kandi BVI received in the Merger will equal each such U.S. holder’s aggregate tax basis in the Kandi common stock

surrendered. A U.S. holder’s holding period for the ordinary shares of Kandi BVI that are received in the Merger will include

such U.S. holder’s holding period for the common stock of Kandi surrendered, provided the surrendered Kandi common stock is

held as a capital asset within the meaning of Section 1221 of the Code (generally, property held for investment). Please see the

section entitled “Material U.S. Federal Income Tax Considerations.” |

| THE TAX TREATMENT OF THE MERGER UNDER STATE OR LOCAL LAW WILL

DEPEND ON THE RELEVANT JURISDICTION. WE URGE YOU TO CONSULT YOUR OWN TAX ADVISOR REGARDING THE PARTICULAR TAX CONSEQUENCES OF THE

MERGER TO YOU. |

| Q: | Has the U.S. Internal Revenue Service rendered

a ruling on any aspects of the Merger? |

| A: | No ruling has been requested from the U.S. Internal

Revenue Service, or the IRS, in connection with the Merger. |

| Q: | When do you expect to complete the Merger? |

| A: | If the adoption of the Merger Agreement is approved by our

shareholders, we anticipate that the Merger will become effective on or about December 27, 2023, although the Merger may be abandoned

by our Board of Directors prior to its completion. Please see the section entitled “Risk Factors — Risks Relating

to the Merger and Reorganization — Our Board of Directors may choose to defer or abandon the Merger.” |

| Q: | What types of information and reports will Kandi BVI

make available to shareholders following the Merger? |

| A: | The term foreign private issuer under the rules and regulations

of the SEC means any foreign issuer other than a foreign government except an issuer meeting the following conditions as of the last

business day of its most recently completed second fiscal quarter: |

| (i) | More than 50 percent of the outstanding voting securities

of such issuer are directly or indirectly owned of record by residents of the United States; and |

| (ii) | Any of the following: |

| (a) | The majority of the executive officers or directors are United States

citizens or residents; |

| (b) | More than 50 percent of the assets of the issuer are located

in the United States; or |

| (c) | The business of the issuer is administered principally in

the United States. |

While we believe Kandi BVI qualifies

as a “foreign private issuer” as of the date of this proxy statement/prospectus, Kandi BVI will remain subject to the mandates

of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and, as long as the Kandi BVI’s ordinary shares are listed

on the NASDAQ Stock Market, or NASDAQ, the governance and disclosure rules of that stock exchange. However, as a foreign private issuer,

Kandi BVI will be exempt from certain rules under the Exchange Act that would otherwise apply if Kandi BVI were a company incorporated

in the United States or did not meet the other conditions to qualify as a foreign private issuer. For example:

Kandi

BVI may include in its SEC filings financial statements prepared in accordance with generally accepted accounting principles in the United States,

or U.S. GAAP, or with the International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards

Board, or IASB, without reconciliation to U.S. GAAP.

Kandi

BVI will not be required to provide as many Exchange Act reports, or as frequently or as promptly, as U.S. companies with securities

registered under the Exchange Act. For example, Kandi BVI will not be required to file current reports on Form 8-K within four business

days from the occurrence of specific material events. Instead, Kandi BVI will need to promptly furnish reports on Form 6-K any information

that Kandi BVI (a) makes or is required to make public under the laws of the British Virgin Islands; (b) files or is required

to file under the rules of any stock exchange; or (iii) otherwise distributes or is required to distribute to its shareholders. Unlike

Form 8-K, there is no precise deadline by which Form 6-K must be furnished. In addition, Kandi BVI will not be required to file

its annual report on Form 10-K, which may be due as soon as 75 days after its fiscal year end. As a foreign private issuer,

Kandi BVI will be required to file an annual report on Form 20-F within four months after its fiscal year end.

| ● | Kandi BVI will not be required to provide the same level

of disclosure on certain issues, such as executive compensation. |

| ● | Kandi BVI will not be required to conduct advisory votes

on executive compensation. |

| ● | Kandi BVI will be exempt from filing quarterly reports under

the Exchange Act with the SEC. |

| ● | Kandi BVI will not be subject to the requirement to comply

with Regulation FD, which imposes certain restrictions on the selected disclosure of material information. |

| ● | Kandi BVI will not be required to comply with the sections

of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under

the Exchange Act. |

| ● | Directors and offices of Kandi BVI will not be required to

file public reports of their stock ownership and trading activities or be subject to “short-swing” profit liability for transactions

in Kandi BVI stock under Section 16 of the Exchange Act. |

If

Kandi BVI takes advantage of these exemptions if the Merger is effected, after the completion of the Merger, if you hold Kandi BVI securities,

you may receive less information about Kandi BVI and its business than you currently receive with respect to Kandi and be afforded less

protection under the U.S. federal securities laws than you are currently entitled to. However, consistent with our policy of seeking

input from, and engaging in discussions with, our shareholders, on executive compensation matters, Kandi BVI intends to provide disclosure

relating to its executive compensation philosophy, policies and practices and conduct an advisory vote on executive compensation once

every year after the Merger is effected. However, Kandi BVI expects to review this practice after the next such advisory vote and may

at that time or in the future determine to conduct such advisory votes more or less frequently or to not conduct them at all.

If Kandi BVI loses its status as a foreign

private issuer at some future time, then it will no longer be exempt from such rules and, among other things, will be required to file

periodic reports and financial statements as if it were a company incorporated in the United States. The costs incurred in fulfilling

these additional regulatory requirements could be substantial. Please see the sections entitled “Risk Factors — Risks

Relating to the Merger and Reorganization — The expected benefits of the Merger and reorganization may not be realized”

and “Risk Factors — Risks Relating to the Merger and Reorganization — If Kandi BVI fails to qualify

as a foreign private issuer upon completion of the Merger, or loses its status as a foreign private issuer at some future time, Kandi

BVI would be required to comply fully with the reporting requirements of the Exchange Act applicable to U.S. domestic issuers

and would incur significant operational, administrative, legal and accounting costs that it would not incur as a foreign private issuer.”

| Q: | Do I have to take any action to exchange my Kandi

common stock and receive Kandi BVI ordinary shares? |

| A: | The Kandi common stock registered in your name or which you

beneficially own through your broker will be converted into the right to receive an equal number of Kandi BVI ordinary shares and such

shares will be registered in your name (or your broker’s name, as applicable) in Kandi BVI’s register of members upon completion

of the Merger, without any further action on your part. Upon completion of the Merger, only registered shareholders reflected in Kandi

BVI’s register of members will have and be entitled to exercise any voting and other rights with respect to and to receive any

dividend and other distributions upon Kandi BVI ordinary shares registered in their respective names. Any attempted transfer of Kandi

stock prior to the Merger that is not properly documented and reflected in the stock records maintained by Kandi’s transfer agent

as of immediately prior to the time that the Merger become effective, or the Effective Time, will not be reflected in Kandi BVI’s

register of members upon completion of the Merger. Registered holders of Kandi BVI’s ordinary shares seeking to transfer Kandi

BVI ordinary shares following the Merger will be required to provide customary transfer documents required by Kandi BVI’s transfer

agent to complete the transfer. |

If

you hold Kandi common stock in uncertificated book-entry form (for example, if you hold your shares through a broker), at the Effective

Time the Kandi common stock registered in your name or which you beneficially own through your broker will be converted into the right

to receive an equal number of Kandi BVI ordinary shares and such shares will be registered in your name (or your broker’s name,

as applicable) in book-entry form without any action on your part.

If

you hold Kandi common stock in certificated form, you may exchange your Kandi stock certificates for new Kandi BVI share certificates

promptly following the Merger. We will request that all Kandi stock certificates be returned to Kandi BVI’s transfer agent following

the Merger. Soon after the closing of the Merger, you will be sent a letter of transmittal from our transfer agent. It is expected that,

prior to the Effective Time, Equiniti Trust Company will be appointed as our transfer agent for the Merger. The letter of transmittal

will contain instructions explaining the procedure for surrendering your Kandi stock certificates for new Kandi BVI share certificates.

Kandi ’s current transfer agent is Equiniti Trust Company, which will continue to serve as the transfer agent for Kandi BVI ordinary shares after the Effective Time.

| Q: | Can I trade my Kandi common stock before the Merger

is completed? |

| A: | Yes. Kandi common stock will continue trading on NASDAQ through

the last trading day prior to the date of completion of the Merger, which date of completion is expected to be on or about December 30,

2023 (ET). |

| Q: | After the Merger, where can I trade my Kandi BVI

ordinary shares? |

| A: | We expect that as of the Effective Time, the Kandi BVI ordinary

shares will be authorized for listing on NASDAQ, and we expect such shares will be traded on the exchange under the symbol “KNDI.”,

which is the same symbol under which shares of Kandi common stock are currently listed. |

| Q: | How will my rights as a shareholder of Kandi BVI change

after the Merger relative to my rights as a shareholder of Kandi prior to the Merger? |

| A: | Because of differences between Delaware law and British Virgin

Islands law and differences between the governing documents of Kandi and Kandi BVI, we are unable to adopt governing documents for Kandi

BVI that are identical to the governing documents for Kandi, but we have attempted to preserve in the memorandum and articles of association

of Kandi BVI the same allocation of material rights and powers between the shareholders and our Board of Directors that exists under

Kandi’s bylaws and certificate of incorporation. |

Nevertheless,

Kandi BVI’s proposed memorandum and articles of association differ from Kandi’s bylaws and certificate of incorporation, both

in form and substance, and your rights as a shareholder of Kandi BVI will change relative to your rights as a shareholder of Kandi as

a result of the Merger and you may not be afforded as many rights as a shareholder of Kandi BVI under applicable laws and the Kandi BVI

memorandum and articles of association as you were as a shareholder of Kandi under applicable laws and the Kandi certificate of incorporation

and bylaws. Please see the sections entitled “Risk Factors — Risks Relating to the Merger and Reorganization — Your

rights as a shareholder of Kandi will change as a result of the Merger and you may not be afforded as many rights as a shareholder of

Kandi BVI under applicable laws and the Kandi BVI memorandum and articles of association as you were as a shareholder of Kandi under applicable

laws and the Kandi certificate of incorporation and bylaws,” “Description of Share Capital of Kandi BVI” and “Differences

in Corporate Law.”

Notwithstanding

the foregoing, the changes above may not change your rights as a shareholder significantly in practice because Kandi has a concentrated

ownership structure with at least two shareholders each holding more than five percent of Kandi’s common stock. For further details

on the security ownership of certain beneficial owners of Kandi, please see the section entitled “Security Ownership of Certain

Beneficial Owners and Management.”

Additionally,

as a foreign private issuer, Kandi BVI will be permitted to follow corporate governance practices in accordance with British Virgin Islands

laws in lieu of certain NASDAQ corporate governance standards. Please see the sections entitled “Reorganization Merger — Background

and Reasons for the Merger.”

SUMMARY

This summary highlights

selected information from this proxy statement/prospectus and may not contain all of the information that is important to you. For more

information, including a more complete description of the Merger, you should read carefully this entire proxy statement/prospectus, including

the Appendices. Please also see the section entitled “Where You Can Find Additional Information.” The Merger Agreement, a

copy of which is attached as Appendix A to this proxy statement/prospectus, contains the terms and conditions of the Merger. The proposed

memorandum and articles of association of Kandi BVI will serve purposes substantially similar to the certificate of incorporation and

bylaws of Kandi. A form of the Third Amended and Restated Memorandum and Articles of Association of Kandi BVI is attached to this proxy

statement/prospectus as Appendix B.

The Merger Agreement

The Merger Agreement provides

for a merger that would result in your shares of Kandi common stock being converted into the right to receive an equal number of ordinary

shares in the capital of Kandi BVI, a company incorporated under the laws of the British Virgin Islands. Under the Merger Agreement, Merger

Sub, a wholly-owned subsidiary of Kandi BVI, which itself is to be formed as a wholly-owned subsidiary of Kandi, will merge with and into

Kandi, with Kandi surviving the Merger as a wholly-owned subsidiary of Kandi BVI.

Parties to the Merger

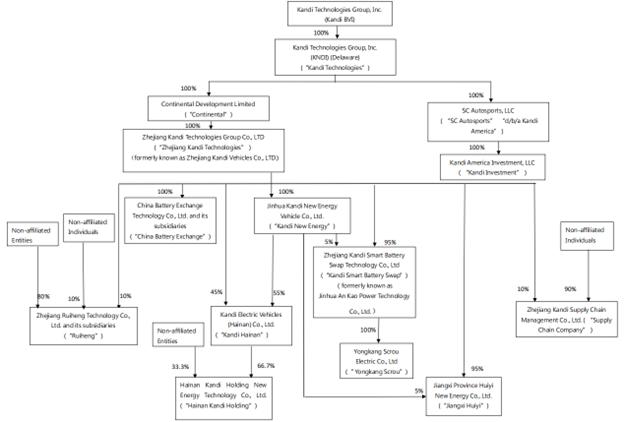

We are a holding company incorporated

in Delaware that is seeking to reincorporate into the British Virgin Islands. As a holding company with no material operations of our

own, we conduct a majority of our operations through our subsidiaries, wholly-owned or partially owned, in PRC. Effective March 14,

2022, Mr. Hu Xiaoming transferred his 50% equity interest of Kandi New Energy to Zhejiang Kandi Technologies. As a result, Kandi

New Energy has become a wholly owned subsidiary of Zhejiang Kandi Technologies. Our common stock currently listed on Nasdaq are shares

of our holding company, and our ordinary shares registered under this prospectus which are to be issued after the merger are shares of

our BVI holding company, investors will never own any shares of our PRC operating entities.

Headquartered in Jinhua City,

Zhejiang Province, People’s Republic of China (“China” or “PRC”), the Company is a producer and manufacturer

of electric vehicle (“EV”) products, EV parts, and off-road vehicles with operations primarily based in China for sale in

the Chinese and the global markets. The Company conducts its primary business operations through its wholly-owned subsidiaries, Zhejiang

Kandi Vehicles Co., Ltd. (“Kandi Vehicles”), Kandi Vehicles’ wholly and partially-owned subsidiaries, and SC Autosports

LLC (“SC Autosports”, d/b/a Kandi America) and its wholly-owned subsidiary, Kandi America Investment, LLC (“Kandi Investment”).

In March 2021, Zhejiang Kandi Vehicles Co., Ltd. changed its name to Zhejiang Kandi Technologies Group Co., Ltd. (“Zhejiang

Kandi Technologies”).

Kandi BVI is a newly-formed

company incorporated under the laws of the British Virgin Islands and will be a wholly-owned subsidiary of Kandi immediately prior to

the Merger. Kandi BVI does not have a significant amount of assets or liabilities and has not engaged in any business since its formation

other than activities associated with its anticipated participation in the Merger. Following the Merger, Kandi BVI, together with its

subsidiaries, will own and continue to conduct our business in substantially the same manner as is currently being conducted by Kandi

and its subsidiaries.

Merger Sub will be formed as

a Delaware corporation and a wholly-owned subsidiary of Kandi BVI. Merger Sub will be formed to accomplish the proposed reorganization

merger and will not have a significant amount of assets or liabilities and will not engage in any business other than activities associated

with its anticipated participation in the Merger.

The principal executive offices

of each of Kandi, Kandi BVI and Merger Sub are or will be located at Jinhua New Energy Vehicle Town, Zhejiang Province, PRC, 321016 and

the telephone number of each company is (86-579) 82239856.

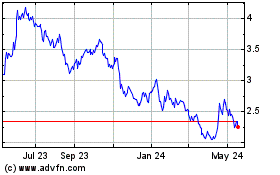

Corporate Structure Prior to Merger

Corporate Structure Post-Merger

Background and Reasons for the Merger

In reaching its decision to

approve the Merger Agreement and the Merger, our Board of Directors identified several potential benefits to our shareholders, which are

described below under “Reorganization Merger Agreement — Background and Reasons for the Merger.” The Merger

is part of a reorganization of Kandi’s corporate structure that we expect will, among other things, result in a reduction in operational,

administrative, legal and accounting costs over the long term. Please also see the section entitled “Risk Factors — Risks

Relating to the Merger and Reorganization” below for a description of certain risks associated with the Merger and reorganization.

The Merger

Under the Merger Agreement,

Merger Sub will merge with and into Kandi. Upon completion of the Merger, Kandi BVI and its subsidiaries will own and continue to conduct

the business that Kandi and its subsidiaries currently conduct, in substantially the same manner. As a result of the Merger, our shareholders

will own ordinary shares of Kandi BVI, a company incorporated under the laws of the British Virgin Islands, rather than common stock in

Kandi, a Delaware corporation. As a result of the Merger, each outstanding share of Kandi common stock will be converted into the right

to receive the same number of ordinary shares of Kandi BVI, which shares will be issued by Kandi BVI in connection with the Merger. No

other organizational changes to our corporate structure are being proposed in connection with this proxy statement/prospectus. Our Board

of Directors reserves the right to defer or abandon the Merger. Please see the section entitled “Risk Factors — Risks

Relating to the Merger and Reorganization — Our Board of Directors may choose to defer or abandon the Merger.”

Conditions to Completion of the Merger

The following conditions must

be satisfied or waived, if allowed by law, to complete the Merger and reorganization:

| 1. | the Merger Agreement has been adopted by the requisite vote

of shareholders of Kandi; |

| 2. | none of the parties to the Merger Agreement is subject to

any decree, order or injunction that prohibits the consummation of the Merger; |

| 3. | the registration statement of which this proxy statement/prospectus

is a part has been declared effective by the SEC and no stop order is in effect; |

| 4. | the Kandi BVI ordinary shares to be issued pursuant to the

Merger have been authorized for listing on NASDAQ, subject to official notice of issuance and satisfaction of other standard conditions; |

| 5. | all material consents and authorizations of, filings or registrations

with, and notices to, any governmental or regulatory authority required of Kandi, Kandi BVI or their subsidiaries to consummate the Merger

have been obtained or made; and |

| 6. | the representations and warranties of the parties to the

Merger Agreement set forth in the Merger Agreement are true and correct in all material respects, and the covenants of the parties set

forth in the Merger Agreement (other than those to be performed after the Effective Time) have been performed in all material respects. |

Our Board of Directors currently

does not anticipate any circumstances in which it would waive the conditions listed above; however, in the event it determines that a

waiver of any such conditions is in the best interests of our shareholders and that such change to the terms of the Merger does not make

the disclosure provided to our shareholders materially misleading (for example, if a representation in the Merger Agreement is not true

but there is otherwise no harm to Kandi or our shareholders), our Board of Directors will not resolicit shareholder approval or consent

of the Merger. If a waiver of any condition listed above would make the disclosure provided to our shareholders materially misleading,

our Board of Directors will resolicit shareholder approval or consent of the Merger. Additionally, our Board of Directors reserves the

right to defer or abandon the Merger as well for the reasons described under “Risk Factors — Risks Relating to the

Merger and Reorganization — Our Board of Directors may choose to defer or abandon the Merger.”

Regulatory Approvals

The only governmental or regulatory

approvals or actions that are required to complete the Merger are compliance with U.S. federal and state securities laws, the NASDAQ

rules and regulations and Delaware corporate laws.

Rights of Dissenting Shareholders

Under the Delaware General

Corporation Law (the “DGCL”) you will not have appraisal rights in connection with the Merger.

Ownership in Kandi BVI

The Kandi common stock registered

in your name or which you beneficially own through your broker will be converted into the right to receive an equal number of Kandi BVI

ordinary shares and such shares will be registered in your name (or your broker’s name, as applicable) in Kandi BVI’s register

of members upon completion of the Merger, without any further action on your part. Upon completion of the Merger, only registered shareholders

reflected in Kandi BVI’s register of members will have and be entitled to exercise any voting and other rights with respect to and

to receive any dividend and other distributions upon Kandi BVI ordinary shares registered in their respective names. Any attempted transfer

of Kandi stock prior to the Merger that is not properly documented and reflected in the stock records maintained by Kandi’s transfer

agent as of immediately prior to the Effective Time will not be reflected in Kandi BVI’s register of members upon completion of

the Merger. Registered holders of Kandi BVI’s ordinary shares seeking to transfer Kandi BVI ordinary shares following the Merger

will be required to provide customary transfer documents required by Kandi BVI’s transfer agent to complete the transfer.

If you hold Kandi common stock

in uncertificated book-entry form (for example, if you hold your shares through a broker), at the Effective Time, the Kandi common stock

registered in your name or which you beneficially own through your broker will be converted into the right to receive an equal number

of Kandi BVI ordinary shares and such shares will be registered in your name (or your broker’s name, as applicable) in book-entry

form without any action on your part.

If you hold Kandi common stock

in certificated form, you may exchange your Kandi stock certificates for new Kandi BVI share certificates promptly following the Merger.

We will request that all Kandi stock certificates be returned to Kandi BVI’s transfer agent following the Merger. Soon after the

closing of the Merger, you will be sent a letter of transmittal from our exchange agent. The letter of transmittal will contain instructions

explaining the procedure for surrendering your Kandi stock certificates for new Kandi BVI share certificates.

Stock Exchange Listing

It is a condition to the completion

of the Merger that the ordinary shares of Kandi BVI will be authorized for listing on NASDAQ, subject to official notice of issuance and

satisfaction of other standard conditions. As such, we expect that as of the Effective Time, the Kandi BVI ordinary shares will be authorized

for listing on NASDAQ, and we expect such shares will be traded on the exchange under the symbol “KNDI” which is the same

symbol under which shares of Kandi common stock are currently listed.

Accounting Treatment of the Merger

The Merger is a legal reorganization

with no change in ultimate ownership interest immediately before and after the transaction. Accordingly, all assets and liabilities will

be recorded at historical cost, in a manner similar to an exchange between entities under common control.

Tax Considerations

United States Federal Income Tax Consequences

of the Merger to Kandi and Kandi BVI

We expect that neither Kandi

nor Kandi BVI will incur U.S. federal income tax as a result of the completion of the Merger. Following the Merger, Kandi BVI will

be subject to U.S. federal income tax on its worldwide income in the same manner as applies to Kandi because of the U.S. federal

income tax rules under Section 7874 of the Code.

United States Federal Income Taxation

of Kandi Shareholders

The Merger should be characterized

for U.S. federal income tax purposes as either a “reorganization” within the meaning of Section 368(a) of the

Code, or a transaction qualifying under Section 351 of the Code. In either case, Kandi Shareholders will not recognize gain or loss

for U.S. federal income tax purposes upon receipt of Kandi BVI ordinary shares in exchange for Kandi common stock. The aggregate

tax basis in the ordinary shares of Kandi BVI received in the Merger will equal each U.S. holder’s aggregate tax basis in the

Kandi common stock surrendered. A U.S. holder’s holding period for the ordinary shares of Kandi BVI that are received in the

Merger will include such U.S. holder’s holding period for the common stock of Kandi surrendered, provided the surrendered Kandi

common stock is held as a capital asset within the meaning of Section 1221 of the Code (generally, property held for investment).

Please see the section entitled

“Material U.S. Federal Income Tax Considerations” for further information regarding material U.S. federal income

tax consequences relating to the Merger and the ownership and disposition of Kandi BVI ordinary shares.

Cash Transfer Policy

Renminbi, as the only official

currency in PRC, is still not freely convertible for direct investment or loans or investments in securities outside China, unless such

use is approved by SAFE. Foreign exchange transactions under our subsidiary’s capital account, including principal payments

in respect of foreign currency-denominated obligations, remain subject to significant foreign exchange controls and the approval requirement

of SAFE. These limitations could affect our ability to convert Renminbi into foreign currency for capital expenditures. To the extent

cash and/or assets in the business is in the PRC or a PRC entity, the funds and/or assets may not be available to fund operations or for

other use outside of the PRC due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries