Wolf Haldenstein Adler Freeman and Herz LLP Commences Class Action Lawsuit on Behalf of KVH Industries, Inc. Shareholders

17 August 2004 - 9:01AM

PR Newswire (US)

Wolf Haldenstein Adler Freeman and Herz LLP Commences Class Action

Lawsuit on Behalf of KVH Industries, Inc. Shareholders NEW YORK,

Aug. 16 /PRNewswire/ -- Wolf Haldenstein Adler Freeman & Herz

LLP filed a class action lawsuit in the United States District

Court for the District of Rhode Island, on behalf of all persons

who purchased or otherwise acquired the securities of KVH

Industries, Inc. ("KVH" or the "Company") (NASDAQ:KVHI) between

October 1, 2003 and July 2, 2004, inclusive, (the "Class Period")

against defendants KHV and certain officers and directors of the

Company. The case name is Horner v. KVH Industries, Inc., et al. A

copy of the complaint filed in this action is available from the

Court, or can be viewed on the Wolf Haldenstein Adler Freeman &

Herz LLP website at http://www.whafh.com/cases/kvh.htm . The

complaint alleges that defendants violated the federal securities

laws by issuing materially false and misleading statements

throughout the Class Period that had the effect of artificially

inflating the market price of the Company's securities. The

complaint further alleges that the statements defendants made

during the Class Period were materially false and misleading when

made because they failed to disclose or indicate the following: (a)

the Company had artificially inflated its third and fourth quarter

earnings by stuffing distribution and inventory channels with

overpriced TracVision A5 systems. Consequently, the Company was

forced to reduce the TracVision A5's retail price and, effectively,

refund millions of dollars in purported sales revenues to its

retail dealers in the form of "vendor purchase commitment charges"

in order to promote sell-through of TracVision retail channel

inventory; (b) the Company had not achieved any material cost

reduction in the manufacturing of the TracVision A5 and would be

forced to write-down its inventory of manufactured goods by

millions of dollars; (c) KVH's retail marketing and sales programs

purportedly aimed at the sell-through market for the TracVision A5

were ineffective because the A5 was overpriced, causing the company

to incur extra expenses and increased losses as inventories of

unsold TracVision systems continued to grow through the Class

Period which would have to be written down; (d) at the suggested

retail price of $3,495, the TracVision A5 was priced too high for

its intended market and, therefore, there was no reasonable basis

for defendants' projected annual sales of 9,000 to 10,000 units;

(e) TracVision production and other related costs were so high that

any price reduction would reduce margins to the extent that the

product could not be sold profitably; (f) the cost reduction

program was flawed and defendants were not able to control

production and marketing costs; (g) as a result of the above, the

defendants' opinions, projections, and forecasts concerning the

Company and its ability to successfully market the TracVision A5

lacked any reasonable basis when made. If you purchased or

otherwise acquired KVH securities during the Class Period, you may

request that the Court appoint you as lead plaintiff by September

20, 2004. A lead plaintiff is a representative party that acts on

behalf of other class members in directing the litigation. In order

to be appointed lead plaintiff, the Court must determine that the

class member's claim is typical of the claims of other class

members, and that the class member will adequately represent the

class. Under certain circumstances, one or more class members may

together serve as "lead plaintiff". Your ability to share in any

recovery is not, however, affected by the decision whether or not

to serve as a lead plaintiff. You may retain Wolf Haldenstein, or

other counsel of your choice, to serve as your counsel in this

action. Wolf Haldenstein has extensive experience in the

prosecution of securities class actions and derivative litigation

in state and federal trial and appellate courts across the country.

The firm has approximately 60 attorneys in various practice areas;

and offices in Chicago, New York City, San Diego, and West Palm

Beach. The reputation and expertise of this firm in shareholder and

other class litigation has been repeatedly recognized by the

courts, which have appointed it to major positions in complex

securities multi-district and consolidated litigation. If you wish

to discuss this action or have any questions, please contact Wolf

Haldenstein Adler Freeman & Herz LLP at 270 Madison Avenue, New

York, New York 10016, by telephone at (800) 575-0735 (Fred Taylor

Isquith, Esq., Gregory M. Nespole, Esq., Christopher S. Hinton,

Esq., George Peters or Derek Behnke), via e-mail at or visit our

website at http://www.whafh.com/ . All e-mail correspondence should

make reference to KVH. DATASOURCE: Wolf Haldenstein Adler Freeman

& Herz LLP CONTACT: Fred Taylor Isquith, Esq., or Gregory M.

Nespole, Esq., or George Peters, or Derek Behnke, all of Wolf

Haldenstein Adler Freeman & Herz LLP, 1-800-575-0735, Web site:

http://www.whafh.com/ http://www.whafh.com/cases/kvh.htm

Copyright

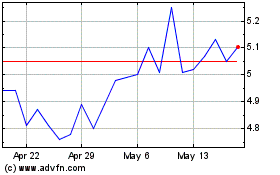

KVH Industries (NASDAQ:KVHI)

Historical Stock Chart

From Jun 2024 to Jul 2024

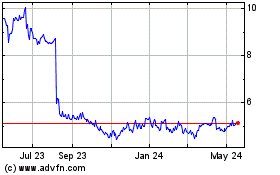

KVH Industries (NASDAQ:KVHI)

Historical Stock Chart

From Jul 2023 to Jul 2024