Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

23 August 2024 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-38261

Kaixin Holdings

(Registrant’s name)

Unit B2-303-137, 198 Qidi Road

Beigan Community, Xiaoshan District

Hangzhou, Zhejiang Province

People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 22, 2024

| |

Kaixin

Holdings |

| |

|

|

| |

By: |

/s/ Yi Yang |

| |

Name: |

Yi Yang |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Kaixin Holdings

Announces Receipt of Nasdaq Delisting Determination and Submission of Appeal

HANGZHOU, August 22, 2024 (GLOBE

NEWSWIRE) -- Kaixin Holdings (“Kaixin” or the “Company”) (NASDAQ: KXIN), a leading new energy vehicle manufacturer

and sales platform in China, today announced that it received a letter from The Nasdaq Stock Market LLC (“Nasdaq”) dated

August 19, 2024, indicating that the Company was not in compliance with Nasdaq Listing Rule 5810(c)(3)(A)(iii), as the Company’s

securities had a closing bid price of $0.10 or less for ten consecutive trading days (the “Letter”). The Letter indicated

that, as a result, the Nasdaq staff has determined to delist the Company’s securities from The Nasdaq Capital Market (the “Delisting

Determination”).

As previously reported, on February 1,

2024, Nasdaq notified the Company that the bid price of its listed securities had closed at less than $1 per share over the previous

30 consecutive business days, and, as a result, did not comply with Listing Rule 5550(a)(2) (the “Rule”). In accordance

with Listing Rule 5810(c)(3)(A), the Company was provided 180 calendar days, or until July 30, 2024, and on July 31, 2024,

the Company was provided an additional 180 calendar days, or until January 27, 2025, to regain compliance with the Rule.

The Letter indicates that unless the

Company requests an appeal of the Delisting Determination by August 26, 2024, trading of the Company’s ordinary shares will

be suspended at the opening of business on August 28, 2024, and a Form 25-NSE will be filed with the Securities and Exchange

Commission (the “SEC”), which will remove the Company’s securities from listing and registration on the Nasdaq.

The Company has submitted a request

for a hearing to appeal the Delisting Determination to a Hearings Panel of the Nasdaq (the “Panel”) on August 21,

2024. As notified by the Panel, a hearing is scheduled to be held on October 3, 2024. The hearing request has stayed the suspension of the

Company’s securities and the filing of the Form 25-NSE pending the Panel’s decision.

The Company is considering all potential

options available to regain compliance with the aforementioned rules, including seeking stockholder approval for a reverse stock split.

As previously reported on the Form 6-K filed with the SEC on August 13, 2024, the Company has scheduled to hold an extraordinary

general meeting of shareholders on October 1, 2024 to vote upon a reverse stock split, with the consolidation to take effect upon

the completion of administrative procedures pursuant to listing exchange requirements.

About Kaixin Holdings

Kaixin Holdings is a leading new energy

vehicle manufacturer in China, equipped with professional teams with rich experience in R&D, production, marketing, and production

facilities with the capacity for stamping, welding, painting, and assembly operations. Kaixin produces multiple electric passenger and

logistics vehicle models. The Company is committed to building up a competitive international market position that integrates online

and offline presence and diversified business operations. Leveraging the expertise of its professional teams and driven by the inspiration

for innovation and sustainability, Kaixin aims to contribute to achieving the goals of “peak carbon emissions and carbon neutrality”.

Safe Harbor Statement

This announcement may contain forward-looking

statements. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act

of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates,"

"future," "intends," "plans," "believes," "estimates" or other similar expressions.

Statements that are not historical facts, including statements about Kaixin’s beliefs and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially

from those contained in any forward-looking statement, including but not limited to the following: our goals and strategies; our future

business development, financial condition and results of operations; our expectations regarding demand for and market acceptance of our

services; our expectations regarding the retention and strengthening of our relationships with auto dealerships; our plans to enhance

user experience, infrastructure and service offerings; competition in our industry in China; and relevant government policies and regulations

relating to our industry. Further information regarding these and other risks is included in our other documents filed with the SEC.

All information provided in this announcement and in the attachments is as of the date of this announcement, and Kaixin does not undertake

any obligation to update any forward-looking statement, except as required under applicable law.

For more information, please contact:

Kaixin Holdings

Investor Relations

Email: ir@kaixin.com

SOURCE: Kaixin Holdings

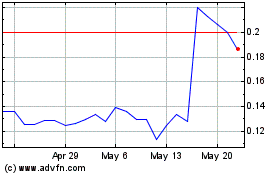

Kaixin (NASDAQ:KXIN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Kaixin (NASDAQ:KXIN)

Historical Stock Chart

From Feb 2024 to Feb 2025