Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

04 October 2024 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number: 001-38261

Kaixin Holdings

(Registrant’s name)

Unit B2-303-137, 198 Qidi Road

Beigan Community, Xiaoshan District

Hangzhou, Zhejiang Province

People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F ¨

Exhibit Index

SIGNATURES

Pursuant to the requirements of Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Kaixin Holdings |

| |

|

| Date: October 3, 2024 |

By: |

/s/

Yi Yang |

| |

Name: |

Yi Yang |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Kaixin Holdings Announces Extraordinary General

Meeting Results

HANGZHOU, October 3, 2024 (GLOBE NEWSWIRE)

-- Kaixin Holdings (“Kaixin” or the “Company”) (NASDAQ: KXIN) today announced that all resolutions presented to

the shareholders at its extraordinary general meeting held on October 1, 2024 (the “Extraordinary General Meeting”) were

duly passed.

The full text of each resolution was included

in the notice of the Extraordinary General Meeting, which was filed with the Securities and Exchange Commission (the “SEC”)

on Form 6-K on August 13, 2024 and subsequently amended on Form 6-K/A on August 23, 2024 and September 3, 2024.

The full text of each resolution is also available on the Company’s website ir.kaixin.com. Capitalized terms not otherwise defined

in this announcement shall have the meanings assigned to them in the Company’s amended notice of the Extraordinary General Meeting

dated September 3, 2024.

The Company will implement and announce the effectiveness

of the Share Consolidation afterwards. The Share Consolidation is primarily being effectuated to regain compliance with Nasdaq Marketplace

Rule 5550(a)(2) related to the minimum price per share of the Company’s ordinary shares. Immediately after the Share Consolidation,

each shareholder’s percentage ownership interest in the Company will remain unchanged, except for minor changes and adjustments

that will result from the treatment of fractional shares. The rights and privileges of the holders of ordinary shares will be substantially

unaffected by the Share Consolidation. No fractional shares will be issued in connection with the Share Consolidation, in the event that

a shareholder would otherwise be entitled to receive a fractional share upon the Share Consolidation, the number of shares to be received

by such shareholder will be rounded up to one ordinary share in lieu of the fractional share that would have resulted from the Share Consolidation.

Shareholders who are holding their shares in electronic form at brokerage firms do not need to take any action, as the effect of the Share

Consolidation will automatically be reflected in their brokerage accounts.

About Kaixin Holdings

Kaixin Holdings is a leading new energy vehicle

manufacturer in China, equipped with professional teams with rich experience in R&D, production, marketing, and production facilities

with the capacity for stamping, welding, painting, and assembly operations. Kaixin produces multiple electric passenger and logistics

vehicle models. The Company is committed to building up a competitive international market position that integrates online and offline

presence and diversified business operations. Leveraging the expertise of its professional teams and driven by the inspiration for innovation

and sustainability, Kaixin aims to contribute to achieving the goals of “peak carbon emissions and carbon neutrality”.

Safe Harbor Statement

This announcement may contain forward-looking

statements. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act

of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates,"

"future," "intends," "plans," "believes," "estimates" or other similar expressions.

Statements that are not historical facts, including statements about Kaixin’s beliefs and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially

from those contained in any forward-looking statement, including but not limited to the following: our goals and strategies; our future

business development, financial condition and results of operations; our expectations regarding demand for and market acceptance of our

services; our expectations regarding the retention and strengthening of our relationships with auto dealerships; our plans to enhance

user experience, infrastructure and service offerings; competition in our industry in China; and relevant government policies and regulations

relating to our industry. Further information regarding these and other risks is included in our other documents filed with the SEC. All

information provided in this announcement and in the attachments is as of the date of this announcement, and Kaixin does not undertake

any obligation to update any forward-looking statement, except as required under applicable law.

For more information, please contact:

Kaixin Holdings

Investor Relations

Email: ir@kaixin.com

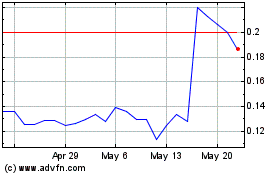

Kaixin (NASDAQ:KXIN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kaixin (NASDAQ:KXIN)

Historical Stock Chart

From Nov 2023 to Nov 2024