UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2024

Commission File Number 000-29962

Kazia Therapeutics Limited

(Translation of registrant’s name into English)

Three

International Towers Level 24 300 Barangaroo Avenue Sydney NSW 2000

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

On November 4, 2024, Kazia Therapeutics Limited (the “Company”) issued a press release titled, “Kazia

Therapeutics Announces Granting of Type C Meeting with FDA to Discuss Potential Next Steps for Paxalisib in the Treatment of Newly Diagnosed Glioblastoma Multiforme.” A copy of this release is attached hereto as Exhibit 99.1 and is

incorporated herein by reference. The Company also updated its corporate presentation for use in meetings with investors, analysts and others. A copy of the corporate presentation is attached hereto as Exhibit 99.2.

EXHIBIT LIST

|

|

|

| Exhibit |

|

Description |

|

|

| 99.1 |

|

Press Release of Kazia Therapeutics Limited dated November 4, 2024 |

|

|

| 99.2 |

|

Corporate Presentation |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

| Kazia Therapeutics Limited (Registrant) |

|

| /s/ John Friend |

| John Friend |

| Chief Executive Officer |

Date: November 4, 2024

Exhibit 99.1

4 November 2024

Kazia Therapeutics Announces Granting of Type C Meeting with FDA to Discuss Potential Next Steps for Paxalisib in the Treatment of Newly Diagnosed

Glioblastoma Multiforme

Company and FDA to meet in December to discuss potential pathways to registration of paxalisib in

glioblastoma multiforme (GBM)

Company updates to corporate presentation and participation in upcoming medical meetings

Sydney, November 4, 2024 – Kazia Therapeutics Limited (NASDAQ: KZIA), an oncology-focused drug development company, announced that the U.S. Food and

Drug Administration (FDA) has granted a Type C meeting with the Company in December 2024 to discuss the potential pathways to registration of Kazia’s blood brain barrier penetrant PI3K/mTOR inhibitor, paxalisib, for the treatment of patients

with newly diagnosed GBM.

In July 2024, the Company announced results from the Phase II/III clinical trial,

GBM-AGILE, in which newly diagnosed unmethylated patients with glioblastoma treated with paxalisib showed clinically meaningful improvement in a prespecified secondary analysis for overall survival. Full data

including secondary endpoints from the paxalisib arm of the GBM-AGILE study is expected to be presented at a scientific meeting later this year.

Paxalisib has previously received orphan drug designation and fast track designation from the FDA for glioblastoma in unmethylated MGMT promoter status

patients, following radiation plus temozolomide therapy.

Updated corporate presentation

Today, the Company also announced that it has updated its corporate presentation, which now incorporates preliminary data from the GBM AGILE Phase II/III

clinical trial evaluating paxalisib versus the standard of care for the treatment of in patients with glioblastoma. The updated presentation can be found at

https://www.kaziatherapeutics.com/site/pdf/ebcc5b2e-29a6-410c-ab9a-c3e722413615/Kazia-Corporate-Presentation-November-2024.pdf

Participation in Upcoming and Recent Medical and Investor Conferences

The company plans on attending the following medical conferences in the fourth quarter of 2024:

| |

• |

|

Society for Neuro-Oncology 29th Annual Meeting and Education

Day, November 21-24, 2024, in Houston, TX |

| |

• |

|

San Antonio Breast Cancer Symposium, December 10-13, 2024, in San

Antonio, TX |

These events provide Kazia with the opportunity to engage with key stakeholders and share the Company’s vision to make

a difference in the lives of patients by developing innovative cancer treatments. Kazia looks forward to meeting with investors in person at these events and invites discussion regarding partnering and investment opportunities.

Over the last several months, the Company has also participated and presented at a number of medical and

investor conferences, including:

| |

• |

|

H C Wainwright 26th Annual Global Investment Conference from Sep. 9-11,

2024 |

| |

• |

|

15th Biennial AACR Ovarian Cancer Research Symposium, Sep. 20 – 21, 2024 |

| |

• |

|

Oppenheimer Oncology Summit, in collaboration with MD Anderson Cancer Center, Sep. 26, 2024

|

| |

• |

|

American Society for Radiation Oncology Annual Meeting, Sep. 29 – Oct. 1, 2024 |

| |

• |

|

Deerfield CEO Conference, Oct. 8-9, 2024 |

| |

• |

|

Maxim Group’s 2024 Healthcare Virtual Summit, Fireside Chat, Oct. 15, 2024 |

About Kazia Therapeutics Limited

Kazia Therapeutics

Limited (NASDAQ: KZIA) is an oncology-focused drug development company, based in Sydney, Australia. Our lead program is paxalisib, an investigational brain-penetrant inhibitor of the PI3K / Akt / mTOR pathway, which is being developed to treat

multiple forms of brain cancer. Licensed from Genentech in late 2016, paxalisib is or has been the subject of ten clinical trials in this disease. A completed Phase 2 study in glioblastoma reported early signals of clinical activity in 2021, and a

pivotal study in glioblastoma, GBM AGILE, has been completed with presentation of paxalisib arm data expected later in 2024 at a major medical conference. Other clinical trials involving paxalisib are ongoing in brain metastases, diffuse midline

gliomas, and primary CNS lymphoma, with several of these trials having reported encouraging interim data. Paxalisib was granted Orphan Drug Designation for glioblastoma by the FDA in February 2018, and Fast Track Designation (FTD) for glioblastoma

by the FDA in August 2020. Paxalisib was also granted FTD in July 2023 for the treatment of solid tumour brain metastases harboring PI3K pathway mutations in combination with radiation therapy. In addition, paxalisib was granted Rare Pediatric

Disease Designation and Orphan Drug Designation by the FDA for diffuse intrinsic pontine glioma in August 2020, and for atypical teratoid / rhabdoid tumours in June 2022 and July 2022, respectively. Kazia is also developing EVT801, a small-molecule

inhibitor of VEGFR3, which was licensed from Evotec SE in April 2021. Preclinical data has shown EVT801 to be active against a broad range of tumour types and has provided evidence of synergy with immuno-oncology agents. A Phase I study has been

completed and preliminary data was presented at 15th Biennial Ovarian Cancer Research Symposium in September 2024. For more information, please visit www.kaziatherapeutics.com or follow us on X @KaziaTx.

Forward-Looking Statements

This announcement may contain forward-looking statements, which can generally be identified as such by the use of words such as “may,”

“will,” “estimate,” “future,” “forward,” “anticipate,” or other similar words. Any statement describing Kazia’s future plans, strategies, intentions, expectations, objectives, goals or

prospects, and other statements that are not historical facts, are also forward-looking statements, including, but not limited to, statements regarding: the timing for results and data related to Kazia’s clinical and preclinical trials,

Kazia’s strategy and plans with respect to its programs, including paxalisib and EVT801, the potential benefits of paxalisib as an investigational PI3K/mTOR inhibitor, timing for any regulatory submissions or discussions with regulatory

agencies, and the potential market opportunity for paxalisib. Such statements are based on Kazia’s current expectations and projections about future events and future trends affecting its business and are subject to certain risks and

uncertainties that could cause actual results to differ materially from those anticipated in the forward-looking statements, including risks and uncertainties: associated with clinical and preclinical trials and product development, related to

regulatory approvals, and related to the impact of global economic conditions. These and other risks and uncertainties are described more fully in Kazia’s Annual Report, filed on form 20-F with the SEC,

and in subsequent filings with the United States Securities and Exchange Commission. Kazia undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise, except as

required under applicable law. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this announcement.

This announcement was authorized for release by Dr John Friend, CEO.

Exhibit 99.2 A Diversified Oncology Drug Development Company Kazia

Corporate Overview November 2024 NASDAQ: KZIA | X: @KaziaTx

Forward Looking Statements This presentation contains forward -looking

statements, which can generally be identified as such by the use of words such as “may,” “will,” “estimate,” “future,” “forward,” “anticipate,” “plan,”

“expect,” “explore,” “potential” or other similar words. Any statement describing Kazia's future plans, strategies, intentions, expectations, objectives, goals or prospects, and other statements that are not

historical facts, are also forward-looking statements, including, but not limited to, statements regarding: the timing for interim or final results and data related to Kazia’s clinical and preclinical trials, or third-party trials evaluating

Kazia’s product candidates, timing and plans with respect to enrolment of patients in Kazia’s clinical and preclinical programs, the potential benefits of paxalisib and EVT801, and Kazia’s strategy and plans with respect to its

business and programs, including paxalisib and EVT801. Such statements are based on Kazia’s expectations and projections about future events and future trends affecting its business and are subject to certain risks and uncertainties that could

cause actual results to differ materially from those anticipated in the forward-looking statements, including risks and uncertainties: associated with clinical and preclinical trials and product development, the risk that interim data may not be

reflective of final data, related to regulatory approvals, and related to the impact of global economic conditions, including disruptions in the banking industry. These and other risks and uncertainties are described more fully in Kazia’s

Annual Report, filed on Form 20- F with the SEC, and in subsequent filings with the SEC. Kazia undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise, except as

required under applicable law. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this presentation. Certain information contained in this presentation and statements made orally during this

presentation relate to or are based on studies, publications, surveys and other data obtained from third-party sources and our own internal estimates and research. While we believe these third-party studies, publications, surveys and other data to

be reliable as of the date of this presentation, it has not independently verified, and makes no representations as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, no

independent source has evaluated the reasonableness or accuracy of our internal estimates or research and no reliance should be made on any information or statements made in this presentation relating to or based on such internal estimates and

research. 1

Company Overview A late-clinical-stage oncology drug development company

Corporate Highlights Licensing-driven business model Paxalisib EVT801 focused on high quality, differentiated clinical-stage assets sourced from Genentech (Paxalisib) and Sanofi / Brain-penetrant pan-PI3K / mTOR inhibitor Selective VEGFR3 inhibitor

Evotec (EVT801) • Well-validated class with five current FDA-approved • Designed to avoid off-target toxicity of older, non- therapies selective angiokinase inhibitors • Only brain-penetrant PI3K inhibitor in development•

Primarily targets lymphangiogenesis Lean virtual pharma model, with ~75% of cashflows applied directly to In development for multiple brain cancers Completed phase I for advanced solid tumors clinical trials • Clinical trials ongoing in brain

metastases, childhood • Preliminary data from adaptive, biomarker study at 2 brain cancer, glioblastoma, IDH-mutant glioma, and leading cancer sites in France to be presented at primary CNS lymphoma upcoming 2024 meeting Potential

opportunities for non-dilutive Unique asset being evaluated in multiple trials Potential use in multiple solid tumor types income via additional partnering • Multiple signals of clinical activity across several • Potential indications

include: ovarian cancer, renal cell activity cancer types carcinoma, liver cancer, colon cancer, and sarcoma • Fast Track, Orphan Drug, and Rare Pediatric Disease Designations from US FDA Rich potential commercial opportunity Potential

combination with immunotherapy Delisted from Australian Securities • Glioblastoma alone sized at US$ 1.5 billion per annum• Strong evidence of synergy in preclinical data supports Exchange (ASX) in Nov 2023; now • Commercial

licensee in place for China potential of monotherapy or combination use solely listed on NASDAQ (KZIA) • Licensee for intractable seizures in rare CNS diseases Top Line Ph. 3 Data: Reported July CY2024 Phase 1 Preliminary Data presented Sep

CY2024 2

Pipeline – Two Differentiated Assets CY2024 positive clinical data

updates driving strong interest in oncology community licensed from: Paxalisib Investigational, small molecule, potent, brain-penetrant inhibitor of PI3K / mTOR Preclinical PHASE 1 PHASE 2 PHASE 3 MARKET Anticipated Collaborators / Sponsors Phase 3

Data Glioblastoma & IDH-mutant glioma 3 studies July CY24 Common primary brain cancer Further DIPG/Advanced Solid Tumors Update 3 studies Childhood brain cancer CY25 Further AT/RT Update Childhood brain cancer CY25 Further Data Brain Metastases

3 studies 4Q CY24 Cancer that spreads to brain from elsewhere Initial Data Primary CNS Lymphoma 1 study CY25 Form of non-Hodgkin’s lymphoma Further Data Cancers outside the CNS 4Q CY24 TNBC, Ovarian licensed from: EVT801 Investigational, small

molecule, highly specific inhibitor of VEGFR3 Initial Data Advanced Solid Tumors 3Q CY24 Patients w/ highly treatment-resistant cancer IDH: Isocitrate dehydrogenase, DIPG: Diffuse Intrinsic Pontine Glioma, AT/RT: Atypical Teratoid Rhabdoid Tumor,

CNS: central nervous system, TNBC: triple negative breast cancer, VEGFR3: vascular endothelial growth factor receptor 3 3

Paxalisib Mechanism of Action Only brain-penetrant drug in development

within the PI3K inhibitor class Paxalisib is the only brain-penetrant 1 2 3 The PI3K pathway is activated in Five PI3K inhibitors have already PI3K inhibitor in development been approved by FDA many forms of cancer • Chronic lymphocytic Only

2% of small-molecule Glioblastoma 90% leukemia drugs are brain-penetrant • Follicular lymphoma Breast 80% • Follicular lymphoma Lung 75% • Chronic lymphocytic leukemia • Follicular lymphoma Endometrial 60% • Breast

cancer Ovarian 60% Not able to cross blood-brain barrier • Follicular lymphoma Able to cross blood-brain barrier Prostate 45% Source: Data on file 4

Paxalisib – Development History Growing Body of Clinical Evidence

Demonstrating Activity in GBM 2012-2015 February 2018 August 2019 7 January 2021 1 August 2022 GDC-0084 becomes GBM AGILE Kazia provides progress Genentech Phase I clinical GDC-0084 awarded ‘paxalisib’ with the granting pivotal study

update on the GBM study in 47 patients with Orphan Drug Designation of an International Non- commences Agile Pivotal Study advanced, high-grade by the US FDA in Proprietary Name (INN) by recruiting glioma. Study demonstrated glioblastoma the World

Health paxalisib arm a favourable safety profile Paxalisib does not Organisation and provided efficacy progress from stage 1 signals to stage 2 Patients enrolled in the first stage of the paxalisib arm to continue on treatment as per protocol, and

in follow-up until final data 10 July 2024 GBM AGILE Phase II/III trial data showed clinically meaningful improvement in a prespecified secondary analysis for overall survival in paxalisib-treated, newly diagnosed unmethylated March 2018 3 December

2021 patients with glioblastoma August 2020 2016 Early 2000’s Kazia in-licenses Phase II study of paxalisib Kazia commences Paxalisib granted Genentech develops GDC-0084 from mono-therapy in 30 company-sponsored Breakthrough GDC-0084 as a

potential new Genentech following newly-diagnosed GBM Phase II clinical study Designation by the therapeutic for glioblastoma deep due diligence patients (NDU) provides of GDC-0084 as a first US FDA for which included Phase efficacy data with mOS of

line therapy in patients glioblastoma I study and animal 15.7 months with glioblastoma data 5

Glioblastoma Background & Market potential 6

Glioblastoma Overview The most aggressive malignant brain cancer Lung

Any age, No clear No clear but most improvement in cause common in prognosis for Breast or strong risk 60s 20 years factors 14 million cancer cases per annum Colon Five-year 3-4 months survival Prostate Stomach 3 – 5% Survival, (breast cancer:

if untreated 90%) Glioblastoma Multiforme 133,000 cases per annum worldwide “Even a few months increase in overall survival makes a huge difference for my patients, so efficacy of an GBM treatment market size approved therapeutic makes the

largest impact.” (2022) US$ 1.5 billion US Neuro-Oncologist Source: Data on file. Market research performed 2021 7

Primary Market Research Outcomes Physicians indicated a 2-month minimum

and 12-month optimum increase in efficacy for newly diagnosed unmethylated GBM treatments, but adoption would be high regardless Key Takeaway • Due to the high unmet need for a more efficacious therapy for Newly Diagnosed Unmethylated (NDU)

GBM patients, physicians indicated high adoption rates if Product X (paxalisib)* is approved by the FDA and achieved their suggested minimum mOS improvement of 2-3 months for newly diagnosed unmethylated GBM patients Source: Data on file.

Company-sponsored market research performed in 2021 * There is no guarantee that the Paxalisib data generated to date will support an FDA approval for commercial use 8

GBM AGILE study data – Primary and secondary analysis

9

Paxalisib and GBM-Agile International, multi-center, adaptive, phase

2/3 study evaluating promising therapeutics in patients with glioblastoma Completed Key Points Regorafenib Negative outcome Bayer (Sep 2022) • A ‘platform study’, sponsored by GCAR run independently of Final Top Line 3 Paxalisib

individual companies, designed Data Kazia Therapeutics to expedite the approval of new Economies of July 2024 drugs for glioblastoma scale due to 2 multiple Completed VAL-083 Comparison • Multiple drugs are evaluated in participating Negative

outcome Kintara Therapeutics against a (Oct 2023) parallel, saving time and money drugs allows for common control large site pool, arm reduces Ongoing • Not a ‘winner-takes-all’ robust study Troriluzole Joined study in Jan overall

subject approach: multiple drugs can infrastructure, Biohaven Pharmaceuticals 2022 numbers, saving succeed and reduced cost time and cost Ongoing (no arm vs. arm • Cutting-edge ‘adaptive design’ VT1021 Joined study in Jan

comparison) avoids redundant recruitment, Vigeo Therapeutics 2022 expediting path to market • FDA acknowledged that GBM- Shared Control Arm AGILE data may be suitable for registration Adaptive study design limits Primary endpoint is overall 1

4 number of subjects required to survival (OS), the ‘gold demonstrate efficacy, eliminating standard’ for approval of redundancy new cancer drugs GCAR: Global Coalition for Adaptive Research 10 Randomization

Paxalisib & GBM-Agile Study schema; Paxalisib arm (n=154) enrolled

Newly Diagnosed Unmethylated GBM patients (NDU) and Recurrent GBM patients Paxalisib Paxalisib stage 1 stage 2 Evaluate for graduation Evaluate for futility Study completed Paxalisib 12 months after enrolment stops last patient enrolled Time

adjusted controls (20 months) Concurrent controls (14 months) July 2019 March 2021 May 2022 May 2023 Cumulative control arm Important notes: • The Cumulative control arm is a combination of Concurrent control patients and the “Time

adjusted control” patients that were enrolled in the study before the Paxalisib arm joined the study • Bayesian Primary Analysis uses data from the Cumulative control arm, while Prespecified Secondary Analysis uses data from the

Concurrent Control Arm (i.e.. Compares paxalisib data with standard of care) • All patients (Paxalisib, concurrent control, and cumulative control) were censored on May 2023 if still alive 11

Paxalisib and GBM-Agile Newly Diagnosed Unmethylated GBM patients (NDU)

Primary endpoint: median Overall Survival analyses (ITT) Bayesian Primary Analysis: Prespecified Secondary Analysis: Paxalisib (n=54) vs Standard of Care Paxalisib (n=54) vs Standard of Care 1 2 (n=77) (n=46) 14.77 months vs 13.84 months 15.54

months vs 11.89 months A prespecified sensitivity analysis in NDU patients showed a similar median OS difference between paxalisib treated patients (15.54 months) and concurrent SOC patients (11.70 months) Important notes: • The Cumulative

control arm is a combination of Concurrent control patients and “Time adjusted control” patients that were enrolled in the study before the Paxalisib arm joined the study • Primary Analysis comparator is the Cumulative control arm,

while Prespecified Secondary Analysis comparator is the Concurrent Control Arm • An efficacy signal was not detected in the recurrent disease population [median OS of 9.69 months for concurrent SOC (n=113) versus 8.05 months for paxalisib

(n=100)] 1. 2. Cumulative controls. Concurrent controls

Recap and next steps for Paxalisib in glioblastoma 13

Paxalisib in Glioblastoma Phase II Clinical Study Encouraging median OS

(mOS) in Newly Diagnosed Unmethylated GBM patients Overall Survival (OS) (n=30) Median OS: 15.7 months (11.1-19.1) Historical mOS for existing therapy: 12.7 months (Hegi et al. 2005) Note: Figures for existing therapy are for temozolomide, per Hegi

et al. (2005); No head-to-head studies have been published 14

Paxalisib in Glioblastoma Phase II Clinical Study Encouraging safety

profile Number of Patients at Any Dose (n=30) Experiencing AEs ‘Possibly’ or ‘Likely’ Related to Paxalisib (affecting ≥10% of patients) Term Gr 1 Gr 2 Gr 3 Gr 4 Total (%) Fatigue 3 13 2 18 (60%) Stomatitis 4 7 3 14

(47%) Decreased appetite 6 6 1 13 (43%) Hyperglycemia 3 1 6 2 12 (40%) Nausea 4 6 1 11 (37%) Rash, maculo-popular 1 1 7 9 (30%) Diarrhea 7 1 8 (27%) Vomiting 4 2 1 7 (23%) Rash 2 4 1 7 (23%) Neutrophils decreased 3 3 1 7 (23%) Platelets decreased 6

1 7 (23%) Weight decreased 5 2 7 (23%) Lymphocytes decreased 2 3 5 (17%) Dehydration 4 1 5 (17%) Dysgeusia 4 4 (13%) Cholesterol increased 4 4 (13%) ALT increased 1 2 3 (10%) Triglycerides increased 1 2 3 (10%) Malaise 2 1 3 (10%) 15

Paxalisib in Glioblastoma Consistent median Overall Survival data in

two studies of NDU glioblastoma patients Standard of Care data GBM AGILE study (left) Compelling Paxalisib data in NDU patients and STUPP historical controls (right) in NDU when compared to SOC patients Paxalisib in Paxalisib in Concurrent SOC STUPP

historical Kazia sponsored control GBM Agile GBM Agile phase II study (n=54) (n=46) (N/A) (n=30) Median OS: 12.7 Median OS: 15.54 Median OS: 11.9 Median OS: 15.7 months months* months months* *GBM Agile; Prespecified secondary analysis of median

Overall Survival 16

Paxalisib glioblastoma program highlights Significant body of clinical

evidence from two clinical trials supporting paxalisib’s activity in newly diagnosed GBM ✓ GBM AGILE Phase II/III trial data showed improvement in a prespecified secondary analysis for overall survival (15.5 months) in

paxalisib-treated, newly diagnosed unmethylated patients with glioblastoma; presentation of data from GBM AGILE anticipated in 4Q CY 2024 ✓ Earlier Phase II study of paxalisib as a mono-therapy in 30 newly-diagnosed GBM patients (NDU)

provides additional clinical evidence of activity with mOS of 15.7 months US FDA has granted a December 2024 Type C meeting with Kazia Therapeutics to discuss results and possible pathways to registration 17

Childhood Brain Cancers 18

Paxalisib in Childhood Brain Cancer High unmet need especially in

patients with diffuse midline gliomas (DMGs) Brain cancer is the most common Brain cancer represents about one Prognosis of childhood brain 1 2 3 malignancy of childhood third of childhood cancer deaths cancer, especially DMGs, has improved little

in recent decades Source: CBTRUS; CDC; Ages 0-14 shown; Adamson PC, CA Cancer J Clin. 2015;65:212–220 19

Summary of Paxalisib in Childhood Brain Cancer Kazia is actively

pursuing three forms of childhood brain cancer Advanced Childhood Cancer Diffuse Midline Gliomas Atypical Teratoid / (PI3K/mTOR activated) (DMG, DIPG) Rhabdoid Tumors (AT/RT) Positive preclinical data as Positive preclinical data in Research

proposals under monotherapy and in Preclinical combination with ONC201 discussion combination Research (AACR 2022, 2023, 2024) Additional clinical trial Phase I monotherapy clinical Clinical trial design/execution opportunities under trial at St

Jude Children’s discussions ongoing between Clinical discussion for Research Hospital completed PNOC and Kazia Trials medulloblastoma and HGG Phase II clinical trial in PNOC022, Phase II clinical combination with chemotherapy trial in

combination with for treatment of high-risk ONC201, ongoing malignancies commenced 2023 Orphan Drug Designation ODD and RPDD granted by Regulatory (ODD) and Rare Pediatric Regulatory strategy under FDA in June and July 2022, Interaction Disease

Designation (RPDD) discussion respectively granted by FDA in Aug 2020 20

Paxalisib in Diffuse Midline Gliomas Follow-up Phase II data presented

at ISPNO 2024 Annual Meeting In spite of research that has helped improve treatment for DIPG patients, the prognosis 1 remains poor–with the median survival range being from 8-11 months • 68 patients with biopsy-proven DMG were enrolled

in the PNOC Overall Survival - Cohort 2 (post RT) Phase II study between November 2021 and June 2023 (median Median OS 15.6 months [CI 95%; 12.0, 22.4] age 9 years [range 3-37], n=41 female [60%]) • Updated Median OS from time of diagnosis was

15.6 months (Confidence interval (CI) 12.0, 22.4) • Cohort 3 enrolled 30 recurrent patients (in conjunction with radiation therapy) had median OS 8.7 months [CI 95% 8.5, NA] • Most common grade 3 and above treatment-related adverse

events were decreased neutrophil count (n=4); mucositis (n=3); and colitis, drug reaction with eosinophilia and systemic symptoms, decreased lymphocyte count, hyperglycemia, and hypokalemia (n=2) • Next Steps: Further PK and biomarker analyses

ongoing for Central imaging review analysis of PFS ongoing subsequent cohorts; anticipate clinical update 1HCY2025 1. Hargrave, D., Bartels, U. & Bouffet, E. Diffuse brainstem glioma in children: critical review of clinical trials. Lancet Oncol

7, 241-8 (2006) 21

Brain Metastases 22

Paxalisib in Brain Metastasis MSKCC-sponsored Phase I trial’s

interim analysis showed encouraging clinical activity of paxalisib in combination with radiation therapy (NCT04192981) 12-13 August 2022 July 2023 February 2024 Data from first stage presented at Fast Track Designation granted by Announced early

conclusion, 2022 Annual Conference on CNS US FDA for paxalisib in combination based on Stage 2 positive safety Clinical Trials and Brain Metastases, with radiation therapy in patients with data and promising clinical Toronto, Canada from 12-13

August solid tumor brain metastases and response findings observed to 2022 PI3K pathway mutations date. All 9 patients evaluated for efficacy Based on the interim Stage 1 data ▪ Data presentation anticipated exhibited a clinical response, from

the MSKCC-sponsored Phase I at upcoming scientific congress according to RANO-BM criteria, with trial’s interim analysis. in 2H CY2024 breast cancer representing the most common primary tumor ▪ Coordinate and plan next clinical study in

conjunction key thought leaders and FDA 23

Paxalisib in Brain Metastasis MSKCC-sponsored Phase I trial’s

interim analysis presented at 2024 ASTRO* meeting showed encouraging clinical activity of paxalisib in combination with radiation therapy (NCT04192981) Robust response signal seen for concurrent paxalisib Overall Summary and brain RT • Primary

objective of identifying the 1 maximum tolerated dose (MTD) was met: – Concurrent daily administration of paxalisib with brain radiotherapy was generally well-tolerated at a maximum dose of 45 mg per day in advanced solid tumor patients with

brain metastases and PI3K pathway mutations • Over two-thirds of the patients at MTD achieved intracranial response which compares favorably to historical response 2 rates (20-40%) for WBRT alone • Future goals include: – Extending

the duration of PI3K inhibition, neoadjuvant, adjuvant and maintenance (ideally with complementary systemic therapy options) – Integrating PI3K inhibition with CNS tumor types with relevant pathway driver * American Society for Radiation

Oncology mutations and potentially SRS 1. Response assessment in neuro-oncology brain metastases (RANO-BM) 2. Zhou et al. 2021, Kim et al. 2020 24

Other Solid Tumors 25

Paxalisib in Triple Negative Breast Cancer QIMR Berghofer Medical

Institute collaboration “In treatment-resistant pre-clinical models of breast cancer, paxalisib (4T1 mouse 1 model, TNBC ) has shown encouraging results in inhibiting both the primary tumor burden and metastasis by reinvigorating the immune

system within the tumor microenvironment” – Professor Sudha Rao, Group Leader, QIMR Berghofer • Leading transcriptional biology and epigenetics expert, Prof Rao identified an entirely novel effect of PI3K inhibition: – Immune

modulator of the tumor and the surrounding microenvironment – Administration of PI3K inhibitors such as paxalisib, at doses and frequencies different to those conventionally used, appears to activate or reinvigorate the immune system in the

tumour, making it more susceptive to immunotherapy • The preliminary data from our collaboration will be presented at an upcoming conference in 4Q CY2024 Paxalisib Combination Combination influence on Paxalisib + Paxalisib + immune system

® LYNPARZA ® KEYTRUDA (example, T cells, Intellectual (olaparib) data in (pembrolizumab) B cells, NK cells) Property (IP) advanced breast 1 data in TNBC and within the update cancer preclinical tumor and its preclinical models micro-

models environment 1. Triple Negative Breast Cancer 26

Triple Negative Breast Cancer Treatment Landscape Projected TNBC market

to exceed $1.5 Billion by 2030 1 American Triple negative 2.3 million Cancer Society breast cancer 2 TNBC market growth forecast Cases / year says nearly TNBC Breast cancer USD $1.5b 300,000 most commonly most aggressive diagnosed form of breast new

cases of cancer cancer invasive BC in USD $953.8m US Characteristics 15-20% TNBC market Higher early valued at Of all breast relapse rate, USD $953.8m in cancers increased 2022. Predicted attributed to metastases risk to grow to USD TNBC and higher

$1.5b by 2022 2030 mortality rate 2 Series1 Series2 2030 actual forecast 1. National Institutes of Health (NIH): Current and future burden of breast cancer: Global statistics for 2020 and 2040 2.

https://www.databridgemarketresearch.com/reports/global-triple-negative-breast-cancer-market 27

EVT801 28

EVT801 is a highly selective VEGFR3 inhibitor, primarily inhibiting

lymphangiogenesis (formation of new lymphatic vessels) Highly selective for VEGFR3 Oral Presentation Expected to minimise off-target toxicities Administered by mouth once or twice daily Strong IP Protection Inhibits lymphangiogenesis

Composition-of-matter to 2032 / 2033 in most jurisdictions Less potential for hypoxia-induced resistance Low Cost of Goods Straightforward manufacture with excellent Very strong preclinical data package stability Evidence of activity in a wide range

of tumour Favourable Preclinical Toxicology types Limited evidence of toxicity in one-month GLP studies Strong potential for immunotherapy combo In Clinical Development Phase 1 clinical trial completed Evidence of synergistic activity with IO agents

29

EVT801 Mechanism of Action pos By targeting VEGFR3 tumor blood vessels,

EVT801 may induce tumor blood vessel normalization, reduce hypoxia, and improve CD8 T-cells infiltration Schematic overview based on pre-clinical data Tumor metastasis EVT801 activity on tumor microenvironment Normalization of tumor

(lymph)-angiogenesis Hypoxia Multiple cooperative pos CD8 T-cell infiltration modes of action EVT801 (SAR131675) Endothelial cell immunotolerance Cytokines involved Myeloid-derived Tumor associated macrophages in MDSC frequency suppressor cells Data

from Tacconi & al. with SAR131675 30

o n f i d e n t i a l EVT801: Phase 1 dose-finding trial; KZA 0801-101

(NCT05114668) Staged development in patients with advanced cancer Phase 1 study in advanced cancer patients Completed STAGE 1 • Primary objective of stage one of the study was successfully Monotherapy dose escalation met: n<48 o MTD has

been reached at 500mg BID o The recommended dose for phase 2 is 400 mg BID* in Dose Cohort 3 continuous monotherapy administration EVT801 monotherapy Number of cycles of treatment: Status on 11 October 2024 Dose Cohort 2 EVT801 monotherapy Dose

Cohort 1 EVT801 monotherapy • Up to 8 cohorts • Single-patient cohorts initially, expand to 3+3 when toxicity is encountered • Mixed population of advanced solid tumors • Doses from 50mg QD to 800mg BID MTD = Maximum

Tolerated Dose; RP2D = Recommended Phase 2 Dose *Human active dose prediction based on predicted human clearance of 2.5 mL/min/kg: 375 mg BID* 31

EVT801 Key Points Well-understood mechanism (anti-angiogenesis) with

unique differentiating feature (high 1 VEGFR3 selectivity) 2 Strong preclinical data package, with observed activity in multiple tumours and favourable toxicology 3 Potential for combination use with immuno-oncology therapies Phase 1 completed

demonstrating encouraging safety and tolerability profile to date: 4 • Clinical and biomarker data presented at AACR Ovarian Cancer Research Symposium September 2024 • Primary and secondary objectives successfully met, with MTD and RP2D

identified • Encouraging signal of activity observed in High Grade Serous (HGS) ovarian cancer as well as strong VEGFR3 biomarker expression 5 Next clinical trial under discussion with scientific thought leaders: • Consolidate safety

data at RP2D and our hypotheses on EVT801 mode of action • Validate HGS ovarian cancer as indication of choice for clinical trial phase 2 as monotherapy or in combination with standard-of-care (ex. PARPi) 32

2024 Corporate Update 33

Paxalisib Licensing and Collaborations Opportunistic partnering and

strategic collaborations continue to add value Licensing Key Collaborations Summary To develop, manufacture and commercialize Cutting edge preclinical program to evaluate To develop and Paxalisib as a potential Paxalisib in combination with

immuno-therapies for Territories and commercialize Paxalisib in treatment for intractable Advanced Breast Cancer responsibilities Greater China, Hong epilepsy in focal cortical Kong, Macau, and Taiwan dysplasia type 2 (FCD T2) and tuberous sclerosis

complex (TSC) disease US$11m, comprising Upfront payment US$7m in cash and a US$ US$1.5 million 4m equity investment • Paxalisib alone and in combination with other Potential milestone Contingent milestone targeted agents is active in

preclinical models of payments of up to US$19 1 payments of up to US$ 281 AT/RT million upon the Milestone payments million in GBM + further achievement of • US FDA has awarded Orphan Drug Disease and milestones payable in development and

indications beyond GBM Rare Pediatric Disease Designations in AT/RT regulatory milestones A percentage of sub- • If Paxalisib were to be approved, Kazia could be Mid-teen percentage licensing revenues and entitled to receive a pediatric

priority review Royalties on net sales royalties on commercial royalties on net sales voucher which are tradeable and have sales of products incorporating historically commanded prices in excess of USD paxalisib $100 million. 1. Atypical Teratoid

Rhabdoid Tumor 34

Kazia Therapeutics: 2024-2025 Corporate Focus Objectives for value

creation • Compile data from all clinical trials Progress paxalisib • FDA granted Type C meeting with Kazia in December 2024 glioblastoma program • Propose potential pathways to registration • PNOC team to complete

PK/biomarker data analysis and provide update 1Q CY2025 Execute paxalisib pediatric and brain • Additional data presentation and advance development to evaluate Paxalisib + Radiation metastasis programs Therapy 4Q CY2024 1 • Advance TNBC

program stemming from QIMR collaboration whereby encouraging signals Paxalisib in other key of immune reinvigoration and cancer stem cell activity have been consistently observed in oncology indications animal models • Complete analysis Stage

one of EVT801 Phase 1 clinical study EVT801 program• Data presented at AACR Ovarian Cancer Research Symposium, September 2024 • Discuss and plan for Phase 2 study in advanced ovarian cancer patients Corporate business • Continue to

be opportunistic in terms of global and regional licensing for paxalisib and development EVT801 1. Triple Negative Breast Cancer 35

www.kaziatherapeutics.com info@kaziatherapeutics.com

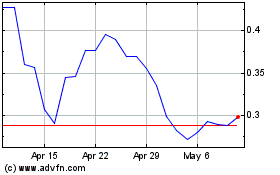

Kazia Therapeutics (NASDAQ:KZIA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Kazia Therapeutics (NASDAQ:KZIA)

Historical Stock Chart

From Mar 2024 to Mar 2025