0001645666false00016456662024-08-132024-08-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 13, 2024 |

Kezar Life Sciences, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38542 |

47-3366145 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4000 Shoreline Court, Suite 300 |

|

South San Francisco, California |

|

94080 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 650 822-5600 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

KZR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 13, 2024, Kezar Life Sciences, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information provided under this Item 2.02 in this Form 8-K, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

KEZAR LIFE SCIENCES, INC. |

|

|

|

|

Dated: |

August 13, 2024 |

By: |

/s/ Marc L. Belsky |

|

|

|

Marc L. Belsky

Chief Financial Officer and Secretary |

Kezar Life Sciences Reports Second Quarter 2024 Financial Results and Provides Business Update

•Enrollment completed in PORTOLA Phase 2a clinical trial of zetomipzomib in patients with autoimmune hepatitis; revising guidance of topline data to first half 2025

•PALIZADE Phase 2b clinical trial of zetomipzomib in patients with active lupus nephritis currently enrolling; reiterating guidance of topline data in mid-2026

•Enrollment stopped in the KZR-261 Phase 1 study in refractory solid tumors; focusing resources on zetomipzomib development programs

•Cash, cash equivalents and marketable securities totaled $164 million as of June 30, 2024

SOUTH SAN FRANCISCO, Calif.—August 13, 2024 — Kezar Life Sciences, Inc. (Nasdaq: KZR), a clinical-stage biotechnology company developing novel small molecule therapeutics to treat unmet needs in immune-mediated diseases and cancer, today reported financial results for the second quarter ended June 30, 2024, and provided a business update.

“We are thrilled to announce completion of enrollment to our PORTOLA trial and look forward to sharing topline results earlier than expected in the first half of 2025. This important milestone brings us one step closer to delivering zetomipzomib as a new treatment option for patients suffering from autoimmune hepatitis, a disease of significant unmet medical need,” said Chris Kirk, PhD, Kezar’s Co-founder and Chief Executive Officer. “In addition, we are continuing to see strong enrollment activity in our global PALIZADE trial and look to continue this momentum by focusing our clinical resources on zetomipzomib development programs going forward. I want to thank our team for their hard work and commitment across all of our clinical trials and share our gratitude to the patients, their families and the study investigators, for their participation in these studies.”

Zetomipzomib: Selective Immunoproteasome Inhibitor

PALIZADE – Phase 2b clinical trial of zetomipzomib in patients with active lupus nephritis (LN) (ClinicalTrials.gov: NCT05781750)

•PALIZADE is a global, placebo-controlled, randomized, double-blind Phase 2b clinical trial evaluating the efficacy and safety of two dose-levels of zetomipzomib in patients with active LN. Target enrollment will be 279 patients, randomly assigned (1:1:1) to receive 30 mg of zetomipzomib, 60 mg of zetomipzomib or placebo subcutaneously once weekly for 52 weeks, in addition to standard background therapy. Background therapy can, but will not be mandated to, include standard induction therapy. Over the initial 16 weeks, there will be a mandatory corticosteroid taper to 5 mg per day or less. End-of-treatment assessments will occur at Week 53. The primary efficacy endpoint is the proportion of patients who achieve a complete renal response (CRR) at Week 37, including a urine protein-to-creatine ratio (UPCR) of 0.5 or less without receiving rescue or prohibited medications.

•Our partner, Everest Medicines, announced that the first patient in China was dosed with zetomipzomib as part of our global PALIZADE trial. Kezar entered into a collaboration and license agreement with Everest Medicines in September 2023 to develop and commercialize zetomipzomib in Greater China, South Korea and Southeast Asia.

•Kezar expects to report topline data from PALIZADE in mid-2026.

PORTOLA – Phase 2a clinical trial of zetomipzomib in patients with autoimmune hepatitis (AIH) (ClinicalTrials.gov: NCT05569759)

•PORTOLA is a placebo-controlled, randomized, double-blind Phase 2a clinical trial evaluating the efficacy and safety of zetomipzomib in patients with AIH that are insufficiently responding to standard of care or have relapsed. The study has completed enrollment of 24 patients, randomized (2:1) to receive 60 mg of zetomipzomib or placebo in addition to background therapy for 24 weeks, with a protocol-suggested steroid taper. The primary efficacy endpoint will measure the proportion of patients who achieve a complete biochemical response by Week 24 measured as normalization of alanine aminotransferase (ALT), aspartate aminotransferase (AST) and Immunoglobulin G (IgG) values (if elevated at baseline), with steroid dose levels not higher than baseline.

•Kezar expects to report topline data from PORTOLA in the first half of 2025.

KZR-261: Broad-Spectrum Sec61 Translocon Inhibitor

KZR-261-101– Phase 1 clinical trial of KZR-261 in patients with locally advanced or metastatic solid malignancies (ClinicalTrials.gov: NCT05047536)

•The Phase 1 clinical trial of KZR-261 is being conducted in two parts: dose escalation and dose expansion in tumor-specific solid tumors. The study is designed to evaluate safety and tolerability, pharmacokinetics and pharmacodynamics, identify a recommended Phase 2 dose and explore the preliminary anti-tumor activity of KZR-261 in patients with locally advanced or metastatic disease.

•Enrollment has been stopped in the KZR-261 Phase 1 study, and clinical resources are being reallocated toward development of zetomipzomib in AIH and LN. Patients already enrolled in the study will continue to have access to KZR-261.

•A total of 61 patients enrolled across the dose-escalation and dose expansion portions of the study, which included seven patients enrolled in the melanoma cohort of the dose-expansion portion at a dose level of 60 mg/m2.

•No objective responses have been observed to date in the study. Five patients (two with melanoma) within the dose escalation portion of the study experienced stable disease for four months or longer, of which two patients (melanoma; head and neck) experienced stable disease for twelve months or longer.

•KZR-261 has demonstrated consistent pharmacokinetics across all dose levels to date, and evidence of dose-dependent inhibition of Sec61 has been observed in patient blood samples.

•Kezar plans to report full data at a medical conference following completion of the study.

Financial Results

•Cash, cash equivalents and marketable securities totaled $164.2 million as of June 30, 2024, compared to $201.4 million as of December 31, 2023. The decrease was primarily attributable to cash used in operations to advance clinical-stage programs.

•Research and development (R&D) expenses for the second quarter of 2024 decreased by $4.7 million to $16.3 million, compared to $21.0 million in the second quarter of 2023. This decrease was primarily due to the Company’s strategic restructuring in October 2023 to prioritize its clinical-stage programs, reducing personnel-related costs and spending in its early-stage research activities. The decrease was partially offset by the increased clinical trial costs related to the PALIZADE and PORTOLA trials.

•General and administrative (G&A) expenses for the second quarter of 2024 decreased by $0.2 million to $5.6 million compared to $5.8 million in the second quarter of 2023. The decrease was primarily due to a decrease in legal and professional service expenses.

•Restructuring and impairment charges for the second quarter of 2024 were $1.5 million. The charges were primarily related to an impairment loss of the right-of-use asset related to vacated space in the company’s leased office facilities.

•Net loss for the second quarter of 2024 was $21.5 million, or $0.30 per basic and diluted common share, compared to a net loss of $24.3 million, or $0.34 per basic and diluted common share, for the second quarter of 2023.

•Total shares of common stock outstandingwere 72.9 million shares as of June 30, 2024. Additionally, there were options to purchase 15.3 million shares of common stock at a weighted-average exercise price of $2.18 per share and 0.2 million restricted stock units outstanding as of June 30, 2024.

About Kezar Life Sciences

Kezar Life Sciences is a clinical-stage biopharmaceutical company developing novel small molecule therapeutics to treat unmet needs in immune-mediated diseases and cancer. Zetomipzomib, a selective immunoproteasome inhibitor, is currently being evaluated in a Phase 2b clinical trial for lupus nephritis and a Phase 2a clinical trial for autoimmune hepatitis. This product candidate also has the potential to address multiple chronic immune-mediated diseases. Kezar’s oncology product candidate, KZR-261, targeting the Sec61 translocon and protein secretion pathway, is being evaluated in an open-label Phase 1 clinical trial to assess safety, tolerability and preliminary tumor activity in solid tumors. For more information, visit www.kezarlifesciences.com, and follow us on LinkedIn, Facebook, Twitter and Instagram.

Cautionary Note on Forward-looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “can,” “should,” “expect,” “believe,” “potential,” “anticipate” and similar expressions (as well as other words or expressions referencing future events, conditions or circumstances) are intended to identify forward-looking statements. These forward-looking statements are based on Kezar’s expectations and assumptions as of the date of this press release. Each of these forward-looking statements involves risks and uncertainties that could cause Kezar’s clinical development programs, future results or performance to differ materially from those expressed or implied by the forward-looking statements. Forward-looking statements contained in this press release include, but are not limited to, statements about the design, initiation, progress, timing, scope and results of clinical trials, the enrollment and expected timing of reporting topline data from our clinical trials, the development of zetomipzomib in additional indications, the likelihood that data will support future development and therapeutic potential, the association of data with treatment

outcomes and the likelihood of obtaining regulatory approval of Kezar’s product candidates. Many factors may cause differences between current expectations and actual results, including clinical trial site activation or enrollment rates that are lower than expected, unexpected safety or efficacy data observed during clinical studies, difficulties enrolling and conducting our clinical trials, changes in expected or existing competition, changes in the regulatory environment, the uncertainties and timing of the regulatory approval process, and unexpected litigation or other disputes. Other factors that may cause actual results to differ from those expressed or implied in the forward-looking statements in this press release are discussed in Kezar’s filings with the U.S. Securities and Exchange Commission, including the “Risk Factors” contained therein. Except as required by law, Kezar assumes no obligation to update any forward-looking statements contained herein to reflect any change in expectations, even as new information becomes available.

|

|

|

|

|

KEZAR LIFE SCIENCES, INC. |

|

|

|

|

Selected Balance Sheets Data |

|

|

|

|

(In thousands) |

|

|

|

|

|

|

June 30, 2024 |

|

December 31, 2023 |

|

|

(unaudited) |

|

|

Cash, cash equivalents and marketable securities |

|

$ 164,182 |

|

$ 201,372 |

Total assets |

|

179,921 |

|

221,235 |

Total current liabilities |

|

17,495 |

|

17,744 |

Total noncurrent liabilities |

|

11,741 |

|

15,921 |

Total stockholders' equity |

|

150,685 |

|

187,570 |

|

|

|

|

|

|

|

|

Summary of Operations Data |

|

|

|

|

|

|

|

(In thousands except share and per share data) |

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

June 30 |

|

June 30 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

(unaudited) |

|

(unaudited) |

Operating expenses: |

|

|

|

|

|

|

|

Research and development |

$ 16,298 |

|

$ 20,999 |

|

$ 33,470 |

|

$ 39,317 |

General and administrative |

5,603 |

|

5,785 |

|

12,142 |

|

11,991 |

Restructuring and impairment charges |

1,482 |

|

- |

|

1,482 |

|

- |

Total operating expenses |

23,383 |

|

26,784 |

|

47,094 |

|

51,308 |

Loss from operations |

(23,383) |

|

(26,784) |

|

(47,094) |

|

(51,308) |

Interest income |

2,237 |

|

2,861 |

|

4,690 |

|

5,556 |

Interest expense |

(401) |

|

(385) |

|

(801) |

|

(755) |

Net loss |

$ (21,547) |

|

$ (24,308) |

|

$ (43,205) |

|

$ (46,507) |

Net loss per common share, basic and diluted |

$ (0.30) |

|

$ (0.34) |

|

$ (0.59) |

|

$ (0.64) |

Weighted-average shares used to compute net loss per common share, basic and diluted |

72,845,869 |

|

72,461,850 |

|

72,822,890 |

|

72,395,410 |

Investor and Media Contact:

Gitanjali Jain

Senior Vice President, Investor Relations and External Affairs

Kezar Life Sciences, Inc.

gjain@kezarbio.com

v3.24.2.u1

Document And Entity Information

|

Aug. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 13, 2024

|

| Entity Registrant Name |

Kezar Life Sciences, Inc.

|

| Entity Central Index Key |

0001645666

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38542

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

47-3366145

|

| Entity Address, Address Line One |

4000 Shoreline Court, Suite 300

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94080

|

| City Area Code |

650

|

| Local Phone Number |

822-5600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

KZR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

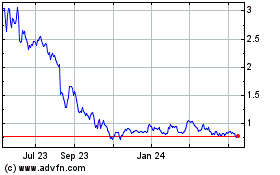

Kezar Life Sciences (NASDAQ:KZR)

Historical Stock Chart

From Feb 2025 to Mar 2025

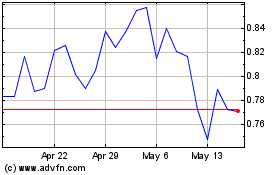

Kezar Life Sciences (NASDAQ:KZR)

Historical Stock Chart

From Mar 2024 to Mar 2025