Liberty Global Ltd. (“Liberty Global” or the “Company”) (NASDAQ:

LBTYA, LBTYB and LBTYK) and Sunrise Communications AG today

announced plans to host an investor call following the recent

publication of its preliminary F-4 filing with the SEC regarding

the planned spin-off of Sunrise in Q4 2024.

You are invited to join the investor call, which will begin at

12:00 p.m. (Eastern Time) on Tuesday, September 10, 2024. During

the call, Liberty Global’s General Counsel, Bryan H. Hall, and its

investor relations team will discuss the preliminary F-4 filing and

address investor questions on the filing.

Liberty Global requests that questions during the call are

solely related to technical matters discussed in the F-4 filing,

including spin mechanics.

We recommend pre-registration by using the link below to receive

a calendar invitation with call access details and unique PIN:

Registration Link:

https://www.netroadshow.com/events/login?show=6252fd4b&confId=70809

If you encounter difficulties registering and still wish to

participate in the call:

International: +1 404 975 4839 United States (Toll-Free): +1 833

470 1428 Access Code: 264554

A replay of the call will be available in the Investor Relations

sections of the Company’s website for at least 30 days.

ABOUT LIBERTY GLOBAL

Liberty Global (NASDAQ: LBTYA, LBTYB and LBTYK) is a world

leader in converged broadband, video and mobile communications

services. We deliver next-generation products through advanced

fiber and 5G networks, and currently provide over 85 million*

connections across Europe. Our businesses operate under some of the

best-known consumer brands, including Sunrise in Switzerland,

Telenet in Belgium, Virgin Media in Ireland, UPC in Slovakia,

Virgin Media-O2 in the U.K. and VodafoneZiggo in The Netherlands.

Through our substantial scale and commitment to innovation, we are

building Tomorrow’s Connections Today, investing in the

infrastructure and platforms that empower our customers to make the

most of the digital revolution, while deploying the advanced

technologies that nations and economies need to thrive.

Liberty Global's consolidated businesses generate annual revenue

of more than $7 billion, while the VMO2 JV and the VodafoneZiggo JV

generate combined annual revenue of more than $18 billion.**

Liberty Global Ventures, our global investment arm, has a

portfolio of more than 75 companies and funds across the content,

technology and infrastructure industries, including stakes in

companies like ITV, Televisa Univision, Plume, AtlasEdge and the

Formula E racing series.

* Represents aggregate consolidated and 50% owned

non-consolidated fixed and mobile subscribers. Includes wholesale

mobile connections of the VMO2 JV and B2B fixed subscribers of the

VodafoneZiggo JV.

** Revenue figures above are provided based on full year 2023

Liberty Global consolidated results and the combined as reported

full year 2023 results for the VodafoneZiggo JV and full year 2023

U.S. GAAP results for the VMO2 JV.

Sunrise, Telenet, the VMO2 JV and the VodafoneZiggo JV deliver

mobile services as mobile network operators. Virgin Media Ireland

delivers mobile services as a mobile virtual network operator

through third-party networks. UPC Slovakia delivers mobile services

as a reseller of SIM cards.

Liberty Global Ltd. is listed on the Nasdaq Global Select Market

under the symbols "LBTYA", "LBTYB" and "LBTYK".

No Offer to Sell or Solicit

This communication is not an offer to sell or a solicitation of

offers to purchase or subscribe for shares or a solicitation of any

vote or approval. This document is not a prospectus within the

meaning of the Swiss Financial Services Act and not a prospectus

under any other applicable laws. Copies of this document may not be

sent to, distributed in or sent from jurisdictions in which this is

barred or prohibited by law. The information contained herein shall

not constitute an offer to sell or the solicitation of an offer to

buy, in any jurisdiction in which such offer or solicitation would

be unlawful prior to registration, exemption from registration or

qualification under the securities laws of any jurisdiction and

there shall be no sale of securities in any such jurisdiction.

This announcement is only addressed to and directed at specific

addressees who: (A) if in member states of the European Economic

Area (the EEA) are people who are “qualified investors” within the

meaning of Article 2(e) of Regulation (EU) 2017/1129 (as amended)

(the Prospectus Regulation) (Qualified Investors); and (B) if in

the U.K., are “qualified investors” within the meaning of Article

2(e) of the UK version of the Prospectus Regulation as it forms

part of domestic law in the U.K. by virtue of the European Union

(Withdrawal) Act 2018 (the UK Prospectus Regulation) who are: (i)

persons having professional experience in matters relating to

investments who fall within the definition of “investment

professionals” in Article 19(5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005, as amended (the

Order); or (ii) high net worth entities falling within Article

49(2)(a) to (d) of the Order; or (C) are other persons to whom an

invitation or inducement to engage in investment activity (within

the meaning of section 21 of the Financial Services and Markets Act

2000 (as amended)) in connection with the sale of any securities of

Sunrise or any member of its group may otherwise lawfully be

communicated or caused to be communicated (all such persons

referred to in (B) and (C) being Relevant Persons). This

announcement must not be acted on or relied on (i) in the U.K., by

persons who are not Relevant Persons and (ii) in any member state

of the EEA by persons who are not Qualified Investors. Any

investment activity to which this announcement relates (i) in the

U.K. is available only to, any may be engaged in only with,

Relevant Persons; and (ii) in any member state of the EEA is

available only to, and may be engaged only with, Qualified

Investors.

This communication is an advertisement for the purposes of the

Prospectus Regulation (EU) 2017/1129 as it forms part of domestic

law by virtue of the European Union (Withdrawal) Act 2018 (as

amended) and underlying legislation. It is not a prospectus. A copy

of any prospectus published by Sunrise will, if approved and

published, be made available for inspection on the Liberty Global’s

website at www.libertyglobal.com subject to certain access

restrictions.

This communication constitutes advertising in accordance with

article 68 of the Swiss Financial Services Act. Such advertisements

are communications to investors aiming to draw their attention to

financial instruments. Any investment decisions with respect to any

securities should not be made based on this advertisement.

Additional Information and Where to Find It

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any securities or a solicitation of

any vote or approval, nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

In connection with the spin-off of Liberty Global’s businesses

attributed to Sunrise into a separate publicly traded company (the

Transaction), Sunrise has filed with the Securities and Exchange

Commission (the SEC) a registration statement on Form F-4 that

includes a preliminary proxy statement (the Proxy

Statement/Prospectus). After the Proxy Statement/Prospectus is

declared effective, Liberty Global will mail a definitive proxy

statement/prospectus and other relevant documents to shareholders

of Liberty Global as of a record date to be established for voting

on the Transaction. LIBERTY GLOBAL SHAREHOLDERS ARE URGED TO READ

THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AS WELL AS ANY AMENDMENTS

OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE

THEREIN AND OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE

PROPOSED TRANSACTION THAT LIBERTY GLOBAL AND SUNRISE WILL FILE WITH

THE SECURITIES AND EXCHANGE COMMISSION WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

TRANSACTION. Liberty Global shareholders and investors may obtain

free copies of the Proxy Statement/Prospectus and other relevant

materials (when they become available) and other documents filed by

Liberty Global and Sunrise at the SEC’s website at www.sec.gov.

Copies of the Proxy Statement/Prospectus (and other relevant

materials when they become available) and the filings that will be

incorporated by reference therein may also be obtained, without

charge, by contacting Liberty Global’s Investor Relations at

ir@libertyglobal.com or +1 (303) 220-6600.

Participants in the Solicitation

Liberty Global and its directors, executive officers and certain

employees, may be deemed, under rules of the SEC, to be

participants in the solicitation of proxies in respect of the

proposed Transaction. Information regarding Liberty Global’s

directors and executive officers is set forth in Liberty Global’s

filings with the SEC. Other information regarding the participants

in the proxy solicitation and a description of their direct and

indirect interests, by security holdings or otherwise, is contained

in the Proxy Statement/Prospectus and other relevant materials to

be filed with the SEC (when they become available). These documents

can be obtained free of charge from the sources indicated

above.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements regarding the Transaction, the listing

of the Sunrise shares for trading on the SIX Swiss Exchange (the

SIX), any 2024 financial or operation guidance provided and other

information and statements that are not historical fact. These

forward-looking statements are subject to certain risks and

uncertainties, some of which are beyond Liberty Global’s and

Sunrise’s control, that could cause actual results to differ

materially from those expressed or implied by these statements.

Such risks and uncertainties include the risk that Liberty Global

does not receive shareholder approval for the Transaction and/or

related matters, Liberty Global’s ability to satisfy the other

conditions to the Transaction on the expected timeframe or at all,

the approval of the shares of Sunrise for listing on the SIX and

the development of a trading market for them, the Liberty Global

Board of Directors’ discretion to decide not to complete the

Transaction for any reason, Liberty Global’s ability to realize the

expected benefits from the Transaction, unanticipated difficulties

or costs in connection with the Transaction, Sunrise’s ability to

successfully operate as an independent public company and maintain

its relationships with material counterparties after the

Transaction and other factors detailed from time to time in Liberty

Global’s or Sunrise’s filings with the Securities and Exchange

Commission, including Liberty Global’s most recently filed annual

report on Form 10-K, as it may be supplemented from time to time by

Liberty Global’s quarterly reports and other subsequent

filings.

These forward-looking statements speak only as of the date

hereof. Liberty Global and Sunrise expressly disclaim any

obligation or undertaking to disseminate any updates or revisions

to any forward-looking statement contained herein to reflect any

change in Liberty Global’s or Sunrise’s expectations with regard

thereto or any change in events, conditions or circumstances on

which any such statement is based. You are cautioned not to place

undue reliance on any forward-looking statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240906846529/en/

For more information, please visit www.libertyglobal.com or

contact:

Investor Relations Michael Bishop +44 20 8483 6246

Bethany Cannon +44 7714 657 776

Corporate Communications Bill Myers +1 303 220 6686 Matt

Beake +44 20 8483 6428

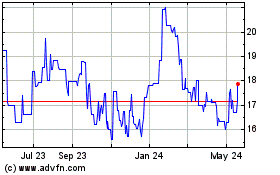

Liberty Global (NASDAQ:LBTYB)

Historical Stock Chart

From Dec 2024 to Jan 2025

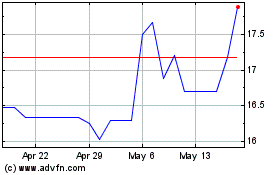

Liberty Global (NASDAQ:LBTYB)

Historical Stock Chart

From Jan 2024 to Jan 2025