Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

08 December 2022 - 3:56AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of December 2022

Commission

File Number: 001-41333

LOCAFY

LIMITED

(Registrant’s

name)

246A

Churchill Avenue, Subiaco Western Australia 6008, Australia

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

On

December 7, 2022, Locafy Limited (the “Company”) held a General Meeting of Shareholders at which meeting the

Company’s shareholders approved a 1-for-20 reverse share split (the “Reverse Share Split”) of the Company’s

ordinary shares, no par value per share (the “Ordinary Shares”) and listed warrants (the “Warrants”),

effective as of 11:00 a.m. (Australia time).

As

a result of the Reverse Share Split, every twenty (20) issued and outstanding Ordinary Shares will be automatically combined into one

(1) issued and outstanding Ordinary Share, without any change in the par value, and every twenty (20) issued and outstanding Warrants

will be automatically combined into one (1) issued and outstanding Warrant. No fractional Ordinary Shares or Warrants will be issued

as a result of the Reverse Share Split. Any fractional Ordinary Shares or Warrants that would otherwise have resulted from the Reverse

Share Split will be rounded up to the next whole number. Pursuant to the Australian Corporations Act 2001 (Cth), the Company is

not limited in the authorized share capital that may be issued nor is it required to amend its Constitution as currently in effect to

effectuate the Reverse Share Split under Australian law.

The

Reverse Share Split will reduce the number of Ordinary Shares issued and outstanding from 20,528,803 Ordinary Shares to approximately

1,026,440 Ordinary Shares and from 1,454,546 Warrants to approximately 72,728 Warrants, subject to adjustment for the rounding up of

fractional shares and Warrants. The Reverse Share Split will also reduce the number of unlisted warrants from 87,272 unlisted warrants

to approximately 4,364 unlisted warrants and 2,384,888 performance rights issued under the Company’s Incentive Performance Rights

Plan into 119,244 performance rights. Proportionate adjustments will be made to the per share exercise price and the number of shares

that may be purchased upon exercise of outstanding of Warrants, unlisted warrants and performance rights issued by the Company.

The

Ordinary Shares and Warrants will begin trading on a reverse share split-adjusted basis on The Nasdaq Capital Market on December 8, 2022.

The trading symbols for the Ordinary Shares and the Warrants will remain “LCFY” and “LCFYW”, respectively. The

new CUSIP number for the Ordinary Shares following the Reverse Share Split is Q56120134 and the new CUSIP number for the Warrants following

the Reverse Share Split is Q56120142.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

| |

LOCAFY LIMITED |

| |

|

|

| Date: December 7, 2022 |

By: |

/s/ Gavin

Burnett |

| |

Name: |

Gavin Burnett |

| |

Title: |

Chief Executive Officer |

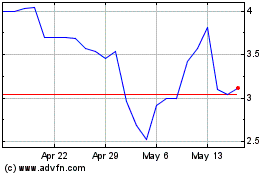

Locafy (NASDAQ:LCFY)

Historical Stock Chart

From Feb 2025 to Mar 2025

Locafy (NASDAQ:LCFY)

Historical Stock Chart

From Mar 2024 to Mar 2025