Locafy Reports Fiscal Fourth Quarter and Full Year 2024 Results

13 November 2024 - 8:05AM

Locafy Limited (Nasdaq: LCFY, LCFYW)

(“Locafy” or the “Company”), a globally recognized

software-as-a-service technology company specializing in

”entity-based” search engine optimization (SEO), today reported

financial results for the fiscal fourth quarter and full year ended

June 30, 2024. All financial results are reported in Australian

Dollars (AUD).

Management Commentary“Our fiscal 2024 was truly

a transformational period for Locafy,” said CEO Gavin Burnett. “The

launch of our enhanced performance-based revenue model, which

aligns more closely with how customers engage with our products

compared to traditional sponsored advertising, has given us strong

momentum in the evolving SEO landscape. Our services revenue surged

by 231%, driven by a several commercial opportunities with

publishers and resellers seeking “on-page” SEO solutions for their

customers. The implementation of our proprietary Keystone

technology to these customer websites has helped combat the decline

in website traffic that many online publishers and businesses in

general are experiencing, further solidifying our industry presence

and credentials.

“Operationally, Locafy has heavily reduced its cost base,

primarily from a decrease in headcount and technology expenses,

which was made possible through increased automation in product

deployments and streamlining products being offered to the market.

The full impact of these cost reductions will be fully reflected in

fiscal 2025.

“As we move into fiscal 2025, we believe that we are

well-positioned to expand our suite of technologies in response to

shifts in the SEO landscape. In an era of AI-driven content growth,

we believe Locafy’s solutions will play a key role in helping our

clients secure and maintain strong search positions. We are

confident that our advanced capabilities will not only drive

Locafy's growth but also deliver superior results for our

customers. We look forward to sharing more progress in the coming

quarters.”

Fiscal 2024 and Recent Operational

Highlights

- Signed its first

contracts related to the Company’s Article Accelerator technology

to media publishers in the U.S. and Australia. Given the recent

seismic changes in the SEO landscape which forced many publishers

to remove “sponsored content” articles from their high-authority

editorial websites, Locafy believes it has laid the foundation for

its Article Accelerator solution to be packaged and marketed as a

credible alternative to help restore lost revenues for those

publishers.

- Introduced the

Hotfrog Proximity Page, a new application developed in partnership

with Yext, allowing businesses to create dynamic, SEO-optimized

landing pages to enhance their online presence. The application

integrates with Yext’s platform, ensuring real-time updates and

consistency across digital listings. The Company intends to build

on this product in fiscal 2025 to enable connectivity with

additional citation management partners.

- Signed a series of

agreements with Localista, acquiring the digital assets of Scoop,

providing SEO consulting services, and adding Localista's sales

team as a reseller of its Article Accelerator product. These deals

aim to enhance Localista’s SEO performance while leveraging its

directory network to promote Locafy's products, positioning both

companies to capitalize on the competitive online marketplace in

Australia and New Zealand. The Company believes the work undertaken

to optimize the Localista website and to structurally separate paid

advertorial content from free editorial content provides a

technical solution and a commercial model that can be replicated

for other publishers in the USA and Australian markets.

2024 Fiscal Fourth Quarter Financial

ResultsResults compare the 2024 fiscal fourth quarter end

(June 30, 2024) to the 2023 fiscal fourth quarter end (June 30,

2023) unless otherwise indicated. All financial results are

reported in Australian Dollars (AUD).

- Total operating

revenue decreased 4.7% to $1.2 million from $1.3 million

in the comparable year-ago period.

- Subscription

revenue decreased 34.6% to $731,000 from $1.1 million in

the comparable year-ago period. For reporting purposes, the Company

has reclassified and incorporated “Data” revenues within

“Subscription” revenues. The reclassification was done on the basis

that Data revenues are consistent with the nature of other

subscription fee revenues i.e. recurring and related to publishing

content, as opposed to the method in which the content data is

received. Notwithstanding the reclassification, the decline in

subscription revenue had commenced from the beginning of the 2024

fiscal year and was mainly driven by extended billing relief

provided to customers transitioning their Proximity product

campaigns onto Locafy’s upgraded technology platform, as well as

general churn among resellers. The Company has sought to address

these concerns by providing better reseller education as to the

reasonable outcomes from implementing its products, enhancing its

reporting dashboard to better articulate the value that its

technology adds to an end user’s marketing efforts and improved

reseller support. The Company expect subscription revenues to

remain steady until the 2025 fiscal third quarter.

- Advertising revenue

decreased 50.1% to $38,000 from $77,000 in the comparable year-ago

period. Advertising yields from existing ad units continue to

underperform. To address this decline, the Company is implementing

strategies to change the type of advertising placements across its

online properties together with SEO strategies designed to improve

audience (traffic).

- Services revenue

increased 525.6% to $435,000 from $69,000 in the comparable

year-ago period. This increase was as a result of a significant SEO

consulting project and a paid proof of concept for the Company’s

recently developed Article publication solution. This level of

services revenue is unlikely to be replicated in the near term,

however, the work has allowed the Company to advance its own

technical and commercial capabilities and expand its portfolio of

digital assets.

- Other income

decreased 95.9% to $29,000 from $709,000 in the comparable year-ago

period. The decrease in other income is partially due to R&D

tax incentive grant received in the 2023 fiscal year, which was not

replicated during the 2024 fiscal year, lower gains from the

extinguishment of liabilities and a net foreign exchange gain in

the comparable year-ago period, which did not occur during the 2024

fiscal fourth quarter.

- Operating expenses

increased 174.6% to $2.1 million from $770,000 in the comparable

year-ago period. The 2023 fiscal fourth quarter included

significant adjustments relating to the reversal of contractor

termination expense provisions and an annual assessment of R&D

expenses that were capitalized. Excluding these adjustments, the

Company’s underlying operating expenses for 2023 fiscal fourth

quarter was $2.5 million. Operating expenses for 2024 fiscal fourth

quarter included a write off of long-standing historical receivable

balance, excluding which, operating expenses would have been $1.6

million.

- Net loss was $883,000, or $0.66 per diluted

share, compared to a net profit of $1.2 million, or $1.03 per

diluted share, in the comparable year-ago period. Excluding the

2024 fiscal fourth quarter write offs (as detailed above) would

have resulted in a net loss $350,000 or $0.26 per diluted share.

Similarly, excluding the 2023 fiscal fourth quarter adjustment to

operating expenses (as detailed above) would have resulted in a net

loss of $1.3 million or $1.15 per diluted share, in the comparable

year-ago period.

Fiscal Full Year 2024 Financial ResultsResults

compare the 2024 fiscal year end (June 30, 2024) to the 2023 fiscal

year end (June 30, 2023) unless otherwise indicated. All financial

results are reported in Australian Dollars (AUD).

- Total operating

revenue decreased 22.8% to $4.2 million from $5.4 million

in the comparable year-ago period.

- Subscription

revenue decreased 31.7% to $3.3 million from $4.9 million

in the comparable year-ago period. Compared to the fiscal third

quarter of 2024, subscription revenue decreased 2.9%. As previously

mentioned, the decline in subscription revenue was primarily

related to the provision of extended billing relief to customers

whose Proximity product campaigns were affected by their transition

to onto the Company’s upgraded technology platform, together with

general reseller churn. The Company expects subscription revenues

to remain steady until the 2025 fiscal third quarter.

- Advertising revenue

decreased 20.1% to $251,000 from $316,000 in the comparable

year-ago period. The decline in advertising revenues resulted from

the changes made by Google to its advertising program during the

year. The Company plans to implement a number of initiatives to

improve its advertising yields together with the expansion of its

online property assets that can carry advertising.

- Services revenue

increased 231.3% to $561,000 from $169,000 in the comparable

year-ago period, driven by an increase in product sales which

require implementation work. Once implemented, these products are

expected to derive monthly subscription revenues. In February 2024,

the Company announced an agreement to provide SEO consulting

services to Localista for $500,000. This work related to the

upgrade of the entire website structure of an online property owned

by Localista comprising in excess of 700,000 individual listing

pages, which the Company completed over a three-month period ending

in June 2024. Further, as previously announced, Locafy separately

acquired from Localista the digital assets of scoop.com.au to

further its R&D and commercial efforts. The scoop.com.au domain

name is a well-recognized brand in the travel, lifestyle and

entertainment niche and, at the time of acquisition, the domain

name had a Moz Domain Authority score of 36, approximately 48,000

backlinks (including approximately 5,000 Wikipedia backlinks) and

ranked for over 157,000 relevant organic keywords (according to

Semrush). The Company’s due diligence suggested that to replicate

the asset would cost in excess of $500,000 and take several years

to complete. Notwithstanding the foregoing, under accounting

standards it was deemed that the scoop.com.au asset and services

revenue transactions were tied together and the value of both

equaled $58,500, which is equivalent to the cost of providing the

consulting services. Accordingly, this position is reflected in the

Company’s financial statements.

- Other income

decreased 93.8% to $61,000 from $993,000 in the comparable year-ago

period. The decrease was primarily due to R&D tax incentive

grant received in the 2023 fiscal year, which was not replicated

during the 2024 fiscal year. The Company’s 2024 fiscal year grant

is currently being prepared and funds are expected to be received

in the 2025 fiscal year.

- Operating expenses

decreased 30.2% to $7.1 million from $10.2 million in the

comparable year-ago period. The decrease was primarily due to a

38.5% decrease in employment expenses to $3.2 million from $5.3

million in the comparable year-ago period as a result of a

reduction in headcount resulting from the Company’s ongoing efforts

to streamline its technology, product suite and the geographical

markets it serves. Technology expenses also decreased 48.2% to

$891,000 from $1.7 million in the comparable year-ago period, which

decrease largely reflects the cost savings as a result of upgrades

made to the Company’s technology platform.

- Net loss for the year to date was $3.0

million, or $2.30 per diluted share, compared to a net loss of $3.9

million, or $3.69 per diluted share, in the comparable year-ago

period.

Key Performance Indicators (KPIs)As part of its

updated go-to-market strategy, Locafy has shifted its focus from

traditional KPIs, which are no longer seen as adequate indicators

of long-term success. The company now prioritizes Monthly Recurring

Revenue (MRR) as the key measure of performance across its

platform. Unless otherwise stated, KPI data is as of the fiscal

fourth quarter of 2024 (ended June 30, 2024).

- Monthly recurring revenue

(MRR) for the 2024 fiscal fourth quarter was $256,000, a

35.6% decrease from the comparable year-ago period, and a 3.7%

decrease compared to the 2024 fiscal third quarter.

For more information, please see Locafy’s investor relations

website at investors.locafy.com.

About LocafyFounded in 2009, Locafy's (Nasdaq:

LCFY, LCFYW) mission is to revolutionize the US$700 billion SEO

sector. We help businesses and brands increase search engine

relevance and prominence in a specific proximity using a fast,

easy, and automated approach. For more information, please visit

www.locafy.com.

About Key Performance IndicatorsLocafy defines

MRR as the value of all recurring subscription contracts with

active entitlements as at the end of each month. MRR across a

period is the average of each month’s MRR within that period.

Locafy’s recent platform upgrade caused a significant change to

the calculation of average page metrics, and Locafy management no

longer views total active reseller count and total end user count

as relevant indicators of the performance of Locafy’s technology.

The Company may introduce additional KPIs in future quarters if

deemed relevant long-term indicators of performance.

Forward-Looking StatementsThis press release

contains “forward-looking statements” that are subject to

substantial risks and uncertainties. All statements, other than

statements of historical fact, contained in this press release are

forward-looking statements. Forward-looking statements contained in

this press release may be identified by the use of words such as

“subject to”, “believe,” “anticipate,” “plan,” “expect,” “intend,”

“estimate,” “project,” “may,” “will,” “should,” “would,” “could,”

“can,” the negatives thereof, variations thereon and similar

expressions, or by discussions of strategy, although not all

forward-looking statements contain these words. Although the

Company believes that the expectations reflected in such

forward-looking statements are reasonable, they do involve

assumptions, risks, and uncertainties, and these expectations may

prove to be incorrect. You should not place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. The Company’s actual results could differ materially

from those anticipated in these forward-looking statements as a

result of a variety of factors and risk factors, including those

discussed in the Company’s filings with the Securities and Exchange

Commission (the “SEC”), including the Company’s Annual Report on

Form 20-F filed with the SEC on November 12, 2024, and available on

its website (http://www.sec.gov). All forward-looking statements

attributable to the Company or persons acting on its behalf are

expressly qualified in their entirety by these factors. Other than

as required under the securities laws, the Company does not assume

a duty to update these forward-looking statements.

Investor Relations ContactMatt Glover or Matt

SzotGateway Investor Relations(949)

574-3860LCFY@gateway-grp.com

|

-Financial Tables to Follow- |

| |

|

Locafy Limited Consolidated Statement of

Profit or Loss and Other Comprehensive Income |

| |

| |

|

3 months to30 Jun 2024AUD

$(unaudited) |

|

|

FY2024AUD

$(audited) |

|

|

FY2023AUD

$(audited) |

|

| Revenue |

|

1,203,566 |

|

|

4,151,088 |

|

|

5,376,693 |

|

| Other income |

|

29,119 |

|

|

61,360 |

|

|

993,493 |

|

| Technology expense |

|

(214,331 |

) |

|

(890,778 |

) |

|

(1,718,974 |

) |

| Employee benefits expense |

|

(916,151 |

) |

|

(3,238,568 |

) |

|

(5,267,246 |

) |

| Occupancy expense |

|

(26,360 |

) |

|

(101,415 |

) |

|

(113,572 |

) |

| Advertising expense |

|

(7,895 |

) |

|

(187,046 |

) |

|

(318,492 |

) |

| Consultancy expense |

|

(195,924 |

) |

|

(853,850 |

) |

|

(874,638 |

) |

| Depreciation and amortization

expense |

|

(394,339 |

) |

|

(1,473,999 |

) |

|

(1,355,170 |

) |

| Other expenses |

|

(21,864 |

) |

|

(68,826 |

) |

|

(213,051 |

) |

| Impairment of financial

assets |

|

(339,382 |

) |

|

(272,236 |

) |

|

(295,262 |

) |

| Operating

loss |

|

(883,561 |

) |

|

(2,874,270 |

) |

|

(3,786,219 |

) |

| Financial cost |

|

(16,539 |

) |

|

(114,199 |

) |

|

(105,367 |

) |

| Loss before income

tax |

|

(900,100 |

) |

|

(2,988,469 |

) |

|

(3,891,586 |

) |

| Income tax expense |

|

- |

|

|

- |

|

|

- |

|

| Loss for the

period |

|

(900,100 |

) |

|

(2,988,469 |

) |

|

(3,891,586 |

) |

| |

|

|

|

|

|

|

|

|

|

| Other comprehensive

income |

|

|

|

|

|

|

|

|

|

| Items that will be

reclassified subsequently to profit and loss |

|

|

|

|

|

|

|

|

|

| Exchange differences on

translating foreign operations |

|

12,274 |

|

|

3,023 |

|

|

(23,010 |

) |

| Total comprehensive

loss for the period |

|

(887,826 |

) |

|

(2,985,446 |

) |

|

(3,914,596 |

) |

| |

|

|

|

|

|

|

|

|

|

| Earnings per

share |

|

|

|

|

|

|

|

|

|

| Basic loss per share |

|

(0.66 |

) |

|

(2.30 |

) |

|

(3.69 |

) |

| Diluted loss per share |

|

(0.66 |

) |

|

(2.30 |

) |

|

(3.69 |

) |

| |

|

Locafy Limited Consolidated Statement of

Financial Position |

| |

|

|

As at30 Jun 2024AUD

$(audited) |

|

|

As at31 Dec 2023AUD

$(audited) |

|

|

As at30 Jun 2023AUD

$(audited) |

|

| Assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

275,875 |

|

|

724,581 |

|

|

3,174,700 |

|

| Trade and other

receivables |

904,564 |

|

|

868,492 |

|

|

1,288,513 |

|

| Other assets |

294,355 |

|

|

453,763 |

|

|

356,782 |

|

| Current

assets |

1,474,794 |

|

|

2,046,836 |

|

|

4,819,995 |

|

| Property, plant and

equipment |

196,929 |

|

|

317,618 |

|

|

380,018 |

|

| Right of use assets |

280,810 |

|

|

268,558 |

|

|

314,596 |

|

| Intangible assets |

4,204,966 |

|

|

4,022,887 |

|

|

3,720,272 |

|

| Non-current

assets |

4,682,705 |

|

|

4,609,063 |

|

|

4,414,886 |

|

| Total

assets |

6,157,499 |

|

|

6,655,899 |

|

|

9,234,881 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

| Trade and other payables |

1,252,503 |

|

|

1,289,251 |

|

|

2,507,573 |

|

| Borrowings |

271,600 |

|

|

271,600 |

|

|

301,600 |

|

| Provisions |

211,300 |

|

|

226,547 |

|

|

214,465 |

|

| Accrued expenses |

496,749 |

|

|

357,776 |

|

|

512,611 |

|

| Lease liabilities |

128,669 |

|

|

120,287 |

|

|

85,165 |

|

| Contract and other

liabilities |

147,640 |

|

|

139,120 |

|

|

152,211 |

|

| Current

liabilities |

2,508,461 |

|

|

2,404,581 |

|

|

3,773,625 |

|

| Lease liabilities |

203,909 |

|

|

269,500 |

|

|

332,578 |

|

| Provisions |

133,399 |

|

|

124,009 |

|

|

138,721 |

|

| Non-current

liabilities |

337,308 |

|

|

393,509 |

|

|

471,299 |

|

| Total

liabilities |

2,845,769 |

|

|

2,798,090 |

|

|

4,244,924 |

|

| Net

assets |

3,311,730 |

|

|

3,857,809 |

|

|

4,989,957 |

|

| |

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

| Issued capital |

48,588,888 |

|

|

47,805,798 |

|

|

47,930,486 |

|

| Reserves |

2,925,679 |

|

|

2,696,635 |

|

|

2,404,933 |

|

| Accumulated losses |

(48,202,837 |

) |

|

(46,644,624 |

) |

|

(45,345,462 |

) |

| Total

equity |

3,311,730 |

|

|

3,857,809 |

|

|

4,989,957 |

|

| |

|

Locafy Limited Consolidated Statement of

Cash Flows |

| |

| |

|

3 months to30 Jun 2023AUD

$(unaudited) |

|

|

FY2024AUD

$(audited) |

|

|

FY2023AUD

$(audited) |

|

| Cash flows from

operating activities |

|

|

|

|

|

|

|

|

|

| Receipts from customers

(inclusive of GST) |

|

605,855 |

|

|

3,098,793 |

|

|

4,463,725 |

|

| Payments to suppliers and

employees (inclusive of GST) |

|

(475,965 |

) |

|

(4,658,997 |

) |

|

(7,005,510 |

) |

| R&D Tax Incentive and

government grants |

|

- |

|

|

561,501 |

|

|

386,181 |

|

| Financial cost |

|

(16,539 |

) |

|

(114,199 |

) |

|

(105,367 |

) |

| Net cash used by

operating activities |

|

113,351 |

|

|

(1,112,902 |

) |

|

(2,260,971 |

) |

| |

|

|

|

|

|

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

|

|

|

|

|

| Purchase of intellectual

property |

|

(492,943 |

) |

|

(2,166,587 |

) |

|

(1,617,446 |

) |

| Purchase of property, plant

and equipment |

|

- |

|

|

- |

|

|

(2,170 |

) |

| Maturity of term deposit |

|

- |

|

|

40,000 |

|

|

- |

|

| Net cash used by

investing activities |

|

(492,943 |

) |

|

(2,126,587 |

) |

|

(1,619,616 |

) |

| |

|

|

|

|

|

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

|

|

|

|

|

| Proceeds from issue of

shares |

|

202,304 |

|

|

769,936 |

|

|

3,295,822 |

|

| Payment for share issue

costs |

|

(22,310 |

) |

|

(313,643 |

) |

|

(403,373 |

) |

| Repayment of borrowings |

|

- |

|

|

(30,000 |

) |

|

(6,500 |

) |

| Leasing liabilities |

|

(29,228 |

) |

|

(85,165 |

) |

|

(32,673 |

) |

| Net cash from

financing activities |

|

150,766 |

|

|

341,128 |

|

|

2,853,276 |

|

| |

|

|

|

|

|

|

|

|

|

| Net decrease in cash and cash

equivalents |

|

(228,826 |

) |

|

(2,898,361 |

) |

|

(1,027,311 |

) |

| Net foreign exchange

difference |

|

20,111 |

|

|

(464 |

) |

|

118,276 |

|

| Cash and cash equivalents at

the beginning of the period |

|

484,590 |

|

|

3,174,700 |

|

|

4,083,735 |

|

| Cash and cash

equivalents at the end of the period |

|

275,875 |

|

|

275,875 |

|

|

3,174,700 |

|

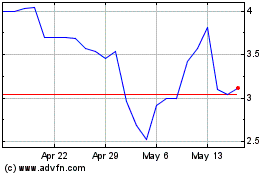

Locafy (NASDAQ:LCFY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Locafy (NASDAQ:LCFY)

Historical Stock Chart

From Feb 2024 to Feb 2025