UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-39407

Li Auto Inc.

(Registrant’s Name)

11 Wenliang Street

Shunyi District, Beijing 101399

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Li Auto Inc. |

| |

|

|

|

| |

By |

|

/s/ Tie Li |

| |

Name |

: |

Tie Li |

| |

Title |

: |

Director and Chief Financial Officer |

Date: August 28,

2024

Exhibit 99.1

Li Auto Inc. Announces Unaudited Second Quarter

2024 Financial Results

Quarterly total revenues reached RMB31.7 billion

(US$4.4 billion)1

Quarterly deliveries reached 108,581 vehicles

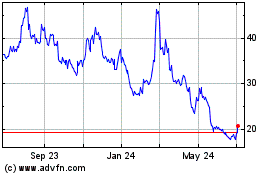

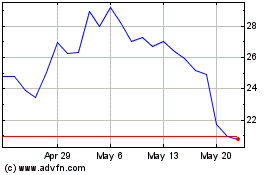

BEIJING, China, August 28, 2024 — Li

Auto Inc. (“Li Auto” or the “Company”) (Nasdaq: LI; HKEX: 2015), a leader in China’s new energy vehicle

market, today announced its unaudited financial results for the quarter ended June 30, 2024.

Operating Highlights for the Second Quarter of 2024

| · | Total deliveries for the second quarter of 2024 were 108,581 vehicles, representing a 25.5% year-over-year

increase. |

| | |

2024 Q2 | | |

2024 Q1 | | |

2023 Q4 | | |

2023 Q3 | |

| Deliveries | |

108,581 | | |

80,400 | | |

131,805 | | |

105,108 | |

| | |

2023 Q2 | | |

2023 Q1 | | |

2022 Q4 | | |

2022 Q3 | |

| Deliveries | |

86,533 | | |

52,584 | | |

46,319 | | |

26,524 | |

| · | As of June 30, 2024, in China, the Company had 497 retail stores in 148 cities, 421 servicing centers

and Li Auto-authorized body and paint shops operating in 220 cities, and 614 super charging stations in operation equipped with 2,726

charging stalls. |

Financial Highlights for the Second Quarter of 2024

| · | Vehicle sales were RMB30.3 billion (US$4.2 billion) in the second quarter of 2024, representing

an increase of 8.4% from RMB28.0 billion in the second quarter of 2023 and an increase of 25.0% from RMB24.3 billion in the first quarter

of 2024. |

| · | Vehicle margin2 was 18.7% in the second quarter of 2024, compared

with 21.0% in the second quarter of 2023 and 19.3% in the first quarter of 2024. |

| · | Total revenues were RMB31.7 billion (US$4.4 billion) in the second quarter of 2024, representing

an increase of 10.6% from RMB28.7 billion in the second quarter of 2023 and an increase of 23.6% from RMB25.6 billion in the first quarter

of 2024. |

| · | Gross profit was RMB6.2 billion (US$850.0 million) in the second quarter of 2024, representing

a decrease of 0.9% from RMB6.2 billion in the second quarter of 2023 and an increase of 16.9% from RMB5.3 billion in the first quarter

of 2024. |

| · | Gross margin was 19.5% in the second quarter of 2024, compared with 21.8% in the second quarter

of 2023 and 20.6% in the first quarter of 2024. |

| · | Operating expenses were RMB5.7 billion (US$785.6 million) in the second quarter of 2024, representing

an increase of 23.9% from RMB4.6 billion in the second quarter of 2023 and a decrease of 2.7% from RMB5.9 billion in the first quarter

of 2024. |

| · | Income from operations was RMB468.0 million (US$64.4 million) in the second quarter of 2024, representing

a decrease of 71.2% from RMB1.6 billion income from operations in the second quarter of 2023 and compared with RMB584.9 million loss from

operations in the first quarter of 2024. |

| · | Operating margin was 1.5% in the second quarter of 2024, compared with 5.7% in the second quarter

of 2023 and negative 2.3% in the first quarter of 2024. |

1

All translations from Renminbi (“RMB”) to U.S. dollars (“US$”) are made at a rate of RMB7.2672 to US$1.00, the

exchange rate on June 28, 2024 as set forth in the H.10 statistical release of the Federal Reserve Board.

2

Vehicle margin is the margin of vehicle sales, which is calculated based on revenues and cost of sales derived from vehicle sales only.

| · | Net income was RMB1.1 billion (US$151.5 million) in the second quarter of 2024, representing a

decrease of 52.3% from RMB2.3 billion in the second quarter of 2023 and an increase of 86.2% from RMB591.1 million in the first quarter

of 2024. Non-GAAP net income3 was RMB1.5 billion (US$206.8 million) in the second quarter of 2024, representing a decrease

of 44.9% from RMB2.7 billion in the second quarter of 2023 and an increase of 17.8% from RMB1.3 billion in the first quarter of 2024. |

| · | Diluted net earnings per ADS4 attributable to ordinary shareholders was RMB1.05 (US$0.14)

in the second quarter of 2024, compared with RMB2.18 in the second quarter of 2023 and RMB0.56 in the first quarter of 2024. Non-GAAP

diluted net earnings per ADS attributable to ordinary shareholders was RMB1.42 (US$0.20) in the second quarter of 2024, compared with

RMB2.58 in the second quarter of 2023 and RMB1.21 in the first quarter of 2024. |

| · | Net cash used in operating activities was RMB429.4 million (US$59.1 million) in the second quarter

of 2024, compared with RMB11.1 billion net cash provided by operating activities in the second quarter of 2023 and RMB3.3 billion net

cash used in operating activities in the first quarter of 2024. |

| · | Free cash flow5 was negative RMB1.9 billion (US$254.9 million) in the second quarter

of 2024, compared with RMB9.6 billion in the second quarter of 2023 and negative RMB5.1 billion in the first quarter of 2024. |

Key Financial Results

(in millions, except for percentages and per ADS data)

| |

|

For the Three Months Ended |

|

|

% Change6 |

|

| |

|

June 30,

2023 |

|

|

March 31,

2024 |

|

|

June 30,

2024 |

|

|

YoY |

|

|

QoQ |

|

| |

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

|

|

|

|

|

| Vehicle sales |

|

27,971.9 |

|

|

24,251.6 |

|

|

30,319.7 |

|

|

8.4 |

% |

|

25.0 |

% |

| Vehicle margin |

|

21.0 |

% |

|

19.3 |

% |

|

18.7 |

% |

|

(2.3 |

)pts |

|

(0.6 |

)pts |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

28,652.7 |

|

|

25,633.7 |

|

|

31,678.4 |

|

|

10.6 |

% |

|

23.6 |

% |

| Gross profit |

|

6,235.3 |

|

|

5,284.3 |

|

|

6,176.9 |

|

|

(0.9 |

)% |

|

16.9 |

% |

| Gross margin |

|

21.8 |

% |

|

20.6 |

% |

|

19.5 |

% |

|

(2.3 |

)pts |

|

(1.1 |

)pts |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

(4,609.4 |

) |

|

(5,869.2 |

) |

|

(5,708.9 |

) |

|

23.9 |

% |

|

(2.7 |

)% |

| Income/(Loss) from operations |

|

1,625.9 |

|

|

(584.9 |

) |

|

468.0 |

|

|

(71.2 |

)% |

|

N/A |

|

| Operating margin |

|

5.7 |

% |

|

(2.3 |

)% |

|

1.5 |

% |

|

(4.2 |

)pts |

|

3.8 |

pts |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

2,310.1 |

|

|

591.1 |

|

|

1,100.9 |

|

|

(52.3 |

)% |

|

86.2 |

% |

| Non-GAAP net income |

|

2,727.5 |

|

|

1,276.4 |

|

|

1,503.1 |

|

|

(44.9 |

)% |

|

17.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net earnings per ADS attributable to ordinary shareholders |

|

2.18 |

|

|

0.56 |

|

|

1.05 |

|

|

(51.8 |

)% |

|

87.5 |

% |

| Non-GAAP diluted net earnings per ADS attributable to ordinary shareholders |

|

2.58 |

|

|

1.21 |

|

|

1.42 |

|

|

(45.0 |

)% |

|

17.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by/(used in) operating activities |

|

11,112.4 |

|

|

(3,342.4 |

) |

|

(429.4 |

) |

|

N/A |

|

|

(87.2 |

)% |

| Free cash flow (non-GAAP) |

|

9,621.4 |

|

|

(5,055.2 |

) |

|

(1,852.7 |

) |

|

N/A |

|

|

(63.4 |

)% |

3

The Company’s non-GAAP financial measures exclude share-based compensation expenses and release of valuation allowance on deferred

tax assets. See “Unaudited Reconciliation of U.S. GAAP and Non-GAAP Results” set forth at the end of this press release.

4 Each ADS represents two Class A ordinary shares.

5

Free cash flow represents operating cash flow less capital expenditures, which is considered a non-GAAP financial measure.

6

Except for vehicle margin, gross margin, and operating margin, where absolute changes instead of percentage changes are presented.

Recent Developments

Delivery Update

| · | In July 2024, the Company delivered 51,000 vehicles, representing an increase of 49.4% from July 2023.

As of July 31, 2024, in China, the Company had 487 retail stores in 146 cities, 411 servicing centers and Li Auto-authorized body

and paint shops operating in 220 cities, and 701 super charging stations in operation equipped with 3,260 charging stalls. |

OTA 6.0 and 6.1 Updates

| · | In July 2024, the Company released OTA update versions 6.0 and 6.1 for Li MEGA and the Li L series,

introducing numerous new features and experience enhancements in autonomous driving, smart space, and smart electric features. For autonomous

driving, the Company rolled out a high-definition map-independent NOA with nationwide coverage to all Li AD Max users and significantly

enhanced the city LCC and AEB capabilities for Li AD Pro. During its Autonomous Driving Summer Launch Event held on July 5, 2024,

the Company unveiled a new technological architecture for autonomous driving integrating an end-to-end (E2E) model and a vision-language

model (VLM). This architecture employs proprietary reconstructed and generative world models for training and validation, and began an

early bird testing at the end of July. |

Product Health Evaluation Results

| · | In July 2024, Li MEGA received the highest overall score in the China Automobile Health Index (C-AHI)

assessment by the China Automotive Engineering Research Institute Co., Ltd. under C-AHI’s updated evaluation protocol. Li MEGA

received top ratings across all three evaluation categories — the Clean Air Index, the Health Protection Index, and the Energy Efficiency

and Emission Index. |

CEO and CFO Comments

Mr. Xiang Li, chairman and chief executive

officer of Li Auto, commented, “Since the second quarter, Li Auto has emerged as the sales champion of Chinese automotive brands

in the RMB200,000 and above NEV market amid intense competition, driven by segment leadership across all Li Auto models and enhanced store

efficiency. Our second-quarter deliveries exceeded 108,000 vehicles, increasing by 25.5% year over year, a strong testament to our product

strength and the effectiveness of our recalibrated operating strategy. In June 2024, we surpassed the 800,000-vehicle milestone in

cumulative deliveries, making history for Chinese premium automotive brands. In addition to our strong sales results, we made substantial

progress in autonomous driving. In July, we rolled out our high-definition map-independent NOA with nationwide coverage to over 240,000

Li AD Max users and launched our next-generation autonomous driving technological architecture that integrates an E2E model and a VLM.

We will relentlessly pursue innovation and excellence to solidify our position as a preferred premium automotive brand for Chinese families,

providing our users with products and services that exceed their expectations, and creating happiness for families.”

Mr. Tie Li, chief financial officer of Li

Auto, added, “Amid intense market competition during the second quarter, we focused on creating user value and improving operating

efficiency. Our solid second-quarter deliveries drove revenues to increase 10.6% year over year to RMB31.7 billion. Despite the impact

from ramping up a new model, our gross margin remained healthy at 19.5%. As Li L6 production stabilizes and our cost reduction and efficiency

enhancement measures take full effect, we expect an increase in both our margins and cash flow in the second half of the year. Looking

ahead, we are committed to investing in technological and product advancements to drive steady business growth, while simultaneously optimizing

our cost structure.”

Financial Results for the Second Quarter of 2024

Revenues

| · | Total revenues were RMB31.7 billion (US$4.4 billion) in the second quarter of 2024, representing

an increase of 10.6% from RMB28.7 billion in the second quarter of 2023 and an increase of 23.6% from RMB25.6 billion in the first quarter

of 2024. |

| · | Vehicle sales were RMB30.3 billion (US$4.2 billion) in the second quarter of 2024, representing

an increase of 8.4% from RMB28.0 billion in the second quarter of 2023 and an increase of 25.0% from RMB24.3 billion in the first quarter

of 2024. The increase in revenue from vehicle sales over the second quarter of 2023 was mainly attributable to the increase in vehicle

deliveries, partially offset by the lower average selling price mainly due to different product mix and pricing strategy changes between

two quarters. The increase in revenue from vehicle sales over the first quarter of 2024 was mainly attributable to the increase in vehicle

deliveries, partially offset by the lower average selling price mainly due to different product mix. |

| · | Other sales and services were RMB1.4 billion (US$187.0 million) in the second quarter of 2024,

representing an increase of 99.6% from RMB680.8 million in the second quarter of 2023 and a decrease of 1.7% from RMB1.4 billion in the

first quarter of 2024. The increase in revenue from other sales and services over the second quarter of 2023 was mainly attributable to

the increased provision of services and sales of accessories, which is in line with higher accumulated vehicle sales, and increased sales

of embedded products and services, including charging stalls, offered together with vehicle sales, which is in line with higher vehicle

deliveries. The revenue from other sales and services remained relatively stable over the first quarter of 2024. |

Cost of Sales and Gross Margin

| · | Cost of sales was RMB25.5 billion (US$3.5 billion) in the second quarter of 2024, representing

an increase of 13.8% from RMB22.4 billion in the second quarter of 2023 and an increase of 25.3% from RMB20.3 billion in the first quarter

of 2024. The increase in cost of sales over the second quarter of 2023 was mainly attributable to increase in vehicle deliveries, partially

offset by the lower average cost of sales due to different product mix and cost reduction. The increase in cost of sales over the first

quarter of 2024 was mainly attributable to increase in vehicle deliveries, partially offset by the lower average cost of sales due to

different product mix. |

| · | Gross profit was RMB6.2 billion (US$850.0 million) in the second quarter of 2024, representing

a decrease of 0.9% from RMB6.2 billion in the second quarter of 2023 and an increase of 16.9% from RMB5.3 billion in the first quarter

of 2024. |

| · | Vehicle margin was 18.7% in the second quarter of 2024, compared with 21.0% in the second quarter

of 2023 and 19.3% in the first quarter of 2024. The decrease in vehicle margin over the second quarter of 2023 was mainly due to different

product mix and pricing strategy changes between two quarters, partially offset by cost reduction. The decrease in vehicle margin over

the first quarter of 2024 was mainly due to different product mix. |

| · | Gross margin was 19.5% in the second quarter of 2024, compared with 21.8% in the second quarter

of 2023 and 20.6% in the first quarter of 2024. The decrease in gross margin over the second quarter of 2023 and first quarter of 2024

was mainly due to the decrease in vehicle margin. |

Operating Expenses

| · | Operating expenses were RMB5.7 billion (US$785.6 million) in the second quarter of 2024, representing

an increase of 23.9% from RMB4.6 billion in the second quarter of 2023 and a decrease of 2.7% from RMB5.9 billion in the first quarter

of 2024. |

| · | Research and development expenses were RMB3.0 billion (US$416.6 million) in the second quarter

of 2024, representing an increase of 24.8% from RMB2.4 billion in the second quarter of 2023 and a decrease of 0.7% from RMB3.0 billion

in the first quarter of 2024. The increase in research and development expenses over the second quarter of 2023 was primarily due to increased

expenses to support the expanding product portfolios and technologies as well as increased employee compensation as a result of the growth

in number of staff. The decrease in research and development expenses over the first quarter of 2024 was primarily due to decreased employee

compensation, offset by increased expenses to support the expanding product portfolios and technologies. |

| · | Selling, general and administrative expenses were RMB2.8 billion (US$387.4 million) in the second

quarter of 2024, representing an increase of 21.9% from RMB2.3 billion in the second quarter of 2023 and a decrease of 5.5% from RMB3.0

billion in the first quarter of 2024. The increase in selling, general and administrative expenses over the second quarter of 2023 was

primarily due to increased employee compensation as a result of the growth in number of staff as well as increased rental and other expenses

associated with the expansion of sales and servicing network. The decrease in selling, general and administrative expenses over the first

quarter of 2024 was primarily due to decreased marketing and promotional activities and employee compensation. |

Income/(Loss) from Operations

| · | Income from operations was RMB468.0 million (US$64.4 million) in the second quarter of 2024, representing

a decrease of 71.2% from RMB1.6 billion income from operations in the second quarter of 2023 and compared with RMB584.9 million loss from

operations in the first quarter of 2024. Operating margin was 1.5% in the second quarter of 2024, compared with 5.7% in the second

quarter of 2023 and negative 2.3% in the first quarter of 2024. Non-GAAP income from operations was RMB870.1 million (US$119.7

million) in the second quarter of 2024, representing a decrease of 57.4% from RMB2.0 billion in the second quarter of 2023 and an increase

of 767.3% from RMB100.3 million in the first quarter of 2024. |

Net Income and Net Earnings Per Share

| · | Net income was RMB1.1 billion (US$151.5 million) in the second quarter of 2024, representing a

decrease of 52.3% from RMB2.3 billion in the second quarter of 2023 and an increase of 86.2% from RMB591.1 million in the first quarter

of 2024. Non-GAAP net income was RMB1.5 billion (US$206.8 million) in the second quarter of 2024, representing a decrease of 44.9%

from RMB2.7 billion in the second quarter of 2023 and an increase of 17.8% from RMB1.3 billion in the first quarter of 2024. |

| · | Basic and diluted net earnings per ADS attributable to ordinary shareholders were RMB1.11 (US$0.15)

and RMB1.05 (US$0.14) in the second quarter of 2024, respectively, compared with RMB2.34 and RMB2.18 in the second quarter of 2023, respectively,

and RMB0.60 and RMB0.56 in the first quarter of 2024, respectively. Non-GAAP basic and diluted net earnings per ADS attributable to

ordinary shareholders were RMB1.51 (US$0.21) and RMB1.42 (US$0.20) in the second quarter of 2024, respectively, compared with RMB2.76

and RMB2.58 in the second quarter of 2023, respectively, and RMB1.29 and RMB1.21 in the first quarter of 2024, respectively. |

Cash Position, Operating Cash Flow and Free Cash Flow

| · | Cash position7 was RMB97.3 billion (US$13.4 billion) as of June 30, 2024. |

| · | Net cash used in operating activities was RMB429.4 million (US$59.1 million) in the second quarter

of 2024, compared with RMB11.1 billion net cash provided by operating activities in the second quarter of 2023 and RMB3.3 billion net

cash used in operating activities in the first quarter of 2024. The change in net cash used in operating activities over the second quarter

of 2023 was mainly due to increased payment related to inventory purchase, partially offset by the increase in cash received from customers.

The change in net cash used in operating activities over the first quarter of 2024 was mainly due to the increase in cash received from

customers as a result of the increase in vehicle deliveries. |

| · | Free cash flow was negative RMB1.9 billion (US$254.9 million) in the second quarter of 2024, compared

with RMB9.6 billion in the second quarter of 2023 and negative RMB5.1 billion in the first quarter of 2024. |

7 Cash position includes

cash and cash equivalents, restricted cash, time deposits and short-term investments, and long-term time deposits and financial instruments

included in long-term investments.

Business Outlook

For the third quarter of 2024, the Company expects:

| · | Deliveries of vehicles to be between 145,000 and 155,000 vehicles, representing an increase of

38.0% to 47.5% from the third quarter of 2023. |

| · | Total revenues to be between RMB39.4 billion (US$5.4 billion) and RMB42.2 billion (US$5.8 billion),

representing an increase of 13.7% to 21.6% from the third quarter of 2023. |

This business outlook reflects the Company’s

current and preliminary views on its business situation and market conditions, which are subject to change.

Conference Call

Management will hold a conference call at 8:00

a.m. U.S. Eastern Time on Wednesday, August 28, 2024 (8:00 p.m. Beijing/Hong Kong Time on August 28, 2024) to discuss

financial results and answer questions from investors and analysts.

For participants who wish to join the call, please

complete online registration using the link provided below prior to the scheduled call start time. Upon registration, participants will

receive the conference call access information, including dial-in numbers, passcode, and a unique access PIN. To join the conference,

please dial the number provided, enter the passcode followed by your PIN, and you will join the conference instantly.

Participant Online Registration: https://s1.c-conf.com/diamondpass/10041167-jgh57t.html

A replay of the conference call will be accessible through September 4,

2024, by dialing the following numbers:

| United States: |

+1-855-883-1031 |

| Mainland China: |

+86-400-1209-216 |

| Hong Kong, China: |

+852-800-930-639 |

| International: |

+61-7-3107-6325 |

| Replay PIN: |

10041167 |

Additionally, a live and archived webcast of the

conference call will be available on the Company’s investor relations website at https://ir.lixiang.com.

Non-GAAP Financial Measures

The Company uses non-GAAP financial measures,

such as non-GAAP cost of sales, non-GAAP research and development expenses, non-GAAP selling, general and administrative expenses, non-GAAP

income from operations, non-GAAP net income, non-GAAP net income attributable to ordinary shareholders, non-GAAP basic and diluted net

earnings per ADS attributable to ordinary shareholders, non-GAAP basic and diluted net earnings per share attributable to ordinary shareholders

and free cash flow, in evaluating its operating results and for financial and operational decision-making purposes. By excluding the impact

of share-based compensation expenses and release of valuation allowance on deferred tax assets, the Company believes that the non-GAAP

financial measures help identify underlying trends in its business and enhance the overall understanding of the Company’s past performance

and future prospects. The Company also believes that the non-GAAP financial measures allow for greater visibility with respect to key

metrics used by the Company’s management in its financial and operational decision-making.

The non-GAAP financial measures are not presented

in accordance with U.S. GAAP and may be different from non-GAAP methods of accounting and reporting used by other companies. The non-GAAP

financial measures have limitations as analytical tools and when assessing the Company’s operating performance, investors should

not consider them in isolation, or as a substitute for financial information prepared in accordance with U.S. GAAP. The Company encourages

investors and others to review its financial information in its entirety and not rely on a single financial measure.

The Company mitigates these limitations by reconciling

the non-GAAP financial measures to the most comparable U.S. GAAP performance measures, all of which should be considered when evaluating

the Company’s performance.

For more information on the non-GAAP financial

measures, please see the table captioned “Unaudited Reconciliation of U.S. GAAP and Non-GAAP Results” set forth at the end

of this press release.

Exchange Rate Information

This press release contains translations of certain

Renminbi amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations

from Renminbi to U.S. dollars and from U.S. dollars to Renminbi are made at a rate of RMB7.2672 to US$1.00, the exchange rate on June 28,

2024, set forth in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the Renminbi or

U.S. dollars amounts referred could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all.

About Li Auto Inc.

Li Auto Inc. is a leader in China’s new

energy vehicle market. The Company designs, develops, manufactures, and sells premium smart electric vehicles. Its mission is: Create

a Mobile Home, Create Happiness (创造移动的家,

创造幸福的家). Through innovations

in product, technology, and business model, the Company provides families with safe, convenient, and comfortable products and services.

Li Auto is a pioneer in successfully commercializing extended-range electric vehicles in China. While firmly advancing along this technological

route, it builds platforms for battery electric vehicles in parallel. The Company leverages technology to create value for users. It concentrates

its in-house development efforts on proprietary range extension systems, innovative electric vehicle technologies, and smart vehicle solutions.

The Company started volume production in November 2019. Its current model lineup includes Li MEGA, a high-tech flagship family MPV,

Li L9, a six-seat flagship family SUV, Li L8, a six-seat premium family SUV, Li L7, a five-seat flagship family SUV, and Li L6, a five-seat

premium family SUV. The Company will continue to expand its product lineup to target a broader user base.

For more information, please visit: https://ir.lixiang.com.

Safe Harbor Statement

This press release contains statements that may

constitute “forward-looking” statements pursuant to the “safe harbor” provisions of the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,”

“anticipates,” “aims,” “future,” “intends,” “plans,” “believes,”

“estimates,” “targets,” “likely to,” “challenges,” and similar statements. Li Auto may

also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”)

and The Stock Exchange of Hong Kong Limited (the “HKEX”), in its annual report to shareholders, in press releases and other

written materials, and in oral statements made by its officers, directors, or employees to third parties. Statements that are not historical

facts, including statements about Li Auto’s beliefs, plans, and expectations, are forward-looking statements. Forward-looking statements

involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in

any forward-looking statement, including but not limited to the following: Li Auto’s strategies, future business development, and

financial condition and results of operations; Li Auto’s limited operating history; risks associated with extended-range electric

vehicles and high-power charging battery electric vehicles; Li Auto’s ability to develop, manufacture, and deliver vehicles of high

quality and appeal to customers; Li Auto’s ability to generate positive cash flow and profits; product defects or any other failure

of vehicles to perform as expected; Li Auto’s ability to compete successfully; Li Auto’s ability to build its brand and withstand

negative publicity; cancellation of orders for Li Auto’s vehicles; Li Auto’s ability to develop new vehicles; and changes

in consumer demand and government incentives, subsidies, or other favorable government policies. Further information regarding these and

other risks is included in Li Auto’s filings with the SEC and the HKEX. All information provided in this press release is as of

the date of this press release, and Li Auto does not undertake any obligation to update any forward-looking statement, except as required

under applicable law.

For investor and media inquiries, please contact:

Li Auto Inc.

Investor Relations

Email: ir@lixiang.com

Christensen Advisory

Roger Hu

Tel: +86-10-5900-1548

Email: Li@christensencomms.com

Li Auto Inc.

Unaudited Condensed Consolidated Statements of Comprehensive Income

(All amounts in thousands, except for ADS/ordinary share and per ADS/ordinary

share data)

| |

|

For the Three Months Ended |

|

| |

|

June 30, 2023 |

|

|

March 31, 2024 |

|

|

June 30, 2024 |

|

|

June 30, 2024 |

|

| |

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| Vehicle sales |

|

27,971,944 |

|

|

24,251,553 |

|

|

30,319,728 |

|

|

4,172,133 |

|

| Other sales and services |

|

680,783 |

|

|

1,382,107 |

|

|

1,358,668 |

|

|

186,959 |

|

| Total revenues |

|

28,652,727 |

|

|

25,633,660 |

|

|

31,678,396 |

|

|

4,359,092 |

|

| Cost of sales: |

|

|

|

|

|

|

|

|

|

|

|

|

| Vehicle sales |

|

(22,084,087 |

) |

|

(19,561,658 |

) |

|

(24,635,504 |

) |

|

(3,389,958 |

) |

| Other sales and services |

|

(333,362 |

) |

|

(787,697 |

) |

|

(865,950 |

) |

|

(119,159 |

) |

| Total cost of sales |

|

(22,417,449 |

) |

|

(20,349,355 |

) |

|

(25,501,454 |

) |

|

(3,509,117 |

) |

| Gross profit |

|

6,235,278 |

|

|

5,284,305 |

|

|

6,176,942 |

|

|

849,975 |

|

| Operating expense: |

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

(2,425,600 |

) |

|

(3,048,886 |

) |

|

(3,027,581 |

) |

|

(416,609 |

) |

| Selling, general and administrative |

|

(2,309,210 |

) |

|

(2,977,585 |

) |

|

(2,815,105 |

) |

|

(387,371 |

) |

| Other operating income, net |

|

125,402 |

|

|

157,264 |

|

|

133,773 |

|

|

18,408 |

|

| Total operating expenses |

|

(4,609,408 |

) |

|

(5,869,207 |

) |

|

(5,708,913 |

) |

|

(785,572 |

) |

| Income/(Loss) from operations |

|

1,625,870 |

|

|

(584,902 |

) |

|

468,029 |

|

|

64,403 |

|

| Other (expense)/income: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

(28,440 |

) |

|

(28,598 |

) |

|

(43,231 |

) |

|

(5,949 |

) |

| Interest income and investment income, net |

|

430,262 |

|

|

1,068,888 |

|

|

370,034 |

|

|

50,918 |

|

| Others, net |

|

324,291 |

|

|

220,184 |

|

|

383,237 |

|

|

52,735 |

|

| Income before income tax |

|

2,351,983 |

|

|

675,572 |

|

|

1,178,069 |

|

|

162,107 |

|

| Income tax expense |

|

(41,885 |

) |

|

(84,446 |

) |

|

(77,129 |

) |

|

(10,613 |

) |

| Net income |

|

2,310,098 |

|

|

591,126 |

|

|

1,100,940 |

|

|

151,494 |

|

| Less: Net income/(loss) attributable to noncontrolling interests |

|

16,945 |

|

|

(1,432 |

) |

|

(1,653 |

) |

|

(227 |

) |

| Net income attributable to ordinary shareholders of Li Auto Inc. |

|

2,293,153 |

|

|

592,558 |

|

|

1,102,593 |

|

|

151,721 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

2,310,098 |

|

|

591,126 |

|

|

1,100,940 |

|

|

151,494 |

|

| Other comprehensive (loss)/income |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation adjustment, net of tax |

|

(120,809 |

) |

|

(59,936 |

) |

|

12,444 |

|

|

1,712 |

|

| Total other comprehensive (loss)/income |

|

(120,809 |

) |

|

(59,936 |

) |

|

12,444 |

|

|

1,712 |

|

| Total comprehensive income |

|

2,189,289 |

|

|

531,190 |

|

|

1,113,384 |

|

|

153,206 |

|

| Less: Net income/(loss) attributable to noncontrolling interests |

|

16,945 |

|

|

(1,432 |

) |

|

(1,653 |

) |

|

(227 |

) |

| Comprehensive income attributable to ordinary shareholders of Li Auto Inc. |

|

2,172,344 |

|

|

532,622 |

|

|

1,115,037 |

|

|

153,433 |

|

| Weighted average number of ADSs |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

980,693,361 |

|

|

993,308,654 |

|

|

994,833,579 |

|

|

994,833,579 |

|

| Diluted |

|

1,053,852,487 |

|

|

1,066,436,872 |

|

|

1,062,428,185 |

|

|

1,062,428,185 |

|

| Net earnings per ADS attributable to ordinary shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

2.34 |

|

|

0.60 |

|

|

1.11 |

|

|

0.15 |

|

| Diluted |

|

2.18 |

|

|

0.56 |

|

|

1.05 |

|

|

0.14 |

|

| Weighted average number of ordinary shares |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

1,961,386,723 |

|

|

1,986,617,307 |

|

|

1,989,667,158 |

|

|

1,989,667,158 |

|

| Diluted |

|

2,107,704,975 |

|

|

2,132,873,744 |

|

|

2,124,856,370 |

|

|

2,124,856,370 |

|

| Net earnings per share attributable to ordinary shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

1.17 |

|

|

0.30 |

|

|

0.55 |

|

|

0.08 |

|

| Diluted |

|

1.09 |

|

|

0.28 |

|

|

0.52 |

|

|

0.07 |

|

Li Auto Inc.

Unaudited Condensed Consolidated Balance Sheets

(All amounts in thousands)

| |

|

As of |

|

| |

|

December 31, 2023 |

|

|

June 30, 2024 |

|

|

June 30, 2024 |

|

| |

|

RMB |

|

|

RMB |

|

|

US$ |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

91,329,030 |

|

|

80,783,571 |

|

|

11,116,189 |

|

| Restricted cash |

|

479 |

|

|

5,225 |

|

|

719 |

|

| Time deposits and short-term investments |

|

11,933,255 |

|

|

16,463,169 |

|

|

2,265,407 |

|

| Trade receivable |

|

143,523 |

|

|

157,954 |

|

|

21,735 |

|

| Inventories |

|

6,871,979 |

|

|

8,307,534 |

|

|

1,143,155 |

|

| Prepayments and other current assets |

|

4,247,318 |

|

|

4,090,179 |

|

|

562,827 |

|

| Total current assets |

|

114,525,584 |

|

|

109,807,632 |

|

|

15,110,032 |

|

| Non-current assets: |

|

|

|

|

|

|

|

|

|

| Long-term investments |

|

1,595,376 |

|

|

1,492,010 |

|

|

205,307 |

|

| Property, plant and equipment, net |

|

15,745,018 |

|

|

21,238,080 |

|

|

2,922,457 |

|

| Operating lease right-of-use assets, net |

|

5,939,230 |

|

|

7,053,875 |

|

|

970,646 |

|

| Intangible assets, net |

|

864,180 |

|

|

892,188 |

|

|

122,769 |

|

| Goodwill |

|

5,484 |

|

|

5,484 |

|

|

755 |

|

| Deferred tax assets |

|

1,990,245 |

|

|

2,317,350 |

|

|

318,878 |

|

| Other non-current assets |

|

2,802,354 |

|

|

2,303,580 |

|

|

316,983 |

|

| Total non-current assets |

|

28,941,887 |

|

|

35,302,567 |

|

|

4,857,795 |

|

| Total assets |

|

143,467,471 |

|

|

145,110,199 |

|

|

19,967,827 |

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

| Short-term borrowings |

|

6,975,399 |

|

|

922,219 |

|

|

126,902 |

|

| Trade and notes payable |

|

51,870,097 |

|

|

46,832,038 |

|

|

6,444,303 |

|

| Amounts due to related parties |

|

10,607 |

|

|

10,284 |

|

|

1,415 |

|

| Deferred revenue, current |

|

1,525,543 |

|

|

1,732,534 |

|

|

238,405 |

|

| Operating lease liabilities, current |

|

1,146,437 |

|

|

1,258,938 |

|

|

173,236 |

|

| Finance lease liabilities, current |

|

— |

|

|

44,766 |

|

|

6,160 |

|

| Accruals and other current liabilities |

|

11,214,626 |

|

|

11,658,692 |

|

|

1,604,287 |

|

| Total current liabilities |

|

72,742,709 |

|

|

62,459,471 |

|

|

8,594,708 |

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

|

| Long-term borrowings |

|

1,747,070 |

|

|

7,982,516 |

|

|

1,098,431 |

|

| Deferred revenue, non-current |

|

812,218 |

|

|

790,023 |

|

|

108,711 |

|

| Operating lease liabilities, non-current |

|

3,677,961 |

|

|

4,576,145 |

|

|

629,699 |

|

| Finance lease liabilities, non-current |

|

— |

|

|

679,419 |

|

|

93,491 |

|

| Deferred tax liabilities |

|

200,877 |

|

|

508,547 |

|

|

69,978 |

|

| Other non-current liabilities |

|

3,711,414 |

|

|

4,800,203 |

|

|

660,530 |

|

| Total non-current liabilities |

|

10,149,540 |

|

|

19,336,853 |

|

|

2,660,840 |

|

| Total liabilities |

|

82,892,249 |

|

|

81,796,324 |

|

|

11,255,548 |

|

| Total Li Auto Inc. shareholders’ equity |

|

60,142,624 |

|

|

62,884,362 |

|

|

8,653,176 |

|

| Noncontrolling interests |

|

432,598 |

|

|

429,513 |

|

|

59,103 |

|

| Total shareholders’ equity |

|

60,575,222 |

|

|

63,313,875 |

|

|

8,712,279 |

|

| Total liabilities and shareholders’ equity |

|

143,467,471 |

|

|

145,110,199 |

|

|

19,967,827 |

|

Li Auto Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(All amounts in thousands)

| |

|

For the Three Months Ended |

|

| |

|

June 30,

2023 |

|

|

March 31,

2024 |

|

|

June 30,

2024 |

|

|

June 30,

2024 |

|

| |

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

| Net cash provided by/(used in) operating activities |

|

11,112,395 |

|

|

(3,342,386 |

) |

|

(429,397 |

) |

|

(59,087 |

) |

| Net cash provided by/(used in) investing activities |

|

7,573,941 |

|

|

(3,098,206 |

) |

|

(3,839,308 |

) |

|

(528,306 |

) |

| Net cash (used in)/provided by financing activities |

|

(1,853,582 |

) |

|

185,257 |

|

|

(104,743 |

) |

|

(14,413 |

) |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

|

138,186 |

|

|

55,813 |

|

|

32,257 |

|

|

4,438 |

|

| Net change in cash, cash equivalents and restricted cash |

|

16,970,940 |

|

|

(6,199,522 |

) |

|

(4,341,191 |

) |

|

(597,368 |

) |

| Cash, cash equivalents and restricted cash at beginning of period |

|

45,284,709 |

|

|

91,329,509 |

|

|

85,129,987 |

|

|

11,714,276 |

|

| Cash, cash equivalents and restricted cash at end of period |

|

62,255,649 |

|

|

85,129,987 |

|

|

80,788,796 |

|

|

11,116,908 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by/(used in) operating activities |

|

11,112,395 |

|

|

(3,342,386 |

) |

|

(429,397 |

) |

|

(59,087 |

) |

| Capital expenditures |

|

(1,491,029 |

) |

|

(1,712,843 |

) |

|

(1,423,332 |

) |

|

(195,857 |

) |

| Free cash flow (non-GAAP) |

|

9,621,366 |

|

|

(5,055,229 |

) |

|

(1,852,729 |

) |

|

(254,944 |

) |

Li Auto Inc.

Unaudited Reconciliation of U.S. GAAP and Non-GAAP Results

(All amounts in thousands, except for ADS/ordinary share and per ADS/ordinary

share data)

| |

|

For the Three Months Ended |

|

| |

|

June 30,

2023 |

|

|

March 31,

2024 |

|

|

June 30,

2024 |

|

|

June 30,

2024 |

|

| |

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

| Cost of sales |

|

(22,417,449 |

) |

|

(20,349,355 |

) |

|

(25,501,454 |

) |

|

(3,509,117 |

) |

| Share-based compensation expenses |

|

9,449 |

|

|

13,469 |

|

|

7,652 |

|

|

1,053 |

|

| Non-GAAP cost of sales |

|

(22,408,000 |

) |

|

(20,335,886 |

) |

|

(25,493,802 |

) |

|

(3,508,064 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development expenses |

|

(2,425,600 |

) |

|

(3,048,886 |

) |

|

(3,027,581 |

) |

|

(416,609 |

) |

| Share-based compensation expenses |

|

247,064 |

|

|

433,764 |

|

|

224,332 |

|

|

30,869 |

|

| Non-GAAP research and development expenses |

|

(2,178,536 |

) |

|

(2,615,122 |

) |

|

(2,803,249 |

) |

|

(385,740 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative expenses |

|

(2,309,210 |

) |

|

(2,977,585 |

) |

|

(2,815,105 |

) |

|

(387,371 |

) |

| Share-based compensation expenses |

|

160,928 |

|

|

237,994 |

|

|

170,129 |

|

|

23,411 |

|

| Non-GAAP selling, general and administrative expenses |

|

(2,148,282 |

) |

|

(2,739,591 |

) |

|

(2,644,976 |

) |

|

(363,960 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income/(Loss) from operations |

|

1,625,870 |

|

|

(584,902 |

) |

|

468,029 |

|

|

64,403 |

|

| Share-based compensation expenses |

|

417,441 |

|

|

685,227 |

|

|

402,113 |

|

|

55,333 |

|

| Non-GAAP income from operations |

|

2,043,311 |

|

|

100,325 |

|

|

870,142 |

|

|

119,736 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

2,310,098 |

|

|

591,126 |

|

|

1,100,940 |

|

|

151,494 |

|

| Share-based compensation expenses |

|

417,441 |

|

|

685,227 |

|

|

402,113 |

|

|

55,333 |

|

| Non-GAAP net income |

|

2,727,539 |

|

|

1,276,353 |

|

|

1,503,053 |

|

|

206,827 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to ordinary shareholders of Li Auto Inc. |

|

2,293,153 |

|

|

592,558 |

|

|

1,102,593 |

|

|

151,721 |

|

| Share-based compensation expenses |

|

417,441 |

|

|

685,227 |

|

|

402,113 |

|

|

55,333 |

|

| Non-GAAP net income attributable to ordinary shareholders of Li Auto Inc. |

|

2,710,594 |

|

|

1,277,785 |

|

|

1,504,706 |

|

|

207,054 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of ADSs |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

980,693,361 |

|

|

993,308,654 |

|

|

994,833,579 |

|

|

994,833,579 |

|

| Diluted |

|

1,053,852,487 |

|

|

1,066,436,872 |

|

|

1,062,428,185 |

|

|

1,062,428,185 |

|

| Non-GAAP net earnings per ADS attributable to ordinary shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

2.76 |

|

|

1.29 |

|

|

1.51 |

|

|

0.21 |

|

| Diluted |

|

2.58 |

|

|

1.21 |

|

|

1.42 |

|

|

0.20 |

|

| Weighted average number of ordinary shares |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

1,961,386,723 |

|

|

1,986,617,307 |

|

|

1,989,667,158 |

|

|

1,989,667,158 |

|

| Diluted |

|

2,107,704,975 |

|

|

2,132,873,744 |

|

|

2,124,856,370 |

|

|

2,124,856,370 |

|

| Non-GAAP net earnings per share attributable to ordinary shareholders8 |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

1.38 |

|

|

0.64 |

|

|

0.76 |

|

|

0.10 |

|

| Diluted |

|

1.29 |

|

|

0.60 |

|

|

0.71 |

|

|

0.10 |

|

8 Non-GAAP basic net earnings per

share attributable to ordinary shareholders is calculated by dividing non-GAAP net income attributable to ordinary shareholders by the

weighted average number of ordinary shares outstanding during the periods. Non-GAAP diluted net earnings per share attributable to ordinary

shareholders is calculated by dividing non-GAAP net income attributable to ordinary shareholders by the weighted average number of ordinary

shares and dilutive potential ordinary shares outstanding during the periods, including the dilutive effects of convertible senior notes

as determined under the if-converted method and the dilutive effect of share-based awards as determined under the treasury stock method.

Exhibit

99.2

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

Li

Auto Inc.

理想汽車

(A

company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability)

(Stock

Code: 2015)

INTERIM

RESULTS ANNOUNCEMENT

FOR

THE SIX MONTHS ENDED JUNE 30, 2024

The

board (the “Board”) of directors (the “Directors”) of Li Auto Inc. (“Li Auto”,

or the “Company”) is pleased to announce the unaudited interim consolidated results of the Company for the six months

ended June 30, 2024 (the “Reporting Period”), together with the comparative figures for the corresponding period

in 2023. These interim results have been prepared in accordance with generally accepted accounting principles in the United States of

America (the “U.S. GAAP”) and have been reviewed by the audit committee (the “Audit Committee”)

of the Board. The unaudited condensed consolidated financial statements for the six months ended June 30, 2024 were reviewed by

PricewaterhouseCoopers, the independent auditor of the Company, in accordance with International Standard on Review Engagements 2410

“Review of Interim Financial Information Performed by the Independent Auditor of the Entity”.

In

this announcement, “we,” “us,” and “our” refer to the Company and where the context otherwise requires,

the Group (as defined under the “General Information” heading in the “Notes to the Unaudited Condensed Consolidated

Financial Statements” section).

FINANCIAL PERFORMANCE

HIGHLIGHTS

| | |

For the Six Months

Ended June 30, | | |

| |

| | |

2023 | | |

2024 | | |

Change (%) | |

| | |

(Unaudited) | | |

(Unaudited) | | |

| |

| | |

(RMB in thousands, except for percentages) | |

| Revenues | |

| 47,439,780 | | |

| 57,312,056 | | |

| 20.8 | % |

| Gross profit | |

| 10,065,384 | | |

| 11,461,247 | | |

| 13.9 | % |

| Income/(Loss) from operations | |

| 2,031,073 | | |

| (116,873 | ) | |

| N/A | |

| Income before income tax | |

| 3,324,767 | | |

| 1,853,641 | | |

| (44.2 | )% |

| Net income | |

| 3,243,935 | | |

| 1,692,066 | | |

| (47.8 | )% |

| Comprehensive

income attributable to the ordinary shareholders of Li Auto Inc. | |

| 3,129,619 | | |

| 1,647,659 | | |

| (47.4 | )% |

| Non-GAAP

Financial Measures: | |

| | | |

| | | |

| | |

|

Non-GAAP

net income | |

| 4,141,605 | | |

| 2,779,406 | | |

| (32.9 | )% |

Non-GAAP Financial

Measures

The

Company uses non-GAAP financial measures, such as non-GAAP net income, in evaluating its operating results and for financial and operational

decision-making purposes. By excluding the impact of share-based compensation expenses and release of valuation allowance on deferred

tax assets, the Company believes that the non-GAAP financial measures help identify underlying trends in its business and enhance the

overall understanding of the Company’s past performance and future prospects. The Company also believes that the non-GAAP financial

measures allow for greater visibility with respect to key metrics used by the Company’s management in its financial and operational

decision-making.

The

non-GAAP financial measures are not presented in accordance with U.S. GAAP and may be different from non-GAAP methods of accounting and

reporting used by other companies. The non-GAAP financial measures have limitations as analytical tools and when assessing the Company’s

operating performance, investors should not consider them in isolation, or as a substitute for the financial information prepared in

accordance with U.S. GAAP. The Company encourages investors and others to review its financial information in its entirety and not rely

on a single financial measure.

The

Company mitigates these limitations by reconciling the non-GAAP financial measures to the most comparable U.S. GAAP performance measures,

all of which should be considered when evaluating the Company’s performance.

The

following table sets forth unaudited reconciliation of U.S. GAAP and non-GAAP results for the periods indicated.

| | |

For the Six Months

Ended June 30, | |

| | |

2023 | | |

2024 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| | |

(RMB in thousands) | |

| Net income | |

| 3,243,935 | | |

| 1,692,066 | |

| Share-based compensation

expenses | |

| 897,670 | | |

| 1,087,340 | |

| | |

| | | |

| | |

Non-GAAP

net income | |

| 4,141,605 | | |

| 2,779,406 | |

BUSINESS REVIEW AND

OUTLOOK

Business Review for

the Reporting Period

In

the first half of 2024, Li Auto embraced challenges and continued to grow amidst an ever-changing market landscape. We further enriched

our model portfolio, focused on users and products, and concentrated on enhancing operating efficiency across our organization. As a

result, all Li Auto models maintained leading positions in terms of market share within their respective segments. Our market share in

the RMB200,000 and higher new energy vehicle (“NEV”) market in China reached 14.1% for the first half of 2024, ranking

us at the top among Chinese auto brands. The total deliveries of Li Auto vehicles reached 188,981 in the first half of 2024, representing

a year-over-year increase of 35.8%, propelling our total revenues to reach RMB57.3 billion in the first half of the year at a year-over-year

increase of 20.8%. As of June 30, 2024, our cumulative deliveries reached 822,345 vehicles, making us the first Chinese emerging

new energy auto brand to cross the 800,000 cumulative delivery milestone.

Products

We

continued to add new models to expand our vehicle line-up. While firmly advancing along the extended-range electric technological route,

we build platforms for battery electric vehicles in parallel. We offer various choices for size and intelligent configurations, allowing

us to fulfill the diverse needs of a broader range of family users. Meanwhile, we continually reinforce our product strength through

model refreshes and OTA updates to offer users better mobility experiences.

On

March 1, 2024, we launched Li MEGA, a high-tech flagship family MPV. Built on an 800-volt battery electric platform, Li MEGA is

equipped with the Qilin 5C battery and can achieve a driving range of 500 kilometers with a 12-minute charge using Li Auto 5C super charging

stalls. In terms of vehicle intelligence, Li MEGA comes standard with Li SS Ultra smart space and Li AD Max autonomous driving systems,

which are powered by a high-performance Qualcomm Snapdragon 8295P chip and dual NVIDIA DRIVE Orin-X chips, respectively. Its outstanding

energy replenishment efficiency, superior performance and intelligent features, spacious interior, and strict safety standards, make

Li MEGA an ideal choice for big families’ travel plans.

Along

with Li MEGA’s launch, we also released the 2024 Li L7, Li L8, and Li L9 models. With extensive upgrades across range extension

system, chassis system, and other configurations, the 2024 Li L series offer enhanced safety, comfort, and intelligent experiences.

On

April 18, 2024, we launched Li L6, a five-seat premium family SUV to satisfy the mobility needs of more young families with a budget

below RMB300,000. Li L6 offers spacious interior and superior configurations, and employs an all-wheel-drive extended range electric

system built with the latest generation of lithium iron phosphate batteries. Li L6 is available in Pro and Max trims, both featuring

a four-screen interaction system powered by a Qualcomm Snapdragon 8295P chip. Li L6 Pro comes standard with Li AD Pro autonomous driving

system, powered by a Horizon Robotics Journey 5, while the Max trim comes standard with Li AD Max autonomous driving system, powered

by dual NVIDIA DRIVE Orin-X chips.

Benefiting

from our compelling product strength and enhanced organizational efficiency, Li L6’s cumulative deliveries already surpassed 50,000

vehicles within three months of its launch, with over 20,000 Li L6s delivered in June alone. As of June 30, 2024, we retained

the title of sales champion among emerging new energy auto brands in the Chinese market for ten consecutive weeks, continually reinforcing

our market standing.

Supply Chain

We

continue to strengthen our supply chain strategic perception and planning, risk management, and cost management to promote the maturity

and completeness of our supply chain system. This has provided robust support for the successful delivery of more vehicle models and

the steady growth in sales. Our efficient collaboration with suppliers positioned us to realize better economies of scale and effectively

reduced production costs. A higher level of supply chain localization also facilitated more efficient operations with optimized cost

management. Meanwhile, we focused on supplier management and empowerment, pursuing win-win cooperations with suppliers. By building a

joint development platform, we engaged more suppliers to participate in technological innovations, thereby co-creating user value and

bolstering the competitiveness of the entire industrial chain.

Manufacturing

We

remain committed to operating our own manufacturing facilities, with established manufacturing bases in Changzhou and Beijing, China.

We adopt highly automated, intelligent, and digitalized production lines. Treating manufacturing facilities as products capable of continuous

upgrades and iterations, we constantly innovate the production lines to boost production efficiency and delivery quality, thereby allowing

us to ensure the consistency of product quality and user experiences right from the start. Additionally, we adhere to green manufacturing

practices, employing energy-saving and environmentally friendly processes to establish sustainable and green facilities.

Direct Sales and

Servicing Network

In

the first half of 2024, we continued to expand our direct sales and servicing network, deepening our retail presence in cities of all

tiers across China. In January this year, our first batch of flagship retail stores landed in Beijing, Shanghai, Shenzhen, and Guangzhou,

bringing an all-round upgrade in store design, experience, and functionality. While increasing brand exposure through retail stores in

shopping malls, we continued to strengthen the store display capabilities and service standards of our retail stores in auto parks to

provide users with a more convenient and comfortable vehicle purchasing experience. At the same time, by upgrading existing retail stores

in shopping malls and replacing low-performing stores in shopping malls with stores in auto parks, we increased the total number of display

spots and average display capacity of a single store, thereby better supporting the continued growth of sales. Moreover, we have adopted

a region-specific sales strategy to maximize sales conversion. At present, our direct sales and servicing network has covered all first-tier,

new first-tier, and second-tier cities in China, as well as ninety percent of third-tier cities. In the second half of the year, we will

continue to expand our footprint to more cities. As of June 30, 2024, we had 497 retail stores in 148 cities, as well as 421 servicing

centers and Li Auto-authorized body and paint shops operating in 220 cities.

In

order to provide users with a convenient and reliable energy replenishment experience, we continue to accelerate the deployment of the

super charging network. As of June 30, 2024, we had 614 super charging stations in operation equipped with 2,726 charging stalls

in China. Through a combination of self-building and cooperative approaches, we will invest steadfastly and accelerate our deployment,

and continue to expand our charging network to ensure that users can travel without range anxiety at different places, whether on highways

or in urban areas, allowing more families to feel confident in choosing Li Auto’s products.

Research and Development

We

consistently invest in the research and development of products, platforms, and systems to continually enhance user value, ensuring that

industry-leading technology serves every member of our family users.

We

relentlessly optimize vehicle use experiences through constant innovations on electrification and intelligentization. With Li MEGA’s

release, we provided one of the fastest-charging mass-produced passenger vehicles on the market. Additionally, we further enhanced user

experiences for smart space features and autonomous driving capabilities by frequently rolling out high-quality OTA updates, offering

users an ever-evolving mobile home.

In

March 2024, we pushed OTA version 5.1 to users, delivering 41 new features and 27 experience optimizations. The newly added features

included full-screen mode for the center console and a panoramic dashcam. We also upgraded AEB’s capabilities to accurately identify

a wider range of stationary obstacles, and improved truck avoidance capabilities for highway NOA, among others. In May 2024, we

released OTA version 5.2 with 19 new features and 23 experience optimizations. For Li AD Pro 3.0, we upgraded highway NOA with a thousand-kilometer-drive

level of zero human driver takeover capability, enhanced city LCC’s capabilities in bypassing and lane selections, and advanced

automated parking to manage over 300 types of complex parking spaces, among others. Moreover, we also enhanced Li AD Max 3.0’s

active safety capabilities under eight high-frequency and high-risk scenarios.

We

remain committed to offering autonomous driving systems as standard configurations to drive continued growth in our user base, which

in turn fuels algorithmic improvements, creating a positive feedback loop that allows us to constantly enhance users’ autonomous

driving experiences. As of June 30, 2024, the usage penetration rate of our autonomous driving function has reached 99.9%, with

cumulative full scenario NOA mileage reaching 860 million kilometers.

Environmental,

Social and Governance (ESG)

We

are committed to promoting sustainable development of the company, the environment, and society through comprehensive ESG strategies

and initiatives. On April 12, 2024, we released our 2023 ESG report, detailing the efforts made in 2023 to achieve our long-term

ESG objectives. For more information on our ESG initiatives and to access the complete ESG report in simplified Chinese, traditional

Chinese, and English, please visit the ESG section of our investor relations website at https://ir.lixiang.com/esg.

Recent Developments

After the Reporting Period

Delivery Update

In

July 2024, the Company delivered 51,000 vehicles, representing an increase of 49.4% from July 2023. As of July 31, 2024,

in China, the Company had 487 retail stores in 146 cities, 411 servicing centers and Li Auto-authorized body and paint shops operating

in 220 cities, and 701 super charging stations in operation equipped with 3,260 charging stalls.

OTA 6.0 and 6.1

Updates

In

July 2024, the Company released OTA update versions 6.0 and 6.1 for Li MEGA and the Li L series, introducing numerous new features

and experience enhancements in autonomous driving, smart space and smart electric features. For autonomous driving, the Company rolled

out a high-definition map-independent NOA with nationwide coverage to all Li AD Max users and significantly enhanced the city LCC and

AEB capabilities for Li AD Pro. During its Autonomous Driving Summer Launch Event held on July 5, 2024, the Company unveiled a new

technological architecture for autonomous driving integrating an end-to-end (E2E) model and a vision-language model (VLM). This architecture

employs proprietary reconstructed and generative world models for training and validation, and began an early bird testing at the end

of July.

Product Health

Evaluation Results

In

July 2024, Li MEGA received the highest overall score in the China Automobile Health Index (C-AHI) assessment by the China Automotive

Engineering Research Institute Co., Ltd. under C-AHI’s updated evaluation protocol. Li MEGA received top ratings across all

three evaluation categories — the Clean Air Index, the Health Protection

Index, and the Energy Efficiency and Emission Index.

Business Outlook

In

the second half of 2024, we will continue to focus on enhancing user value and operating efficiency, further solidifying the market leadership

position of Li L series in terms of sales, while actively planning the BEV series.

To

support our multi-platform and multi-model development, we will continue to strengthen the collaboration across research and development,

supply chain, manufacturing, and sales. While persisting in investment in research and development, we will continually expand and upgrade

our direct sales and servicing network and accelerate the deployment of the super charging network. We are dedicated to enhancing vehicle

use experiences for family users through continued innovation in the fields of autonomous driving, smart space, and smart electrification,

as well as by offering higher quality products and services.

We

are confident that, with in-depth user insights, compelling product strength, combined with improved operating efficiency, Li Auto will

further expand its share in the RMB200,000 and higher NEV market in China, and drive healthy and steady growth in the ever-changing market

environment.

MANAGEMENT DISCUSSION

AND ANALYSIS

| | |

For the Six Months

Ended June 30, | |

| | |

2023 | | |

2024 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| | |

(RMB in thousands) | |

| Revenues | |

| | |

| |

| Vehicle sales | |

46,299,260 | | |

54,571,281 | |

| Other sales and services | |

1,140,520 | | |

2,740,775 | |

| | |

| | |

| |

| Total revenues | |

47,439,780 | | |

57,312,056 | |

| | |

| | |

| |

| Cost of sales | |

| | |

| |

| Vehicle sales | |

(36,789,230 | ) | |

(44,197,162 | ) |

| Other sales and services | |

(585,166 | ) | |

(1,653,647 | ) |

| | |

| | |

| |

| Total cost of sales | |

(37,374,396 | ) | |

(45,850,809 | ) |

| | |

| | |

| |

| Gross profit | |

10,065,384 | | |

11,461,247 | |

| | |

| | |

| |

| Operating expenses: | |

| | |

| |

| Research and development expenses | |

(4,277,897 | ) | |

(6,076,467 | ) |

| Selling, general and administrative expenses | |

(3,954,517 | ) | |

(5,792,690 | ) |

| Other operating income,

net | |

198,103 | | |

291,037 | |

| | |

| | |

| |

| Total operating expenses | |

(8,034,311 | ) | |

(11,578,120 | ) |

| | |

| | |

| |

| Income/(Loss) from operations | |

2,031,073 | | |

(116,873 | ) |

| | |

| | |

| |

| Other (expense)/income: | |

| | |

| |

| Interest expense | |

(60,878 | ) | |

(71,829 | ) |

| Interest income and investment income, net | |

848,793 | | |

1,438,922 | |

| Others, net | |

505,779 | | |

603,421 | |

| | |

| | |

| |

| Income before income tax | |

3,324,767 | | |

1,853,641 | |

| Income tax expense | |

(80,832 | ) | |

(161,575 | ) |

| | |

| | |

| |

| Net income | |

3,243,935 | | |

1,692,066 | |

| | |

| | |

| |

| Less: Net income/(loss)

attributable to noncontrolling interests | |

21,114 | | |

(3,085 | ) |

| | |

| | |

| |

| Net income attributable to

ordinary shareholders of Li Auto Inc. | |

3,222,821 | | |

1,695,151 | |

| | |

| | |

| |

| Net income | |

3,243,935 | | |

1,692,066 | |

| | |

| | |

| |

| Other comprehensive loss | |

| | |

| |

| Foreign currency translation

adjustment, net of tax | |

(93,202 | ) | |

(47,492 | ) |

| Total other comprehensive loss | |

(93,202 | ) | |

(47,492 | ) |

| | |

| | |

| |

| Total comprehensive income | |

3,150,733 | | |

1,644,574 | |

| Less: Net income/(loss)

attributable to noncontrolling interests | |

21,114 | | |

(3,085 | ) |

| | |

| | |

| |