false000175670100017567012025-01-272025-01-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 27, 2025 |

LINKBANCORP, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Pennsylvania |

001-41505 |

82-5130531 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1250 Camp Hill Bypass, Suite 202 |

|

Camp Hill, Pennsylvania |

|

17011 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 855 569-2265 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 |

|

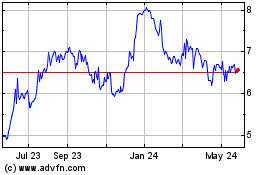

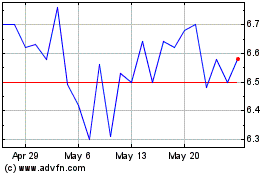

LNKB |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 27, 2025, LINKBANCORP, Inc. (the “Company”) issued a press release reporting its financial results as of and for the three and twelve months ended December 31, 2024.

A copy of the press release is attached as Exhibit 99.1 to this report and is being furnished to the Securities and Exchange Commission and shall not be deemed filed for any purpose.

Item 7.01 Regulation FD

A copy of LINKBANCORP, Inc.’s investor presentation based on December 31, 2024 financial information is furnished as Exhibit 99.2 hereto.

The information in Exhibit 99.2 to this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, or otherwise subject to the liabilities thereof, nor shall it be deemed to be incorporated by reference in any filing under the Securities and Exchange Act of 1934 or under the Securities Act of 1933, except to the extent specifically provided in any such filing.

Item 8.01 Other Events.

On January 23, 2025, the Board of Directors of LINKBANCORP, Inc. (the “Company”) declared a quarterly cash dividend of $0.075 per share, payable on March 14, 2025 to shareholders of record at the close of business on February 28, 2025.

Item 9.01 Financial Statements and Exhibits.

|

|

(a) |

Financial statements of businesses acquired. None. |

(b) |

Pro forma financial information. None. |

(c) |

Shell company transactions. None. |

(d) |

Exhibits. |

|

99.1 Press release dated January 27, 2025 |

|

99.2 Investor Presentation |

|

104 Cover Page Interactive Data File (embedded in the cover page formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

LINKBANCORP, INC. |

|

|

|

|

Date: |

January 27, 2025 |

By: |

/s/ Carl D. Lundblad |

|

|

|

Carl D. Lundblad

President |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Contact:

Nicole Davis

Corporate and Investor Relations Officer

717.803.8895

IR@LINKBANCORP.COM

LINKBANCORP, Inc. Announces Record Fourth Quarter 2024 and Full Year 2024 Financial Results and Declares Dividend

January 27, 2025 – HARRISBURG, PA – LINKBANCORP, Inc. (NASDAQ: LNKB) (the “Company”), the parent company of LINKBANK (the “Bank”) reported record net income of $7.6 million, or $0.20 per diluted share, for the quarter ended December 31, 2024, compared to net income of $7.1 million, or $0.19 per diluted share, for the quarter ended September 30, 2024. Excluding expenses associated with the pending sale of its New Jersey branches and branch consolidations, adjusted earnings were $7.6 million1, or $0.211 per diluted share for the fourth quarter of 2024, compared with $7.2 million1, or $0.191 per diluted share for the third quarter of 2024. Net income for the year ended December 31, 2024 was $26.2 million, or $0.71 per diluted share. Excluding merger and restructuring related expenses, adjusted net income was $26.91 million, or $0.731 per diluted share for the year ended December 31, 2024.

Additionally, the Company announced that the Board of Directors declared a quarterly cash dividend of $0.075 per share of common stock which is expected to be paid on March 14, 2025 to shareholders of record on February 28, 2025.

Fourth Quarter 2024 Highlights

•Annualized return on average assets was 1.06% for the fourth quarter of 2024, compared to 1.00% for the third quarter of 2024. Adjusted return on average assets was 1.07%1 for the fourth quarter of 2024, compared to 1.02%1 for the third quarter of 2024.

1 See Appendix A — Reconciliation to Non-GAAP Financial Measures for the computation of this non-GAAP measure.

2 Total loans and total deposits include balances held for sale in the Branch Sale of $91.8 million and $93.6 million, respectively, at December 31, 2024. These balances were $102.3 million and $94.0 million, respectively, at September 30, 2024. Average deposits include deposits held for sale in the Branch Sale.

•Excluding deposits held for sale, total deposits2 increased $161.8 million, or 7.36%, from $2.20 billion at December 31, 2023 to $2.36 billion at December 31, 2024. While total deposits decreased slightly quarter over quarter, average deposits2grew $26.9 million from $2.35 billion for the quarter ended September 30, 2024 to $2.38 billion for the quarter ended December 31, 2024. Excluding loans held for sale, total loans2 increased $127.5 million, or 5.99% from $2.13 billion at December 31, 2023 to $2.26 billion at December 31, 2024.

•Net interest margin expanded to 3.85% for the fourth quarter of 2024 from 3.82% for the third quarter of 2024. For the full year, net interest margin expanded 79 basis points to 3.88% for the year ended December 31, 2024 from 3.09% for the year ended December 31, 2023.

•Net interest income before provision for credit losses improved to $25.5 million for the fourth quarter of 2024 compared to $25.0 million for the third quarter of 2024.

•Noninterest expense decreased $150 thousand quarter over quarter to $18.3 million for the fourth quarter of 2024. The Company’s efficiency ratio continued to improve to 65.04% for the fourth quarter of 2024 compared to 66.71% for the third quarter of 2024 and 72.33% for the first quarter of 2024 as the Company continues to execute on post-merger cost-saving initiatives.

•On May 9, 2024, the Company announced that LINKBANK had entered into a definitive purchase and assumption agreement for the sale of the Bank’s banking operations and three branches in New Jersey, including related loans and deposits (the “Branch Sale”) to American Heritage Federal Credit Union. The Federal Deposit Insurance Corporation (“FDIC”) has approved the Branch Sale and the transaction is expected to close in the first quarter of 2025, subject to customary closing conditions, including regulatory approval from the National Credit Union Administration (“NCUA”).

1 See Appendix A — Reconciliation to Non-GAAP Financial Measures for the computation of this non-GAAP measure.

As a result of the Branch Sale announcement, associated loans and deposits were reclassified as held for sale, impacting the Company’s allowance for credit losses and purchase accounting amortization related to the loans held for sale.

“We are very pleased to announce record earnings for both the fourth quarter and the full year 2024, after a full year of implementing and executing on strategic initiatives to improve our performance. Our teams have continued to focus on reducing costs, generating additional fee income and growing interest income with solid growth in quality loans and core deposits throughout the year,” said Andrew Samuel, Chief Executive Officer of LINKBANCORP. “As we move into 2025, we are excited to continue to leverage the talent we have in place with an emphasis on operational efficiency and further earnings growth.”

Income Statement

Net interest income before the provision for credit losses for the fourth quarter of 2024 was $25.5 million compared to $25.0 million in the third quarter of 2024. Net interest margin expanded to 3.85% for the fourth quarter of 2024 compared to 3.82% for the third quarter of 2024. The improvement in net interest margin was driven by a 10 basis points decrease in cost of funds to 2.32% for the fourth quarter of 2024 compared to 2.42% for the third quarter of 2024, while the average yield on interest earning assets decreased seven basis points to 6.09% for the fourth quarter of 2024 from 6.16% for the third quarter of 2024 due to the cut in the target federal funds rate.

Noninterest income decreased slightly quarter-over-quarter to $2.6 million for the fourth quarter of 2024 compared to $2.7 million for the third quarter of 2024, as decreases in swap fee income and gain on sale of loans were partially offset by continued growth in service charges on deposit accounts.

Noninterest expense for the fourth quarter of 2024 was $18.3 million compared to $18.5 million for the third quarter of 2024. Excluding one-time costs associated with the Branch Sale and branch consolidations of $56 thousand in the fourth quarter of 2024 and $171 thousand in the third quarter of 2024, adjusted noninterest expense was generally flat at $18.3 million1 for the third and fourth quarter of 2024, as increases in salaries and employee benefits and equipment and data processing costs were offset by decreases in professional fees and FDIC deposit insurance and supervisory fees. The increase in salaries and employee benefits was primarily

1 See Appendix A — Reconciliation to Non-GAAP Financial Measures for the computation of this non-GAAP measure.

related to a $250 thousand expense resulting from a change in paid time off (PTO) accrual policy.

Income tax expense was $2.1 million for the fourth quarter of 2024, reflecting an effective tax rate of 21.9%.

Balance Sheet

Total assets were $2.88 billion at December 31, 2024 compared to $2.88 billion at September 30, 2024 and $2.67 billion at December 31, 2023. Deposits and net loans as of December 31, 2024 totaled $2.36 billion and $2.23 billion, respectively, compared to deposits and net loans of $2.37 billion and $2.19 billion, respectively, at September 30, 2024 and $2.20 billion and $2.10 billion, respectively, at December 31, 2023. Deposits and net loans exclude balances held for sale in the Branch Sale of $93.6 million and $91.8 million, respectively, at December 31, 2024, which are reflected in liabilities held for sale and assets held for sale. These balances were $94.0 million and $102.3 million respectively, at September 30, 2024.

Including loans held for sale, total loans increased $29.4 million, from $2.32 billion at September 30, 2024 to $2.35 billion at December 31, 2024. Total commercial loan commitments for the fourth quarter of 2024 were $176.3 million with funded balances of $93.7 million. The average commercial loan commitment originated during the fourth quarter of 2024 totaled approximately $979 thousand with an average outstanding funded balance of $521 thousand.

Including deposits held for sale, total deposits at December 31, 2024 totaled $2.45 billion, a decrease of $12.5 million from $2.47 billion at September 30, 2024. Average deposits increased $26.9 million from $2.35 billion for the quarter ended September 30, 2024 to $2.38 billion for the quarter ended December 31, 2024. Noninterest bearing deposits totaled $686.5 million at December 31, 2024, representing 28.0% of total deposits.

The Company continues to focus on maintaining strong on-balance sheet liquidity, as cash and cash equivalents increased to $166.1 million at December 31, 2024 compared to $80.2 million at December 31, 2023.

Shareholders’ equity increased from $277.4 million at September 30, 2024 to $280.2 million at December 31, 2024 primarily as a result of a $4.8 million increase in retained earnings offset by a $2.3 million increase in accumulated other comprehensive loss resulting from the rate

1 See Appendix A — Reconciliation to Non-GAAP Financial Measures for the computation of this non-GAAP measure.

environment. Book value per share increased to $7.50 at December 31, 2024 compared to $7.42 at September 30, 2024. Tangible book value per share increased to $5.36 at December 31, 2024 compared to $5.26 at September 30, 2024 and $4.90 at December 31, 20231, representing 9.4% annual growth.

Asset Quality

The Company recorded a $132 thousand provision for credit losses during the fourth quarter of 2024, after recording a $84 thousand provision for credit losses in the third quarter of 2024.

As of December 31, 2024, the Company’s non-performing assets were $17.2 million, representing 0.60% of total assets, compared to $17.4 million, representing 0.60% of total assets at September 30, 2024.

Loans 30-89 days past due at December 31, 2024 were $4.6 million, representing 0.21% of total loans compared to $2.7 million or 0.12% of total loans at September 30, 2024 and $4.7 million or 0.22% of total loans at December 31, 2023.

The allowance for credit losses-loans was $26.4 million, or 1.17% of total loans held for investment at December 31, 2024, compared to $26.5 million, or 1.20% of total loans held for investment at September 30, 2024. The allowance for credit losses-loans to nonperforming assets ratio was 153.95% at December 31, 2024, compared to 152.73% at September 30, 2024.

Capital

The Bank’s regulatory capital ratios were well in excess of regulatory minimums to be considered “well capitalized” as of December 31, 2024. The Bank’s Total Capital Ratio and Tier 1 Capital Ratio were 11.55% and 10.74% respectively, at December 31, 2024, compared to 11.44% and 10.62%, respectively, at September 30, 2024 and 10.62% and 9.92%, respectively, at December 31, 2023. The Company’s ratio of Tangible Common Equity to Tangible Assets was 7.16%1 at December 31, 2024.

1 See Appendix A — Reconciliation to Non-GAAP Financial Measures for the computation of this non-GAAP measure.

ABOUT LINKBANCORP, Inc.

LINKBANCORP, Inc. was formed in 2018 with a mission to positively impact lives through community banking. Its subsidiary bank, LINKBANK, is a Pennsylvania state-chartered bank serving individuals, families, nonprofits and business clients throughout Pennsylvania, Maryland, Delaware, Virginia, and New Jersey through 26 client solutions centers and www.linkbank.com. LINKBANCORP, Inc. common stock is traded on the Nasdaq Capital Market under the symbol "LNKB". For further company information, visit ir.linkbancorp.com.

Forward Looking Statements

This press release contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of current or historical fact and involve substantial risks and uncertainties. Words such as "anticipates," "believes," "estimates," "expects," "forecasts," "intends," "plans," "projects," "may," "will," "should," and other similar expressions can be used to identify forward-looking statements. Such statements are subject to factors that could cause actual results to differ materially from anticipated results. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements include, but are not limited to the following: costs or difficulties associated with newly developed or acquired operations; risks related to the integration of the Partners Merger; the timing and receipt of regulatory approvals to complete the Branch Sale; changes in general economic trends, including inflation and changes in interest rates; increased competition; changes in consumer demand for financial services; our ability to control costs and expenses; adverse developments in borrower industries and, in particular, declines in real estate values; changes in and compliance with federal and state laws that regulate our business and capital levels; our ability to raise capital as needed; and the effects of any cybersecurity breaches. The Company does not undertake, and specifically disclaims, any obligation to publicly revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. Accordingly, you should not place undue reliance on forward-looking statements.

1 See Appendix A — Reconciliation to Non-GAAP Financial Measures for the computation of this non-GAAP measure.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINKBANCORP, Inc. and Subsidiaries |

|

Consolidated Balance Sheet (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

(In Thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing cash equivalents |

|

$ |

13,834 |

|

|

$ |

15,295 |

|

|

$ |

14,516 |

|

|

$ |

13,552 |

|

|

$ |

13,089 |

|

Interest-bearing deposits with other institutions |

|

|

152,266 |

|

|

|

175,937 |

|

|

|

167,141 |

|

|

|

158,731 |

|

|

|

67,101 |

|

Cash and cash equivalents |

|

|

166,100 |

|

|

|

191,232 |

|

|

|

181,657 |

|

|

|

172,283 |

|

|

|

80,190 |

|

Securities available for sale, at fair value |

|

|

145,590 |

|

|

|

149,315 |

|

|

|

140,121 |

|

|

|

133,949 |

|

|

|

115,490 |

|

Securities held to maturity, net of allowance for credit losses |

|

|

31,508 |

|

|

|

34,155 |

|

|

|

35,343 |

|

|

|

36,109 |

|

|

|

36,223 |

|

Loans receivable, gross |

|

|

2,255,749 |

|

|

|

2,215,868 |

|

|

|

2,193,197 |

|

|

|

2,129,919 |

|

|

|

2,128,284 |

|

Allowance for credit losses - loans |

|

|

(26,435 |

) |

|

|

(26,542 |

) |

|

|

(26,288 |

) |

|

|

(23,842 |

) |

|

|

(23,767 |

) |

Loans receivable, net |

|

|

2,229,314 |

|

|

|

2,189,326 |

|

|

|

2,166,909 |

|

|

|

2,106,077 |

|

|

|

2,104,517 |

|

Investments in restricted bank stock |

|

|

5,209 |

|

|

|

4,904 |

|

|

|

4,928 |

|

|

|

4,286 |

|

|

|

3,965 |

|

Premises and equipment, net |

|

|

18,029 |

|

|

|

17,623 |

|

|

|

18,364 |

|

|

|

20,102 |

|

|

|

20,130 |

|

Right-of-Use Asset – premises |

|

|

14,913 |

|

|

|

14,150 |

|

|

|

13,970 |

|

|

|

14,577 |

|

|

|

15,497 |

|

Bank-owned life insurance |

|

|

52,079 |

|

|

|

51,646 |

|

|

|

49,616 |

|

|

|

49,230 |

|

|

|

48,847 |

|

Goodwill and other intangible assets |

|

|

79,761 |

|

|

|

80,924 |

|

|

|

82,129 |

|

|

|

81,494 |

|

|

|

82,701 |

|

Deferred tax asset |

|

|

22,280 |

|

|

|

21,662 |

|

|

|

22,024 |

|

|

|

22,717 |

|

|

|

24,153 |

|

Assets held for sale |

|

|

94,146 |

|

|

|

104,660 |

|

|

|

118,362 |

|

|

|

118,115 |

|

|

|

115,499 |

|

Accrued interest receivable and other assets |

|

|

22,405 |

|

|

|

20,344 |

|

|

|

25,170 |

|

|

|

26,730 |

|

|

|

22,113 |

|

TOTAL ASSETS |

|

$ |

2,881,334 |

|

|

$ |

2,879,941 |

|

|

$ |

2,858,593 |

|

|

$ |

2,785,669 |

|

|

$ |

2,669,325 |

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand, noninterest bearing |

|

$ |

658,646 |

|

|

$ |

658,473 |

|

|

$ |

661,292 |

|

|

$ |

618,277 |

|

|

$ |

624,780 |

|

Interest bearing |

|

|

1,701,936 |

|

|

|

1,714,179 |

|

|

|

1,699,220 |

|

|

|

1,662,124 |

|

|

|

1,574,019 |

|

Total deposits |

|

|

2,360,582 |

|

|

|

2,372,652 |

|

|

|

2,360,512 |

|

|

|

2,280,401 |

|

|

|

2,198,799 |

|

Long-term borrowings |

|

|

40,000 |

|

|

|

40,000 |

|

|

|

40,000 |

|

|

|

40,000 |

|

|

|

— |

|

Short-term borrowings |

|

|

10,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

10,000 |

|

Note payable |

|

|

565 |

|

|

|

572 |

|

|

|

578 |

|

|

|

584 |

|

|

|

590 |

|

Subordinated debt |

|

|

61,984 |

|

|

|

61,843 |

|

|

|

61,706 |

|

|

|

61,573 |

|

|

|

61,444 |

|

Lease liabilities |

|

|

15,666 |

|

|

|

14,911 |

|

|

|

14,746 |

|

|

|

15,357 |

|

|

|

16,361 |

|

Liabilities held for sale |

|

|

93,777 |

|

|

|

94,228 |

|

|

|

96,916 |

|

|

|

105,716 |

|

|

|

99,777 |

|

Accrued interest payable and other liabilities |

|

|

18,539 |

|

|

|

18,382 |

|

|

|

12,726 |

|

|

|

13,795 |

|

|

|

16,558 |

|

TOTAL LIABILITIES |

|

|

2,601,113 |

|

|

|

2,602,588 |

|

|

|

2,587,184 |

|

|

|

2,517,426 |

|

|

|

2,403,529 |

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Common stock |

|

|

370 |

|

|

|

370 |

|

|

|

370 |

|

|

|

369 |

|

|

|

369 |

|

Surplus |

|

|

264,449 |

|

|

|

264,059 |

|

|

|

263,795 |

|

|

|

263,577 |

|

|

|

263,310 |

|

Retained earnings |

|

|

19,947 |

|

|

|

15,147 |

|

|

|

10,826 |

|

|

|

7,724 |

|

|

|

4,843 |

|

Accumulated other comprehensive loss |

|

|

(4,545 |

) |

|

|

(2,223 |

) |

|

|

(3,582 |

) |

|

|

(3,427 |

) |

|

|

(3,209 |

) |

Total equity attributable to parent |

|

|

280,221 |

|

|

|

277,353 |

|

|

|

271,409 |

|

|

|

268,243 |

|

|

|

265,313 |

|

Noncontrolling interest in consolidated subsidiary |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

483 |

|

TOTAL SHAREHOLDERS' EQUITY |

|

|

280,221 |

|

|

|

277,353 |

|

|

|

271,409 |

|

|

|

268,243 |

|

|

|

265,796 |

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

$ |

2,881,334 |

|

|

$ |

2,879,941 |

|

|

$ |

2,858,593 |

|

|

$ |

2,785,669 |

|

|

$ |

2,669,325 |

|

Common shares outstanding |

|

|

37,370,917 |

|

|

|

37,361,560 |

|

|

|

37,356,278 |

|

|

|

37,348,151 |

|

|

|

37,340,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINKBANCORP, Inc. and Subsidiaries |

|

Consolidated Statements of Operations (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

|

12/31/2024 |

|

|

9/30/2024 |

|

|

12/31/2023 |

|

|

|

|

12/31/2024 |

|

|

12/31/2023 |

|

(In Thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTEREST AND DIVIDEND INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans receivable, including fees |

|

$ |

37,082 |

|

|

$ |

36,856 |

|

|

$ |

21,461 |

|

|

|

|

$ |

146,175 |

|

|

$ |

58,791 |

|

Other |

|

|

3,224 |

|

|

|

3,338 |

|

|

|

1,642 |

|

|

|

|

|

12,549 |

|

|

|

6,407 |

|

Total interest and dividend income |

|

|

40,306 |

|

|

|

40,194 |

|

|

|

23,103 |

|

|

|

|

|

158,724 |

|

|

|

65,198 |

|

INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

12,823 |

|

|

|

13,292 |

|

|

|

7,445 |

|

|

|

|

|

51,033 |

|

|

|

22,638 |

|

Other Borrowings |

|

|

962 |

|

|

|

949 |

|

|

|

727 |

|

|

|

|

|

3,929 |

|

|

|

1,923 |

|

Subordinated Debt |

|

|

976 |

|

|

|

972 |

|

|

|

615 |

|

|

|

|

|

3,868 |

|

|

|

1,926 |

|

Total interest expense |

|

|

14,761 |

|

|

|

15,213 |

|

|

|

8,787 |

|

|

|

|

|

58,830 |

|

|

|

26,487 |

|

NET INTEREST INCOME BEFORE

PROVISION FOR CREDIT LOSSES |

|

|

25,545 |

|

|

|

24,981 |

|

|

|

14,316 |

|

|

|

|

|

99,894 |

|

|

|

38,711 |

|

Provision for credit losses |

|

|

132 |

|

|

|

84 |

|

|

|

9,844 |

|

|

|

|

|

257 |

|

|

|

9,295 |

|

NET INTEREST INCOME AFTER

PROVISION FOR CREDIT LOSSES |

|

|

25,413 |

|

|

|

24,897 |

|

|

|

4,472 |

|

|

|

|

|

99,637 |

|

|

|

29,416 |

|

NONINTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service charges on deposit accounts |

|

|

1,339 |

|

|

|

1,052 |

|

|

|

385 |

|

|

|

|

|

4,036 |

|

|

|

978 |

|

Bank-owned life insurance |

|

|

433 |

|

|

|

430 |

|

|

|

250 |

|

|

|

|

|

1,633 |

|

|

|

738 |

|

Net realized gains (losses) on the sale of debt securities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

4 |

|

|

|

(2,370 |

) |

Gain on sale of loans |

|

|

70 |

|

|

|

138 |

|

|

|

166 |

|

|

|

|

|

270 |

|

|

|

465 |

|

Other |

|

|

752 |

|

|

|

1,060 |

|

|

|

374 |

|

|

|

|

|

2,919 |

|

|

|

1,276 |

|

Total noninterest income |

|

|

2,594 |

|

|

|

2,680 |

|

|

|

1,175 |

|

|

|

|

|

8,862 |

|

|

|

1,087 |

|

NONINTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

10,147 |

|

|

|

9,855 |

|

|

|

8,262 |

|

|

|

|

|

41,061 |

|

|

|

20,612 |

|

Occupancy |

|

|

1,368 |

|

|

|

1,440 |

|

|

|

911 |

|

|

|

|

|

5,945 |

|

|

|

3,015 |

|

Equipment and data processing |

|

|

1,884 |

|

|

|

1,640 |

|

|

|

1,201 |

|

|

|

|

|

7,174 |

|

|

|

3,720 |

|

Professional fees |

|

|

531 |

|

|

|

763 |

|

|

|

536 |

|

|

|

|

|

2,830 |

|

|

|

1,698 |

|

FDIC insurance and supervisory fees |

|

|

687 |

|

|

|

812 |

|

|

|

198 |

|

|

|

|

|

2,396 |

|

|

|

817 |

|

Bank Shares Tax |

|

|

693 |

|

|

|

752 |

|

|

|

323 |

|

|

|

|

|

2,796 |

|

|

|

1,158 |

|

Intangible amortization |

|

|

1,162 |

|

|

|

1,205 |

|

|

|

484 |

|

|

|

|

|

4,778 |

|

|

|

663 |

|

Merger & restructuring expenses |

|

|

56 |

|

|

|

171 |

|

|

|

9,496 |

|

|

|

|

|

914 |

|

|

|

11,176 |

|

Advertising |

|

|

128 |

|

|

|

163 |

|

|

|

61 |

|

|

|

|

|

633 |

|

|

|

329 |

|

Other |

|

|

1,646 |

|

|

|

1,651 |

|

|

|

813 |

|

|

|

|

|

6,377 |

|

|

|

2,644 |

|

Total noninterest expense |

|

|

18,302 |

|

|

|

18,452 |

|

|

|

22,285 |

|

|

|

|

|

74,904 |

|

|

|

45,832 |

|

Income (loss) before income tax expense |

|

|

9,705 |

|

|

|

9,125 |

|

|

|

(16,638 |

) |

|

|

|

|

33,595 |

|

|

|

(15,329 |

) |

Income tax expense (benefit) |

|

|

2,121 |

|

|

|

2,030 |

|

|

|

(3,641 |

) |

|

|

|

|

7,386 |

|

|

|

(3,361 |

) |

NET INCOME (LOSS) |

|

$ |

7,584 |

|

|

$ |

7,095 |

|

|

$ |

(12,997 |

) |

|

|

|

$ |

26,209 |

|

|

$ |

(11,968 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS (LOSS) PER SHARE, BASIC |

|

$ |

0.20 |

|

|

$ |

0.19 |

|

|

$ |

(0.56 |

) |

|

|

|

$ |

0.71 |

|

|

$ |

(0.67 |

) |

EARNINGS (LOSS) PER SHARE, DILUTED |

|

$ |

0.20 |

|

|

$ |

0.19 |

|

|

$ |

(0.56 |

) |

|

|

|

$ |

0.71 |

|

|

$ |

(0.67 |

) |

WEIGHTED-AVERAGE COMMON SHARES

OUTSTANDING, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC |

|

|

37,045,701 |

|

|

|

36,983,637 |

|

|

|

23,063,202 |

|

|

|

|

|

36,990,672 |

|

|

|

17,753,914 |

|

DILUTED |

|

|

37,166,107 |

|

|

|

37,090,111 |

|

|

|

23,063,202 |

|

|

|

|

|

37,105,614 |

|

|

|

17,753,914 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINKBANCORP, Inc. and Subsidiaries |

|

Financial Highlights (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

For the Twelve Months Ended |

|

(Dollars In Thousands, except per share data) |

12/31/2024 |

|

|

9/30/2024 |

|

|

12/31/2023 |

|

|

12/31/2024 |

|

|

12/31/2023 |

|

Operating Highlights |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (loss) |

$ |

7,584 |

|

|

$ |

7,095 |

|

|

$ |

(12,997 |

) |

|

$ |

26,209 |

|

|

$ |

(11,968 |

) |

Net Interest Income |

|

25,545 |

|

|

|

24,981 |

|

|

|

14,316 |

|

|

|

99,894 |

|

|

|

38,711 |

|

Provision for Credit Losses |

|

132 |

|

|

|

84 |

|

|

|

9,844 |

|

|

|

257 |

|

|

|

9,295 |

|

Non-Interest Income |

|

2,594 |

|

|

|

2,680 |

|

|

|

1,175 |

|

|

|

8,862 |

|

|

|

1,087 |

|

Non-Interest Expense |

|

18,302 |

|

|

|

18,452 |

|

|

|

22,285 |

|

|

|

74,904 |

|

|

|

45,832 |

|

Earnings (loss) per Share, Basic |

|

0.20 |

|

|

|

0.19 |

|

|

|

(0.56 |

) |

|

|

0.71 |

|

|

|

(0.67 |

) |

Adjusted Earnings per Share, Basic (2) |

|

0.21 |

|

|

|

0.20 |

|

|

|

0.09 |

|

|

|

0.73 |

|

|

|

0.36 |

|

Earnings (loss) per Share, Diluted |

|

0.20 |

|

|

|

0.19 |

|

|

|

(0.56 |

) |

|

|

0.71 |

|

|

|

(0.67 |

) |

Adjusted Earnings per Share, Diluted (2) |

|

0.21 |

|

|

|

0.19 |

|

|

|

0.09 |

|

|

|

0.73 |

|

|

|

0.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Operating Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Margin |

|

3.85 |

% |

|

|

3.82 |

% |

|

|

3.55 |

% |

|

|

3.88 |

% |

|

|

3.09 |

% |

Annualized Return on Assets ("ROA") |

|

1.06 |

% |

|

|

1.00 |

% |

|

|

-2.96 |

% |

|

|

0.94 |

% |

|

|

-0.88 |

% |

Adjusted ROA2 |

|

1.07 |

% |

|

|

1.02 |

% |

|

|

0.49 |

% |

|

|

0.97 |

% |

|

|

0.47 |

% |

Annualized Return on Equity ("ROE") |

|

10.82 |

% |

|

|

10.30 |

% |

|

|

-28.24 |

% |

|

|

9.62 |

% |

|

|

-7.88 |

% |

Adjusted ROE2 |

|

10.88 |

% |

|

|

10.50 |

% |

|

|

4.70 |

% |

|

|

9.89 |

% |

|

|

4.21 |

% |

Efficiency Ratio |

|

65.04 |

% |

|

|

66.71 |

% |

|

|

143.86 |

% |

|

|

68.87 |

% |

|

|

115.16 |

% |

Adjusted Efficiency Ratio3 |

|

64.84 |

% |

|

|

66.09 |

% |

|

|

82.56 |

% |

|

|

68.04 |

% |

|

|

82.19 |

% |

Noninterest Income to Avg. Assets |

|

0.36 |

% |

|

|

0.38 |

% |

|

|

0.27 |

% |

|

|

0.43 |

% |

|

|

0.08 |

% |

Noninterest Expense to Avg. Assets |

|

2.56 |

% |

|

|

2.61 |

% |

|

|

5.08 |

% |

|

|

3.60 |

% |

|

|

3.38 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12/31/2024 |

|

|

9/30/2024 |

|

|

6/30/2024 |

|

|

3/31/2024 |

|

|

12/31/2023 |

|

Financial Condition Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

$ |

2,881,334 |

|

|

$ |

2,879,941 |

|

|

$ |

2,858,593 |

|

|

$ |

2,785,669 |

|

|

$ |

2,669,325 |

|

Loans Receivable, Net |

|

2,229,314 |

|

|

|

2,189,326 |

|

|

|

2,166,909 |

|

|

|

2,106,077 |

|

|

|

2,104,517 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing Deposits |

|

658,646 |

|

|

|

658,473 |

|

|

|

661,292 |

|

|

|

618,277 |

|

|

|

624,780 |

|

Interest-bearing Deposits |

|

1,701,936 |

|

|

|

1,714,179 |

|

|

|

1,699,220 |

|

|

|

1,662,124 |

|

|

|

1,574,019 |

|

Total Deposits |

|

2,360,582 |

|

|

|

2,372,652 |

|

|

|

2,360,512 |

|

|

|

2,280,401 |

|

|

|

2,198,799 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Balance Sheet Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Capital Ratio1 |

|

11.55 |

% |

|

|

11.44 |

% |

|

|

11.09 |

% |

|

|

11.04 |

% |

|

|

10.62 |

% |

Tier 1 Capital Ratio1 |

|

10.74 |

% |

|

|

10.62 |

% |

|

|

10.30 |

% |

|

|

10.24 |

% |

|

|

9.92 |

% |

Common Equity Tier 1 Capital Ratio1 |

|

10.74 |

% |

|

|

10.62 |

% |

|

|

10.30 |

% |

|

|

10.24 |

% |

|

|

9.92 |

% |

Leverage Ratio1 |

|

9.49 |

% |

|

|

9.41 |

% |

|

|

9.17 |

% |

|

|

9.23 |

% |

|

|

14.13 |

% |

Tangible Common Equity to Tangible Assets4 |

|

7.16 |

% |

|

|

7.02 |

% |

|

|

6.82 |

% |

|

|

6.91 |

% |

|

|

7.08 |

% |

Tangible Book Value per Share5 |

$ |

5.36 |

|

|

$ |

5.26 |

|

|

$ |

5.07 |

|

|

$ |

5.00 |

|

|

$ |

4.90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-performing Assets |

$ |

17,171 |

|

|

$ |

17,378 |

|

|

$ |

10,589 |

|

|

$ |

6,675 |

|

|

$ |

7,250 |

|

Non-performing Assets to Total Assets |

|

0.60 |

% |

|

|

0.60 |

% |

|

|

0.37 |

% |

|

|

0.24 |

% |

|

|

0.27 |

% |

Non-performing Loans to Total Loans |

|

0.76 |

% |

|

|

0.78 |

% |

|

|

0.48 |

% |

|

|

0.31 |

% |

|

|

0.34 |

% |

Allowance for Credit Losses - Loans ("ACLL") |

$ |

26,435 |

|

|

$ |

26,542 |

|

|

$ |

26,288 |

|

|

$ |

23,842 |

|

|

$ |

23,767 |

|

ACLL to Total Loans6 |

|

1.17 |

% |

|

|

1.20 |

% |

|

|

1.20 |

% |

|

|

1.06 |

% |

|

|

1.06 |

% |

ACLL to Nonperforming Assets |

|

153.95 |

% |

|

|

152.73 |

% |

|

|

248.26 |

% |

|

|

357.18 |

% |

|

|

327.82 |

% |

Net chargeoffs (recoveries) |

$ |

252 |

|

|

$ |

(28 |

) |

|

$ |

(20 |

) |

|

$ |

70 |

|

|

$ |

195 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) - These capital ratios have been calculated using bank-level capital |

|

(2) - This is a non-GAAP financial measure. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures at the end of this release. |

|

(3) - The efficiency ratio, as adjusted represents noninterest expense divided by the sum of net interest income and noninterest income, excluding gains or losses from securities sales and merger related expenses. This is a non-GAAP financial measure. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures at the end of this release. |

|

|

|

(4) - We calculate tangible common equity as total shareholders' equity less goodwill and other intangibles, and we calculate tangible assets as total assets less goodwill and other intangibles. This is a non-GAAP financial measure. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures at the end of this release. |

|

(5) - We calculate tangible book value per common share as total shareholders' equity less goodwill and other intangibles, divided by the outstanding number of shares of our common stock at the end of the relevant period. Tangible book value per common share is a non-GAAP financial measure, and, as we calculate tangible book value per common share, the most directly comparable GAAP financial measure is book value per common share. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures at the end of this release. |

|

(6) - The historical ratios have not been recast for the reclassification of loans held for sale. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINKBANCORP, Inc. and Subsidiaries |

|

Net Interest Margin - Quarter-To-Date (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

(Dollars in thousands) |

|

Avg Bal |

|

|

Interest (2) |

|

|

Yield/Rate |

|

|

Avg Bal |

|

|

Interest (2) |

|

|

Yield/Rate |

|

Int. Earn. Cash |

|

$ |

128,802 |

|

|

$ |

1,300 |

|

|

|

4.02 |

% |

|

$ |

63,572 |

|

|

$ |

405 |

|

|

|

2.53 |

% |

Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable (1) |

|

|

138,168 |

|

|

|

1,540 |

|

|

|

4.43 |

% |

|

|

88,632 |

|

|

|

951 |

|

|

|

4.26 |

% |

Tax-Exempt |

|

|

44,958 |

|

|

|

486 |

|

|

|

4.30 |

% |

|

|

38,269 |

|

|

|

362 |

|

|

|

3.75 |

% |

Total Securities |

|

|

183,126 |

|

|

|

2,026 |

|

|

|

4.40 |

% |

|

|

126,901 |

|

|

|

1,313 |

|

|

|

4.10 |

% |

Total Cash Equiv. and Investments |

|

|

311,928 |

|

|

|

3,326 |

|

|

|

4.24 |

% |

|

|

190,473 |

|

|

|

1,718 |

|

|

|

3.58 |

% |

Total Loans (3)(4) |

|

|

2,327,829 |

|

|

|

37,082 |

|

|

|

6.34 |

% |

|

|

1,411,129 |

|

|

|

21,461 |

|

|

|

6.03 |

% |

Total Earning Assets |

|

|

2,639,757 |

|

|

|

40,408 |

|

|

|

6.09 |

% |

|

|

1,601,602 |

|

|

|

23,179 |

|

|

|

5.74 |

% |

Other Assets |

|

|

202,693 |

|

|

|

|

|

|

|

|

|

138,537 |

|

|

|

|

|

|

|

Total Assets |

|

$ |

2,842,450 |

|

|

|

|

|

|

|

|

$ |

1,740,139 |

|

|

|

|

|

|

|

Interest bearing demand(5) |

|

$ |

537,856 |

|

|

$ |

3,043 |

|

|

|

2.25 |

% |

|

$ |

328,342 |

|

|

$ |

1,746 |

|

|

|

2.11 |

% |

Money market demand(5) |

|

|

567,593 |

|

|

|

3,139 |

|

|

|

2.20 |

% |

|

|

367,821 |

|

|

|

2,287 |

|

|

|

2.47 |

% |

Time deposits(5) |

|

|

607,231 |

|

|

|

6,641 |

|

|

|

4.35 |

% |

|

|

348,580 |

|

|

|

3,412 |

|

|

|

3.88 |

% |

Total Borrowings |

|

|

153,117 |

|

|

|

1,938 |

|

|

|

5.04 |

% |

|

|

113,492 |

|

|

|

1,342 |

|

|

|

4.69 |

% |

Total Interest-Bearing Liabilities |

|

|

1,865,797 |

|

|

|

14,761 |

|

|

|

3.15 |

% |

|

|

1,158,235 |

|

|

|

8,787 |

|

|

|

3.01 |

% |

Non Interest-Bearing Deposits(5) |

|

|

665,276 |

|

|

|

|

|

|

|

|

|

371,051 |

|

|

|

|

|

|

|

Total Cost of Funds |

|

$ |

2,531,073 |

|

|

$ |

14,761 |

|

|

|

2.32 |

% |

|

$ |

1,529,286 |

|

|

$ |

8,787 |

|

|

|

2.28 |

% |

Other Liabilities |

|

|

32,493 |

|

|

|

|

|

|

|

|

|

28,244 |

|

|

|

|

|

|

|

Total Liabilities |

|

$ |

2,563,566 |

|

|

|

|

|

|

|

|

$ |

1,557,530 |

|

|

|

|

|

|

|

Shareholders' Equity |

|

$ |

278,884 |

|

|

|

|

|

|

|

|

$ |

182,609 |

|

|

|

|

|

|

|

Total Liabilities & Shareholders' Equity |

|

$ |

2,842,450 |

|

|

|

|

|

|

|

|

$ |

1,740,139 |

|

|

|

|

|

|

|

Net Interest Income/Spread (FTE) |

|

|

|

|

|

25,647 |

|

|

|

2.94 |

% |

|

|

|

|

|

14,392 |

|

|

|

2.73 |

% |

Tax-Equivalent Basis Adjustment |

|

|

|

|

|

(102 |

) |

|

|

|

|

|

|

|

|

(76 |

) |

|

|

|

Net Interest Income |

|

|

|

|

$ |

25,545 |

|

|

|

|

|

|

|

|

$ |

14,316 |

|

|

|

|

Net Interest Margin |

|

|

|

|

|

|

|

|

3.85 |

% |

|

|

|

|

|

|

|

|

3.55 |

% |

(1) Taxable income on securities includes income from available for sale securities and income from certificates of deposits with other banks. |

|

(2) Income stated on a tax equivalent basis which is a non-GAAP measure and reconciled to GAAP at the bottom of the table |

|

(3) Includes the balances of nonaccrual loans |

|

(4) Includes the balances of loans held for sale |

|

(5) Includes the balances of deposits held for sale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINKBANCORP, Inc. and Subsidiaries |

|

Net Interest Margin - Linked Quarter-To-Date (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

|

December 31, 2024 |

|

|

September 30, 2024 |

|

(Dollars in thousands) |

|

Avg Bal |

|

|

Interest (2) |

|

|

Yield/Rate |

|

|

Avg Bal |

|

|

Interest (2) |

|

|

Yield/Rate |

|

Int. Earn. Cash |

|

$ |

128,802 |

|

|

$ |

1,300 |

|

|

|

4.02 |

% |

|

$ |

114,383 |

|

|

$ |

1,296 |

|

|

|

4.51 |

% |

Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable (1) |

|

|

138,168 |

|

|

|

1,540 |

|

|

|

4.43 |

% |

|

|

133,443 |

|

|

|

1,683 |

|

|

|

5.02 |

% |

Tax-Exempt |

|

|

44,958 |

|

|

|

486 |

|

|

|

4.30 |

% |

|

|

42,800 |

|

|

|

453 |

|

|

|

4.21 |

% |

Total Securities |

|

|

183,126 |

|

|

|

2,026 |

|

|

|

4.40 |

% |

|

|

176,243 |

|

|

|

2,136 |

|

|

|

4.82 |

% |

Total Cash Equiv. and Investments |

|

|

311,928 |

|

|

|

3,326 |

|

|

|

4.24 |

% |

|

|

290,626 |

|

|

|

3,432 |

|

|

|

4.70 |

% |

Total Loans (3)(4) |

|

|

2,327,829 |

|

|

|

37,082 |

|

|

|

6.34 |

% |

|

|

2,313,228 |

|

|

|

36,856 |

|

|

|

6.34 |

% |

Total Earning Assets |

|

|

2,639,757 |

|

|

|

40,408 |

|

|

|

6.09 |

% |

|

|

2,603,854 |

|

|

|

40,288 |

|

|

|

6.16 |

% |

Other Assets |

|

|

202,693 |

|

|

|

|

|

|

|

|

|

208,407 |

|

|

|

|

|

|

|

Total Assets |

|

$ |

2,842,450 |

|

|

|

|

|

|

|

|

$ |

2,812,261 |

|

|

|

|

|

|

|

Interest bearing demand(5) |

|

$ |

537,856 |

|

|

|

3,043 |

|

|

|

2.25 |

% |

|

$ |

497,100 |

|

|

$ |

2,902 |

|

|

|

2.32 |

% |

Money market demand(5) |

|

|

567,593 |

|

|

|

3,139 |

|

|

|

2.20 |

% |

|

|

580,766 |

|

|

|

3,396 |

|

|

|

2.33 |

% |

Time deposits(5) |

|

|

607,231 |

|

|

|

6,641 |

|

|

|

4.35 |

% |

|

|

613,402 |

|

|

|

6,993 |

|

|

|

4.54 |

% |

Total Borrowings |

|

|

153,117 |

|

|

|

1,938 |

|

|

|

5.04 |

% |

|

|

153,699 |

|

|

|

1,922 |

|

|

|

4.97 |

% |

Total Interest-Bearing Liabilities |

|

|

1,865,797 |

|

|

|

14,761 |

|

|

|

3.15 |

% |

|

|

1,844,967 |

|

|

|

15,213 |

|

|

|

3.28 |

% |

Non Interest-Bearing Deposits(5) |

|

|

665,276 |

|

|

|

|

|

|

|

|

|

659,825 |

|

|

|

|

|

|

|

Total Cost of Funds |

|

$ |

2,531,073 |

|

|

$ |

14,761 |

|

|

|

2.32 |

% |

|

$ |

2,504,792 |

|

|

$ |

15,213 |

|

|

|

2.42 |

% |

Other Liabilities |

|

|

32,493 |

|

|

|

|

|

|

|

|

|

33,534 |

|

|

|

|

|

|

|

Total Liabilities |

|

$ |

2,563,566 |

|

|

|

|

|

|

|

|

$ |

2,538,326 |

|

|

|

|

|

|

|

Shareholders' Equity |

|

$ |

278,884 |

|

|

|

|

|

|

|

|

$ |

273,935 |

|

|

|

|

|

|

|

Total Liabilities & Shareholders' Equity |

|

$ |

2,842,450 |

|

|

|

|

|

|

|

|

$ |

2,812,261 |

|

|

|

|

|

|

|

Net Interest Income/Spread (FTE) |

|

|

|

|

|

25,647 |

|

|

|

2.94 |

% |

|

|

|

|

|

25,075 |

|

|

|

2.88 |

% |

Tax-Equivalent Basis Adjustment |

|

|

|

|

|

(102 |

) |

|

|

|

|

|

|

|

|

(94 |

) |

|

|

|

Net Interest Income |

|

|

|

|

$ |

25,545 |

|

|

|

|

|

|

|

|

$ |

24,981 |

|

|

|

|

Net Interest Margin |

|

|

|

|

|

|

|

|

3.85 |

% |

|

|

|

|

|

|

|

|

3.82 |

% |

(1) Taxable income on securities includes income from available for sale securities and income from certificates of deposits with other banks. |

|

(2) Income stated on a tax equivalent basis which is a non-GAAP measure and reconciled to GAAP at the bottom of the table |

|

(3) Includes the balances of nonaccrual loans |

|

(4) Includes the balances of loans held for sale |

|

(5) Includes the balances of deposits held for sale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINKBANCORP, Inc. and Subsidiaries |

|

Net Interest Margin - Year-To-Date (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Twelve Months Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

(Dollars in thousands) |

|

Avg Bal |

|

|

Interest (2) |

|

|

Yield/Rate |

|

|

Avg Bal |

|

|

Interest (2) |

|

|

Yield/Rate |

|

Int. Earn. Cash |

|

$ |

111,790 |

|

|

$ |

4,890 |

|

|

|

4.37 |

% |

|

$ |

55,501 |

|

|

$ |

1,966 |

|

|

|

3.54 |

% |

Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable (1) |

|

|

128,140 |

|

|

|

6,206 |

|

|

|

4.84 |

% |

|

|

84,860 |

|

|

|

3,260 |

|

|

|

3.84 |

% |

Tax-Exempt |

|

|

43,134 |

|

|

|

1,839 |

|

|

|

4.26 |

% |

|

|

38,591 |

|

|

|

1,495 |

|

|

|

3.87 |

% |

Total Securities |

|

|

171,274 |

|

|

|

8,045 |

|

|

|

4.70 |

% |

|

|

123,451 |

|

|

|

4,755 |

|

|

|

3.85 |

% |

Total Cash Equiv. and Investments |

|

|

283,064 |

|

|

|

12,935 |

|

|

|

4.57 |

% |

|

|

178,952 |

|

|

|

6,721 |

|

|

|

3.76 |

% |

Total Loans (3)(4) |

|

|

2,290,618 |

|

|

|

146,175 |

|

|

|

6.38 |

% |

|

|

1,071,864 |

|

|

|

58,791 |

|

|

|

5.48 |

% |

Total Earning Assets |

|

|

2,573,682 |

|

|

|

159,110 |

|

|

|

6.18 |

% |

|

|

1,250,816 |

|

|

|

65,512 |

|

|

|

5.24 |

% |

Other Assets |

|

|

205,568 |

|

|

|

|

|

|

|

|

|

106,267 |

|

|

|

|

|

|

|

Total Assets |

|

$ |

2,779,250 |

|

|

|

|

|

|

|

|

$ |

1,357,083 |

|

|

|

|

|

|

|

Interest bearing demand(5) |

|

$ |

476,686 |

|

|

$ |

10,344 |

|

|

|

2.17 |

% |

|

$ |

269,615 |

|

|

$ |

5,684 |

|

|

|

2.11 |

% |

Money market demand(5) |

|

|

579,232 |

|

|

|

12,981 |

|

|

|

2.24 |

% |

|

|

278,418 |

|

|

|

7,053 |

|

|

|

2.53 |

% |

Time deposits(5) |

|

|

617,894 |

|

|

|

27,708 |

|

|

|

4.48 |

% |

|

|

301,101 |

|

|

|

9,901 |

|

|

|

3.29 |

% |

Total Borrowings |

|

|

149,572 |

|

|

|

7,797 |

|

|

|

5.21 |

% |

|

|

90,468 |

|

|

|

3,849 |

|

|

|

4.25 |

% |

Total Interest-Bearing Liabilities |

|

|

1,823,384 |

|

|

|

58,830 |

|

|

|

3.23 |

% |

|

|

939,602 |

|

|

|

26,487 |

|

|

|

2.82 |

% |

Non Interest-Bearing Deposits(5) |

|

|

653,966 |

|

|

|

|

|

|

|

|

|

245,703 |

|

|

|

|

|

|

|

Total Cost of Funds |

|

$ |

2,477,350 |

|

|

$ |

58,830 |

|

|

|

2.37 |

% |

|

$ |

1,185,305 |

|

|

$ |

26,487 |

|

|

|

2.23 |

% |

Other Liabilities |

|

|

29,515 |

|

|

|

|

|

|

|

|

|

19,850 |

|

|

|

|

|

|

|

Total Liabilities |

|

$ |

2,506,865 |

|

|

|

|

|

|

|

|

$ |

1,205,155 |

|

|

|

|

|

|

|

Shareholders' Equity |

|

$ |

272,385 |

|

|

|

|

|

|

|

|

$ |

151,928 |

|

|

|

|

|

|

|

Total Liabilities & Shareholders' Equity |

|

$ |

2,779,250 |

|

|

|

|

|

|

|

|

$ |

1,357,083 |

|

|

|

|

|

|

|

Net Interest Income/Spread (FTE) |

|

|

|

|

|

100,280 |

|

|

|

2.95 |

% |

|

|

|

|

|

39,025 |

|

|

|

2.42 |

% |

Tax-Equivalent Basis Adjustment |

|

|

|

|

|

(386 |

) |

|

|

|

|

|

|

|

|

(314 |

) |

|

|

|

Net Interest Income |

|

|

|

|

$ |

99,894 |

|

|

|

|

|

|

|

|

$ |

38,711 |

|

|

|

|

Net Interest Margin |

|

|

|

|

|

|

|

|

3.88 |

% |

|

|

|

|

|

|

|

|

3.09 |

% |

(1) Taxable income on securities includes income from available for sale securities and income from certificates of deposits with other banks. |

|

(2) Income stated on a tax equivalent basis which is a non-GAAP measure and reconciled to GAAP at the bottom of the table |

|

(3) Includes the balances of nonaccrual loans |

|

(4) Includes the balances of loans held for sale |

|

(5) Includes the balances of deposits held for sale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINKBANCORP, Inc. and Subsidiaries |

|

Loans Receivable Detail (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In Thousands) |

|

December 31, 2024 |

|

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Agriculture and farmland loans |

|

$ |

67,741 |

|

|

$ |

65,166 |

|

|

$ |

66,937 |

|

|

$ |

67,359 |

|

|

$ |

65,861 |

|

Construction loans |

|

|

158,296 |

|

|

|

175,373 |

|

|

|

201,174 |

|

|

|

194,391 |

|

|

|

178,483 |

|

Commercial & industrial loans |

|

|

252,163 |

|

|

|

241,597 |

|

|

|

247,190 |

|

|

|

218,724 |

|

|

|

238,343 |

|

Commercial real estate loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Multifamily |

|

|

217,331 |

|

|

|

212,444 |

|

|

|

199,740 |

|

|

|

190,146 |

|

|

|

180,788 |

|

Owner occupied |

|

|

493,906 |

|

|

|

500,643 |

|

|

|

492,065 |

|

|

|

489,467 |

|

|

|

501,732 |

|

Non-owner occupied |

|

|

658,615 |

|

|

|

626,030 |

|

|

|

610,649 |

|

|

|

589,731 |

|

|

|

580,972 |

|

Residential real estate loans |

|

|

|

|

|

|

|