Portman Ridge Finance Corporation (Nasdaq: PTMN) (“Portman Ridge”)

and Logan Ridge Finance Corporation (Nasdaq: LRFC) (“Logan Ridge”)

announced today that their boards of directors have established

special committees of independent directors to more fully evaluate

the potential business combination of the two companies that was

previously disclosed in their respective Form 10-Q filings with the

Securities and Exchange Commission (the “SEC”), which may

result in the use of an exchange ratio other than NAV-for-NAV

(including but not limited to relative market price or a fixed

exchange ratio) in connection therewith.

The special committee of Portman Ridge’s board of directors has

retained Keefe, Bruyette & Woods, Inc. as financial

advisor and Stradley Ronon Stevens & Young, LLP as legal

counsel. The special committee of Logan Ridge’s board of directors

has retained Houlihan Lokey, Inc. as financial advisor

and Skadden, Arps, Slate, Meagher & Flom LLP as legal

counsel.

There can be no assurance that Portman Ridge and Logan Ridge

will pursue the potential business combination, or that the

potential business combination will be approved or consummated.

Portman Ridge and Logan Ridge do not intend to disclose further

developments regarding this matter unless and until further

disclosure is determined to be appropriate or necessary.

About Portman Ridge Finance

Corporation

Portman Ridge Finance Corporation (Nasdaq: PTMN) is a

publicly traded, externally managed investment company that has

elected to be regulated as a business development company under the

Investment Company Act of 1940. Portman Ridge’s middle market

investment business originates, structures, finances and manages a

portfolio of term loans, mezzanine investments and selected equity

securities in middle market companies. Portman Ridge’s investment

activities are managed by its investment adviser, Sierra Crest

Investment Management LLC, an affiliate of BC Partners

Advisors, L.P.

Portman Ridge’s filings with the SEC, earnings releases,

press releases and other financial, operational and governance

information are available on Portman Ridge’s website

at https://www.portmanridge.com.

About Logan Ridge Finance Corporation

Logan Ridge Finance Corporation (Nasdaq: LRFC) is a

publicly traded, externally managed investment company that has

elected to be regulated as a business development company under the

Investment Company Act of 1940. Logan Ridge invests primarily in

first lien loans and, to a lesser extent, second lien loans and

equity securities issued by lower middle market companies.

Logan Ridge Finance Corporation is externally managed

by Mount Logan Management, LLC, a wholly owned subsidiary of

Mount Logan Capital Inc.

Logan Ridge’s filings with the SEC, earnings releases,

press releases and other financial, operational and governance

information are available on Logan Ridge’s website

at https://www.loganridgefinance.com.

About BC Partners Advisors L.P. and BC

Partners Credit

BC Partners Advisors L.P. (“BC Partners”) is a leading

international investment firm in private equity, private credit and

real estate strategies. Established in 1986, BC

Partners has played an active role in developing the European

buyout market for three decades. Today, BC

Partners executives operate across markets as an integrated

team through the firm’s offices in North

America and Europe. For more information, please

visit https://www.bcpartners.com/.

BC Partners Credit was launched in February 2017 and

has pursued a strategy focused on identifying attractive credit

opportunities in any market environment and across sectors,

leveraging the deal sourcing and infrastructure made available

from BC Partners.

Cautionary Statement Regarding Forward-Looking

Statements

This press release may contain forward-looking statements. The

matters discussed in this press release, as well as in future oral

and written statements by management of Portman Ridge or Logan

Ridge, that are forward-looking statements are based on current

management expectations that involve substantial risks and

uncertainties which could cause actual results to differ materially

from the results expressed in, or implied by, these forward-looking

statements.

Forward-looking statements relate to future events or our future

financial performance and include, but are not limited to,

projected financial performance, expected development of the

business, plans and expectations about future investments and the

future liquidity of Portman Ridge or Logan Ridge. Forward-looking

statements are generally identified by terminology such as “may,”

“will,” “should,” “expects,” “plans,” “anticipates,” “could,”

“intends,” “target,” “projects,” “outlook”, “contemplates,”

“believes,” “estimates,” “predicts,” “potential” or “continue” or

the negative of these terms or other similar words. Forward-looking

statements are based upon current plans, estimates and expectations

that are subject to risks, uncertainties and assumptions. Should

one or more of these risks or uncertainties materialize, or should

underlying assumptions prove to be incorrect, actual results may

vary materially from those indicated or anticipated by such

forward-looking statements.

In light of these uncertainties, the inclusion of a

forward-looking statement in this press release should not be

regarded as a representation that such plans, estimates,

expectations or objectives will be achieved. The forward-looking

statements should be read in conjunction with the risks and

uncertainties discussed in with respect to Portman Ridge’s and

Logan Ridge’s filings with the SEC, including their most

recent Forms 10-K, Forms 10-Q and other SEC filings.

Portman Ridge and Logan Ridge do not undertake to publicly update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, except as required to

be reported under the rules and regulations of the SEC.

Additional Information and Where to Find It

This document relates to a potential business combination

between Portman Ridge and Logan Ridge. In connection with the

potential business combination, Portman Ridge and Logan Ridge may

file with the SEC and mail to their respective stockholders

documents that contain important information about Portman Ridge,

Logan Ridge and the potential business combination. This

communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities or a solicitation of

any vote or approval. No offer of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of

the Securities Act. STOCKHOLDERS OF PORTMAN RIDGE AND LOGAN

RIDGE ARE URGED TO READ THE DOCUMENTS THAT ARE FILED OR WILL BE

FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO

THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT PORTMAN RIDGE, LOGAN RIDGE AND THE POTENTIAL BUSINESS

COMBINATION. Investors and security holders will be able

to obtain the documents filed with the SEC free of charge at the

SEC’s website at http://www.sec.gov, or, for documents filed by

Portman Ridge, from Portman Ridge’s website at

https://www.portmanridge.com, and, for documents filed by Logan

Ridge, from Logan Ridge’s website at

https://www.loganridgefinance.com.

Contacts

Portman Ridge Finance Corporation650 Madison Avenue, 3rd

floorNew York, NY 10022

Brandon SatorenChief Financial

OfficerBrandon.Satoren@bcpartners.com(212) 891-2880

Patrick SchaferChief Investment

OfficerPatrick.Schafer@bcpartners.com(212) 891-2880

Logan Ridge Finance Corporation650 Madison Avenue, 3rd floorNew

York, NY 10022

Brandon SatorenChief Financial

OfficerBrandon.Satoren@bcpartners.com(212) 891-2880

Patrick SchaferChief Investment

OfficerPatrick.Schafer@bcpartners.com(212) 891-2880

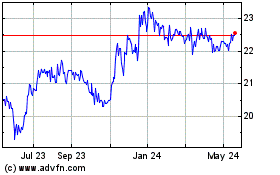

Logan Ridge Finance (NASDAQ:LRFC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Logan Ridge Finance (NASDAQ:LRFC)

Historical Stock Chart

From Mar 2024 to Mar 2025