0001325964

false

0001325964

2023-07-17

2023-07-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported) July

17, 2023

Lightwave Logic, Inc.

(Exact name of registrant as specified in its

charter)

| |

|

|

|

|

| Nevada |

|

001-40766 |

|

82-0497368 |

(State or

other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

369 Inverness Parkway, Suite 350, Englewood,

CO 80112

(Address of principal executive offices, including

Zip Code)

(720) 340-4949

(Registrant’s

telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.001 per share |

|

LWLG |

|

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 5.02

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers

Appointment of Laila Partridge to Board of

Directors

On July

17, 2023, the Board of Directors (the “Board”)

of Lightwave Logic, Inc. (the “Company”)

elected Laila Partridge to serve as a Class III member of the Board. Ms. Partridge’s initial term as a Class III member of

the Board will begin on August 1, 2023 and continue until the Company’s 2026 Annual Meeting of Shareholders or until her successor

is duly appointed.

Ms. Partridge

brings over 30 years of executive experience in technology, corporate innovation and finance to the Board– having worked with a

wide range of technologies, including telecommunications, internet infrastructure, AI, internet of things and more. She was named by Boston

Business Journal as one of the ten “2017 Women to Watch in Science and Technology". She currently serves as Founder and Chief

Executive Officer of The HardTech Project, a new venture with a novel approach to early-stage hardware investing. Previously, she was

Managing Director of the STANLEY + Techstars Accelerator where she directed a global effort for Stanley Black & Decker’s Chief

Technology Officer to identify and invest in innovative technologies for industrial applications with an emphasis on electrification,

sustainability and advanced manufacturing. Prior to that, she began her technology career at Intel Capital, serving as a Director of Strategic

Investments. Ms. Partridge began her career as a VP of Corporate Banking at Wells Fargo, where she led complex corporate finance transactions

for the Company’s senior secured debt agencies in the Midwest.

Ms. Partridge’s

specific Board committee membership and overall compensation for serving as a director on the Board has not yet been determined. Ms. Partridge

will receive compensation commensurate with other non-employee directors of the Company. Once Ms. Partridge’s Board committee membership

and compensation is determined, the Company will file an amendment to this Form 8-K filing under this Item 5.02 containing such information

within four business days after the information is determined.

Item 8.01 Other Events.

Press Release

On July

19, 2023, the Company issued a press release announcing the election of Laila Partridge as a member of the Board. A copy of the press

release is attached as Exhibit 99.1 to this report and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| LIGHTWAVE LOGIC, INC. |

|

| |

|

|

| By: |

/s/ James S. Marcelli |

|

| Name: |

James S. Marcelli |

|

| Title: |

President |

|

Dated: July 19, 2023

Exhibit 99.1

Lightwave

Logic Appoints Respected Industry Executive Laila Partridge to Board of Directors

Laila

Partridge Brings 30+ Years Track Record of Executing Transactions in the Technology Space

ENGLEWOOD,

Colo., July 19, 2023 -- Lightwave Logic, Inc. (NASDAQ: LWLG), a technology platform company leveraging its proprietary electro-optic

(EO) polymers to transmit data at higher speeds with less power in a small form factor, today announced the appointment of respected

industry executive Laila Partridge to Lightwave Logic’s Board of Directors effective August 1, 2023.

Ms.

Partridge brings over 30 years of executive experience in technology, corporate innovation and finance to the Board of Directors –

having worked with a wide range of technologies, including telecommunications, internet infrastructure, AI, internet of things and more.

She was named by Boston Business Journal as one of the ten “2017 Women to Watch in Science and Technology".

She

currently serves as Founder and Chief Executive Officer of The HardTech Project, a new venture with a novel approach to early-stage hardware

investing. Previously, she was Managing Director of the STANLEY + Techstars Accelerator where she directed a global effort for Stanley

Black & Decker’s Chief Technology Officer to identify and invest in innovative technologies for industrial applications with

an emphasis on electrification, sustainability and advanced manufacturing. Prior to that, she began her technology career at Intel Capital,

serving as a Director of Strategic Investments. Ms. Partridge began her career at Wells Fargo, where ultimately achieved the role of

VP of Corporate Banking, having led complex corporate finance transactions for the Company’s senior secured debt agencies in the

Midwest.

Ms.

Partridge brings significant board experience to the Board of Directors, including at Intel Capital serving privately-held technology

companies, and in her current role as an independent Director at Cambridge Trust [NASDAQ: CATC]. She holds a Bachelor’s degree

with Honors from Wellesley College.

Ms.

Partridge stated: “I am excited by the opportunity to join the Board of Lightwave Logic. Their breakthrough technology is a critical

infrastructure ingredient for the next generation of computing. Tools like ChatGPT and Bard are putting unprecedented capabilities into

the hands of the average consumer and as individuals begin exploring those capabilities, the underlying datacenter infrastructure needs

to innovate to support that demand. I look forward to working closely with the Board to offer my decades of experience in helping traditional

industries incorporate disruptive new technologies – including IP licensing and technology transfer business models.”

Michael

Lebby, Chairman and CEO of Lightwave Logic, added: “I am truly excited to have Laila join the Lightwave Logic Board of Directors.

I worked directly with Laila at Intel Capital during the technology boom – where I saw her expedite and navigate technology investments

and business deals in the telecommunications, datacom, and internet markets. Over the past two decades, Laila has deepened her acumen

as a world respected industry executive for innovative technology opportunities utilizing licensing and technology transfer approaches

to monetization. Laila’s experience aligns perfectly with our drive to make electro-optic polymers ubiquitous through our 3-prong

business model of 1) technology transfer and partnering with foundries, transceiver companies etc., 2) selling product with polymer based

photonic integrated circuits (PICs), and 3) commercial licensing of our chromophore materials.”

At

Intel, Laila gained incredible operational experience from sitting on the Itanium™ Executive Launch Team, a 10-member cross-divisional

management team, coordinating and directing all elements of Intel’s 15-year Itanium™

chip family launch. Her appointment to this team was

a result of creating the $253 Million Intel 64 Fund™,

an ecosystem development effort that generated Harvard Business School Case Study N9-800-351.

“Laila’s

knowledge of both the fiber optic communications markets as well as non-communications markets (such as artificial intelligence, consumer,

display, sensing, medical, biotech, etc.), will help Lightwave Logic hone business strategies for growing our electro-optic polymer business,”

concluded Lebby.

About

Lightwave Logic, Inc.

Lightwave

Logic, Inc. (NASDAQ: LWLG) is developing a platform leveraging its proprietary engineered electro-optic (EO) polymers to transmit data

at higher speeds with less power in a small form factor. The company's high-activity and high-stability organic polymers allow Lightwave

Logic to create next-generation photonic EO devices, which convert data from electrical signals into optical signals, for applications

in data communications and telecommunications markets. For more information, please visit the company's website at lightwavelogic.com.

Safe

Harbor Statement

The

information posted in this release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. You can identify these statements by use of the words "may," "will," "should," "plans,"

"explores," "expects," "anticipates," "continue," "estimate," "project,"

"intend," and similar expressions. Forward-looking statements involve risks and uncertainties that could cause actual results

to differ materially from those projected or anticipated. These risks and uncertainties include, but are not limited to, lack of available

funding; general economic and business conditions; competition from third parties; intellectual property rights of third parties; regulatory

constraints; changes in technology and methods of marketing; delays in completing various engineering and manufacturing programs; changes

in customer order patterns; changes in product mix; success in technological advances and delivering technological innovations; shortages

in components; production delays due to performance quality issues with outsourced components; those events and factors described by

us in Item 1.A "Risk Factors" in our most recent Form 10-K and 10-Q; other risks to which our company is subject; other factors

beyond the company's control.

Investor

Relations Contact:

Lucas A. Zimmerman

MZ Group - MZ North America

949-259-4987

LWLG@mzgroup.us

www.mzgroup.us

v3.23.2

Cover

|

Jul. 17, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 17, 2023

|

| Entity File Number |

001-40766

|

| Entity Registrant Name |

Lightwave Logic, Inc.

|

| Entity Central Index Key |

0001325964

|

| Entity Tax Identification Number |

82-0497368

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

369 Inverness Parkway

|

| Entity Address, Address Line Two |

Suite 350

|

| Entity Address, City or Town |

Englewood

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80112

|

| City Area Code |

(720)

|

| Local Phone Number |

340-4949

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

LWLG

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

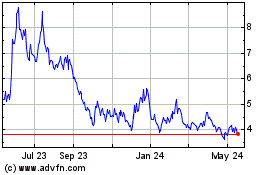

Lightwave Logic (NASDAQ:LWLG)

Historical Stock Chart

From Jan 2025 to Feb 2025

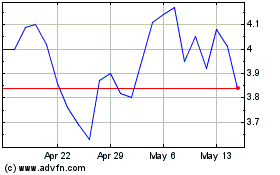

Lightwave Logic (NASDAQ:LWLG)

Historical Stock Chart

From Feb 2024 to Feb 2025