As filed with the Securities and Exchange Commission on February 26, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

LexinFintech Holdings Ltd.

(Exact name of registrant as specified in its charter)

_______________

|

|

|

Cayman Islands |

|

Not Applicable |

(State or other jurisdiction of |

|

(I.R.S. Employer |

incorporation or organization) |

|

Identification Number) |

27/F CES Tower

No. 3099 Keyuan South Road

Nanshan District, Shenzhen 518057

The People’s Republic of China

(Address of Principal Executive Offices and Zip Code)

_______________

2017 Share Incentive Plan

(Full title of the plan)

_______________

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(800) 221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_______________

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

Large accelerated filer |

|

Accelerated filer |

Non-accelerated filer |

|

Smaller reporting company |

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

Copies to:

|

|

James Xigui Zheng Chief Financial Officer LexinFintech Holdings Ltd. 27/F CES Tower No. 3099 Keyuan South Road Nanshan District, Shenzhen 518057 The People’s Republic of China +86 755 3637 8888 |

Haiping Li, Esq. Skadden, Arps, Slate, Meagher & Flom LLP c/o 42/F, Edinburgh Tower The Landmark 15 Queen’s Road Central Hong Kong +852 3740-4700 |

EXPLANATORY NOTE

This Registration Statement is filed by LexinFintech Holdings Ltd. (the “Registrant”) to register additional securities issuable pursuant to the 2017 Share Incentive Plan, as amended (the “2017 Plan”), and consists of only those items required by General Instruction E to Form S-8. The additional securities registered hereby consist of 5,000,000 Class A ordinary shares, par value US$0.0001 per share, representing the number of Class A ordinary shares reserved for future grants under the 2017 Plan, which were not previously registered under the registration statement on Form S-8 as filed with the Securities and Exchange Commission (the “Commission”) on May 31, 2018 (File No. 333-225322). In accordance with General Instruction E to Form S-8, the contents of such earlier registration statement are incorporated herein by reference, except as otherwise set forth herein.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference

The following documents previously filed by the Registrant with the Commission are incorporated by reference herein:

(b)The description of the Registrant’s Class A ordinary shares incorporated by reference in the Registrant’s registration statement on Form 8-A (File No. 001-38328) filed with the Commission on December 13, 2017, which incorporates by reference the description of the Registrant’s Class A ordinary shares set forth in the Registrant’s registration statement on Form F-1 (File No. 333-221509), as amended, originally filed with the Commission on November 13, 2017, including any amendments or reports filed for the purpose of updating such description.

All documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after the date of this registration statement and prior to the filing of a post-effective amendment to this registration statement which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this registration statement and to be part hereof from the date of filing of such documents. Any statement in a document incorporated or deemed to be incorporated by reference in this registration statement will be deemed to be modified or superseded to the extent that a statement contained in this registration statement or in any other later filed document that also is or is deemed to be incorporated by reference modifies or supersedes such statement. Any such statement so modified or superseded will not be deemed, except as so modified or superseded, to be a part of this registration statement.

Item 8. Exhibits

EXHIBIT INDEX

|

|

4.2 |

Registrant’s Specimen American Depositary Receipt (incorporated by reference to Exhibit 4.1 of the registration statement on Form F-1 (file no. 333-221509), as amended, initially filed with the Commission on November 13, 2017) |

4.3 |

Deposit Agreement dated December 20, 2017 among the Registrant, the depositary and holder of the American Depositary Receipts (incorporated by reference to Exhibit 4.3 of the registration statement on Form S-8 (file no. 333-225322) filed with the Commission on May 31, 2018) |

5.1* |

Opinion of Maples and Calder (Hong Kong) LLP, Cayman Islands counsel to the Registrant, regarding the legality of the Class A Ordinary Shares being registered |

10.1* |

2017 Share Incentive Plan (incorporated by reference to Exhibit 10.2 of the registration statement on Form F-1 (file no. 333-221509) filed with the Commission on November 13, 2017) |

23.1* |

Consent of PricewaterhouseCoopers Zhong Tian LLP, an independent registered public accounting firm |

23.2* |

Consent of Maples and Calder (Hong Kong) LLP (included in Exhibit 5.1) |

24.1* |

Power of Attorney (included on signature page hereto) |

107* |

Filing Fee table |

___________

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Shenzhen, China, on February 26, 2024.

|

|

|

|

LexinFintech Holdings Ltd. |

By: |

/s/ Jay Wenjie Xiao |

|

Name: |

Jay Wenjie Xiao |

|

Title: |

Chief Executive Officer and Chairman of the Board |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints, severally and not jointly, each of Jay Wenjie Xiao and James Xigui Zheng, with full power to act alone, as his or her true and lawful attorney-in-fact, with the power of substitution, for and in such person’s name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto each said attorney-in-fact full power and authority to do and perform each and every act and thing requisite and necessary to be done as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that each said attorney-in-fact may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons in the capacities on February 26, 2024.

|

|

|

|

Signature |

Title |

|

|

/s/ Jay Wenjie Xiao Jay Wenjie Xiao |

|

Chief Executive Officer and Chairman of the Board (Principal Executive Officer) |

|

|

/s/ Jared Yi Wu Jared Yi Wu |

|

Director |

|

|

/s/ James Xigui Zheng James Xigui Zheng |

|

Chief Financial Officer and Director (Principal Financial and Accounting Officer) |

|

|

/s/ Suining Xiao Suining Xiao |

|

Director |

|

|

/s/ Wei Wu Wei Wu |

|

Independent Director |

|

|

/s/ Xiaoguang Wu Xiaoguang Wu |

|

Independent Director |

|

|

/s/ Neng Wang Neng Wang |

|

Independent Director |

|

|

/s/ Annabelle Yu Long Annabelle Yu Long |

|

Independent Director |

|

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE IN THE UNITED STATES

Pursuant to the Securities Act of 1933, as amended, the undersigned, the duly authorized representative in the United States of LexinFintech Holdings Ltd. has signed this registration statement or amendment thereto in New York on February 26, 2024.

|

|

|

Authorized U.S. Representative |

|

Cogency Global Inc. |

|

|

By: |

/s/ Coleen A. De Vries |

Name: |

Colleen A. De Vries |

Title: |

Senior Vice President |

LexinFintech Holdings Ltd

No. 3099 Keyuan South Road

Nanshan District, Shenzhen 518057

The People's Republic of China

26 February 2024

Dear Sirs

LexinFintech Holdings Ltd. (the "Company")

We have acted as Cayman Islands legal counsel to the Company in connection with a registration statement on Form S-8 to be filed with the Securities and Exchange Commission (the "Commission") on 26 February 2024 (the "Registration Statement") relating to the registration under the United States Securities Act of 1933, as amended, (the "Securities Act") of 5,000,000 Class A ordinary shares, par value US$0.0001 per share (the "Shares"), issuable by the Company pursuant to the 2017 Share Incentive Plan adopted by the directors of the Company on 30 October 2017 (the "Plan") which term does not include any other document or agreement whether or not specifically referred to therein or attached as an exhibit or schedule thereto).

For the purposes of giving this opinion, we have examined copies of the Registration Statement and the Plan. We have also reviewed copies of the sixth amended and restated memorandum and articles of association of the Company adopted by special resolution on 30 October 2017 and effective immediately prior to the completion of the initial public offering of the Company's American depositary shares representing the Shares (the "Memorandum and Articles"), the written resolutions of the board of directors of the Company passed on 30 October 2017 and the minutes (the "Minutes") of the meeting of the board of directors of the Company held on 21 November 2023 (the "Meeting") and the written resolutions of the shareholders of the Company passed on 30 October 2017 (together, the "Resolutions").

Based upon, and subject to, the assumptions and qualifications set out below, and having regard to such legal considerations as we deem relevant, we are of the opinion that:

1. The Shares to be issued by the Company and registered under the Registration Statement have been duly and validly authorised.

2. When issued and paid for in accordance with the terms of the Plan and in accordance with the Resolutions, and appropriate entries are made in the register of members (shareholders) of the Company, the Shares will be validly issued, fully paid and non-assessable.

In this opinion letter, the phrase "non-assessable" means, with respect to the issuance of the Shares, that a shareholder shall not, in respect of the relevant Shares, have any obligation to make further contributions to the Company's assets (except in exceptional circumstances, such as involving fraud, the establishment of an agency relationship or an illegal or improper purpose or other circumstances in which a court may be prepared to pierce or lift the corporate veil).

These opinions are subject to the qualification that under the Companies Act (As Revised) of the Cayman Islands, the register of members of a Cayman Islands company is by statute regarded as prima facie evidence

of any matters which the Companies Act (As Revised) directs or authorises to be inserted therein. A third party interest in the shares in question would not appear. An entry in the register of members may yield to a court order for rectification (for example, in the event of fraud or manifest error).

These opinions are given only as to, and based on, circumstances and matters of fact existing and known to us on the date of this opinion letter. These opinions only relate to the laws of the Cayman Islands which are in force on the date of this opinion letter. We express no opinion as to the meaning, validity or effect of any references to foreign (i.e. non-Cayman Islands) statutes, rules, regulations, codes, judicial authority or any other promulgations.

We have also relied upon the assumptions, which we have not independently verified, that (a) all signatures, initials and seals are genuine, (b) copies of documents, conformed copies or drafts of documents provided to us are true and complete copies of, or in the final forms of, the originals, (c) where a document has been provided to us in draft or undated form, it will be duly executed, dated and unconditionally delivered in the same form as the last version provided to us, (d) the Memorandum and Articles remain in full force and effect and are unamended, (e) the Minutes are a true and correct record of the proceedings of the Meeting, which was duly convened and held, and at which a quorum was present throughout, in each case, in the manner prescribed in the Memorandum and Articles and the Resolutions and the resolutions set out in the Minutes were duly passed in the manner prescribed in the memorandum and articles of association of the Company effective at the relevant time (including, without limitation, with respect to the disclosure of interests (if any) by directors of the Company) and have not been amended, varied or revoked in any respect, (f) there is nothing under any law (other than the laws of the Cayman Islands) which would or might affect the opinions set out above, (g) there is nothing contained in the minute book or corporate records of the Company (which we have not inspected) which would or might affect the opinions set out below, and (h) upon the issue of any Shares, the Company will receive consideration which shall be equal to at least the par value of such Shares.

This opinion letter is to and for the benefit solely of the addressee and may not be relied upon by any other person for any purpose.

We consent to the use of this opinion as an exhibit to the Registration Statement and further consent to all references to us in the Registration Statement and any amendments thereto. In giving such consent, we do not consider that we are "experts" within the meaning of such term as used in the Securities Act, or the rules and regulations of the Commission issued thereunder, with respect to any part of the Registration Statement, including this opinion as an exhibit or otherwise.

Yours faithfully

/s/ Maples and Calder (Hong Kong) LLP

Maples and Calder (Hong Kong) LLP

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of LexinFintech Holdings Ltd. of our report dated April 26, 2023 relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in LexinFintech Holdings Ltd.’s Annual Report on Form 20-F for the year ended December 31, 2022.

/s/ PricewaterhouseCoopers Zhong Tian LLP

Beijing, the People’s Republic of China

February 26, 2024

Exhibit 107

Calculation of Filing Fee Table

Form S-8

(Form Type)

LexinFintech Holdings Ltd.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

|

|

|

|

|

|

|

Security Type |

Security Class Title(1) |

Fee Calculation Rule |

Amount Registered(2) |

Proposed Maximum Offering Price Per Share |

Maximum Aggregate Offering Price |

Fee Rate |

Amount of Registration Fee |

Equity |

Class A ordinary shares, par value US$0.0001 per share |

Rule 457(c) and Rule 457(h) |

5,000,000(3) |

US$0.88(4) |

US$4,400,000.00 |

US$0.0001476 |

US$649.44 |

|

|

|

|

|

|

|

|

|

Total Offering Amounts |

|

|

US$4,400,000.00 |

|

US$649.44 |

Total Fee Offsets |

|

|

|

— |

Net Fee Due |

|

|

|

US$649.44 |

(1)These shares may be represented by the Registrant’s American Depositary Shares, or ADSs, each representing two Class A ordinary shares. The Registrant’s ADSs issuable upon deposit of the Class A ordinary shares registered hereby have been registered under a separate registration statement on Form F-6 (File No. 333-222020).

(2)Represents additional Class A ordinary shares registered hereby, issuable pursuant to the awards granted under the Registrant’s 2017 Share Incentive Plan, as amended (the “2017 Plan”). Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall be deemed to cover an indeterminate number of additional shares which may be offered and issued to prevent dilution from share splits, share dividends or similar transactions as provided in the 2017 Plan. Any Class A ordinary shares covered by an award granted under the 2017Plan (or portion of an award) that terminates, expires or lapses for any reason will be deemed not to have been issued for purposes of determining the maximum aggregate number of Class A ordinary shares that may be issued under the 2017 Plan.

(3)Represents Class A ordinary shares reserved for future grants under the 2017 Plan, which were not previously registered under the registration statement on Form S-8 as filed with the Securities and Exchange Commission on May 31, 2018 (File No. 333-225322).

(4)The proposed maximum offering price per share, which is estimated solely for the purposes of calculating the registration fee under Rule 457(c) and Rule 457(h) under the Securities Act, is based on the average of the high and low prices for the Registrant’s ADSs as quoted on the Nasdaq Global Select Market on February 21, 2024, adjusted for ADS to Class A ordinary share ratio.

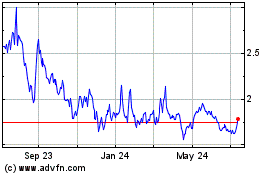

LexinFintech (NASDAQ:LX)

Historical Stock Chart

From Oct 2024 to Nov 2024

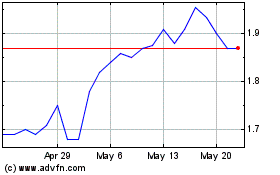

LexinFintech (NASDAQ:LX)

Historical Stock Chart

From Nov 2023 to Nov 2024