Lyell Immunopharma, Inc. (Nasdaq: LYEL), a clinical-stage company

advancing a pipeline of next-generation CAR T-cell therapies for

patients with cancer, today reported financial results and business

highlights for the fourth quarter and year ended December 31,

2024.

“Last year was transformative for Lyell and now, based on

promising emerging clinical data, we are poised to initiate pivotal

development of IMPT-314, our next-generation dual-targeting

CD19/CD20 CAR T-cell product candidate for patients with

aggressive large B‑cell lymphoma,” said Lynn Seely, M.D., Lyell’s

President and CEO. “We believe IMPT-314 has the potential to

deliver improved outcomes for patients by increasing complete

response rates and prolonging the duration of response over

approved CD19 CAR T-cell therapies, and this year we expect to

share more mature data from the ongoing Phase 1/2 trial of

IMPT-314. We also plan to initiate two pivotal programs for

IMPT-314: one for patients in the 3rd line and later setting by the

middle of this year and a second program for patients in the 2nd

line setting by early 2026. In addition, we expect to submit a new

IND in 2026 for a next-generation solid tumor CAR T-cell product

candidate with a new target that is fully-armed with a suite of

technologies, including our proprietary clinically-validated

anti-exhaustion technology. Our strong cash position enables us to

advance our pipeline through important clinical milestones and fund

operations into 2027.”

Fourth Quarter Updates and Recent Business

Highlights

Lyell is advancing a pipeline of next-generation CAR T-cell

product candidates. Its lead program, IMPT-314, is in

Phase 1/2 clinical development for relapsed or refractory

aggressive large B-cell lymphoma (LBCL) and its preclinical

programs target solid tumor indications. Lyell’s programs target

cancers with large unmet need with substantial patient

populations.

IMPT-314: A next-generation dual-targeting CD19/CD20 CAR

T-cell product candidate designed to increase complete response

rates and prolong the duration of response as compared to the

approved CD19‑targeted CAR T-cell therapies for the treatment of

LBCL

IMPT-314 is an autologous CAR T-cell product candidate with a

true ‘OR’ logic gate to target B cells that express either CD19 or

CD20 with full potency and is manufactured with a process that

enriches for CD62L+ cells to generate more naïve and central memory

CAR T cells with enhanced stemlike features and antitumor activity.

The ongoing Phase 1/2 clinical trial is a multi-center, open-label

study designed to evaluate the tolerability and clinical benefit of

IMPT-314 in patients with relapsed/refractory LBCL and determine a

recommended Phase 2 dose. IMPT-314 has received Fast Track

Designation from the U.S. Food and Drug Administration for the

treatment of relapsed/refractory aggressive B-cell lymphoma in the

3rd line and later (3rd line+) setting.

- A Phase 1/2 clinical trial is ongoing

and currently enrolling patients in the 3rd line+ and 2nd line

settings who have not previously received CAR T-cell therapy.

- Initial data from the Phase 1/2 trial

was presented at the American Society for Hematology 2024 Annual

Meeting on December 9, 2024. Data from 23 patients with relapsed or

refractory, CAR T-naive LBCL who received IMPT-314 were reported.

The efficacy evaluable population consisted of 17 patients. The

overall response rate was 94% (16/17 patients), with 71% (12/17

patients) achieving a complete response by three months. The median

follow up was 6.3 months (range 1.2 – 12.5 months) and 71% of

patients were experiencing a response at last follow-up. In the

safety evaluable population of 23 patients, no Grade 3+ CRS was

reported. Grade 3 ICANS was reported in 13% (3/23) of patients with

a median time to ICANS resolution of 5 days, and rapid improvement

to Grade 2 or lower with standard therapy.

- More mature data from the ongoing Phase

1/2 trial in the 3rd line+ setting and initial data from patients

in the 2nd line setting are expected to be presented in

mid-2025.

- Pivotal trial in the 3rd line+ setting

is expected to be initiated in mid-2025 in patients with

relapsed/refractory aggressive LBCL who have not previously

received CAR T-cell therapy.

- Pivotal trial in the 2nd line setting

expected to be initiated by early 2026 in patients with

relapsed/refractory aggressive LBCL who have not previously

received CAR T-cell therapy.

Preclinical Pipeline, Technologies and Manufacturing

Protocols

- The first IND for a fully-armed CAR

T-cell product candidate with an undisclosed target for solid

tumors is expected in 2026. Lyell is advancing next-generation

fully-armed CAR T-cell product candidates, meaning they are armed

with multiple technologies, each designed to address different

barriers to effective cell therapies, including T-cell exhaustion,

lack of durable stemness, as well as immune suppression within the

hostile tumor microenvironment.

- Presented nonclinical and clinical data

from cell therapy product candidates incorporating anti‑exhaustion

and manufacturing technologies that demonstrated the potential of

Lyell’s technologies to improve T‑cell function in solid tumors.

These presentations, from multiple scientific conferences

throughout the year, can be found on the Lyell website here.

Corporate Updates

- Streamlined expenses and expect net

cash use in 2025 to be between $175 million - $185 million. The

disciplined expense management will be accomplished by focusing

clinical development efforts on the pivotal trials of IMPT-314 and

research efforts on developing next-generation fully-armed CAR

T-cell programs for solid tumors.

Fourth Quarter and Full Year 2024 Financial

Results

Lyell reported a net loss of $191.9 million and

$343.0 million for the fourth quarter and year ended

December 31, 2024, respectively, compared to a net loss of

$52.9 million and $234.6 million for the same periods in

2023. Net loss for the fourth quarter and year ended

December 31, 2024 included $87.2 million in acquired

in-process research and development (IPR&D) expense as part of

our acquisition of ImmPACT Bio USA Inc (ImmPACT Bio) and

$51.3 million of long‑lived asset impairment expense. Non‑GAAP

net loss, which excludes stock-based compensation, non-cash

expenses related to the change in the estimated fair value of

success payment liabilities, acquired IPR&D expense, long‑lived

asset impairment expense and certain non-cash investment gains and

charges, was $45.9 million and $159.5 million for the

fourth quarter and year ended December 31, 2024, respectively,

compared to $43.9 million and $177.4 million for the same periods

in 2023.

GAAP and Non-GAAP Operating Expenses

- Research and development (R&D)

expenses were $48.7 million and $171.6 million for the

fourth quarter and year ended December 31, 2024, respectively,

compared to $47.0 million and $182.9 million for the same

periods in 2023. The increase in fourth quarter 2024 R&D

expenses of $1.7 million was primarily due to increased

facilities costs. The decrease in annual 2024 R&D expenses of

$11.3 million was primarily driven by a $14.0 million

decrease in personnel-related expenses mainly due to lower

headcount following the Company’s November 2023 reduction in

workforce, partially offset by a $3.2 million increase in

research activities primarily driven by clinical trial activity.

Non‑GAAP R&D expenses, which exclude non-cash stock-based

compensation and non-cash expenses related to the change in the

estimated fair value of success payment liabilities, for the fourth

quarter and year ended December 31, 2024 were

$45.4 million and $157.3 million, respectively, compared

to $42.9 million and $165.7 million for the same periods

in 2023. The $2.5 million increase in fourth quarter 2024

non-GAAP R&D expenses was primarily driven by increased

facilities costs. The $8.3 million decrease in annual 2024

non-GAAP R&D expenses was primarily driven by the decrease in

personnel-related expenses mainly due to lower headcount following

the Company’s November 2023 reduction in workforce.

- General and administrative (G&A)

expenses were $14.5 million and $52.0 million for the

fourth quarter and year ended December 31, 2024, respectively,

compared to $13.2 million and $67.0 million for the same

periods in 2023. The decrease in annual 2024 G&A expenses of

$14.9 million was primarily driven by a decrease in non‑cash

stock-based compensation. Non‑GAAP G&A expenses, which exclude

non-cash stock‑based compensation, for the fourth quarter and year

ended December 31, 2024 were $9.7 million and

$33.5 million, respectively, compared to $8.5 million and

$38.1 million for the same periods in 2023. The

$1.3 million increase in fourth quarter 2024 non-GAAP G&A

expenses was primarily driven by acquisition-related personnel

expenses. The $4.6 million decrease in annual 2024 non-GAAP

G&A expenses was primarily driven by the decrease in

personnel-related expenses mainly due to lower headcount following

the Company’s November 2023 reduction in workforce.

- Operating expenses for the fourth

quarter and year ended December 31, 2024, include

$87.2 million of acquired IPR&D expenses recognized as a

part of the acquisition of ImmPACT Bio. Additionally, operating

expenses for the fourth quarter and year ended December 31,

2024, include an impairment charge of $51.3 million for

long-lived assets, resulting from the continued decline in our

stock price and related market capitalization.

A discussion of non-GAAP financial measures, including

reconciliations of the most comparable GAAP measures to non‑GAAP

financial measures, is presented below under “Non-GAAP Financial

Measures.”

Cash, cash equivalents and marketable securities

Cash, cash equivalents and marketable securities as of

December 31, 2024 were $383.5 million compared to

$562.7 million as of December 31, 2023. Lyell believes

that its cash, cash equivalents and marketable securities balances

will be sufficient to meet working capital and capital expenditure

needs into 2027.

About Lyell Immunopharma, Inc.

Lyell is a clinical-stage company advancing a pipeline of

next-generation CAR T-cell therapies for patients with hematologic

malignancies and solid tumors. To realize the potential of cell

therapy for cancer, Lyell utilizes a suite of technologies to endow

CAR T cells with attributes needed to drive durable tumor

cytotoxicity and achieve consistent and long-lasting clinical

responses, including the ability to resist exhaustion, maintain

qualities of durable stemness and function in the hostile tumor

microenvironment. Lyell is based in South San Francisco, California

with facilities in West Hills, California and Seattle and Bothell,

Washington. To learn more, please visit www.lyell.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements expressed or implied in this press

release include, but are not limited to, statements regarding: the

anticipated benefits of Lyell’s acquisition of ImmPACT Bio; Lyell’s

ability to accelerate the development of IMPT-314 and deliver

improved outcomes for patients by increasing complete response

rates and prolonging the duration of response over approved CD19

CAR T‑cell therapies; Lyell’s initiation of pivotal trials in 2025

and 2026 for IMPT-314; timing of Lyell’s submission of a new IND in

2026 for a next-generation solid tumor CAR T-cell product

candidate; the ability of Lyell’s technology to enable and generate

T cells that resist exhaustion and have qualities of durable

stemness in order to drive durable tumor cytotoxicity and achieve

consistent and long-lasting clinical response; Lyell’s anticipated

progress, business plans, business strategy and clinical trials;

Lyell’s advancement of its pipeline and its research, development

and clinical capabilities; the potential clinical benefits and

therapeutic potential of Lyell’s product candidates; the

advancement of Lyell’s technology platform; Lyell’s expectation

that its financial position and cash runway will support

advancement of its pipeline through multiple clinical milestones

and fund operations into 2027; expectations around enrollment and

the timing of initial and updated clinical data from Lyell’s Phase

1/2 trial for IMPT-314; and other statements that are not

historical fact. These statements are based on Lyell’s current

plans, objectives, estimates, expectations and intentions, are not

guarantees of future performance and inherently involve significant

risks and uncertainties. Actual results and the timing of events

could differ materially from those anticipated in such

forward-looking statements as a result of these risks and

uncertainties, which include, but are not limited to, risks and

uncertainties related to: the inability to recognize the

anticipated benefits of acquiring ImmPACT Bio and successful

integration of ImmPACT Bio’s business with Lyell’s, including a

successful manufacturing technology transfer of IMPT-314 to Lyell’s

LyFE manufacturing facility; the effects of macroeconomic

conditions, including any geopolitical instability and actual or

perceived changes in interest rates and economic inflation; Lyell’s

ability to submit planned INDs or initiate or progress clinical

trials on the anticipated timelines, if at all; Lyell’s limited

experience as a company in enrolling and conducting clinical

trials, and lack of experience in completing clinical trials;

Lyell’s ability to manufacture and supply its product candidates

for its clinical trials; the nonclinical profiles of Lyell’s

product candidates or technology not translating in clinical

trials; the potential for results from clinical trials to differ

from nonclinical, early clinical, preliminary or expected results;

significant adverse events, toxicities or other undesirable side

effects associated with Lyell’s product candidates; the significant

uncertainty associated with Lyell’s product candidates ever

receiving any regulatory approvals; Lyell’s ability to obtain,

maintain or protect intellectual property rights related to its

product candidates; implementation of Lyell’s strategic plans for

its business and product candidates; the sufficiency of Lyell’s

capital resources and need for additional capital to achieve its

goals; and other risks, including those described under the heading

“Risk Factors” in Lyell’s Quarterly Report on Form 10-Q for the

quarter ended September 30, 2024, filed with the Securities and

Exchange Commission (SEC) on November 7, 2024, and its Annual

Report on Form 10-K for the year ended December 31, 2024,

being filed with the SEC later today. Forward-looking statements

contained in this press release are made as of this date, and Lyell

undertakes no duty to update such information except as required

under applicable law.

|

Lyell Immunopharma, Inc. |

|

Unaudited Selected Consolidated Financial

Data |

|

(in thousands) |

| |

|

|

|

| Statement

of Operations Data: |

| |

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

$ |

11 |

|

|

$ |

13 |

|

|

$ |

61 |

|

|

$ |

130 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development(1) |

|

48,668 |

|

|

|

46,995 |

|

|

|

171,603 |

|

|

|

182,945 |

|

|

General and administrative |

|

14,522 |

|

|

|

13,167 |

|

|

|

52,041 |

|

|

|

66,983 |

|

|

Other operating income, net |

|

(513 |

) |

|

|

(641 |

) |

|

|

(3,309 |

) |

|

|

(2,790 |

) |

|

Acquired in-process research and development |

|

87,184 |

|

|

|

— |

|

|

|

87,184 |

|

|

|

— |

|

|

Impairment of long-lived assets |

|

51,297 |

|

|

|

— |

|

|

|

51,297 |

|

|

|

— |

|

|

Total operating expenses |

|

201,158 |

|

|

|

59,521 |

|

|

|

358,816 |

|

|

|

247,138 |

|

| Loss from operations |

|

(201,147 |

) |

|

|

(59,508 |

) |

|

|

(358,755 |

) |

|

|

(247,008 |

) |

|

Interest income, net |

|

4,920 |

|

|

|

7,084 |

|

|

|

24,068 |

|

|

|

23,453 |

|

|

Other income (loss), net(1) |

|

4,292 |

|

|

|

(506 |

) |

|

|

4,694 |

|

|

|

1,846 |

|

|

Impairment of other investments |

|

— |

|

|

|

— |

|

|

|

(13,001 |

) |

|

|

(12,923 |

) |

|

Total other income, net |

|

9,212 |

|

|

|

6,578 |

|

|

|

15,761 |

|

|

|

12,376 |

|

| Net loss |

$ |

(191,935 |

) |

|

$ |

(52,930 |

) |

|

$ |

(342,994 |

) |

|

$ |

(234,632 |

) |

|

(1) |

As

of October 1, 2024, the Company’s success payment liability was

recognized at fair value as Stanford had provided the requisite

service obligation to earn the potential success payment

consideration. The change in the estimated fair value of Stanford

success payment liabilities beginning in Q4 2024 was recognized

within other income (loss), net in the Consolidated Statements of

Operations and Comprehensive Loss. The change in the estimated fair

value of Stanford success payment liabilities in 2023 and the first

nine months of 2024 were recognized within research and development

expenses in the Consolidated Statements of Operations and

Comprehensive Loss. The change in the estimated fair value of Fred

Hutch success payment liabilities was recognized within other

income (loss), net in the Consolidated Statements of Operations and

Comprehensive Loss. |

Balance Sheet Data:

| |

As of December 31, |

|

|

|

2024 |

|

|

2023 |

| |

|

|

|

| Cash, cash equivalents and

marketable securities |

$ |

383,541 |

|

$ |

562,729 |

| Property and equipment,

net |

$ |

48,200 |

|

$ |

102,654 |

| Total assets |

$ |

490,859 |

|

$ |

750,029 |

| Total stockholders’

equity |

$ |

382,824 |

|

$ |

654,952 |

| |

|

|

|

|

|

Non-GAAP Financial Measures

To supplement our financial results and guidance presented in

accordance with U.S. generally accepted accounting principles

(GAAP), we present non-GAAP net loss, non-GAAP R&D expenses and

non-GAAP G&A expenses. Non‑GAAP net loss and non-GAAP R&D

expenses exclude non-cash stock-based compensation expense and

non-cash expenses related to the change in the estimated fair value

of success payment liabilities from GAAP net loss and GAAP R&D

expenses. Non-GAAP net loss further adjusts non-cash acquired

IPR&D expense, non‑cash long-lived asset impairment expense and

non‑cash investment gains and charges, as applicable. Non‑GAAP

G&A expenses exclude non-cash stock-based compensation expense

from GAAP G&A expenses. We believe that these non‑GAAP

financial measures, when considered together with our financial

information prepared in accordance with GAAP, can enhance

investors’ and analysts’ ability to meaningfully compare our

results from period to period, and to identify operating trends in

our business. We have excluded stock-based compensation expense,

changes in the estimated fair value of success payment liabilities,

acquired IPR&D expense, long-lived asset impairment expense and

non-cash investment gains and charges from our non‑GAAP financial

measures because they are non-cash gains and charges that may vary

significantly from period to period as a result of changes not

directly or immediately related to the operational performance for

the periods presented. We also regularly use these non‑GAAP

financial measures internally to understand, manage and evaluate

our business and to make operating decisions. These non-GAAP

financial measures are in addition to, and not a substitute for or

superior to, measures of financial performance prepared in

accordance with GAAP. In addition, these non‑GAAP financial

measures have no standardized meaning prescribed by GAAP and are

not prepared under any comprehensive set of accounting rules or

principles and, therefore, have limits in their usefulness to

investors. We encourage investors to carefully consider our results

under GAAP, as well as our supplemental non-GAAP financial

information, to more fully understand our business.

|

Lyell Immunopharma, Inc. |

|

Unaudited Reconciliation of GAAP to Non-GAAP Net

Loss |

|

(in thousands) |

| |

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net loss - GAAP |

$ |

(191,935 |

) |

|

$ |

(52,930 |

) |

|

$ |

(342,994 |

) |

|

$ |

(234,632 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

8,083 |

|

|

|

8,463 |

|

|

|

33,144 |

|

|

|

47,084 |

|

|

Change in the estimated fair value of success payment

liabilities |

|

(496 |

) |

|

|

529 |

|

|

|

(1,165 |

) |

|

|

(2,780 |

) |

|

Impairment of other investments |

|

— |

|

|

|

— |

|

|

|

13,001 |

|

|

|

12,923 |

|

|

Acquired in-process research and development expense |

|

87,184 |

|

|

|

— |

|

|

|

87,184 |

|

|

|

— |

|

|

Impairment of long-lived assets |

|

51,297 |

|

|

|

— |

|

|

|

51,297 |

|

|

|

— |

|

| Net loss - Non-GAAP(1) |

$ |

(45,867 |

) |

|

$ |

(43,938 |

) |

|

$ |

(159,533 |

) |

|

$ |

(177,405 |

) |

|

(1) |

There was no income tax effect related to the adjustments made to

calculate non-GAAP net loss because of the full valuation allowance

on our net deferred tax assets for all periods presented. |

|

Lyell Immunopharma, Inc. |

|

Unaudited Reconciliation of GAAP to Non-GAAP Research and

Development Expenses |

|

(in thousands) |

| |

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Research and development -

GAAP |

$ |

48,668 |

|

|

$ |

46,995 |

|

|

$ |

171,603 |

|

|

$ |

182,945 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

(3,295 |

) |

|

|

(3,768 |

) |

|

|

(14,577 |

) |

|

|

(18,207 |

) |

|

Change in the estimated fair value of success payment

liabilities(1) |

|

— |

|

|

|

(319 |

) |

|

|

308 |

|

|

|

930 |

|

| Research and development -

Non-GAAP |

$ |

45,373 |

|

|

$ |

42,908 |

|

|

$ |

157,334 |

|

|

$ |

165,668 |

|

|

(1) |

As of October 1, 2024, the Company’s success payment liability was

recognized at fair value as Stanford had provided the requisite

service obligation to earn the potential success payment

consideration. The change in the estimated fair value of Stanford

success payment liabilities beginning in Q4 2024 was recognized

within other income (loss), net in the Consolidated Statements of

Operations and Comprehensive Loss. The changes in the estimated

fair value of Stanford success payment liabilities in 2023 and the

first nine months of 2024 were recognized within research and

development expenses in the Consolidated Statements of Operations

and Comprehensive Loss. The change in the estimated fair value of

Fred Hutch success payment liabilities was recognized within other

income (loss), net in the Consolidated Statements of Operations and

Comprehensive Loss. |

|

Lyell Immunopharma, Inc. |

|

Unaudited Reconciliation of GAAP to Non-GAAP General and

Administrative Expenses |

|

(in thousands) |

| |

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| General and administrative -

GAAP |

$ |

14,522 |

|

|

$ |

13,167 |

|

|

$ |

52,041 |

|

|

$ |

66,983 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

(4,788 |

) |

|

|

(4,695 |

) |

|

|

(18,567 |

) |

|

|

(28,877 |

) |

| General and administrative -

Non-GAAP |

$ |

9,734 |

|

|

$ |

8,472 |

|

|

$ |

33,474 |

|

|

$ |

38,106 |

|

Contact:

Ellen Rose

Senior Vice President, Communications and

Investor Relations

erose@lyell.com

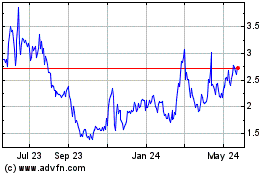

Lyell Immunopharma (NASDAQ:LYEL)

Historical Stock Chart

From Mar 2025 to Apr 2025

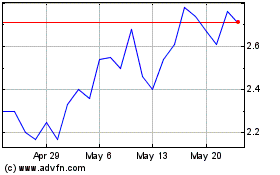

Lyell Immunopharma (NASDAQ:LYEL)

Historical Stock Chart

From Apr 2024 to Apr 2025