MARA Announces Bitcoin Production and Mining Operation Updates for December 2024

04 January 2025 - 12:05AM

MARA Holdings, Inc. (NASDAQ:

MARA) ("MARA" or the "Company"),

a global leader in leveraging digital asset compute to support the

energy transformation, today published unaudited BTC production and

miner installation updates for December 2024.

Management Commentary"In

December, we surpassed our year-end hash rate target of 50 EH/s

while improving our fleet efficiency to 20 J/TH," said Fred Thiel,

MARA's chairman and CEO. "We mined 249 blocks, the second most

blocks in a month on record.

"Our energized hash rate increased to 53.2 EH/s,

a 15% improvement over November, while BTC production declined 2%

to 890 BTC, primarily due to a slight decrease in luck. While some

of our bitcoin and hash rate was acquired outside of our own pool,

MARAPool achieved an impressive annual hash rate growth of 168% in

2024, exceeding bitcoin's network growth rate of 49%. These results

underscore the substantial progress we've achieved in expanding our

operations and enhancing performance, further solidifying our

leadership within the industry.

"In 2024, we acquired 22,065 BTC at an average

price of $87,205 and mined an additional 9,457 BTC. Our year-end

BTC yield per diluted share was 62.7%. Overall, we now own a total

of 44,893 BTC, valued at $4.2 billion based on a spot price of

$93,354 per BTC. Of note, as of December 31, 2024, we had 7,377 BTC

loaned to third parties generating additional return for our

stakeholders.

| Bitcoin HODL

Addition* |

2024 |

| Mined |

9,457 |

| Purchased |

22,065 |

| Total |

31,522 |

*Total HODL of 44,893 as of December 31,

2024 includes 7,377 BTC the Company has temporarily loaned to third

parties.

"As a miner that mines and buys bitcoin, the

hybrid approach provides us significant flexibility to acquire

bitcoin at attractive prices. It further allows us to capitalize on

market conditions by buying BTC during price declines, optimizing

our acquisition cost. We believe we maintain a competitive

advantage through our mining operations, enabling us to produce BTC

at a lower cost than the prevailing spot price. We believe this

dual approach strengthens our position and enhances our ability to

deliver long-term shareholder value."

Figure 1: Operational Highlights and

Updates

| |

|

Prior Month Comparison |

| Metric |

|

12/31/2024 |

|

11/30/2024 |

|

% Δ |

|

Number of Blocks Won 1 |

|

249 |

|

|

254 |

|

|

(2)% |

|

BTC Produced |

|

890 |

|

|

907 |

|

|

(2)% |

|

Average BTC Produced per Day |

|

28.7 |

|

|

30.2 |

|

|

(5)% |

|

Share of available miner rewards 2 |

|

6.1 |

% |

|

6.5 |

% |

|

NM |

|

Transaction Fees as % of Total 1 |

|

2.7 |

% |

|

3.3 |

% |

|

NM |

|

Energized Hash Rate (EH/s) 1 |

|

53.2 |

|

|

46.1 |

|

|

15% |

- These metrics are MARAPool only and

do not include blocks won from joint ventures.

- Defined as the total amount of

block rewards including transaction fees that MARA earned during

the period divided by the total amount of block rewards and

transaction fees awarded by the Bitcoin network during the

period.

NM - Not Meaningful

Figure 2: BTC

Yield1

Reconciliation

|

|

|

12/31/2023 |

|

9/30/2024 |

|

12/31/2024 |

|

| Total Bitcoin Holdings |

|

|

15,174 |

|

|

|

26,747 |

|

|

|

44,893 |

|

|

| Shares Outstanding (in

'000s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

242,829 |

|

|

|

304,913 |

|

|

|

339,382 |

|

|

|

Basic Shares Outstanding |

|

|

242,829 |

|

|

|

304,913 |

|

|

|

339,382 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

2026 Convertible Shares (November 2021 issuance) |

|

|

5,969 |

|

|

|

5,969 |

|

|

|

1,321 |

|

|

|

2030 Convertible Shares (November 2024 issuance) |

|

|

- |

|

|

|

- |

|

|

|

55,006 |

|

|

|

2031 Convertible Shares (August 2024 issuance) |

|

|

- |

|

|

|

19,854 |

|

|

|

19,854 |

|

|

|

2031 Convertible Shares (December 2024 issuance) |

|

|

- |

|

|

|

- |

|

|

|

37,449 |

|

|

|

Warrants |

|

|

324 |

|

|

|

324 |

|

|

|

324 |

|

|

|

RSUs/PSUs Unvested |

|

|

5,766 |

|

|

|

10,872 |

|

|

|

10,064 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Assumed Fully Diluted Shares Outstanding

2 |

|

|

254,888 |

|

|

|

341,932 |

|

|

|

463,400 |

|

|

|

BTC Yield % (Year to Date) |

|

|

|

|

|

|

|

|

|

|

62.7 |

% |

|

- BTC Yield is a key performance

indicator that represents the percentage change period-to-period of

the ratio between the Company's bitcoin holdings and its Assumed

Fully Diluted Shares Outstanding. For additional information, refer

to the Company’s Current Report on Form 8-K filed with the U.S.

Securities and Exchange Commission (the "SEC") on December 19,

2024.

- Assumed Fully Diluted Shares

Outstanding refers to the aggregate of our Basic Shares Outstanding

as of the end of each period plus all additional shares that would

result from the assumed conversion of all outstanding convertible

notes, exercise of all outstanding stock warrants, and settlement

of all outstanding restricted stock units and performance-based

restricted stock units. Assumed Fully Diluted Shares Outstanding is

not calculated using the treasury method and does not take into

account any vesting conditions (in the case of equity awards), the

exercise price of any warrants or any contractual conditions

limiting convertibility of convertible debt instruments.

Investor Notice Investing in

our securities involves a high degree of risk. Before making an

investment decision, you should carefully consider the risks,

uncertainties and forward-looking statements described under the

heading "Risk Factors" in our most recent annual report on Form

10-K and any other periodic reports that we may file with the SEC.

If any of these risks were to occur, our business, financial

condition or results of operations would likely suffer. In that

event, the value of our securities could decline, and you could

lose part or all of your investment. The risks and uncertainties we

describe are not the only ones facing us. Additional risks not

presently known to us or that we currently deem immaterial may also

impair our business operations. In addition, our past financial

performance may not be a reliable indicator of future performance,

and historical trends should not be used to anticipate results in

the future. See "Forward-Looking Statements" below.

The operational highlights and updates presented

in this press release pertain solely to our BTC mining operations.

Detailed information regarding our other operations can be found in

our periodic reports filed with the SEC.

Forward-Looking Statements This

press release contains forward-looking statements within the

meaning of the federal securities laws. All statements, other than

statements of historical fact, included in this press release are

forward-looking statements. The words "may," "will," "could,"

"anticipate," "expect," "intend," "believe," "continue," "target"

and similar expressions or variations or negatives of these words

are intended to identify forward-looking statements, although not

all forward-looking statements contain these identifying words.

Such forward-looking statements include, among other things,

statements related to our strategy, bitcoin lending arrangements

and BTC treasury policy. Such forward-looking statements are based

on management's current expectations about future events as of the

date hereof and involve many risks and uncertainties that could

cause our actual results to differ materially from those expressed

or implied in our forward-looking statements. Subsequent events and

developments, including actual results or changes in our

assumptions, may cause our views to change. We do not undertake to

update our forward-looking statements except to the extent required

by applicable law. Readers are cautioned not to place undue

reliance on such forward-looking statements. All forward-looking

statements included herein are expressly qualified in their

entirety by these cautionary statements. Our actual results and

outcomes could differ materially from those included in these

forward-looking statements as a result of various factors,

including, but not limited to, the factors set forth under the

heading "Risk Factors" in our most recent annual report on Form

10-K, and any other periodic reports that we may file with the

SEC.

About MARAMARA (NASDAQ:MARA) is

a global leader in digital asset compute that develops and deploys

innovative technologies to build a more sustainable and inclusive

future. MARA secures the world's preeminent blockchain ledger and

supports the energy transformation by converting clean, stranded,

or otherwise underutilized energy into economic value.

For more information, visit www.mara.com, or

follow us on:

Twitter: @MARAHoldingsLinkedIn:

www.linkedin.com/company/maraholdings Facebook:

www.facebook.com/MARAHoldings Instagram: @maraholdingsinc

MARA Company Contact:

Telephone: 800-804-1690Email: ir@mara.com

MARA Media Contact:Email:

marathon@wachsman.com

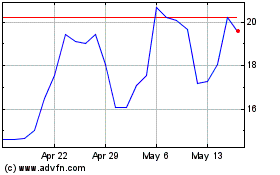

MARA (NASDAQ:MARA)

Historical Stock Chart

From Dec 2024 to Jan 2025

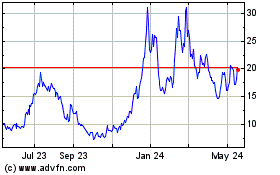

MARA (NASDAQ:MARA)

Historical Stock Chart

From Jan 2024 to Jan 2025