UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

| Matthews International Corporation |

(Name of Registrant as Specified In Its Charter)

|

| |

BARINGTON COMPANIES EQUITY PARTNERS, L.P.

BARINGTON COMPANIES INVESTORS, LLC

BARINGTON CAPITAL GROUP, L.P.

LNA CAPITAL CORP.

JAMES A. MITAROTONDA

ANA B. AMICARELLA

CHAN W. GALBATO

1 NBL EH, LLC

JOSEPH GROMEK

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Barington Companies Equity

Partners, L.P. (“Barington”), together with the other participants named herein, has filed a preliminary proxy statement and

accompanying GOLD universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes

for the election of Barington’s slate of director nominees at the 2025 annual meeting of shareholders (the “Annual Meeting”)

of Matthews International Corporation, a Pennsylvania corporation (the “Company”).

Item 1: On December 19,

2024, Barington issued the following press release:

Barington Capital Group Files Preliminary Proxy

Statement For Nomination of Ana Amicarella, Chan Galbato and James Mitarotonda for Election to the Matthews International Board of Directors

Nominations Follow Years of Stock Price Underperformance,

Unacceptable Capital Allocation, Poor Execution, and Excessive Spending at Matthews

Believes Director Candidates Have the Skills, Experience,

and Commitment to Shareholders Required

to Enhance Long-Term Value

Calls for a New, Credible CEO and a Refreshed, Declassified

Board Committed to Holding Management Accountable

NEW YORK, December 19, 2024 – Barington

Capital Group L.P. (“Barington Capital”) and certain of its affiliates (collectively “Barington” or “we”),

a fundamental, value-oriented activist investor that beneficially owns approximately 2% of the outstanding common stock of Matthews International

Corporation (NASDAQ: MATW) (“Matthews” or the “Company”), today announced that it has filed a preliminary proxy

statement with the U.S. Securities and Exchange Commission in connection with its nomination of Ana B. Amicarella, Chan W. Galbato and

James Mitarotonda for election to the Matthews Board of Directors (the “Board”) at the Company’s 2025 Annual Meeting

of Shareholders.

James Mitarotonda, Chairman and CEO of Barington Capital,

said, “We believe that Matthews has vast value potential. It is for this reason that we first invested in the Company in 2022 and

sought to work constructively with the Board and management team since then to realize this potential. Unfortunately, despite our best

efforts, our engagement has proven unproductive. Indeed, we believe that CEO Joseph Bartolacci is either unwilling or unable to make meaningful

progress on the value-creating initiatives put before him.

“Worse, the Matthews Board has idly stood by

as the Company’s performance lagged through unacceptable capital allocation, poor execution and excessive spending, not just over

the past one-, three-, five-, and ten-year periods, but over Mr. Bartolacci’s entire 18-year term as CEO, as set forth in more detail

in our preliminary proxy statement. During this time, Matthews dramatically underperformed its self-selected peer group, the S&P 500

and the Russell 2000. It is clear to us that the Board as currently constructed does not effectively oversee management and that immediate

change to the Board is warranted. We believe a prompt refresh and declassification of the Board, coupled with the appointment of a new

CEO, will ensure Matthews is put on a path to sustained value creation.

“The individuals that we have nominated are

highly qualified, significantly experienced and ready to ensure that the interests of shareholders, the owners of Matthews, are appropriately

represented in the boardroom. They bring proven track records of working with management teams to develop strategies, enhance capabilities,

execute effectively, and deliver results. We believe their fresh perspectives, extensive leadership experience, financial, corporate strategy

and turnaround expertise, and shared objective of enhancing value for the benefit of all Matthews shareholders will restore confidence

in Matthews’ future.”

Barington’s nominees include:

| · | Ana B. Amicarella – Ms. Amicarella

is a seasoned business leader with a strong track record of driving innovation and value creation as a CEO and as a public company board

member. She currently serves on the boards of Forward Air Corporation and Warrior Met Coal, Inc. Since 2019, she has served as Chief Executive

Officer of EthosEnergy, a global provider of rotating equipment services. Previously, she was Managing Director for Latin America and

Vice President of various business units at Aggreko PLC from 2011 to 2019. She began her career at GE Energy and Oil & Gas, holding

leadership roles in field services and global operations from 1988 to 2011. Barington believes that Ms. Amicarella’s extensive

business management and public board experience, coupled with over 30 years’ experience in the energy and power generation industry

and financial expertise, would make her a valuable addition to the Board. |

| · | Chan W. Galbato – Mr. Galbato is

a proven executive with extensive experience working with CEOs to drive strategy, build capabilities, and deliver results. He currently

serves as Chief Executive Officer of Cerberus Operations and Advisory Company, LLC, where he oversees operating executives and investment

strategies for Cerberus’ portfolio companies. He has served on numerous boards, including as Chairman of Avon Products, YP Holdings,

and North American Bus Industries, and as Lead Director for Brady Corporation. Prior to joining Cerberus in 2009, Mr. Galbato was CEO

of the Controls Division at Invensys plc, President of Services at The Home Depot, and CEO of Armstrong Floor Products and Choice Parts.

He spent 14 years at General Electric in leadership roles across its industrial divisions, including as CEO of Coregis, a GE Capital company.

Barington believes that Mr. Galbato’s significant experience in multiple operational and strategic roles, as well as his extensive

service on the boards of various public and private companies, would make him a valuable addition to the Board. |

| · | James Mitarotonda – Mr. Mitarotonda

is an accomplished business leader with extensive board experience across a broad range of companies and industries. He has a deep understanding

of value creation at multi-business unit companies, along with expertise in finance, M&A, corporate governance, compensation, and

financial markets. Mr. Mitarotonda currently serves as Chairman, President, and CEO of Barington Capital Group, L.P. and Barington Companies

Investors, LLC, the general partner of Barington Companies Equity Partners, L.P. Since 2015, he has been a director of The Eastern Company,

serving as Chairman since 2016, where he also chairs the Executive Committee and has served on multiple other committees, including Audit,

Compensation, and Nominating and Corporate Governance. Over the past five years, Mr. Mitarotonda has held board roles at Rambus, Inc.,

Avon Products, OMNOVA Solutions, and A. Schulman Inc. He has also served as an advisor to HanesBrands Inc., L Brands, Matthews International

Corporation, and Rambus Inc. Earlier in his career, he held board positions at companies such as The Pep Boys, Barington/Hilco Acquisition

Corp., and The Jones Group, among others. Barington believes that Mr. Mitarotonda’s knowledge of, and experience investing in,

companies in a wide variety of industries, coupled with his financial, investment banking, and corporate governance expertise and his

extensive public board service, would make him a valuable addition to the Board. |

For additional information regarding Barington’s campaign at Matthews,

visit: https://barington.com/matthews

About Barington Capital Group, L.P.

Barington Capital Group, L.P. is a fundamental, value-oriented

activist investment firm established by James Mitarotonda in January 2000. Barington invests in undervalued publicly traded companies

that Barington believes can appreciate significantly in value when substantive improvements are made to their operations, corporate strategy,

capital allocation and corporate governance. Barington’s investment team, advisors and network of industry experts draw upon their

extensive strategic, operating and boardroom experience to assist companies in designing and implementing initiatives to improve long-term

shareholder value.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Barington Companies Equity Partners, L.P. (“Barington”),

together with the other participants named herein, has filed a preliminary proxy statement and accompanying GOLD universal proxy

card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of Barington’s

slate of highly-qualified director nominees at the 2025 annual meeting of shareholders of Matthews International Corporation, a Pennsylvania

corporation (the “Company”).

BARINGTON STRONGLY ADVISES ALL SHAREHOLDERS OF

THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS, INCLUDING A PROXY CARD, AS THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION,

THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS

FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the anticipated proxy solicitation

are expected to be Barington, Barington Companies Investors, LLC (“Barington Companies Investors”), Barington Capital Group,

L.P. (“Barington Capital Group”), LNA Capital Corp. (“LNA Capital”), James Mitarotonda, 1 NBL EH, LLC (“NBL”),

Joseph Gromek, Ana B. Amicarella and Chan W. Galbato.

As of the date hereof, Barington directly beneficially

owns 563,962 shares of Class A Common Stock, $1.00 par value (the “Common Stock”), of the Company, 100 shares of which are

held in record name. As of the date hereof, Barington Companies Investors, as the general partner of Barington, may be deemed to beneficially

own the 563,962 shares of Common Stock beneficially owned by Barington. Barington Capital Group, as the majority member of Barington Companies

Investors, may be deemed to beneficially own the 563,962 shares of Common Stock beneficially owned by Barington. LNA Capital, as the general

partner of Barington Capital Group, may be deemed to beneficially own the 563,962 shares of Common Stock beneficially owned by Barington.

Mr. Mitarotonda, as the sole shareholder and director of LNA Capital, may be deemed to beneficially own the 563,962 shares of Common Stock.

As of the date hereof, NBL directly beneficially owns 17,990 shares of Common Stock. Mr. Gromek, as the managing member of NBL, may be

deemed to beneficially own the 17,990 shares of Common Stock beneficially owned by NBL. As of the date hereof, Ms. Amicarella and Mr.

Galbato do not beneficially own any shares of Common Stock.

Media Contact:

Jonathan Gasthalter/Amanda Shpiner

Gasthalter & Co.

212-257-4170

Item 2: Also on December 19, 2024,

the following materials were posted by Barington to www.barington.com:

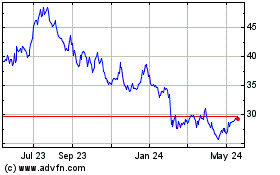

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Nov 2024 to Dec 2024

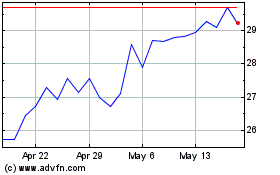

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Dec 2023 to Dec 2024