UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

MATTHEWS INTERNATIONAL CORPORATION

|

(Name of Registrant as Specified In Its Charter)

|

| |

BARINGTON COMPANIES EQUITY PARTNERS, L.P.

BARINGTON COMPANIES INVESTORS, LLC

BARINGTON CAPITAL GROUP, L.P.

LNA CAPITAL CORP.

JAMES MITAROTONDA

ANA B. AMICARELLA

CHAN W. GALBATO

1 NBL EH, LLC

JOSEPH GROMEK

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED DECEMBER 19, 2024

BARINGTON COMPANIES EQUITY PARTNERS,

L.P.

___________________, 2024

Dear Fellow Matthews Shareholders:

Barington Companies Equity

Partners, L.P. and certain of its affiliates named herein (collectively, “Barington,” “we” or “our”),

are significant investors in Matthews International Corporation, a Pennsylvania corporation (“Matthews” or the “Company”),

which, together with the other participants in this solicitation, are the beneficial owners of 581,952 shares of Class A Common Stock,

$1.00 par value (the “Common Stock”), of the Company, representing approximately 1.9% of the outstanding shares of Common

Stock. We believe meaningful change to the composition of the Board of Directors of the Company (the “Board”) is necessary

to ensure that the Company is being run in a manner consistent with your best interests. Accordingly, we are seeking your support for

the election of our three (3) highly-qualified nominees as directors at the 2025 annual meeting of shareholders to be held on [______],

2025 at [_:__ [a/p].m.] Eastern Standard Time virtually at www.____________ (including any adjournments, postponements or continuations

thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”).

The Company has a classified

Board, which is currently divided into three (3) classes. The terms of three (3) directors expire at the Annual Meeting. Through the accompanying

Proxy Statement and enclosed GOLD universal proxy card, we are soliciting proxies to elect our three (3) nominees, Ana B. Amicarella,

Chan W. Galbato and James Mitarotonda (the “Barington Nominees”). Barington and the Company will each be using a universal

proxy card for voting on the election of directors at the Annual Meeting, which will include the names of all nominees for election to

the Board. Shareholders will have the ability to vote for up to three (3) nominees on Barington’s enclosed GOLD universal

proxy card. Any shareholder who wishes to vote for any combination of our nominees and the Company’s nominees may do so on Barington’s

enclosed GOLD universal proxy card. There is no need to use the Company’s white universal proxy card or voting instruction

form, regardless of how you wish to vote. In any case, we urge shareholders to vote in favor of the Barington Nominees, who we believe

are the most qualified candidates to serve as directors in order to achieve a Board composition that we believe is in the best interest

of all shareholders.

We strongly believe that

shareholders will benefit from a meaningfully reconstituted Board that includes the addition of new directors with fresh perspectives,

extensive leadership experience, financial, corporate strategy and turnaround expertise, and a shared objective of enhancing long-term

value for the benefit of all Matthews shareholders. The individuals that we have nominated are highly qualified, significantly experienced

and ready to ensure that the interests of shareholders, the owners of Matthews, are appropriately represented in the boardroom.

We urge you to carefully consider

the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed GOLD

universal proxy card today. The attached Proxy Statement and the enclosed GOLD universal proxy card are first being mailed to shareholders

on or about December ___, 2024.

If you have already voted for

the incumbent management slate, you have every right to change your vote by signing, dating, marking your vote and returning a later dated

GOLD universal proxy card or by voting virtually at the Annual Meeting.

If you have any questions or require

any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at its address and toll-free number listed below.

Thank you for your support,

/s/ James Mitarotonda

James Mitarotonda

Barington Companies Equity Partners, L.P.

|

If you have any questions, require assistance in

voting your GOLD universal proxy card,

or need additional copies of Barington’s proxy

materials,

please contact:

Okapi Partners LLC

1212 Avenue of the Americas, 17th Floor

New York, New York 10036

Shareholders may call toll-free: (877) 285-5990

Banks and brokers call: (212) 297-0720

E-mail: info@okapipartners.com

|

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED DECEMBER 19, 2024

ANNUAL MEETING OF SHAREHOLDERS

OF

MATTHEWS INTERNATIONAL CORPORATION

_________________________

PROXY STATEMENT

OF

BARINGTON COMPANIES EQUITY PARTNERS, L.P.

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED

GOLD UNIVERSAL PROXY CARD TODAY

Barington Companies Equity Partners, L.P. (“BCEP”) and

certain of its affiliates (collectively, “Barington,” “we” or “our”), are significant investors in

Matthews International Corporation, a Pennsylvania corporation (“Matthews” or the “Company”), which, together

with the other participants in their solicitation, are the beneficial owners of 581,952 shares of Class A Common Stock, $1.00 par value

(the “Common Stock”), of the Company, representing approximately 1.9% of the outstanding shares of Common Stock. We strongly

believe that the Board must be meaningfully reconstituted with directors who have the perspectives, skills and expertise to help guide

the Company at this critical juncture and drive shareholder value. To that end, we have nominated three (3) highly qualified director

nominees, each of whom would bring substantial expertise and deep experience to the Board and was selected specifically for his or her

ability to work with the current Board to act on the significant value-creation opportunity we believe is present at Matthews today. Accordingly,

we are seeking your support at the 2025 annual meeting of shareholders of the Company scheduled to be held virtually via live webcast

at _____, on [______], 2025, at [_:__ [a/p].m.] Eastern Standard Time (including any and all adjournments, postponements, continuations

or reschedulings thereof, or any other meeting of shareholders held in lieu thereof, the “Annual Meeting”), for the following

items of business:

| 1. | To elect Barington’s three (3) director nominees, Ana B. Amicarella, Chan W. Galbato and James Mitarotonda (each, a “Barington Nominee” and together, the “Barington Nominees”), to for a term of three (3) years; |

| 2. | To vote on the Company’s proposal to ratify the appointment of Ernst & Young LLP as the Company’s

independent registered public accounting firm to audit the records of the Company for the fiscal year ending September 30, 2025; |

| 3. | To vote on the Company’s proposal to provide an advisory (non-binding) vote on the executive compensation

of the Company’s named executive officers; and |

| 4. | To transact such other business as may properly come before the Annual Meeting. |

This Proxy Statement and

the enclosed GOLD universal proxy card are first being mailed to shareholders on or about December [__], 2024.

The Company has disclosed

that the Annual Meeting will take place in a virtual meeting format only. Shareholders will not be able to attend the Annual Meeting

in person. For further information on how to attend and vote virtually at the Annual Meeting and by proxy, please see the “Voting

and Proxy Procedures” and “Virtual Meetings” sections of this Proxy Statement.

The Company has a classified Board, which is currently divided into

three (3) classes. The terms of three (3) directors expire at the Annual Meeting. Through this Proxy Statement and enclosed GOLD

universal proxy card, we are soliciting proxies to elect the Barington Nominees. Barington and Matthews will each be using a universal

proxy card for voting on the election of directors at the Annual Meeting, which will include the names of all nominees for election to

the Board. Shareholders will have the ability to vote for up to three (3) nominees on Barington’s enclosed GOLD universal

proxy card. Any shareholder who wishes to vote for three (3) Company nominees or a combination of the Barington Nominees may do so on

Barington’s GOLD universal proxy card. There is no need to use the Company’s white universal proxy card or voting instruction

form, regardless of how you wish to vote.

Your vote to elect the Barington

Nominees will have the legal effect of replacing three (3) incumbent directors. If elected, the Barington Nominees, subject to their fiduciary

duties as directors, will seek to work with the other members of the Board to evaluate all opportunities to enhance shareholder value.

However, the Barington Nominees will constitute a minority of the Board and there can be no guarantee that they will be able to implement

the actions that they believe are necessary to unlock shareholder value. There is no assurance that any of the Company’s nominees

will serve as directors if all or some of the Barington Nominees are elected. The names, backgrounds and qualifications of the Company’s

nominees, along with other information about them, can be found in the Company’s proxy statement.

Shareholders are permitted to

vote for fewer than three (3) nominees or for any combination (up to three (3) total) of the Barington Nominees and the Company’s

nominees on the enclosed GOLD universal proxy card. We recommend that shareholders do not vote for any of the Company’s nominees.

Among other potential consequences, voting for the Company’s nominees may result in the failure of one or all of the Barington Nominees

to be elected to the Board. Barington urges shareholders using our GOLD universal proxy card to vote “FOR” all

of the Barington Nominees.

IF YOU MARK FEWER THAN THREE

(3) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, OUR GOLD UNIVERSAL PROXY CARD, WHEN DULY EXECUTED, WILL BE VOTED

ONLY AS DIRECTED. IF NO DIRECTION IS INDICATED WITH RESPECT TO HOW YOU WISH ONLY TO VOTE YOUR SHARES, THE PROXIES NAMED THEREIN WILL VOTE

SUCH SHARES “FOR” THE THREE (3) BARINGTON NOMINEES.

IMPORTANTLY, IF YOU MARK MORE

THAN THREE (3) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS WILL

BE DEEMED INVALID.

The Company has set the close

of business on [________] as the record date for determining shareholders entitled to notice of and to vote at the Annual Meeting (the

“Record Date”). The address of the principal executive offices of the Company is Two Northshore Center, Pittsburgh, Pennsylvania

15212. Shareholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to

the Company, as of the Record Date, there were [_______] shares of Common Stock outstanding and entitled to vote at the Annual Meeting.

As of the date hereof, the participants

in this solicitation collectively beneficially own an aggregate of 581,952 shares of Common Stock, and intend to vote all of such shares

FOR the election of the Barington Nominees, FOR the ratification of the appointment of Ernst & Young LLP as the independent

registered public accounting firm to audit the records of the Company for the fiscal year ending September 30, 2025, and AGAINST the

proposal to provide an advisory (non-binding) vote on the executive compensation of the Company’s named executive officers, as described

herein.

We urge you to carefully consider

the information contained in this Proxy Statement and then support our efforts by signing, dating and returning the enclosed GOLD

universal proxy card today.

THIS SOLICITATION IS BEING MADE

BY BARINGTON AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE

ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH BARINGTON IS NOT AWARE OF A REASONABLE TIME

BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED GOLD UNIVERSAL PROXY

CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

BARINGTON URGES YOU TO PROMPTLY

SIGN, DATE AND RETURN THE GOLD UNIVERSAL PROXY CARD VOTING “FOR” THE ELECTION OF THE BARINGTON NOMINEES.

IF YOU HAVE ALREADY SENT A UNIVERSAL

PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS

PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED GOLD UNIVERSAL PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE

THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER

DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING VIRTUALLY AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of

Proxy Materials for the Annual Meeting—This Proxy Statement and our GOLD universal proxy card are available at

www.__________.com

IMPORTANT

Your vote is important,

no matter how many shares of Common Stock you own. Barington urges you to sign, date and return the enclosed GOLD universal proxy card

today to vote FOR the election of the Barington Nominees and in accordance with Barington’s recommendations on the other proposals

on the agenda for the Annual Meeting.

| · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed GOLD

universal proxy card and return it to Barington, c/o Okapi Partners LLC (“Okapi”), in the enclosed postage-paid envelope today.

Shareholders also have the following two options for authorizing a proxy to vote shares registered in their name: |

| o | Via the Internet at www.okapivote.com/MATW2025 at any time prior to 11:59 p.m. (Eastern Time) on the day

before the Annual Meeting, and follow the instructions provided on the GOLD universal proxy card; or |

| o | By telephone, by calling (866) 494-4435 at any time prior to 11:59 p.m. (Eastern Time) on the day before

the Annual Meeting, and follow the instructions provided on the GOLD universal proxy card. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial

owner of the shares of Common Stock, and these proxy materials, together with a GOLD voting instruction form, are being forwarded

to you by your broker or bank. As a beneficial owner, if you wish to vote, you must instruct your broker, trustee or other representative

how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the

Internet. Please refer to the enclosed GOLD voting instruction form for instructions on how to vote electronically. You may also

vote by signing, dating and returning the enclosed GOLD voting instruction form. |

| · | You may vote your shares virtually at the Annual Meeting. Even if you plan to attend the Annual Meeting

virtually, we recommend that you submit your GOLD universal proxy card by mail, internet or telephone by the applicable deadline

so that your vote will be counted if you later decide not to attend the Annual Meeting. |

As Barington is using a

“universal” proxy card, which includes the Barington Nominees as well as the Company’s nominees, there is no need to

use any other proxy card regardless of how you intend to vote.

We strongly urge you

NOT to sign or return any proxy cards or voting instruction forms that you may receive from the Company. If you return the Company’s

white universal proxy card or voting instruction form, it will revoke any proxy card or voting instruction form you may have sent to us

previously.

|

If you have any questions, require assistance in

voting your GOLD universal proxy card,

or need additional copies of Barington’s proxy

materials,

please contact:

Okapi Partners LLC

1212 Avenue of the Americas, 17th Floor

New York, New York 10036

Shareholders may call toll-free: (877) 285-5990

Banks and brokers call: (212) 297-0720

E-mail: info@okapipartners.com

|

BACKGROUND TO THE SOLICITATION

The following is a chronology of material events

leading up to this proxy solicitation:

| · | In April 2022, BCEP began acquiring shares of Common Stock based on Barington’s belief that the

Company’s shares were significantly undervalued. |

| · | On August 9, 2022, September 21, 2022, and November 21, 2022, James Mitarotonda of Barington met with

representatives of Matthews, including CEO Joseph Bartolacci, CFO Steven Nicola, and William Wilson to discuss Barington’s analysis

of and perspectives on the Company, including Barington’s assessment of Matthews’ value potential, Barington’s perspectives

on Matthews’ long-term performance challenges, Barington’s concerns with the composition of the Board, and Barington’s

recommendations for value creation at the Company. |

| · | On December 2, 2022, Barington delivered a notice to the Company nominating three highly qualified individuals

for election to the Board at the Company’s 2023 annual meeting of shareholders. On December 20 and December 21, 2022, the nominees

participated in individual videoconferences with members of Matthews’ Governance and Sustainability Committee regarding their candidacies. |

| · | On December 13, 2022, Mr. Mitarotonda presented Barington’s analysis of and perspectives on the

Company, including Barington’s assessment of Matthews’ value potential, Barington’s perspectives on Matthews’

long-term performance challenges, and Barington’s concerns with the composition of the Board at the 2022 Bloomberg Activist Conference.

Mr. Mitarotonda also shared Barington’s recommendations for value creation at the Company, including recommending that Matthews

initiate a strategic review to simplify its business, deploy cash to reduce indebtedness, decrease corporate and non-operating expenses,

and refresh its Board. |

| · | Between December 7, 2022, and December 26, 2022, Mr. Mitarotonda and representatives of Matthews, including

Mr. Bartolacci, Mr. Nicola and EVP and GC Brian Walters, spoke eight times via videoconference regarding Barington’s recommendations

for value creation, Barington’s nominations to the Board, and entering into a potential consulting agreement. |

| · | On December 30, 2022, members of Barington and Matthews entered into an agreement (the “2022 Agreement”),

pursuant to which, among other things, Barington withdrew the nomination of its nominees for election to the Board at the Company’s

2023 annual meeting of shareholders, Matthews retained Barington Companies Management (as defined below) as a consultant to provide advisory

services to the Company, and the parties agreed to certain customary standstill and mutual non-disparagement obligations. |

| · | On May 10 and June 7, 2023, Mr. Mitarotonda reviewed second quarter fiscal 2023 results with representatives

of Matthews via videoconference. |

| · | On August 8, 2023, Mr. Mitarotonda reviewed third quarter fiscal 2023 results with representatives of

Matthews via videoconference. |

| · | On September 12, 2023, Mr. Mitarotonda and Mr. Bartolacci met via videoconference to discuss the performance

of the Company’s businesses, Barington’s recommendations for long-term value creation at the Company and Barington’s

upcoming presentation to the Board. |

| · | On September 26, 2023, Mr. Mitarotonda delivered a presentation to the Board recommending specific steps

for improving the Company’s operating and share price performance, including the development of its Memorialization business, the

divestiture of the SGK Brand Solutions business, and a strategic review of its Industrial Technology businesses. |

| · | On October 11, 2023, Mr. Mitarotonda, Mr. Bartolacci and Mr. Walters met via teleconference to discuss

Barington’s engagement with Matthews and the extension of the 2022 Agreement. Subsequently, on October 14, 2023, Barington and Matthews

extended the 2022 Agreement for an additional year. |

| · | On November 3, 2023, Mr. Mitarotonda and Mr. Bartolacci met via teleconference to discuss Matthews’

progress with respect to the implementation of Barington’s recommendations. |

| · | On November 20 and November 21, 2023, Mr. Mitarotonda reviewed fiscal 2023 results with representatives

of Matthews via videoconference. |

| · | On November 27, 2023, Mr. Mitarotonda shared with Mr. Bartolacci his in-depth and updated analysis of

the value of Matthews’ portfolio of businesses and the opportunity to create long-term shareholder value through divestitures. Mr.

Mitarotonda reiterated Barington’s recommendation that Matthews divest its SGK Brand Solutions business and conduct a review of

each of its Industrial Technology businesses. |

| · | On February 6, February 9 and April 1, 2024, Mr. Mitarotonda reviewed first quarter fiscal 2024 results

with representatives of Matthews via videoconference. |

| · | On April 18, 2024, Mr. Mitarotonda met via videoconference with Mr. Garicia-Tunon, Chairman of the Board,

and Mr. Walters. Mr. Mitarotonda expressed Barington’s dismay at the Company’s record of poor capital allocation, uneven execution,

and lagging share price performance. Mr. Mitarotonda shared Barington’s view that the Board should seek to replace Mr. Bartolacci

based on the Company’s extended period of poor performance under Mr. Bartolacci’s leadership. |

| · | On May 8 and May 9, 2024, Mr. Mitarotonda reviewed second quarter fiscal 2024 results with representatives

of Matthews via videoconference. |

| · | On August 2 and August 8, 2024, Mr. Mitarotonda reviewed first quarter fiscal 2024 results with representatives

of Matthews via videoconference. |

| · | On October 15, 2024, Mr. Mitarotonda, Mr. Bartolacci and Matthews’ representative, Mr. Alfredo Poretti,

Managing Director and Global Co-Head of Shareholder Engagement and M&A Capital Markets at J.P. Morgan, met to discuss Barington’s

engagement with Matthews. Barington expressed its dissatisfaction with the Company’s continued poor operating and share price performance,

the lack of progress with respect to the implementation of Barington’s recommendations and the low level of engagement with Barington.

Mr. Bartolacci proposed that Barington enter into a non-disclosure agreement. Mr. Mitarotonda subsequently declined to enter into a non-disclosure

agreement. |

| · | On October 18, 2024, Matthews sent a notice of non-renewal of the 2022 Agreement and on November 1, 2024,

the 2022 Agreement terminated pursuant to its terms. |

| · | On November 27, 2024, BCEP delivered notice to the Company of its nomination of the Barington Nominees

for election to the Board at the Annual Meeting. |

| · | On December 10, 2024, Barington issued an open letter to Matthews’ Chairman, Mr. Garcia-Tunon, reiterating

its dissatisfaction with Matthews’ operating and share price performance, outlining the need for divestitures, a reduction of expenses

and indebtedness, and calling for improvements to the composition of the Board and corporate governance by adding new, experienced directors

to the Board. The Company responded by stating, in our view, that it is comfortable with its record of shareholder value creation and

the status quo. |

| · | On December 19, 2024, Barington filed this preliminary proxy statement. |

REASONS FOR THE SOLICITATION

Barington is an investment

firm with a twenty-three year track record of working with underperforming companies to help design and implement measures to improve

their long-term financial and share price performance. As a frequent investor in industrial and multi-segment companies, we have actively

followed Matthews over the years and have had regular discussions with the Company for nearly three years.

We believe that the Company

has a vast value potential that is not being realized under its current leadership. It is our belief that Mr. Bartolacci has failed to

take full advantage of the tremendous opportunities for long-term value creation available to the Company. This is evidenced by the Company’s

prolonged and severe underperformance relative to its self-selected peers and the broader market, not just over the past one-, three-,

five- and ten-year periods, but over Mr. Bartolacci’s entire 18-year tenure as CEO. We believe the Company’s disappointing

share price performance is the result of poor capital allocation, uneven execution, and, ultimately, a lack of accountability to shareholders

in the boardroom. Given the Company’s extended and severe share price underperformance, we question whether the Board has the independence

and objectivity needed to effectively oversee management and hold them accountable. We do not have confidence that the Board, as currently

composed, will take the decisive action necessary to maximize opportunities for value creation.

We have attempted in good-faith

to work constructively with the Company to address these issues, but we believe that our efforts have been unproductive. In December 2022,

we entered into the 2022 Agreement to provide consulting and advisory services to Matthews, drawing on our successful experience at L

Brands, where we collaborated closely with its leadership team and board of directors to unlock significant shareholder value. Despite

Barington’s track record, it appears to us that the Company has not made meaningful progress on the initiatives we suggested. We

believe that the Company kept us at arms-length, as our interactions were largely limited to quarterly meetings to discuss recent results

and a single presentation to the Board. Given this limited collaboration, we are convinced that the Board must be meaningfully refreshed,

including by adding a shareholder representative, to help the Company realize its full value potential.

Therefore, we are soliciting

your support at the Annual Meeting to elect our three highly-qualified Barington Nominees, who we believe would bring to the Board significant

and relevant experience, fresh perspectives, renewed accountability to shareholders and importantly, the objectivity to make decisions

without the burden of attachment to past practices. We are also calling on the Company to declassify the Board to increase accountability

to shareholders by having all directors elected on an annual basis. After 18 years of underperformance, we believe Matthews’ shareholders

deserve far better than what the current Board has delivered.

We Are Very Disappointed with the Company’s

Prolonged Share Price Underperformance

The Company’s record

of long-term value creation for shareholders has been dismal under the protracted tenure of Mr. Bartolacci, who has served as the Company’s

President and Chief Executive Officer since 2006. As shown in the table below, the Company’s Common Stock (including dividends)

has significantly underperformed its self-selected peers and the market as a whole, not just over the past one-, three-, five- and ten-year

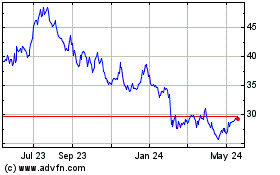

periods, but over Mr. Bartolacci’s entire 18-year tenure as CEO:

| | |

Cumulative

Total Return to Shareholders through 12/6/2024

(Percent change)

|

| | |

Matthews | |

Company Peer Group1 | |

S&P 500 Index | |

Russell 2000 Index |

| 1-Year | |

| (11.0 | ) | |

| 23.2 | | |

| 31.8 | | |

| 27.9 | |

| 3-Years | |

| (11.8 | ) | |

| 31.2 | | |

| 30.5 | | |

| 8.5 | |

| 5-Years | |

| (11.3 | ) | |

| 64.5 | | |

| 94.2 | | |

| 47.8 | |

| 10-Years | |

| (23.9 | ) | |

| 166.6 | | |

| 195.7 | | |

| 102.8 | |

| 18-Years (CEO Tenure) | |

| 8.9 | | |

| 629.3 | | |

| 357.5 | | |

| 235.1 | |

Source: S&P Capital IQ

We Believe the Company’s Track Record

of Capital Allocation and Execution is Extremely Poor

In our view, the

Company’s dismal share price performance reflects a consistent pattern of poor capital allocation decisions, including

unsuccessful acquisitions. It appears to us that the Company has invested solely to increase revenue, which expanded by 150.8%

during Mr. Bartolacci’s tenure, with little regard for return on capital invested, which declined by 8.9 percentage points

from 14.7% in fiscal 2007 to 5.9% in fiscal 2024.2

In aggregate, the Company has invested a whopping $1.8 billion during Mr. Bartolacci’s tenure, including $1.2 billion in

acquisitions and $625.2 million in capital expenditures. Notably, we estimate that more than half (approximately 53%) of these

investments have gone to the Company’s lower margin, declining SGK Brand Solutions segment and only 23% to its highest margin,

highest return Memorialization segment.3

The acquisition of Schawk,

Inc. (SGK Brand Solutions), a global packaging and brand experience business, is a prime example of poor capital allocation. Since being

acquired for $616.7 million in fiscal 2014, SGK Brand Solutions’ revenue has decreased by $262.3 million, or 32.8%, falling from

$798.4 million in fiscal 2015 to $536.6 million in fiscal 2024. Moreover, Matthews was required to write down its investment by a total

of $266.2 million, underscoring what we see as likely missteps associated with the acquisition and the operation of this business under

Mr. Bartolacci’s leadership. While the revenue of this business appears to have stabilized, we do not find a modest revenue increase

of $3.3 million (or 0.6%) in fiscal 2024 compared to fiscal 2023 a turnaround or a reason for the Company to declare victory.4

Similarly, we believe that

the Company’s investments in the Industrial Technologies segment during Mr. Bartolacci’s tenure – which includes more

established businesses such as Warehouse Automation and Product Identification, as well as its emerging Energy Storage (dry cell lithium-ion

battery manufacturing) business – have delivered little meaningful value for shareholders. Given the Company’s track record

to date, we do not support the Company pursuing additional bolt-on acquisitions for its Industrial Technologies segment at this time.

1 Company Peer Group performance is based on the market capitalization-weighted total shareholder return (including dividends) of the companies in the Company’s peer group as identified in its 2024 proxy statement which consists of Barnes Group Inc., Columbus McKinnon Corporation, Deluxe Corporation, Enpro Inc., Graco Inc., ICF International, Inc., Hillenbrand, Inc., John Wiley & Sons, Inc., Mativ Holdings, Inc., MSA Safety Incorporated, Minerals Technologies Inc., Moog Inc. , Service Corporation International, Standex International Corporation, TriMas Corporation, Woodward, Inc., but excluding Altra Industrial Motion Corp., Kaman Corporation, and Stagwell Inc. whose stock did not trade for the entire period from October 2, 2006 to December 6, 2024. (the “Peer Group”).

2 Return on invested capital (“ROIC”) is based on the Company’s

tax-effected EBIT divided by the average annual capital. We note that the Company’s use of EBITDA in place of tax-effected EBIT

to compute its annual ROIC for the purpose of compensation, does not reflect the Company’s actual annual interest and tax expense,

depreciation (the deferred cost of the Company’s actual capital expenditures), and amortization (the cost of the Company’s

acquisitions.). Company SEC filings.

3 Company SEC filings.

4 Company SEC filings.

We are also deeply concerned

about the Company’s investment in dry cell lithium-ion battery manufacturing equipment. Regardless of the merits of Matthews’

battery manufacturing technology, we believe that the Company’s ability to commercialize and scale this technology remains highly

uncertain. Matthews appears to have limited experience competing in the energy storage and lithium-ion battery market. It appears that

Tesla, Inc. (“Tesla”) is likely the Company’s only customer for this equipment today and ongoing litigation between

the parties raises serious questions about the future of this relationship.5

The EV battery industry is evolving rapidly, with new chemistries and manufacturing technologies continually emerging. Between 2021 and

2023, cumulative early-stage investment in battery innovation more than tripled to nearly $1.4 billion, with lithium technologies accounting

for only 60% of the total.6 Moreover, the

market is dominated by well-funded Chinese incumbents with significant excess capacity. China currently represents nearly 90% of global

installed cathode active material manufacturing capacity and over 97% of anode active material manufacturing capacity.7

We Believe Mr. Bartolacci Has Not Created

Value for Shareholders During His 18-year Tenure

We believe that Mr. Bartolacci

lacks the credibility and requisite experience to continue to lead Matthews, as evidenced by the Company’s poor share price performance

during his 18-year tenure as CEO. In our view, his record of capital allocation and operating execution has been particularly dismal.

In addition, we question

the sincerity and sufficiency of the Company’s recent announcements regarding its strategic review and expense reductions. These

initiatives appear reactive, and we question whether they were only undertaken in response to our growing frustration over the Company’s

lack of progress in addressing the issues we have identified. Unfortunately, Mr. Bartolacci’s has a long history of making lofty

commitments to shareholders without delivering meaningful results.8

In our view, the latest announcements are likely only another hollow attempt to prolong his already protracted tenure.

Moreover, Mr. Bartolacci’s

background and experience appear ill-suited for a diversified conglomerate like Matthews with extensive investments in technology-focused

businesses. A lawyer by training, Mr. Bartolacci spent more than half of his pre-CEO career in various legal roles, followed by six years

in leadership positions within the Company’s Memorialization segment and a single year as President and COO before ascending to

the CEO role. Notably, it appears he lacked meaningful experience in capital allocation or managing technology-driven, high-growth businesses

when he assumed leadership of the Company—a shortcoming that we believe continues to hinder Matthews’ ability to create long-term

shareholder value.

5

Telsa sued Matthews for allegedly stealing trade secrets related to Tesla's battery-manufacturing process and sharing them with

Tesla’s competitors. The lawsuit claims that Matthews owes damages that Tesla “conservatively estimates will exceed $1

billion” for misusing Tesla trade secrets. Tesla, Inc. v. Matthews International Corporation (5:24-cv-03615).

6 Source: Global EV Outlook 2024, the International Energy Agency.

7 Source: Global EV Outlook 2024, the International Energy Agency.

8 For example, in 2018, Mr. Bartolacci shared that “we are making

good progress on the execution of our growth strategy … within our SKG Brand Solutions segment, for the first time in a while,

our pipeline of wins and proposals is robust and growing” (Matthews, Q2 2018 earnings call, April 27, 2018). In 2020, Mr. Bartolacci

opined that “SGK … is expected to deliver nominalized results for the fourth quarter and positioned to deliver a strong recovery

into next year” (Matthews, Q3 2020 earnings call, July 31, 2020) and again in 2022 he announced that “with SGK, we’re

expecting growth” (Matthews Q4 2022 earnings call, November 18, 2022). Yet, revenue decreased by $262.3 million, or 32.8% between

fiscal 2015 and fiscal 2024. Similarly, nearly every year since 2017, Mr. Bartolacci has lauded the imminent launch of a new innovative

printing solution, telling investors in January of 2017 that “[w]e are approaching the launch of what we believe to be a significant

new product” (Matthews Q1 2017 earnings call, January 27, 2017) and frequently claiming “progress”. As of the date of

this letter, the product is still in beta testing and the Company is preparing for another delayed launch in “the latter half of

fiscal 2025” (Matthews Q4 2024 Earnings Call, November 22, 2022).

We Are Concerned with the Board’s

Effectiveness and Alignment with Shareholders

Lastly, given the dismal

share price performance of the Company over a long period of time, we strongly believe that meaningful changes to the composition

of the Board are urgently needed. Ultimately, the Board is responsible for holding management accountable, retaining Mr. Bartolacci as

CEO for an extended tenure and approving and overseeing the Company’s capital allocation strategy. While boards of directors at

other companies are increasingly holding leadership accountable, the Board at Matthews has seemingly chosen to look the other way for

far too long. Indeed, in our view, this Board is not holding itself accountable for the Company’s performance during its tenure.

We believe that the status

quo is not acceptable. To ensure that the Board is acting in the best interests of shareholders, we believe that the Board must promptly

be refreshed with experienced directors, committed to shareholder value creation. We have nominated three directors with the boardroom

skills and experience that we believe are needed to help create long-term value for shareholders. If elected, they are committed to working

diligently with the Board to implement our recommendations, subject to their fiduciary duties.

We Are Concerned with the Board’s

Entrenchment

In our view, the Board’s composition is overly entrenched and

long-tenured, in part due to its classified structure, and needs new, experienced directors. By the Annual Meeting, directors on the Board

will have an average tenure of approximately 11 years – four years longer than the average director tenure at Russell 3000 companies.

Alarmingly, by the Annual Meeting, eight of the Company’s 11 directors have been on the Board for 10 or more years, raising questions

about whether these directors are truly independent. We believe that shareholders should support directors with long tenures if they create

shareholder value. We do not support long-tenured directors who destroy shareholder value, and each of the Matthews directors has presided

over a declining share price during his or her tenure.

We believe that directors

should be elected annually, enabling shareholders to evaluate the performance of directors each year and use their vote to either support

the status quo or encourage change. We believe a well-functioning capital markets system requires companies to have governance structures,

such as a declassified board structure, that safeguard and support foundational rights for shareholders. To address these issues and enhance

accountability to shareholders, we strongly believe that the Company should take the necessary steps to declassify the Board and increase

accountability to shareholders. After 18 years of underperformance, we believe Matthews’ shareholders deserve far better than what

the current Board has delivered.

OUR THREE NOMINEES HAVE THE EXPERIENCE,

QUALIFICATIONS AND COMMITMENT NECESSARY TO FULLY EXPLORE AVAILABLE OPPORTUNITIES TO UNLOCK VALUE FOR SHAREHOLDERS

We have identified three highly-qualified

director nominees— Ana B. Amicarella, Chan W. Galbato, and James Mitarotonda—who possess significant business, financial,

and public company board experience, as evidenced by their biographies set forth in Proposal 1. We believe they will bring fresh perspective

into the Boardroom and will be valuable in assessing and ensuring the execution of the necessary initiatives to improve long-term value

at the Company. We believe Matthews’ continued underperformance at this critical juncture warrants the addition of new directors

whose interests are closely aligned with those of all shareholders, and who will work constructively with the other members of the Board

to protect shareholder interests.

If elected, the Barington

Nominees will work diligently to establish a culture of accountability and will fully and fairly evaluate all opportunities to maximize

shareholder value. As a long-term investor in Matthews, Barington’s interests are closely aligned with those of all shareholders,

and the Barington Nominees will relentlessly seek to deliver value to shareholders.

PROPOSAL 1

ELECTION OF DIRECTORS

The Company has a classified Board

which is currently divided into three (3) classes. The directors in each class are elected for staggered terms of three (3) years such

that the term of office of one (1) class of directors expires at each annual meeting of shareholders. We believe that the terms of three

(3) directors expire at the Annual Meeting. We are seeking your support at the Annual Meeting to elect the Barington Nominees, Ana B.

Amicarella, Chan W. Galbato and James Mitarotonda, to serve until their respective successors are elected and qualified for terms ending

at the 2028 annual meeting of shareholders (the “2028 Annual Meeting”).

Your vote to elect the Barington

Nominees will have the legal effect of replacing three (3) incumbent directors of the Company with the Barington Nominees. If elected,

the Barington Nominees will constitute a minority of the Board and there can be no guarantee that the Barington Nominees will be able

to implement any actions that they may believe are necessary to unlock shareholder value. However, we believe the election of the Barington

Nominees is a critical step in the right direction for enhancing long-term value at the Company.

There is no assurance that any

incumbent director will serve as a director if the Barington Nominees are elected to the Board. You should refer to the Company’s

proxy statement for the names, backgrounds, qualifications, and other information concerning the Company’s nominees.

This Proxy Statement is soliciting

proxies to elect our three (3) Barington Nominees. We have provided the required notice to the Company pursuant to the Universal Proxy

Rules, including Rule 14a-19(a)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and intend

to solicit the holders of Common Stock representing at least 67% of the voting power of Common Stock entitled to vote on the election

of directors in support of director nominees other than the Company’s nominees.

THE BARINGTON NOMINEES

The following information sets

forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices or employments

for the past five (5) years of each of the Barington Nominees. The nominations were made in a timely manner and in compliance with the

applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that

led us to conclude that the Barington Nominees should serve as directors of the Company are set forth above in the section entitled “Reasons

for the Solicitation” and below. This information has been furnished to us by the Barington Nominees. All of the Barington Nominees

are citizens of the United States of America, and Ms. Amicarella is also a citizen of Venezuela and Italy.

Ana B. Amicarella, age

58, has served as Chief Executive Officer of EthosEnergy, an independent service provider of rotating equipment services and solutions

to the global power, oil and gas and industrial markets, since 2019. Ms. Amicarella previously served as Managing Director for the Latin

America business, as well as Vice President of various business units of Aggreko PLC, a rental business of mobile power plants and temperature

control solutions, from 2011 to 2019. Ms. Amicarella began her career in various field service roles, as well as global operations and

leadership positions at GE Energy and Oil & Gas, provider of equipment, services, and technology solutions to the energy and oil &

gas industry, from 1988 to 2011. Ms. Amicarella has served on the board of directors of Forward Air Corporation (NASDAQ: FWRD), a transportation

and logistics company since 2017 and Warrior Met Coal, Inc. (NYSE: HCC), a coal mining company that produces and exports coal for the

global steel industry, since 2018. Ms. Amicarella received a B.S. in Electrical Engineering from The Ohio State University and an M.B.A.

from Oakland University.

We believe that Ms. Amicarella’s

extensive business management, financial expertise and public board experience, coupled with over 30 years’ experience in the energy

and power generation industry, would make her a valuable addition to the Board.

Chan W. Galbato, age 61, currently

serves as Chief Executive Officer of Cerberus Operations and Advisory Company, LLC (“Cerberus”), a wholly owned subsidiary

of Cerberus Capital Management, L.P. Prior to joining Cerberus in 2009, Mr. Galbato served as President and Chief Executive Officer of

the Controls Division of Invensys plc, a multinational engineering and information technology company, from 2005 to 2007, as well as President

of Professional Distribution and Services at The Home Depot (NYSE: HD), a home improvement retailer, from 2003 to 2005. Prior to that,

Mr. Galbato served as President and Chief Executive Officer of Armstrong Floor Products, a division of Armstrong World Industries, from

2001 to 2003, and as Chief Executive Officer of Choice Parts LLC, a joint venture auto parts locator and catalog business, from 2000 to

2001. Additionally, Mr. Galbato spent 14 years with General Electric Company (NYSE: GE), holding several operating and finance leadership

positions within their various industrial divisions, including Transportation Systems, Aircraft Engines, Medical Systems and Appliances,

as well as serving as President and Chief Executive Officer of Coregis Insurance Company, a GE Capital company, from 1998 to 2000. Mr.

Galbato served on various board of directors, including Co-Chairman of Albertsons Companies, Inc. (NYSE: ACI), a food and drug retailer,

from April 2021 to October 2024; FirstKey Homes, LLC, a property management company that specializes in single-family rental homes, from

September 2017 to May 2024; Blue Bird Corporation (NASDAQ: BLBD) (“Blue Bird”), a technology leader and innovator of school

buses, from February 2015 to May 2023; Staples Solutions B.V., a retail, contract, and online businesses company, from February 2017 to

January 2023; AutoWeb, Inc. (formerly, NASDAQ: AUTO), an automotive media and marketing services company, from January 2019 to May 2022;

KORE Group Holdings, Inc. (NYSE: KORE), a pioneer in delivering IoT solutions and services, from September 2021 to February 2022; Lead

Director of Delta Tucker Holdings, Inc. (formerly, DynCorp International Inc.), a manufacturer of aerospace and defense products, from

May 2014 to November 2020; Steward Health Care Systems LLC, a private, physician-led health care network, from February 2013 to May 2020;

and Chairman of Avon Products, Inc., (formerly, NYSE: AVP), a global manufacturer and marketer of beauty and related products, from March

2016 to January 2020. Prior to that, Mr. Galbato served as Lead Director of Brady Corporation (NYSE: BRC), a manufacturing company, from

2006 to 2013. Mr. Galbato has previously served on the board of directors of prior Cerberus investments, including Chairman of School

Bus Holdings Inc., an indirect parent company of Blue Bird, from 2009 to 2016; Chairman of YP Holdings LLC, provider of marketing solutions;

Chairman of North American Bus Industries, Inc., manufacturer of heavy-duty transit buses; Chairman of Guilford Mills, Inc., a company

that designs, manufactures, and markets a variety of fabrics for automotive and specialty use; New Avon, a beauty company; Tower International,

Inc., a manufacturer of automotive structural metal components; and Chairman of NewPage Group, Inc., producer of printing and specialty

papers. Mr. Galbato received an M.B.A. from the University of Chicago and a B.A. in Economics from the State University of New York.

We believe that Mr. Galbato’s

significant experience in multiple operational and strategic roles, as well as his extensive service on the boards of various public and

private companies, would make him a valuable addition to the Board.

James Mitarotonda, age

70, has served as Chairman, President and Chief Executive Officer of Barington Capital Group, L.P. (“Barington Capital Group”),

since 1991, and of Barington Companies Investors, LLC (“Barington Companies Investors”), the general partner of BCEP, an activist

investment fund, since 1999. Mr. Mitarotonda has also served on the board of directors of The Eastern Company (NASDAQ: EML), a manufacturer

of industrial hardware, security and metal products, since 2015, and as Chairman since 2016. Mr. Mitarotonda previously served on the

board of directors of Rambus, Inc. (NASDAQ: RMBS) (“Rambus”), a technology company that designs, develops, and licenses chip

interface technologies and architectures used in digital electronics products, from March 2021 to April 2022; Avon Products, Inc. (formerly,

NYSE: AVP), a global manufacturer and marketer of beauty and related products, from April 2018 to January 2020; and OMNOVA Solutions Inc.

(formerly, NYSE: OMN), a global provider of emulsion polymers and specialty chemicals, from 2015 to April 2020. Prior to this, Mr. Mitarotonda

served on the board of directors of A. Schulman Inc. (formerly, NASDAQ: SHLM), an international supplier of plastic compounds and resins,

from 2005 to 2018; Barington/Hilco Acquisition Corp. (formerly, NASDAQ: BHAC), a special purpose acquisition company, from 2015 to 2018,

as well as Chief Executive Officer, from February 2015 to May 2015, and as Chairman from 2015 to 2017; The Pep Boys – Manny, Moe

& Jack (formerly, NYSE: PBY), an automotive aftermarket service and retail chain, from 2006 to 2016, as well as Chairman from 2008

to 2009; Ebix, Inc. (NASDAQ: EBIX), a supplier of software and e-commerce services to the insurance, financial and healthcare industries,

from January 2015 to March 2015; The Jones Group Inc. (formerly, NYSE: JNY), a designer, marketer and wholesaler of branded clothing,

shoes and accessories, from 2013 to 2014; Griffon Corporation (NYSE: GFF), a diversified manufacturing company, from 2007 to 2012; Gerber

Scientific, Inc. (formerly, NYSE: GRB), an international supplier of automated manufacturing systems, from 2010 to 2011; and Ameron International

Corporation (formerly, NYSE: AMN), a multinational manufacturer of products and materials for the chemical, industrial, energy, transportation

and infrastructure markets, from March 2011 to October 2011. Additionally, Mr. Mitarotonda served as a consultant to this Company from

December 2022 to November 2024; advisor to Hanesbrands Inc. (NYSE: HBI), a multinational clothing company, from November 2023 to October

2024; consulting advisor to Rambus from April 2022 to April 2023; and special advisor to the board of directors of Bath & Body Works,

Inc. (formerly, L Brands, Inc., (NYSE: LTD)), a specialty retail company, from April 2019 to February 2022. Mr. Mitarotonda received a

B.A. in Economics from Queens College, and an M.B.A. from New York University’s Graduate School of Business Administration (now

known as the Stern School of Business).

We believe that Mr. Mitarotonda’s

knowledge of, and experience investing in, companies in a wide variety of industries, coupled with his financial, investment banking,

and corporate governance expertise and his extensive public board service, would make him a valuable addition to the Board.

The principal business address

of Ms. Amicarella is 3551 W Ridge Ln, Manvel, Texas 77578. The principal business address of Mr. Galbato is 168 West 86th Street, New

York, New York 10024. The principal business address of Mr. Mitarotonda is 888 Seventh Avenue, 6th Floor, New York, New York 10019.

As of the date hereof, Ms. Amicarella

and Mr. Galbato do not beneficially own any shares of Common Stock and have not entered into any transactions in the securities of the

Company during the past two years.

As of the date hereof, BCEP directly

beneficially owns 563,962 shares of Common Stock. Barington Companies Investors, as the general partner of BCEP, may be deemed to beneficially

own the 563,962 shares of Common Stock owned by BCEP. Barington Capital Group, as the majority member of Barington Companies Investors,

may be deemed to beneficially own the 563,962 shares of Common Stock owned by BCEP. LNA Capital, as the general partner of Barington

Capital Group, may be deemed to beneficially own the 563,962 shares of Common Stock owned by BCEP. Mr. Mitarotonda, as the sole shareholder

and director of LNA Capital, may be deemed to beneficially own the 563,962 shares of Common Stock owned by BCEP. Mr. Mitarotonda disclaims

beneficial ownership of such shares of Common Stock, except to the extent of his pecuniary interest therein. Mr. Mitarotonda has not

entered into any transactions in the securities of the Company during the past two years. For information regarding purchases and sales

of securities of the Company during the past two years by Barington and NBL, please see Schedule I.

Except as set forth below

with respect to Mr. Mitarotonda, we believe that each Barington Nominee presently is, and if elected as a director of the Company, each

of the Barington Nominees would be, an “independent director” within the meaning of (i) applicable NASDAQ listing standards

applicable to board composition and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. Notwithstanding the foregoing, we acknowledge

that no director of a NASDAQ listed company qualifies as “independent” under the NASDAQ listing standards unless the board

of directors affirmatively determines that such director is independent under such standards. Accordingly, we acknowledge that if any

Barington Nominee is elected, the determination of such Barington Nominees’ independence under the NASDAQ listing standards ultimately

rests with the judgment and discretion of the Board. No Barington Nominee is a member of the Company’s compensation, nominating

or audit committee that is not independent under any such committee’s applicable independence standards. As set forth below, Mr.

Mitarotonda had an indirect interest in the payments made by the Company to Barington Companies Management, LLC (“Barington Companies

Management”) pursuant to the 2022 Agreement and, as a result, may not be deemed to be an “independent director” within

the meaning of the applicable NASDAQ listing standards as of the date hereof.

On December 30, 2022, each

of BCEP, Barington Capital Group and Barington Companies Management entered into the 2022 Agreement with the Company, pursuant to which

the Company agreed to appoint Barington Companies Management as a consultant to the Company for the term of the 2022 Agreement. Pursuant

to the 2022 Agreement, the Company paid Barington Companies Management, at the end of each month during the term of the 2022 Agreement,

$19,167 for its consulting and advisory services relating to corporate governance and strategic matters, and also reimbursed Barington

Companies Management and certain of its affiliates $50,000 for their out-of-pocket fees and expenses incurred in connection with their

communication and meetings with representatives of the Board and the Company’s management. The 2022 Agreement terminated pursuant

to its terms on November 1, 2024.

Except as otherwise set forth

in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no Barington Nominee has been convicted in a criminal

proceeding (excluding traffic violations or similar misdemeanors); (ii) no Barington Nominee directly or indirectly beneficially owns

any securities of the Company; (iii) no Barington Nominee owns any securities of the Company which are owned of record but not beneficially;

(iv) no Barington Nominee has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price

or market value of the securities of the Company owned by any Barington Nominee is represented by funds borrowed or otherwise obtained

for the purpose of acquiring or holding such securities; (vi) no Barington Nominee nor any of his or her associates is, or within the

past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company,

including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit,

division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any Barington Nominee owns beneficially,

directly or indirectly, any securities of the Company; (viii) no Barington Nominee owns beneficially, directly or indirectly, any securities

of any parent or subsidiary of the Company; (ix) no Barington Nominee nor any of his or her affiliates, associates or immediate family

members was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year,

or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries

was or is to be a party, in which the amount involved exceeds $120,000; (x) no Barington Nominee nor any of his or her associates has

any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect

to any future transactions to which the Company or any of its affiliates will or may be a party; (xi) no Barington Nominee nor any of

his or her associates has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on

at the Annual Meeting; (xii) no Barington Nominee holds any positions or offices with the Company; (xiii) no Barington Nominee has a family

relationship with any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer,

(xiv) no companies or organizations, with which any of the Barington Nominees has been employed in the past five years, is a parent, subsidiary

or other affiliate of the Company and (xv) there are no material proceedings to which any Barington Nominee or any of his or her associates

is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

Except as disclosed herein, with respect to each of the Barington Nominees, (a) none of the events enumerated in Item 401(f)(1)-(8) of

Regulation S-K of the Exchange Act (“Regulation S-K”) occurred during the past 10 years, (b) there are no relationships involving

any Barington Nominee or any of such Barington Nominee’s associates that would have required disclosure under Item 407(e)(4) of

Regulation S-K had such Barington Nominee been a director of the Company, and (c) none of the Barington Nominees nor any of their associates

has received any fees earned or paid in cash, stock awards, option awards, non-equity incentive plan compensation, changes in pension

value or nonqualified deferred compensation earnings or any other compensation from the Company during the Company’s last completed

fiscal year, or was subject to any other compensation arrangement described in Item 402 of Regulation S-K.

Other than as set forth in this

Proxy Statement, there are no agreements, arrangements or understandings between or among Barington and the Barington Nominees or any

other person or persons pursuant to which the nominations described herein are to be made, other than the consent by each of the Barington

Nominees to be named as a nominee of Barington in any proxy statement relating to the Annual Meeting and serving as a director of the

Company if elected. None of the Barington Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest

adverse to the Company or any of its subsidiaries in any material pending legal proceeding.

We do not expect that any

of the Barington Nominees will be unable to stand for election, but, in the event any Barington Nominee is unable to serve or for good

cause will not serve, the shares of Common Stock represented by the enclosed GOLD universal proxy card will be voted for substitute

nominee(s), to the extent this is not prohibited under the Company’s Amended and Restated By-Laws (the “Bylaws”) or

applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to the

Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Barington Nominee,

to the extent this is not prohibited under the Bylaws and applicable law. In any such case, we would identify and properly nominate such

substitute nominee(s) in accordance with the Bylaws and the shares of Common Stock represented by the enclosed GOLD universal proxy

card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent that is not prohibited

under Matthews’ organizational documents and applicable law, if the Company increases the size of the Board above its existing size.

Barington and Matthews will each be using a universal proxy card for

voting on the election of directors at the Annual Meeting, which will include the names of all nominees for election to the Board. Shareholders

will have the ability to vote for up to three (3) nominees on Barington’s enclosed GOLD universal proxy card. Any shareholder

who wishes to vote for any combination of the Company’s nominees and the Barington Nominees may do so on Barington’s enclosed

GOLD universal proxy card. There is no need to use the Company’s white proxy card or voting instruction form, regardless

of how you wish to vote.

Shareholders are permitted to

vote for fewer than three (3) nominees or for any combination (up to three (3) total) of the Barington Nominees and the Company’s

nominees on the GOLD universal proxy card. There is no need to use the Company’s white universal proxy card or voting

instruction form, regardless of how you wish to vote. However, Barington urges shareholders to vote using our GOLD universal

proxy card “FOR” all of the Barington Nominees.

IF YOU MARK FEWER THAN THREE

(3) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, OUR GOLD UNIVERSAL PROXY CARD, WHEN DULY EXECUTED, WILL BE VOTED

ONLY AS DIRECTED. IF NO DIRECTION IS INDICATED WITH RESPECT TO HOW YOU WISH TO VOTE YOUR SHARES, THE PROXIES NAMED THEREIN WILL VOTE SUCH

SHARES “FOR” THE THREE (3) BARINGTON NOMINEES.

IMPORTANTLY, IF YOU MARK MORE

THAN THREE (3) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS WILL

BE DEEMED INVALID.

WE STRONGLY URGE YOU TO VOTE “FOR”

THE ELECTION OF THE BARINGTON NOMINEES ON THE ENCLOSED GOLD UNIVERSAL PROXY CARD.

PROPOSAL 2

SELECTION OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

As discussed in further detail

in the Company’s proxy statement, the Audit Committee of the Board has appointed Ernst & Young LLP as the independent registered

public accounting firm to audit the records of the Company for the year ending September 30, 2025. According to the Company’s proxy

statement, the Audit Committee of the Board has determined that it would be desirable as a matter of good corporate practice to request

an expression of opinion from the shareholders on the appointment. If the shareholders do not ratify the selection of Ernst & Young

LLP, the selection of an alternative independent registered public accounting firm will be considered by the Audit Committee of the Board;

provided, however, even if the shareholders do ratify the selection of Ernst & Young LLP, the Audit Committee of the Board reserves

the right, at any time, to re-designate and retain a different independent registered public accounting firm to audit the records of the

Company for the year ending September 30, 2025.

According to the Company’s

proxy statement, ratification of the appointment of Ernst & Young LLP requires the affirmative vote of a majority of the shares cast

at the meeting and entitled to vote, a quorum being present. Abstentions and broker non-votes will have the effect of a vote cast “against”

the proposal.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THE RATIFICATION

OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM AND INTEND TO VOTE OUR

SHARES “FOR” THIS PROPOSAL.

PROPOSAL 3

ADVISORY (NON-BINDING) VOTE ON THE EXECUTIVE COMPENSATION

OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

As discussed in further

detail in the Company’s proxy statement, as required by the Exchange Act, the Company is presenting the below proposal, which

gives shareholders the opportunity to endorse or not endorse the Company’s pay program for its named executive officers by

voting for or against the resolution set forth below. Accordingly, the Board is asking shareholders to approve the following

resolution:

“RESOLVED, that the shareholders

approve (on a non-binding basis) the compensation of the Company’s named executive officers, as disclosed in the Compensation Discussion

and Analysis, the compensation tables, and the related disclosure contained in the Proxy Statement set forth under the caption ‘Executive

Compensation and Retirement Benefits.’”

As disclosed in the Company’s

proxy statement, because the vote is advisory, it will not be binding on the Board. However, the Board and the Compensation Committee

of the Board will review the voting results and take into account the outcome when considering future executive compensation arrangements.

According to the Company’s proxy statement, the affirmative vote of at least a majority of the shares cast at the Annual Meeting

and entitled to vote, a quorum being present, is required for the approval of this proposal. Abstentions and broker non-votes will have

the effect of a vote cast “against” the proposal.

We recommend shareholders

vote against approving (on a non-binding basis) the executive compensation of the Company’s named executive officers. We believe

the Company’s executive compensation is not adequately aligned with the interest of its shareholders and does not reflect the Company’s

“pay-for-performance philosophy.” The Company has set sequentially lower operating cash flow performance targets for compensation

between 2020 and 2023. The corporate operating cash flow performance target was $226.1 million for fiscal 2020, when it was introduced,

and was $150.0 million for fiscal 2023, a reduction of 33.7%. The Company has raised the corporate net income performance target for compensation

at an average annual rate of only 1.2% between 2011 and 2023, despite spending $1.8 billion on acquisitions and capital expenditures over

this period. Furthermore, we believe that the Company’s selected peers for the purpose of executive compensation inflate the Company’s

overall compensation levels. The companies in the Peer Group for the purpose of benchmarking Matthews’ compensation are significantly

larger than the Company. The median market capitalization and enterprise value of the Company Peer Group is 170% larger and 100% larger,

respectively, than the Company’s market capitalization and enterprise value.9

WE RECOMMEND SHAREHOLDERS VOTE “AGAINST”

THE COMPANY’S ADVISORY VOTE ON EXECUTIVE COMPENSATION AND INTEND TO VOTE OUR SHARES “AGAINST” THIS PROPOSAL.

9 Company Peer Group as defined in footnote 1. Company SEC filings.

VOTING AND PROXY PROCEDURES

Only shareholders of record

on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Shareholders who sell their shares of Common Stock

before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares. Shareholders of record

on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares after the Record

Date. Based on publicly available information, Barington believes that the only outstanding class of securities of the Company entitled

to vote at the Annual Meeting is the Common Stock.

Shares of Common Stock represented

by properly executed GOLD universal proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions,

will be voted FOR the election of the Barington Nominees, FOR the ratification of the appointment of Ernst & Young LLP

as the independent registered public accounting firm, AGAINST the proposal to approve, on an advisory basis, the compensation of

the Company’s named executive officers, and in the discretion of the persons named as proxies on all other matters as may properly

come before the Annual Meeting, as described herein.

According to the Company’s

proxy statement, the current Board intends to nominate three directors for election at the Annual Meeting. Barington and Matthews will

each be using a universal proxy card for voting on the election of directors at the Annual Meeting, which will include the names of all

nominees for election to the Board. Shareholders will have the ability to vote for up to three (3) nominees on Barington’s enclosed

GOLD universal proxy card. Any shareholder who wishes to vote for any combination of the Company’s nominees and the Barington

Nominees may do so on Barington’s GOLD universal proxy card. There is no need to use the Company’s white universal

proxy card or voting instruction form, regardless of how you wish to vote.

Shareholders are permitted

to vote for fewer than three (3) nominees or for any combination (up to three (3) total) of the Barington Nominees and the Company’s

nominees on the GOLD universal proxy card.

We believe that voting

on the GOLD universal proxy card provides the best opportunity for shareholders to elect all of the Barington Nominees. Barington

therefore urges shareholders to use our GOLD universal proxy card to vote “FOR” the three (3) Barington Nominees.

IMPORTANTLY, IF YOU

MARK MORE THAN THREE (3) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS

WILL BE DEEMED INVALID. IF YOU MARK FEWER THAN THREE (3) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, THIS PROXY

CARD, WHEN DULY EXECUTED, WILL BE VOTED “FOR” THOSE NOMINEES YOU HAVE SO MARKED AND DEFAULT TO A “WITHHOLD” VOTE

WITH RESPECT TO ANY NOMINEE LEFT UNMARKED.

VIRTUAL MEETING

The Company has disclosed

that the Annual Meeting will take place in a virtual meeting format only. Shareholders will not be able to attend the Annual Meeting in

person.

According to the Company’s

proxy statement, the process for attending the Annual Meeting depends on how your Common Stock is held. Generally, you may hold Common

Stock in your name as a “record holder” or in an account with a bank, broker, or other nominee (i.e., in “street

name”).

If you are a record shareholder

(i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the Annual Meeting

virtually on the Internet. Record shareholders should follow the instructions provided in their proxy materials.

If you hold your shares

in “street name,” you must register in advance to attend and vote at the virtual Annual Meeting webcast. If you hold your

shares in “street name” and do not register, you may still listen to the Annual Meeting webcast by visiting [_______], but

you will not be able to participate or vote in the meeting. To register, you must obtain a “legal proxy” from the bank, broker

or other nominee of your shares and submit the legal proxy to Computershare in order to be entitled to vote those shares electronically.

Please note that obtaining a legal proxy may take several days. Requests must be received no later than [_______] on [_______]. You will

receive a confirmation of your registration by email. Requests must include your legal proxy (an image of the legal proxy or a forward

of the email from your broker including the legal proxy are acceptable) and be sent by email to [_______] with the subject “Legal

Proxy” or by mail to Computershare, Matthews International Corporation Legal Proxy, P.O. Box 43001, Providence, RI 02940-3001. If

you wish to observe the Annual Meeting without being able to vote or submit questions, you may do so by visiting the above website and

using your name and email address.

Whether or not you plan

to attend the Annual Meeting, we urge you to sign, date and return the enclosed GOLD universal proxy card in the postage-paid envelope

provided, or vote via the Internet or telephone as instructed on the GOLD universal proxy card. Additional information and Barington’s

proxy materials can also be found at www._______.com. If you have any difficulty following the registration process, please email our

proxy solicitor at info@okapipartners.com.

VOTING

Shareholder of Record

If you are a shareholder

of record, you may vote at the Annual Meeting. To vote online during the annual meeting, visit [__________]. You will need the 15-digit

control number that is printed on your GOLD universal proxy card to vote online at the Annual Meeting. You may also vote by completing,

signing and dating the GOLD universal proxy card or by proxy via the internet or telephone. To vote online before the Annual Meeting,

go to www.______.com and transmit your voting instructions up until 11:59 p.m. Eastern Standard Time on [______], 2025.

Beneficial Owner

According to the Company’s

proxy statement, if you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should receive

a proxy card and voting instructions from that organization. Simply complete and mail the proxy card to ensure that your vote is submitted

to your broker or bank. Alternatively, you may vote over the internet as instructed by your broker or bank. According to the Company’s

proxy statement, to vote in real time at the Annual Meeting, you must obtain a valid legal proxy from your broker, bank or other agent.

Follow the instructions from your broker or bank or contact your broker or bank to request a proxy form.

Whether or not you plan to attend

the Annual Meeting, we urge you to sign, date and return the enclosed GOLD universal proxy card in the postage-paid envelope provided,