Medallion Financial Announces Second Fintech Strategic Partnership at Medallion Bank

05 March 2021 - 8:05AM

Business Wire

Medallion Financial Corp. (Nasdaq: MFIN, “Medallion Financial”

or the “Company”) announced today that Medallion Bank (Nasdaq:

MBNKP, “the Bank”) has entered into a definitive agreement with

ClearGage, LLC to provide loan origination services. ClearGage

operates a technology platform which allows merchants or providers

to offer a point-of-sale consumer finance program and ongoing loan

servicing for their customers with a focus on the healthcare and

wellness industries.

Donald Poulton, President and Chief Executive Officer of

Medallion Bank, stated, “We are excited to bring ClearGage onto our

platform as we grow the bank with companies offering leading edge

technologies that make financial services more accessible to

consumers. Our effective and comprehensive compliance framework,

along with our credit risk management and ongoing monitoring and

testing, will be a positive addition to ClearGage’s offerings.”

“Partnering with Medallion Bank will provide a solid foundation

to expand our technology offerings,” stated Derek Barclay, Chief

Executive Officer of ClearGage. “We believe this engagement will

complement our program to provide full-service patient solutions

for healthcare and wellness providers ultimately leading to

increased patient volumes and conversion rates, reduction in bad

debt, and effective collections of receivables. We have a

long-lasting relationship with John Taylor, the Senior Vice

President overseeing the program at Medallion Bank, and look

forward to accelerating our growth together.”

About Medallion Financial Corp.

Medallion Financial Corp. is a finance company that originates

and services loans in various industries, and its wholly owned

subsidiary, Medallion Bank, also originates and services consumer

loans. Medallion Financial Corp. has lent more than $9 billion

since its initial public offering in 1996.

About Medallion Bank

Medallion Bank specializes in providing consumer loans for the

purchase of recreational vehicles, boats and home improvements, and

offering loan origination services to fintech partners. The Bank

works directly with thousands of dealers, contractors and financial

service providers serving their customers throughout the United

States. Medallion Bank is a Utah-chartered, FDIC-insured industrial

bank headquartered in Salt Lake City with an office in Bothell,

Washington, and is a wholly owned subsidiary of Medallion Financial

Corp. (Nasdaq: MFIN).

About ClearGage

ClearGage is a consumer-centric healthcare payments technology

and financial services company providing payment processing

solutions to the healthcare community. ClearGage’s sole purpose is

to enhance the consumer’s quality of life by providing flexible and

ethical payment solutions that enable them to receive and pay for

the products or services they need or want. ClearGage recognizes

the need for modern payment options and deliver innovative patient

payment technology that significantly reduces accounts receivable,

elevates patient satisfaction and increases total patient payments.

To learn more about ClearGage, please visit www.cleargage.com.

Please note that this press release contains forward-looking

statements that involve risks and uncertainties relating to

business performance, cash flow, net interest income and expenses,

other expenses, earnings, and growth. These statements are often,

but not always, made through the use of words or phrases such as

“will” and “continue” or the negative version of those words or

other comparable words or phrases of a future or forward-looking

nature. These statements relate to future public announcements of

our earnings, expectations regarding medallion loan portfolio, the

potential for future asset growth and market share opportunities.

Medallion’s actual results may differ significantly from the

results discussed in such forward-looking statements. For example,

statements about the effects of the COVID-19 pandemic on

Medallion’s business, operations, financial performance and

prospects constitute forward-looking statements and are subject to

the risk that the actual impacts may differ, possibly materially,

from what is reflected in those forward-looking statements due to

factors and future developments that are uncertain, unpredictable

and in many cases beyond Medallion’s control, including the scope

and duration of the pandemic, actions taken by governmental

authorities in response to the pandemic, and the direct and

indirect impact of the pandemic on Medallion, its customers and

third parties. In addition to risks related to the ongoing COVID-19

pandemic, for a description of certain risks to which Medallion is

or may be subject, please refer to the factors discussed under the

heading “Risk Factors” in Medallion’s 2019 Annual Report on Form

10-K and Form 10-Q for the quarter ended September 30, 2020.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210304005841/en/

Medallion Financial

Contact:

Alex Arzeno Investor Relations 212-328-2168

InvestorRelations@medallion.com

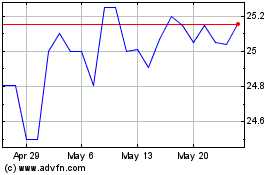

Medallion Bank (NASDAQ:MBNKP)

Historical Stock Chart

From Feb 2025 to Mar 2025

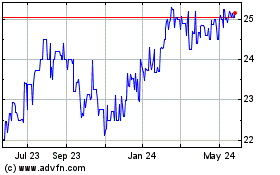

Medallion Bank (NASDAQ:MBNKP)

Historical Stock Chart

From Mar 2024 to Mar 2025