Mercer International Inc. (Nasdaq: MERC) today reported second

quarter 2024 Operating EBITDA of $30.4 million, an increase from

negative Operating EBITDA of $68.7 million in the same quarter of

2023 and a decrease from Operating EBITDA of $63.6 million in the

first quarter of 2024.

In the second quarter of 2024, net loss was

$67.6 million ($1.01 per share), which included a non-cash

impairment of $34.3 million ($0.51 per share) against goodwill

related to the Torgau facility, compared to a net loss of $98.3

million ($1.48 per share) in the second quarter of 2023 and a net

loss of $16.7 million ($0.25 per share) in the first quarter of

2024, which included a non-cash loss on disposal of $23.6 million

($0.35 per share) related to the dissolution of the Cariboo Pulp

and Paper ("CPP") joint venture.

Mr. Juan Carlos Bueno, Chief Executive Officer,

stated: "The second quarter was another improved quarter for our

pulp segment as we continued to benefit from strengthening markets.

Despite lower pulp sales volumes primarily stemming from previously

announced scheduled downtime and the disposal of CPP, cash flow

from operations improved significantly in the second quarter of

2024. This improved aggregate liquidity allowed us to reduce

borrowings by approximately $45 million under our revolving credit

facilities during the quarter.

In the second quarter, pulp prices continued to

improve in all key markets due to strengthening demand and

supply-side disruptions. As these supply-side disruptions ease and

we enter into a period of traditionally lower seasonal demand, we

currently expect pulp prices to soften slightly in the third

quarter of 2024.

Lumber pricing was relatively flat in the second

quarter of 2024 compared to the first quarter of 2024 due to

continued weakness in both the U.S. and Europe. We currently expect

lumber prices to remain relatively steady in the third quarter as

demand continues to be impacted by the high interest rate

environment and economic uncertainty.

In the second quarter, we recognized a non-cash

goodwill impairment of $34.3 million related to the Torgau facility

as a result of ongoing weakness in European lumber, pallet and

biofuel markets stemming from high interest rates and other

economic conditions. We continue to expect to realize the synergies

at Torgau as market and economic conditions improve. To position

for improved markets, we continue to proceed with certain

previously announced, high-return capital projects at the Torgau

facility designed to increase the facility's lumber production

capacity to approximately 440 million board feet and planing

capacity to approximately 145 million board feet. The addition of

planing capacity will allow us to produce more U.S. dimensional

lumber while also providing us with the flexibility to shift

production between pallets and planed goods in order to maximize

profitability. These projects are currently progressing ahead of

schedule and we expect to start to see their benefits in

mid-2025.

In the second quarter of 2024, we had 44 days of

downtime (approximately 77,600 ADMTs) at our pulp mills which

included 37 days of planned major maintenance and seven additional

days due to slower than expected start-up compared to no days of

planned maintenance in the first quarter of 2024. We are currently

planning for a total of 18 days of maintenance downtime

(approximately 19,700 ADMTs) at our pulp mills in the third quarter

of 2024.

Overall per unit fiber costs for both our pulp

and solid wood segments were flat in the second quarter of 2024

compared to the first quarter and we currently expect stable per

unit fiber costs for the third quarter of 2024.

In the second quarter, we continued to work

towards fulfilling previously secured orders for large scale mass

timber projects. We have seen tremendous growth in our mass timber

business since last year, despite the challenging economic

conditions in this high interest rate environment, and will

continue to focus on project execution and growing the business. As

part of our growth strategy, we are completing optimization

projects at our Mercer Spokane facility which are expected to have

a meaningful impact on our production costs."

Mr. Bueno concluded: "We are seeing the positive

impact of strong pulp prices and stable costs in our operating

results. Our solid wood segment continues to be negatively impacted

by the high interest rate environment, but we remain committed to

continue making strategic investments in this segment to ensure we

are in a strong position as markets recover. With our strong

liquidity position and the significant majority of our annual

scheduled maintenance downtime completed, we currently believe we

are well-positioned to realize on strengthened pulp markets going

into the second half of 2024."

____________________

*Operating EBITDA is not a measure of financial

performance under accounting principles generally accepted in the

United States ("GAAP") and should not be considered in isolation or

as a substitute for analysis of our results as reported under GAAP.

See page 6 of the financial tables included in this press release

for a reconciliation of net loss to Operating EBITDA.

Consolidated Financial

Results

| |

Q2 |

|

|

Q1 |

|

|

Q2 |

|

|

YTD |

|

|

YTD |

|

| |

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

(in thousands, except per share amounts) |

|

|

Revenues |

$ |

499,384 |

|

|

$ |

553,430 |

|

|

$ |

529,863 |

|

|

$ |

1,052,814 |

|

|

$ |

1,052,529 |

|

| Operating loss |

$ |

(43,779 |

) |

|

$ |

(448 |

) |

|

$ |

(108,832 |

) |

|

$ |

(44,227 |

) |

|

$ |

(128,953 |

) |

| Operating EBITDA |

$ |

30,439 |

|

|

$ |

63,601 |

|

|

$ |

(68,680 |

) |

|

$ |

94,040 |

|

|

$ |

(41,210 |

) |

| Net loss |

$ |

(67,586 |

) |

|

$ |

(16,703 |

) |

|

$ |

(98,306 |

) |

|

$ |

(84,289 |

) |

|

$ |

(128,884 |

) |

| Net loss per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(1.01 |

) |

|

$ |

(0.25 |

) |

|

$ |

(1.48 |

) |

|

$ |

(1.26 |

) |

|

$ |

(1.94 |

) |

|

Diluted |

$ |

(1.01 |

) |

|

$ |

(0.25 |

) |

|

$ |

(1.48 |

) |

|

$ |

(1.26 |

) |

|

$ |

(1.94 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated – Three Months Ended

June 30, 2024 Compared to Three Months Ended June 30,

2023

Total revenues for the second quarter of 2024

decreased by approximately 6% to $499.4 million from $529.9 million

in the same quarter of 2023 primarily due to lower pulp and lumber

sales volumes partially offset by higher pulp sales realizations

and manufactured products revenues.

Costs and expenses in the second quarter of 2024

decreased by approximately 15% to $543.2 million from $638.7

million in the same quarter of 2023 primarily as a result of lower

pulp and lumber sales volumes and lower per unit fiber, energy and

chemical costs. In the second quarter of 2024, costs and expenses

included a non-cash goodwill impairment of $34.3 million related to

the Torgau facility, which was recognized as a result of ongoing

weakness in lumber, pallet and biofuels markets in Europe stemming

from high interest rates and other economic conditions. We continue

to expect to realize the synergies from the Torgau acquisition as

market and economic conditions improve. In the second quarter of

2023, we recorded a non-cash inventory impairment of $51.4 million,

which was partially offset by $22.0 million of insurance proceeds

received relating to the 2021 turbine downtime at our Rosenthal

mill and the July 2022 fire at our Stendal mill.

In the second quarter of 2024, Operating EBITDA

increased to $30.4 million from negative Operating EBITDA of $68.7

million in the same quarter of 2023 primarily due higher pulp sales

realizations and lower per unit fiber, energy and chemical costs.

In the second quarter of 2023, we recorded a non-cash inventory

impairment which was partially offset by insurance proceeds

received.

Segment Results

Pulp

| |

Three Months Ended June 30, |

|

| |

2024 |

|

|

2023 |

|

| |

(in thousands) |

|

|

Pulp revenues |

$ |

346,808 |

|

|

$ |

374,175 |

|

| Energy and chemical

revenues |

$ |

20,563 |

|

|

$ |

28,519 |

|

| Operating income (loss) |

$ |

4,481 |

|

|

$ |

(83,459 |

) |

| |

|

|

|

|

|

|

|

In the second quarter of 2024, pulp segment

operating income increased to $4.5 million from an operating loss

of $83.5 million in the same quarter of 2023 primarily due to

higher pulp sales realizations and lower per unit fiber and other

production costs. In the second quarter of 2023, we recorded a

non-cash inventory impairment which was partially offset by

insurance proceeds received.

Pulp segment revenues, which includes pulp,

energy and chemical revenues, in the second quarter of 2024

decreased by approximately 9% to $367.4 million from $402.7 million

in the same quarter of 2023 as a result of lower sales volumes and

lower energy and chemical sales realizations partially offset by

higher pulp sales realizations.

Pulp revenues in the second quarter of 2024

decreased by approximately 7% to $346.8 million from $374.2 million

in the same quarter of 2023 due to lower sales volumes partially

offset by higher sales realizations.

In the second quarter of 2024, third party

industry quoted average list prices for NBSK pulp increased in both

Europe and North America from the same quarter of 2023, including

achieving a record list price of $1,635 per ADMT in Europe as of

June 30, 2024. Third party industry quoted average net prices for

NBSK pulp in China also increased from the same quarter of 2023.

Our average NBSK pulp sales realizations in the second quarter of

2024 increased by approximately 15% to $811 per ADMT from $706 per

ADMT in the same quarter of 2023. In the second quarter of 2024,

average NBHK pulp sales realizations increased by approximately 16%

to $701 per ADMT from $602 per ADMT in the same quarter of

2023.

Total pulp sales volumes in the second quarter

of 2024 decreased by approximately 19% to 433,320 ADMTs from

536,878 ADMTs in the same quarter of 2023 primarily because of

lower production, due to scheduled maintenance downtime and the

disposal of CPP, and the timing of sales.

Energy and chemical revenues in the second

quarter of 2024 decreased by approximately 28% to $20.6 million

from $28.5 million in the same quarter of 2023 primarily due to

lower sales realizations and energy sales volumes.

Costs and expenses in the second quarter of 2024

decreased by approximately 25% to $364.0 million from $486.3

million in the same quarter of 2023 primarily as a result of lower

sales volumes and lower per unit fiber, energy and chemical costs.

In the second quarter of 2023, we recorded a non-cash inventory

impairment of $51.4 million which was partially offset by $22.0

million of insurance proceeds received relating to the 2021 turbine

downtime at our Rosenthal mill and the July 2022 fire at our

Stendal mill.

Total pulp production in the second quarter of

2024 decreased by approximately 11% to 421,692 ADMTs compared with

475,615 ADMTs in the same quarter of 2023 primarily due to higher

production lost for annual maintenance downtime and the disposal of

the CPP joint venture investment in the first quarter of 2024,

partially offset by the market curtailment at the Peace River and

CPP mills in the second quarter of 2023. We estimate that annual

maintenance downtime in the second quarter of 2024 adversely

impacted our operating income by approximately $60.2 million,

comprised of approximately $44.9 million in direct out-of-pocket

expenses and the balance in reduced production. Many of our

competitors that report their results using International Financial

Reporting Standards capitalize their direct costs of maintenance

downtime.

On average, in the second quarter of 2024,

overall per unit fiber costs decreased by approximately 15%

compared to the same quarter of 2023 due to stable supply. We

currently expect stable per unit fiber costs in the third quarter

of 2024.

Solid Wood

| |

Three Months Ended June 30, |

|

| |

2024 |

|

|

2023 |

|

| |

(in thousands) |

|

|

Lumber revenues |

$ |

53,910 |

|

|

$ |

59,264 |

|

| Energy revenues |

$ |

4,301 |

|

|

$ |

5,360 |

|

| Manufactured products

revenues(1) |

$ |

35,381 |

|

|

$ |

15,989 |

|

| Pallet revenues |

$ |

26,741 |

|

|

$ |

32,675 |

|

| Biofuels revenues(2) |

$ |

8,155 |

|

|

$ |

10,242 |

|

| Wood residuals revenues |

$ |

1,750 |

|

|

$ |

2,520 |

|

| Operating loss |

$ |

(43,679 |

) |

|

$ |

(22,493 |

) |

|

______________ |

|

| (1)

Manufactured products primarily includes

cross-laminated timber ("CLT"), glue-laminated timber ("glulam")

and finger joint lumber. |

|

| (2)

Biofuels includes pellets and briquettes. |

|

| |

|

In the second quarter of 2024, our solid wood

segment had an operating loss of $43.7 million compared to $22.5

million in the same quarter of 2023 primarily due to the non-cash

goodwill impairment charge partially offset by higher mass timber

sales volumes and lower per unit fiber costs.

Solid wood segment revenues in the second

quarter of 2024 modestly increased to $130.2 million from $126.1

million in the same quarter of 2023 driven by higher manufactured

products revenues partially offset by lower revenues from our other

products.

Lumber revenues in the second quarter of 2024

decreased by approximately 9% to $53.9 million from $59.3 million

in the same quarter of 2023 primarily due to lower sales volumes

partially offset by a modestly higher sales realization. Average

lumber sales realizations in the second quarter of 2024 increased

by approximately 5% to $463 per Mfbm from $443 per Mfbm in the same

quarter of 2023 driven by a modest increase in demand in the U.S.

market. In Europe, realized lumber prices were flat compared to the

same quarter of 2023. The U.S. market accounted for approximately

45% of our lumber revenues and approximately 39% of our lumber

sales volumes in the second quarter of 2024. The majority of the

balance of our lumber sales were to Europe.

Lumber sales volumes in the second quarter of

2024 decreased by approximately 13% to 116.6 MMfbm from 133.9 MMfbm

in the same quarter of 2023 primarily due to lower production and

the timing of sales.

In the second quarter of 2024, as a result of

the continued ramp-up of our mass timber business, manufactured

products revenues more than doubled to $35.4 million from $16.0

million in the same quarter of 2023. Manufactured products sales

realizations increased by approximately 31% to $2,942 per m3 in the

second quarter of 2024 from $2,243 per m3 in the same quarter of

2023 as a result of higher CLT sales volumes, which generate higher

sales realizations relative to other manufactured products.

Energy, biofuels and wood residuals revenues in

the second quarter of 2024 decreased by approximately 22% to $14.2

million from $18.1 million in the same quarter of 2023 driven by

lower sales realizations and sales volumes.

Pallet revenues in the second quarter of 2024

decreased by approximately 18% to $26.7 million from $32.7 million

in the same quarter of 2023 due to lower sales volumes and sales

realizations as weak economic conditions in Europe negatively

impacted demand.

Lumber production in the second quarter of 2024

decreased by approximately 9% to 111.4 MMfbm from 122.3 MMfbm in

the same quarter of 2023 driven by planned maintenance

downtime.

Fiber costs were approximately 75% of our lumber

cash production costs in the second quarter of 2024. In the second

quarter of 2024, per unit fiber costs for lumber production

decreased by approximately 12% compared to the same quarter of 2023

because of stable supply. We currently expect stable per unit fiber

costs in the third quarter of 2024.

Consolidated – Six Months Ended

June 30, 2024 Compared to Six Months Ended June 30,

2023

Total revenues for the first half of 2024 were

flat compared to the same period of 2023 as higher manufactured

products sales revenues and pulp sales volumes were offset by lower

lumber sales volumes and lower energy, pallet and pulp sales

realizations.

Costs and expenses in the first half of 2024

decreased by approximately 7% to $1,097.0 million from $1,181.5

million in the same period of 2023 primarily as a result of lower

per unit fiber, energy and chemical costs partially offset by the

non-cash goodwill impairment of $34.3 million and the non-cash loss

on disposal of the CPP joint venture investment of $23.6 million.

In the first half of 2023, we recorded a non-cash inventory

impairment of $66.6 million which was partially offset by $29.5

million of insurance proceeds received.

In the first half of 2024, Operating EBITDA

increased to $94.0 million from negative Operating EBITDA of $41.2

million in the same period of 2023 primarily due to lower per unit

fiber, energy and chemical costs. In the first half of 2023, we

recorded a non-cash inventory impairment which was partially offset

by insurance proceeds received.

Liquidity

As of June 30, 2024, we had cash and cash

equivalents of $263.2 million, approximately $317.4 million

available under our revolving credit facilities and aggregate

liquidity of about $580.6 million.

The following table is a summary of selected

financial information as of the dates indicated:

| |

June 30, |

|

|

December 31, |

|

| |

2024 |

|

|

2023 |

|

| |

(in thousands) |

|

|

Cash and cash equivalents |

$ |

263,173 |

|

|

$ |

313,992 |

|

| Working capital |

$ |

760,126 |

|

|

$ |

806,468 |

|

| Total assets |

$ |

2,484,462 |

|

|

$ |

2,662,578 |

|

| Long-term liabilities |

$ |

1,688,183 |

|

|

$ |

1,740,731 |

|

| Total shareholders'

equity |

$ |

487,669 |

|

|

$ |

635,410 |

|

| |

|

|

|

|

|

|

|

Quarterly Dividend

A quarterly dividend of $0.075 per share will be

paid on October 3, 2024 to all shareholders of record on September

25, 2024. Future dividends will be subject to Board approval and

may be adjusted as business and industry conditions warrant.

Earnings Release Call

In conjunction with this release, Mercer

International Inc. will host a conference call, which will be

simultaneously broadcast live over the Internet. Management will

host the call, which is scheduled for August 9, 2024 at 10:00 AM

ET. Listeners can access the conference call live and archived for

30 days over the Internet at

https://edge.media-server.com/mmc/p/3qmekae8/ or through a link on

the company's home page at https://www.mercerint.com. Please allow

15 minutes prior to the call to visit the website and download and

install any necessary audio software.

Mercer International Inc. is a global forest

products company with operations in Germany, USA and Canada with

consolidated annual production capacity of 2.1 million tonnes of

pulp, 960 million board feet of lumber, 210 thousand cubic meters

of CLT, 45 thousand cubic meters of glulam, 17 million pallets and

230,000 metric tonnes of biofuels. To obtain further information on

the company, please visit its website at

https://www.mercerint.com.

The preceding includes forward looking

statements which involve known and unknown risks and uncertainties

which may cause our actual results in future periods to differ

materially from forecasted results. Words such as "expects",

"anticipates", "are optimistic that", "projects", "intends",

"designed", "will", "believes", "estimates", "may", "could" and

variations of such words and similar expressions are intended to

identify such forward-looking statements. Among those factors which

could cause actual results to differ materially are the following:

the highly cyclical nature of our business, raw material costs, our

level of indebtedness, competition, foreign exchange and interest

rate fluctuations, our use of derivatives, expenditures for capital

projects, environmental regulation and compliance, disruptions to

our production, market conditions and other risk factors listed

from time to time in our SEC reports.

APPROVED BY: William D. McCartney Chairman (604)

684-1099

Juan Carlos Bueno Chief Executive Officer (604)

684-1099

-FINANCIAL TABLES FOLLOW-

Summary Financial Highlights

| |

Q2 |

|

|

Q1 |

|

|

Q2 |

|

|

YTD |

|

|

YTD |

|

| |

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

(in thousands, except per share amounts) |

|

|

Pulp segment revenues |

$ |

367,371 |

|

|

$ |

432,404 |

|

|

$ |

402,694 |

|

|

$ |

799,775 |

|

|

$ |

803,095 |

|

|

Solid wood segment revenues |

|

130,238 |

|

|

|

119,023 |

|

|

|

126,050 |

|

|

|

249,261 |

|

|

|

247,064 |

|

|

Corporate and other revenues |

|

1,775 |

|

|

|

2,003 |

|

|

|

1,119 |

|

|

|

3,778 |

|

|

|

2,370 |

|

| Total revenues |

$ |

499,384 |

|

|

$ |

553,430 |

|

|

$ |

529,863 |

|

|

$ |

1,052,814 |

|

|

$ |

1,052,529 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pulp segment operating income (loss) |

$ |

4,481 |

|

|

$ |

17,447 |

|

|

$ |

(83,459 |

) |

|

$ |

21,928 |

|

|

$ |

(70,688 |

) |

|

Solid wood segment operating loss |

|

(43,679 |

) |

|

|

(13,706 |

) |

|

|

(22,493 |

) |

|

|

(57,385 |

) |

|

|

(49,562 |

) |

|

Corporate and other operating loss |

|

(4,581 |

) |

|

|

(4,189 |

) |

|

|

(2,880 |

) |

|

|

(8,770 |

) |

|

|

(8,703 |

) |

| Total operating loss |

$ |

(43,779 |

) |

|

$ |

(448 |

) |

|

$ |

(108,832 |

) |

|

$ |

(44,227 |

) |

|

$ |

(128,953 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pulp segment depreciation and amortization |

$ |

27,193 |

|

|

$ |

27,373 |

|

|

$ |

27,783 |

|

|

$ |

54,566 |

|

|

$ |

55,182 |

|

|

Solid wood segment depreciation and amortization |

|

12,526 |

|

|

|

12,811 |

|

|

|

12,126 |

|

|

|

25,337 |

|

|

|

32,024 |

|

|

Corporate and other depreciation and amortization |

|

222 |

|

|

|

220 |

|

|

|

243 |

|

|

|

442 |

|

|

|

537 |

|

| Total depreciation and

amortization |

$ |

39,941 |

|

|

$ |

40,404 |

|

|

$ |

40,152 |

|

|

$ |

80,345 |

|

|

$ |

87,743 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating EBITDA |

$ |

30,439 |

|

|

$ |

63,601 |

|

|

$ |

(68,680 |

) |

|

$ |

94,040 |

|

|

$ |

(41,210 |

) |

| Loss on disposal of investment

in joint venture |

$ |

— |

|

|

$ |

23,645 |

|

|

$ |

— |

|

|

$ |

23,645 |

|

|

$ |

— |

|

| Goodwill impairment |

$ |

34,277 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

34,277 |

|

|

$ |

— |

|

| Income tax recovery

(provision) |

$ |

(1,263 |

) |

|

$ |

6,365 |

|

|

$ |

27,479 |

|

|

$ |

5,102 |

|

|

$ |

32,835 |

|

| Net loss |

$ |

(67,586 |

) |

|

$ |

(16,703 |

) |

|

$ |

(98,306 |

) |

|

$ |

(84,289 |

) |

|

$ |

(128,884 |

) |

| Net loss per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(1.01 |

) |

|

$ |

(0.25 |

) |

|

$ |

(1.48 |

) |

|

$ |

(1.26 |

) |

|

$ |

(1.94 |

) |

|

Diluted |

$ |

(1.01 |

) |

|

$ |

(0.25 |

) |

|

$ |

(1.48 |

) |

|

$ |

(1.26 |

) |

|

$ |

(1.94 |

) |

| Common shares outstanding at

period end |

|

66,871 |

|

|

|

66,850 |

|

|

|

66,525 |

|

|

|

66,871 |

|

|

|

66,525 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary Operating Highlights

| |

Q2 |

|

|

Q1 |

|

|

Q2 |

|

|

YTD |

|

|

YTD |

|

| |

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Pulp

Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pulp production ('000

ADMTs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NBSK |

|

357.8 |

|

|

|

453.2 |

|

|

|

450.7 |

|

|

|

811.0 |

|

|

|

880.7 |

|

|

NBHK |

|

63.9 |

|

|

|

85.7 |

|

|

|

24.9 |

|

|

|

149.6 |

|

|

|

97.3 |

|

| Annual maintenance downtime

('000 ADMTs) |

|

64.9 |

|

|

|

— |

|

|

|

24.5 |

|

|

|

64.9 |

|

|

|

38.0 |

|

| Annual maintenance downtime

(days) |

|

37 |

|

|

|

— |

|

|

|

25 |

|

|

|

37 |

|

|

|

35 |

|

| Pulp sales ('000 ADMTs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NBSK |

|

377.6 |

|

|

|

488.2 |

|

|

|

473.6 |

|

|

|

865.8 |

|

|

|

852.1 |

|

|

NBHK |

|

55.7 |

|

|

|

77.5 |

|

|

|

63.3 |

|

|

|

133.2 |

|

|

|

120.7 |

|

| Average NBSK pulp prices

($/ADMT)(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe |

|

1,602 |

|

|

|

1,400 |

|

|

|

1,247 |

|

|

|

1,501 |

|

|

|

1,312 |

|

|

China |

|

811 |

|

|

|

745 |

|

|

|

668 |

|

|

|

778 |

|

|

|

780 |

|

|

North America |

|

1,697 |

|

|

|

1,440 |

|

|

|

1,510 |

|

|

|

1,568 |

|

|

|

1,593 |

|

| Average NBHK pulp prices

($/ADMT)(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

China |

|

735 |

|

|

|

662 |

|

|

|

483 |

|

|

|

698 |

|

|

|

597 |

|

|

North America |

|

1,437 |

|

|

|

1,223 |

|

|

|

1,277 |

|

|

|

1,330 |

|

|

|

1,400 |

|

| Average pulp sales

realizations ($/ADMT)(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NBSK |

|

811 |

|

|

|

732 |

|

|

|

706 |

|

|

|

766 |

|

|

|

769 |

|

|

NBHK |

|

701 |

|

|

|

631 |

|

|

|

602 |

|

|

|

660 |

|

|

|

700 |

|

| Energy production ('000

MWh)(3) |

|

493.9 |

|

|

|

576.4 |

|

|

|

538.3 |

|

|

|

1,070.4 |

|

|

|

1,073.0 |

|

| Energy sales ('000

MWh)(3) |

|

185.0 |

|

|

|

220.6 |

|

|

|

207.7 |

|

|

|

405.5 |

|

|

|

404.6 |

|

| Average energy sales

realizations ($/MWh)(3) |

|

84 |

|

|

|

88 |

|

|

|

101 |

|

|

|

86 |

|

|

|

114 |

|

| Solid Wood

Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lumber |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production (MMfbm) |

|

111.4 |

|

|

|

127.0 |

|

|

|

122.3 |

|

|

|

238.4 |

|

|

|

256.3 |

|

|

Sales (MMfbm) |

|

116.6 |

|

|

|

121.4 |

|

|

|

133.9 |

|

|

|

238.0 |

|

|

|

273.7 |

|

|

Average sales realizations ($/Mfbm) |

|

463 |

|

|

|

460 |

|

|

|

443 |

|

|

|

461 |

|

|

|

436 |

|

| Energy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production and sales ('000 MWh) |

|

33.7 |

|

|

|

38.7 |

|

|

|

41.9 |

|

|

|

72.4 |

|

|

|

82.4 |

|

|

Average sales realizations ($/MWh) |

|

128 |

|

|

|

125 |

|

|

|

128 |

|

|

|

126 |

|

|

|

134 |

|

| Manufactured products(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production ('000 cubic meters) |

|

11.1 |

|

|

|

7.2 |

|

|

|

3.2 |

|

|

|

18.4 |

|

|

|

4.0 |

|

|

Sales ('000 cubic meters) |

|

11.2 |

|

|

|

4.0 |

|

|

|

6.1 |

|

|

|

15.2 |

|

|

|

10.4 |

|

|

Average sales realizations ($/cubic meters) |

|

2,942 |

|

|

|

3,644 |

|

|

|

2,243 |

|

|

|

3,128 |

|

|

|

1,587 |

|

| Pallets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production ('000 units) |

|

2,547.8 |

|

|

|

3,056.3 |

|

|

|

2,747.2 |

|

|

|

5,604.1 |

|

|

|

5,627.4 |

|

|

Sales ('000 units) |

|

2,570.4 |

|

|

|

2,916.3 |

|

|

|

2,882.7 |

|

|

|

5,486.7 |

|

|

|

5,825.2 |

|

|

Average sales realizations ($/unit) |

|

10 |

|

|

|

10 |

|

|

|

11 |

|

|

|

10 |

|

|

|

12 |

|

| Biofuels(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production ('000 tonnes) |

|

41.0 |

|

|

|

37.9 |

|

|

|

43.6 |

|

|

|

78.9 |

|

|

|

76.2 |

|

|

Sales ('000 tonnes) |

|

40.4 |

|

|

|

48.2 |

|

|

|

40.4 |

|

|

|

88.6 |

|

|

|

66.2 |

|

|

Average sales realizations ($/tonne) |

|

202 |

|

|

|

234 |

|

|

|

254 |

|

|

|

219 |

|

|

|

277 |

|

| Average Spot Currency

Exchange Rates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ / €(6) |

|

1.0766 |

|

|

|

1.0855 |

|

|

|

1.0888 |

|

|

|

1.0810 |

|

|

|

1.0810 |

|

| $ / C$(6) |

|

0.7310 |

|

|

|

0.7415 |

|

|

|

0.7447 |

|

|

|

0.7362 |

|

|

|

0.7420 |

|

|

______________ |

|

| (1)

Source: RISI pricing report. Europe and North America are

list prices. China are net prices which include discounts,

allowances and rebates. |

|

| (2)

Sales realizations after customer discounts, rebates and

other selling concessions. Incorporates the effect of pulp price

variations occurring between the order and shipment dates. |

|

| (3)

Does not include our 50% joint venture interest in the CPP

mill, which is accounted for using the equity method. In the first

quarter of 2024, we disposed of our investment in CPP. |

|

| (4)

Manufactured products includes CLT, glulam and finger joint

lumber. |

|

| (5)

Biofuels includes pellets and briquettes. |

|

| (6)

Average Federal Reserve Bank of New York Noon Buying Rates

over the reporting period. |

|

|

MERCER INTERNATIONAL INC.INTERIM CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited)(In thousands, except per share

data) |

| |

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenues |

|

$ |

499,384 |

|

|

$ |

529,863 |

|

|

$ |

1,052,814 |

|

|

$ |

1,052,529 |

|

| Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales, excluding depreciation and amortization |

|

|

439,220 |

|

|

|

566,200 |

|

|

|

897,402 |

|

|

|

1,027,538 |

|

|

Cost of sales depreciation and amortization |

|

|

39,877 |

|

|

|

40,103 |

|

|

|

80,227 |

|

|

|

87,601 |

|

|

Selling, general and administrative expenses |

|

|

29,789 |

|

|

|

32,392 |

|

|

|

61,490 |

|

|

|

66,343 |

|

|

Loss on disposal of investment in joint venture |

|

|

— |

|

|

|

— |

|

|

|

23,645 |

|

|

|

— |

|

|

Goodwill impairment |

|

|

34,277 |

|

|

|

— |

|

|

|

34,277 |

|

|

|

— |

|

| Operating loss |

|

|

(43,779 |

) |

|

|

(108,832 |

) |

|

|

(44,227 |

) |

|

|

(128,953 |

) |

| Other income (expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(26,843 |

) |

|

|

(20,091 |

) |

|

|

(54,402 |

) |

|

|

(39,138 |

) |

|

Other income |

|

|

4,299 |

|

|

|

3,138 |

|

|

|

9,238 |

|

|

|

6,372 |

|

| Total other expenses, net |

|

|

(22,544 |

) |

|

|

(16,953 |

) |

|

|

(45,164 |

) |

|

|

(32,766 |

) |

| Loss before income taxes |

|

|

(66,323 |

) |

|

|

(125,785 |

) |

|

|

(89,391 |

) |

|

|

(161,719 |

) |

| Income tax recovery

(provision) |

|

|

(1,263 |

) |

|

|

27,479 |

|

|

|

5,102 |

|

|

|

32,835 |

|

| Net loss |

|

$ |

(67,586 |

) |

|

$ |

(98,306 |

) |

|

$ |

(84,289 |

) |

|

$ |

(128,884 |

) |

| Net loss per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(1.01 |

) |

|

$ |

(1.48 |

) |

|

$ |

(1.26 |

) |

|

$ |

(1.94 |

) |

|

Diluted |

|

$ |

(1.01 |

) |

|

$ |

(1.48 |

) |

|

$ |

(1.26 |

) |

|

$ |

(1.94 |

) |

| Dividends declared per common

share |

|

$ |

0.075 |

|

|

$ |

0.075 |

|

|

$ |

0.150 |

|

|

$ |

0.150 |

|

|

MERCER INTERNATIONAL INC.INTERIM

CONSOLIDATED BALANCE

SHEETS(Unaudited)(In thousands,

except share and per share data) |

| |

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

| ASSETS |

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

263,173 |

|

|

$ |

313,992 |

|

|

Accounts receivable, net |

|

|

344,819 |

|

|

|

306,166 |

|

|

Inventories |

|

|

399,515 |

|

|

|

414,161 |

|

|

Prepaid expenses and other |

|

|

26,177 |

|

|

|

23,461 |

|

|

Assets classified as held for sale |

|

|

35,052 |

|

|

|

35,125 |

|

| Total current assets |

|

|

1,068,736 |

|

|

|

1,092,905 |

|

|

Property, plant and equipment, net |

|

|

1,332,414 |

|

|

|

1,409,937 |

|

|

Investment in joint ventures |

|

|

3,984 |

|

|

|

41,665 |

|

|

Amortizable intangible assets, net |

|

|

54,548 |

|

|

|

52,641 |

|

|

Goodwill |

|

|

— |

|

|

|

35,381 |

|

|

Operating lease right-of-use assets |

|

|

9,432 |

|

|

|

11,725 |

|

|

Pension asset |

|

|

5,458 |

|

|

|

5,588 |

|

|

Other long-term assets |

|

|

9,890 |

|

|

|

12,736 |

|

| Total assets |

|

$ |

2,484,462 |

|

|

$ |

2,662,578 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

Accounts payable and other |

|

$ |

300,550 |

|

|

$ |

278,986 |

|

|

Pension and other post-retirement benefit obligations |

|

|

798 |

|

|

|

826 |

|

|

Liabilities associated with assets held for sale |

|

|

7,262 |

|

|

|

6,625 |

|

| Total current liabilities |

|

|

308,610 |

|

|

|

286,437 |

|

|

Long-term debt |

|

|

1,569,068 |

|

|

|

1,609,425 |

|

|

Pension and other post-retirement benefit obligations |

|

|

12,425 |

|

|

|

12,483 |

|

|

Operating lease liabilities |

|

|

5,973 |

|

|

|

7,755 |

|

|

Other long-term liabilities |

|

|

13,343 |

|

|

|

13,744 |

|

|

Deferred income tax |

|

|

87,374 |

|

|

|

97,324 |

|

| Total liabilities |

|

|

1,996,793 |

|

|

|

2,027,168 |

|

| Shareholders’ equity |

|

|

|

|

|

|

|

Common shares $1 par value; 200,000,000 authorized; 66,871,000

issued and outstanding (2023 – 66,525,000) |

|

|

66,850 |

|

|

|

66,471 |

|

|

Additional paid-in capital |

|

|

362,313 |

|

|

|

359,497 |

|

|

Retained earnings |

|

|

241,795 |

|

|

|

336,113 |

|

|

Accumulated other comprehensive loss |

|

|

(183,289 |

) |

|

|

(126,671 |

) |

| Total shareholders’

equity |

|

|

487,669 |

|

|

|

635,410 |

|

| Total liabilities and

shareholders’ equity |

|

$ |

2,484,462 |

|

|

$ |

2,662,578 |

|

|

MERCER INTERNATIONAL INC.INTERIM CONSOLIDATED STATEMENTS OF

CASH FLOWS(Unaudited)(In thousands) |

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Cash flows from (used in)

operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(67,586 |

) |

|

$ |

(98,306 |

) |

|

$ |

(84,289 |

) |

|

$ |

(128,884 |

) |

|

Adjustments to reconcile net loss to cash flows from operating

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

39,941 |

|

|

|

40,152 |

|

|

|

80,345 |

|

|

|

87,743 |

|

|

Deferred income tax provision (recovery) |

|

|

7,322 |

|

|

|

(34,105 |

) |

|

|

(6,104 |

) |

|

|

(44,049 |

) |

|

Inventory impairment |

|

|

— |

|

|

|

51,400 |

|

|

|

— |

|

|

|

66,600 |

|

|

Loss on disposal of investment in joint venture |

|

|

— |

|

|

|

— |

|

|

|

23,645 |

|

|

|

— |

|

|

Goodwill impairment |

|

|

34,277 |

|

|

|

— |

|

|

|

34,277 |

|

|

|

— |

|

|

Defined benefit pension plans and other post-retirement benefit

plan expense |

|

|

431 |

|

|

|

451 |

|

|

|

641 |

|

|

|

897 |

|

|

Stock compensation expense |

|

|

1,403 |

|

|

|

1,387 |

|

|

|

3,432 |

|

|

|

2,613 |

|

|

Foreign exchange transaction losses (gains) |

|

|

(3,382 |

) |

|

|

224 |

|

|

|

(6,831 |

) |

|

|

494 |

|

|

Other |

|

|

1,389 |

|

|

|

(5,452 |

) |

|

|

2,116 |

|

|

|

(6,601 |

) |

|

Defined benefit pension plans and other post-retirement benefit

plan contributions |

|

|

(288 |

) |

|

|

(1,318 |

) |

|

|

(617 |

) |

|

|

(1,565 |

) |

|

Changes in working capital |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

21,929 |

|

|

|

12,168 |

|

|

|

(41,800 |

) |

|

|

23,510 |

|

|

Inventories |

|

|

4,506 |

|

|

|

58,880 |

|

|

|

4,595 |

|

|

|

(27,554 |

) |

|

Accounts payable and accrued expenses |

|

|

15,718 |

|

|

|

(7,490 |

) |

|

|

18,108 |

|

|

|

(7,181 |

) |

|

Other |

|

|

6,525 |

|

|

|

(3,293 |

) |

|

|

5,473 |

|

|

|

(975 |

) |

|

Net cash from (used in) operating activities |

|

|

62,185 |

|

|

|

14,698 |

|

|

|

32,991 |

|

|

|

(34,952 |

) |

| Cash flows from (used in)

investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

(17,883 |

) |

|

|

(39,482 |

) |

|

|

(36,344 |

) |

|

|

(72,911 |

) |

|

Acquisition, net of cash acquired |

|

|

— |

|

|

|

(82,100 |

) |

|

|

— |

|

|

|

(82,100 |

) |

|

Property insurance proceeds |

|

|

— |

|

|

|

2,710 |

|

|

|

— |

|

|

|

2,710 |

|

|

Proceeds from government grants |

|

|

— |

|

|

|

— |

|

|

|

787 |

|

|

|

— |

|

|

Other |

|

|

(2,271 |

) |

|

|

1,120 |

|

|

|

(2,081 |

) |

|

|

1,925 |

|

|

Net cash from (used in) investing activities |

|

|

(20,154 |

) |

|

|

(117,752 |

) |

|

|

(37,638 |

) |

|

|

(150,376 |

) |

| Cash flows from (used in)

financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from (repayment of) revolving credit facilities, net |

|

|

(44,965 |

) |

|

|

24,305 |

|

|

|

(35,840 |

) |

|

|

54,407 |

|

|

Dividend payments |

|

|

(5,014 |

) |

|

|

(4,982 |

) |

|

|

(5,014 |

) |

|

|

(4,982 |

) |

|

Payment of finance lease obligations |

|

|

(2,687 |

) |

|

|

(1,898 |

) |

|

|

(4,876 |

) |

|

|

(3,787 |

) |

|

Other |

|

|

(614 |

) |

|

|

(115 |

) |

|

|

(729 |

) |

|

|

(229 |

) |

|

Net cash from (used in) financing activities |

|

|

(53,280 |

) |

|

|

17,310 |

|

|

|

(46,459 |

) |

|

|

45,409 |

|

| Effect of exchange rate

changes on cash and cash equivalents |

|

|

150 |

|

|

|

(1,478 |

) |

|

|

287 |

|

|

|

(775 |

) |

| Net decrease in cash and cash

equivalents |

|

|

(11,099 |

) |

|

|

(87,222 |

) |

|

|

(50,819 |

) |

|

|

(140,694 |

) |

| Cash and cash equivalents,

beginning of period |

|

|

274,272 |

|

|

|

300,560 |

|

|

|

313,992 |

|

|

|

354,032 |

|

| Cash and cash equivalents, end

of period |

|

$ |

263,173 |

|

|

$ |

213,338 |

|

|

$ |

263,173 |

|

|

$ |

213,338 |

|

|

MERCER INTERNATIONAL INC.COMPUTATION OF OPERATING

EBITDA(Unaudited)(In thousands) |

| |

Operating EBITDA is defined as operating loss

plus depreciation and amortization and non-recurring capital asset

impairment charges. Management uses Operating EBITDA as a benchmark

measurement of its own operating results, and as a benchmark

relative to its competitors. Management considers it to be a

meaningful supplement to operating loss as a performance measure

primarily because depreciation expense and non-recurring capital

asset impairment charges are not an actual cash cost, and

depreciation expense varies widely from company to company in a

manner that management considers largely independent of the

underlying cost efficiency of our operating facilities. In

addition, management believes Operating EBITDA is commonly used by

securities analysts, investors and other interested parties to

evaluate our financial performance.

Operating EBITDA does not reflect the impact of

a number of items that affect our net loss, including financing

costs and the effect of derivative instruments. Operating EBITDA is

not a measure of financial performance under GAAP, and should not

be considered as an alternative to net loss or operating loss as a

measure of performance, nor as an alternative to net cash from

(used in) operating activities as a measure of liquidity. Operating

EBITDA is an internal measure and therefore may not be comparable

to other companies.

The following table sets forth a reconciliation

of net loss to Operating EBITDA for the periods indicated:

|

|

Q2 |

|

|

Q1 |

|

|

Q2 |

|

|

YTD |

|

|

YTD |

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net loss |

$ |

(67,586 |

) |

|

$ |

(16,703 |

) |

|

$ |

(98,306 |

) |

|

$ |

(84,289 |

) |

|

$ |

(128,884 |

) |

| Income tax provision

(recovery) |

|

1,263 |

|

|

|

(6,365 |

) |

|

|

(27,479 |

) |

|

|

(5,102 |

) |

|

|

(32,835 |

) |

| Interest expense |

|

26,843 |

|

|

|

27,559 |

|

|

|

20,091 |

|

|

|

54,402 |

|

|

|

39,138 |

|

| Other income |

|

(4,299 |

) |

|

|

(4,939 |

) |

|

|

(3,138 |

) |

|

|

(9,238 |

) |

|

|

(6,372 |

) |

| Operating loss |

|

(43,779 |

) |

|

|

(448 |

) |

|

|

(108,832 |

) |

|

|

(44,227 |

) |

|

|

(128,953 |

) |

| Add: Depreciation and

amortization |

|

39,941 |

|

|

|

40,404 |

|

|

|

40,152 |

|

|

|

80,345 |

|

|

|

87,743 |

|

| Add: Loss on disposal of

investment in joint venture |

|

— |

|

|

|

23,645 |

|

|

|

— |

|

|

|

23,645 |

|

|

|

— |

|

| Goodwill impairment |

|

34,277 |

|

|

|

— |

|

|

|

— |

|

|

|

34,277 |

|

|

|

— |

|

| Operating EBITDA |

$ |

30,439 |

|

|

$ |

63,601 |

|

|

$ |

(68,680 |

) |

|

$ |

94,040 |

|

|

$ |

(41,210 |

) |

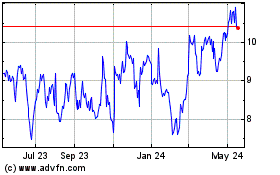

Mercer (NASDAQ:MERC)

Historical Stock Chart

From Nov 2024 to Dec 2024

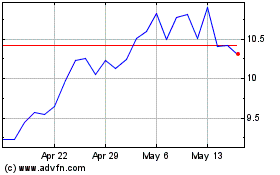

Mercer (NASDAQ:MERC)

Historical Stock Chart

From Dec 2023 to Dec 2024