As filed with the Securities and Exchange Commission

on February 21, 2025

Registration No. 333-__________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

MAWSON

INFRASTRUCTURE GROUP INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

80-0445167 |

(State or other jurisdiction

of incorporation) |

|

(I.R.S. Employer

Identification No.) |

950 Railroad Avenue

Midland, Pennsylvania 15059

(Address of Principal Executive Offices) (Zip

Code)

Mawson

Infrastructure Group Inc. 2024 Omnibus Equity Incentive Plan

(Full title of the plan)

Rahul Mewawalla

Chief Executive Officer

Mawson Infrastructure Group Inc.

950 Railroad Avenue

Midland, Pennsylvania 15059

(Name and address of agent for service)

(412) 515-0896

(Telephone number, including area code, of agent

for service)

with a copy to:

Meaghan S. Nelson

Stoel Rives LLP

101 S. Capitol Boulevard, Suite 1900

Boise, Idaho 83702

Telephone: (208) 387-4283

Indicate by check mark whether the Registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule

12b-2 of the Exchange Act.:

| |

Large Accelerated Filer ☐ |

Accelerated Filer ☐ |

| |

Non-Accelerated Filer ☒ |

Smaller Reporting Company ☒ |

| |

|

Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Registration Statement on Form S-8 is being

filed by Mawson Infrastructure Group Inc. (the “Company”) to register an additional 7,500,000 shares of the Company’s

common stock, par value $0.001 per share (“Common Stock”), issuable under the Company’s 2024 Omnibus Equity Incentive

Plan (the “Plan”). The registration of 5,000,000 additional shares under the Plan is pursuant to the provision in the Plan

which provides for annual automatic increases in the number of shares of Common Stock reserved for issuance under the Plan. In addition,

shares of Common Stock delivered (either by actual delivery or attestation) to the Company by a participant to (i) satisfy the applicable

exercise or purchase price of an award, and/or (ii) satisfy any applicable tax withholding obligation, in each case, shall be added to

the number of shares of Common Stock available for the grant of awards under the Plan. Therefore, an additional 2,500,000 shares of Common

Stock are being registered hereunder for those purposes.

The Company previously filed a Registration Statement

on Form S-8 on June 21, 2024 (File No. 333-280370) relating to the Plan (the “Prior Registration Statement”). Pursuant to

General Instruction E to Form S-8, this Registration Statement incorporates by reference the contents of the Prior Registration Statement,

except for Items 3 and 8, which are being updated by this Registration Statement.

PART II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The Company incorporates by reference into this

Registration Statement the following documents previously filed with the Securities and Exchange Commission (the “Commission”):

| 1. | the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Commission on April 1,

2024; |

| 2. | the portions of the Company’s Definitive Proxy Statement on Schedule 14A filed with the Commission on April 30, 2024, that are

incorporated by reference into Part III of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023; |

| 4. | the Company’s Current Reports on Form 8-K filed with the Commission on April

1, 2024, April 15, 2024, April

18, 2024, April 30, 2024, May

10, 2024, May 20, 2024, June

14, 2024, June 18, 2024, June

21, 2024, June 25, 2024, July

3, 2024, July 17, 2024, July

18, 2024, August 9, 2024, August

12, 2024, August 22, 2024, August

27, 2024, September 9,

2024, September 10,

2024, September 11,

2024, September 16, 2024, October

17, 2024, October 28,

2024, December 4, 2024, December

10, 2024, December 13,

2024, January 7, 2025, January

10, 2025, January 17, 2025 and, January

29, 2025 and February 12, 2025 (excluding information furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on

such form that are related to such items); |

| 5. | the description of the Common Stock contained in the Company’s registration statement on Form 8-A, filed with the Commission

on September 28, 2021, and all amendments or reports filed for the purpose of updating such description, including Exhibit 4.2 of the

Company’s Annual Report referred to in (1) above. |

All other reports and documents filed by the Company

pursuant to Sections 13(a), 13(c), 14 and/or 15(d) of the Securities Exchange Act of 1934, as amended, (other than Current Reports furnished

under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form that relate to such items) subsequent to the date of this

Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement that indicates that all securities

offered hereby have been sold or that deregisters all securities offered hereby then remaining unsold, shall be deemed to be incorporated

by reference into this Registration Statement and to be a part hereof from the date of filing such reports and documents.

Any statement contained in a document incorporated

or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement

to the extent that a statement herein or in any subsequently filed document that also is or is deemed to be incorporated by reference

herein modifies or supersedes such statement. Any such statement so modified or superseded shall not constitute a part of this Registration

Statement, except as so modified or superseded.

Item 8. Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant

certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this

registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Bellevue, State of Washington,

on February 21, 2025.

| |

MAWSON INFRASTRUCTURE GROUP INC. |

| |

|

|

| |

By: |

/s/ Rahul Mewawalla |

| |

Name: |

Rahul Mewawalla |

| |

Title: |

Chief Executive Officer, President, and Director |

POWERS OF ATTORNEY

Each of the undersigned officers and directors of Mawson Infrastructure

Group Inc., a Delaware corporation, hereby constitutes and appoints Rahul Mewawalla and William Regan and each of them, severally, as

his or her attorney-in-fact and agent, with full power of substitution and re-substitution, in his or her name and on his or her behalf,

to sign in any and all capacities this registration statement and any and all amendments (including

post-effective amendments) and exhibits to this registration statement and any and all applications and other documents relating

thereto, with the Securities and Exchange Commission, with full power and authority to perform and do any and all acts and things whatsoever

which any such attorney or substitute may deem necessary or advisable to be performed or done in connection with any or all of the above

described matters, as fully as each of the undersigned could do if personally present and acting, hereby ratifying and approving all acts

of any such attorney or substitute.

Pursuant to the requirements of the Securities Act of 1933, this registration

statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Rahul Mewawalla |

|

Chief Executive Officer, President, and Director |

|

February 21, 2025 |

| Rahul Mewawalla |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ William Regan |

|

Chief Financial Officer |

|

February 21, 2025 |

| William Regan |

|

(Principal Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ Michael Hughes |

|

Director |

|

February 21, 2025 |

| Michael Hughes |

|

|

|

|

| |

|

|

|

|

| /s/ Gregory Martin |

|

Director |

|

February 21, 2025 |

| Gregory Martin |

|

|

|

|

| |

|

|

|

|

| /s/ Ryan Costello |

|

Director |

|

February 21, 2025 |

| Ryan Costello |

|

|

|

|

Exhibit 5.1

| February 21, 2025 |

|

101

S. Capitol Boulevard, Suite 1900 |

| |

|

Boise,

Idaho 83702 |

| Mawson Infrastructure Group Inc. |

|

T: 208.389.9000 |

| 950 Railroad Avenue |

|

|

| Midland, Pennsylvania 15059 |

|

|

Re: Mawson Infrastructure Group Inc. – Registration Statement

on Form S-8

Ladies and Gentlemen:

You have requested our opinion with respect to

certain matters in connection with the filing by Mawson Infrastructure Group Inc., a Delaware corporation (the “Company”),

of a Registration Statement on Form S-8 (the “Registration Statement”) under the Securities Act of 1933, as

amended (the “Securities Act”), with the Securities and Exchange Commission, covering 7,500,000 shares (the

“Shares”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”),

reserved for future issuance under the Mawson Infrastructure Group Inc. 2024 Omnibus Equity Incentive Plan (the “Plan”).

We have reviewed the corporate actions of the

Company in connection with this matter and have examined the documents, corporate records, and other instruments we deemed necessary for

the purposes of this opinion.

In such examination, we have assumed: (i) the

authenticity and completeness of all documents submitted to us as original documents and the genuineness of all signatures; (ii) the conformity

to the authentic originals of all documents submitted to us as copies; (iii) the truth, accuracy, and completeness of the information,

representations and warranties contained in the records, documents, instruments, and certificates we have reviewed; (iv) the legal capacity

of each natural person executing the agreements described in this opinion; (v) that there has been no undisclosed waiver of any right,

remedy or provision contained in any such documents; (vi) that the statements contained in the certificates and comparable documents of

public officials, officers and representatives of the Company and other persons on which we have relied for the purposes of this opinion

letter are true and correct on and as of the date hereof; (vii) shares of the Common Stock that the board of directors of the Company

reserved for issuance under the Plan will remain available for the issuance of the Shares, and (viii) none of the Company’s Certificate

of Incorporation, as amended and in effect on the date hereof, the Company’s Bylaws, as in effect on the date hereof, nor any of

the proceedings relating to either the Plan or any of the award agreements relating to the Shares will be rescinded, amended or otherwise

modified prior to the issuance of the Shares. In making our examination of executed documents or documents to be executed, we have assumed

that the parties to such documents, other than the Company, had or will have the power, corporate, trust or otherwise, to enter into and

perform all obligations under such documents and have also assumed the due authorization by all requisite action, corporate, trust or

otherwise, and execution and delivery by such parties of such documents and that such documents constitute valid and binding obligations

of such parties. We have also assumed that the Shares will be uncertificated in accordance with Section 158 of the Delaware General Corporation

Law, and the transfer agent therefor will register the purchaser thereof as the registered owner of any uncertificated Shares on its stock

transfer books and records.

On the basis of the foregoing, and in reliance

thereon, we are of the opinion that the Shares, when issued and sold in accordance with the terms of the Plan and against proper payment

and consideration thereof and pursuant to the agreements that accompany the Plan, will be validly issued, fully paid and nonassessable.

We consent to the filing of this opinion as an

exhibit to the Registration Statement. In giving such consent, we do not thereby admit that we are included in the category of persons

whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Securities and Exchange Commission

promulgated thereunder.

We express no opinion as to matters governed by

any laws other than the Delaware General Corporation Law and reported decisions of the Delaware courts interpreting such law.

This opinion letter is rendered as of the date

first written above, and we disclaim any obligation to advise you of facts, circumstances, events or developments which hereafter may

be brought to our attention and which may alter, affect or modify the opinion expressed herein. Our opinion is expressly limited to the

matters set forth above, and we render no opinion, whether by implication or otherwise, as to any other matters relating to the Company,

the Shares, the Plan, the award agreements related to the Shares or the Registration Statement.

Very truly yours,

/s/ Stoel Rives LLP

Stoel Rives LLP

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of Mawson Infrastructure Group Inc. of our report

dated March 29, 2024, relating to the consolidated financial statements of Mawson Infrastructure Group Inc., appearing in the Annual Report

on Form 10-K for the year ended December 31, 2023.

| /s/ Wolf & Company, P.C. |

|

| |

|

| Wolf & Company, P.C. |

|

| Boston, Massachusetts |

|

| February 21, 2025 |

|

Exhibit 23.3

LNP Audit and Assurance

International Pty Ltd

ABN 53 649 276 666

L8 309 Kent Street

Sydney NSW 2000

L24 570 Bourke Street

Melbourne VIC 3000

L14 167 Eagle Street

Brisbane QLD 4000

1300 551 266

www.lnpaudit.com

January 31, 2025

The Directors

Mawson Infrastructure Group Inc.

950 Railroad Avenue

Midland, Pennsylvania 16146

CONSENT OF INDEPENDENT PUBLIC ACCOUNTING

FIRM

We hereby consent to (a) the inclusion of our report of independent

public accounting firm dated March 23, 2023, on our audit of the consolidated balance sheets of Mawson Infrastructure Group Inc and its

subsidiaries, as of December 31, 2022, and the related consolidated statement of earnings, of comprehensive earnings, of equity and of

cash flows for the years in the period ended December 31, 2022, including the related notes, and (b) the use of our name as it appears

in the Form S-8 Registration Statement of Mawson Infrastructure Group Inc. We were auditors of the Company until April 4, 2023 and were

subsequently replaced by the Company’s current auditors Wolf & Company, PC.

LNP Audit and Assurance International

Pty Ltd

Anthony Rose, Director

Liability

limited by a scheme approved under the professional standards legislation

Exhibit 107

Calculation of Filing Fee Tables

FORM S-8

(Form Type)

Mawson Infrastructure Group Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| Security Type | |

Security Class Title | |

Fee

Calculation

Rule | |

Amount

Registered (1) | | |

Proposed

Maximum

Offering

Price Per

Unit | | |

Maximum

Aggregate

Offering

Price | | |

Fee

Rate | |

Amount of

Registration

Fee | |

| Equity | |

Common Stock, $0.001 par value | |

Rule 457(c) and Rule 457(h) | |

| 7,500,000 | (2) | |

$ | 0.61 | (3) | |

$ | 4,575,000 | | |

$153.10 per $1,000,000 | |

$ | 700.43 | |

| Total Offering Amounts | | |

| | | |

$ | 4,575,000 | | |

| |

$ | 700.43 | |

| Total Fee Offsets | | |

| | | |

| | | |

| |

| — | |

| Net Fee Due | | |

| | | |

| | | |

| |

$ | 700.43 | |

| (1) | Pursuant to Rule 416 under the Securities Act of 1933, as amended

(the “Securities Act”), this Registration Statement shall also cover any additional shares of Common Stock, par value $0.001

per share (“Common Stock”), of Mawson Infrastructure Group Inc. (the “Company”) that become issuable under the

Mawson Infrastructure Group Inc. 2024 Omnibus Equity Incentive Plan (the “Plan”) by reason of any stock dividend, stock split,

recapitalization or other similar transaction that increases the number of the outstanding shares of the Common Stock. |

| (2) | Represents the sum of (i) 5,000,000 shares of Common Stock that

were automatically added to the shares reserved for issuance under the Plan pursuant to an “evergreen” provision contained

in the Plan and (ii) 2,500,000 shares of Common Stock that may be delivered (either by actual delivery or attestation) to the Company

by a participant to (A) satisfy the applicable exercise or purchase price of an award, and/or (B) satisfy any applicable tax withholding

obligation, and, in each case, added to the number of shares of Common Stock available for the grant of awards under the Plan. Pursuant

to the Plan’s “evergreen” provision, the number of shares of Common Stock reserved for issuance under the Plan automatically

increases on January 1 of each year by an amount equal to the lesser of (i) 5,000,000 shares of Common Stock and (ii) such lesser

specified number of shares of Common Stock as determined by the board of directors of the Company. |

| (3) | Estimated solely for purposes of calculating the registration

fee pursuant to Rules 457(c) and 457(h) of the Securities Act. The proposed maximum offering price per share is based on the average

of the high and the low prices per share of Common Stock as reported on The Nasdaq Capital Market on February 18, 2025, which date is

within five business days prior to the filing of this Registration Statement. |

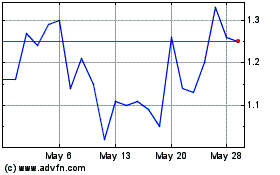

Mawson Infrastructure (NASDAQ:MIGI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Mawson Infrastructure (NASDAQ:MIGI)

Historical Stock Chart

From Feb 2024 to Feb 2025