0000807863FALSE00008078632025-01-282025-01-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 28, 2025

MITEK SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-35231 | 87-0418827 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | | |

| 770 First Avenue, Suite 425 | | |

| San Diego, | California | | 92101 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (619) 269-6800

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | MITK | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 28, 2025, the Board of Directors (the “Board”) of Mitek Systems, Inc. (the “Company”), based upon the recommendation of the Compensation Committee of the Board, approved the Company’s annual incentive program for the fiscal year ending September 30, 2025 (the “2025 Plan”). Pursuant to the terms of the 2025 Plan, certain full time permanent employees of the Company, including the Company’s executive team, will be eligible to receive cash bonuses based upon the achievement of certain corporate and individual performance goals during the 2025 fiscal year. These bonuses are designed to attract, motivate, retain and reward the Company’s employees and executive team.

Under the 2025 Plan, the corporate performance goals are comprised of two financial metrics, revenue and adjusted earnings before interest, taxes, depreciation, and amortization ("Adjusted EBITDA") calculated with respect to the Company’s key business areas, deposits and identity. Participants in the deposits and identity business areas are assigned a primary business area for purposes of the 2025 Plan. For participants who are director-level and above, 50% of the target incentive is based upon achievement of the revenue component of the 2025 Plan (with either (i) 50% of such target based upon the combination of all business area revenue targets or (ii) 40% of such target based upon the primary business area and 10% of such target based on the combination of all business area revenue targets) and the remaining 50% is based upon the achievement of the Adjusted EBITDA component of the 2025 Plan, subject to additional limitations, as set forth in the 2025 Plan. For all other participants, 40% of the target incentive is based upon achievement of the revenue component of the 2025 Plan (with either (i) 40% of such target based upon the combination of all business area revenue targets or (ii) 30% of such target based upon the primary business area and 10% of such target based on the combination of all business area revenue targets), 40% is based upon the achievement of the Adjusted EBITDA component of the 2025 Plan, and the remaining 20% of the target incentive is based upon the achievement of individual objectives, as determined at the sole discretion of the Company, subject to additional limitations, as set forth in the 2025 Plan.

Under the 2025 Plan, our Chief Executive Officer has a bonus target equal to 100% of his annualized salary; our Chief Financial Officer has a bonus target equal to 65% of his annualized salary; our Chief Legal Officer has a bonus target equal to 60% of his annualized salary; and our Senior Vice President, Deposit Solutions and Chief Product Officer have a bonus target equal to 50% of their annualized salaries. The maximum bonus payable to participants is 200% of their respective bonus targets. The Board also retains the sole discretion, with respect to the Chief Executive Officer and his direct reports, to modify individual achievement by up to 10% of the executive's target incentive amount based on individual performance and contribution. A named executive officer must be a permanent full-time employee to qualify for participation in the 2025 Plan.

The foregoing description is intended only as a summary of the material terms of the 2025 Plan and is qualified in its entirety by reference to the text of the 2025 Plan, a copy of which is attached as Exhibit 10.1 to this Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | Mitek Systems, Inc. |

| | | | |

| January 28, 2025 | | By: | /s/ Jason Gray |

| | | | Jason Gray |

| | | | Chief Legal Officer |

Annual Incentive Plan

The Mitek Annual Incentive Plan (the “Plan”) applies to employees of Mitek for achievement of objectives as defined in this Plan. This Plan is designed to support the growth, profitability, and success of the organization through shared objectives and alignment with the creation of shareholder value.

Definitions

The Company: Refers to Mitek Systems Inc. and its affiliates

Plan Term: The fiscal year beginning October 1st and ending September 30th of the applicable fiscal year

Plan Participant: A full-time employee of the Company designated as a participant in the plan, who is not already participating in an alternative commission or incentive plan and is employed by the Company through the completion of the applicable fiscal year

Business Area: The business area, either Deposits or Identity, for which the Plan Participant is designated for participation purposes. Each participant will be assigned a primary business area and/or Total Company revenue for purposes of the plan

Revenue: Defined as the applicable revenue determined in accordance with generally accepted accounting principles excluding acquisition-related revenue not included in the original plan target and adjusted for acquisition-related write-downs of revenue or deferred revenue

| | | | | |

Adjusted EBITDA | Defined profitability measurement in accordance with generally accepted accounting principles and as determined by the Company |

Individual Objectives: Assigned goals as applicable for the fiscal year

Eligibility & Applicability

To be eligible for participation in the Plan, a Plan Participant must be employed by the Company through the completion of the fiscal year for which the plan is approved and in force.

Plan Participants who are partial year employees, either due to commencing following the start of the fiscal year or having taken certain types of leaves of absence during the year, but who are employed by the Company through the completion of the fiscal year, will be eligible to receive a pro-rated payment under the Plan. Generally, partial year employees must be employed prior to the beginning of the 4th quarter of the fiscal year to be eligible for plan participation.

Term

This Plan is effective for the applicable fiscal year beginning October 1st ending September 30th.

Plan Structure

Each Plan Participant is eligible to earn a target incentive up to, equal to or in excess of their annual incentive target percentage multiplied by their annual base salary based upon performance against plan objectives.

Earnings under the Plan result from successful performance against a combination of two Financial Targets (Revenue and Adjusted EBITDA targets) and against Individual Performance Objectives as applicable.

The two Financial Targets of the Plan are weighted individually and specific participation in the Plan is accordance with the following:

Director-level and above: Achievement under the Plan is tied to the two Financial Targets (Revenue and Adjusted EBITDA) upon which 100% of target bonus is earned at plan. The plan is structured as follows:

•50% of the target incentive shall be based upon the achievement of the Revenue component of the plan

◦The target incentive related to Revenue achievement will either be comprised of: (i) the entire 50% will be based upon the combination of all Business Area revenue targets or (ii) will be comprised of 40% based upon a Primary Business Area revenue target and 10% based on the combination of all Business Area revenue targets.

◦A minimum of a defined percentage of the respective Revenue target must be attained for any earnings under the component to be achieved.

•50% of the target incentive shall be based upon the achievement of the Adjusted EBITDA component of the plan.

◦A minimum of 90% of the Adjusted EBITDA target must be attained for any earnings under the component to be achieved.

•Participants may achieve up to 200% of the target incentive based on over-achievement of Plan Targets.

•Specific to the CEO & direct reports to the CEO: Individual achievement against the financial metrics of the plan is subject to modification by the board of directors at their sole discretion by up to 10% of the participant’s target incentive amount based upon individual contribution.

All Other Plan Participants: Achievement under the Plan is tied to the two Financial Targets (Revenue and Adjusted EBITDA) upon which 100% of target bonus is earned at plan. The plan is structured as follows:

•40% of the target incentive shall be based upon the achievement of the Revenue component of the plan

◦The target incentive related to Revenue achievement will either be comprised of (i) the entire 40% will be based upon the combination of all Business Area revenue targets or (ii) will be comprised of 30% based upon a Primary Business Area revenue target and 10% based on the combination of all Business Area revenue targets.

◦A minimum of a defined percentage of the respective Revenue target must be attained for any earnings under the component to be achieved.

•40% of the target incentive shall be based upon the achievement of the Adjusted EBITDA component of the plan.

◦A minimum of 90% of the Adjusted EBITDA target must be attained for any earnings under the component to be achieved.

•20% of the target incentive shall be based upon the achievement of Individual Objectives as determined at the sole discretion of the Company.

◦A minimum of a defined percentage of the aggregate Revenue targets must be attained for any earnings under the component to be achieved.

•Participants may achieve up to 200% of the target incentive based on over-achievement of Plan Targets.

Plan Targets

The Financial Metrics shall be set by the Company upon approval by its Board of Directors, in their sole discretion.

Payment Schedule

Incentives shall be earned for the applicable fiscal year and shall be paid in the quarter that follows the year for which the incentive is earned at the sole discretion and following approval of the Company’s Board of Directors.

General Provisions

A Plan Participant shall not assign nor give any part of an incentive to any agent, customer or representative of the customer, or any other person, as an inducement in obtaining an order. Unless expressly approved in advance by the

CEO of the Company, a Plan Participant shall not accept any compensation from third parties related to sales of third-party products or services made by the Company.

In the event a Plan Participant, compensated in accordance with this Plan, owes any sum of money to the Company, including without limitation draw payments, charge backs, and travel advances, the Company shall have the right at any time to offset such obligations against the employee’s base salary, commissions, or bonuses.

The Company reserves the right without advance notice to:

•Accept, reject, or cancel any order,

•Make any adjustments or revisions to targets, structure, incentive rates, quotas, salaries, or any other matters pertaining to this Plan; and

•Resolve, in its sole and absolute discretion, any matters of interpretation under the Plan and matters not covered by the provisions of the Plan.

•Modify or terminate this Plan at any time.

The contents of this Plan are Company proprietary and confidential and are not to be disclosed by any Plan Participant to any person who is not an employee of the Company. Any legal action brought concerning this Plan shall be brought only in the state or federal courts of the country in which the Plan Participant is employed, and both parties submit to venue and jurisdiction in these courts. This Plan contains the entire agreement of the parties with respect to the matters addressed herein, and supersedes all other representations, statements and understandings concerning this subject matter.

EXHIBIT A

Plan Targets & Achievement Schedule

Financial Performance Target Metrics

Revenue targets and Adjusted EBITDA targets are determined annually in accordance with the Annual Operating plan as approved by the Board of Directors

Plan participants will be assigned a Revenue target associated with their primary business role:

oIdentity revenue plan defined as all revenue associated with the Identity line of business inclusive of ID R&D and any other revenue as may be defined in the Annual Operating Plan as approved by the Board of Directors

oDeposits revenue plan defined as all revenue associated with the Deposits line of business inclusive Mobile Deposits, Check Intelligence, and Check Fraud Defender and any other revenue as may be defined in the Annual Operating Plan as approved by the Board of Directors

oAll Mitek revenue plan defined as all revenue associated with the Deposits line of business inclusive Mobile Deposits, Check Intelligence, and Check Fraud Defender and any other revenue as may be defined in the Annual Operating Plan as approved by the Board of Directors

Individual Objectives

Individual achievement is gated by a minimum defined % of financial performance achievement for the fiscal year.

oMinimum % revenue achievement may dictate any payment related to Individual achievement payout; payout eligibility is earned based on individual performance and is at the sole discretion of management.

Plan Structure

| | | | | | | | | | | | | | |

| Plan Elements | ELT | Director Level & Above | All Other Participants |

| Identity | Total Identity Revenue | 40% | 40% | 30% |

| All Mitek Revenue | 10% | 10% | 10% |

| | | | |

| Deposits | Deposits Revenue | 40% | 40% | 30% |

| All Mitek Revenue | 10% | 10% | 10% |

| | | | |

| Corporate | All Mitek Revenue | 50% | 50% | 40% |

| | | | |

| ALL | Adjusted EBITDA (Profit) | 50% | 50% | 40% |

| | | |

| Individual Objectives | BOD & CEO ability to modify financial metric outcome by 10% based upon individual contribution. | | 20% |

v3.24.4

Cover

|

Jan. 28, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 28, 2025

|

| Entity Registrant Name |

MITEK SYSTEMS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35231

|

| Entity Tax Identification Number |

87-0418827

|

| Entity Address, Address Line One |

770 First Avenue, Suite 425

|

| Entity Address, City or Town |

San Diego,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92101

|

| City Area Code |

619

|

| Local Phone Number |

269-6800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

MITK

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000807863

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

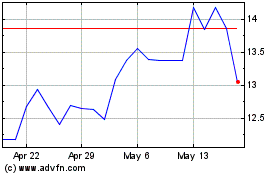

Mitek Systems (NASDAQ:MITK)

Historical Stock Chart

From Jan 2025 to Feb 2025

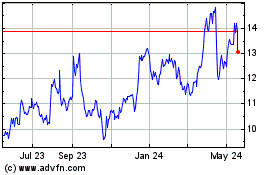

Mitek Systems (NASDAQ:MITK)

Historical Stock Chart

From Feb 2024 to Feb 2025