Filed pursuant to Rule 424(b)(3)

Registration No. 333-284304

PROSPECTUS

882,761 Shares

Common Stock Offered by the Selling Stockholder

This prospectus relates to the resale from time to time of up to 882,761 shares of our common stock, par value $0.001 per share (the “Common Stock”), issuable upon the exercise of 882,761 outstanding pre-funded warrants to purchase shares of our Common Stock held by the selling stockholder identified in this prospectus (the “Selling Stockholder”), and which were issued by us in a private placement on December 23, 2024.

We have agreed, pursuant to an agreement that we are party to with the Selling Stockholder, to bear all of the registration expenses incurred in connection with the registration of these shares of Common Stock. The Selling Stockholder will pay any discounts, commissions and similar expenses, if any, incurred for the sale of these shares of our Common Stock.

The Selling Stockholder, or its pledgees, assignees, donees, transferees or successors-in-interest, may offer the shares from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or through any other means described in this prospectus under the caption “Plan of Distribution.” The shares may be sold at fixed prices, at prevailing market prices, at prices related to prevailing market prices or at negotiated prices. For more information on the Selling Stockholder, see the section entitled “Selling Stockholder” on page 8.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Our Common Stock is traded on the Nasdaq Capital Market under the symbol “MNPR.” On January 24, 2025, the last reported sale price of our Common Stock was $41.46 per share.

Investing in our Common Stock involves a high degree of risk. You should carefully read and consider the section entitled “Risk Factors” on page 4 and the risk factors included in our periodic reports filed with the Securities and Exchange Commission (“SEC”), in any applicable prospectus supplement and in any other documents we file with the SEC.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is January 27, 2025.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

We urge you to read carefully this prospectus, together with the information incorporated herein by reference as described under the heading “Where You Can Find Additional Information,” before buying any of the securities being offered.

You should rely only on the information contained or incorporated by reference in this prospectus and any applicable prospectus supplement or in any amendment to this prospectus. Neither we nor the Selling Stockholder have authorized anyone to provide you with different information, and if anyone provides, or has provided you, with different or inconsistent information, you should not rely on it. The Selling Stockholder is offering to sell, and seeking offers to buy, shares of our Common Stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus, as well as the information filed previously with the Securities and Exchange Commission (the “SEC”), and incorporated herein by reference, is accurate only as of the date of the document containing the information, regardless of the time of delivery of this prospectus or any applicable prospectus supplement or any sale of our Common Stock.

A prospectus supplement may add to, update or change the information contained in this prospectus. In addition, documents filed after the date hereof that are deemed incorporated by reference herein may modify and supersede the information in this prospectus. You should read both this prospectus and any applicable prospectus supplement together with additional information described below under the heading “Where You Can Find Additional Information” and “Incorporation of Certain Documents By Reference.”

In this prospectus, references to “Monopar,” “Monopar Therapeutics,” the “Company,” the “registrant,” “we,” “us,” and “our” refer to Monopar Therapeutics Inc., a Delaware corporation. The phrase “this prospectus” refers to this prospectus and any applicable prospectus supplement, unless the context requires otherwise.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus and in the documents we incorporate by reference. This summary does not contain all of the information you should consider before making an investment decision. You should read this entire prospectus and the documents incorporated by reference carefully, especially the risks of investing in our Common Stock discussed under “Risk Factors” beginning on page 4 of this prospectus.

Overview

Monopar Therapeutics is a clinical-stage biotechnology company with late-stage ALXN-1840 for Wilson disease, and radiopharma programs including Phase 1-stage MNPR-101-Zr for imaging advanced cancers, and Phase 1a-stage MNPR-101-Lu and late preclinical-stage MNPR-101-Ac225 for the treatment of advanced cancers.

Private Placement

On December 20, 2024, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with the Selling Stockholder named in this prospectus, pursuant to which we issued and sold to the Selling Stockholder in a private placement (the “Private Placement”) 882,761 pre-funded warrants to purchase up to an aggregate of 882,761 shares of our Common Stock at a purchase price of $23.789 per pre-funded warrant. The aggregate gross proceeds from the Private Placement, before deducting placement agent fees and offering expenses, were approximately $21.0 million. The Private Placement closed on December 23, 2024.

Each pre-funded warrant has an exercise price of $0.001 per share. The pre-funded warrants are exercisable at any time after their original issuance on December 23, 2024, and do not expire. The Selling Stockholder may not exercise any portion of their pre-funded warrant to the extent that immediately prior to or after giving effect to such exercise the Selling Stockholder would beneficially own more than 9.99% of our outstanding Common Stock, which percentage may be changed at the Selling Stockholder’s election to a lower or higher percentage not in excess of 19.99% upon 61 days’ notice us to subject to the terms of the pre-funded warrants. As of the date of this prospectus, the Selling Stockholder has not given us any notice to change the ownership percentage limit.

The pre-funded warrants issued to the Selling Stocking in connection with the Private Placement were not registered under the Securities Act or any state securities laws. The Private Placement was conducted in reliance upon the exemption from securities registration afforded by Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D promulgated thereunder. In connection with their execution of the Purchase Agreement, the Selling Stockholder represented to us that such Selling Stockholder is an “accredited investor” within the meaning of Rule 501(a) of Regulation D of the Securities Act.

Under the terms of the Registration Rights Agreement, dated December 23, 2024, that we entered into with the Selling Stockholder (the “Registration Rights Agreement”), we agreed to prepare and file, on or before January 22, 2025, a registration statement with the SEC to register for resale the shares of our Common Stock issuable upon the exercise of pre-funded warrants issued under the Purchase Agreement, and to use commercially reasonable efforts to cause such registration statement to be declared effective within a specified time period set forth in the Registration Rights Agreement.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in the Exchange Act. Smaller reporting companies may take advantage of certain scaled disclosures, including, among other things, providing only two years of audited financial statements in their Annual Report on Form 10-K and having reduced disclosure obligations regarding executive compensation. In addition, as a non-accelerated filer, we are not required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act. We will continue to be a smaller reporting company if either (i) the market value of our stock held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed fiscal year and the market value of our stock held by non-affiliates was less than $700 million. For so long as we remain a smaller reporting company, we are permitted and intend to rely on exemptions from certain disclosure.

Corporate Information

We were formed as a Delaware limited liability company in December 2014, with the name Monopar Therapeutics, LLC. In December 2015, we converted to a Delaware C corporation. Our principal executive offices are located at 1000 Skokie Blvd, Suite 350, Wilmette, IL 60091. Our telephone number is (847) 388-0349. Our corporate website is located at www.monopartx.com. Any information contained in, or that can be accessed through our website, is not incorporated by reference in this prospectus.

THE OFFERING

|

Common Stock Offered by Selling Stockholder

|

Up to 882,761 shares of Common Stock issuable upon the exercise of outstanding pre-funded warrants to purchase shares of our Common Stock held by the Selling Stockholder.

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of shares of Common Stock by the Selling Stockholder.

|

|

Risk Factors

|

You should read the “Risk Factors” section of this prospectus and in the documents incorporated by reference in this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our Common Stock.

|

|

Nasdaq Capital Market Symbol

|

“MNPR”

|

RISK FACTORS

Investing in our Common Stock involves a high degree of risk. Before deciding to invest in our Common Stock, you should consider carefully the risk factors, and all of the other information, in our Annual Report on Form 10-K for the year ended December 31, 2023 and subsequent Quarterly Reports on Form 10-Q, as well as the risks, uncertainties and other information in subsequent filings with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after the date of this prospectus, all of which are incorporated by reference herein. This risk factor disclosure should be viewed together with all other information contained or incorporated by reference in this prospectus and any prospectus supplements or free writing prospectuses that we authorize for use in connection with this offering before you make a decision to invest in our Common Stock. If any of the risk factors incorporated by reference herein were to materialize, our business, financial condition, results of operations, and future growth prospects could be materially and adversely affected. In that event, the market price of our Common Stock could decline, and you could lose part of or all of your investment in our Common Stock.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains and incorporated by reference “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts included or incorporated by reference in this prospectus are forward-looking statements. The words “hopes,” “believes,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “expects,” “intends,” “may,” “could,” “should,” “would,” “will,” “continue,” and similar expressions are intended to identify forward-looking statements. The following uncertainties and factors, among others, could affect future performance and cause actual results to differ materially from those matters expressed in or implied by forward-looking statements:

| |

●

|

our ability to raise sufficient funds in order for us to support continued clinical, regulatory and commercial development of our programs and to make contractual future milestone payments, as well as our ability to further raise additional funds in the future to support any future product candidate programs through completion of clinical trials, the approval processes and, if applicable, commercialization;

|

| |

●

|

our ability to raise funds on acceptable terms;

|

| |

●

|

our ability to find a suitable pharmaceutical partner or partners to further our development efforts, under acceptable financial terms;

|

| |

●

|

risks and uncertainties associated with our or any development partners' research and development activities, including preclinical studies, clinical trials, regulatory submissions, and manufacturing and quality expenses;

|

| |

●

|

known and unknown risks associated with developing copper-chelating therapies and radiopharmaceutical therapeutics and imaging agents;

|

| |

●

|

the uncertainty of timeframes for our clinical trials and regulatory reviews for approval to market products;

|

| |

●

|

our ability to address the fulfillment and logistical challenges posed by the potential time-limited shelf-life of our current radiopharmaceutical programs or future drug candidates;

|

| |

●

|

our ability to obtain an adequate supply at reasonable costs of radioisotopes that we are currently using or that we may incorporate in the future into our drug candidates;

|

| |

●

|

uncertainties related to the regulatory discussions we intend to initiate related to ALXN-1840 and the outcome thereof;

|

| |

●

|

delays or additional significant expenses related to developing and filing a New Drug Application ("NDA") for ALXN-1840;

|

| |

●

|

the rate of market acceptance and competitiveness in terms of pricing, efficacy and safety, of any products for which we receive marketing approval, and our ability to competitively market any such products as compared to larger pharmaceutical companies;

|

| |

●

|

the difficulties of commercialization, marketing and product manufacturing and overall strategy;

|

| |

●

|

uncertainties of intellectual property position and strategy including new discoveries and patent filings;

|

| |

●

|

our ability to attract and retain experienced and qualified key personnel and/or to find and utilize external sources of experience, expertise and scientific, medical and commercialization knowledge to complete product development and commercialization of new products;

|

| |

●

|

the risks inherent in our estimates regarding the level of needed expenses, capital requirements and the availability of required additional financing at acceptable terms;

|

| |

●

|

the impact of the changes in U.S. political leadership potentially affecting the economy and future government laws, tariffs, and regulations including increased or decreased governmental control of healthcare and pharmaceuticals, other governmental regulations affecting cost requirements and structures for selling therapeutic or imaging products, and governmental legislation or tariffs affecting other industries which may indirectly increase our costs of obtaining goods and services and our cost of capital;

|

| |

●

|

the uncertain impact any resurgence of COVID-19 or another pandemic could have on our ability to advance our clinical programs and raise additional financing;

|

| |

●

|

the cumulative impact of domestic and global inflation, volatility in financial markets and/or the potential for an economic recession increasing our costs of obtaining goods and services or making financing more difficult to obtain on acceptable terms or at all;

|

| |

●

|

the uncertain impact of the Russia-Ukraine war, the Israel-Hamas war, or any potential future conflicts on our clinical material manufacturing expenses and timelines, as well as on general political, economic, trade and financial market conditions; and

|

| |

●

|

uncertainty of our financial projections and operational timelines and the development of new competitive products and technologies.

|

Although we believe that the risk assessments identified in such forward-looking statements are appropriate, we can give no assurance that such risks will materialize or that other risks will not materialize. Cautionary statements addressing forward-looking statements are disclosed in the “Risk Factors” sections of the documents incorporated by reference herein. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements. We undertake no obligation to update any statements made in this prospectus or the documents incorporated by reference herein, including without limitation any forward-looking statements, except as required by law.

Any forward-looking statements in this prospectus or incorporated by reference herein reflect our current views with respect to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances projected in this information.

USE OF PROCEEDS

We are filing the registration statement of which this prospectus forms a part to permit the Selling Stockholder to sell shares of our Common Stock. We are not selling any shares of Common Stock under this prospectus, and we will not receive any proceeds from the sale or other disposition of the shares held by the Selling Stockholder and offered hereby.

We will bear all costs, fees and expenses incurred in effecting the registration of the shares of Common Stock covered by this prospectus. The Selling Stockholder will be responsible for any discounts, commissions or other similar fees and expenses in connection with the sale of the shares of Common Stock offered by this prospectus.

SELLING STOCKHOLDER

On December 23, 2024, we closed the transaction contemplated in the Purchase Agreement with RA Capital Healthcare Fund, L.P. (the “Selling Stockholder” or “RA Capital”), pursuant to which RA Capital purchased 882,761 pre-funded warrants to purchase 882,761 shares of our Common Stock in the Private Placement in reliance upon the exemption from securities registration afforded by Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D promulgated thereunder. We are registering the shares of Common Stock issuable upon the exercise of the pre-funded warrants in order to permit the Selling Shareholder to offer the shares for resale from time to time. Except for the ownership of the shares of Common Stock purchased from us in a registered offering in October 2024 and the pre-funded warrants resulting from the Purchase Agreement, or as otherwise set forth herein, the Selling Stockholder has not had any material relationship with us within the past three years.

The table below sets forth, to our knowledge, information concerning the beneficial ownership of shares of our Common Stock by the Selling Stockholder as of January 6, 2025. The information in the table below is based upon certain information obtained from the Selling Stockholder. When we refer to the “Selling Stockholder” in this prospectus, we mean the Selling Stockholder listed in the table below as offering shares, as well as its donees, pledgees, transferees or other successors-in-interest. The Selling Stockholder may sell all, some or none of the shares subject to this prospectus. See “Plan of Distribution.”

The percentages of shares owned before and after the offering are based on 6,102,528 shares of Common Stock outstanding as of January 15, 2025.

| |

|

Shares of Common Stock

Beneficially Owned Prior to

Offering

|

|

|

|

|

|

Shares of Common Stock to

be Beneficially Owned

After Offering(4)

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

|

Percentage

|

|

|

Number of Shares

of Common Stock

Being Offered(3)

|

|

|

Number

|

|

|

Percentage

|

|

|

RA Capital Healthcare Fund, L.P. (1)

|

|

|

620,567 |

(2) |

|

|

9.99 |

% |

|

|

882,761 |

|

|

|

511,207 |

|

|

|

7.32 |

% |

| |

(1)

|

RA Capital Management, L.P. is the investment manager for RA Capital Healthcare Fund, L.P. (“RACHF”). The general partner of RA Capital Management, L.P. is RA Capital Management GP, LLC, of which Peter Kolchinsky and Rajeev Shah are the managing members. Each of RA Capital Management, L.P., RA Capital Management GP, LLC, Mr. Kolchinsky and Mr. Shah may be deemed to have voting and investment power over the securities held by RACHF. RA Capital Management, L.P., RA Capital Management GP, LLC, Mr. Kolchinsky and Mr. Shah disclaim beneficial ownership of such securities, except to the extent of any pecuniary interest therein. The principal business address of the persons and entities listed above is 200 Berkeley Street, 18th Floor, Boston, MA 02116.

|

| |

(2)

|

Consists of 511,207 shares of Common Stock held by RACHF, plus 109,360 shares (out of the 882,761 shares) of Common Stock that may be acquired pursuant to the pre-funded warrants up to the 9.99% beneficial ownership limit as of January 15, 2025.

|

| |

(3)

|

This amount represents the shares of Common Stock issuable to the Selling Stockholder upon exercise of the pre-funded warrants. We do not know when or in what amounts the Selling Stockholder may offer shares for sale. The Selling Stockholder might not sell any or might sell all of the shares offered by this prospectus.

|

| |

(4)

|

Because the Selling Stockholder may offer all or some of the shares pursuant to this prospectus, and because the Selling Stockholder may also sell all or some of the shares of Common Stock that it holds that are not offered pursuant to this prospectus, we cannot estimate the number of the shares that will be held by the Selling Stockholder after completion of the offering. However, for purposes of this table, we have assumed that, after completion of the offering, all of the shares covered by this prospectus will be sold by the Selling Stockholder and the Selling Stockholder will continue to hold all of its currently held 511,207 shares that are not offered pursuant to this prospectus.

|

PLAN OF DISTRIBUTION

The Selling Stockholder, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of Common Stock or interests in shares of Common Stock received after the date of this prospectus from the Selling Stockholder as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of Common Stock or interests in shares of Common Stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The Selling Stockholder may use any one or more of the following methods when disposing of shares or interests therein:

| |

•

|

distributions to members, partners, stockholders or other equityholders of the Selling Stockholder;

|

| |

•

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

| |

•

|

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

| |

•

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

| |

•

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

| |

•

|

privately negotiated transactions;

|

| |

•

|

short sales and settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part;

|

| |

•

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

| |

•

|

broker-dealers may agree with the Selling Stockholder to sell a specified number of such shares at a stipulated price per share;

|

| |

•

|

a combination of any such methods of sale; and

|

| |

•

|

any other method permitted pursuant to applicable law.

|

The Selling Stockholder may, from time to time, pledge or grant a security interest in some or all of the shares of Common Stock owned by the Selling Stockholder and, if the Selling Stockholder defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell the shares of Common Stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act, amending the Selling Stockholder to include the pledgee, transferee or other successors in interest as the Selling Stockholder under this prospectus. The Selling Stockholder also may transfer the shares of Common Stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the Selling Stockholder for purposes of this prospectus.

In connection with the sale of our Common Stock or interests therein, the Selling Stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the Common Stock in the course of hedging the positions they assume. The Selling Stockholder may also sell shares of our Common Stock short and deliver these securities to close out their short positions, or loan or pledge the Common Stock to broker-dealers that in turn may sell these securities. The Selling Stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the Selling Stockholder from the sale of the Common Stock offered by the Selling Stockholder will be the purchase price of the Common Stock less discounts or commissions, if any. The Selling Stockholder reserves the right to accept and, together with its agents from time to time, to reject, in whole or in part, any proposed purchase of Common Stock to be made directly or through agents. We will not receive any of the proceeds from this offering. Upon any exercise of the pre-funded warrants by payment of cash, however, we will receive the exercise price of the pre-funded warrants.

The Selling Stockholder also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule, or another available exemption from the registration requirements under the Securities Act.

The Selling Stockholder and any underwriters, broker-dealers or agents that participate in the sale of the Common Stock or interests therein may be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act (it being understood that the Selling Stockholder shall not be deemed to be an underwriter solely as a result of the Selling Stockholder’s participation in this offering). Any discounts, commissions, concessions or profit the Selling Stockholder earns on any resale of the shares may be underwriting discounts and commissions under the Securities Act. If the Selling Stockholder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act, then the Selling Stockholder will be subject to the prospectus delivery requirements of the Securities Act.

To the extent required, the shares of our Common Stock to be sold, the respective purchase prices and public offering prices, the names of any agent, dealer or underwriter, and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of some states, if applicable, the Common Stock may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the Common Stock may not be sold unless it has been registered or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

We have advised the Selling Stockholder that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the Selling Stockholder and its affiliates. In addition, to the extent applicable, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the Selling Stockholder for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The Selling Stockholder may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

We have agreed to indemnify the Selling Stockholder against liabilities, including liabilities under the Securities Act and state securities laws, relating to the registration of the shares offered by this prospectus.

We have agreed with the Selling Stockholder to use commercially reasonable efforts to cause the registration statement of which this prospectus constitutes a part to become effective and to remain continuously effective until the earlier of: (i) such time as all of the shares covered by this prospectus have been publicly sold by the Selling Stockholder; (ii) the date that all shares covered by this prospectus may be sold by non-affiliates without volume or manner-of-sale restrictions pursuant to Rule 144, without the requirement for us to be in compliance with the current public information requirement under Rule 144 as determined by our counsel pursuant to a written opinion letter to such effect, addressed and reasonably acceptable to our transfer agent or (iii) the expiration of two years from the effective date of the registration statement.

LEGAL MATTERS

Certain legal matters will be passed on for us by Baker & Hostetler LLP.

EXPERTS

The consolidated financial statements of Monopar Therapeutics Inc. as of December 31, 2023 and 2022, and for each of the two years in the period ended December 31, 2023, incorporated in this prospectus by reference to its Annual Report on Form 10-K for the year ended December 31, 2023, have been so incorporated in reliance on the report of BPM LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the Common Stock offered by this prospectus. This prospectus does not contain all of the information included in the registration statement. For further information pertaining to us and our Common Stock, you should refer to the registration statement and to its exhibits. Whenever we make reference in this prospectus to any of our contracts, agreements or other documents, the references are not necessarily complete, and you should refer to the exhibits attached to the registration statement or to the documents incorporated by reference herein for copies of the actual contract, agreement or other document.

We file annual, quarterly and current reports, information statements and proxy statements and other information with the SEC. You can read our SEC filings, including the registration statement of which this prospectus forms a part, at the SEC’s website at www.sec.gov. We also maintain a website at http://www.monopartx.com. You may access, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10- Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. The information contained on, or that can be accessed through, our website is not a part of, and should not be construed as being incorporated by reference into, this prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to incorporate by reference the information we file with it, which means that we can disclose important information to you by referring you to another document that we have filed separately with the SEC. You should read the information incorporated by reference because it is an important part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information in this prospectus. We incorporate by reference into this prospectus and the registration statement of which this prospectus is a part the information and documents listed below that we have filed with the SEC:

|

●

|

our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, filed with the SEC on November 8, 2024;

|

| |

|

|

●

|

our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, filed with the SEC on August 9, 2024;

|

| |

|

|

●

|

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 9, 2024;

|

| |

|

|

●

|

our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 28, 2024 (the “2023 Form 10-K”);

|

| |

|

|

●

|

our Current Reports on Form 8-K, filed with the SEC on February 28, 2024, May 24, 2024, August 9, 2024, October 24, 2024, October 30, 2024 and December 23, 2024, to the extent the information in such reports is filed and not furnished; and

|

| |

|

|

●

|

the description of our Common Stock contained in our Registration Statement on Form 8-A, registering our Common Stock under Section 12(b) under the Exchange Act, filed with the SEC on September 30, 2019, as supplemented by the “Description of Capital Stock” incorporated by reference herein from Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December 31, 2023 and including any amendments or reports filed for the purpose of updating such description.

|

We also incorporate by reference any future filings (other than Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of such registration statement, until the termination of the offering of the Common Stock made by this prospectus and will become a part of this prospectus from the date that such documents are filed with the SEC. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

We will furnish without charge to each person, including any beneficial owner, to whom a prospectus is delivered, upon written or oral request, a copy of any or all of the documents incorporated by reference into this prospectus but not delivered with the prospectus, including exhibits that are specifically incorporated by reference into such documents. You should direct any requests for documents to Monopar Therapeutics Inc., Attention: Corporate Secretary, 1000 Skokie Blvd., Suite 350, Wilmette, IL 60091. Our phone number is (847) 388-0349. You may also view the documents that we file with the SEC and incorporate by reference in this prospectus on our corporate website at www.monopartx.com. The information on our website is not incorporated by reference and is not a part of this prospectus.

PROSPECTUS

January 27, 2025

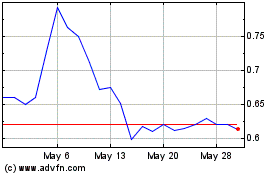

Monopar Therapeutics (NASDAQ:MNPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Monopar Therapeutics (NASDAQ:MNPR)

Historical Stock Chart

From Jan 2024 to Jan 2025