New Marqeta Research Finds UK Consumers Are Leading Global Adopters of Digital Payments, With Over Two-Thirds Now Comfortable Ditching Wallet For the Phone

23 July 2024 - 5:00PM

Business Wire

- In the last seven days, 80% of UK consumers surveyed reported

using contactless payments, compared to 46% of US respondents.

- Half (50%) of UK respondents confirmed their cash usage had

decreased over the past year, as comfort grows with the idea of a

cashless society.

- Embedded finance opportunity builds as 20% of UK respondents

would consider shifting completely to a digital only bank, and 39%

would consider using a non-financial provider.

UK consumers are leading the charge on digital financial

services adoption amid rising demand for more innovation and

convenience in payments and banking, according to a study from

Marqeta (NASDAQ: MQ), the global modern card issuing platform

powering some of today’s most innovative embedded finance

solutions. The 2024 State of Payments Report released today -

surveying 4,000 consumers across UK, US and Australia, including

over 1,000 in the UK - reveals that the UK is ahead of the US in

digital financial services adoption with 80% of UK respondents

reporting using contactless payments in the past week, almost

double the number reported in the US (46%).

The report, the fifth annual Marqeta survey of consumers about

their purchase preferences, reveals that UK consumers are growing

more comfortable with a cashless society with 50% of UK respondents

citing they’re feeling positive about this shift and 50% have also

decreased their cash spending in the past year, compared to 31% of

US respondents. UK consumers have also embraced the transition to

digital wallets, with almost three-quarters (74%) of those surveyed

confirming that they automatically add a new card to their mobile

wallet, 40% surveyed reporting using a mobile wallet in the last

week, and over two-thirds (68%) now feeling confident enough to

leave their physical wallets at home, demonstrating the societal

shift to increased reliance on digital payments.

Demand grows for faster pay

The study also finds that in the UK, existing payment structures

are lagging behind the growing consumer demand for instant, digital

payments. Despite 88% of UK respondents agreeing that getting paid

earlier would improve their financial peace of mind, the majority

(82%) still only have access to owed funds at the end of the month.

Providing earlier access to wage programs like Accelerated Wage

Access (AWA) could help UK workers that are struggling to keep up

with the rising cost of living, including the 36% of UK respondents

that reported using credit between paychecks and the 76% that cited

they often live paycheck-to-paycheck.

“Competition is rife in payments, and there is pressure on

payment and financial providers to innovate at the speed demanded

by consumers, which means business need to offer people more

convenient ways to make payments and access their wages,” said

Marcin Glogowski, SVP, Managing Director Europe and UK CEO at

Marqeta. “While traditional banks still have a hold on the UK

market, consumers are experimenting with new payment and banking

options alongside their traditional banks, and they're very open to

exploring embedded finance offerings from non-financial services

companies. This is opening up a world of opportunity for brands

that can keep up with the changing preferences and consumer desires

around how they want to pay and be paid.”

Banking slower to evolve, but change is underway

Within banking, UK consumers have been slower to adapt to a

completely digital offering compared to the trendsetting pace of

digital payments adoption, with over half (53%) of UK respondents

reporting they’ve been a customer of the same bank for a decade or

more. However, 20% of UK respondents confirmed they would consider

shifting completely to a digital only bank, and 39% would consider

using a non-financial provider. UK consumers value trust above all

else when selecting a non-financial services provider, with over

half (52%) of consumers citing trust in a brand as a reason for

selecting it. As embedded finance becomes more widely adopted, and

alternative providers more established, it's likely that digital

options outside of traditional banks will be more strongly

embraced.

Download the full report here.

About the research

The survey was performed on behalf of Marqeta by a third-party

advisory firm in the payments space in June 2024. Marqeta surveyed

4,000 consumers (2,000 in the United States, 1,000 in Australia,

1,000 in the UK) ages 18 and above.

About Marqeta

Marqeta’s modern card issuing platform empowers its customers to

create customised and innovative payment cards and embedded finance

offerings. Marqeta’s platform, powered by open APIs, gives its

customers the ability to build more configurable and flexible

payment experiences, accelerating product development and

democratising access to card issuing technology. Its modern

architecture provides instant access to highly scalable,

cloud-based payment infrastructure that enables customers to launch

and manage their own card programs, issue cards and authorise and

settle transactions. Marqeta is headquartered in Oakland,

California and is certified to operate in more than 40 countries

globally. For more information, visit www.marqeta.com, Twitter and

LinkedIn.

Forward-Looking Statements

This press release contains "forward-looking statements" within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements expressed or implied in this press release include, but

are not limited to, quotations and statements relating to changing

consumer preferences; increasing consumer adoption of certain

digital payment methods, products, and solutions; which payment,

banking, and financial services products and solutions may succeed;

technological and market trends; Marqeta’s business and growth;

Marqeta’s products and services; and statements made by Marqeta’s

senior leadership. Actual results may differ materially from the

expectations contained in these statements due to risks and

uncertainties, including, but not limited to, the following: any

factors creating issues with changes in domestic and international

business, market, financial, political and legal conditions; and

those risks and uncertainties included in the “Risk Factors”

disclosed in Marqeta's Annual Report on Form 10-K, as may be

updated from time to time in Marqeta’s periodic filings with the

SEC, available at www.sec.gov and Marqeta’s website at

http://investors.marqeta.com. The forward-looking statements in

this press release are based on information available to Marqeta as

of the date hereof. Marqeta disclaims any obligation to update any

forward-looking statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723129452/en/

James Robinson press@marqeta.com

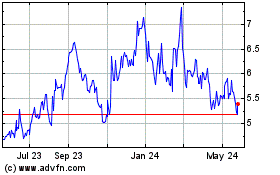

Marqeta (NASDAQ:MQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

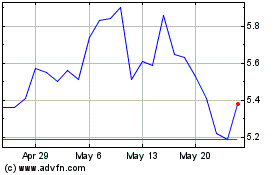

Marqeta (NASDAQ:MQ)

Historical Stock Chart

From Nov 2023 to Nov 2024