0001522540FALSE00015225402024-11-012024-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 1, 2024

MARQETA, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40465 | | 27-4306690 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

180 Grand Avenue, 6th Floor

Oakland, California 94612

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (877) 962-7738

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value per share | | MQ | | The Nasdaq Stock Market LLC |

| | | | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This Amendment No. 1 to the Current Report on Form 8-K amends the Current Report on Form 8-K filed by Marqeta, Inc. (the “Company” or “Marqeta”) with the Securities and Exchange Commission on November 1, 2024 (the “Original Form 8-K”). The purpose of this Current Report on Form 8-K/A is to provide additional information regarding the Chief Product and Technology Officer Transition and file the exhibits included in Item 9.01. No other changes have been made to the Original Form 8-K.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Departure of Randy Kern

On November 1, 2024, Marqeta announced that Randy Kern was no longer the Chief Product and Technology Officer of the Company, effective immediately (the “Initial Transition Date”). On November 8, 2024, Marqeta and Mr. Kern entered into an agreement whereby Mr. Kern will remain employed by the Company and perform transition work as requested following the Initial Transition Date through December 31, 2024. His existing compensation arrangements will remain in place during his remaining period of employment, after which, if the conditions specified in the agreement are met, he is expected to receive the benefits specified in the Marqeta Executive Severance Plan.

The Company does not intend to immediately fill the Chief Product and Technology Officer role. Mr. Kern’s responsibilities will be overseen by other members of the Company’s management team following the Initial Transition Date.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | |

| | MARQETA, INC. |

| Date: November 12, 2024 | /s/ Michael (Mike) Milotich |

| | Michael (Mike) Milotich |

| | Chief Financial Officer |

Exhibit 10.1

Exhibit 10.1

October 31, 2024

Dear Randy Kern:

This Transition Agreement (the “Agreement”) confirms the agreement between Randy Kern (“you”) and Marqeta, Inc. (the “Company”) (jointly referred to as the “Parties” or individually referred to as a “Party”) regarding the transition and separation of your employment with the Company. You will have until November 8, 2024 to execute this Agreement.

RECITALS

A.You are an at-will employee of the Company, and if you sign this Agreement, the Company has agreed to extend your at-will employment through December 31, 2024 (the “Planned Separation Date”) at which time you will separate from your employment with the Company (the date on which your employment with the Company terminates, the “Actual Separation Date”). You must sign both this Agreement and the Separation Date Supplemental Waiver and Release (the “Supplemental Release”) attached as Exhibit A in order to be entitled to the Severance Benefits described below.

B.If you choose not to sign this Agreement, your employment with the Company will end on November 12, 2024.

C.The Parties wish to ensure a smooth transition during the period of time between the date you sign this Agreement and the Actual Separation Date (the “Transition Period”).

D.The Parties wish by this Agreement to fully and finally resolve, settle, and compromise any and all issues, disputes, differences, claims, and/or liabilities arising out of or relating to your employment with the Company.

In consideration of the foregoing Recitals and of the promises, covenants, and conditions contained herein, the Parties hereby agree as follows:

1.Consideration

a.Continued Employment. During the Transition Period, the Company agrees to continue to employ you on the terms set forth in this Agreement and you agree to transition your day-to-day duties pursuant to the terms of Section 2 below. During the Transition Period, the Company will continue to make salary payments to you at your normal pay rate, less all applicable withholdings and taxes, and you shall also remain eligible to participate in then-available Company benefit programs at the same level as you would have been eligible to participate in such programs immediately prior to the start of the Transition Period, subject to the terms and conditions, including eligibility requirements, of such programs, and further subject to any modifications herein. You acknowledge that the continuation of your employment during the Transition Period, subject to the terms and conditions herein, is valuable consideration to which you are not otherwise entitled. Nothing in this Agreement alters your at-will

Randy Kern

October 31, 2024

Page 2

employment during the Transition Period. As a result, you are free to terminate your employment at any time, for any reason or for no reason and the Company is free to terminate your employment at any time, for any reason or for no reason even before the Planned Separation Date.

b.Supplemental Release Consideration. You acknowledge that you will only receive the consideration provided in this Section 1.b. if you (i) return all Company property on or before the Actual Separation Date; (ii) unless the Company terminates your employment without Cause (as defined in the Marqeta, Inc. Executive Severance Plan dated May 21, 2021 prior to the Planned Separation Agreement) complete the transition duties outlined in Section 2 below satisfactorily, as determined by the Company in its discretion; and (iii) have signed the Supplemental Release and returned it to the Company within the time provided for therein. Contingent upon your compliance with (i)-(iii) in the foregoing sentence, the Company agrees to provide you with the following consideration (together, the “Supplemental Release Consideration”): (x) a single lump payment in an amount equal to nine (9) months of your base salary (which amount is $356,250.00), plus seventy-five percent (75%) of your annual target bonus in effect as of the Separation Date (which amount is $267,187.50), for a total payment of $623,437.50, less all applicable withholdings shall be paid by the next regularly scheduled payroll date following the Supplemental Release Effective Date (as defined in the Supplemental Release); (y) reimburse you for the payments you make for COBRA coverage for you and your covered dependents as of the Actual Separation Date for a period of up to the first nine (9) full calendar months that occur after the Actual Separation Date or until Employee has secured health insurance coverage through another employer, whichever occurs first; ((x) and (y), the “Severance Benefits”) and (z) the Company will not contest your eligibility for unemployment insurance benefits following your separation, but reserves the right to truthfully and fully answer any inquiries from any government agency regarding your application for unemployment benefits. Once you provide the Company with the Supplemental Release, signed by you on or after the Actual Separation Date, the Company will make the separation payment described above on the next standard payday following the expiration of the Revocation Period set forth in Section 4 of the Supplemental Release via direct deposit. For the avoidance of doubt, subject to your compliance with (i) and (iii) above, you shall remain entitled to the Severance Benefits if the Company terminates your employment without Cause prior to the Planned Separation Date.

2.Your Transition Period Duties

a.In addition to any obligations and duties set forth elsewhere in this Agreement, you hereby agree to provide transitional assistance and support, including but not limited to answering questions from management. You agree and understand that you will perform transition work during this period only when and as instructed to do so by the Chief Executive Officer. You shall provide your services and meet your obligations in a manner that is timely and in accordance with generally acceptable standards in your profession, with a standard of care equal or superior to care used by your peers.

b.You understand and agree that you are expected to comply with all Company policies and procedures during the Transition Period. You agree that during the Transition Period you will not accept or engage in any work or relationship with any other employer or entity that could or will conflict with the Company’s interests, to be determined in the sole discretion of the Company. In order to allow the Company to assess the potential for a conflict of interest, you must

Randy Kern

October 31, 2024

Page 3

receive approval in writing from the Company’s Chief Compliance Officer before beginning any employment or contracting relationship with another employer or entity during the Transition Period.

c.No later than the Actual Separation Date, you will return to the Company all property that belongs to the Company, including (without limitation) copies of documents that belong to the Company and files stored on your computer(s) that contain information belonging to the Company.

d.Supplemental Release. In exchange for the Supplemental Release Consideration, you agree to execute, within five (5) business days after the Actual Separation Date, the Supplemental Release, which agreement will serve to cover the time period from the Effective Date of this Agreement through the Supplemental Release Effective Date; provided, however, the Parties agree to modify the Supplemental Release to comply with any new laws that become applicable prior to the end of the Transition Period. You agree that you cannot not sign the Supplemental Release prior to the Actual Separation Date. If you refuse to sign the Supplemental Release, you agree and acknowledge that you shall be deemed to have breached this Agreement. Further, you understand and agree that you will only be entitled to the consideration set forth in Section 1.b. if you execute the Supplemental Release within the time allotted in this Section 2.d.

3.Final Pay. Regardless of whether you decide to enter into this Agreement, you will be paid all wages earned and, if applicable, your accrued and unused vacation benefits, less any required deductions, through and including the Actual Separation Date. You acknowledge that, prior to the execution of this Agreement, you were not entitled to receive any additional money from the Company and that the only payments and benefits that you are entitled to receive from the Company in the future are those specified in this Agreement.

4.Acknowledgments. By signing this Agreement, you understand and acknowledge: (a) you are receiving the benefits set forth herein because you have entered into this Agreement and have promised to execute the Supplemental Release and would not otherwise be entitled to receive them otherwise; (b) your signing of and your agreement to this Agreement is knowing and voluntary and that you have not been coerced or threatened; (c) except as otherwise provided in this Agreement, you are not entitled to receive compensation or benefits of any kind from the Company on or after the Actual Separation Date; (d) the Company has properly provided you any leave of absence because of your or a family member’s health condition or military service and you have not been subjected to any improper treatment, conduct or actions due to a request for or taking such leave; (e) you have not suffered or incurred any workplace injury in the course of your employment with the Company on or before the date of your signing this Agreement, other than any injury that was the subject of an injury report or workers’ compensation claim on or before that date; (f) you having had the opportunity to provide the Company with written notice of any and all concerns regarding suspected ethical and compliance issues or violations on the part of the Company or any other Released Party; and (g) you have not filed any complaint, charge, lawsuit, or other legal action that is now pending against the Company or any other Released Party.

5.Release of Claims. In consideration for receiving the benefits described above, to the fullest extent permitted by law, you and your heirs, executors, beneficiaries, successors, assignees, immediate family members, and any other person or entity who could now or hereafter assert a claim in your name or on your behalf waive, release, and forever discharge the Company or its predecessors, successors or past or present subsidiaries, stockholders, directors, officers, former or current employees,

Randy Kern

October 31, 2024

Page 4

consultants, attorneys, agents, assigns and employee benefit plans (“Released Parties”) with respect to any matter, from any and all past, present, or future claims, lawsuits, demands, actions, or causes of actions, whether or not now known (collectively “Claims”), including (without limitation) any matter related to your employment with the Company and/or the termination of that employment. The claims which you agree to release and settle include, but are not limited to: (i) any claim of alleged discrimination, harassment, or retaliation, under Title VII of the Civil Rights Act of 1964, the Civil Rights Act of 1866, the Americans With Disabilities Act, the Equal Pay Act, the Rehabilitation Act, the Genetic Information Nondiscrimination Act, or any other federal, state, or local statute or common law which forbids discrimination, harassment, or retaliation in any aspect of employment (with the exception of the California Fair Employment and Housing Act); (ii) any claim of negligence, breach of an express or implied employment contract, violation of public policy, wrongful discharge, conspiracy, fraud, infliction of emotional distress, mental or physical injury, or defamation; (iii) any claim for benefits under any of the Company’s employee benefits plans; (iv) any claim for wages, bonuses, commissions, vacation pay, sick pay, severance or compensation of any kind; (v) any claim or violation under any other federal, state, or local statute or common law that may apply in the context of your employment with the Company, including, but not limited to, the Employee Retirement Income Security Act, the False Claims Act, and the federal Worker Adjustment and Retraining Notification Act (WARN Act) or any similar state or local law governing plant closings or mass layoffs; and (vi) any claim for reinstatement, equitable relief, or damages of any kind whatsoever. The scope of what you release in this Agreement includes, but is not limited to, a full general release of any and all Claims or potential Claims that you may have against the Company and/or against any of the other Released Parties, for any and all injunctive relief, declaratory relief, physical injury, personal injury, and injury of any and all other kinds, and/or any and all other kinds of alleged damages, or other monetary obligation, or obligation of any other sort, including but not limited to, any and all compensatory damages, emotional distress damages, punitive damages, costs, attorneys’ fees, and any and all other kinds of damages that are based in whole or in part on any act or omission occurring before this Agreement becomes effective. However, this release covers only those claims that arose prior to the execution of this Agreement. Additionally, this release does not cover or include claims under the California Fair Employment and Housing Act, which are specifically exempted from the scope of the release in this Section. Execution of this Agreement does not bar any claim that arises hereafter, including (without limitation) a claim for breach of this Agreement. This release of claims does not affect your vested rights in and to any benefit plan to which you may be entitled upon your separation. This release also does not extend to any obligations incurred under this Agreement or the Supplemental Release.

6.Waiver. You expressly waive and release any and all rights and benefits under Section 1542 of the California Civil Code (or any analogous law of any other state), which reads as follows:

1.A general release does not extend to claims that the creditor or releasing party does not know or suspect to exist in his or her favor at the time of executing the release and that, if known by him or her, would have materially affected his or her settlement with the debtor or released party.

You expressly waive and release any and all rights and benefits under Section 1542 of the California Civil Code (or any analogous law of any other state) with respect to the claims released hereby

Randy Kern

October 31, 2024

Page 5

to the full extent allowed by applicable law. In connection with such waiver and release, you acknowledge and agree that you may hereafter discover claims or facts in addition to or different from those which you now know or believe to be true with respect to the matters released herein, but that it is your intention to fully, finally and forever, waive, release and relinquish all such matters and all such claims relative thereto which do exist, may exist, or heretofore have existed. In furtherance of such intention, the release given herein shall be and remain in effect as the full and complete general release of any such additional or different claims or facts relative thereto. However, this release covers only those claims that arose prior to the execution of this Agreement. Execution of this Agreement does not bar any claim that arises hereafter, including (without limitation) a claim for breach of this Agreement.

7.Consideration Period. This Agreement is executed voluntarily and without any duress or undue influence on the part or behalf of the Parties hereto, with the full intent of releasing all claims. You acknowledge that you:

(a) are entitled to a full five (5) business days within which to consider this Agreement before executing it, that no changes to this Agreement, whether material or immaterial, shall restart the five-day period, and that if you sign this Agreement before this consideration period has ended you freely and voluntarily waive the remainder of the consideration period;

(b) this Agreement will become effective on the date it has been signed by both Parties (the “Effective Date”).

(c) have carefully read and fully understand all of the provisions of this Agreement;

(d) have been and are in this Agreement advised by the Company to consult an attorney prior to deciding whether to accept this Agreement;

(e) understand the terms and consequences of this Agreement and of the releases it contains; and

(f) are fully aware of the legal and binding effect of this Agreement.

8.Right to Engage in Protected Activity. Nothing in this Agreement shall be construed to waive any right provided by law that is not subject to waiver by private agreement. It is also expressly understood that nothing in this Agreement shall prohibit you from bringing any complaint, claim or action seeking to challenge the validity of, or alleging a breach of this Agreement by the Company. In addition, nothing in this Agreement including but not limited to the acknowledgments, release of claims, proprietary information, confidentiality, cooperation, and non-disparagement provisions waives your right to testify in an administrative, legislative, or judicial proceeding concerning alleged criminal conduct or alleged sexual harassment on the part of the Company, or on the part of the agents or employees of the Company, when you have been required or requested to attend such a proceeding pursuant to a court order, subpoena, or written request from an administrative agency or the legislature. Further, you agree and acknowledge that nothing contained in this Agreement will prevent you from filing a charge or complaint with, reporting possible violations of any law or regulation, providing information or documents to, and/or participating in any investigation or proceeding conducted by, the National Labor Relations Board, the Equal Employment Opportunity Commission, the Securities and Exchange Commission, and/or any governmental authority charged with the enforcement of any laws, provided that by signing this Agreement, you are waiving all rights to individual relief from Released Parties (including but not limited to backpay, front pay, reinstatement, or other legal or equitable relief) based on claims asserted in such a charge or complaint, or asserted by any third-party on your behalf,

Randy Kern

October 31, 2024

Page 6

except where such a waiver of individual relief is prohibited and except for any right you may have to receive a payment from a government agency (and not the Company) for information provided to a government agency. Additionally, nothing in this Agreement prevents a non-management, non-supervisory employees from engaging in protected concerted activity under §7 of the NLRA or similar state law such as joining, assisting, or forming a union, bargaining, picketing, striking, or participating in other activity for mutual aid or protection, or refusing to do so; this includes using or disclosing information acquired through lawful means regarding wages, hours, benefits, or other terms and conditions of employment, except where the information was entrusted to the employee in confidence by the Company as part of the employee’s job duties. Notwithstanding your confidentiality and non-disclosure obligations in this Agreement and otherwise, you understand that as provided by the Federal Defend Trade Secrets Act, you will not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret made: (1) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney, and solely for the purpose of reporting or investigating a suspected violation of law; or (2) in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal.

9.No Admission. Nothing contained herein shall be construed as an admission of wrongdoing, violation of any federal, state, or local law, or violation of any Company policy or procedure by either you or the Company or any of its divisions, affiliates or any of their respective officers, directors, or employees.

10.Other Agreements. At all times in the future, you will remain bound by your At-Will Employment, Confidential Information, Invention Assignment, and Arbitration Agreement with the Company that you signed on May 22, 2021 (to the extent applicable) (the “Confidentiality Agreement”). Any prior agreements between or directly involving you and the Company are superseded by this Agreement, except any prior agreements related to arbitration, inventions, business ideas, confidentiality of corporate information, and unfair competition remain intact. This Agreement may be modified only in a written document signed by you and a duly authorized officer of the Company. You represent that you have not relied upon any representations or statements in entering into this Agreement which are not specifically set forth in this Agreement.

11.Severability. If any term of this Agreement, with the exception of Section 5 , is held to be invalid, void or unenforceable, the remainder of this Agreement will remain in full force and effect and will in no way be affected, and the parties will use their best efforts to find an alternate way to achieve the same result. In the event that Section 1 or any other provision in the Supplemental Release releasing your claims against the Company is held to be illegal, unenforceable or void, then this Agreement shall be deemed null and void, and you agree to repay to the Company the Severance Benefits except as otherwise prohibited by law.

12. No Reliance. The parties represent and acknowledge that, in executing this Agreement, they do not rely and have not relied upon any representation or statement made by any of the parties or by any of the parties’ agents, attorneys, or representatives with regard to the subject matter, basis, or effect of this Agreement or otherwise, other than those specifically stated in this written Agreement. In exchange for severance and other promises contained in this Agreement, you are entering into this Agreement voluntarily, deliberately, and with all information needed to make an informed decision to enter this Agreement, and you agree that have been given the opportunity to ask any questions

Randy Kern

October 31, 2024

Page 7

regarding this Agreement and given notice of and an opportunity to retain an attorney or is already represented by an attorney.

13.Section 409a. Notwithstanding anything herein to the contrary, (i) if at the time of your termination of employment with the Company you are a “specified employee” as defined in Section 409A of the Code (and any related regulations or other pronouncements there under) and the deferral of the commencement of any payments or benefits otherwise payable hereunder as a result of such termination of employment is necessary in order to prevent any accelerated or additional tax under Section 409A of the Code, then the Company will defer the commencement of the payment of any such payments or benefits hereunder (without any reduction in such payments or benefits ultimately paid or provided to you) until the date that is six months following your termination of employment with the Company (or the earliest date as is permitted under Section 409A of the Code) and (ii) if any other payments of money or other benefits due to you hereunder could cause the application of an accelerated or additional tax under Section 409A of the Code, such payments or other benefits shall be deferred if deferral will make such payment or other benefits compliant under Section 409A of the Code, or otherwise such payment or other benefits shall be restructured, to the extent possible, in a manner, determined by the Company, that does not cause such an accelerated or additional tax. Each payment made under this Agreement shall be designated as a “separate payment” within the meaning of Section 409A of the Code. The Company shall consult with you in good faith regarding the implementation of the provisions of this Section; provided that neither the Company nor any the Released Parties shall have any liability to you with respect thereto.

14.Choice of Law. This Agreement will be construed under the law of the state of California.

15.No Waiver. Failure by any party to enforce any rights or remedies provided in this Agreement shall not be deemed a waiver of those rights.

16.Execution. This Agreement may be executed in counterparts, each of which will be considered an original, but all of which together will constitute one agreement. Execution of a facsimile copy will have the same force and effect as execution of an original, and a facsimile signature will be deemed an original and valid signature.

Please indicate your agreement with the above terms by signing below.

I acknowledge that I have read and understand this Agreement, I agree to the terms of this Agreement, and I am voluntarily signing this release of all claims.

RANDY KERN, an individual

/s/ Randy Kern

Signature of Randy Kern

Dated: November 8, 2024

Randy Kern

October 31, 2024

Page 8

COMPANY

/s/ Crystal Sumner

Signature of Crystal Summer

Dated: November 8, 2024

EXHIBIT A

SUPPLEMENTAL WAIVER AND RELEASE

The purpose of this Supplemental Waiver and Release (the “Supplemental Release”) is to bring forward to your Actual Separation Date your waiver and release of all claims, as described in the October 2024 Transition Agreement executed by you and the Company (the “Transition Agreement”) to which this Exhibit A is attached. Capitalized terms have the meaning set forth in the Transition Agreement unless otherwise defined herein. As consideration for receiving the severance compensation described in Section 1.b. of the Transition Agreement, you agree to comply with the terms of the Transition Agreement to which this Exhibit A is attached and further agree as follows:

1.Release of Claims. In consideration for receiving the benefits described herein, to the fullest extent permitted by law, you and your heirs, executors, beneficiaries, successors, assignees, immediate family members, and any other person or entity who could now or hereafter assert a claim in your name or on your behalf waive, release, and forever discharge the Company or its predecessors, successors or past or present subsidiaries, stockholders, directors, officers, former or current employees, consultants, attorneys, agents, assigns and employee benefit plans (“Released Parties”) with respect to any matter, from any and all past, present, or future claims, lawsuits, demands, actions, or causes of actions, whether or not now known (collectively “Claims”), including (without limitation) any matter related to your employment with the Company or the termination of that employment. The claims which you agree to release and settle include, but are not limited to,: (i) any claim of alleged discrimination, harassment, or retaliation, under Title VII of the Civil Rights Act of 1964, the Civil Rights Act of 1866, the Americans With Disabilities Act, the Equal Pay Act, the Rehabilitation Act, the Genetic Information Nondiscrimination Act, the California Fair Employment and Housing Act, the Age Discrimination in Employment Act (“ADEA”) or any other federal, state, or local statute or common law which forbids discrimination, harassment, or retaliation in any aspect of employment; (ii) any claim of negligence, breach of an express or implied employment contract, violation of public policy, wrongful discharge, conspiracy, fraud, infliction of emotional distress, mental or physical injury, or defamation; (iii) any claim for benefits under any of the Company’s employee benefits plans; (iv) any claim for wages, bonuses, commissions, vacation pay, sick pay, severance or compensation of any kind; (v) any claim or violation under any other federal, state, or local statute or common law that may apply in the context of your employment with the Company, including, but not limited to, the Employee Retirement Income Security Act, the False Claims Act, and the federal Worker Adjustment and Retraining Notification Act (WARN Act) or any similar state or local law governing plant closings or mass layoffs; and (vi) any claim for reinstatement, equitable relief, or damages of any kind whatsoever. The scope of what you release in this Supplemental Release includes, but is not limited to, a full general release of any and all Claims or potential Claims that you may have against the Company and/or against any of the other Released Parties, for any and all injunctive relief, declaratory relief, physical injury, personal injury, and injury of any and all other kinds, and/or any and all other kinds of alleged damages, or other monetary obligation, or obligation of any other sort, including but not limited to, any and all compensatory damages, emotional distress damages, punitive damages, costs, attorneys’ fees, and any and all other kinds of damages that are based in whole or in part on any act or omission occurring before this Supplemental Release becomes effective. However, this release covers only those claims that arose prior to the execution of this Supplemental Release. Execution of this Supplemental Release does not bar any claim that arises hereafter, including (without limitation) a claim for breach of this Supplemental Release. This release of

Randy Kern

October 31, 2024

Page 10

claims does not affect your vested rights in and to any benefit plan to which you may be entitled upon your separation.

You acknowledge and agree that this Supplemental Release does not constitute an admission of liability or wrongdoing on the part of the Company (or any of the other Released Parties), and the Company and the other Released Parties in fact expressly deny any liability or wrongdoing. This release does not waive or release any claim which cannot be waived or released by law, including any claims for workers’ compensation benefits, claims for unemployment benefits, or claims under California Labor Code section 2802.

2.Waiver. You expressly waive and release any and all rights and benefits under Section 1542 of the California Civil Code (or any analogous law of any other state), which reads as follows:

2.A general release does not extend to claims that the creditor or releasing party does not know or suspect to exist in his or her favor at the time of executing the release and that, if known by him or her, would have materially affected his or her settlement with the debtor or released party.

You expressly waive and release any and all rights and benefits under Section 1542 of the California Civil Code (or any analogous law of any other state) with respect to the claims released hereby to the full extent allowed by applicable law. In connection with such waiver and release, you acknowledges and agree that you may hereafter discover claims or facts in addition to or different from those which you now know or believe to be true with respect to the matters released herein, but that it is your intention to fully, finally and forever, waive, release and relinquish all such matters and all such claims relative thereto which do exist, may exist, or heretofore have existed. In furtherance of such intention, the release given herein shall be and remain in effect as the full and complete general release of any such additional or different claims or facts relative thereto. However, this release covers only those claims that arose prior to the execution of this Supplemental Release. Execution of this Supplemental Release does not bar any claim that arises hereafter, including (without limitation) a claim for breach of this Supplemental Release.

3.Post-Employment Cooperation. Following the Actual Separation Date, you agree to cooperate with and assist the Company, including but not limited to providing prompt, accurate and complete responses to questions, producing requested documents, submitting requested declarations attesting to facts known by you, and preparing for, submitting to and attending any deposition or trial in which their testimony is requested by the Company in any action against the Company. The Company will pay you the hourly rate of Four Hundred Dollars ($400.00) per hour, plus reasonable and necessary expenses for any services or travel after the Actual Separation Date upon your submission of invoices and receipts for any and all pre-approved services and expenses.

4.Payment of Compensation and Receipt of All Benefits. You acknowledge and represent that the Company has paid or provided all salary, wages, bonuses, vacation/paid time off, premiums, leaves, housing allowances, relocation costs, interest, severance, outplacement costs, fees, reimbursable expenses, commissions, stock, stock options, vesting, and any and all other benefits and compensation due to you.

Randy Kern

October 31, 2024

Page 11

5.Benefits. Your health insurance benefits ceased on the last day of the month in which the Actual Separation Date occurs (except as otherwise set forth in the Company’s applicable benefit plan(s)), subject to your right to continue your health insurance under COBRA (if any). Your participation in all benefits and incidents of employment, including, but not limited to, vesting in stock options, and the accrual of bonuses, vacation, and paid time off, ceased as of the Actual Separation Date.

6.Confidentiality of Agreement. Without otherwise limiting your right to participate in protected activity as set forth below, You agree that you will not disclose to others the existence or terms of this Supplemental Release, except that you may disclose such information to your spouse, attorney or tax adviser if such individuals agree that they will not disclose to others the existence or terms of this Supplemental Release and you may make such disclosures as are required by law, including as necessary for legitimate enforcement or compliance purposes.

7.No Disparagement. Without otherwise limiting your right to participate in protected activity as set forth below, you agree that you will not make any negative or disparaging statements (orally or in writing) about the Company or its directors, officers, investors, customers, employees, products, services or business practices, except as required by law. This Paragraph does not, in any way, restrict or impede you from exercising protected rights to the extent that such rights cannot be waived by agreement or from complying with any applicable law or regulation or a valid order of a court of competent jurisdiction or an authorized government agency, provided that such compliance does not exceed that required by the law, regulation or order. You shall promptly provide written notice of any such order to Company’s Legal Counsel (notices@marqeta.com).

8.No Cooperation. Subject to the Protected Activity provision, you agree that Employee will not knowingly encourage, counsel, or assist any attorneys or their clients in the presentation or prosecution of any disputes, differences, grievances, claims, charges, or complaints by any third party against any of the Released Parties, unless under a subpoena or other court order to do so or upon written request from an administrative agency or the legislature or as related directly to the ADEA waiver in this Supplemental Release. You agree both to immediately notify the Company upon receipt of any such subpoena or court order or written request from an administrative agency or the legislature, and to furnish, within three (3) business days of its receipt, a copy of such subpoena or other court order or written request from an administrative agency or the legislature. If approached by anyone for counsel or assistance in the presentation or prosecution of any disputes, differences, grievances, claims, charges, or complaints against any of the Released Parties, you shall state no more than that you cannot provide counsel or assistance.

9.Arbitration. EXCEPT AS PROHIBITED BY LAW, THE PARTIES AGREE THAT ANY AND ALL DISPUTES ARISING OUT OF THE TERMS OF THIS SUPPLEMENTAL RELEASE, THEIR INTERPRETATION, YOUR EMPLOYMENT WITH THE COMPANY OR THE TERMS THEREOF, OR ANY OF THE MATTERS HEREIN RELEASED, SHALL BE SUBJECT TO ARBITRATION UNDER THE FEDERAL ARBITRATION ACT (THE “FAA”) AND THAT THE FAA SHALL GOVERN AND APPLY TO THIS ARBITRATION AGREEMENT WITH FULL FORCE AND EFFECT; HOWEVER, WITHOUT LIMITING ANY PROVISIONS OF THE FAA, A MOTION OR PETITION OR ACTION TO COMPEL ARBITRATION MAY ALSO BE BROUGHT IN STATE COURT UNDER THE PROCEDURAL PROVISIONS OF SUCH STATE’S LAWS RELATING TO MOTIONS OR PETITIONS OR ACTIONS TO COMPEL ARBITRATION. YOU AGREES THAT, TO

Randy Kern

October 31, 2024

Page 12

THE FULLEST EXTENT PERMITTED BY LAW, YOU MAY BRING ANY SUCH ARBITRATION PROCEEDING ONLY IN YOUR INDIVIDUAL CAPACITY. ANY ARBITRATION WILL OCCUR IN ALAMEDA COUNTY, CALIFORNIA BEFORE JAMS, PURSUANT TO ITS EMPLOYMENT ARBITRATION RULES & PROCEDURES (“JAMS RULES”), EXCEPT AS EXPRESSLY PROVIDED IN THIS SECTION. THE PARTIES AGREE THAT THE ARBITRATOR SHALL HAVE THE POWER TO DECIDE ANY MOTIONS BROUGHT BY ANY PARTY TO THE ARBITRATION, INCLUDING MOTIONS FOR SUMMARY JUDGMENT AND/OR ADJUDICATION, AND MOTIONS TO DISMISS AND DEMURRERS, APPLYING THE STANDARDS SET FORTH UNDER THE CALIFORNIA CODE OF CIVIL PROCEDURE. THE PARTIES AGREE THAT THE ARBITRATOR SHALL ISSUE A WRITTEN DECISION ON THE MERITS. THE PARTIES ALSO AGREE THAT THE ARBITRATOR SHALL HAVE THE POWER TO AWARD ANY REMEDIES AVAILABLE UNDER APPLICABLE LAW, AND THAT THE ARBITRATOR MAY AWARD ATTORNEYS’ FEES AND COSTS TO THE PREVAILING PARTY, WHERE PERMITTED BY APPLICABLE LAW. THE ARBITRATOR MAY GRANT INJUNCTIONS AND OTHER RELIEF IN SUCH DISPUTES. THE DECISION OF THE ARBITRATOR SHALL BE FINAL, CONCLUSIVE, AND BINDING ON THE PARTIES TO THE ARBITRATION. THE PARTIES AGREE THAT THE PREVAILING PARTY IN ANY ARBITRATION SHALL BE ENTITLED TO INJUNCTIVE RELIEF IN ANY COURT OF COMPETENT JURISDICTION TO ENFORCE THE ARBITRATION AWARD. THE PARTIES TO THE ARBITRATION SHALL EACH PAY AN EQUAL SHARE OF THE COSTS AND EXPENSES OF SUCH ARBITRATION, AND EACH PARTY SHALL SEPARATELY PAY FOR ITS RESPECTIVE COUNSEL FEES AND EXPENSES; PROVIDED, HOWEVER, THAT THE ARBITRATOR MAY AWARD ATTORNEYS’ FEES AND COSTS TO THE PREVAILING PARTY, EXCEPT AS PROHIBITED BY LAW. THE PARTIES HEREBY AGREE TO WAIVE THEIR RIGHT TO HAVE ANY DISPUTE BETWEEN THEM RESOLVED IN A COURT OF LAW BY A JUDGE OR JURY. NOTWITHSTANDING THE FOREGOING, THIS SECTION WILL NOT PREVENT EITHER PARTY FROM SEEKING INJUNCTIVE RELIEF (OR ANY OTHER PROVISIONAL REMEDY) FROM ANY COURT HAVING JURISDICTION OVER THE PARTIES AND THE SUBJECT MATTER OF THEIR DISPUTE RELATING TO THIS SUPPLEMENTAL RELEASE AND THE AGREEMENTS INCORPORATED HEREIN BY REFERENCE. SHOULD ANY PART OF THE ARBITRATION AGREEMENT CONTAINED IN THIS SECTION CONFLICT WITH ANY OTHER ARBITRATION AGREEMENT BETWEEN THE PARTIES, THE PARTIES AGREE THAT THIS ARBITRATION AGREEMENT IN THIS SECTION SHALL GOVERN.

10.Incorporation of Terms of Transition Agreement. The Parties further acknowledge that the terms of the Transition Agreement shall apply to this Supplemental Release and are incorporated herein to the extent that they are not inconsistent with the express terms of this Supplemental Release.

11.Right to Engage in Protected Activity. Nothing in this Supplemental Release shall be construed to waive any right provided by law that is not subject to waiver by private agreement. It is also expressly understood that nothing in this Supplemental Release shall prohibit you from bringing any complaint, claim or action seeking to challenge the validity of, or alleging a breach of this Supplemental Release by the Company. In addition, nothing in this Supplemental Release including but not limited to the acknowledgments, release of claims, proprietary information, confidentiality, cooperation, and non-disparagement provisions waives your right to testify in an administrative, legislative, or judicial proceeding concerning alleged criminal conduct or alleged sexual harassment on the part of the Company, or on the part of the agents or employees of the Company, when you have been required or requested to

Randy Kern

October 31, 2024

Page 13

attend such a proceeding pursuant to a court order, subpoena, or written request from an administrative agency or the legislature. Further, you agree and acknowledge that nothing contained in this Supplemental Release will prevent you from filing a charge or complaint with, reporting possible violations of any law or regulation, providing information or documents to, and/or participating in any investigation or proceeding conducted by, the National Labor Relations Board, the Equal Employment Opportunity Commission, the Securities and Exchange Commission, and/or any governmental authority charged with the enforcement of any laws, provided that by signing this Supplemental Release, you are waiving all rights to individual relief from Released Parties (including but not limited to backpay, front pay, reinstatement, or other legal or equitable relief) based on claims asserted in such a charge or complaint, or asserted by any third-party on your behalf, except where such a waiver of individual relief is prohibited and except for any right you may have to receive a payment from a government agency (and not the Company) for information provided to a government agency. Additionally, nothing in this Supplemental Release prevents a non-management, non-supervisory employees from engaging in protected concerted activity under §7 of the NLRA or similar state law such as joining, assisting, or forming a union, bargaining, picketing, striking, or participating in other activity for mutual aid or protection, or refusing to do so; this includes using or disclosing information acquired through lawful means regarding wages, hours, benefits, or other terms and conditions of employment, except where the information was entrusted to the employee in confidence by the Company as part of the employee’s job duties. Notwithstanding your confidentiality and non-disclosure obligations in this Supplemental Release and otherwise, you understand that as provided by the Federal Defend Trade Secrets Act, you will not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret made: (1) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney, and solely for the purpose of reporting or investigating a suspected violation of law; or (2) in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal.

12.Acknowledgment of Waiver of Claims under ADEA. You understand and acknowledge that you are waiving and releasing any rights you may have under the Age Discrimination in Employment Act of 1967 (“ADEA”). You further acknowledge that this Supplemental Release and the waiver and release reflected in this Section has been executed voluntarily and without any duress or undue influence on the part or behalf of the Parties hereto, with the full intent of releasing all claims, and that you:

a)have had more than twenty one days to consider this Supplemental Release;

b)have seven days after signing this Supplemental Release to revoke by sending a revocation to hr@marqeta.com and that this Supplemental Release shall not be effective until after the revocation period has expired;

c)have carefully read and fully understand all of the provisions of this Supplemental Release;

d)should consult an attorney prior to executing this Supplemental Release

e)understand the terms and consequences of this Supplemental Release and of the releases it contains;

f)are fully aware of the legal and binding effect of this Supplemental Release; and

g)understand that nothing in this Supplemental Release prevents or precludes you from challenging or seeking a determination in good faith of the validity of this waiver under the ADEA, nor does it impose any condition precedent, penalties, or costs for doing so, unless specifically authorized by federal law.

Randy Kern

October 31, 2024

Page 14

The Parties agree that changes, whether material or immaterial, do not restart the running of the 21-day period.

13.Acknowledgements and Representations:

a)With the receipt of your final paycheck, you agree you have received all compensation or wages owed to you as a result of your employment with the Company.

b)You agree that you have submitted and been reimbursed for all business expenses incurred by you during your employment.

c)You represent that you have returned to the Company all property that belongs to the Company, including (without limitation) electronic or physical copies of documents that belong to the Company and files stored on your computer(s) that contain information belonging to the Company, identification cards or badges, access codes or devices, keys, laptops, computers, telephones, mobile phones, hand-held electronic devices, and credit cards. You acknowledge that all documents compiled by you or made available to you during the term of your employment with the Company concerning its business or customers is the Company’s property, whether or not confidential, and has been returned by you to the Company.

d)You represent that you have not signed this Supplemental Release until on or after your date of separation from the Company.

14.Unemployment Insurance. The Company will not contest your eligibility for unemployment insurance benefits following your separation, but reserves the right to truthfully and fully answer any inquiries from any government agency regarding your application for unemployment benefits.

15.Breach. In addition to the rights provided in the “Attorneys’ Fees” Section below, you acknowledge and agree that any material breach of this Supplemental Release, unless such breach constitutes a legal action by you challenging or seeking a determination in good faith of the validity of the waiver herein under the ADEA, or of any provision of the Confidentiality Agreement shall entitle the Company immediately to recover and/or cease providing the consideration provided to you under this Supplemental Release and to obtain damages, except as provided by law.

16.Acknowledgments. By signing this Supplemental Release, you understand and acknowledge: (a) you are receiving the benefits set forth herein because you have entered into this Supplemental Release with the Company and would not otherwise be entitled to receive them; (b) your signing of and your agreement to this Supplemental Release is knowing and voluntary and that you have not been coerced or threatened; (c) except as otherwise provided in this Supplemental Release, you are not entitled to receive compensation or benefits of any kind from the Company on or after the Actual Separation Date; (d) that the Company has properly provided you any leave of absence because of your or a family member’s health condition or military service and you have not been subjected to any improper treatment, conduct or actions due to a request for or taking such leave; (e) you have not suffered or incurred any workplace injury in the course of your employment with the Company on or before the date of your signing this Supplemental Release, other than any injury that was the subject of an injury report or workers’ compensation claim on or before that date; (f) you having had the opportunity to provide the Company with written notice of any and all concerns regarding suspected ethical and compliance issues or violations on the part of the Company or any other Released Party; and (g) you have not filed any

Randy Kern

October 31, 2024

Page 15

complaint, charge, lawsuit, or other legal action that is now pending against the Company or any other released party.

17.Severability. If any term of this Supplemental Release, with the exception of Section 1, is held to be invalid, void or unenforceable, the remainder of this Supplemental Release will remain in full force and effect and will in no way be affected, and the parties will use their best efforts to find an alternate way to achieve the same result. In the event that Section 1 is held to be illegal, unenforceable or void, then this Supplemental Release shall be deemed null and void, and you agree to repay to the Company the Severance Benefits to the maximum extent permitted by law.

18.Supplemental Release Effective Date. You understand that this Supplemental Release shall be null and void if not executed by you within five (5) business days after the Actual Separation Date, and that you cannot sign this Supplemental Release prior to the Actual Separation Date. Each Party has seven (7) days after that Party signs this Supplemental Release to revoke it. This Supplemental Release will become effective on the eighth (8th) day after you have signed this Supplemental Release, so long as it has been signed by the Parties and has not been revoked by either Party before that date (the “Supplemental Release Effective Date”).

19.References. The Company agrees that, in response to any request submitted to its Human Resources Department for references regarding your employment with it, the Company will release only dates of employment and last position held.

YOUR SIGNATURE BELOW ACKNOWLEDGES THAT YOU HAVE READ THIS SUPPLEMENTAL RELEASE CAREFULLY IN ITS ENTIRETY, THAT YOU KNOW AND UNDERSTAND ITS CONTENTS, AND THAT YOU ENTER INTO THIS SUPPLEMENTAL RELEASE FREELY AND AS A VOLUNTARY ACT.

Your Signature: ________________________________________________________

Dated: [Not to be Signed Before Date of Separation]: ____________________________

COMPANY Signature: ___________________________________________________________

v3.24.3

Cover page

|

Nov. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Document Period End Date |

Nov. 01, 2024

|

| Entity Registrant Name |

MARQETA, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40465

|

| Entity Tax Identification Number |

27-4306690

|

| Entity Address, Address Line One |

180 Grand Avenue

|

| Entity Address, Address Line Two |

6th Floor

|

| Entity Address, City or Town |

Oakland

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94612

|

| City Area Code |

877

|

| Local Phone Number |

962-7738

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.0001 par value per share

|

| Trading Symbol |

MQ

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001522540

|

| Amendment Flag |

false

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line Two |

6th Floor

|

| Entity Address, Address Line One |

180 Grand Avenue

|

| Entity Address, City or Town |

Oakland

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

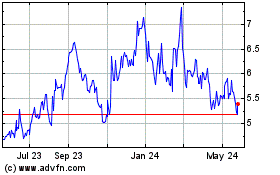

Marqeta (NASDAQ:MQ)

Historical Stock Chart

From Dec 2024 to Jan 2025

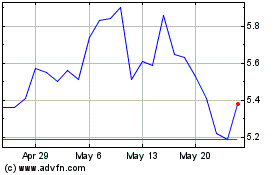

Marqeta (NASDAQ:MQ)

Historical Stock Chart

From Jan 2024 to Jan 2025