MEDIROM Healthcare Technologies Inc. (Nasdaq CM: MRM), a holistic

healthcare company based in Japan (the “Company”), today announced

its preliminary, unaudited consolidated financial results for the

year ended December 31, 2024, prepared under Japanese generally

accepted accounting principles (“JGAAP”). These preliminary

financial results and management’s estimates included in this press

release are unreviewed, unaudited, and preliminary, are prepared in

accordance with JGAAP (subject to the exclusion of offering-related

expenses from operating expenses and operating income, as described

in the following paragraph), have not been reviewed or audited

under U.S. generally accepted accounting principles (“U.S. GAAP”),

and are based solely on information available to the management of

the Company and management’s assumptions and expectations as of the

date of this press release, which remain subject to change. Actual

results for the year ended December 31, 2024 remain subject to the

completion of management’s reviews and reconciliations and/or

adjustments under U.S. GAAP, the Company’s other financial closing

procedures, and the audit by the Company’s independent auditor in

accordance with U.S. GAAP, and may differ from these estimated

preliminary results due to the completion of the Company’s

financial closing procedures, the audit under U.S. GAAP, and other

developments that may arise during the audit process. Accordingly,

you should not place undue reliance on this preliminary

information. See “Important Notice Regarding these Preliminary

Financial Results and Management’s Estimates” below.

The preliminary financial results present adjusted operating

expenses and adjusted operating income, both of which exclude

offering-related expenses incurred by the Company for its second

public equity offering, which closed in December 2024, to improve

comparability with the Company’s audited financial results for the

year ended December 31, 2023. The inclusion of offering-related

expenses in operating expenses under JGAAP is inconsistent with

U.S. GAAP, and therefore the Company is providing adjusted

operating expenses and adjusted operating income to improve

comparability with the Company’s audited financial results for the

year ended December 31, 2023, prepared in accordance with U.S.

GAAP. These offering expenses are not expected to impact the

Company’s operating expenses or operating income included in the

Company’s financial results to be prepared in accordance with U.S.

GAAP for the year ended December 31, 2024.

The Company is currently working with its

independent registered public accounting firm to complete the audit

of its financial results for the year ended December 31, 2024 in

accordance with U.S. GAAP and to prepare its Annual Report on Form

20-F containing the audited financial statements for full year

2024. The Company intends to file such Annual Report by the filing

deadline prescribed by the Securities and Exchange Commission (the

“SEC”).

Preliminary Financial Results Overview

for the Year Ended December 31, 2024 Under JGAAP

- The unaudited,

preliminary total revenue for the year ended December 31, 2024 is

expected to be approximately JPY8.2 billion ($52.6 million(1)),

representing a projected increase of approximately JPY1.4 billion

($9.2 million(1)) from the total revenue reported in accordance

with U.S. GAAP for the year ended December 31, 2023. Such increase

was primarily due to increase in sales of salons to investors,

increased store outsourcing revenue from such sold salons, and

increased revenue from the rehabilitation business which the

Company acquired in October 2024.

- The unaudited,

preliminary, adjusted operating expenses(2) are expected to be

approximately JPY8.12 billion ($51.6 million(1)) for the year ended

December 31, 2024, representing a projected increase of

approximately JPY0.9 billion ($5.7 million(1)) from the operating

expenses reported in accordance with U.S. GAAP for the year ended

December 31, 2023. Such increase was primarily due to increased

cost of sales of salons, increased cost of operation of salons

outsourced to the Company by salon owners, and increased

professional fees.

- The unaudited,

preliminary, adjusted operating income(2) is expected to be to

approximately JPY160 million ($1.0 million(1)) for the year ended

December 31, 2024, representing a projected increase of

approximately JPY552 million ($3.5 million(1)) from the operating

loss reported in accordance with U.S. GAAP for the year ended

December 31, 2023. Such increase was primarily due to the increase

in total revenue outpacing the increase in operating expenses in

2023.

Notes:

(1) Convenience translations included in this

press release of Japanese yen into U.S. dollars have been made at

the exchange rate of JPY157.37 = US$1.00, which was the foreign

exchange rate on December 31, 2024 as reported by the Board of

Governors of the Federal Reserve System in its weekly release on

January 6, 2025.

(2) As described above, adjusted operating expenses and adjusted

operating income exclude approximately JPY140 million of

offering-related expenses incurred by the Company for its second

public equity offering, which closed in December 2024. The

inclusion of offering-related expenses in operating expenses and

operating income under JGAAP is inconsistent with U.S. GAAP, and

therefore the Company is providing adjusted operating expenses and

adjusted operating income to improve comparability with the

Company’s audited financial results for the year ended December 31,

2023, prepared in accordance with U.S. GAAP. These offering

expenses are not expected to impact the Company’s operating

expenses or operating income in the Company’s financial results to

be prepared in accordance with U.S. GAAP for the year ended

December 31, 2024.

|

(Millions of yen) |

|

(UNAUDITED,Preliminary

Results)(1) |

| Consolidated

Statements of Income: |

|

Year Ended December 31, 2024 |

| Revenue |

|

8,280 |

| Adjusted operating

expenses(2) |

|

8,120 |

| Adjusted operating

income(2) |

|

160 |

| |

|

|

Notes:

(1) As described above, these preliminary

results are unreviewed, unaudited, and prepared in accordance with

JGAAP (subject to the exclusion of offering-related expenses from

operating expenses, as described in the following footnote). Actual

results for the year ended December 31, 2024 remain subject to the

completion of management’s reviews and reconciliations and/or

adjustments under U.S. GAAP, the Company’s other financial closing

procedures, and the audit by the Company’s independent auditor in

accordance with U.S. GAAP, and may differ from these estimated

preliminary results due to the completion of the Company’s

financial closing procedures, the audit under U.S. GAAP, and other

developments that may arise during the audit process. Accordingly,

you should not place undue reliance on these preliminary results.

See “Important Notice Regarding These Preliminary Financial Results

and Management’s Estimates” below.

(2) As described above, adjusted operating expenses and adjusted

operating income exclude approximately JPY140 million of

offering-related expenses incurred by the Company for its second

public equity offering, which closed in December 2024. The

inclusion of offering-related expenses in operating expenses and

operating income under JGAAP is inconsistent with U.S. GAAP, and

therefore the Company is providing adjusted operating expenses and

adjusted operating income to improve comparability with the

Company’s audited financial results for the year ended December 31,

2023, prepared in accordance with U.S. GAAP. These offering

expenses are not expected to impact the Company’s operating

expenses or operating income in the Company’s financial results to

be prepared in accordance with U.S. GAAP for the year ended

December 31, 2024.

Key Performance Indicators, or KPIs, for

the Year Ended December 31, 2024

The Company reported major key performance

indicators, or KPIs, for the year ended December 31, 2024. Data is

provided for all salons for which comparable financial and customer

data is available and excludes certain salons where such

information is not available.

- The total

number of salons was 308 in December 2024.

- Total customers

served was 945,395 for the year ended December 31, 2024.

- Average sales

per customer was JPY7,111 (US$45.2)(1) for the year ended December

31, 2024.

- Average repeat

ratio, a measure of repeat customers, was 76.3% for the year ended

December 31, 2024.

- Average

operation ratio was 45.7% for the year ended December 31,

2024.

- The total

number of salons with data was 283 in December 2024.

Note:

(1) Convenience translations included in this press release of

Japanese yen into U.S. dollars have been made at the exchange rate

of JPY157.37 = US$1.00, which was the foreign exchange rate on

December 31, 2024 as reported by the Board of Governors of the

Federal Reserve System in its weekly release on January 6,

2025.

Management Discussion

Kouji Eguchi, CEO of the Company, said, “We are

pleased with the revenue growth and improved adjusted operating

income during the year ended December 31, 2024, based on the

unaudited, preliminary financial results prepared under JGAAP. Our

directly-operated salons and our franchised salons contributed in

very complementary ways to the strong operational results of the

year thanks to a more distinct recovery from the COVID-19 pandemic,

as well as the growth in sales of directly-owned salons to

investors, which continues to be one of our key revenue streams. In

addition, revenue from the rehabilitation business which the

Company acquired in October 2024 contributed to our revenue growth,

though its contribution is not so large. The entire MEDIROM team

coalesced around our goals and we were able to finish the year on a

strong note. We intend to work diligently with our independent

auditor to complete the audit of our 2024 financial results under

U.S. GAAP. We hope to continue our growth momentum in 2025.”

Important Notice Regarding These

Preliminary Financial Results and Management’s

Estimates

The preliminary financial results and management’s estimates

included in this press release are unreviewed, unaudited, and

preliminary, are prepared in accordance with JGAAP (subject to the

one adjustment to exclude offering-related expenses, as described

above in more detail), have not been reviewed or audited under U.S.

GAAP, and do not present all information necessary for an

understanding of the Company’s results of operations for the year

ended December 31, 2024. These preliminary financial results for

the year ended December 31, 2024 and management’s estimates

presented in this press release are based solely on information

available to the management of the Company and management’s

assumptions and expectations as of the date of this press release,

which remain subject to change. Actual results for the year ended

December 31, 2024 remain subject to the completion of management’s

reviews and reconciliations and/or adjustments under U.S. GAAP, the

Company’s other financial closing procedures, and the audit by the

Company’s independent auditor in accordance with U.S. GAAP, and may

differ from these estimated preliminary results due to the

completion of the Company’s financial closing procedures, the audit

under U.S. GAAP, and other developments that may arise during the

audit process.

The Company expects the actual results may

differ from the preliminary results contained in this press release

in revenue recognition of franchise membership fees (accounted for

on an as-billed basis in these preliminary results as compared to

an as-earned basis during the estimated franchising periods after

conversion to U.S. GAAP), when converted from JGAAP into U.S. GAAP,

the impact of which, based upon management’s current assumption and

estimates, is believed to be insignificant, and elimination of

amortization of goodwill recognized under JGAAP, which management

expects to be offset with recognition of amortization of store

operating rights under U.S. GAAP. Other potential changes from the

these preliminary financial results could result from the

conversion into U.S. GAAP of the following line items, among

others: (1) recognition of impairment losses on the Company’s

long-lived salon assets; (2) recognition of impairment losses on

the Company’s goodwill and other intangible assets; (3)

increase/decrease in allowance or provisional expenses; (4)

increase/decrease in cost of goods sold or inventories,

particularly those related to MOTHER BraceletⓇ, which are currently

calculated based on standard costs and subject to adjustments into

actual costs primarily due to changes in foreign currency exchange

rates, and (5) recognition of deferred tax expense or benefit.

The preliminary financial results for the year

ended December 31, 2024 included in this press release have been

prepared by and are the responsibility of the Company’s management.

The Company’s independent auditor has not audited, reviewed,

compiled, or performed any procedures with respect to the

preliminary financial results presented in this press release

either under JGAAP or U.S. GAAP. Accordingly, the Company’s

independent auditor does not express an opinion or any other form

of assurance with respect thereto.

The Company intends to file its Annual Report on

Form 20-F containing the audited financial statements for the year

ended December 31, 2024 prepared in accordance with U.S. GAAP

by the filing deadline prescribed by the SEC, and such financial

information for 2024 contained in the Annual Report, including the

Company’s audited financial statements prepared in accordance with

U.S. GAAP, may differ from that disclosed in this preliminary

annual results press release. As such, these estimates should not

be viewed as a substitute for the Company’s audited annual

financial statements prepared in accordance with U.S. GAAP and are

not necessarily indicative of any future period. Accordingly, you

should not place undue reliance on this preliminary

information.

Forward-Looking Statements

Certain statements in this press release are

forward-looking statements for purposes of the safe harbor

provisions under the U.S. Private Securities Litigation Reform Act

of 1995. Forward-looking statements may include estimates or

expectations about the Company’s possible or assumed operational

results, financial condition, business strategies and plans, market

opportunities, competitive position, industry environment, and

potential growth opportunities. In some cases, forward-looking

statements can be identified by terms such as “may,” “will,”

“should,” “design,” “target,” “aim,” “hope,” “expect,” “could,”

“intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,”

“predict,” “project,” “potential,” “goal,” or other words that

convey the uncertainty of future events or outcomes. These

statements relate to future events or to the Company’s future

financial performance, and involve known and unknown risks,

uncertainties and other factors that may cause the Company’s actual

results, levels of activity, performance, or achievements to be

different from any future results, levels of activity, performance

or achievements expressed or implied by these forward-looking

statements. You should not place undue reliance on forward-looking

statements because they involve known and unknown risks,

uncertainties and other factors which are, in some cases, beyond

the Company’s control and which could, and likely will, affect

actual results, levels of activity, performance or achievements.

Any forward-looking statement reflects the Company’s current views

with respect to future events and is subject to these and other

risks, uncertainties and assumptions relating to the Company’s

operations, results of operations, growth strategy and liquidity.

Some of the factors that could cause actual results to differ

materially from those expressed or implied by the forward-looking

statements in this press release include:

- the Company’s

ability to achieve its development goals for its business and

execute and evolve its growth strategies, priorities and

initiatives;

- the Company’s

ability to sell certain of its owned salons to investors, and

receive management fees from such sold salons, on acceptable

terms;

- changes in

Japanese and global economic conditions and financial markets,

including their effects on the Company’s expansion in Japan and

certain overseas markets;

- the Company’s

ability to achieve and sustain profitability in its Digital

Preventative Healthcare Segment;

- the fluctuation

of foreign exchange rates, which affects the Company’s expenses and

liabilities payable in foreign currencies;

- the Company’s

ability to hire and train a sufficient number of therapists and

place them at salons in need of additional staffing;

- changes in

demographic, unemployment, economic, regulatory or weather

conditions affecting the Tokyo region of Japan, where the Company’s

relaxation salon base is geographically concentrated;

- the Company’s

ability to maintain and enhance the value of its brands and to

enforce and maintain its trademarks and protect its other

intellectual property;

- the financial

performance of the Company’s franchisees and the Company’s limited

control with respect to their operations;

- the Company’s

ability to raise additional capital on acceptable terms or at

all;

- the Company’s

level of indebtedness and potential restrictions on the Company

under the Company’s debt instruments;

- changes in

consumer preferences and the Company’s competitive

environment;

- the Company’s

ability to respond to natural disasters, such as earthquakes and

tsunamis, and to global pandemics, such as COVID-19; and

- the regulatory environment in which

the Company operates.

More information on these risks and other

potential factors that could affect the Company’s business,

reputation, results of operations, financial condition, and stock

price is included in the Company’s filings with the SEC, including

in the “Risk Factors” and “Operating and Financial Review and

Prospects” sections of the Company’s most recently filed periodic

report on Form 20-F and subsequent filings, which are available on

the SEC website at www.sec.gov. The Company assumes no obligation

to update or revise these forward-looking statements for any

reason, or to update the reasons actual results could differ from

those anticipated in these forward-looking statements, even if new

information becomes available in the future.

About MEDIROM Healthcare Technologies

Inc.

MEDIROM, a holistic healthcare company, operates

308 (as of December 31, 2024) relaxation salons across Japan,

Re.Ra.Ku® being its leading brand, and provides healthcare

services. In 2015, MEDIROM entered the health tech business and

launched new healthcare programs using an on-demand training app

called “Lav®”, which is developed by the Company. MEDIROM also

entered the device business in 2020 and has developed a smart

tracker “MOTHER Bracelet®”. In 2023, MEDIROM launched REMONY, a

remote monitoring system for corporate clients, and has received

orders from a broad range of industries, including nursing care,

transportation, construction, and manufacturing, among others.

MEDIROM hopes that its diverse health-related product and service

offerings will help it collect and manage healthcare data from

users and customers and enable it to become a leader in big data in

the healthcare industry. For more information, visit

https://medirom.co.jp/en.

■ContactsInvestor Relations Teamir@medirom.co.jp

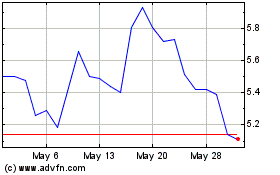

MEDIROM Healthcare Techn... (NASDAQ:MRM)

Historical Stock Chart

From Feb 2025 to Mar 2025

MEDIROM Healthcare Techn... (NASDAQ:MRM)

Historical Stock Chart

From Mar 2024 to Mar 2025