false

0000799167

0000799167

2025-01-27

2025-01-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 27, 2025

MARTEN TRANSPORT, LTD.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

0-15010

|

|

39-1140809

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification Number)

|

|

129 Marten Street

Mondovi, Wisconsin

|

|

54755

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(715) 926-4216

(Registrant’s telephone number, including area code)

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

Trading symbol: |

Name of each exchange on which registered: |

|

COMMON STOCK, PAR VALUE

$.01 PER SHARE

|

MRTN |

THE NASDAQ STOCK MARKET LLC

(NASDAQ GLOBAL SELECT MARKET)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 – Financial Information

Item 2.02. Results of Operations and Financial Condition.

On January 27, 2025, the company issued a press release announcing financial results for the quarter and year ended December 31, 2024. Attached hereto as Exhibit 99.1 is a copy of the company’s press release dated January 27, 2025 announcing the company’s financial results for this period.

The press release also includes a discussion of operating revenue, net of fuel surcharge revenue; and operating expenses as a percentage of operating revenue, with both amounts net of fuel surcharge revenue. The company provided these additional disclosures because management believes removing these items provide a more consistent basis for comparing results of operations from period to period. These financial measures in the press release have not been determined in accordance with generally accepted accounting principles (“GAAP”). Pursuant to Regulation G, the company has included a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures. For the discussion of operating revenue, net of fuel surcharge revenue; and operating expenses as a percentage of operating revenue, with both amounts net of fuel surcharge revenue, the most directly comparable GAAP financial measures are operating revenue, and operating expenses divided by operating revenue, which are reconciled in the attached Exhibit 99.1.

The information contained in this report and the exhibit hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Section 7 – Regulation FD

Item 7.01. Regulation FD Disclosure.

Representatives of the company make presentations at investor conferences and in other forums, and these presentations may include the information contained in Exhibit 99.2 attached to this current report on Form 8-K. A copy of the presentation slides containing such information that may be disclosed by the company is attached as Exhibit 99.2 to this report and the information set forth therein is incorporated herein by reference and constitutes a part of this report. The company expects to disclose the information contained in Exhibit 99.2, in whole or in part, and possibly with modifications, in connection with presentations to investors, analysts and others during 2025.

The company is furnishing the information contained in Exhibit 99.2 pursuant to Regulation FD and Item 7.01 of Form 8-K. The information in Exhibit 99.2 shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act, or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

The information contained in Exhibit 99.2 is summary information that is intended to be considered in the context of the company’s SEC filings and other public announcements that the company may make, by press release or otherwise, from time to time. The company undertakes no duty or obligation to publicly update or revise the information contained in Exhibit 99.2, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure. By filing this current report on Form 8-K and furnishing this information, the company makes no admission as to the materiality of any information contained in this report, including Exhibit 99.2.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

| |

(a)

|

Financial Statements of Businesses Acquired.

|

Not Applicable.

| |

(b)

|

Pro Forma Financial Information.

|

Not Applicable.

| |

(c)

|

Shell Company Transactions.

|

Not Applicable.

|

Exhibit No.

|

Description

|

| |

|

|

99.1

|

|

|

99.2

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

MARTEN TRANSPORT, LTD.

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: January 27, 2025

|

By:

|

/s/ James J. Hinnendael

|

|

|

|

|

James J. Hinnendael

|

|

|

|

|

Its: Executive Vice President and

|

|

| |

|

Chief Financial Officer |

|

Exhibit 99.1

MARTEN TRANSPORT ANNOUNCES FOURTH QUARTER AND YEAR END RESULTS

MONDOVI, Wis., January 27, 2025 (GLOBE NEWSWIRE) -- Marten Transport, Ltd. (Nasdaq/GS:MRTN) today reported net income of $5.6 million, or 7 cents per diluted share, for the fourth quarter ended December 31, 2024, compared with $12.4 million, or 15 cents per diluted share, for the fourth quarter of 2023. The 2024 fourth-quarter earnings improved 50.1% sequentially from 2024 third-quarter net income of $3.8 million, or 5 cents per diluted share. For the year ended December 31, 2024, net income was $26.9 million, or 33 cents per diluted share, compared with $70.4 million, or 86 cents per diluted share, for 2023.

Operating revenue was $230.4 million for the fourth quarter of 2024 compared with $268.2 million for the fourth quarter of 2023. Excluding fuel surcharges, operating revenue was $202.9 million for the 2024 quarter compared with $229.4 million for the 2023 quarter. Fuel surcharge revenue decreased to $27.6 million for the 2024 quarter from $38.8 million for the 2023 quarter.

Operating revenue was $963.7 million for 2024 compared with $1.131 billion for 2023. Excluding fuel surcharges, operating revenue was $840.0 million for 2024 compared with $972.0 million for 2023. Fuel surcharge revenue decreased to $123.7 million for 2024 compared with $159.4 million for 2023.

Operating income was $6.7 million for the fourth quarter of 2024 compared with $15.7 million for the fourth quarter of 2023. The 2024 fourth-quarter operating income improved 57.6% from operating income of $4.3 million for the third quarter of 2024.

Operating income was $33.2 million for 2024 compared with $90.1 million for 2023.

Operating expenses as a percentage of operating revenue were 97.1% for the 2024 fourth quarter and 94.2% for the 2023 fourth quarter. Operating expenses as a percentage of operating revenue, with both amounts net of fuel surcharges, were 96.7% for the 2024 fourth quarter and 93.2% for the 2023 fourth quarter – compared with 97.9% for the third quarter of 2024.

Operating expenses as a percentage of operating revenue were 96.6% for 2024 and 92.0% for 2023. Operating expenses as a percentage of operating revenue, with both amounts net of fuel surcharges, were 96.0% for 2024 and 90.7% for 2023.

Executive Chairman Randolph L. Marten stated, “We are encouraged by this quarter being the first quarter with sequential improvement in each of our net income, operating income and operating ratio, net of fuel surcharges, since the second quarter of 2022, a period that preceded the freight market recession’s severe inflationary operating costs, freight rate reductions and freight network disruptions. Our people also drove sequential increases this quarter in our revenue per tractor, rate per total mile and miles per tractor within each of our truckload and dedicated operations.”

“We continue to focus on minimizing the freight market’s impact on our operations while investing in and positioning our operations to capitalize on profitable organic growth opportunities, with fair compensation for our premium services, across each of our business operations for what comes next in the freight cycle as the market moves toward equilibrium.”

Current Investor Presentation

Marten Transport, with headquarters in Mondovi, Wis., is a multifaceted business offering a network of refrigerated and dry truck-based transportation capabilities across Marten’s five distinct business platforms - Truckload, Dedicated, Intermodal, Brokerage and MRTN de Mexico. Marten is one of the leading temperature-sensitive truckload carriers in the United States, specializing in transporting and distributing food, beverages and other consumer packaged goods that require a temperature-controlled or insulated environment. The Company offers service in the United States, Mexico and Canada, concentrating on expedited movements for high-volume customers. Marten’s common stock is traded on the Nasdaq Global Select Market under the symbol MRTN.

This press release contains certain statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include a discussion of Marten’s prospects for future growth and by their nature involve substantial risks and uncertainties, and actual results may differ materially from those expressed in such forward-looking statements. Important factors known to the Company that could cause actual results to differ materially from those discussed in the forward-looking statements are discussed in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. The Company undertakes no obligation to correct or update any forward-looking statements, whether as a result of new information, future events or otherwise.

CONTACTS: Tim Kohl, Chief Executive Officer, Doug Petit, President, and Jim Hinnendael, Executive Vice President and Chief Financial Officer, of Marten Transport, Ltd., 715-926-4216.

MARTEN TRANSPORT, LTD.

CONSOLIDATED CONDENSED BALANCE SHEETS

| |

|

December 31,

|

|

|

December 31,

|

|

|

(In thousands, except share information)

|

|

2024

|

|

|

2023

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

17,267 |

|

|

$ |

53,213 |

|

|

Receivables:

|

|

|

|

|

|

|

|

|

|

Trade, net

|

|

|

89,992 |

|

|

|

105,501 |

|

|

Other

|

|

|

5,364 |

|

|

|

10,356 |

|

|

Prepaid expenses and other

|

|

|

25,888 |

|

|

|

27,512 |

|

|

Total current assets

|

|

|

138,511 |

|

|

|

196,582 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment:

|

|

|

|

|

|

|

|

|

|

Revenue equipment, buildings and land, office equipment and other

|

|

|

1,198,737 |

|

|

|

1,162,336 |

|

|

Accumulated depreciation

|

|

|

(370,124 |

) |

|

|

(370,103 |

) |

|

Net property and equipment

|

|

|

828,613 |

|

|

|

792,233 |

|

|

Other noncurrent assets

|

|

|

1,633 |

|

|

|

1,524 |

|

|

Total assets

|

|

$ |

968,757 |

|

|

$ |

990,339 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

25,781 |

|

|

$ |

36,516 |

|

|

Insurance and claims accruals

|

|

|

44,246 |

|

|

|

47,017 |

|

|

Accrued and other current liabilities

|

|

|

23,492 |

|

|

|

26,709 |

|

|

Total current liabilities

|

|

|

93,519 |

|

|

|

110,242 |

|

|

Deferred income taxes

|

|

|

107,034 |

|

|

|

122,462 |

|

|

Noncurrent operating lease liabilities

|

|

|

282 |

|

|

|

249 |

|

|

Total liabilities

|

|

|

200,835 |

|

|

|

232,953 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.01 par value per share; 2,000,000 shares authorized; no shares issued and outstanding

|

|

|

- |

|

|

|

- |

|

|

Common stock, $.01 par value per share; 192,000,000 shares authorized; 81,463,938 shares at December 31, 2024, and 81,312,168 shares at December 31, 2023, issued and outstanding

|

|

|

815 |

|

|

|

813 |

|

|

Additional paid-in capital

|

|

|

52,941 |

|

|

|

49,789 |

|

|

Retained earnings

|

|

|

714,166 |

|

|

|

706,784 |

|

|

Total stockholders’ equity

|

|

|

767,922 |

|

|

|

757,386 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

968,757 |

|

|

$ |

990,339 |

|

MARTEN TRANSPORT, LTD.

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

| |

|

Three Months

|

|

|

Year

|

|

| |

|

Ended December 31,

|

|

|

Ended December 31,

|

|

|

(In thousands, except per share information)

|

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating revenue

|

|

$ |

230,432 |

|

|

$ |

268,222 |

|

|

$ |

963,708 |

|

|

$ |

1,131,455 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses (income):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries, wages and benefits

|

|

|

83,009 |

|

|

|

91,350 |

|

|

|

341,732 |

|

|

|

378,818 |

|

|

Purchased transportation

|

|

|

39,231 |

|

|

|

47,259 |

|

|

|

169,142 |

|

|

|

199,334 |

|

|

Fuel and fuel taxes

|

|

|

32,992 |

|

|

|

42,731 |

|

|

|

147,143 |

|

|

|

180,437 |

|

|

Supplies and maintenance

|

|

|

14,331 |

|

|

|

16,120 |

|

|

|

63,337 |

|

|

|

67,411 |

|

|

Depreciation

|

|

|

27,528 |

|

|

|

28,748 |

|

|

|

111,653 |

|

|

|

116,722 |

|

|

Operating taxes and licenses

|

|

|

2,683 |

|

|

|

2,708 |

|

|

|

10,302 |

|

|

|

11,053 |

|

|

Insurance and claims

|

|

|

15,134 |

|

|

|

15,209 |

|

|

|

53,109 |

|

|

|

56,014 |

|

|

Communications and utilities

|

|

|

2,195 |

|

|

|

2,524 |

|

|

|

9,029 |

|

|

|

10,149 |

|

|

Gain on disposition of revenue equipment

|

|

|

(387 |

) |

|

|

(1,802 |

) |

|

|

(4,971 |

) |

|

|

(13,612 |

) |

|

Other

|

|

|

6,989 |

|

|

|

7,718 |

|

|

|

30,012 |

|

|

|

35,019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

223,705 |

|

|

|

252,565 |

|

|

|

930,488 |

|

|

|

1,041,345 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

6,727 |

|

|

|

15,657 |

|

|

|

33,220 |

|

|

|

90,110 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

|

|

|

(394 |

) |

|

|

(868 |

) |

|

|

(3,126 |

) |

|

|

(3,806 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

7,121 |

|

|

|

16,525 |

|

|

|

36,346 |

|

|

|

93,916 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes expense

|

|

|

1,488 |

|

|

|

4,126 |

|

|

|

9,424 |

|

|

|

23,543 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

5,633 |

|

|

$ |

12,399 |

|

|

$ |

26,922 |

|

|

$ |

70,373 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share

|

|

$ |

0.07 |

|

|

$ |

0.15 |

|

|

$ |

0.33 |

|

|

$ |

0.87 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per common share

|

|

$ |

0.07 |

|

|

$ |

0.15 |

|

|

$ |

0.33 |

|

|

$ |

0.86 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per common share

|

|

$ |

0.06 |

|

|

$ |

0.06 |

|

|

$ |

0.24 |

|

|

$ |

0.24 |

|

MARTEN TRANSPORT, LTD.

SEGMENT INFORMATION

(Unaudited)

| |

|

|

|

|

|

|

|

|

|

Dollar

|

|

|

Percentage

|

|

| |

|

|

|

|

|

|

|

|

|

Change

|

|

|

Change

|

|

| |

|

Three Months

|

|

|

Three Months

|

|

|

Three Months

|

|

| |

|

Ended

|

|

|

Ended

|

|

|

Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

|

December 31,

|

|

|

(Dollars in thousands)

|

|

2024

|

|

|

2023

|

|

|

2024 vs. 2023

|

|

|

2024 vs. 2023

|

|

|

Operating revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload revenue, net of fuel surcharge revenue

|

|

$ |

93,106 |

|

|

$ |

95,461 |

|

|

$ |

(2,355 |

) |

|

|

(2.5 |

)% |

|

Truckload fuel surcharge revenue

|

|

|

14,188 |

|

|

|

18,023 |

|

|

|

(3,835 |

) |

|

|

(21.3 |

) |

|

Total Truckload revenue

|

|

|

107,294 |

|

|

|

113,484 |

|

|

|

(6,190 |

) |

|

|

(5.5 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dedicated revenue, net of fuel surcharge revenue

|

|

|

64,997 |

|

|

|

77,731 |

|

|

|

(12,734 |

) |

|

|

(16.4 |

) |

|

Dedicated fuel surcharge revenue

|

|

|

11,391 |

|

|

|

17,310 |

|

|

|

(5,919 |

) |

|

|

(34.2 |

) |

|

Total Dedicated revenue

|

|

|

76,388 |

|

|

|

95,041 |

|

|

|

(18,653 |

) |

|

|

(19.6 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intermodal revenue, net of fuel surcharge revenue

|

|

|

11,238 |

|

|

|

15,610 |

|

|

|

(4,372 |

) |

|

|

(28.0 |

) |

|

Intermodal fuel surcharge revenue

|

|

|

1,971 |

|

|

|

3,467 |

|

|

|

(1,496 |

) |

|

|

(43.1 |

) |

|

Total Intermodal revenue

|

|

|

13,209 |

|

|

|

19,077 |

|

|

|

(5,868 |

) |

|

|

(30.8 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brokerage revenue

|

|

|

33,541 |

|

|

|

40,620 |

|

|

|

(7,079 |

) |

|

|

(17.4 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating revenue

|

|

$ |

230,432 |

|

|

$ |

268,222 |

|

|

$ |

(37,790 |

) |

|

|

(14.1 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income/(loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload

|

|

$ |

1,821 |

|

|

$ |

2,487 |

|

|

$ |

(666 |

) |

|

|

(26.8 |

)% |

|

Dedicated

|

|

|

4,073 |

|

|

|

9,234 |

|

|

|

(5,161 |

) |

|

|

(55.9 |

) |

|

Intermodal

|

|

|

(1,502 |

) |

|

|

296 |

|

|

|

(1,798 |

) |

|

|

(607.4 |

) |

|

Brokerage

|

|

|

2,335 |

|

|

|

3,640 |

|

|

|

(1,305 |

) |

|

|

(35.9 |

) |

|

Total operating income

|

|

$ |

6,727 |

|

|

$ |

15,657 |

|

|

$ |

(8,930 |

) |

|

|

(57.0 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating ratio:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload

|

|

|

98.3 |

% |

|

|

97.8 |

% |

|

|

|

|

|

|

|

|

|

Dedicated

|

|

|

94.7 |

|

|

|

90.3 |

|

|

|

|

|

|

|

|

|

|

Intermodal

|

|

|

111.4 |

|

|

|

98.4 |

|

|

|

|

|

|

|

|

|

|

Brokerage

|

|

|

93.0 |

|

|

|

91.0 |

|

|

|

|

|

|

|

|

|

|

Consolidated operating ratio

|

|

|

97.1 |

% |

|

|

94.2 |

% |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating ratio, net of fuel surcharges:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload

|

|

|

98.0 |

% |

|

|

97.4 |

% |

|

|

|

|

|

|

|

|

|

Dedicated

|

|

|

93.7 |

|

|

|

88.1 |

|

|

|

|

|

|

|

|

|

|

Intermodal

|

|

|

113.4 |

|

|

|

98.1 |

|

|

|

|

|

|

|

|

|

|

Brokerage

|

|

|

93.0 |

|

|

|

91.0 |

|

|

|

|

|

|

|

|

|

|

Consolidated operating ratio, net of fuel surcharges

|

|

|

96.7 |

% |

|

|

93.2 |

% |

|

|

|

|

|

|

|

|

MARTEN TRANSPORT, LTD.

SEGMENT INFORMATION

(Unaudited)

| |

|

|

|

|

|

|

|

|

|

Dollar

|

|

|

Percentage

|

|

| |

|

|

|

|

|

|

|

|

|

Change

|

|

|

Change

|

|

| |

|

Year

|

|

|

Year

|

|

|

Year

|

|

| |

|

Ended

|

|

|

Ended

|

|

|

Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

|

December 31,

|

|

|

(Dollars in thousands)

|

|

2024

|

|

|

2023

|

|

|

2024 vs. 2023

|

|

|

2024 vs. 2023

|

|

|

Operating revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload revenue, net of fuel surcharge revenue

|

|

$ |

377,452 |

|

|

$ |

395,565 |

|

|

$ |

(18,113 |

) |

|

|

(4.6 |

)% |

|

Truckload fuel surcharge revenue

|

|

|

62,340 |

|

|

|

69,910 |

|

|

|

(7,570 |

) |

|

|

(10.8 |

) |

|

Total Truckload revenue

|

|

|

439,792 |

|

|

|

465,475 |

|

|

|

(25,683 |

) |

|

|

(5.5 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dedicated revenue, net of fuel surcharge revenue

|

|

|

267,077 |

|

|

|

334,962 |

|

|

|

(67,885 |

) |

|

|

(20.3 |

) |

|

Dedicated fuel surcharge revenue

|

|

|

52,058 |

|

|

|

73,310 |

|

|

|

(21,252 |

) |

|

|

(29.0 |

) |

|

Total Dedicated revenue

|

|

|

319,135 |

|

|

|

408,272 |

|

|

|

(89,137 |

) |

|

|

(21.8 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intermodal revenue, net of fuel surcharge revenue

|

|

|

49,468 |

|

|

|

75,887 |

|

|

|

(26,419 |

) |

|

|

(34.8 |

) |

|

Intermodal fuel surcharge revenue

|

|

|

9,286 |

|

|

|

16,191 |

|

|

|

(6,905 |

) |

|

|

(42.6 |

) |

|

Total Intermodal revenue

|

|

|

58,754 |

|

|

|

92,078 |

|

|

|

(33,324 |

) |

|

|

(36.2 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brokerage revenue

|

|

|

146,027 |

|

|

|

165,630 |

|

|

|

(19,603 |

) |

|

|

(11.8 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating revenue

|

|

$ |

963,708 |

|

|

$ |

1,131,455 |

|

|

$ |

(167,747 |

) |

|

|

(14.8 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income/(loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload

|

|

$ |

3,283 |

|

|

$ |

24,835 |

|

|

$ |

(21,552 |

) |

|

|

(86.8 |

)% |

|

Dedicated

|

|

|

23,037 |

|

|

|

48,377 |

|

|

|

(25,340 |

) |

|

|

(52.4 |

) |

|

Intermodal

|

|

|

(3,922 |

) |

|

|

(156 |

) |

|

|

(3,766 |

) |

|

|

(2,414.1 |

) |

|

Brokerage

|

|

|

10,822 |

|

|

|

17,054 |

|

|

|

(6,232 |

) |

|

|

(36.5 |

) |

|

Total operating income

|

|

$ |

33,220 |

|

|

$ |

90,110 |

|

|

$ |

(56,890 |

) |

|

|

(63.1 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating ratio:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload

|

|

|

99.3 |

% |

|

|

94.7 |

% |

|

|

|

|

|

|

|

|

|

Dedicated

|

|

|

92.8 |

|

|

|

88.2 |

|

|

|

|

|

|

|

|

|

|

Intermodal

|

|

|

106.7 |

|

|

|

100.2 |

|

|

|

|

|

|

|

|

|

|

Brokerage

|

|

|

92.6 |

|

|

|

89.7 |

|

|

|

|

|

|

|

|

|

|

Consolidated operating ratio

|

|

|

96.6 |

% |

|

|

92.0 |

% |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating ratio, net of fuel surcharges:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload

|

|

|

99.1 |

% |

|

|

93.7 |

% |

|

|

|

|

|

|

|

|

|

Dedicated

|

|

|

91.4 |

|

|

|

85.6 |

|

|

|

|

|

|

|

|

|

|

Intermodal

|

|

|

107.9 |

|

|

|

100.2 |

|

|

|

|

|

|

|

|

|

|

Brokerage

|

|

|

92.6 |

|

|

|

89.7 |

|

|

|

|

|

|

|

|

|

|

Consolidated operating ratio, net of fuel surcharges

|

|

|

96.0 |

% |

|

|

90.7 |

% |

|

|

|

|

|

|

|

|

MARTEN TRANSPORT, LTD.

OPERATING STATISTICS

(Unaudited)

| |

|

Three Months

|

|

|

Year

|

|

| |

|

Ended December 31,

|

|

|

Ended December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Truckload Segment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (in thousands)

|

|

$ |

107,294 |

|

|

$ |

113,484 |

|

|

$ |

439,792 |

|

|

$ |

465,475 |

|

|

Average revenue, net of fuel surcharges, per tractor per week(1)

|

|

$ |

4,227 |

|

|

$ |

4,183 |

|

|

$ |

4,123 |

|

|

$ |

4,377 |

|

|

Average tractors(1)

|

|

|

1,676 |

|

|

|

1,737 |

|

|

|

1,751 |

|

|

|

1,733 |

|

|

Average miles per trip

|

|

|

535 |

|

|

|

533 |

|

|

|

533 |

|

|

|

519 |

|

|

Non-revenue miles percentage(2)

|

|

|

11.8 |

% |

|

|

12.4 |

% |

|

|

12.1 |

% |

|

|

12.4 |

% |

|

Total miles (in thousands)

|

|

|

39,147 |

|

|

|

39,278 |

|

|

|

158,985 |

|

|

|

155,929 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dedicated Segment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (in thousands)

|

|

$ |

76,388 |

|

|

$ |

95,041 |

|

|

$ |

319,135 |

|

|

$ |

408,272 |

|

|

Average revenue, net of fuel surcharges, per tractor per week(1)

|

|

$ |

3,841 |

|

|

$ |

3,895 |

|

|

$ |

3,767 |

|

|

$ |

3,936 |

|

|

Average tractors(1)

|

|

|

1,288 |

|

|

|

1,518 |

|

|

|

1,356 |

|

|

|

1,632 |

|

|

Average miles per trip

|

|

|

313 |

|

|

|

335 |

|

|

|

319 |

|

|

|

335 |

|

|

Non-revenue miles percentage(2)

|

|

|

1.5 |

% |

|

|

1.2 |

% |

|

|

1.3 |

% |

|

|

1.2 |

% |

|

Total miles (in thousands)

|

|

|

26,799 |

|

|

|

31,215 |

|

|

|

110,681 |

|

|

|

133,163 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intermodal Segment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (in thousands)

|

|

$ |

13,209 |

|

|

$ |

19,077 |

|

|

$ |

58,754 |

|

|

$ |

92,078 |

|

|

Loads

|

|

|

3,803 |

|

|

|

5,289 |

|

|

|

16,975 |

|

|

|

25,160 |

|

|

Average tractors

|

|

|

88 |

|

|

|

133 |

|

|

|

110 |

|

|

|

159 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brokerage Segment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (in thousands)

|

|

$ |

33,541 |

|

|

$ |

40,620 |

|

|

$ |

146,027 |

|

|

$ |

165,630 |

|

|

Loads

|

|

|

21,749 |

|

|

|

23,594 |

|

|

|

89,138 |

|

|

|

91,077 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31, 2024 and December 31, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total tractors(1)

|

|

|

3,006 |

|

|

|

3,349 |

|

|

|

|

|

|

|

|

|

|

Average age of company tractors (in years)

|

|

|

1.9 |

|

|

|

1.9 |

|

|

|

|

|

|

|

|

|

|

Total trailers

|

|

|

5,440 |

|

|

|

5,653 |

|

|

|

|

|

|

|

|

|

|

Average age of company trailers (in years)

|

|

|

5.3 |

|

|

|

4.6 |

|

|

|

|

|

|

|

|

|

|

Ratio of trailers to tractors(1)

|

|

|

1.8 |

|

|

|

1.7 |

|

|

|

|

|

|

|

|

|

|

Total refrigerated containers

|

|

|

786 |

|

|

|

787 |

|

|

|

|

|

|

|

|

|

| |

|

Three Months

|

|

|

Year

|

|

| |

|

Ended December 31,

|

|

|

Ended December 31,

|

|

|

(In thousands)

|

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities

|

|

$ |

23,793 |

|

|

$ |

38,045 |

|

|

$ |

134,814 |

|

|

$ |

164,378 |

|

|

Net cash used for investing activities

|

|

|

(44,891 |

) |

|

|

(48,070 |

) |

|

|

(152,138 |

) |

|

|

(172,540 |

) |

|

Net cash used for financing activities

|

|

|

(4,625 |

) |

|

|

(4,829 |

) |

|

|

(18,622 |

) |

|

|

(19,225 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

81,457 |

|

|

|

81,309 |

|

|

|

81,406 |

|

|

|

81,272 |

|

|

Diluted

|

|

|

81,507 |

|

|

|

81,418 |

|

|

|

81,472 |

|

|

|

81,413 |

|

|

(1)

|

Includes tractors driven by both company-employed drivers and independent contractors. Independent contractors provided 88 and 94 tractors as of December 31, 2024 and 2023, respectively.

|

| |

|

|

(2)

|

Represents the percentage of miles for which the company is not compensated.

|

Exhibit 99.2

v3.24.4

Document And Entity Information

|

Jan. 27, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MARTEN TRANSPORT, LTD.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 27, 2025

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

0-15010

|

| Entity, Tax Identification Number |

39-1140809

|

| Entity, Address, Address Line One |

129 Marten Street

|

| Entity, Address, City or Town |

Mondovi

|

| Entity, Address, State or Province |

WI

|

| Entity, Address, Postal Zip Code |

54755

|

| City Area Code |

715

|

| Local Phone Number |

926-4216

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

COMMON STOCK

|

| Trading Symbol |

MRTN

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000799167

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

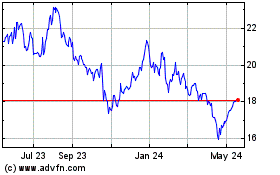

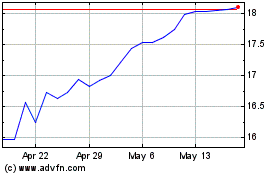

Marten Transport (NASDAQ:MRTN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Marten Transport (NASDAQ:MRTN)

Historical Stock Chart

From Feb 2024 to Feb 2025