false

0001499961

0001499961

2025-01-15

2025-01-15

0001499961

muln:CommonStockParValue0.001Member

2025-01-15

2025-01-15

0001499961

muln:RightsToPurchaseSeriesA1JuniorParticipatingPreferredStockMember

2025-01-15

2025-01-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

January 15, 2025 |

|

MULLEN AUTOMOTIVE INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-34887 |

|

86-3289406 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1405 Pioneer Street, Brea, California 92821

(Address, including zip code, of principal executive offices)

| Registrant’s telephone number, including area code |

(714) 613-1900 |

|

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 |

|

MULN |

|

The Nasdaq Stock Market, LLC

(Nasdaq Capital Market) |

| Rights to Purchase Series A-1 Junior Participating Preferred Stock |

|

None |

|

The Nasdaq Stock Market, LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 3.01 |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

On January 15, 2025, Mullen Automotive Inc. (the

“Company”) received an expected notice (the “Notice”) from the Listing Qualifications Staff of The

Nasdaq Stock Market LLC (“Nasdaq”) stating that because the Company has not yet filed its Annual Report on Form 10-K for the

fiscal year ended September 30, 2024 (the “Form 10-K”), the Company is no longer in compliance with Nasdaq Listing

Rule 5250(c)(1) (the “Listing Rule”), which requires listed companies to timely file all required periodic financial

reports with the Securities and Exchange Commission (the “SEC”).

The Notice has no immediate effect on the listing

or trading of the Company’s common stock on the Nasdaq Capital Market. However, if the Company fails to timely regain compliance

with the Listing Rule, the Company’s common stock will be subject to delisting from Nasdaq.

Under the Nasdaq rules, the Company has 60 days

from the date of the Notice either to file the Form 10-K or to submit a plan to Nasdaq to regain compliance with Nasdaq’s listing

rules. If a plan is submitted and accepted, the Company could be granted up to 180 days from the Form 10-K’s due date to regain

compliance. If Nasdaq does not accept the Company’s plan, then the Company will have the opportunity to appeal that decision to

a Nasdaq hearings panel.

While the Company can provide no assurances as

to timing, the Company is working diligently to complete and file the Form 10-K and is expected to file on or before January 31, 2025

or as soon as practicable (and within the 60-day period described above) to regain compliance with the Listing Rule.

| Item 7.01. |

Regulation FD Disclosure. |

On January 22, 2025, the Company issued a press release, a copy of

which is furnished as Exhibit 99.1 to this report and incorporated herein by reference into this Item 7.01.

The information in this Item 7.01 and Exhibit 99.1 attached hereto

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it

be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific

reference in such filing.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MULLEN AUTOMOTIVE INC. |

| |

|

|

| Date: January 22, 2025 |

By: |

/s/ David Michery |

| |

|

David Michery |

| |

|

Chief Executive Officer |

Exhibit

99.1

Mullen

Receives Expected Nasdaq Notice

Regarding

Delayed Form 10-K

Company

expects to file 10-K on or before January 31, 2025

BREA, Calif., Jan 22, 2025 -- via IBN --

Mullen Automotive Inc. (NASDAQ: MULN) (“Mullen” or the “Company”), an emerging electric vehicle

manufacturer, today announced that it received an expected notice (the “Notice”) from the Listing Qualifications Staff of

The Nasdaq Stock Market LLC (“Nasdaq”) stating that because the Company has not yet filed its Annual Report on Form 10-K for

the fiscal year ended Sept. 30, 2024 (the “Form 10-K”), the Company is no longer in compliance with Nasdaq Listing Rule 5250(c)(1)

(the “Listing Rule”), which requires listed companies to timely file all required periodic financial reports with the Securities

and Exchange Commission (the “SEC”).

The

Notice has no immediate effect on the listing or trading of the Company’s common stock on the Nasdaq Capital Market. However, if

the Company fails to timely regain compliance with the Listing Rule, the Company’s common stock will be subject to delisting from

Nasdaq.

Under

the Nasdaq rules, the Company has 60 days from the date of the Notice either to file the Form 10-K or to submit a plan to Nasdaq to regain

compliance with Nasdaq’s listing rules. If a plan is submitted and accepted, the Company could be granted up to 180 days from the

Form 10-K’s due date to regain compliance. If Nasdaq does not accept the Company’s plan, then the Company will have the opportunity

to appeal that decision to a Nasdaq hearings panel.

While the Company can provide no assurances as

to timing, the Company is working diligently to complete and file the Form 10-K and is expected to file on or before Jan. 31, 2025 or

as soon as practicable (and within the 60-day period described above) to regain compliance with the Listing Rule.

About

Mullen

Mullen

Automotive (NASDAQ: MULN) is a Southern California-based automotive company building the next generation of commercial electric vehicles

(“EVs”) with two United States-based vehicle plants located in Tunica, Mississippi, (120,000 square feet) and Mishawaka,

Indiana (650,000 square feet). In August 2023, Mullen began commercial vehicle production in Tunica. In September 2023, Mullen received

IRS approval for federal EV tax credits on its commercial vehicles with a Qualified Manufacturer designation that offers eligible customers

up to $7,500 per vehicle. As of January 2024, both the Mullen ONE, a Class 1 EV cargo van, and Mullen THREE, a Class 3 EV cab chassis

truck, are California Air Resource Board (“CARB”) and EPA certified and available for sale in the U.S. Recently, CARB issued

HVIP approval on the Mullen THREE, Class 3 EV truck, providing up to $45,000 cash voucher at time of vehicle purchase. The Company has

also recently expanded its commercial dealer network to seven dealers, which includes Papé Kenworth, Pritchard EV, National Auto

Fleet Group, Ziegler Truck Group, Range Truck Group, Eco Auto, and Randy Marion Auto Group, providing sales and service coverage in key

West Coast, Midwest, Pacific Northwest, New England and Mid-Atlantic markets.

To

learn more about the Company, visit www.MullenUSA.com.

Forward-Looking

Statements

Certain

statements in this press release that are not historical facts are forward-looking statements within the meaning of Section 27A of the

Securities Exchange Act of 1934, as amended. Words such as “continue,” “will,” “may,” “could,”

“should,” “expect,” “expected,” “plans,” “intend,” “anticipate,”

“believe,” “estimate,” “predict,” “potential” and similar expressions are intended to

identify such forward-looking statements. Any statements contained in this press release that are not statements of historical fact may

be deemed forward-looking statements, including statement regarding the Company’s ability to regain and maintain compliance with

the listing standards of Nasdaq; the timing of completion and filing of the Form 10-K; and the impact of these matters on the Company’s

performance and outlook. All forward-looking statements involve significant risks and uncertainties that could cause actual results to

differ materially from those expressed or implied in the forward-looking statements, many of which are generally outside the control

of Mullen and are difficult to predict. Examples of such risks and uncertainties include but are not limited to risks related to the

timely and correct completion of the Form 10-K; the risk that additional information may become known prior to the expected filing with

the SEC of the Form 10-K or that other subsequent events may occur that would delay the filing of the Form 10-K; the ability to meet

stock exchange continued listing standards; the possibility that the Nasdaq may delist the Company’s securities; risks related

to our ability to implement and maintain effective internal control over financial reporting in the future, which may adversely affect

the accuracy and timeliness of our financial reporting; and the impact of these matters on the Company’s performance and outlook.

Additional factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements

can be found in the most recent annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed by Mullen

with the SEC. Mullen anticipates that subsequent events and developments may cause its plans, intentions and expectations to change.

Mullen assumes no obligation, and it specifically disclaims any intention or obligation, to update any forward-looking statements, whether

as a result of new information, future events or otherwise, except as expressly required by law. Forward-looking statements speak only

as of the date they are made and should not be relied upon as representing Mullen’s plans and expectations as of any subsequent

date.

Contact:

Mullen

Automotive Inc.

+1

(714) 613-1900

www.MullenUSA.com

Corporate

Communications

IBN

Austin, Texas

www.InvestorBrandNetwork.com

512.354.7000 Office

Editor@InvestorBrandNetwork.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=muln_CommonStockParValue0.001Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=muln_RightsToPurchaseSeriesA1JuniorParticipatingPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

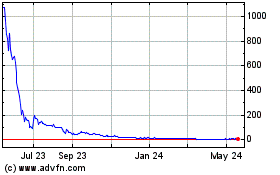

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Dec 2024 to Jan 2025

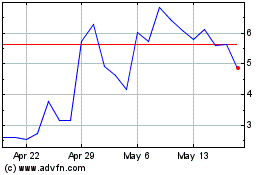

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Jan 2024 to Jan 2025