0001288469false00012884692025-01-292025-01-290001288469exch:XNGS2025-01-292025-01-29

| | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 29, 2025

MaxLinear, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-34666 | 14-1896129 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

5966 La Place Court, Suite 100, Carlsbad, California 92008

(Address of principal executive offices) (Zip Code)

(760) 692-0711

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock | MXL | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 29, 2025, MaxLinear, Inc. issued a press release announcing its unaudited financial results for the fourth quarter and year ended December 31, 2024. A copy of the press release is furnished as Exhibits 99.1 to this Current Report on Form 8-K, and is incorporated herein by reference.

The information in this Current Report on Form 8-K and the exhibits attached hereto are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information in this Current Report on Form 8-K shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits | | | | | |

| Exhibit | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | | | | |

| | | | |

| Date: | January 29, 2025 | | MAXLINEAR, INC. |

| | |

| | | (Registrant) |

| | | |

| | | By: | /s/ Steven G. Litchfield |

| | | | Steven G. Litchfield |

| | | | Chief Financial Officer and Chief Corporate Strategy Officer |

| | | | (Principal Financial Officer) |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

Exhibit 99.1

FOR IMMEDIATE RELEASE

MaxLinear, Inc. Announces Fourth Quarter and Fiscal Year 2024 Financial Results

•Q4 net revenue of $92.2 million, GAAP gross margin of 55.6% and non-GAAP gross margin of 59.1%

•FY'24 net revenue of $360.5 million, GAAP gross margin of 54.0% and non-GAAP gross margin of 59.7%

Carlsbad, Calif. – January 29, 2025 – MaxLinear, Inc. (Nasdaq: MXL), a leading provider of radio frequency (RF), analog, digital and mixed-signal integrated circuits, today announced financial results for the fourth quarter and fiscal year ended December 31, 2024.

Fourth Quarter Financial Highlights

GAAP basis:

•Net revenue was $92.2 million, up 14% sequentially and down 26% from the year-ago quarter.

•GAAP gross margin was 55.6%, compared to 54.4% in the prior quarter, and 54.7% in the year-ago quarter.

•GAAP operating expenses were $92.4 million in the fourth quarter 2024, or 100% of net revenue, compared to $110.8 million in the prior quarter, or 137% of net revenue, and $110.3 million in the year-ago quarter, or 88% of net revenue.

•GAAP loss from operations was 45% of net revenue, compared to loss from operations of 82% of net revenue in the prior quarter, and loss from operations of 33% of net revenue in the year-ago quarter.

•Net cash flow used in operating activities was $27.8 million, compared to net cash flow used in operating activities of $30.7 million in the prior quarter, and net cash flow used in operating activities of $16.6 million in the year-ago quarter.

•GAAP diluted loss per share was $0.68, compared to diluted loss per share of $0.90 in the prior quarter, and diluted loss per share of $0.47 in the year-ago quarter.

Non-GAAP basis:

•Non-GAAP gross margin was 59.1%, compared to 58.7% in the prior quarter, and 61.4% in the year-ago quarter.

•Non-GAAP operating expenses were $61.3 million, or 67% of net revenue, compared to $72.8 million or 90% of net revenue in the prior quarter, and $75.7 million or 60% of net revenue in the year-ago quarter.

•Non-GAAP loss from operations was 7% of net revenue, compared to loss of 31% in the prior quarter, and income of 1% in the year-ago quarter.

•Non-GAAP diluted loss per share was $0.09, compared to loss of $0.36 in the prior quarter, and earnings of $0.01 in the year-ago quarter.

| | | | | | | | |

| Fiscal Year 2024 Financial Highlights | | | |

• | Net revenue was $360.5 million, down 48.0% over fiscal 2023. | | | |

• | GAAP gross margin was 54.0%, down from 55.6% in the prior year, and non-GAAP gross margin was 59.7%, down from 60.8% the prior year. | | | |

• | GAAP operating expenses were $418.1 million, or 116% of net revenue, compared to $423.9 million or 61% of net revenue in fiscal 2023, and non-GAAP operating expenses were $283.7 million, or 79% of net revenue, compared to $314.1 million or 45% of net revenue in the prior year. | | | |

• | GAAP loss from operations was 62% of net revenue, compared to GAAP loss from operations of 6% in fiscal 2023, and non-GAAP loss from operations was 19% of net revenue, compared to non-GAAP income from operations of 16% in the prior year. | | | |

• | Net cash flow used in operations of $45.3 million, compared to net cash flow provided by operations of $43.4 million in fiscal 2023. | | | |

• | GAAP diluted loss per share was $2.93 compared to GAAP diluted loss per share of $0.91 in the prior year, while non-GAAP diluted loss per share was $0.90 compared to non-GAAP diluted earnings per share of $1.10 in fiscal 2023. | | | |

Management Commentary

“Another quarter of improvement in customer orders and continued new product traction give us confidence that we are entering our next stage of growth in 2025,” said Kishore Seendripu, PhD, Chairman and CEO. “In particular, we’re excited by the progress in our optical interconnect business, where we have now shipped more than one million units across multiple customers into high-volume opportunities. We also believe that our investments into strategic applications such as fiber broadband access gateways, Wi-Fi, Ethernet, and wireless infrastructure position us for meaningful growth and TAM expansion this year. With our strong focus on operational efficiency, we are working hard towards a return to profitability in the coming quarters.”

First Quarter 2025 Business Outlook

The company expects net revenue in the first quarter of 2025 to be approximately $85 million to $105 million. The Company also estimates the following:

•GAAP gross margin of approximately 54.5% to 57.5%;

•Non-GAAP gross margin of approximately 57.5% to 60.5%;

•GAAP operating expenses of approximately $93 million to $99 million;

•Non-GAAP operating expenses of approximately $56 million to $62 million;

•GAAP and non-GAAP interest and other expense of approximately $1.0 million to $2.0 million each;

•GAAP and non-GAAP income tax provision of $2.7 million and $0; and

•GAAP and non-GAAP diluted share count of approximately 85.5 million each.

Webcast and Conference Call

MaxLinear will host its fourth quarter financial results conference call today, January 29, 2025 at 1:30 p.m. Pacific Time (4:30 p.m. Eastern Time). To access this call, dial US toll free: 1-877-407-3109 / International: 1-201-493-6798. A live webcast of the conference call will be accessible from the investor relations section of the MaxLinear website at https://investors.maxlinear.com, and will be archived and available after the call at https://investors.maxlinear.com until February 12, 2025. A replay of the conference call will also be available until February 12, 2025 by dialing US toll free: 1-877-660-6853 / International: 1-201-612-7415 and Conference ID#: 13750660.

Cautionary Note Concerning Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, among others, statements concerning our future financial performance (including our current guidance for first quarter 2025 net revenue, and GAAP and non-GAAP amounts for each of the following: gross margins, operating expenses, interest and other expenses, income tax provision, and diluted share counts); our potential growth, TAM expansion, revenue and profitability opportunities; market trends; settlement of bonus awards for our 2024 performance period; and statements by our Chairman and CEO. These forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results expressed or implied by the forward-looking statements and our future financial performance and operating results forecasts generally. Forward-looking statements are based on management’s current, preliminary expectations and are subject to various risks and uncertainties. In particular, our future operating results are substantially dependent on our assumptions about market trends and conditions. Additional risks and uncertainties affecting our business, future operating results and financial condition include, without limitation; risks relating to our terminated merger with Silicon Motion and related arbitration and class action complaint and the risks related to potential payment of damages; the effect of intense and increasing competition; impacts of global economic conditions; the cyclical nature of the semiconductor industry; a significant variance in our operating results and impact on volatility in our stock price, and our ability to sustain our current level of revenue, which has previously declined, and/or manage future growth effectively, and the impact of excess inventory in the channel on our customers’ expected demand for certain of our products and on our revenue; the geopolitical and economic tensions among the countries in which we conduct business; increased tariffs, export controls or imposition of other trade barriers; our ability to obtain or retain government authorization to export certain of our products or technology; risks associated with international geopolitical and military conflicts; risks related to the loss of, or a significant reduction in orders from major customers; costs of legal proceedings or potential violations of regulations; information technology failures; a decrease in the average selling prices of our products; failure to penetrate new applications and markets; development delays and consolidation trends in our industry; inability to make substantial research and development investments; delays or expenses caused by undetected defects or bugs in our products; substantial quarterly and annual fluctuations in our revenue and operating results; failure to timely develop and introduce new or enhanced products; order and shipment uncertainties; failure to accurately predict our future revenue and appropriately budget expenses; lengthy and expensive customer qualification processes; customer product plan cancellations; failure to maintain compliance with government regulations; failure to attract and retain qualified personnel; any adverse impact of rising interest rates on us, our customers, and our distributors and related demand; risks related to compliance with privacy, data protection and cybersecurity laws and regulations; risks related to conforming our products to industry standards; risks related to business acquisitions and investments; claims of intellectual property infringement; our ability to protect our intellectual property; risks related to security vulnerabilities of our products; use of open source software in our products; and failure to manage our relationships with, or negative impacts from, third parties.

In addition to these risks and uncertainties, investors should review the risks and uncertainties contained in our filings with the Securities and Exchange Commission (SEC), including our Current Reports on Form 8-K, as well as the information to be set forth under the caption "Risk Factors" in MaxLinear's Annual Report on Form 10-K for the year ended December 31, 2024. All forward-looking statements are based on the estimates, projections and assumptions of management as of January 29, 2025, and MaxLinear is under no obligation (and expressly disclaims any such obligation) to update or revise any forward-looking statements whether as a result of new information, future events, or otherwise.

Use of Non-GAAP Financial Measures

To supplement our unaudited consolidated financial statements presented on a basis consistent with GAAP, we disclose certain non-GAAP financial measures, including non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating expenses as a percentage of net revenue, non-GAAP income (loss) from operations, non-GAAP income (loss) from operations as percentage of revenue, non-GAAP interest and other income (expense), non-GAAP income tax provision, non-GAAP diluted earnings (loss) per share, and non-GAAP diluted share count. These supplemental measures exclude the effects of (i) stock-based compensation expense; (ii) accruals related to our performance-based bonus plan for 2024, which we intend to settle in shares of our common stock; (iii) accruals related to our performance-based bonus plan for 2023, which we settled in shares of common stock in February 2024; (iv) amortization of purchased intangible assets; (v) research and development funded by others; (vi) acquisition and integration costs related to our acquisitions, if any, including costs incurred related to the termination of the previously pending (now terminated) merger with Silicon Motion; (vii) impairment of intangible assets; (viii) severance and other restructuring charges; (ix) other non-recurring interest and other income (expenses), net attributable to acquisitions, including impairment of investments in a privately held entity and ticking fees paid to lenders in August 2023 following the termination of the previously pending (now terminated) merger with Silicon Motion; and (x) non-cash income tax benefits and expenses. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for the comparable GAAP financial measures. Non-GAAP financial measures are subject to limitations, and should

be read only in conjunction with the company’s consolidated financial statements prepared in accordance with GAAP. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similarly titled measures presented by other companies. We believe that these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our GAAP results of operations. We compensate for the limitations of non-GAAP financial measures by relying upon GAAP results to gain a complete picture of our performance.

We believe that non-GAAP financial measures can provide useful information to both management and investors by excluding certain non-cash and other one-time expenses that we believe are not indicative of our core operating results. Among other uses, our management uses non-GAAP measures to compare our performance relative to forecasts and strategic plans and to benchmark our performance externally against competitors. In addition, management’s incentive compensation will be determined in part using these non-GAAP measures because we believe non-GAAP measures better reflect our core operating performance.

The following are explanations of each type of adjustment that we incorporate into non-GAAP financial measures:

Stock-based compensation expense relates to equity incentive awards granted to our employees, directors, and consultants. Our equity incentive plans are important components of our employee incentive compensation arrangements and are reflected as expenses in our GAAP results. Stock-based compensation expense has been and will continue to be a significant recurring expense for MaxLinear. While we include the dilutive impact of equity awards in weighted average shares outstanding, the expense associated with stock-based awards reflects a non-cash charge that we exclude from non-GAAP net income or loss.

Performance-based equity consists of accruals related to our executive and non-executive bonus programs, and have been excluded from our non-GAAP net income or loss for all periods reported. Bonus payments for the 2023 performance periods were settled through the issuance of shares of common stock under our equity incentive plans in February 2024. We currently expect that bonus awards under our fiscal 2024 program will be settled in common stock in the first quarter of fiscal 2025.

Expenses incurred in relation to acquisitions include amortization of purchased intangible assets, acquisition and integration costs primarily consisting of professional and consulting fees, including costs incurred related to the termination of the previously pending (now terminated) merger with Silicon Motion; ticking fees paid to lenders following the termination of such merger which were recorded in other expense; and accretion of discount on contingent consideration to interest expense.

Research and development funded by others represents proceeds received under contracts for jointly funded R&D projects to develop technology that may be commercialized into a product in the future. Initially such proceeds may not yet be recognized in GAAP results if, pursuant to contract terms, the Company may be required to repay all or a portion of the funds provided by the other party under certain conditions. Management believes it is not probable that it will trigger such conditions. Once such conditions have been resolved, the proceeds are recognized in GAAP results, and accordingly, reversed from non-GAAP results.

Impairment losses are related to abandonment of acquired or purchased intangible assets.

Restructuring charges incurred are related to our restructuring plans which eliminate redundancies and primarily include severance and restructuring costs related to impairment of leased right-of-use assets or from exiting certain facilities.

Other expense also includes losses from impairment of privately held investments.

Income tax benefits and expense adjustments are those that do not affect cash income taxes payable.

Reconciliations of non-GAAP measures for the historic periods disclosed in this press release appear below. Because of the inherent uncertainty associated with our ability to project future charges, we are also unable to predict their probable significance, particularly related to stock-based compensation and its related tax effects as well as potential impairments, a quantitative reconciliation is not available without unreasonable efforts and accordingly, in reliance on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K, we have not provided a reconciliation for non-GAAP guidance provided for the first quarter 2025.

About MaxLinear, Inc.

MaxLinear, Inc. (Nasdaq:MXL) is a leading provider of radio frequency (RF), analog, digital and mixed-signal integrated circuits for access and connectivity, wired and wireless infrastructure, and industrial and multi-market applications. MaxLinear is headquartered in Carlsbad, California. For more information, please visit www.maxlinear.com.

MXL is MaxLinear’s registered trademark. Other trademarks appearing herein are the property of their respective owners.

MaxLinear, Inc. Investor Relations Contact:

Leslie Green

lgreen@maxlinear.com

MAXLINEAR, INC.

UNAUDITED GAAP CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31, 2024 | | September 30, 2024 | | December 31, 2023 |

| Net revenue | $ | 92,167 | | | $ | 81,102 | | | $ | 125,353 | |

| Cost of net revenue | 40,919 | | | 37,022 | | | 56,814 | |

| Gross profit | 51,248 | | | 44,080 | | | 68,539 | |

| Operating expenses: | | | | | |

| Research and development | 51,278 | | | 52,604 | | | 65,250 | |

| Selling, general and administrative | 38,087 | | | 30,154 | | | 34,384 | |

| Impairment losses | — | | | 1,237 | | | — | |

| Restructuring charges | 3,056 | | | 26,828 | | | 10,648 | |

| Total operating expenses | 92,421 | | | 110,823 | | | 110,282 | |

| Loss from operations | (41,173) | | | (66,743) | | | (41,743) | |

| Interest income | 1,040 | | | 1,653 | | | 1,781 | |

| Interest expense | (2,802) | | | (2,655) | | | (2,909) | |

| | | | | |

| Other income (expense), net | 2,113 | | | (14,753) | | | 240 | |

| Total other income (expense), net | 351 | | | (15,755) | | | (888) | |

| Loss before income taxes | (40,822) | | | (82,498) | | | (42,631) | |

| Income tax provision (benefit) | 17,016 | | | (6,713) | | | (4,131) | |

| Net loss | $ | (57,838) | | | $ | (75,785) | | | $ | (38,500) | |

| Net loss per share: | | | | | |

| Basic | $ | (0.68) | | | $ | (0.90) | | | $ | (0.47) | |

| Diluted | $ | (0.68) | | | $ | (0.90) | | | $ | (0.47) | |

| Shares used to compute net loss per share: | | | | | |

| Basic | 84,485 | | | 84,074 | | | 81,681 | |

| Diluted | 84,485 | | | 84,074 | | | 81,681 | |

MAXLINEAR, INC.

UNAUDITED GAAP CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | Twelve Months Ended |

| | | | | | December 31, 2024 | | December 31, 2023 |

| Net revenue | | | | | | $ | 360,528 | | | $ | 693,263 | |

| Cost of net revenue | | | | | | 165,746 | | | 307,600 | |

| Gross profit | | | | | | 194,782 | | | 385,663 | |

| Operating expenses: | | | | | | | | |

| Research and development | | | | | | 225,189 | | | 269,504 | |

| Selling, general and administrative | | | | | | 138,329 | | | 132,156 | |

| Impairment losses | | | | | | 1,237 | | | 2,438 | |

| Restructuring charges | | | | | | 53,379 | | | 19,786 | |

| Total operating expenses | | | | | | 418,134 | | | 423,884 | |

| Loss from operations | | | | | | (223,352) | | | (38,221) | |

| Interest income | | | | | | 6,386 | | | 6,053 | |

| Interest expense | | | | | | (10,874) | | | (10,702) | |

| | | | | | | | |

| Other income (expense), net | | | | | | (10,877) | | | (20,940) | |

| Total other income (expense), net | | | | | | (15,365) | | | (25,589) | |

| Loss before income taxes | | | | | | (238,717) | | | (63,810) | |

| Income tax provision | | | | | | 6,481 | | | 9,337 | |

| Net loss | | | | | | $ | (245,198) | | | $ | (73,147) | |

| Net loss per share: | | | | | | | | |

| Basic | | | | | | $ | (2.93) | | | $ | (0.91) | |

| Diluted | | | | | | $ | (2.93) | | | $ | (0.91) | |

| Shares used to compute net loss per share: | | | | | | | | |

| Basic | | | | | | 83,600 | | | 80,719 | |

| Diluted | | | | | | 83,600 | | | 80,719 | |

| | | | | | | | |

MAXLINEAR, INC.

UNAUDITED GAAP CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31, 2024 | | September 30, 2024 | | December 31, 2023 |

| Operating Activities | | | | | |

| Net loss | $ | (57,838) | | | $ | (75,785) | | | $ | (38,500) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | |

| Amortization and depreciation | 11,714 | | | 12,142 | | | 16,593 | |

| Impairment of intangible assets | — | | | 1,237 | | | — | |

| | | | | |

| | | | | |

| Impairment of investments and other assets | — | | | 14,000 | | | — | |

| | | | | |

| Amortization of debt issuance costs and accretion of discount on debt and leases | 548 | | | 637 | | | 703 | |

| Stock-based compensation | 18,813 | | | 12,788 | | | 16,413 | |

| Deferred income taxes | 13,884 | | | (8,320) | | | (10,954) | |

| Loss on disposal of property and equipment | — | | | 623 | | | — | |

| Gain on sale of investments | — | | | — | | | (434) | |

| | | | | |

| Unrealized holding gain on investments | — | | | — | | | (2,152) | |

| | | | | |

| Impairment of leased right-of-use assets | 2,140 | | | 677 | | | — | |

| | | | | |

| Gain on extinguishment of lease liabilities | (1) | | | (1) | | | — | |

| | | | | |

| (Gain) loss on foreign currency and other | (2,226) | | | 2,339 | | | 2,335 | |

| Excess tax deficiencies on stock based awards | 262 | | | 1,469 | | | 276 | |

| | | | | |

| Changes in operating assets and liabilities: | | | | | |

| Accounts receivable, net | (37,534) | | | 37,010 | | | (12,363) | |

| Inventory | 5,720 | | | (1,325) | | | 15,034 | |

| Prepaid expenses and other assets | 6,742 | | | (7,852) | | | 887 | |

| | | | | |

| Accounts payable, accrued expenses and other current liabilities | 17,448 | | | (6,708) | | | (11,514) | |

| Accrued compensation | (2,092) | | | 159 | | | 932 | |

| | | | | |

| Accrued price protection liability | (1,071) | | | (17,158) | | | 3,474 | |

| Lease liabilities | (2,889) | | | (2,761) | | | (2,780) | |

| Other long-term liabilities | (1,458) | | | 6,098 | | | 5,477 | |

| Net cash used in operating activities | (27,838) | | | (30,731) | |

| (16,573) | |

| Investing Activities | | | | | |

| Purchases of property and equipment | (2,193) | | | (4,132) | | | (1,274) | |

| | | | | |

| Purchases of intangible assets | (805) | | | (1,818) | | | (157) | |

| Cash used in acquisitions, net of cash acquired | — | | | — | | | (940) | |

| | | | | |

| | | | | |

| | | | | |

| Sales of trading securities | — | | | — | | | 17,198 | |

| Net cash provided by (used in) investing activities | (2,998) | | | (5,950) | | | 14,827 | |

| Financing Activities | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net proceeds from issuance of common stock | 2,512 | | | — | | | 1,391 | |

| Minimum tax withholding paid on behalf of employees for restricted stock units | (1,091) | | | (58) | | | (220) | |

| | | | | |

| Net cash provided by (used in) financing activities | 1,421 | | | (58) | | | 1,171 | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (474) | | | 94 | | | 779 | |

| Increase (decrease) in cash, cash equivalents and restricted cash | (29,889) | | | (36,645) | | | 204 | |

| Cash, cash equivalents and restricted cash at beginning of period | 149,492 | | | 186,137 | | | 188,152 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 119,603 | | | $ | 149,492 | | | $ | 188,356 | |

| | | | | |

| | | | | |

| | | | | |

MAXLINEAR, INC.

UNAUDITED GAAP CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

| | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | Year Ended |

| | | | | December 31, 2024 | | December 31, 2023 |

| Operating Activities | | | | | | | |

| Net loss | | | | | $ | (245,198) | | | $ | (73,147) | |

| Adjustments to reconcile net loss to cash provided by (used in) operating activities: | | | | | | | |

| Amortization and depreciation | | | | | 54,140 | | | 71,516 | |

| Impairment of intangible assets | | | | | 1,237 | | | 2,438 | |

| | | | | | | |

| | | | | | | |

| Impairment of investments and other assets | | | | | 14,000 | | | — | |

| | | | | | | |

| Amortization of debt issuance costs and accretion of discount on debt and leases | | | | | 2,538 | | | 2,561 | |

| Stock-based compensation | | | | | 66,021 | | | 55,176 | |

| Deferred income taxes | | | | | 826 | | | (4,452) | |

| Loss on disposal of property and equipment | | | | | 1,068 | | | 2,057 | |

| Gain on sale of investments | | | | | — | | | (434) | |

| Unrealized holding loss on investments | | | | | — | | | 1,765 | |

| | | | | | | |

| | | | | | | |

| Impairment of leased right-of-use assets | | | | | 5,555 | | | — | |

| | | | | | | |

| Gain on settlement of pension | | | | | — | | | (1,008) | |

| Gain on extinguishment of lease liabilities | | | | | (555) | | | — | |

| (Gain) loss on foreign currency | | | | | (1,253) | | | 2,475 | |

| Excess tax (benefits) deficiencies on stock based awards | | | | | 3,250 | | | (253) | |

| | | | | | | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable, net | | | | | 85,155 | | | 1,406 | |

| Inventory | | | | | 9,565 | | | 60,636 | |

| Prepaid expenses and other assets | | | | | (1,873) | | | (9,328) | |

| | | | | | | |

| Accounts payable, accrued expenses and other current liabilities | | | | | (4,569) | | | (29,431) | |

| Accrued compensation | | | | | 919 | | | 9,708 | |

| | | | | | | |

| Accrued price protection liability | | | | | (28,283) | | | (41,562) | |

| Lease liabilities | | | | | (10,695) | | | (11,671) | |

| Other long-term liabilities | | | | | 2,857 | | | 4,920 | |

| Net cash provided by (used in) operating activities | | | | | (45,295) | | | 43,372 | |

| Investing Activities | | | | | | | |

| Purchases of property and equipment | | | | | (17,680) | | | (13,454) | |

| | | | | | | |

| Purchases of intangible assets | | | | | (5,766) | | | (6,355) | |

| Cash used in acquisitions, net of cash acquired | | | | | — | | | (13,324) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Sales of trading securities | | | | | — | | | 17,198 | |

| Net cash used in investing activities | | | | | (23,446) | | | (15,935) | |

| Financing Activities | | | | | | | |

| | | | | | | |

| | | | | | | |

| Payment of debt commitment fees | | | | | — | | | (18,325) | |

| | | | | | | |

| Net proceeds from issuance of common stock | | | | | 4,091 | | | 4,559 | |

Minimum tax withholding paid on behalf of employees for restricted stock units

| | | | | (2,805) | | | (12,590) | |

| | | | | | | |

| Net cash provided by (used in) financing activities | | | | | 1,286 | | | (26,356) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | | | | | (1,298) | | | (1,082) | |

| Decrease in cash, cash equivalents and restricted cash | | | | | (68,753) | | | (1) | |

| Cash, cash equivalents and restricted cash at beginning of period | | | | | 188,356 | | | 188,357 | |

| Cash, cash equivalents and restricted cash at end of period | | | | | $ | 119,603 | | | $ | 188,356 | |

| | | | | | | |

| | | | | | | |

MAXLINEAR, INC.

UNAUDITED GAAP CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

| | | | | | | | | | | | | | | | | |

| December 31, 2024 | | September 30, 2024 | | December 31, 2023 |

| Assets | | | | | |

| Current assets: | | | | | |

| Cash and cash equivalents | $ | 118,575 | | | $ | 148,476 | | | $ | 187,288 | |

| Short-term restricted cash | 1,003 | | | 993 | | | 1,051 | |

| | | | | |

| Accounts receivable, net | 85,464 | | | 47,930 | | | 170,619 | |

| Inventory | 90,343 | | | 96,063 | | | 99,908 | |

| Prepaid expenses and other current assets | 28,057 | | | 34,798 | | | 29,159 | |

| Total current assets | 323,442 | | | 328,260 | | | 488,025 | |

| Long-term restricted cash | 25 | | | 23 | | | 17 | |

| | | | | |

| Property and equipment, net | 59,300 | | | 63,493 | | | 66,431 | |

| Leased right-of-use assets | 18,184 | | | 22,549 | | | 31,264 | |

| Intangible assets, net | 55,008 | | | 58,031 | | | 73,630 | |

| Goodwill | 318,588 | | | 318,588 | | | 318,588 | |

| Deferred tax assets | 68,662 | | | 82,552 | | | 69,493 | |

| Other long-term assets | 21,430 | | | 21,807 | | | 32,809 | |

| Total assets | $ | 864,639 | | | $ | 895,303 | | | $ | 1,080,257 | |

| | | | | |

| Liabilities and stockholders’ equity | | | | | |

| Current liabilities | $ | 182,284 | | | $ | 168,597 | | | $ | 222,129 | |

| Long-term lease liabilities | 16,952 | | | 19,433 | | | 26,243 | |

| Long-term debt | 122,996 | | | 122,840 | | | 122,375 | |

| Other long-term liabilities | 26,124 | | | 27,561 | | | 23,245 | |

| Stockholders’ equity | 516,283 | | | 556,872 | | | 686,265 | |

| Total liabilities and stockholders’ equity | $ | 864,639 | | | $ | 895,303 | | | $ | 1,080,257 | |

MAXLINEAR, INC.

UNAUDITED RECONCILIATION OF NON-GAAP ADJUSTMENTS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31, 2024 | | September 30, 2024 | | December 31, 2023 |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| GAAP gross profit | $ | 51,248 | | | $ | 44,080 | | | $ | 68,539 | |

| Stock-based compensation | 186 | | | 81 | | | 137 | |

| Performance based equity | 8 | | | (19) | | | 17 | |

| | | | | |

| Amortization of purchased intangible assets | 2,990 | | | 3,498 | | | 8,332 | |

| | | | | |

| | | | | |

| | | | | |

| Non-GAAP gross profit | 54,432 | | | 47,640 | | | 77,025 | |

| | | | | |

| GAAP R&D expenses | 51,278 | | | 52,604 | | | 65,250 | |

| Stock-based compensation | (10,862) | | | (7,423) | | | (11,061) | |

| | | | | |

| Performance based equity | (743) | | | 775 | | | (1,918) | |

| | | | | |

| | | | | |

| Research and development funded by others | — | | | 3,000 | | | (2,000) | |

| | | | | |

| Non-GAAP R&D expenses | 39,673 | | | 48,956 | | | 50,271 | |

| | | | | |

| GAAP SG&A expenses | 38,087 | | | 30,154 | | | 34,384 | |

| Stock-based compensation | (7,766) | | | (5,284) | | | (5,215) | |

| | | | | |

| Performance based equity | (811) | | | 384 | | | (1,324) | |

| Amortization of purchased intangible assets | (592) | | | (591) | | | (591) | |

| | | | | |

| Acquisition and integration costs | (7,261) | | | (801) | | | (1,799) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Non-GAAP SG&A expenses | 21,657 | | | 23,862 | | | 25,455 | |

| | | | | |

| GAAP impairment losses | — | | | 1,237 | | | — | |

| Impairment losses | — | | | (1,237) | | | — | |

| Non-GAAP impairment losses | — | | | — | | | — | |

| | | | | |

| GAAP restructuring expenses | 3,056 | | | 26,828 | | | 10,648 | |

| Restructuring charges | (3,056) | | | (26,828) | | | (10,648) | |

| Non-GAAP restructuring expenses | — | | | — | | | — | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| GAAP loss from operations | (41,173) | | | (66,743) | | | (41,743) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Total non-GAAP adjustments | 34,275 | | | 41,565 | | | 43,042 | |

| Non-GAAP income (loss) from operations | (6,898) | | | (25,178) | | | 1,299 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| GAAP interest and other income (expense), net | 351 | | | (15,755) | | | (888) | |

| Non-recurring interest and other income (expense), net | 326 | | | 11,769 | | | 54 | |

| Non-GAAP interest and other income (expense), net | 677 | | | (3,986) | | | (834) | |

| | | | | |

| GAAP loss before income taxes | (40,822) | | | (82,498) | | | (42,631) | |

| Total non-GAAP adjustments | 34,601 | | | 53,334 | | | 43,096 | |

| Non-GAAP income (loss) before income taxes | (6,221) | | | (29,164) | | | 465 | |

| | | | | |

| GAAP income tax provision (benefit) | 17,016 | | | (6,713) | | | (4,131) | |

| Adjustment for non-cash tax benefits/expenses | (16,016) | | | 7,568 | | | 4,177 | |

| | | | | |

| Non-GAAP income tax provision | 1,000 | | | 855 | | | 46 | |

| | | | | |

| GAAP net loss | (57,838) | | | (75,785) | | | (38,500) | |

| Total non-GAAP adjustments before income taxes | 34,601 | | | 53,334 | | | 43,096 | |

| Less: total tax adjustments | (16,016) | | | 7,568 | | | 4,177 | |

| Non-GAAP net income (loss) | $ | (7,221) | | | $ | (30,019) | | | $ | 419 | |

| | | | | |

| Shares used in computing GAAP and non-GAAP basic net income (loss) per share | 84,485 | | | 84,074 | | | 81,681 | |

| Shares used in computing GAAP diluted net loss per share | 84,485 | | | 84,074 | | | 81,681 | |

| Dilutive common stock equivalents | — | | | — | | | 1,000 | |

| Shares used in computing non-GAAP diluted net income (loss) per share | 84,485 | | | 84,074 | | | 82,681 | |

| Non-GAAP basic net income (loss) per share | $ | (0.09) | | | $ | (0.36) | | | $ | 0.01 | |

| Non-GAAP diluted net income (loss) per share | $ | (0.09) | | | $ | (0.36) | | | $ | 0.01 | |

MAXLINEAR, INC.

UNAUDITED RECONCILIATION OF NON-GAAP ADJUSTMENTS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Year ended | | | |

| December 31, 2024 | | December 31, 2023 | | | | | |

| GAAP gross profit | $ | 194,782 | | | $ | 385,663 | | | | | | |

| Stock-based compensation | 621 | | | 763 | | | | | | |

| Performance based equity | 24 | | | 111 | | | | | | |

| | | | | | | | |

| Amortization of purchased intangible assets | 19,798 | | | 35,102 | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Non-GAAP gross profit | 215,225 | | | 421,639 | | | | | | |

| | | | | | | | |

| GAAP R&D expenses | 225,189 | | | 269,504 | | | | | | |

| Stock-based compensation | (38,814) | | | (44,189) | | | | | | |

| | | | | | | | |

| Performance based equity | (3,108) | | | (7,568) | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Research and development funded by others | 2,000 | | | (9,500) | | | | | | |

| | | | | | | | |

| Non-GAAP R&D expenses | 185,267 | | | 208,247 | | | | | | |

| | | | | | | | |

| GAAP SG&A expenses | 138,329 | | | 132,156 | | | | | | |

| Stock-based compensation | (26,586) | | | (10,224) | | | | | | |

| | | | | | | | |

| Performance based equity | (2,132) | | | (3,874) | | | | | | |

| Amortization of purchased intangible assets | (2,366) | | | (2,881) | | | | | | |

| | | | | | | | |

| Acquisition and integration costs | (8,828) | | | (9,286) | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Non-GAAP SG&A expenses | 98,417 | | | 105,891 | | | | | | |

| | | | | | | | |

| GAAP impairment losses | 1,237 | | | 2,438 | | | | | | |

| Impairment losses | (1,237) | | | (2,438) | | | | | | |

| Non-GAAP impairment losses | — | | | — | | | | | | |

| | | | | | | | |

| GAAP restructuring expenses | 53,379 | | | 19,786 | | | | | | |

| Restructuring charges | (53,379) | | | (19,786) | | | | | | |

| Non-GAAP restructuring expenses | — | | | — | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| GAAP loss from operations | (223,352) | | | (38,221) | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Total non-GAAP adjustments | 154,893 | | | 145,722 | | | | | | |

| Non-GAAP income (loss) from operations | (68,459) | | | 107,501 | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| GAAP interest and other income (expense), net | (15,365) | | | (25,589) | | | | | | |

| Non-recurring interest and other income (expense), net | 12,233 | | | 18,628 | | | | | | |

| Non-GAAP interest and other income (expense), net | (3,132) | | | (6,961) | | | | | | |

| | | | | | | | |

| GAAP loss before income taxes | (238,717) | | | (63,810) | | | | | | |

| Total non-GAAP adjustments | 167,126 | | | 164,350 | | | | | | |

| Non-GAAP income (loss) before income taxes | (71,591) | | | 100,540 | | | | | | |

| | | | | | | | |

| GAAP income tax provision | 6,481 | | | 9,337 | | | | | | |

| Adjustment for non-cash tax benefits/expenses | (2,481) | | | 717 | | | | | | |

| | | | | | | | |

| Non-GAAP income tax provision | 4,000 | | | 10,054 | | | | | | |

| | | | | | | | |

| GAAP net loss | (245,198) | | | (73,147) | | | | | | |

| Total non-GAAP adjustments before income taxes | 167,126 | | | 164,350 | | | | | | |

| Less: total tax adjustments | (2,481) | | | 717 | | | | | | |

| Non-GAAP net income (loss) | $ | (75,591) | | | $ | 90,486 | | | | | | |

| | | | | | | | |

| Shares used in computing GAAP and non-GAAP basic net income (loss) per share | 83,600 | | | 80,719 | | | | | | |

| Shares used in computing GAAP diluted net loss per share | 83,600 | | | 80,719 | | | | | | |

| Dilutive common stock equivalents | — | | | 1,210 | | | | | | |

| Shares used in computing non-GAAP diluted net income (loss) per share | 83,600 | | | 81,929 | | | | | | |

| Non-GAAP basic net income (loss) per share | $ | (0.90) | | | $ | 1.12 | | | | | | |

| Non-GAAP diluted net income (loss) per share | $ | (0.90) | | | $ | 1.10 | | | | | | |

| | | | | | | | |

MAXLINEAR, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

AS A PERCENTAGE OF NET REVENUE

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31, 2024 | | September 30, 2024 | | December 31, 2023 |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| GAAP gross margin | 55.6 | % | | 54.4 | % | | 54.7 | % |

| Stock-based compensation | 0.2 | % | | 0.1 | % | | 0.1 | % |

| Performance based equity | — | % | | — | % | | — | % |

| | | | | |

| Amortization of purchased intangible assets | 3.2 | % | | 4.3 | % | | 6.7 | % |

| | | | | |

| | | | | |

| | | | | |

| Non-GAAP gross margin | 59.1 | % | | 58.7 | % | | 61.4 | % |

| | | | | |

| GAAP R&D expenses | 55.6 | % | | 64.9 | % | | 52.1 | % |

| Stock-based compensation | (11.8) | % | | (9.2) | % | | (8.8) | % |

| | | | | |

| Performance based equity | (0.8) | % | | 1.0 | % | | (1.5) | % |

| | | | | |

| | | | | |

| Research and development funded by others | — | % | | 3.7 | % | | (1.6) | % |

| | | | | |

| Non-GAAP R&D expenses | 43.0 | % | | 60.4 | % | | 40.1 | % |

| | | | | |

| GAAP SG&A expenses | 41.3 | % | | 37.2 | % | | 27.4 | % |

| Stock-based compensation | (8.4) | % | | (6.5) | % | | (4.2) | % |

| | | | | |

| Performance based equity | (0.9) | % | | 0.5 | % | | (1.1) | % |

| Amortization of purchased intangible assets | (0.6) | % | | (0.7) | % | | (0.5) | % |

| | | | | |

| Acquisition and integration costs | (7.9) | % | | (1.0) | % | | (1.4) | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Non-GAAP SG&A expenses | 23.5 | % | | 29.4 | % | | 20.3 | % |

| | | | | |

| GAAP impairment losses | — | % | | 1.5 | % | | — | % |

| Impairment losses | — | % | | (1.5) | % | | — | % |

| Non-GAAP impairment losses | — | % | | — | % | | — | % |

| | | | | |

| GAAP restructuring expenses | 3.3 | % | | 33.1 | % | | 8.5 | % |

| Restructuring charges | (3.3) | % | | (33.1) | % | | (8.5) | % |

| Non-GAAP restructuring expenses | — | % | | — | % | | — | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| GAAP loss from operations | (44.7) | % | | (82.3) | % | | (33.3) | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Total non-GAAP adjustments | 37.2 | % | | 51.3 | % | | 34.3 | % |

| Non-GAAP income (loss) from operations | (7.5) | % | | (31.0) | % | | 1.0 | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| GAAP interest and other income (expense), net | 0.4 | % | | (19.4) | % | | (0.7) | % |

| Non-recurring interest and other income (expense), net | 0.4 | % | | 14.5 | % | | — | % |

| Non-GAAP interest and other income (expense), net | 0.7 | % | | (4.9) | % | | (0.7) | % |

| | | | | |

| GAAP loss before income taxes | (44.3) | % | | (101.7) | % | | (34.0) | % |

| Total non-GAAP adjustments before income taxes | 37.5 | % | | 65.8 | % | | 34.4 | % |

| Non-GAAP income (loss) before income taxes | (6.8) | % | | (36.0) | % | | 0.4 | % |

| | | | | |

| GAAP income tax provision (benefit) | 18.5 | % | | (8.3) | % | | (3.3) | % |

| Adjustment for non-cash tax benefits/expenses | (17.4) | % | | 9.3 | % | | 3.3 | % |

| | | | | |

| Non-GAAP income tax provision | 1.1 | % | | 1.1 | % | | — | % |

| | | | | |

| GAAP net loss | (62.8) | % | | (93.4) | % | | (30.7) | % |

| Total non-GAAP adjustments before income taxes | 37.5 | % | | 65.8 | % | | 34.4 | % |

| Less: total tax adjustments | (17.4) | % | | 9.3 | % | | 3.3 | % |

| Non-GAAP net income (loss) | (7.8) | % | | (37.0) | % | | 0.3 | % |

MAXLINEAR, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

AS A PERCENTAGE OF NET REVENUE

| | | | | | | | | | | | | | | | | |

| | | | | | | |

| Year ended | | |

| December 31, 2024 | | December 31, 2023 | | | | |

| GAAP gross margin | 54.0 | % | | 55.6 | % | | | | |

| Stock-based compensation | 0.2 | % | | 0.1 | % | | | | |

| Performance based equity | — | % | | — | % | | | | |

| | | | | | | |

| Amortization of purchased intangible assets | 5.5 | % | | 5.1 | % | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Non-GAAP gross margin | 59.7 | % | | 60.8 | % | | | | |

| | | | | | | |

| GAAP R&D expenses | 62.5 | % | | 38.9 | % | | | | |

| Stock-based compensation | (10.8) | % | | (6.4) | % | | | | |

| | | | | | | |

| Performance based equity | (0.9) | % | | (1.1) | % | | | | |

| | | | | | | |

| | | | | | | |

| Research and development funded by others | 0.6 | % | | (1.4) | % | | | | |

| | | | | | | |

| Non-GAAP R&D expenses | 51.4 | % | | 30.0 | % | | | | |

| | | | | | | |

| GAAP SG&A expenses | 38.4 | % | | 19.1 | % | | | | |

| Stock-based compensation | (7.4) | % | | (1.5) | % | | | | |

| | | | | | | |

| Performance based equity | (0.6) | % | | (0.6) | % | | | | |

| Amortization of purchased intangible assets | (0.7) | % | | (0.4) | % | | | | |

| | | | | | | |

| Acquisition and integration costs | (2.5) | % | | (1.3) | % | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Non-GAAP SG&A expenses | 27.3 | % | | 15.3 | % | | | | |

| | | | | | | |

| GAAP impairment losses | 0.3 | % | | 0.4 | % | | | | |

| Impairment losses | (0.3) | % | | (0.4) | % | | | | |

| Non-GAAP impairment losses | — | % | | — | % | | | | |

| | | | | | | |

| GAAP restructuring expenses | 14.8 | % | | 2.9 | % | | | | |

| Restructuring charges | (14.8) | % | | (2.9) | % | | | | |

| Non-GAAP restructuring expenses | — | % | | — | % | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| GAAP loss from operations | (62.0) | % | | (5.5) | % | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total non-GAAP adjustments | 43.0 | % | | 21.0 | % | | | | |

| Non-GAAP income (loss) from operations | (19.0) | % | | 15.5 | % | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| GAAP interest and other income (expense), net | (4.3) | % | | (3.7) | % | | | | |

| Non-recurring interest and other income (expense), net | 3.4 | % | | 2.7 | % | | | | |

| Non-GAAP interest and other income (expense), net | (0.9) | % | | (1.0) | % | | | | |

| | | | | | | |

| GAAP loss before income taxes | (66.2) | % | | (9.2) | % | | | | |

| Total non-GAAP adjustments | 46.4 | % | | 23.7 | % | | | | |

| Non-GAAP income (loss) before income taxes | (19.9) | % | | 14.5 | % | | | | |

| | | | | | | |

| GAAP income tax provision | 1.8 | % | | 1.4 | % | | | | |

| Adjustment for non-cash tax benefits/expenses | (0.7) | % | | 0.1 | % | | | | |

| | | | | | | |

| Non-GAAP income tax provision | 1.1 | % | | 1.5 | % | | | | |

| | | | | | | |

| GAAP net loss | (68.0) | % | | (10.6) | % | | | | |

| Total non-GAAP adjustments before income taxes | 46.4 | % | | 23.7 | % | | | | |

| Less: total tax adjustments | (0.7) | % | | 0.1 | % | | | | |

| Non-GAAP net income (loss) | (21.0) | % | | 13.1 | % | | | | |

| | | | | | | |

DEI Document

|

Jan. 29, 2025 |

| Entity Information [Line Items] |

|

| Entity Central Index Key |

0001288469

|

| Document Period End Date |

Jan. 29, 2025

|

| Document Type |

8-K

|

| Entity Registrant Name |

MaxLinear, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34666

|

| Entity Tax Identification Number |

14-1896129

|

| Entity Address, Address Line One |

5966 La Place Court, Suite 100,

|

| Entity Address, City or Town |

Carlsbad,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92008

|

| City Area Code |

760

|

| Local Phone Number |

692-0711

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| NASDAQ/NGS (GLOBAL SELECT MARKET) |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

MXL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNGS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

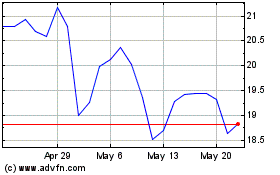

MaxLinear (NASDAQ:MXL)

Historical Stock Chart

From Feb 2025 to Mar 2025

MaxLinear (NASDAQ:MXL)

Historical Stock Chart

From Mar 2024 to Mar 2025