ENDRA Life Sciences Announces Pricing of $8.0 Million Public Offering

04 June 2024 - 11:21PM

Business Wire

ENDRA Life Sciences Inc. (Nasdaq: NDRA) (“ENDRA” or the

“Company”), a pioneer of Thermo Acoustic Enhanced UltraSound

(TAEUS®), announced today that it has priced a public offering with

gross proceeds to the Company expected to be approximately $8.0

million, before deducting placement agent fees and other estimated

expenses payable by the Company. The offering is a best-efforts

offering, with no minimum amount of securities required to be

sold.

The offering is comprised of 61,538,461 shares of the Company’s

common stock (or pre-funded warrants in lieu of shares of common

stock). Each share of common stock or pre-funded warrant will be

sold with one Series A Warrant to purchase one share of common

stock at an exercise price of $0.22 per share (the “Series A

Warrants”) and one Series B Warrant to purchase one share of common

stock at an exercise price of $0.22 per share or, pursuant to an

alternative cashless exercise option, three shares of common stock

at a price of $0.001 per share (the “Series B Warrants” and,

together with the Series A Warrants, the “Warrants”). The Warrants

cannot be exercised until the later of the approval of their terms

by the Company’s stockholders at a stockholders’ meeting and

effectiveness of an amendment to the Company’s certificate of

incorporation increasing the number of authorized shares of its

common stock. The Series A Warrants will expire on the five-year

anniversary of the initial exercise date and the Series B Warrants

will expire on the two and one-half-year anniversary of the initial

exercise date.

The purchase price of each share of common stock and

accompanying Warrants is $0.13 and the purchase price of each

pre-funded warrant and accompanying Warrants will be equal to such

price minus $0.0001.

The Company intends to use the net proceeds from this offering

for working capital and general corporate purposes. This offering

is expected to close on or about June 5, 2024, subject to

satisfaction of customary closing conditions.

Craig-Hallum is acting as sole placement agent for the

offering.

The securities described above are being offered by the Company

pursuant to a registration statement on Form S-1 (File No.

333-278842) previously filed and declared effective by the

Securities and Exchange Commission (the “SEC”). This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any sale of these securities

in any state or jurisdiction in which such offer, solicitation or

sale would be unlawful prior to the registration or qualification

under the securities laws of any such state or jurisdiction.

The offering is being made only by means of a written preliminary

prospectus and final prospectus that will form a part of the

registration statement. A final prospectus relating to the offering

will be filed with the SEC and will be available on the SEC’s

website at www.sec.gov. Alternatively, when available, copies of

the final prospectus relating to this offering may be obtained from

Craig-Hallum Capital Group LLC, Attention: Equity Capital Markets,

222 South Ninth Street, Suite 350, Minneapolis, MN 55402, by

telephone at (612) 334-6300 or by email at prospectus@chlm.com.

About ENDRA Life Sciences Inc.

ENDRA Life Sciences is the pioneer of Thermo Acoustic Enhanced

UltraSound (TAEUS®), a ground-breaking technology that

characterizes tissue similar to an MRI, but at 1/40th the cost and

at the point of patient care. TAEUS® is designed to work in concert

with the more than 700,000 ultrasound systems in use globally

today. TAEUS ® is initially focused on the non-invasive assessment

of fatty tissue in the liver. Steatotic liver disease (SLD,

formerly known as NAFLD-NASH) is a chronic liver disease spectrum

that affects over two billion people globally, and for which there

are no practical diagnostic tools. Beyond the liver, ENDRA is

exploring several other clinical applications of TAEUS®, including

non-invasive visualization of tissue temperature during

energy-based surgical procedures. For more information, please

visit www.endrainc.com.

Forward-Looking Statements

All statements in this press release that are not based on

historical fact are “forward-looking statements” within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements, which

are based on certain assumptions and describe our future plans,

strategies and expectations, can generally be identified by the use

of terms such as “approximate,” “anticipate,” “attempt,” “believe,”

“could,” “estimate,” “expect,” “forecast,” “future,” “goal,”

“hope,” “intend,” “may,” “plan,” “possible,” “potential,”

“project,” “seek,” “should,” “will,” “would,” or other comparable

terms (including the negative of any of the foregoing), although

some forward-looking statements are expressed differently. Examples

of forward-looking statements for ENDRA include, among others:

statements regarding the expected closing of the public offering,

the amount of proceeds from the public offering and the intended

use of proceeds from the offering; estimates of the timing of

future events and anticipated results of our development efforts,

including the timing of submission for and receipt of required

regulatory approvals and product launches; statements relating to

future financial position and projected costs and revenue;

expectations concerning ENDRA’s business strategy; and statements

regarding ENDRA’s ability to find and maintain development

partners. Forward-looking statements involve inherent risks and

uncertainties that could cause actual results to differ materially

from those in the forward-looking statements as a result of various

factors including, among others: market and other general economic

conditions, which may impact whether we consummate the public

offering; whether we will be able to satisfy the conditions

required to close any sale of securities in the proposed offering;

the fact our management will have broad discretion in the use of

the proceeds from any sale of the securities in the proposed

offering; the ability to raise additional capital in order to

continue as a going concern; the ability to obtain regulatory

approvals necessary to sell ENDRA medical devices in certain

markets in a timely manner, or at all; the ability to develop a

commercially feasible technology and its dependence on third

parties to design and manufacture its products; ENDRA’s ability to

maintain compliance with Nasdaq listing standards; ENDRA’s

dependence on its senior management team; the ability to find and

maintain development partners; market acceptance of ENDRA’s

technology and the amount and nature of competition in its

industry; ENDRA’s ability to protect its intellectual property; and

the other risks and uncertainties described in the Risk Factors and

Management’s Discussion and Analysis of Financial Condition and

Results of Operations sections of the Company’s most recent Annual

Report on Form 10-K and in subsequent Quarterly Reports on Form

10-Q filed with the Securities and Exchange Commission and the Risk

Factors sections of the preliminary prospectus describing the terms

of the proposed offering filed with the SEC. You should not rely

upon forward-looking statements as predictions of future events.

The forward-looking statements made in this press release speak

only as of the date of issuance, and ENDRA assumes no obligation to

update any such forward-looking statements to reflect actual

results or changes in expectations, except as otherwise required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240603362895/en/

Company: Irina Pestrikova Senior Director, Finance

investors@endrainc.com www.endrainc.com

Investor Relations: Yvonne Briggs LHA Investor Relations

(310) 691-7100 ybriggs@lhai.com

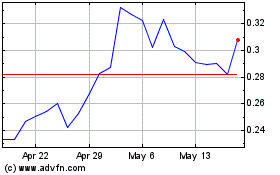

ENDRA Life Sciences (NASDAQ:NDRA)

Historical Stock Chart

From Dec 2024 to Jan 2025

ENDRA Life Sciences (NASDAQ:NDRA)

Historical Stock Chart

From Jan 2024 to Jan 2025