NeoGames S.A. (Nasdaq: NGMS) (“NeoGames” or the “Company”), a

technology-driven provider of end-to-end iLottery and iGaming

solutions, announced today financial results for the fourth quarter

and year ended December 31, 2023.

Moti Malul, Chief Executive Officer of NeoGames,

said: “We are very pleased with the progress we made during the

fourth quarter and during the entire year of 2023, progressing our

strategic goals and working to complete our merger with Aristocrat

Leisure, which we announced last May. We continue to see strong

growth across our business lines, as three of our four segments,

including iLottery, Games, and Sports, all demonstrated strong

double-digit growth in 2023.

- Our iLottery business continues to

show strong growth, increasing 11.1% during the quarter and 22.4%

for the full year 2023, with further room to run.

- We just launched our market leading

eInstants with the North Carolina Education Lottery, where the

launch has demonstrated significant early success, mirroring trends

we saw when we first launched our eInstants product in Virginia. We

also signed a two-year extension with the North Carolina Education

Lottery, further cementing this valuable partnership. In another

exciting development, NeoPollard Interactive was awarded a new

ten-year contract to provide our turn-key iLottery solutions to the

West Virginia Lottery, which is expected to launch during the

fourth quarter of 2024.

- Our Pariplay business also saw

excellent growth, signing several major new operators during the

quarter including Hard Rock Digital, DraftKings and bet365.

- Subsequent to quarter-end, we are

also excited with our planned launch in Tennessee in the coming

weeks with Action 24/7, Aspire’s first U.S. customer to go live

with online sports betting.

We are focused on achieving sustainable growth

and remain encouraged by the interest and pipeline in the U.S.

market for our iGaming offering. As we look ahead, we will maintain

our focus on investing in the execution of our recently announced

partnerships and product enhancements. These efforts will further

strengthen our capabilities and position us to capitalize on the

meaningful growth opportunities across our business as the market

continues to evolve.”

Malul continued, “We continue to make progress

towards completing our merger with Aristocrat Leisure and continue

to receive the regulatory approvals required to close. We currently

expect we will be able to obtain the remaining regulatory approvals

by the end of April and should that happen we see a path to close

during May.” Malul stated. “In the meantime, we remain dedicated to

elevating the iGaming landscape, capitalizing on opportunities, and

diligently executing on our strategic objectives for the benefit of

all stakeholders.”

Fourth Quarter 2023 Financial

Highlights

- The total of Revenues and the

Company’s share of NPI revenues was $64.9 million during the fourth

quarter of 2023, compared to $83.2 million during the fourth

quarter of 2022. These figures reflect accounting for the majority

of Aspire Core revenues on a net basis in the fourth quarter of

2023 compared to historical figures in the fourth quarter of 2022,

which were prepared on a gross basis, prompted by new commercial

terms in certain Aspire Core contracts which went into effect on

January 1, 2023. If iGaming revenues had been accounted for on a

gross basis for the Aspire Core, the total of Revenue and the

Company’s share in NPI revenues would have been $95.2 million,

which would have reflected 14.5% year-over-year growth when

measured in reporting currency. In addition to accounting for the

new commercial terms, current year results reflect continued growth

in the Company’s iLottery, Games and Sports business lines,

partially offset by a slowdown in Aspire Core revenues due to

regulatory changes in the United Kingdom and a temporary pause in

operations in Germany prior and due to the Company obtaining

its local license to operate.

- iLottery revenues were $14.4

million during the fourth quarter of 2023, compared to $14.5

million during the fourth quarter of 2022, representing a decrease

of (0.4)% year-over-year. In addition, the Company’s share in NPI

revenues was $17.2 million during the fourth quarter of 2023,

compared to $14.0 million during the fourth quarter of 2022,

representing an increase of 22.9% year-over-year. The total of

NeoGames’ iLottery revenue plus the Company’s share of NPI revenues

during the fourth quarter of 2023 was $31.6 million, up 11.1%

year-over-year, primarily driven by continued positive growth trend

across most major accounts as well as by very strong performance of

new game launches by NeoGames Studio.

- iGaming revenues were $33.4 million

for the fourth quarter of 2023. These figures reflect accounting

for the majority of Aspire Core revenues on a net basis compared to

historical figures which were prepared on a gross basis, prompted

by new commercial terms in certain Aspire Core contracts which went

into effect on January 1, 2023. If iGaming revenues had been

accounted for on a gross basis for the Aspire Core, total revenue

would have been $63.7 million for iGaming primarily driven by

continued growth in Games and Sports business lines, partially

offset by a slowdown in Aspire Core revenues due to regulatory

changes in the United Kingdom and a temporary pause in operations

in Germany prior to the Company recently securing its local license

to operate, which would have reflected 16.2% year-over-year growth

when measured in reporting currency.

- Net loss was $(6.1) million, or

$(0.18) per share, during the fourth quarter of 2023, compared to a

net loss of $(0.8) million, or $(0.02) per share, during the fourth

quarter of 2022. Net loss during the fourth quarter of 2023 was

mainly due to costs attributed to the Aristocrat transaction and

the amortization attributable to the Aspire business combination,

income tax expenses and interest and finance related expenses.

- Adjusted net income1 was $1.7

million, or $0.05 per share, during the fourth quarter of 2023,

compared to $7.3 million, or $0.22 per share, during the fourth

quarter of 2022.

- Adjusted EBITDA¹ was $18.2

million during the fourth quarter of 2023, compared to $18.1

million during the fourth quarter of 2022, representing an increase

of 0.4% year-over-year. Adjusted EBITDA results slightly increased

during the quarter compared to the prior year, mainly due to good

performance of the iLottery and the sports business lines, offset

primarily by the Aspire Core business due to several factors

related to the adaptation of regulatory changes as well as changes

in partner mix.

Full Year 2023 Financial

Highlights

- The total of Revenues and the

Company’s share of NPI revenues was $254.6 million for the year

ended December 31, 2023, compared to $210.2 million for the year

ended December 31, 2022. These figures reflect accounting for the

majority of Aspire Core revenues on a net basis for the year ended

December 31, 2023, compared to historical figures during the year

ended December 31, 2022, which were prepared on a gross basis,

prompted by new commercial terms in certain Aspire Core contracts

which went into effect on January 1, 2023. If iGaming revenues had

been accounted for on a gross basis for the Aspire Core, the total

of Revenue and the Company’s share in NPI revenues would have been

$351.3 million, which would have reflected 15.2% year-over-year

growth when measured in reporting currency. In addition to

accounting for the new commercial terms, current year results

reflect continued growth in the Company’s iLottery, Games and

Sports business lines, partially offset by a slowdown in Aspire

Core revenues due to regulatory changes in the United Kingdom and a

temporary pause in operations in Germany prior to the Company

recently securing its local license to operate. In addition to

growth in our business lines, the strong comparison to the prior

year is also due to partial year results from the Aspire business,

as our acquisition completed on June 16, 2022.

- iLottery revenues were $57.0

million for the year ended December 31, 2023, compared to $53.6

million for the year ended December 31, 2022, representing an

increase of 6.3% year-over-year. In addition, the Company’s share

in NPI revenues was $63.0 million for the year ended December 31,

2023, compared to $44.5 million for the year ended December 31,

2022, representing an increase of 41.8% year-over-year. The total

of NeoGames’ iLottery revenue plus the Company’s share of NPI

revenues for the year ended December 31, 2023 was $120.0 million,

up 22.4% year-over-year, primarily driven by continued positive

growth trend across most major accounts, as well as a jackpot run

during the third quarter of 2023.

- iGaming revenues were $134.6

million for the year ended December 31, 2023. These figures reflect

accounting for the majority of Aspire Core revenues on a net basis

compared to historical figures which were prepared on a gross

basis, prompted by new commercial terms in certain Aspire Core

contracts which went into effect on January 1, 2023. If iGaming

revenues had been accounted for on a gross basis for the Aspire

Core, total revenue would have been $231.3 million for iGaming

primarily driven by continued growth in Games and Sports business

lines, partially offset by a slowdown in Aspire Core revenues due

to regulatory changes in the United Kingdom and a temporary pause

in operations in Germany prior to the Company recently securing its

local license to operate, which would have reflected 11.8%

year-over-year growth when measured in reporting currency.

- Net loss was $(18.3) million, or

$(0.54) per share, for the year ended December 31, 2023, compared

to a net loss of $(19.0) million, or $(0.64) per share, for the

year ended December 31, 2022. Net loss during the year ended

December 31, 2023 was mainly due to income tax expenses, interest

and other finance related expenses and the amortization

attributable to the Aspire business combination, offset by a

reduction in business combination related expenses.

- Adjusted net income1 was $12.8

million, or $0.38 per share, for the year ended December 31, 2023,

compared to Adjusted net loss1 of $(3.1) million, or $(0.11) per

share, for the year ended December 31, 2022.

- Adjusted EBITDA1 was $76.2

million for the year ended December 31, 2023, compared to $54.5

million for the year ended December 31, 2022, representing an

increase of 39.8% year-over-year.

- Cash and cash equivalents balance

as of the year ended December 31, 2023 was $29.0 million, compared

to $41.2 million at the end of 2022, resulting in net negative cash

of $12.2 million for the twelve months of 2023. The difference in

cash flows is primarily attributable to a number of key factors

including advisor payments related to the Aristocrat transaction,

slowness in Aspire Core operations, a consideration for the

acquisition of the remaining shares of GMS Entertainment Ltd. from

the managing director of Pariplay, and the impact from a bank

guarantee required to secure the Company’s German license.

Recent Business Highlights

- North Carolina Education Lottery

went live with NeoGames Studio eInstants during the fourth quarter,

and NeoPollard also recently signed a two-year extension with the

North Carolina Education Lottery, further cementing our strong

presence in North Carolina.

- NeoPollard Interactive awarded new

contract for West Viginia Lottery to provide the state with a

turn-key iLottery system, including a fully integrated omnichannel

Player Loyalty Program and full-featured mobile application. The

initial contract period is ten years, with an optional one-year

renewal and is expected to launch in the fourth quarter of

2024.

- Subsequent to quarter end, NeoGames

Studio content went line with the Georgia Lottery, one of the

largest lotteries in the United States.

- Pariplay entered Pennsylvania with

Rush Street Interactive (NYSE: RSI), and New Jersey with Hard Rock

Digital and Tipico.

- Pariplay is showing strong revenue

growth, with room for more, signing 8 new operators during the

quarter, including DraftKings and bet365.

- Expected launch with Action 24/7 in

Tennessee over the coming weeks, Aspire’s first U.S. customer to go

live with OSB, including our suite of turn-key solutions.

- Won the public tender in Hungary to

provide eInstant games to the Hungarian lottery.

______________________________¹ The section

titled “Non-IFRS Financial Measures and Key Performance Indicators”

below contains a description of the non-IFRS financial measures

discussed in this press release. Reconciliations between historical

IFRS and non-IFRS information are contained in the tables below.

Throughout this press release, we also provide a number of key

performance indicators used by our management and often used by

competitors in our industry. These and other key performance

indicators are discussed in more detail in the section titled

“Non-IFRS Financial Measures and Key Performance Indicators” in

this press release.

Aristocrat Transaction

On May 15, 2023, the Company entered into a

definitive Business Combination Agreement (the “Agreement”) with

Aristocrat Leisure Limited (ASX:ALL) (“Aristocrat”) and Anaxi

Investments Limited, a Cayman Islands exempted company and wholly

owned indirect subsidiary of Aristocrat (“Merger Sub”), pursuant to

which the Company is to be acquired by Aristocrat for $29.50 per

share in an all-cash transaction. Under the terms of the Agreement,

the Company agreed to transfer its statutory seat, registered

office and seat of central administration (siège de

l'administration centrale) from the Grand Duchy of Luxembourg to

the Cayman Islands by way of continuation (the “Continuation”) and

as promptly practical, Merger Sub will be merged with and into the

Company, which will be the surviving company and become a wholly

owned indirect subsidiary of Aristocrat (the “Merger”). On July 18,

2023, NeoGames’ shareholders approved the Agreement and the

Continuation, which will become effective subject to certain

regulatory approvals. A second NeoGames shareholder vote to approve

the Merger will take place immediately following the effectiveness

of the Continuation during the second quarter of fiscal year 2024.

NeoGames’ shareholders representing approximately 61% of the

Company’s outstanding shares have executed a support agreement with

Aristocrat, pursuant to which they have also irrevocably agreed to

vote in favor of the Merger. Completion of the transaction is

contingent upon customary closing conditions, including the receipt

of all required gaming and antitrust approvals. We continue to

receive regulatory approvals as we work closely with Aristocrat

towards finalizing the deal. We currently remain on track and

expect to receive all regulatory approvals before the end of April

2024. We continue to plan to work closely with those remaining

regulatory authorities and expect a closing date in May 2024 is

possible. Please refer to the Company’s Current Report on Form 6-K

filed on June 21, 2023 for further detail.

Conference Call / Webcast &

Guidance

In light of the expected sale of the Company to

Aristocrat, NeoGames will not be hosting a conference call, or

providing quantitative financial guidance in conjunction with its

fourth quarter and year-end 2023 earnings release.

About NeoGames

NeoGames is a technology-driven innovator and a

global leader of iLottery and iGaming solutions and services for

regulated lotteries and gaming operators. The Company offers its

customers a full-service suite of solutions, including proprietary

technology platforms, two dedicated game studios with an extensive

portfolio of engaging games – one in lottery and one in casino

games, and a range of value-added services. As an end-to-end

provider of iLottery and iGaming solutions, NeoGames offers the

most comprehensive portfolio across iLottery, an innovative sports

betting platform, an advanced content aggregation solution, and a

complete set of B2B Gaming tech and Managed Services. NeoGames

remains an instrumental partner to its customers worldwide, as it

works to maximize their revenue potential through various

offerings, including regulation and compliance, payment processing,

risk management, player relationship management, and player value

optimization. NeoGames strives to be the long-term partner of

choice for its customers, empowering them to deliver enjoyable and

profitable programs to their players, generate more revenue, and

maximize proceeds to governments and good causes.

Cautionary Statement Regarding

Forward-looking Statements

This press release contains forward-looking

statements and information within the meaning of U.S. Private

Securities Litigation Reform Act of 1995 that relate to our current

expectations and views of future events. We intend such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in Section 27A

of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements contained in this press

release other than statements of historical facts, including

without limitation statements regarding, the completion of the

Merger and anticipated timing thereof, including with respect to

regulatory approvals and the closing, our future operating results

and financial position, our business strategy and plans, market

growth, integration plans and any future benefits and synergies

related to the Aspire acquisition, our objectives for future

operations, the expansion of our products and offerings to global

markets, and any potential impact or uncertainties relating to the

Israel-Hamas war are forward-looking statements. The words or

phrases such as “may,” “will,” “expect,” “anticipate,” “aim,”

“estimate,” “intend,” “plan,” “believe,” “potential,” “continue,”

“could,” “would,” “project,” “target,” and similar expressions are

intended to identify forward-looking statements, though not all

forward-looking statements use these words or expressions. These

forward-looking statements are subject to risks, uncertainties and

assumptions, some of which are beyond our control. In addition,

these forward-looking statements reflect our current views with

respect to future events and are not a guarantee of future

performance. Actual outcomes may differ materially from the

information contained in the forward-looking statements as a result

of a number of factors, including, without limitation, the

following: the risk that the sale of the Company to Aristocrat may

not be completed in a timely manner or at all, or that following

the Continuation the Company may be required to reincorporate in

Luxembourg, which may adversely affect the companies’ businesses

and the price of their securities; uncertainties as to the timing

of the consummation of the transaction and the potential failure to

satisfy the conditions to the consummation of the transaction,

including the receipt of certain governmental and regulatory

approvals; the potential for regulatory authorities to require

divestitures, behavioral remedies or other concessions in order to

obtain their approval of the proposed transaction; the occurrence

of any event, change or other circumstance that could give rise to

the termination of the Business Combination Agreement; the effect

of the announcement or pendency of the sale of the Company to

Aristocrat on the Company’s business relationships, operating

results, and business generally; the potential that the Company’s

shareholders may not approve the transaction; expected benefits,

including financial benefits, of the transaction may not be

realized; integration of the acquisition post-closing may not occur

as anticipated, and the combined companies’ ability to achieve the

growth prospects and synergies expected from the transaction, as

well as delays, challenges and expenses associated with integrating

the combined companies’ existing businesses may exceed current

expectations; litigation related to the transaction or otherwise;

unanticipated restructuring costs may be incurred or undisclosed

liabilities assumed; attempts to retain key personnel and customers

may not succeed; risks related to diverting management’s attention

from Parent’s ongoing business operations; exposure to inflation,

currency rate and interest rate fluctuations and risks associated

with doing business locally and internationally, as well as

fluctuations in the market price of Parent and the Company’s traded

securities. We have a concentrated customer base, and our failure

to retain our existing contracts with our customers could have a

significant adverse effect on our business; our inability to

successfully integrate Aspire, or complete or integrate other

future acquisitions, could limit our future growth or otherwise be

disruptive to our ongoing business; a reduction in discretionary

consumer spending could have an adverse impact on our business; the

growth of our business largely depends on our continued ability to

procure new contracts; we incur significant costs related to the

procurement of new contracts, which we may be unable to recover in

a timely manner, or at all; intense competition exists in the

iLottery industry, and we expect competition to continue to

intensify; our information technology and infrastructure may be

vulnerable to attacks by hackers or breached due to employee error,

malfeasance or other disruptions; in addition to competition with

other iLottery providers, we and our customers also compete with

providers of other online offerings; the gaming and lottery

industries are heavily regulated, and changes to the regulatory

framework in the jurisdictions in which we operate could harm our

existing operations; while we have not experienced a material

impact to date, the ongoing COVID-19 pandemic, including variants,

and similar health epidemics and contagious disease outbreaks could

significantly disrupt our operations and adversely affect our

business, results of operations, cash flows or financial condition;

and other risk factors described in our Annual Report on Form 20-F

for the year ended December 31, 2022, filed with the Securities and

Exchange Commission (the “SEC”) on April 28, 2023, and other

documents filed with or furnished to the SEC. It is not possible

for our management to predict all risks, nor can we assess the

impact of all factors on our business or the extent to which any

factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking

statements we may make. We caution you therefore against relying on

these forward-looking statements, and we qualify all of our

forward-looking statements by these cautionary statements. These

statements reflect management’s current expectations regarding

future events and operating performance and speak only as of the

date of this press release. You should not put undue reliance on

any forward-looking statements. Although we believe that the

expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee that future results, levels of

activity, performance and events and circumstances reflected in the

forward-looking statements will be achieved or will occur. Except

as required by applicable law, we undertake no obligation to update

or revise publicly any forward-looking statements, whether as a

result of new information, future events or otherwise, after the

date on which the statements are made or to reflect the occurrence

of unanticipated events.

Non-IFRS Financial Measures and Key

Performance Indicators

This press release may include E(L)BIT, EBITDA,

Adjusted EBITDA, NPI and NPI Revenues Interest, adjusted net income

(loss), Adjusted EPS and revenues growth measured in constant

currency which are financial measures not presented in accordance

with IFRS. We use these financial measures to supplement our

results presented in accordance with IFRS. We include these

non-IFRS financial measures because they are used by our management

to evaluate our operating performance and trends and to make

strategic decisions regarding the allocation of capital and new

investments. The Company presents revenues growth measured in

constant currency since we use constant currency information to

provide a framework in assessing how our business and geographic

segments performed excluding the effects of foreign currency

exchange rate fluctuations and believe this information is useful

to investors to facilitate comparisons and better identify trends

in our business.

E(L)BIT, EBITDA, Adjusted EBITDA, adjusted net

income (loss), Adjusted EPS and revenues growth measured in

constant currency. We define “E(L)BIT” as net income (loss), plus

income taxes, and interest and finance-related expenses. We define

“EBITDA” as E(L)BIT, plus depreciation and amortization. We define

Adjusted EBITDA as EBITDA, plus share-based compensation,

prospective business combination and business combination related

expenses and the Company’s share in NPI depreciation and

amortization. We define adjusted net income (loss) as net loss

adjusted by adding amortization attributable to intangible assets

acquired in business combination, net of tax. We define adjusted

EPS as adjusted net income (loss) divided by the weighted average

number of ordinary shares outstanding. We define revenues growth

measured in constant currency as revenue adjusted by using the

average foreign exchange rates for fiscal year 2023, as reported by

third parties, when converting revenues recorded in foreign

currencies to US dollar. We believe E(L)BIT, EBITDA and Adjusted

EBITDA, adjusted net income (loss) and revenues growth measured in

constant currency are useful in evaluating our operating

performance, as they are regularly used by security analysts,

institutional investors and others in analyzing operating

performance and prospects. Adjusted EBITDA, adjusted net income

(loss) and revenues growth measured in constant currency are not

intended to be a substitute for any IFRS financial measure and, as

calculated, may not be comparable to other similarly titled

measures of performance of other companies in other industries or

within the same industry.

NPI. Refers to NeoPollard Interactive LLC that

represents the Company’s 50/50 joint venture with Pollard Banknote

Limited (“Pollard”). The joint venture was formed for the purpose

of identifying, pursuing, winning and executing iLottery contracts

in the North American lottery market. NPI is managed by an

executive board of four members, consisting of two members

appointed by NeoGames and two members appointed by Pollard. NPI has

its own general manager and dedicated workforce and operates as a

separate entity. However, it relies on NeoGames and Pollard for

certain services, such as technology development, business

operations and support services from NeoGames and corporate

services, including legal, banking and certain human resources

services, from Pollard.

Company share in NPI Revenues. NPI Revenues is

not recorded as revenues in our consolidated statements of

comprehensive loss, but rather is reflected in our consolidated

financial statements in accordance with the equity method, as we

share 50% of the profit of NPI subject to certain adjustments.

Contacts

Investor Contact: ir@neogames.com

Media Relations: pr@neogames.com

|

|

|

NeoGames S.A. |

|

Consolidated Condensed Statements of Financial

Position |

|

(Unaudited, U.S. dollars in thousands) |

|

|

|

|

|

December 31, 2023 |

|

December 31, 2022 |

|

ASSETS |

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

29,019 |

|

|

$ |

41,179 |

|

|

Restricted deposits |

|

|

476 |

|

|

|

489 |

|

|

Prepaid expenses and other receivables |

|

|

6,813 |

|

|

|

5,789 |

|

|

Due from the Michigan Joint Operation and NPI |

|

|

5,894 |

|

|

|

3,768 |

|

|

Trade receivables |

|

|

43,414 |

|

|

|

38,537 |

|

|

Income tax receivables |

|

|

283 |

|

|

|

536 |

|

|

Total current assets |

|

$ |

85,899 |

|

|

$ |

90,298 |

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

Restricted deposits – Joint Venture and other |

|

|

9,954 |

|

|

|

4,247 |

|

|

Property and equipment |

|

|

3,443 |

|

|

|

3,992 |

|

|

Intangible assets |

|

|

344,338 |

|

|

|

347,213 |

|

|

Right-of-use assets |

|

|

8,742 |

|

|

|

7,973 |

|

|

Investment in Associates |

|

|

5,965 |

|

|

|

4,770 |

|

|

Deferred taxes |

|

|

1,039 |

|

|

|

2,451 |

|

|

Total non-current assets |

|

|

373,481 |

|

|

|

370,646 |

|

|

Total assets |

|

$ |

459,380 |

|

|

$ |

460,944 |

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

Trade and other payables |

|

$ |

20,443 |

|

|

$ |

16,042 |

|

|

Royalty payables |

|

|

13,328 |

|

|

|

10,838 |

|

|

Client liabilities |

|

|

5,783 |

|

|

|

6,927 |

|

|

Income tax payables |

|

|

6,701 |

|

|

|

7,396 |

|

|

Gaming tax payables |

|

|

7,520 |

|

|

|

10,133 |

|

|

Lease liabilities |

|

|

1,864 |

|

|

|

1,150 |

|

|

Contingent consideration on business combination and other |

|

|

10,729 |

|

|

|

17,256 |

|

|

Employees' related payables and accruals |

|

|

9,866 |

|

|

|

7,262 |

|

|

Total current liabilities |

|

$ |

76,234 |

|

|

$ |

77,004 |

|

|

NON-CURRENT LIABILITIES |

|

|

|

|

|

Liability with respect to Caesars' IP option |

|

|

3,450 |

|

|

|

3,450 |

|

|

Loans from financial institution, net |

|

|

217,969 |

|

|

|

209,287 |

|

|

Company share of Joint Venture liabilities, net |

|

|

416 |

|

|

|

539 |

|

|

Lease liabilities |

|

|

6,970 |

|

|

|

6,823 |

|

|

Accrued severance pay, net |

|

|

1,002 |

|

|

|

1,033 |

|

|

Deferred taxes |

|

|

17,867 |

|

|

|

17,469 |

|

|

Total non-current liabilities |

|

$ |

247,674 |

|

|

$ |

238,601 |

|

|

EQUITY |

|

|

|

|

|

Share capital |

|

|

60 |

|

|

|

59 |

|

|

Reserve with respect to transaction under common control |

|

|

(8,467) |

|

|

|

(8,467) |

|

|

Reserve with respect to funding transactions with related

parties |

|

|

20,072 |

|

|

|

20,072 |

|

|

Accumulated other comprehensive income |

|

|

5,769 |

|

|

|

482 |

|

|

Share premium |

|

|

179,731 |

|

|

|

173,908 |

|

|

Share based payments reserve |

|

|

4,240 |

|

|

|

6,941 |

|

|

Accumulated losses |

|

|

(65,933) |

|

|

|

(47,656) |

|

|

Total equity |

|

|

135,472 |

|

|

|

145,339 |

|

|

Total liabilities and equity |

|

$ |

459,380 |

|

|

$ |

460,944 |

|

|

NeoGames S.A. |

|

Consolidated Condensed Statements of

Operations |

|

(Unaudited, U.S. dollars in thousands, except per share

amounts) |

|

|

|

|

|

Quarter ended December 31, |

|

Year to date December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

47,761 |

|

|

$ |

69,222 |

|

|

$ |

191,538 |

|

|

$ |

165,698 |

|

|

Distribution expenses |

|

|

25,425 |

|

|

|

45,419 |

|

|

|

96,497 |

|

|

|

97,579 |

|

|

Development expenses |

|

|

2,313 |

|

|

|

2,622 |

|

|

|

14,896 |

|

|

|

10,278 |

|

|

Selling and marketing expenses |

|

|

3,530 |

|

|

|

2,817 |

|

|

|

10,859 |

|

|

|

5,364 |

|

|

General and administrative expenses |

|

|

9,384 |

|

|

|

8,977 |

|

|

|

33,544 |

|

|

|

23,306 |

|

|

Business combinations related expenses |

|

|

598 |

|

|

|

767 |

|

|

|

6,477 |

|

|

|

17,984 |

|

|

Depreciation and amortization |

|

|

14,246 |

|

|

|

12,258 |

|

|

|

55,940 |

|

|

|

35,611 |

|

|

|

|

|

55,496 |

|

|

|

72,860 |

|

|

|

218,213 |

|

|

|

190,122 |

|

|

Loss from operations |

|

|

(7,735) |

|

|

|

(3,638) |

|

|

|

(26,675) |

|

|

|

(24,424) |

|

|

Interest expenses with respect to funding from related parties |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,867 |

|

|

Finance expenses |

|

|

7,432 |

|

|

|

5,882 |

|

|

|

24,778 |

|

|

|

12,238 |

|

|

The Company's share in profits of Joint Venture and associated

companies |

|

|

10,626 |

|

|

|

8,132 |

|

|

|

37,334 |

|

|

|

22,110 |

|

|

Loss before income tax expense |

|

|

(4,541) |

|

|

|

(1,388) |

|

|

|

(14,119) |

|

|

|

(17,419) |

|

|

Income tax (expenses) benefit |

|

|

(1,534) |

|

|

|

595 |

|

|

|

(4,158) |

|

|

|

(1,546) |

|

|

Net loss |

|

$ |

(6,075) |

|

|

$ |

(793) |

|

|

$ |

(18,277) |

|

|

$ |

(18,965) |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share outstanding, basic |

|

$ |

(0.18) |

|

|

$ |

(0.02) |

|

|

$ |

(0.54) |

|

|

$ |

(0.64) |

|

|

Net loss per common share outstanding,

diluted |

|

$ |

(0.18) |

|

|

$ |

(0.02) |

|

|

$ |

(0.54) |

|

|

$ |

(0.64) |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of ordinary shares

outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

33,738,570 |

|

|

|

33,482,197 |

|

|

|

33,633,838 |

|

|

|

29,716,281 |

|

|

Diluted |

|

|

33,738,570 |

|

|

|

33,482,197 |

|

|

|

33,633,838 |

|

|

|

29,716,281 |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EPS² |

|

$ |

0.05 |

|

|

$ |

0.22 |

|

|

$ |

0.38 |

|

|

$ |

(0.11) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

______________________________² See

Reconciliation of Net Loss to Adjusted Net (Loss) Income.

|

|

|

NeoGames S.A. |

|

Consolidated Condensed Statement of Cash

Flows |

|

(Unaudited, U.S. dollars in thousands) |

|

|

|

|

|

YTDDecember 31, 2023 |

| Cash flows from

operating activities: |

|

|

|

Net loss |

|

$ |

(18,277) |

|

| Changes in other financial

assets and liabilities |

|

|

(6,840) |

|

| Amortization and

depreciation |

|

|

55,940 |

|

| Finance expenses |

|

|

24,778 |

|

| Share based compensation |

|

|

2,910 |

|

| Other |

|

|

(423) |

|

| Net cash generated

from operating activities |

|

$ |

58,088 |

|

| |

|

|

| Net cash used in

investing activities |

|

$ |

(44,002) |

|

| |

|

|

| Net cash used in

financing activities |

|

$ |

(28,075) |

|

| |

|

|

| |

|

|

| Net decrease in cash and cash

equivalents |

|

|

(13,989) |

|

| Cash and cash equivalents –

beginning of period |

|

|

41,179 |

|

| Currency exchange differences

on cash and cash equivalents |

|

|

1,829 |

|

| Cash and cash

equivalents – end of period |

|

$ |

29,019 |

|

|

NeoGames S.A. |

|

Reconciliation of Net Loss to Adjusted EBITDA |

|

(Unaudited, U.S. dollars in thousands) |

|

|

|

|

|

Quarter ended December 31, |

|

Year to date December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(6,075) |

|

|

$ |

(793) |

|

|

$ |

(18,277) |

|

|

$ |

(18,965) |

|

|

Income tax expenses (benefit) |

|

|

1,534 |

|

|

|

(595) |

|

|

|

4,158 |

|

|

|

1,546 |

|

|

Finance expenses |

|

|

7,432 |

|

|

|

5,882 |

|

|

|

24,778 |

|

|

|

15,105 |

|

|

E(L)BIT |

|

|

2,891 |

|

|

|

4,494 |

|

|

|

10,659 |

|

|

|

(2,314) |

|

|

Depreciation and amortization |

|

|

14,246 |

|

|

|

12,258 |

|

|

|

55,940 |

|

|

|

35,611 |

|

|

EBITDA |

|

|

17,137 |

|

|

|

16,752 |

|

|

|

66,599 |

|

|

|

33,297 |

|

|

Business combination related expenses |

|

|

598 |

|

|

|

767 |

|

|

|

6,477 |

|

|

|

17,984 |

|

|

Share-based compensation |

|

|

367 |

|

|

|

518 |

|

|

|

2,910 |

|

|

|

2,994 |

|

|

Company share of NPI depreciation and amortization |

|

|

54 |

|

|

|

52 |

|

|

|

212 |

|

|

|

222 |

|

|

Adjusted EBITDA |

|

$ |

18,156 |

|

|

$ |

18,089 |

|

|

$ |

76,198 |

|

|

$ |

54,497 |

|

|

NeoGames S.A. |

|

Revenues generated by NeoGames as well as Company's share

in NPI Revenues |

|

(Unaudited, U.S. dollars in thousands unless otherwise noted) |

|

|

|

|

|

Quarter ended December 31, |

|

Year to date December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

Royalties from turnkey contracts |

|

$ |

7,849 |

|

|

$ |

8,348 |

|

|

$ |

31,001 |

|

|

$ |

29,729 |

|

|

Royalties from games contracts |

|

|

573 |

|

|

|

426 |

|

|

|

1,977 |

|

|

|

1,709 |

|

|

Use of IP rights |

|

|

4,441 |

|

|

|

4,154 |

|

|

|

18,155 |

|

|

|

14,293 |

|

|

Development and other services – Aspire |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

767 |

|

|

Development and other services – NPI |

|

|

1,042 |

|

|

|

1,242 |

|

|

|

4,349 |

|

|

|

5,651 |

|

|

Development and other services – Michigan Joint Operation |

|

|

492 |

|

|

|

284 |

|

|

|

1,498 |

|

|

|

1,449 |

|

|

Revenues |

|

$ |

14,397 |

|

|

$ |

14,454 |

|

|

$ |

56,980 |

|

|

$ |

53,598 |

|

|

NeoGames' NPI revenues interest |

|

$ |

17,162 |

|

|

$ |

13,961 |

|

|

$ |

63,045 |

|

|

$ |

44,473 |

|

|

NeoGames revenues plus NPI revenues interest |

|

$ |

31,559 |

|

|

$ |

28,415 |

|

|

$ |

120,025 |

|

|

$ |

98,071 |

|

|

iGaming revenues |

|

$ |

33,364 |

|

|

$ |

54,768 |

|

|

$ |

134,558 |

|

|

$ |

112,100 |

|

|

Revenues plus NeoGames NPI revenues interest |

|

$ |

64,923 |

|

|

$ |

83,183 |

|

|

$ |

254,583 |

|

|

$ |

210,171 |

|

|

NeoGames S.A. |

|

Reconciliation of Net Loss to Adjusted Net (Loss)

Income |

|

(Unaudited, U.S. dollars in thousands) |

|

|

|

|

|

Quarter ended December 31, |

|

Year to date December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net loss |

|

$ |

(6,075) |

|

|

$ |

(793) |

|

|

$ |

(18,277) |

|

|

$ |

(18,965) |

|

|

Amortization attributable to business combination, net of tax |

|

|

7,724 |

|

|

|

8,068 |

|

|

|

31,103 |

|

|

|

15,840 |

|

|

Adjusted net income (loss) |

|

$ |

1,649 |

|

|

$ |

7,275 |

|

|

$ |

12,826 |

|

|

$ |

(3,125) |

|

|

Adjusted net income (loss) per common share outstanding |

|

$ |

0.05 |

|

|

$ |

0.22 |

|

|

$ |

0.38 |

|

|

$ |

(0.11) |

|

|

Aspire Global |

|

Non-IFRS Financial Measures –

Reconciliation |

|

(Unaudited, U.S. dollars in thousands unless otherwise noted) |

|

|

|

|

|

Quarter ended December 31, |

|

$ Change |

|

% Change |

|

|

|

2023 |

|

2022 |

|

As reported |

|

Foreign exchange impact |

|

In constant currency |

|

As reported |

|

In constant currency |

|

Aspire Core3 |

|

$ |

11,761 |

|

|

$ |

40,979 |

|

|

$ |

11,761 |

|

|

$ |

(668) |

|

|

$ |

11,093 |

|

|

(71.3) |

% |

|

(72.9) |

% |

|

Games |

|

|

12,369 |

|

|

|

7,996 |

|

|

|

12,369 |

|

|

|

(687) |

|

|

|

11,682 |

|

|

54.7 |

% |

|

46.1 |

% |

|

Sports |

|

|

9,234 |

|

|

|

5,793 |

|

|

|

9,234 |

|

|

|

(510) |

|

|

|

8,724 |

|

|

59.4 |

% |

|

50.6 |

% |

|

Net Revenues, as reported |

|

$ |

33,364 |

|

|

$ |

54,768 |

|

|

$ |

33,364 |

|

|

$ |

(1,865) |

|

|

$ |

31,499 |

|

|

|

|

|

|

|

|

Year to date December 31, |

|

$ Change |

|

% Change |

|

|

|

2023 |

|

2022 |

|

As reported |

|

Foreign exchange impact |

|

In constant currency |

|

As reported |

|

In constant currency |

|

Aspire Core4 |

|

$ |

56,726 |

|

|

$ |

149,743 |

|

|

$ |

56,726 |

|

|

$ |

(1,693) |

|

|

$ |

55,033 |

|

|

(62.1) |

% |

|

(63.2) |

% |

|

Games |

|

|

43,879 |

|

|

|

34,535 |

|

|

|

43,879 |

|

|

|

(1,230) |

|

|

|

42,649 |

|

|

27.1 |

% |

|

23.5 |

% |

|

Sports |

|

|

33,953 |

|

|

|

22,686 |

|

|

|

33,953 |

|

|

|

(1,124) |

|

|

|

32,829 |

|

|

49.7 |

% |

|

44.7 |

% |

|

Net Revenues, as reported |

|

$ |

134,558 |

|

|

$ |

206,964 |

|

|

$ |

134,558 |

|

|

$ |

(4,047) |

|

|

$ |

130,511 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

______________________________3 2022 Aspire Core

revenues are presented based on Gross revenues presentation, prior

to the changes in commercial terms triggered Net revenue

presentation. If fourth quarter 2023 Aspire Core figures were

presented on a Gross basis, then like-for-like revenues would have

been $42.1million, which reflects 1.5% YoY increase on Aspire Core,

and total iGaming revenues of $63.7 million, reflecting 16.2% YoY

growth.4 2022 Aspire Core revenues are presented based on Gross

revenues presentation, prior to the changes in commercial terms

triggered Net revenue presentation. If Year to date 2023 Aspire

Core figures were presented on a Gross basis, then like-for-like

revenues would have been $153.50 million, which reflects 2.2% YoY

growth on Aspire Core, and total iGaming revenues of $231.3

million, reflecting 11.8% YoY growth.

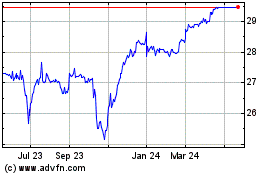

NeoGames (NASDAQ:NGMS)

Historical Stock Chart

From Dec 2024 to Jan 2025

NeoGames (NASDAQ:NGMS)

Historical Stock Chart

From Jan 2024 to Jan 2025