Natural Health Trends Reports Fourth Quarter and Full Year 2024 Financial Results

06 February 2025 - 1:00AM

Natural Health Trends Corp. (NASDAQ: NHTC), a leading

direct-selling and e-commerce company that markets premium quality

personal care, wellness and “quality of life” products

under the NHT Global brand, today announced its financial results

for the fourth quarter and full year ended December 31, 2024.

Fourth Quarter

2024 Financial Highlights

- Revenue of $10.8 million was roughly

unchanged compared to $10.9 million in the fourth quarter of 2023.

Revenue from our Hong Kong business increased 9% sequentially and

7% compared to the fourth quarter of 2023.

- Operating loss was $421,000, compared

to $292,000 in the fourth quarter of 2023. The increase primarily

can be attributed to the timing of expenses incurred

year-over-year.

- Net income was $176,000, or $0.02 per

diluted share, compared to $358,000, or $0.03 per diluted share, in

the fourth quarter of 2023.

- The number of Active Members1 were

30,870 at December 31, 2024, roughly unchanged compared to 30,880

at September 30, 2024, and decreased 5% compared to 32,410 at

December 31, 2023.

|

1 |

Natural Health Trends defines Active Members as those that have

placed at least one product order with the Company during the

preceding twelve-month period. |

| |

|

Full Year 2024 Financial

Highlights

- Revenue of $43.0 million decreased 2%

compared to $43.9 million in 2023.

- Operating loss was $1.3 million,

compared to $1.7 million in 2023.

- Net income was $572,000, or $0.05 per

diluted share, compared to $568,000, or $0.05 per diluted share, in

2023.

Management Commentary

"Our fourth quarter performance was steady as our

business in Greater China achieved a 7% increase in net

sales compared to the fourth quarter of 2023 and a 9% increase

compared to last quarter, despite ongoing tepid consumer sentiment.

Overall, our results for the fourth quarter and the full year were

tempered by the performance of other markets, particularly Taiwan

and North America, where we implemented strategic price adjustments

in 2023 and offered fewer product promotions throughout 2024.

However, these changes position us for long-term benefits of

safeguarding margins and reinforcing market discipline."

Corporate Development

In February 2025, the Company relocated its

corporate headquarters from Hong Kong back to Rolling Hills

Estates, California.

Balance Sheet and Cash Flow

- Net cash provided operating activities

was $88,000 in the fourth quarter of 2024, compared net cash used

in operating activities of $69,000 in the fourth quarter of 2023.

Net cash used in operating activities was $3.4 million in 2024,

compared to $4.3 million in 2023. Before tax installment payments,

the liability of which arises from the 2017 U.S. Tax Cuts and Jobs

Act (the “Act Act”), cash provided by operating activities was

$602,000 in 2024, versus cash used in operations of $1.2 million a

year ago. Of the total Tax Act liability of $20.2 million, $15.1

million has been paid to date.

- Total cash, cash equivalents and

marketable securities were $43.9 million as of December 31, 2024,

down from $46.3 million as of September 30, 2024.

- On February 3, 2025, the Company’s

Board of Directors declared a quarterly cash dividend of $0.20 on

each share of common stock outstanding. The dividend will be

payable on February 28, 2025 to stockholders of record as of

February 18, 2025.

The Company expects to issue its 2024 audited

financial results in late February with its Annual Report on Form

10-K to be filed with the United States Securities and Exchange

Commission. These financial results are preliminary and the

accompanying financial statements have not been audited or have not

yet been reviewed by the Company’s independent accountants.

Significant updates and revisions may be required before the

release of the Company’s 2024 audited financial results.

Fourth Quarter and Full Year

2024 Financial Results Conference Call

Management will host a conference call to discuss

the fourth quarter and full year 2024 financial results today,

Wednesday, February 5, 2025 at 11:30 a.m. Eastern Time. The

conference call details are as follows:

|

Date: |

Wednesday, February 5, 2025 |

| Time: |

11:30 a.m. Eastern Time / 8:30

a.m. Pacific Time |

| Dial-in: |

1-877-407-0789

(Domestic)1-201-689-8562 (International) |

| Conference

ID: |

13750282 |

| Webcast: |

https://viavid.webcasts.com/starthere.jsp?ei=1698806&tp_key=ccfcb08f42 |

| |

|

For those unable to participate during the live

broadcast, a replay of the call will also be available from 2:30

p.m. Eastern Time on February 5, 2025 through 11:59 p.m.

Eastern Time on February 12, 2025 by dialing 1-844-512-2921

(domestic) and 1-412-317-6671 (international) and referencing the

replay pin number: 13750282.

About Natural Health Trends

Corp.

Natural Health Trends Corp. (NASDAQ: NHTC) is an

international direct-selling and e-commerce company operating

through its subsidiaries throughout Asia, the Americas, and Europe.

The Company markets premium quality personal care products under

the NHT Global brand. Additional information can be found on the

Company’s website at www.naturalhealthtrendscorp.com.

Forward-Looking Statements

Safe Harbor Statement under the Private Securities

Litigation Reform Act of 1995 -- Forward-looking statements in this

press release do not constitute guarantees of future performance.

Such forward-looking statements are subject to risks and

uncertainties that could cause the Company’s actual results to

differ materially from those anticipated. Such risks and

uncertainties include the risks and uncertainties detailed under

the caption “Risk Factors” in Natural Health Trends Corp.’s Annual

Report on Form 10-K filed on February 28, 2024 with the

Securities and Exchange Commission (SEC), as well as in subsequent

reports filed this year with the SEC. The Company assumes no

obligation to update any forward-looking information contained in

this press release or with respect to the announcements described

herein.

| |

|

|

|

NATURAL HEALTH TRENDS CORP.CONSOLIDATED

BALANCE SHEETS(In thousands, except share

data) |

| |

|

|

| |

December 31, |

|

| |

2024 |

|

|

2023 |

|

| |

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

13,533 |

|

|

$ |

56,178 |

|

|

Marketable securities |

|

30,407 |

|

|

|

— |

|

|

Inventories |

|

3,272 |

|

|

|

4,293 |

|

|

Other current assets |

|

3,771 |

|

|

|

3,758 |

|

| Total current assets |

|

50,983 |

|

|

|

64,229 |

|

| Property and equipment,

net |

|

190 |

|

|

|

266 |

|

| Operating lease right-of-use

assets |

|

2,498 |

|

|

|

3,319 |

|

| Restricted cash |

|

34 |

|

|

|

39 |

|

| Deferred tax asset |

|

382 |

|

|

|

369 |

|

| Other assets |

|

1,272 |

|

|

|

869 |

|

| Total assets |

$ |

55,359 |

|

|

$ |

69,091 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

895 |

|

|

$ |

990 |

|

|

Income taxes payable |

|

4,908 |

|

|

|

3,716 |

|

|

Accrued commissions |

|

2,021 |

|

|

|

2,067 |

|

|

Other accrued expenses |

|

1,425 |

|

|

|

1,170 |

|

|

Deferred revenue |

|

6,428 |

|

|

|

6,166 |

|

|

Amounts held in eWallets |

|

3,286 |

|

|

|

3,945 |

|

|

Operating lease liabilities |

|

1,127 |

|

|

|

1,146 |

|

|

Other current liabilities |

|

709 |

|

|

|

784 |

|

| Total current liabilities |

|

20,799 |

|

|

|

19,984 |

|

| Income taxes payable |

|

— |

|

|

|

5,054 |

|

| Deferred tax liability |

|

174 |

|

|

|

135 |

|

| Operating lease

liabilities |

|

1,514 |

|

|

|

2,318 |

|

| Total liabilities |

|

22,487 |

|

|

|

27,491 |

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

Preferred stock |

|

— |

|

|

|

— |

|

|

Common stock |

|

13 |

|

|

|

13 |

|

|

Additional paid-in capital |

|

84,901 |

|

|

|

84,695 |

|

|

Accumulated deficit |

|

(26,344 |

) |

|

|

(17,703 |

) |

|

Accumulated other comprehensive loss |

|

(1,301 |

) |

|

|

(1,069 |

) |

|

Treasury stock, at cost |

|

(24,397 |

) |

|

|

(24,336 |

) |

| Total stockholders’

equity |

|

32,872 |

|

|

|

41,600 |

|

| Total liabilities and

stockholders’ equity |

$ |

55,359 |

|

|

$ |

69,091 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

NATURAL HEALTH TRENDS

CORP. CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except per share

data) |

| |

|

|

|

|

|

| |

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

(Unaudited) |

|

|

(Unaudited) |

|

|

|

|

|

|

Net sales |

$ |

10,846 |

|

|

$ |

10,937 |

|

|

$ |

42,963 |

|

|

$ |

43,924 |

|

| Cost of sales |

|

2,802 |

|

|

|

2,789 |

|

|

|

11,178 |

|

|

|

11,175 |

|

| Gross profit |

|

8,044 |

|

|

|

8,148 |

|

|

|

31,785 |

|

|

|

32,749 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commissions expense |

|

4,549 |

|

|

|

4,553 |

|

|

|

17,571 |

|

|

|

18,414 |

|

|

Selling, general and administrative expenses |

|

3,916 |

|

|

|

3,837 |

|

|

|

15,513 |

|

|

|

16,006 |

|

| Total operating expenses |

|

8,465 |

|

|

|

8,390 |

|

|

|

33,084 |

|

|

|

34,420 |

|

| Loss from operations |

|

(421 |

) |

|

|

(242 |

) |

|

|

(1,299 |

) |

|

|

(1,671 |

) |

| Other income, net |

|

396 |

|

|

|

708 |

|

|

|

1,919 |

|

|

|

2,416 |

|

| Income (loss) before income

taxes |

|

(25 |

) |

|

|

466 |

|

|

|

620 |

|

|

|

745 |

|

| Income tax provision

(benefit) |

|

(201 |

) |

|

|

108 |

|

|

|

48 |

|

|

|

177 |

|

| Net income |

$ |

176 |

|

|

$ |

358 |

|

|

$ |

572 |

|

|

$ |

568 |

|

| Net income per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.02 |

|

|

$ |

0.03 |

|

|

$ |

0.05 |

|

|

$ |

0.05 |

|

|

Diluted |

$ |

0.02 |

|

|

$ |

0.03 |

|

|

$ |

0.05 |

|

|

$ |

0.05 |

|

| Weighted-average number of

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

11,478 |

|

|

|

11,448 |

|

|

|

11,467 |

|

|

|

11,436 |

|

|

Diluted |

|

11,486 |

|

|

|

11,461 |

|

|

|

11,490 |

|

|

|

11,456 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

NATURAL HEALTH TRENDS CORP.CONSOLIDATED

STATEMENTS OF CASH FLOWS (In

thousands) |

| |

|

|

| |

Year Ended December 31, |

|

| |

2024 |

|

|

2023 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

(Unaudited) |

|

|

|

|

|

| Net income |

$ |

572 |

|

|

$ |

568 |

|

| Adjustments to reconcile net

income to net cash used in operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

131 |

|

|

|

164 |

|

|

Net accretion of marketable securities |

|

(441 |

) |

|

|

— |

|

|

Share-based compensation |

|

145 |

|

|

|

161 |

|

|

Noncash lease expense |

|

1,087 |

|

|

|

1,109 |

|

|

Deferred income taxes |

|

17 |

|

|

|

(178 |

) |

| Changes in assets and

liabilities: |

|

|

|

|

|

|

|

|

Inventories |

|

1,000 |

|

|

|

228 |

|

|

Other current assets |

|

(113 |

) |

|

|

(452 |

) |

|

Other assets |

|

(421 |

) |

|

|

(270 |

) |

|

Accounts payable |

|

(94 |

) |

|

|

181 |

|

|

Income taxes payable |

|

(3,862 |

) |

|

|

(3,299 |

) |

|

Accrued commissions |

|

(19 |

) |

|

|

(866 |

) |

|

Other accrued expenses |

|

271 |

|

|

|

(4 |

) |

|

Deferred revenue |

|

245 |

|

|

|

565 |

|

|

Amounts held in eWallets |

|

(672 |

) |

|

|

(947 |

) |

|

Operating lease liabilities |

|

(1,151 |

) |

|

|

(1,119 |

) |

|

Other current liabilities |

|

(62 |

) |

|

|

(119 |

) |

| Net cash used in operating

activities |

|

(3,367 |

) |

|

|

(4,278 |

) |

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

(57 |

) |

|

|

(46 |

) |

|

Purchases of marketable securities |

|

(70,431 |

) |

|

|

— |

|

|

Proceeds from maturities of marketable securities |

|

40,413 |

|

|

|

— |

|

| Net cash used in investing

activities |

|

(30,075 |

) |

|

|

(46 |

) |

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

|

|

|

|

Dividends paid |

|

(9,213 |

) |

|

|

(9,215 |

) |

| Net cash used in financing

activities |

|

(9,213 |

) |

|

|

(9,215 |

) |

| Effect of exchange rates on

cash, cash equivalents and restricted cash |

|

5 |

|

|

|

10 |

|

| Net decrease in cash, cash

equivalents and restricted cash |

|

(42,650 |

) |

|

|

(13,529 |

) |

| CASH, CASH EQUIVALENTS AND

RESTRICTED CASH, beginning of period |

|

56,217 |

|

|

|

69,746 |

|

| CASH, CASH EQUIVALENTS AND

RESTRICTED CASH, end of period |

$ |

13,567 |

|

|

$ |

56,217 |

|

| SUPPLEMENTAL DISCLOSURE OF

NONCASH INVESTING AND FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Right-of-use assets obtained in exchange for operating lease

liabilities |

$ |

124 |

|

|

$ |

147 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT:

Scott DavidsonSenior Vice President and Chief Financial

OfficerNatural Health Trends Corp.Tel (U.S.):

310-541-0888investor.relations@nhtglobal.com

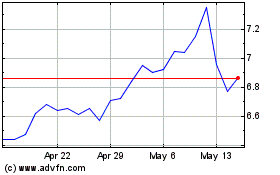

Natural Health Trends (NASDAQ:NHTC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Natural Health Trends (NASDAQ:NHTC)

Historical Stock Chart

From Feb 2024 to Feb 2025