NETSOL Technologies, Inc.

(Nasdaq: NTWK),

a global business services and asset finance solutions provider,

reported results for the second fiscal quarter and six months ended

December 31, 2024.

Najeeb Ghauri, Co-Founder, Chief Executive Officer, and Chairman

of NETSOL Technologies Inc., commented, “Our second quarter of

fiscal 2025 was highlighted by strong growth in recurring revenues

which have been a key strategic focus of ours. During the quarter,

we also made investments in the business which better position us

for long-term growth. While these investments, particularly in AI,

impacted our short-term profitability, they better position us to

capitalize on our established expertise as a leading provider of

business services and asset financing solutions. With a strong

sales pipeline and growing market presence in the US, we believe

that we are well positioned to drive positive results in the full

fiscal year.”

Second Quarter 2025 Financial

Results

Total net revenues for the second quarter of fiscal 2025

increased 2% to $15.5 million, compared with $15.2 million in the

prior year period, driven primarily by increases in subscription

and support revenues and services revenues in the quarter. On a

constant currency basis, total net revenues were $15.4 million.

- Total license fees were $73,000

compared with $3.0 million in the prior year period.

- Total subscription (SaaS and cloud)

and support revenues increased 27% to $8.6 million compared with

$6.8 million in the prior year period. Total subscription and

support revenues as percentage of sales were 56%, compared with 45%

in the prior year period. Included in subscription and support

revenues in the quarter is a one-time catch up of approximately

$1.0 million. Absent this one-time catch up, total subscription and

support revenues in the quarter would have increased approximately

12% compared to the prior year period, which more accurately

reflects increases in contract values. Total subscription and

support revenues on a constant currency basis were $8.6

million.

- Total services revenues increased 26% to $6.8 million, compared

with $5.4 million in the prior year period. Total services revenues

on a constant currency basis were $6.7 million.

Gross profit for the second quarter of fiscal 2025 was $6.9

million or 45% of net revenues, compared to $7.2 million or 47% of

net revenues in the second quarter of fiscal 2024. On a constant

currency basis, gross profit was $6.9 million or 45% of net

revenues.

Operating expenses for the second quarter of fiscal 2025 were

$7.4 million or 48% of sales compared to $6.1 million or 40% of

sales for the second quarter of fiscal 2024. On a constant currency

basis, operating expenses were $7.3 million or 47% of sales. The

increase in operating expenses is primarily related to increased

sales and marketing costs as the Company continues to invest in

growth opportunities.

Loss from operations for the second quarter of fiscal 2025 was

$(487,000) compared to income from operations of $1.0 million in

the second quarter of fiscal 2024. On a constant currency basis,

loss from operations was $389,000.

GAAP net loss attributable to NETSOL for the second quarter of

fiscal 2025 totaled $(1.1 million) or $(0.10) per diluted share,

compared with GAAP net income of $408,000 or $0.04 per diluted

share in the prior year period. Included in GAAP net loss

attributable to NETSOL in the quarter was a loss on foreign

currency exchange transactions of $(698,000).

Non-GAAP EBITDA for the second quarter of fiscal 2025 was a loss

of $(775,000) or $(0.07) per diluted share, compared with non-GAAP

EBITDA of $1.4 million or $0.12 per diluted share in the second

quarter of fiscal 2024 (see note regarding “Use of Non-GAAP

Financial Measures,” below for further discussion of this non-GAAP

measure).

Non-GAAP adjusted EBITDA for the second quarter of fiscal 2025

was a loss of $(789,000) or $(0.07) per diluted share, compared

with a non-GAAP adjusted EBITDA of $725,000 or $0.06 per diluted

share in the prior year period (see note regarding “Use of Non-GAAP

Financial Measures,” below for further discussion of this non-GAAP

measure).

Six Months Ended December 31, 2024, Financial

Results

Total net revenues for the six months ended December 31, 2024,

were $30.1 million, compared to $29.5 million in the prior year

period. On a constant currency basis, total net revenues were $29.8

million.

- License fees totaled $74,000 compared with $4.3 million in the

prior year period. License fees on a constant currency basis were

$71,000.

- Total subscription (SaaS and Cloud) and support revenues for

the six months ended December 31, 2024, increased 26% to $16.8

million from $13.3 million in the prior year period. Subscription

and support revenues in the six months ended December 31, 2024,

included a one-time catch up of approximately $1.7 million. Absent

this one-time catch up, total subscription and support revenues for

the six months ended December 31, 2024 would have increased

approximately 14% compared to the previous period, which more

accurately reflects increases in contract values. Total

subscription and support revenues on a constant currency basis were

$16.7 million.

- Total services revenues increased 11% to $13.2 million from

$11.9 million in the prior year period. Total services revenues on

a constant currency basis were $13.0 million. The increase in total

services revenues during this period is primarily related to

increased implementation services in the US and the UK.

Gross profit for the six months ended December 31, 2024, was

$13.5 million or 45% of net revenues, compared with $13.3 million

of 45% of net revenues in the prior year period. On a constant

currency basis, gross profit for the six months ended December 31,

2024, was $13.6 million or 46% of net revenues as measured on a

constant currency basis.

Operating expenses for the six months ended December 31, 2024,

were $14.7 million or 49% of sales, compared with $12.0 million or

41% of sales in the prior year period. On a constant currency

basis, operating expenses for the six months ended December 31,

2024, were $14.4 million or 48% of sales on as measured on a

constant currency basis.

GAAP net loss attributable to NETSOL for the six months ended

December 31, 2024, totaled $(1.1 million) or $(0.09) per diluted

share, compared with GAAP net income of $439,000 or $0.04 per

diluted share in the prior year period. On a constant currency

basis, GAAP net loss attributable to NETSOL for the first six

months of fiscal 2025 totaled $(877,000) or $(0.08) per diluted

share.

Non-GAAP EBITDA for the six months ended December 31, 2024, was

a loss of $(473,000) or $(0.04) per diluted share, compared with

non-GAAP EBITDA of $2.2 million or $0.19 per diluted share in the

prior year period (see note regarding “Use of Non-GAAP Financial

Measures,” below for further discussion of this non-GAAP

measure).

Non-GAAP adjusted EBITDA for the six months ended December 31,

2024, was a loss of $(585,000) or $(0.05) per diluted share,

compared with non-GAAP adjusted EBITDA of $1.2 million or $0.10 per

diluted share in the prior year period (see note regarding “Use of

Non-GAAP Financial Measures,” below for further discussion of this

non-GAAP measure).

Balance Sheet and Capital Structure

Cash and cash equivalents was $21.3 million as of December 31,

2024, compared with $19.1 million as of June 30, 2024. Working

capital was $23.0 million as of December 31, 2024, compared with

$23.6 million as of June 30, 2024. Total NETSOL stockholders’

equity at December 31, 2024, was $33.9 million or $2.91 per

share.

Management Commentary

Najeeb Ghauri, Co-Founder, Chief Executive Officer, and Chairman

of NETSOL Technologies Inc., commented, “We’re investing in AI

product development to enhance our already robust suite of asset

finance and leasing solutions. Our Transcend Retail platform is

gaining encouraging traction, primarily driven by our agreement

with a major German auto manufacturer that continues to ramp.

Internationally, we announced a multi-million dollar expansion

agreement during the quarter with a longstanding customer in China,

and subsequent to the quarter, we expanded an existing agreement

with a leading Japanese equipment finance company that is now live

with our Transcend Finance platform in their operations in New

Zealand and Australia. Contracts like these demonstrate both the

depth of our customer relationships, and the superior performance

and reliability of our products.”

Roger Almond, Chief Financial Officer of NETSOL Technologies

Inc., commented, “The growth in recurring revenues during the

quarter demonstrates the continued evolution of our business model

that over time should drive enhanced predictability and

profitability in our business. During the quarter, the strategic

investments we made in sales and marketing, coupled with the

fluctuation in our licensing revenue as well as fluctuations in the

foreign currency exchange rate, impacted our profitability. We are

confident that the sustained growth in our recurring revenue,

coupled with the investments we are making in the long-term growth

of our business will translate into enhanced value for our

shareholders. Importantly, our robust balance sheet with

substantial cash and shareholders’ equity provides a strong

financial underpinning to the business as we execute on our

strategy.”

Conference Call

NETSOL Technologies management will hold a conference call on

Thursday, February 13, at 9:00 a.m. Eastern Time (6:00 a.m. Pacific

Time) to discuss these financial results. A question-and-answer

session will follow management's presentation.

U.S. dial-in: 877-407-0789International dial-in:

201-689-8562

Please call the conference telephone number 5-10 minutes prior

to the start time and provide the operator with the conference ID:

NETSOL. The operator will register your name and organization. If

you have any difficulty connecting with the conference call, please

contact Investor Relations at 203-972-9200.

The conference call will also be broadcast live and available

for replay here, along with additional replay access being

provided through the company information section of NETSOL’s

website.

A telephone replay of the conference call will be available

approximately three hours after the call concludes through

Thursday, February 27, 2024.

Toll-free replay number: 844-512-2921International replay

number: 412-317-6671Replay ID: 13751199

About NETSOL TechnologiesNETSOL Technologies,

Inc. (Nasdaq: NTWK) is a worldwide provider of IT and enterprise

software solutions primarily serving the global leasing and finance

industry. The Company’s suite of applications is backed by 40 years

of domain expertise and supported by a committed team of

professionals placed in ten strategically located support and

delivery centers throughout the world. NETSOL’s products help

companies transform their finance and leasing operations, providing

a fully automated asset-based finance solution covering the

complete leasing and finance lifecycle.

Forward-Looking StatementsThis press release

may contain forward-looking statements relating to the development

of the Company's products and services and future operation

results, including statements regarding the Company that are

subject to certain risks and uncertainties that could cause actual

results to differ materially from those projected. The words

“expects,” “anticipates,” variations of such words, and similar

expressions, identify forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995, but their

absence does not mean that the statement is not forward-looking.

These statements are not guarantees of future performance and are

subject to certain risks, uncertainties, and assumptions that are

difficult to predict. Factors that could affect the Company's

actual results include the progress and costs of the development of

products and services and the timing of the market acceptance. The

subject Companies expressly disclaim any obligation or undertaking

to update or revise any forward-looking statement contained herein

to reflect any change in the company's expectations with regard

thereto or any change in events, conditions or circumstances upon

which any statement is based.

Use of Non-GAAP Financial MeasuresThe

reconciliation of Adjusted EBITDA to net income, the most

comparable financial measure based upon GAAP, as well as a further

explanation of adjusted EBITDA, is included in the financial tables

in Schedule 4 of this press release.

Investor Relations Contact:

IMS Investor

Relationsnetsol@imsinvestorrelations.com+1 203-972-9200

| |

|

| |

NETSOL Technologies, Inc. and

Subsidiaries1: Consolidated Balance

Sheets |

| |

|

| |

ASSETS |

December 31, 2024 |

|

June 30, 2024 |

| Current

assets: |

|

|

|

| |

Cash and cash

equivalents |

$ |

21,270,642 |

|

|

$ |

19,127,165 |

|

| |

Accounts

receivable, net of allowance of $17,028 and $398,809 |

|

7,829,823 |

|

|

|

13,049,614 |

|

| |

Revenues in excess

of billings, net of allowance of $595,875 and $116,148 |

|

10,661,549 |

|

|

|

12,684,518 |

|

| |

Other current

assets |

|

3,191,378 |

|

|

|

2,600,786 |

|

|

|

|

Total current assets |

|

42,953,392 |

|

|

|

47,462,083 |

|

| Revenues in excess

of billings, net - long term |

|

777,428 |

|

|

|

954,029 |

|

| Property and

equipment, net |

|

4,934,498 |

|

|

|

5,106,842 |

|

| Right of use

assets - operating leases |

|

1,069,948 |

|

|

|

1,328,624 |

|

| Other assets |

|

32,339 |

|

|

|

32,340 |

|

| Intangible assets,

net |

|

- |

|

|

|

- |

|

| Goodwill |

|

9,302,524 |

|

|

|

9,302,524 |

|

| |

|

Total

assets |

$ |

59,070,129 |

|

|

$ |

64,186,442 |

|

| |

|

|

|

|

|

| |

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Current

liabilities: |

|

|

|

| |

Accounts payable

and accrued expenses |

$ |

7,332,560 |

|

|

$ |

8,232,342 |

|

| |

Current portion of

loans and obligations under finance leases |

|

8,784,232 |

|

|

|

6,276,125 |

|

| |

Current portion of

operating lease obligations |

|

518,075 |

|

|

|

608,202 |

|

| |

Unearned

revenue |

|

3,320,286 |

|

|

|

8,752,153 |

|

| |

|

Total current

liabilities |

|

19,955,153 |

|

|

|

23,868,822 |

|

| Loans and

obligations under finance leases; less current maturities |

|

86,951 |

|

|

|

95,771 |

|

| Operating lease

obligations; less current maturities |

|

512,062 |

|

|

|

688,749 |

|

| |

|

Total

liabilities |

|

20,554,166 |

|

|

|

24,653,342 |

|

| |

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

| |

Preferred stock,

$.01 par value; 500,000 shares authorized; |

|

- |

|

|

|

- |

|

| |

Common stock, $.01

par value; 14,500,000 shares authorized; |

|

|

|

| |

|

12,589,046 shares issued and

11,650,015 outstanding as of December 31, 2024 , |

|

|

|

| |

|

12,359,922 shares issued and

11,420,891 outstanding as of June 30, 2024 |

|

125,894 |

|

|

|

123,602 |

|

| |

Additional

paid-in-capital |

|

129,194,697 |

|

|

|

128,783,865 |

|

| |

Treasury stock (at

cost, 939,031 shares |

|

|

|

| |

as of December 31,

2024 and June 30, 2024) |

|

(3,920,856 |

) |

|

|

(3,920,856 |

) |

| |

Accumulated

deficit |

|

(45,288,560 |

) |

|

|

(44,212,313 |

) |

| |

Other

comprehensive loss |

|

(46,187,766 |

) |

|

|

(45,935,616 |

) |

| |

|

Total NetSol

stockholders' equity |

|

33,923,409 |

|

|

|

34,838,682 |

|

| |

Non-controlling

interest |

|

4,592,554 |

|

|

|

4,694,418 |

|

| |

|

Total stockholders'

equity |

|

38,515,963 |

|

|

|

39,533,100 |

|

| |

|

Total liabilities and

stockholders' equity |

$ |

59,070,129 |

|

|

$ |

64,186,442 |

|

|

|

|

NETSOL Technologies, Inc. and

SubsidiariesSchedule 2: Consolidated Statement of

Operations |

| |

| |

|

|

For the Three Months |

|

For the Six Months |

|

|

|

|

Ended December 31, |

|

Ended December 31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

Revenues: |

|

|

|

|

|

|

|

| |

License fees |

$ |

72,688 |

|

|

$ |

2,990,453 |

|

|

$ |

73,917 |

|

|

$ |

4,270,902 |

|

| |

Subscription and

support |

|

8,642,629 |

|

|

|

6,827,781 |

|

|

|

16,835,100 |

|

|

|

13,340,024 |

|

| |

Services |

|

6,821,344 |

|

|

|

5,419,707 |

|

|

|

13,226,142 |

|

|

|

11,869,196 |

|

| |

|

Total net revenues |

|

15,536,661 |

|

|

|

15,237,941 |

|

|

|

30,135,159 |

|

|

|

29,480,122 |

|

| |

|

|

|

|

|

|

|

|

|

| Cost of

revenues |

|

8,616,320 |

|

|

|

8,062,204 |

|

|

|

16,650,706 |

|

|

|

16,142,368 |

|

| Gross

profit |

|

6,920,341 |

|

|

|

7,175,737 |

|

|

|

13,484,453 |

|

|

|

13,337,754 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

| |

Selling, general

and administrative |

|

7,073,622 |

|

|

|

5,807,494 |

|

|

|

14,037,943 |

|

|

|

11,240,463 |

|

| |

Research and

development cost |

|

333,669 |

|

|

|

341,411 |

|

|

|

693,618 |

|

|

|

719,830 |

|

| |

|

Total operating expenses |

|

7,407,291 |

|

|

|

6,148,905 |

|

|

|

14,731,561 |

|

|

|

11,960,293 |

|

| |

|

|

|

|

|

|

|

|

|

| Income

(loss) from operations |

|

(486,950 |

) |

|

|

1,026,832 |

|

|

|

(1,247,108 |

) |

|

|

1,377,461 |

|

| |

|

|

|

|

|

|

|

|

|

| Other

income and (expenses) |

|

|

|

|

|

|

|

| |

Interest

expense |

|

(236,386 |

) |

|

|

(290,322 |

) |

|

|

(494,605 |

) |

|

|

(566,339 |

) |

| |

Interest

income |

|

529,072 |

|

|

|

468,280 |

|

|

|

1,298,939 |

|

|

|

882,998 |

|

| |

Gain (loss) on

foreign currency exchange transactions |

|

(698,392 |

) |

|

|

(14,617 |

) |

|

|

(155,847 |

) |

|

|

(148,870 |

) |

| |

Other income |

|

38,064 |

|

|

|

(57,305 |

) |

|

|

191,555 |

|

|

|

576 |

|

| |

|

Total other income

(expenses) |

|

(367,642 |

) |

|

|

106,036 |

|

|

|

840,042 |

|

|

|

168,365 |

|

| |

|

|

|

|

|

|

|

|

|

| Net income

before income taxes |

|

(854,592 |

) |

|

|

1,132,868 |

|

|

|

(407,066 |

) |

|

|

1,545,826 |

|

| Income tax

provision |

|

(331,614 |

) |

|

|

(150,053 |

) |

|

|

(561,431 |

) |

|

|

(271,948 |

) |

| Net

income |

|

(1,186,206 |

) |

|

|

982,815 |

|

|

|

(968,497 |

) |

|

|

1,273,878 |

|

| |

Non-controlling interest |

|

39,164 |

|

|

|

(574,499 |

) |

|

|

(107,750 |

) |

|

|

(834,672 |

) |

| Net income

attributable to NetSol |

$ |

(1,147,042 |

) |

|

$ |

408,316 |

|

|

$ |

(1,076,247 |

) |

|

$ |

439,206 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net income

per share: |

|

|

|

|

|

|

|

| |

Net income per

common share |

|

|

|

|

|

|

|

| |

|

Basic |

$ |

(0.10 |

) |

|

$ |

0.04 |

|

|

$ |

(0.09 |

) |

|

$ |

0.04 |

|

| |

|

Diluted |

$ |

(0.10 |

) |

|

$ |

0.04 |

|

|

$ |

(0.09 |

) |

|

$ |

0.04 |

|

| |

|

|

|

|

|

|

|

|

|

| Weighted average

number of shares outstanding |

|

|

|

|

|

|

|

| |

Basic |

|

11,484,298 |

|

|

|

11,372,819 |

|

|

|

11,456,996 |

|

|

|

11,359,338 |

|

| |

Diluted |

|

11,484,298 |

|

|

|

11,372,819 |

|

|

|

11,456,996 |

|

|

|

11,359,338 |

|

|

|

|

NETSOL Technologies, Inc. and

SubsidiariesSchedule 3: Consolidated Statement of

Cash Flows |

| |

| |

|

|

|

For the Six Months |

| |

|

|

|

Ended December 31, |

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

| Cash flows

from operating activities: |

|

|

|

| |

Net income

(loss) |

$ |

(968,497 |

) |

|

$ |

1,273,878 |

|

| |

Adjustments to

reconcile net income (loss) to net cash |

|

|

|

| |

|

provided by

operating activities: |

|

|

|

| |

Depreciation and

amortization |

|

738,582 |

|

|

|

959,949 |

|

| |

Provision (reversal) for bad

debts |

|

|

|

475,172 |

|

|

|

29,191 |

|

| |

Gain on sale of

assets |

|

(25,084 |

) |

|

|

(98 |

) |

| |

Stock based

compensation |

|

95,134 |

|

|

|

111,787 |

|

| |

Changes in

operating assets and liabilities: |

|

|

|

| |

|

Accounts

receivable |

|

4,405,610 |

|

|

|

5,722,791 |

|

| |

|

Revenues in excess

of billing |

|

2,688,774 |

|

|

|

(4,239,762 |

) |

| |

|

Other current

assets |

|

(170,856 |

) |

|

|

329,171 |

|

| |

|

Accounts payable

and accrued expenses |

|

(878,148 |

) |

|

|

72,501 |

|

| |

|

Unearned

revenue |

|

(5,990,971 |

) |

|

|

(3,654,724 |

) |

| |

Net cash

provided by operating activities |

|

369,716 |

|

|

|

604,684 |

|

| |

|

|

|

|

|

|

| Cash flows

from investing activities: |

|

|

|

| |

Purchases of

property and equipment |

|

(568,134 |

) |

|

|

(570,584 |

) |

| |

Sales of property

and equipment |

|

45,535 |

|

|

|

1,248 |

|

| |

Purchase of

subsidiary shares |

|

(8,878 |

) |

|

|

- |

|

| |

Net cash

used in investing activities |

|

(531,477 |

) |

|

|

(569,336 |

) |

| |

|

|

|

|

|

|

| Cash flows

from financing activities: |

|

|

|

| |

Proceeds from the

exercise of stock options and warrants |

|

430,000 |

|

|

|

- |

|

| |

Dividend paid by

subsidiary to non-controlling interest |

|

(306,799 |

) |

|

|

- |

|

| |

Proceeds from bank

loans |

|

2,676,932 |

|

|

|

135,123 |

|

| |

Payments on

finance lease obligations and loans - net |

|

(162,370 |

) |

|

|

(162,482 |

) |

| |

Net cash

provided by (used in) financing activities |

|

2,637,763 |

|

|

|

(27,359 |

) |

| Effect of

exchange rate changes |

|

(332,525 |

) |

|

|

118,273 |

|

| Net

increase (decrease) in cash and cash equivalents |

|

2,143,477 |

|

|

|

126,262 |

|

| Cash and cash

equivalents at beginning of the period |

|

19,127,165 |

|

|

|

15,533,254 |

|

| Cash and

cash equivalents at end of period |

$ |

21,270,642 |

|

|

$ |

15,659,516 |

|

|

|

|

NETSOL Technologies, Inc. and

SubsidiariesSchedule 4: Reconciliation to

GAAP |

| |

| |

For the Three Months |

|

For the Six Months |

|

|

Ended December 31, |

|

Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

| Net Income (loss) attributable

to NetSol |

$ |

(1,147,042 |

) |

|

$ |

408,316 |

|

|

$ |

(1,076,247 |

) |

|

$ |

439,206 |

|

|

Non-controlling interest |

|

(39,164 |

) |

|

|

574,499 |

|

|

|

107,750 |

|

|

|

834,672 |

|

|

Income taxes |

|

331,614 |

|

|

|

150,053 |

|

|

|

561,431 |

|

|

|

271,948 |

|

|

Depreciation and amortization |

|

372,585 |

|

|

|

429,163 |

|

|

|

738,582 |

|

|

|

959,949 |

|

|

Interest expense |

|

236,386 |

|

|

|

290,322 |

|

|

|

494,605 |

|

|

|

566,339 |

|

|

Interest (income) |

|

(529,072 |

) |

|

|

(468,280 |

) |

|

|

(1,298,939 |

) |

|

|

(882,998 |

) |

| EBITDA |

$ |

(774,693 |

) |

|

$ |

1,384,073 |

|

|

$ |

(472,818 |

) |

|

$ |

2,189,116 |

|

| Add back: |

|

|

|

|

|

|

|

|

Non-cash stock-based compensation |

|

47,355 |

|

|

|

51,433 |

|

|

|

95,134 |

|

|

|

111,787 |

|

| Adjusted EBITDA, gross |

$ |

(727,338 |

) |

|

$ |

1,435,506 |

|

|

$ |

(377,684 |

) |

|

$ |

2,300,903 |

|

| Less non-controlling interest

(a) |

|

(61,529 |

) |

|

|

(710,171 |

) |

|

|

(207,310 |

) |

|

|

(1,109,611 |

) |

| Adjusted EBITDA, net |

$ |

(788,867 |

) |

|

$ |

725,335 |

|

|

$ |

(584,994 |

) |

|

$ |

1,191,292 |

|

| |

|

|

|

|

|

|

|

| Weighted Average number of

shares outstanding |

|

|

|

|

|

|

|

| Basic |

|

11,484,298 |

|

|

|

11,372,819 |

|

|

|

11,456,996 |

|

|

|

11,359,338 |

|

| Diluted |

|

11,484,298 |

|

|

|

11,372,819 |

|

|

|

11,456,996 |

|

|

|

11,359,338 |

|

| |

|

|

|

|

|

|

|

| Basic adjusted EBITDA |

$ |

(0.07 |

) |

|

$ |

0.06 |

|

|

$ |

(0.05 |

) |

|

$ |

0.10 |

|

| Diluted adjusted EBITDA |

$ |

(0.07 |

) |

|

$ |

0.06 |

|

|

$ |

(0.05 |

) |

|

$ |

0.10 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| (a)The reconciliation of

adjusted EBITDA of non-controlling interest |

|

|

|

|

|

|

|

| to net income attributable to

non-controlling interest is as follows |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Net Income (loss) attributable

to non-controlling interest |

$ |

(39,164 |

) |

|

$ |

574,499 |

|

|

$ |

107,750 |

|

|

$ |

834,672 |

|

|

Income Taxes |

|

102,414 |

|

|

|

75,407 |

|

|

|

173,001 |

|

|

|

111,784 |

|

|

Depreciation and amortization |

|

92,546 |

|

|

|

109,765 |

|

|

|

181,681 |

|

|

|

251,116 |

|

|

Interest expense |

|

68,636 |

|

|

|

91,295 |

|

|

|

147,828 |

|

|

|

177,184 |

|

|

Interest (income) |

|

(165,365 |

) |

|

|

(144,578 |

) |

|

|

(408,012 |

) |

|

|

(272,669 |

) |

| EBITDA |

$ |

59,067 |

|

|

$ |

706,388 |

|

|

$ |

202,248 |

|

|

$ |

1,102,087 |

|

| Add back: |

|

|

|

|

|

|

|

|

Non-cash stock-based compensation |

|

2,462 |

|

|

|

3,783 |

|

|

|

5,062 |

|

|

|

7,524 |

|

| Adjusted EBITDA of

non-controlling interest |

$ |

61,529 |

|

|

$ |

710,171 |

|

|

$ |

207,310 |

|

|

$ |

1,109,611 |

|

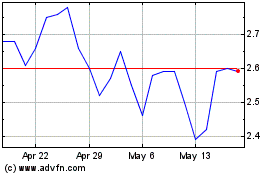

NetSol Technologies (NASDAQ:NTWK)

Historical Stock Chart

From Jan 2025 to Feb 2025

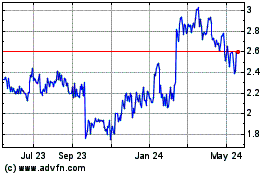

NetSol Technologies (NASDAQ:NTWK)

Historical Stock Chart

From Feb 2024 to Feb 2025