false

0001661053

0001661053

2024-03-06

2024-03-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 6, 2024

enVVeno

Medical Corporation

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38325 |

|

33-0936180 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

70

Doppler

Irvine,

California 92618

(Address

of principal executive offices) (Zip Code)

(949)

261-2900

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.00001 per share |

|

NVNO |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01 Regulation FD Disclosure.

On

March 6, 2024, enVVeno Medical Corporation (“we,” “us,” “our,” or the “Company”) issued

a press release announcing that positive topline efficacy data showing significant clinical improvement from the SAVVE U.S. pivotal trial

for the VenoValve is being presented today at the 2024 American Venous Forum (AFV) Annual Meeting in Tampa, Florida. The press release

is being furnished as Exhibit 99.1 to this report.

Statements

that are not historical fact may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements are not statements of historical facts, but rather reflect our current expectations concerning

future events and results. We generally use the words “believes,” “expects,” “intends,” “plans,”

“anticipates,” “likely,” “will” and similar expressions to identify forward-looking statements. Such

forward-looking statements, including those concerning our clinical trials, involve risks, uncertainties and other factors, some of which

are beyond our control, which may cause our actual results, performance or achievements, or industry results, to be materially different

from any future results, performance, or achievements expressed or implied by such forward-looking statements. These risks, uncertainties

and factors include, but are not limited to, those factors set forth in “Item 1A - Risk Factors” and other sections of our

most recent Annual Report on Form 10-K as well as in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. We undertake

no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise,

except as required by law. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented

in this Current Report.

Item

9.01 Financial Statements and Exhibits.

Set

forth below is a list of Exhibits included as part of this Current Report:

| Exhibit

No. |

|

Description |

| 99.1 |

|

Press Release |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ENVVENO

MEDICAL CORPORATION |

| |

|

| Dated:

March 6, 2024 |

/s/

Robert A. Berman |

| |

Robert

A. Berman |

| |

Chief

Executive Officer |

Exhibit

99.1

Positive

Topline Efficacy Data Showing Significant Clinical Improvement from enVVeno Medical’s VenoValve® Pivotal Trial to

be Presented Today at the VENOUS2024 American Venous Forum Annual Meeting

97%

of VenoValve Study Patients Showing Clinical Improvement at Six Months (as Measured by the Revised Venous Clinical Severity Score (rVCSS))

74%

of the Study Patients Showing Clinical Meaningful Benefit from the VenoValve at Six Months (Improvement in rVCSS of 3 or More Points)

Average

rVCSS Improvement Per Patient is 8 Points, More Than Two and a Half Times the Amount Needed to Show the VenoValve’s Clinically

Meaningful Benefit

Company

on Track to File Application Seeking VenoValve FDA Approval in Q4 2024

Company

to Host Live Webcast with Presenting PI, Today, March 6th at 1:30 PM ET – Access the Webcast Here

IRVINE,

Calif. – March 6, 2024 – enVVeno Medical Corporation (Nasdaq: NVNO) (“enVVeno” or the “Company”),

a company setting new standards of care for the treatment of venous disease, today announced the

presentation of positive topline efficacy data showing significant clinical improvement from the SAVVE U.S. pivotal trial for the VenoValve

at the 2024 American Venous Forum (AFV) Annual Meeting in Tampa, Florida. The data being presented today shows that overall, 97%

of the study patients receiving the VenoValve have shown clinical improvement as measured by revised Venous Clinical Severity Score (rVCSS),

74% of the study patients have improved the 3 or more rVCSS points needed to demonstrate the VenoValve’s clinically meaningful

benefit, and the average amount of per patient improvement for patients showing clinically meaningful benefit is 8 points, more than

two and a half times the amount of rVCSS improvement required by the U.S. Food and Drug Administration (FDA) to show that the VenoValve

provides clinically meaningful benefit. All of the reported data was derived by comparing rVCSS patient evaluations at six months to

baseline readings taken prior to VenoValve implantation. The Company will host a live webcast to discuss the results, today, March

6, 2024, at 1:30 PM ET (details below) – access it here.

“The

results that we are seeing exceed our expectations and we are thrilled with both the number of patients whose Chronic Venous Insufficiency

(CVI) is improving, and the amount of clinical improvement that we are seeing across our study population,” said Robert Berman,

enVVeno Medical’s CEO. “A large portion of our patients are not only getting better, they are getting a lot better. This

means that many of the study participants have progressed from having severe, debilitating CVI, to a much more mild form of the disease,

or no disease at all. It is extremely gratifying to see widespread and dramatic improvements in patients that have no other effective

treatment options.”

In

assessing the benefit and risk of a novel technology such as the VenoValve, which addresses an unmet medical need, the FDA considers

a variety of factors including whether a medical device provides a clinically meaningful benefit compared to existing technologies. Patients

who were enrolled in the SAVVE study all showed little or no improvement after at least three months of conventional treatment with existing

technologies (compression therapy, leg elevation, and wound care for venous ulcer patients). For severe CVI patients, an improvement

in the rVCSS of 3 or more points is considered by the FDA to be evidence of clinically meaningful benefit.

The

rVCSS is an objective grading system used by vascular specialists throughout the world to report clinical outcomes and responses to treatments

for venous diseases such as CVI. The score consists of 10 categories graded from 0 to 3 and includes patient reported outcomes and physician

assessments.

Severe

CVI is a debilitating disease that is most often caused by blood clots (deep vein thromboses or DVTs) in the deep veins of the leg. When

valves inside of the veins of the leg fail, blood flows in the wrong direction and pools in the lower leg, causing pressure within the

veins of the leg to increase (venous hypertension). Symptoms of severe CVI include leg swelling, pain, edema, and in the most severe

cases, recurrent open sores known as venous ulcers. The disease can severely impact everyday functions such as sleeping, bathing, and

walking, and is known to result in high rates of depression and anxiety. There are currently no effective treatments for severe CVI of

the deep vein system caused by valvular incompetence and the Company estimates that there are approximately 2.5 million new patients

each year in the U.S. that could be candidates for the VenoValve.

The

FDA has asked the Company to collect a minimum of one year of data on all SAVVE patients prior to filing its PMA application seeking

FDA approval, which the Company will have completed collecting in September of 2024. As of December 31, 2023, the Company had cash and

investments of $46.4 million on hand, which should be sufficient capital to fund operations through an FDA decision on the VenoValve

and the end of 2025.

The

Surgical Anti-reflux Venous Valve Endoprosthesis (SAVVE) U.S. pivotal study for the VenoValve is a

prospective, non-blinded, single arm, multi-center study of seventy-five (75) CVI patients enrolled at 21 U.S. sites. The presentation

at AVF will be made by primary investigator Dr. Cassius Iyad Ochoa Chaar MD, MS, RPVI, Associate Professor of Surgery, Division of Vascular

Surgery, Yale School of Medicine, the top enrolling site for the trial. To hear from patients in the SAVVE study, see examples of venous

ulcer healing caused by the VenoValve, and learn more about the SAVVE pivotal trial, please visit enVVeno.com.

Webcast

Details

The

Company will host a webcast presentation to discuss the results for investors, analysts, and other interested parties today, March

6, 2024, at 1:30 PM ET. Joining enVVeno management for the event will be Dr. Chaar. The live webcast will be accessible on

the Events page of the enVVeno website, envveno.com, and will be archived for 90 days.

About

enVVeno Medical Corporation

enVVeno

Medical (NASDAQ:NVNO) is an Irvine, California-based, late clinical-stage medical device Company focused on the advancement of innovative

bioprosthetic (tissue-based) solutions to improve the standard of care for the treatment of venous disease. The Company’s lead

product, the VenoValve®, is a first-in-class surgical replacement venous valve being developed for the treatment of deep

venous Chronic Venous Insufficiency (CVI). The Company is also developing a non-surgical, transcatheter based replacement venous valve

for the treatment of deep venous CVI called enVVe®. CVI occurs when valves inside of the veins of the leg become damaged,

resulting in the backwards flow of blood (reflux), blood pooling in the lower leg, increased pressure in the veins of the leg (venous

hypertension) and in severe cases, venous ulcers that are difficult to heal and become chronic. Both the VenoValve and enVVe are designed

to act as one-way valves, to help assist in propelling blood up the leg, and back to the heart and lungs. The VenoValve is currently

being evaluated in the SAVVE U.S. pivotal study and the company is currently performing the final testing necessary to seek approval

for the enVVe pivotal trial.

Cautionary

Note on Forward-Looking Statements

This

press release and any statements of stockholders, directors, employees, representatives and partners of enVVeno Medical Corporation (the

“Company”) related thereto contain, or may contain, among other things, certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve significant risks

and uncertainties. Such statements may include, without limitation, statements identified by words such as “projects,” “may,”

“will,” “could,” “would,” “should,” “believes,” “expects,” “anticipates,”

“estimates,” “intends,” “plans,” “potential” or similar expressions. These statements

are based upon the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties,

including those detailed in the Company’s filings with the Securities and Exchange Commission. Actual results and timing (may differ

significantly from those set forth or implied in the forward-looking statements. Forward-looking statements involve certain risks and

uncertainties that are subject to change based on various factors (many of which are beyond the Company’s control). The Company

undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future presentations

or otherwise, except as required by applicable law.

###

INVESTOR

CONTACT:

Jenene

Thomas, JTC Team, LLC

NVNO@jtcir.com

(833)

475-8247

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

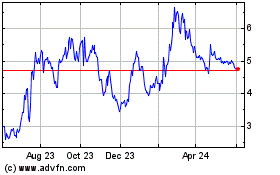

enVVeno Medical (NASDAQ:NVNO)

Historical Stock Chart

From Feb 2025 to Mar 2025

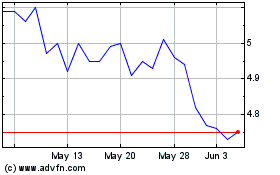

enVVeno Medical (NASDAQ:NVNO)

Historical Stock Chart

From Mar 2024 to Mar 2025