Eightco Announces Third Quarter 2024 Financial Results

15 November 2024 - 9:15AM

Eightco Holdings Inc. (NASDAQ: OCTO) (the “Company” or “Eightco”)

today announced financial results for the three months ended

September 30, 2024.

Paul Vassilakos, CEO of Eightco and President of

Forever 8 Fund, LLC (“Forever 8”), the Company’s largest

subsidiary, said “The Company continues to focus on prioritizing

the Forever 8 business in providing inventory capital for

e-commerce sellers and refurbished Apple product sellers. The

Company was pleased to regain compliance with Nasdaq listing

requirements at the end of September 2024, and believes it is now

in a strong position to replace the capital used to repay the $5.4

million in convertible notes and deliver on its plan for 2025

revenues of $100 million.”

Financial Highlights and Commentary

During the nine months ended September 30, 2024,

Eightco took significant steps to resolve certain deficiencies with

its Nasdaq Listing, as well as raise equity capital at attractive

levels:

- As of September 30, 2024, the

Company had sold 627,390 shares of common stock for net proceeds of

$2,207,933 under its At-The-Market Issuance Sales Agreement

(average price of $3.52 per share)As of November 14, 2024, there

are 2,441,363 shares of common stock outstanding

Repayment of the convertible note reduced the

Company’s capital base by $5.4 million which resulted in a decrease

in top line revenues as compared to the prior year quarter. The

focus on the operations of Eightco’s Forever 8 subsidiary also

allowed for a reduction in selling, general and administrative

expenses.

- Third quarter 2024 net loss of

($3.2) million compared to net loss of ($3.5) million for the prior

year quarter, due to better gross margins

- Third quarter 2024 revenues of $7.7

million compared to $23.3 million in the prior year quarter, driven

by reduction in capital available for cell phone sales after

repayment of the previously outstanding convertible note

- Third quarter 2024 gross profit of

$2.0 million compared to $2.7 million in the prior year quarter,

driven by reduction in capital available for cell phone sales after

repayment of the previously outstanding convertible note

- Third quarter 2024 gross profit

margin of 26.7%, compared to 11.8% in the prior year quarter, due

to a decrease in cell phone sales which typically have lower

margins

- Third quarter 2024 SG&A of $3.7

million, up 14.65% from $3.2 million in the prior year quarter,

driven by an increase in professional expenses

- Third quarter 2024 EBITDA loss of

($1.0) million compared to an EBITDA loss of ($0.0) million in the

prior year quarter, driven by an increase in professional expenses

and decrease in gross profit

- Third quarter 2024 Adjusted EBITDA

loss of ($0.9) million compared to an Adjusted EBITDA loss of

($0.1) million in the prior year quarter, driven by an increase in

professional expenses and decrease in gross profit

| |

For the Three Months Ended |

|

|

September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues, net |

|

$ |

7,672,395 |

|

|

$ |

23,334,588 |

|

| Cost of revenues |

|

|

5,625,524 |

|

|

|

20,587,284 |

|

|

Gross profit |

|

|

2,046,871 |

|

|

|

2,747,304 |

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

| Selling, general and

administrative expenses |

|

$ |

3,723,191 |

|

|

$ |

3,247,561 |

|

| Restructuring and

severance |

|

|

- |

|

|

|

187,286 |

|

| Impairment |

|

|

- |

|

|

|

- |

|

|

Total operating expenses |

|

|

3,723,191 |

|

|

|

3,434,847 |

|

| Operating loss |

|

|

(1,676,320 |

) |

|

|

(687,543 |

) |

|

Net income (loss) |

|

|

(3,177,373 |

) |

|

|

(3,453,150 |

) |

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

|

|

September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

| Net income

(loss) |

|

|

(3,177,373 |

) |

|

|

(3,453,150 |

) |

| Interest (income) expense,

net |

|

|

1,525,274 |

|

|

|

2,795,169 |

|

| Income tax expense |

|

|

- |

|

|

|

- |

|

| Depreciation and

amortization |

|

|

612,634 |

|

|

|

644,250 |

|

| EBITDA |

|

|

(1,039,465 |

) |

|

|

(13,731 |

) |

| Stock-based compensation |

|

|

128,480 |

|

|

|

(46,875 |

) |

| Loss on issuance of

warrants |

|

|

- |

|

|

|

- |

|

| Gain on extinguishment of

liabilities |

|

|

- |

|

|

|

- |

|

| Adjusted EBITDA |

|

|

(910,985 |

) |

|

|

(60,606 |

) |

Reconciliation of EBITDA and Adjusted

EBITDA

EBITDA and Adjusted EBITDA are non-GAAP

performance measures. Management believes EBITDA and Adjusted

EBITDA, in addition to operating profit, net (loss) income and

other GAAP measures, are useful to investors to evaluate the

Company’s results because they exclude certain items that are not

directly related to the Company’s core operating performance.

Investors should recognize that EBITDA and Adjusted EBITDA might

not be comparable to similarly-titled measures of other companies.

These measures should be considered in addition to, and not as a

substitute for or superior to, any measure of performance prepared

in accordance with GAAP.

Reconciliations of the non-GAAP measures used in

this press release are included in the table above. Because GAAP

financial measures on a forward-looking basis are not accessible,

and reconciling information is not available without unreasonable

effort, we have not provided reconciliations for forward-looking

non-GAAP measures. Items excluded to arrive at forward-looking

non-GAAP measures may have a significant, and potentially

unpredictable, impact on our future GAAP results.

A reconciliation of EBITDA and Adjusted EBITDA

to the most directly comparable GAAP measure in accordance with SEC

Regulation G is set forth above.

About Eightco

Eightco (NASDAQ: OCTO) is committed to growth of

its subsidiaries, made up of Forever 8, an inventory capital and

management platform for e-commerce sellers, and Ferguson

Containers, Inc., a provider of complete manufacturing and

logistical solutions for product and packaging needs, through

strategic management and investment. In addition, the Company is

actively seeking new opportunities to add to its portfolio of

technology solutions focused on the e-commerce ecosystem through

strategic acquisitions. Through a combination of innovative

strategies and focused execution, Eightco aims to create

significant value and growth for its portfolio companies and

stockholders.

For additional information, please

visit www.8co.holdings

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements in this press release other than

statements of historical fact could be deemed forward looking.

Words such as “plans,” “expects,” “will,” “anticipates,”

“continue,” “expand,” “advance,” “develop” “believes,” “guidance,”

“target,” “may,” “remain,” “project,” “outlook,” “intend,”

“estimate,” “could,” “should,” and other words and terms of similar

meaning and expression are intended to identify forward-looking

statements, although not all forward-looking statements contain

such terms. Forward-looking statements are based on management’s

current beliefs and assumptions that are subject to risks and

uncertainties and are not guarantees of future performance. Actual

results could differ materially from those contained in any

forward-looking statement as a result of various factors,

including, without limitation: Eightco’s ability to maintain

compliance with the Nasdaq’s continued listing requirements;

unexpected costs, charges or expenses that reduce Eightco’s capital

resources; Eightco’s inability to raise adequate capital to fund

its business and achieve its 2025 revenue goal; Eightco’s inability

to innovate and attract users for Eightco’s products; future

legislation and rulemaking negatively impacting digital assets; and

shifting public and governmental positions on digital asset mining

activity. Given these risks and uncertainties, you are cautioned

not to place undue reliance on such forward-looking statements. For

a discussion of other risks and uncertainties, and other important

factors, any of which could cause Eightco’s actual results to

differ from those contained in forward-looking statements, see

Eightco’s filings with the Securities and Exchange Commission (the

“SEC”), including in its Annual Report on Form 10-K filed with the

SEC on April 1, 2024. All information in this press release is as

of the date of the release, and Eightco undertakes no duty to

update this information or to publicly announce the results of any

revisions to any of such statements to reflect future events or

developments, except as required by law.

For further information, please

contact:Investor Relationsinvestors@8co.holdings

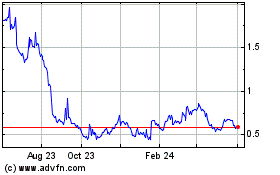

Eightco (NASDAQ:OCTO)

Historical Stock Chart

From Jan 2025 to Feb 2025

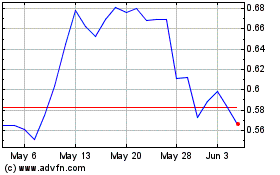

Eightco (NASDAQ:OCTO)

Historical Stock Chart

From Feb 2024 to Feb 2025