Oncocyte Corp. (Nasdaq: OCX), a pioneering diagnostics technology

company, today announced that it has entered into securities

purchase agreements with existing investors for a registered direct

offering (“Registered Direct Offering”) and concurrent private

placement (“PIPE Offering”).

The Company’s five largest shareholders, including Bio-Rad

Laboratories, Inc., (NYSE: BIO) (“Bio-Rad”), a key strategic

partner of the Company, led the funding round. The round is

expected to result in gross cash proceeds to the Company totaling

$29.1 million priced at $2.05 per share. Two members of the

Company’s management team also participated in the private

placement.

In addition to its equity investment, Bio-Rad has pledged to

provide valuable financial support for the upcoming clinical trial

and further commercialization assistance, underscoring the depth of

its strategic partnership with Oncocyte.

Combined with Oncocyte’s current cash on hand, the offering

proceeds are expected to fully fund the development of the

Company's FDA In-Vitro Diagnostic (IVD) transplant assay program.

FDA clearance of Oncocyte’s proprietary transplant assay is a key

milestone to driving self-sustaining revenue.

Oncocyte remains committed to advancing its mission to improve

patient outcomes by democratizing access to groundbreaking

diagnostic solutions. The company’s immediate focus is on

transplant diagnostics. Oncocyte’s proprietary technology is

designed with the transplant center in mind. The assay’s simple

workflow is easy to adopt and provides rapid results that allow

doctors to make quicker, better decisions. Published clinical data,

for example, show that Oncocyte’s technology can detect signs of

kidney transplant rejection more than 11 months sooner than

standard protocols. The Company intends to use the net proceeds

from the offering for working capital and general corporate

purposes.

“We’re going to make it easier for transplant doctors to manage

their patients’ care. Securing the necessary funding to complete

our FDA IVD clearance program gets us closer to making that a

reality,” said Josh Riggs, the Company’s President and Chief

Executive Officer. “Early feedback from our beta sites is that

we’ve built technology that is fast, reliable, and easy to use.

Following FDA clearance, we expect rapid adoption for clinical use

at transplant centers across the U.S.”

“We are thrilled at the support from existing shareholders in

funding our expected future growth as we seek to capture share in

the $1 billion global transplant testing market,” said Andrea

James, the Company’s Chief Financial Officer. “Financial discipline

and sound capital stewardship will remain two of our core values

going forward.”

Important Details About the Offering

As noted above, the offerings were priced at $2.05 per share,

which represented no discounts nor incentive warrants, and total

gross proceeds of $29.1 million, before deducting offering expenses

payable by the Company. The Company sold 3,609,755 shares of common

stock in the registered direct offering and 7,536,708 shares of

common stock and common stock equivalent pre-funded warrants to

purchase 3,069,925 shares of common stock in the PIPE Offering.

The PIPE Offering was priced at least "at-the-market" under the

rules and regulations of The Nasdaq Stock Market LLC and the

closings of the Registered Direct Offering and the PIPE Offering

are expected to occur on or about February 10, 2025, subject

to the satisfaction of customary closing conditions. Needham &

Company acted as a financial advisor to Oncocyte.

The Company has agreed to file a registration statement on Form

S-1 under the Act with the Securities and Exchange Commission (the

“SEC”), covering the resale of the shares of common stock and

shares of common stock underlying the pre-funded warrants to be

issued in the PIPE Offering no later than March 15, 2025, and to

use reasonable best efforts to have the registration statement

declared effective as promptly as practical thereafter, and in any

event 15 days thereafter.

The offer and sale of the securities in the PIPE Offering

described above are being offered and sold in a private placement

under Section 4(a)(2) of the Securities Act of 1933, as amended

(the “Act”), and Regulation D promulgated thereunder, and have not

been registered under the Act, or applicable state securities laws.

Accordingly, such securities issued in the PIPE Offering may not be

offered or sold in the United States except pursuant to an

effective registration statement or an applicable exemption from

the registration requirements of the Act and such applicable state

securities laws.

The offer and sale of the securities in the Registered Direct

Offering described above are being offered and sold by the Company

in a registered direct offering pursuant to a “shelf” registration

statement on Form S-3, as amended (File No. 333-281159), that was

originally filed with the Securities and Exchange Commission (the

“SEC”) on August 1, 2024, and was declared effective by the SEC on

August 7, 2024. The offering of the securities in the Registered

Direct Offering is being made only by means of a base prospectus

and prospectus supplement that forms a part of the effective

registration statement. A final prospectus supplement and the

accompanying base prospectus relating to the registered direct

offering was filed with the SEC on February 10, 2025, and is

available on the SEC’s website at www.sec.gov.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any of the securities described

herein, nor shall there be any sale of these securities in any

state or other jurisdiction in which such an offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such state or other jurisdiction.

Forward-Looking Statements

This press release contains “forward-looking statements” made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. All statements pertaining to the

Company’s expectations regarding the completion of the offering,

the satisfaction of customary closing conditions related to the

offering, the intended use of proceeds from the offering in this

press release constitute forward-looking statements.

These statements may be identified by the use of forward-looking

expressions, including, but not limited to, “expect,” “anticipate,”

“intend,” “plan,” “believe,” “estimate,” “potential,” “predict,”

“project,” “should,” “would” and similar expressions and the

negatives of those terms. These statements relate to future events

or our financial performance and involve known and unknown risks,

uncertainties, and other factors, such as market and other

conditions, which may cause actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Such factors include market conditions,

the ability of the Company to satisfy all conditions precedent to

the closing of the PIPE Offering and Registered Direct Offering,

the completion of the PIPE Offering and Registered Direct Offering,

the anticipated use of proceeds from the PIPE Offering and

Registered Direct Offering, as well as those set forth in the

Company’s annual, quarterly and current reports (i.e., Form 10-K,

Form 10-Q and Form 8-K) as filed or furnished with the SEC and any

subsequent public filings. Prospective investors are cautioned not

to place undue reliance on such forward-looking statements, which

speak only as of the date of this press release. The Company

undertakes no obligation to publicly update any forward-looking

statement, whether as a result of new information, future events or

otherwise, except as required by law.

About OncocyteOncocyte is a leading diagnostics

technology company. The company’s tests are designed to help

provide clarity and confidence to physicians and their patients.

VitaGraft™ is a clinical blood-based solid organ transplantation

monitoring test. GraftAssure™ is a research use only (RUO)

blood-based solid organ transplantation monitoring test. DetermaIO™

is a gene expression test that assesses the tumor microenvironment

to predict response to immunotherapies. DetermaCNI™ is a

blood-based monitoring tool for monitoring therapeutic efficacy in

cancer patients.

Additional Information for Investors:

Please visit https://investors.oncocyte.com/ to find our latest

investor materials.

A refreshed investor presentation has been posted to the

Company’s investor site. You may access that here or by accessing

this URL:

https://investors.oncocyte.com/~/media/Files/O/Oncocyte-IR/events-and-presentations/ocx-presentation-feb-2025.pdf

Jeff RamsonPCG Advisory(646) 863-6893jramson@pcgadvisory.com

Andrea JamesCFOOncocyteajames@oncocyte.com

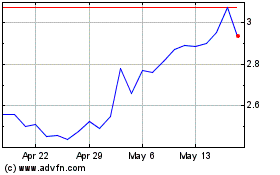

Oncocyte (NASDAQ:OCX)

Historical Stock Chart

From Jan 2025 to Feb 2025

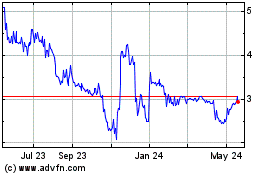

Oncocyte (NASDAQ:OCX)

Historical Stock Chart

From Feb 2024 to Feb 2025