0001487918FALSE00014879182024-07-302024-07-300001487918us-gaap:CommonStockMember2024-07-302024-07-300001487918ofs:NotesDue2025Member2024-07-302024-07-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 30, 2024

OFS Capital Corporation

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Delaware | 814-00813 | 46-1339639 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| | | | | |

10 S. Wacker Drive, Suite 2500 Chicago, Illinois | 60606 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (847) 734-2000

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | OFS | | The Nasdaq Global Select Market |

| 4.95% Notes due 2028 | | OFSSH | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | | | | |

| Item 2.02. | Results of Operations and Financial Condition |

On August 1, 2024, OFS Capital Corporation (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2024. On July 30, 2024, the Company’s board of directors declared a 2024 third quarter distribution of $0.34 per common share, payable September 30, 2024 to stockholders of record as of September 20, 2024. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information disclosed under this Item 2.02, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made under the Securities Exchange Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

| | | | | | | | |

| Item 9.01. | Financial Statements and Exhibits |

(a)Not applicable.

(b)Not applicable.

(c)Not applicable.

(d)Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | OFS Capital Corporation |

| | | |

| Date: August 1, 2024 | By: | /s/ Bilal Rashid |

| | | Chief Executive Officer |

OFS CAPITAL CORPORATION ANNOUNCES SECOND QUARTER 2024 FINANCIAL RESULTS

DECLARES THIRD QUARTER DISTRIBUTION OF $0.34 PER SHARE

Chicago, IL - August 1, 2024 - OFS Capital Corporation (NASDAQ: OFS) (“OFS Capital,” the “Company,” “we,” “us,” or “our”) today announced its financial results for the fiscal quarter ended June 30, 2024.

SECOND QUARTER FINANCIAL HIGHLIGHTS

•Net investment income decreased to $0.26 per common share for the quarter ended June 30, 2024 from $0.42 per common share for the quarter ended March 31, 2024.

•Net gain on investments of $0.51 per common share for the quarter ended June 30, 2024, primarily comprised of net unrealized appreciation of $0.83 per common share, partially offset by net realized losses of $0.32 per common share.

•Net asset value per common share increased to $11.51 as of June 30, 2024 from $11.08 as of March 31, 2024.

•As of June 30, 2024, based on fair value, 92% of our loan portfolio consisted of floating rate loans and approximately 100% of our loan portfolio consisted of first lien and second lien loans.

•For the quarter ended June 30, 2024, the investment portfolio’s weighted-average performing income yield increased to 13.4% from 13.0% during the prior quarter, primarily due to the acceleration of deferred fees from loan repayments.

•No new loans were placed on non-accrual status during the second quarter. The number of issuers with loans on non-accrual status decreased by one from the prior quarter.

OTHER RECENT EVENTS

•On July 30, 2024, our Board of Directors declared a distribution of $0.34 per common share for the third quarter of 2024, payable on September 30, 2024 to stockholders of record as of September 20, 2024.

| | | | | | | | | | | |

| SELECTED FINANCIAL HIGHLIGHTS (unaudited) | Three Months Ended |

| (Per common share) | June 30, 2024 | | March 31, 2024 |

| Net Investment Income | | | |

| Net investment income | $ | 0.26 | | | $ | 0.42 | |

| | | |

| Net Realized/Unrealized Gain (Loss) | | | |

| Net realized gain (loss) on investments, net of taxes | $ | (0.32) | | | $ | 0.06 | |

| Net unrealized appreciation (depreciation) on investments, net of taxes | 0.83 | | | (1.15) | |

| | | |

| Net realized/unrealized gain (loss) | $ | 0.51 | | | $ | (1.09) | |

| | | |

| Earnings (Loss) | | | |

| Earnings (loss) | $ | 0.77 | | | $ | (0.67) | |

| | | |

| Net Asset Value | | | |

| Net asset value | $ | 11.51 | | | $ | 11.08 | |

| Distributions paid | $ | 0.34 | | | $ | 0.34 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | | | | | |

| As of |

| (in millions) | June 30, 2024 | | March 31, 2024 |

| Balance Sheet Highlights (unaudited) | | | |

| Investment portfolio, at fair value | $ | 398.2 | | | $ | 400.4 | |

| Total assets | 407.9 | | | 410.5 | |

| Net assets | 154.2 | | | 148.4 | |

“We are pleased to announce an increase in our net asset value per common share to $11.51 as of June 30, 2024 from $11.08 as of March 31, 2024”, said Bilal Rashid, OFS Capital’s Chairman and Chief Executive Officer. “We believe that we continue to benefit from our balance sheet positioning, with the vast majority of our loan portfolio being floating rate and the majority of our debt being fixed-rate.”

PORTFOLIO AND INVESTMENT ACTIVITIES

($ in millions)

| | | | | | | | | | | | | | |

| | Three Months Ended |

Portfolio Yields(1) | | June 30, 2024 | | March 31, 2024 |

Average performing interest-bearing investments, at cost | | $ | 322.6 | | | $ | 338.0 | |

Weighted-average performing income yield - interest-bearing investments(2) | | 13.4 | % | | 13.0 | % |

Weighted-average realized yield - interest-bearing investments(3) | | 11.8 | % | | 11.6 | % |

(1) The weighted-average yield of our investments is not the same as a return on investment for our stockholders, but rather relates to our investment portfolio and is calculated before the payment of all of our fees and expenses.

(2) Performing income yield is calculated as (a) the actual amount earned on performing interest-bearing investments, including interest, prepayment fees and amortization of net loan fees, divided by (b) the weighted-average of total performing interest-bearing investments at amortized cost.

(3) Realized yield is calculated as (a) the actual amount earned on interest-bearing investments, including interest, prepayment fees and amortization of net loan fees, divided by (b) the weighted-average of total interest-bearing investments at amortized cost, in each case, including debt investments on non-accrual status and non-income producing structured finance securities.

| | | | | | | | | | | | | | |

| | Three Months Ended |

| Portfolio Purchase Activity | | June 30, 2024 | | March 31, 2024 |

| Investments in debt and equity investments | | $ | 5.0 | | | $ | 7.3 | |

| Investments in structured finance securities | | — | | | — | |

| Total investment purchases and originations | | $ | 5.0 | | | $ | 7.3 | |

As of June 30, 2024, based on fair value, our investment portfolio was comprised of the following:

•Total investments of $398.2 million, which was equal to approximately 103% of amortized cost;

•Debt investments of $236.9 million, of which approximately 85% and 15% were first lien and second lien loans, respectively;

•Equity investments of $85.7 million;

•Structured finance securities of $75.6 million; and

•Unfunded commitments of $8.9 million to eight portfolio companies.

During the quarter ended June 30, 2024, no new loans were placed on non-accrual status.

| | | | | | | | | | | |

RESULTS OF OPERATIONS (unaudited) | | | |

| (in thousands) | Three Months Ended |

| June 30, 2024 | | March 31, 2024 |

| Total investment income | $ | 11,165 | | | $ | 14,233 | |

| Expenses: | | | |

| Interest expense | 4,117 | | | 4,572 | |

| Base management and incentive fees | 2,337 | | | 2,922 | |

| Other expenses | 1,274 | | | 1,143 | |

| Total expenses | 7,728 | | | 8,637 | |

| Net investment income | 3,437 | | | 5,596 | |

| Net gain (loss) on investments | 6,891 | | | (14,645) | |

| Net increase (decrease) in net assets resulting from operations | $ | 10,328 | | | $ | (9,049) | |

Investment Income

For the quarter ended June 30, 2024, total investment income decreased to $11.2 million from $14.2 million in the prior quarter, primarily due to decreases in total dividend income of $2.4 million and interest income of $0.5 million.

Expenses

For the quarter ended June 30, 2024, total expenses decreased by $0.9 million to $7.7 million compared to the prior quarter, primarily due to declines in interest expense of $0.5 million and incentive fees of $0.5 million.

Net Gain (Loss) on Investments

For the quarter ended June 30, 2024, we recognized a net gain on investments of $6.9 million, primarily comprised of net unrealized appreciation of $11.3 million, partially offset by net realized losses of $4.3 million.

LIQUIDITY AND CAPITAL RESOURCES

As of June 30, 2024, we had $5.6 million in cash, which includes $2.7 million held by OFSCC-FS, LLC (“OFSCC-FS”), an indirect wholly owned subsidiary. Our use of cash held by OFSCC-FS is restricted by contractual conditions of our credit facility with BNP Paribas, including limitations on the amount of cash OFSCC-FS can distribute to us.

As of June 30, 2024, we had no outstanding balance and an unused commitment of $25.0 million under our senior secured revolving credit facility with Banc of California, as well as an unused commitment of $80.9 million under our revolving credit facility with BNP Paribas, both of which are subject to borrowing base requirements and other covenants. As of June 30, 2024, we had outstanding commitments to fund portfolio company investments totaling $8.9 million under various undrawn revolvers and other credit facilities.

CONFERENCE CALL

OFS Capital will host a conference call to discuss these results on Friday, August 2, 2024, at 10:00 AM Eastern Time. Interested parties may participate in the call via the following:

INTERNET: Go to www.ofscapital.com at least 15 minutes prior to the start time of the call to register, download, and install any necessary audio software. A replay will be available for 90 days on OFS Capital’s website at www.ofscapital.com.

TELEPHONE: Dial (844) 816-1364 (Domestic) or (412) 317-5699 (International) approximately 15 minutes prior to the call. A telephone replay of the conference call will be available through August 12, 2024 and may be accessed by calling (877) 344-7529 (Domestic) or (412) 317-0088 (International) and utilizing conference ID #5908152.

For more detailed discussion of the financial and other information included in this press release, please refer to OFS Capital’s Form 10-Q for the second quarter ended June 30, 2024.

OFS Capital Corporation and Subsidiaries

Consolidated Statements of Assets and Liabilities (unaudited)

(Dollar amounts in thousands, except per share data)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| | | |

| Assets | | | |

| | | |

| | | |

| | | |

| | | |

| Total investments, at fair value (amortized cost of $385,446 and $403,530, respectively) | $ | 398,156 | | | $ | 420,287 | |

| Cash and cash equivalents | 5,580 | | | 45,349 | |

| Interest receivable | 2,945 | | | 2,217 | |

| | | |

| Prepaid expenses and other assets | 1,194 | | | 1,965 | |

| Total assets | $ | 407,875 | | | $ | 469,818 | |

| | | |

| Liabilities | | | |

| Revolving lines of credit | $ | 69,100 | | | $ | 90,500 | |

| Unsecured Notes (net of deferred debt issuance costs of $2,178 and $2,667, respectively) | 177,822 | | | 177,333 | |

| SBA debentures (net of deferred debt issuance costs of $0 and $20, respectively) | — | | | 31,900 | |

| Interest payable | 3,249 | | | 3,712 | |

| Payable to adviser and affiliates | 2,931 | | | 3,556 | |

| | | |

| | | |

| Other liabilities | 601 | | | 813 | |

| Total liabilities | $ | 253,703 | | | $ | 307,814 | |

| | | |

| | | |

| Net assets | | | |

| Preferred stock, par value of $0.01 per share, 2,000,000 shares authorized, -0- shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | $ | — | | | $ | — | |

| Common stock, par value of $0.01 per share, 100,000,000 shares authorized, 13,398,078 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | 134 | | | 134 | |

| Paid-in capital in excess of par | 184,841 | | | 184,841 | |

| Total accumulated losses | (30,803) | | | (22,971) | |

| Total net assets | 154,172 | | | 162,004 | |

| | | |

| Total liabilities and net assets | $ | 407,875 | | | $ | 469,818 | |

| | | |

| Number of common shares outstanding | 13,398,078 | | | 13,398,078 | |

| Net asset value per share | $ | 11.51 | | | $ | 12.09 | |

OFS Capital Corporation and Subsidiaries

Consolidated Statements of Operations (unaudited)

(Dollar amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Investment income | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Interest income | $ | 10,854 | | | $ | 14,101 | | | $ | 22,247 | | | $ | 27,494 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Dividend income | 280 | | | 334 | | | 2,991 | | | 1,119 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Fee income | 31 | | | 91 | | | 160 | | | 196 | |

Total investment income | 11,165 | | | 14,526 | | | 25,398 | | | 28,809 | |

| Expenses | | | | | | | |

| Interest expense | 4,117 | | | 5,011 | | | 8,689 | | | 9,885 | |

| Base management fee | 1,478 | | | 1,883 | | | 3,001 | | | 3,777 | |

| Income Incentive Fee | 859 | | | 1,280 | | | 2,258 | | | 2,518 | |

| | | | | | | |

| Professional fees | 414 | | | 429 | | | 828 | | | 865 | |

| Administration fee | 453 | | | 440 | | | 847 | | | 922 | |

| Other expenses | 407 | | | 360 | | | 742 | | | 769 | |

| Total expenses | 7,728 | | | 9,403 | | | 16,365 | | | 18,736 | |

Net investment income | 3,437 | | | 5,123 | | | 9,033 | | | 10,073 | |

| | | | | | | |

Net realized and unrealized gain (loss) on investments | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net realized loss, net of taxes | (4,304) | | | (10,408) | | | (3,506) | | | (10,412) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net unrealized appreciation (depreciation), net of taxes | 11,195 | | | 3,321 | | | (4,248) | | | 2,200 | |

| Net gain (loss) on investments | 6,891 | | | (7,087) | | | (7,754) | | | (8,212) | |

| Loss on extinguishment of debt | — | | | — | | | — | | | (19) | |

| Net increase (decrease) in net assets resulting from operations | $ | 10,328 | | | $ | (1,964) | | | $ | 1,279 | | | $ | 1,842 | |

| | | | | | | |

Net investment income per common share – basic and diluted | $ | 0.26 | | | $ | 0.38 | | | $ | 0.67 | | | $ | 0.75 | |

| Net increase (decrease) in net assets resulting from operations per common share – basic and diluted | $ | 0.77 | | | $ | (0.15) | | | $ | 0.10 | | | $ | 0.13 | |

| Distributions declared per common share | $ | 0.34 | | | $ | 0.33 | | | $ | 0.68 | | | $ | 0.66 | |

| Basic and diluted weighted-average common shares outstanding | 13,398,078 | | | 13,398,078 | | | 13,398,078 | | | 13,398,078 | |

ABOUT OFS CAPITAL

The Company is an externally managed, closed-end, non-diversified management investment company that has elected to be regulated as a business development company. The Company’s investment objective is to provide stockholders with both current income and capital appreciation primarily through debt investments and, to a lesser extent, equity investments. The Company invests primarily in privately held middle-market companies in the United States, including lower-middle-market companies, targeting investments of $3 million to $20 million in companies with annual EBITDA between $5 million and $50 million. The Company offers flexible solutions through a variety of asset classes including senior secured loans, which includes first-lien, second-lien and unitranche loans, as well as subordinated loans and, to a lesser extent, warrants and other equity securities. The Company’s investment activities are managed by OFS Capital Management, LLC, an investment adviser registered under the Investment Advisers Act of 1940(4), as amended, and headquartered in Chicago, Illinois, with additional offices in New York and Los Angeles.

FORWARD-LOOKING STATEMENTS

Statements in this press release regarding management's future expectations, beliefs, intentions, goals, strategies, plans or prospects, including statements relating to: OFS Capital’s results of operations, including net investment income, net asset value and net investment gains and losses and the factors that may affect such results; management’s belief that the Company continues to benefit from its balance sheet positioning due to a high percentage of floating rate loans in the portfolio and a majority of liabilities that have a fixed rate of interest, when there can be no assurance that such a composition will lead to future success; and other factors may constitute forward-looking statements for purposes of the safe harbor protection under applicable securities laws. Forward-looking statements can be identified by terminology such as “anticipate,” “believe,” “could,” “could increase the likelihood,” “estimate,” “expect,” “intend,” “is planned,” “may,” “should,” “will,” “will enable,” “would be expected,” “look forward,” “may provide,” “would” or similar terms, variations of such terms or the negative of those terms. Such forward-looking statements involve known and unknown risks, uncertainties and other factors including those risks, uncertainties and factors referred to in OFS Capital’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission under the section “Risk Factors,” as well as other documents that may be filed by OFS Capital from time to time with the Securities and Exchange Commission. As a result of such risks, uncertainties and factors, actual results may differ materially from any future results, performance or achievements discussed in or implied by the forward-looking statements contained herein. OFS Capital is providing the information in this press release as of this date and assumes no obligations to update the information included in this press release or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

INVESTOR RELATIONS CONTACT:

Steve Altebrando

847-734-2084

investorrelations@ofscapital.com

(4) Registration does not imply a certain level of skill or training

OFS® and OFS Capital® are registered trademarks of Orchard First Source Asset Management, LLC

v3.24.2.u1

Cover

|

Jul. 30, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 30, 2024

|

| Entity Registrant Name |

OFS Capital Corporation

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

814-00813

|

| Entity Tax Identification Number |

46-1339639

|

| Entity Address, Address Line One |

10 S. Wacker Drive, Suite 2500

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60606

|

| City Area Code |

847

|

| Local Phone Number |

734-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001487918

|

| Amendment Flag |

false

|

| Common Stock, $0.01 par value per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

OFS

|

| Security Exchange Name |

NASDAQ

|

| 4.95% Notes due 2028 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.95% Notes due 2028

|

| Trading Symbol |

OFSSH

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ofs_NotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

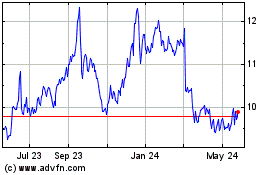

OFS Capital (NASDAQ:OFS)

Historical Stock Chart

From Nov 2024 to Dec 2024

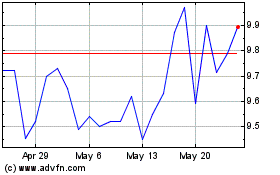

OFS Capital (NASDAQ:OFS)

Historical Stock Chart

From Dec 2023 to Dec 2024